Let’s check out the Top & Upcoming Buy Now Pay Later [BNPL] Platforms in India, 2023. Here’s how they disrupt the space for consumers and merchants!

Top & Upcoming BNPL Platforms In India In 2024

Table of Contents

A Quick Glance

| Name of Application | Value Proposition |

| Yelow | Yelow offers its customers an assured cashback of up to 5% on every purchase they make |

| Flexmoney | InstaCred™ is a digital credit network platform that helps fill the gap between merchants & customers |

| BharatX | Creating the Credit-as-a-Feature for customers |

| UNI Cards | Allows users to split their transactions into three instalments over a period of 3 months |

| Slice | Zero-fee BNPL card and comes with no hidden charges or annual fees. |

| PostPe | Credit Limit of up to ₹10Lakh and comes interest-free for both macro & micro-purchases |

| ePay Later | A credit line of a whopping ₹25Lakh |

| Freo Pay | The app is used in 1200+ cities in India |

| Aspire | India’s Digital Credit Card aimed at lower-income and self-employed customers |

| Lazy Pay | The platform comes with a repayment period of 15 days |

| Simpl | Simpl has partnered with 10,000+ merchants across sectors, has processed 49 million transactions, and serves more than 7 million users. |

| Zest Money | Credit limit of up to ₹2 Lakhs |

| MoneyTap | Credit Cap of ₹ 5 Lakh |

| Mobikwik Zip | Credit limit up to ₹ 30,000 |

| Shopse | 25-Million pre-approved ‘cardless’ EMI credit lines from 6 trusted Banks and NBFCs and has a customer base of over 50 million. |

| Amazon Pay Later | Credit limit of up to ₹60,000 |

| Flipkart Pay Later | Credit limit of 1 Lakh, and repayment tenure of 35 days |

| Paytm Postpaid | The company has 3 Million plus users as of 2022 |

| HDFC Flexipay | Zero Convenience Fees, Zero Processing Fees, and No Hidden Charges |

| ICICI PayLater | Repayment tenure of 45 days |

If Shakespeare or any Rennaisance writer were to describe the buy now pay later scheme, what do you think would be their definition?

Thou art can’t pay now? No worries!

But what thou hearts will pay thou shall at will!

Before we go any further, my apologies for a feeble attempt to reconstruct what these great souls have given the world.

Renaissance or otherwise, we know the charm behind BNPL. A super-smooth payment experience, easy credit without excruciating efforts for procurement, and flexible repayment efforts, among others. The numbers speak for themselves; just take a look below

India’s BNPL or Buy Now Pay Later market is estimated at $3-3.5 billion today but could potentially grow to $45-50 billion by 2026, according to consultancy firm RedSeer. The firm also estimates that the number of BNPL users in the country may touch 80-100 million by 2026 from the 10-15 million estimated currently.

But before that,

What is BNPL?

Buy Now Pay Later is a financial offering that helps consumers purchase a product without paying the amount upfront. This arrangement offers an extended period for repayment that makes purchase decisions easier for customers and lowers their hesitation significantly.

Today, let’s look at the top and upcoming BNPL players that are already or getting ready to disrupt the space.

P.S. As is the case for all our listicle blogs, we aren’t ranking these BNPL platforms, just curating the list for you! 🙂 We do understand that this isn’t an all-encompassing list of buy now pay later platforms in India. So, stay tuned; we’ll keep updating this list with more players in the future! If your company is not covered, please reach out and we’ll be happy to incorporate this.

We’ve segmented the platforms into different categories for your ease! Hope it helps.

Card-based BNPL Platforms

These players provide a prepaid payment instrument, a card, for consumers to pay, avail credit easily, and pay at a preset, convenient time. A prominent use case includes POS payment using cards.

Yelow

Yelow, or the Payment Revolution 3.0, is on a mission to provide convenient BNPL with No Cost EMI to its customers.

It aims to increase brand and merchant retention rates by providing them with a seamless experience. Consumers can shop quickly, with ease, and enjoy more time for themselves.

Being well funded and having a passionate team, at Yelow, you can enjoy the excellent uptime and the fantastic shopping experience they provide customers daily.

Moreover, Yelow offers its customers an assured cashback up to 5% on every purchase they make.

Flexmoney

Simplifying and Democratizing Consumer Finance for India.

Flexmoney aims to offer a full-featured credit solution to the merchants and consumers of their network under one roof.

Flexmoney is extremely good at providing a lot of infrastructure for flexible payments for buyers and sellers who like to use credit cards. People love it, and of course, we do!

With Flexmoney’s platform, people can make purchases on their credit card (or cardless) from thousands of merchants who accept credit and debit cards.

InstaCred™ is a digital credit network platform that helps fill the gap between merchants & customers. Flexmoney’s world-class digital credit infrastructure enables trusted Banks and NBFCs to easily offer branded, Instant, “Cardless” Point of Sale Credit.

It further helps offer instant EMI and “Pay Later” digital credit lines to existing and new customers with your branding.

BharatX

Give Credit to your Users!

With BharatX, users can use the 30 lines of Code in their White-Labelled Embedded Credit Product that is integrated just like a Payment Gateway to get credits.

They streamline the entire Credit Risk while you get the payments upfront on T+1, making it a Zero Risk for its customer.

They aim to power journeys like Khata, Pay Later, Try & Buy, or whatever you can Imagine in a White-Labelled Manner! It’s like creating the best Credit-as-a-Feature for customers.

On top of this, the end consumers don’t need to upload any Documentation to get the Credit they want! Wait, what?

Yes, you heard it right! And that’s the best part about BharatX which provides the highest industry Approval Rate of around 45%.

Let’s redefine Credit using technology and empower the Indian Middle Class.

UNI Cards

UNI cards, or the Pay 1/3rd Card as it is called, is a card-based BNPL app that allows users to split their transactions into three installments, over a period of 3 months, at no extra charges.

If the user opts to pay the entire amount at one go within a month, the app also offers 1% cashback.

UNI offers both physical and virtual cards that can be used for both online and offline purchases. UNI has waived joining fees and annual charges for early customers as a limited offer.

According to Uni, since its beta launch in June 2021, the BNPL app has amassed 12,000 customers along with 80,000 downloads.

Slice

Slice is a fintech that provides credit to users who have no prior, impeccable credit history without hassle. This BNPL app is one of India’s finest credit card challengers to pay bills, manage expenses, and unlock cool rewards. Slice currently has about 7 million registered users.

Slice offers a zero-fee BNPL card and comes with no hidden charges or annual fees. It also offers the feature to split bills and pay within 3 months, at zero interest or extra charges.

In addition, Slice offers up to 2% cashback on each transaction.

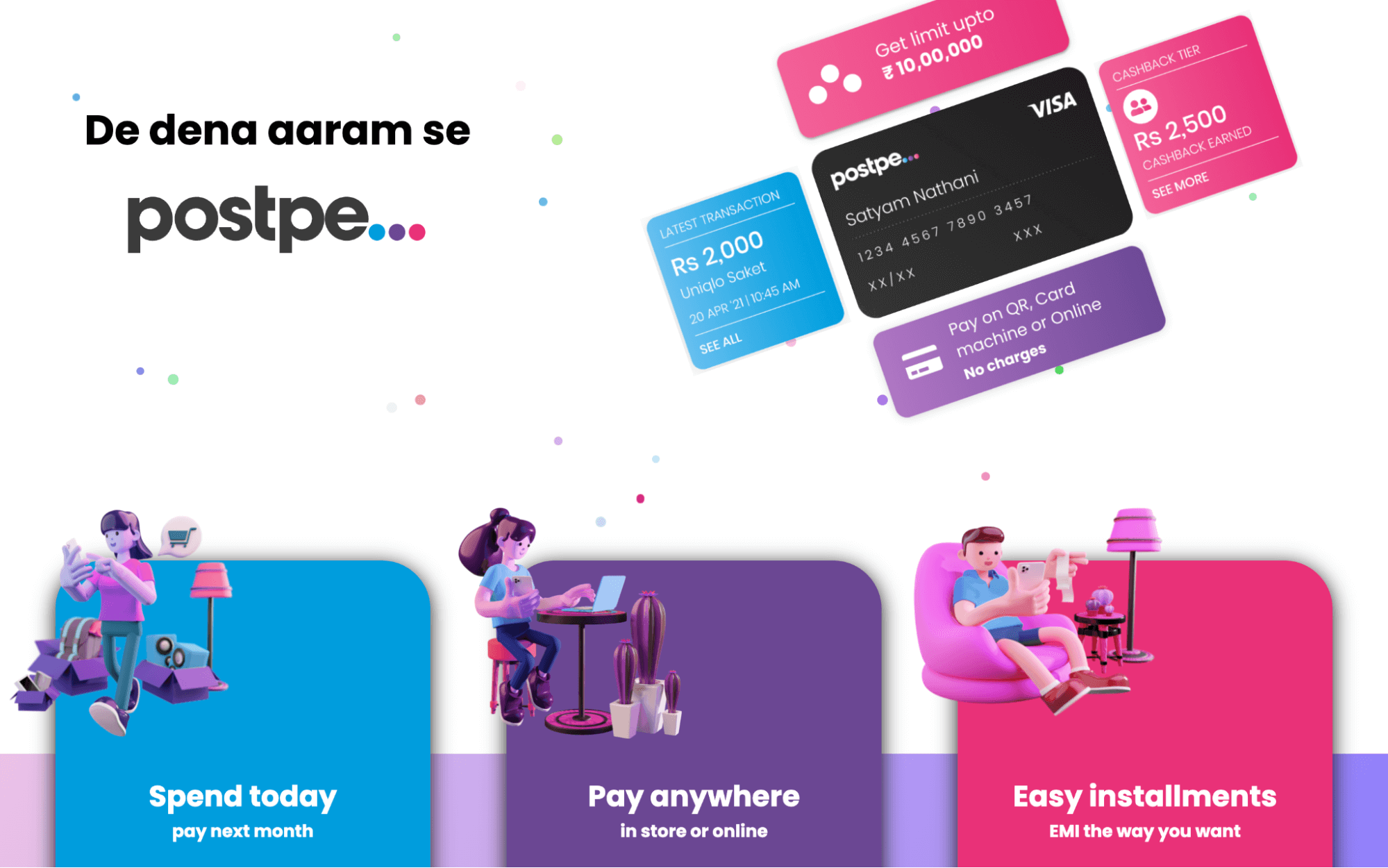

PostPe

PostPe is a BNPL platform, part of the parent company BharatPe. Users can download the PostPe app, available on Play Store, and get started easily. After KYC verification via PAN & Aadhar cards verification, users get spending limits based on their credit scores.

The platform offers a Credit Limit of up to ₹10Lakh and comes interest-free for both macro & micro-purchases. The BNPL service can be availed either via Q.R. payments, card-swiping, or any online payment.

Users can easily track transactions, due dates, credit limits, and more with a dedicated dashboard. PostPe offers personalized cards, and users also get to win cashback on transactions.

ePay Later

What started out as a hassle-free checkout for online platforms, has evolved to a BNPL tailormade for business fraction, with a credit line of a whopping ₹25Lakh, with a complete waiver of interest during the billing period. It partners with some of the biggest brands in the country including Flipkart wholesale, Metro wholesale, and many more.

Easily use your credits from Rs 25k to Rs 25 lakhs and get 14 days to settle it at 0% interest. However, there is a penalty of 3% flat on the defaulted amount every month.

Shop offline and Pay Later

Freo Pay

Freo Pay offers its customers up to Rs.6000 to shop now and pay later. Customers can scan any QR code in stores and the app makes the payment instantly. Customers enjoy the convenience of clearing their dues after 30 days at Zero interest. The app is used in 1200+ cities in India today by customers for their daily shopping needs.

Aspire

Aspire is India’s Digital Credit Card. Aspire provides lower-income and self-employed customers a fair and transparent path toward financial services. Their target market is ~100 million users who might not qualify for a traditional bank credit card.

LazyPay

LazyPay is one of India’s leading BNPL platforms that offer easy credit facilities to users. It is part of the global fintech firm PayU Finance.

Users can download the LazyPay app, signup, undergo KYC, and start transacting. The platform comes with a repayment period of 15 days. LazyPay can be used anywhere, offline or online, where UPI payments are accepted.

The key products of LazyPay include:

- LazyCard

- Merchant Checkout

- UPI on LazyPay (LazyPlus)

- Credit Shield

- XPRESS Cash

Users can also win exciting rewards & cashbacks while making payments via LazyPay. Further, it also offers personal loans of from ₹10,000 to up to ₹1 lakh along with EMI plans for 3-24 months and interest rates between 15% and 32%. Further, LazyPay also levies a 2% processing fee on the amount.

Simpl

Simpl is a credit platform whose mission is simple- “provide simple, transparent financial services to everyone using just a smartphone and one click of a button in real-time.”

One of the top BNPL players in India, Simpl has partnered with 10,000+ merchants across sectors, has processed 49 million transactions, and serves more than 7 million users.

A user can download the Simpl app, sign up, and get credit approvals instantly. The repayment cycles are every 15 days. Further, you can also pay utility bills like water & electricity via Simpl.

Simpl offers a 0% transaction failure rate to its merchant partners, 20% growth in cart size, and up to 2x increase in purchase frequency.

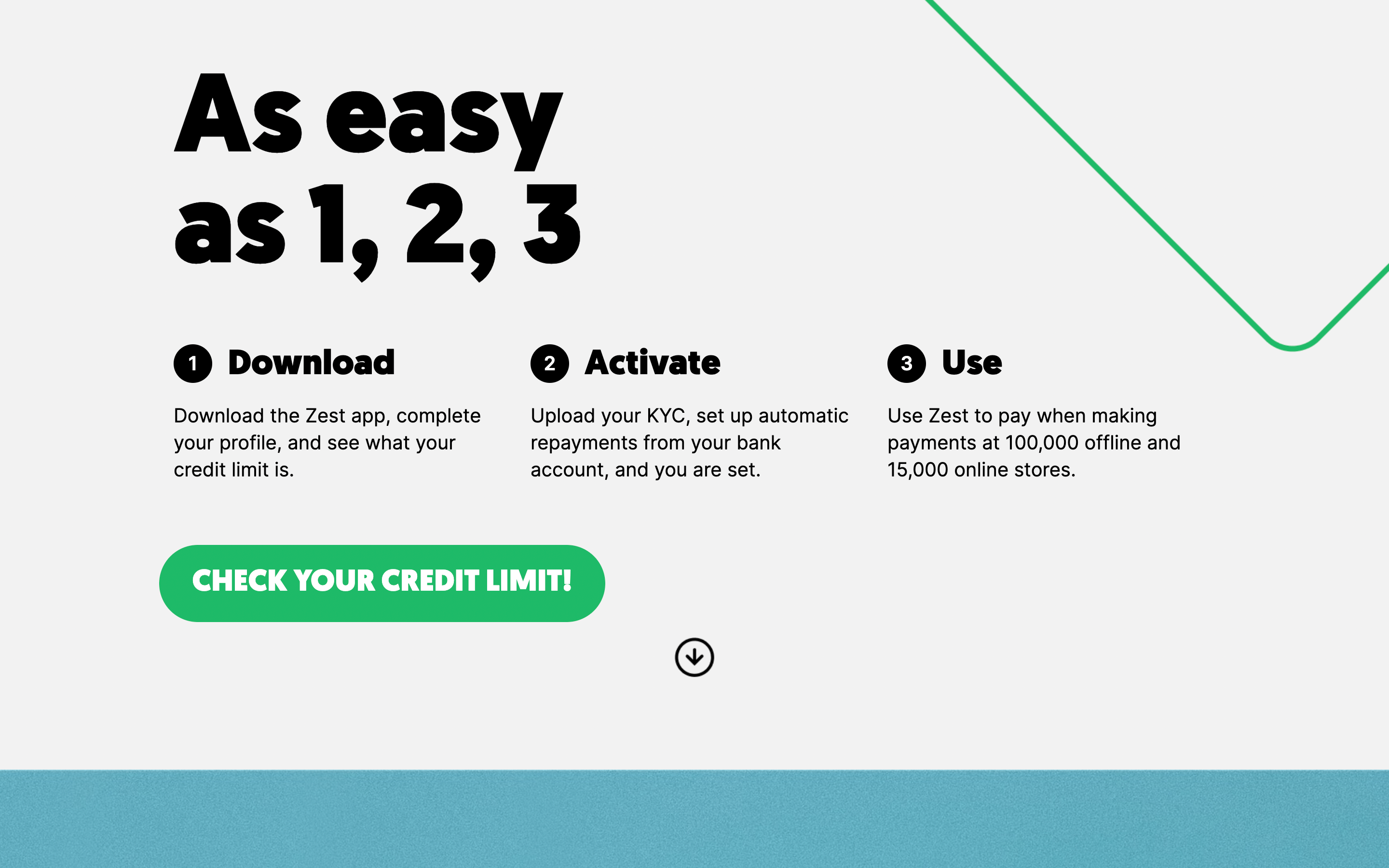

ZestMoney

ZestMoney is a BNPL platform that allows users to avail credit with a quick 3-step approval process minus paperwork and credit card requirements. It helps you to pay at a go and split the repayments into smaller amounts, with 0% interest.

ZestMoney doesn’t levy joining fees or any hidden charges to users and provides a credit limit of up to ₹2 Lakhs.

ZestMoney is accepted in over 10,000 online stores and 75,000 physical stores across India and has 11+ million users on board.

MoneyTap

MoneyTap, also has a BNPL model which is one of its kind because of its regulated structure and approval from RBI. With a 5 Lakh credit cap, MoneyTap allows you to tap into big-ticket sizes in terms of loans such as medical, education, travel, and much more. With a flexible EMI option, MoneyTap does charge interest on the money borrowed. However, the given backing of regulated financial institutions in India, makes it a foolproof model to indulge in.

Mobikwik Zip

MobiKwik ZIP is a small credit offering with a credit limit up to INR 30,000. ZIP users pay bills, shop for clothes, groceries, electronics, order foods, medicines and much more with this credit offering.

Checkout-based BNPL Platforms

Shopse

ShopSe is an instant EMI platform that allows users to make purchases with efficient, no-cost EMI options. It allows seamless & instant digital EMI facilitation without any documentation.

Shopse facilitates real-time credit eligibility checks and provides swift approvals for enabling users to shop anywhere, anytime. The BNPL player has over a 25-Million pre-approved ‘cardless’ EMI credit lines from 6 trusted Banks and NBFCs and has a customer base of over 50 million.

Integrated Apps BNPL Platforms

Amazon Pay Later

The widespread adoption of the e-commerce way of living during the pandemic paved the way for e-commerce giant Amazon to launch its Pay Later option n 2020. While signing up for the program is via the mobile app, the access ost hat is across desktop and mobile platforms. The key pointers of Amazon Pay Later

- A 3 – 12 months wide EMI repayment window

- No processing/cancellation fees

- No pre-closure fees

- Maximum limit of up to ₹60000.

- The loan partner is IDFC First Bank and Capital Float.

Reportedly, Amazon Pay Later has recorded over 10 million transactions at a 99.9% payment success rate since its launch, reflecting its growing preference among customers.

Flipkart Pay Later

Keeping in line with the application introducing its own version of BNPL, Flipkart also launched its Flipkart Pay Later model, back in 2017, serviceable only while shopping from Flipkart, Flipkart retail, Myntra, and 2GUD.

With a credit limit of 1 Lakh, and a repayment tenure of 35 days, you can now buy your products, experience using them, and then pay for them before the 5th of the next month with zero additional charges.

Paytm Post Paid

The payments giant also has its own BNPL model, with interest-free payments which can be paid back in a 30-day window. While the credit line for Paytm Postpaid caps ta Rs. 60,000, the wide adoption of Paytm across online and offline stores makes it a worthy BNPL contender.

According to the business insider, the company has 3 Million plus users as of 2022.

BNPL by Banks

Banks aren’t far behind when it comes to providing pay-later services to their customers. Let’s take a look at some of the finest players in the same.

HDFC FlexiPay

FlexiPay is the BNPL service of HDFC Bank.

It comes with a host of benefits such as:

- Zero Convenience Fees, Zero Processing Fees, and No Hidden Charges.

- Flexible repayments from 15 days to 3 months at nominal interest rates.

- Instant access to a credit line from ₹1000 up to ₹20000.

- Feature to pay utilized principal and interest at the end of tenure.

Only pre-approved current account and savings account holding customers of HDFC Bank are eligible for the FlexiPay facility. Flexipay has merchants across sectors such as Ecommerce, ravel (Flights & Hotel Bookings), Fashion & apparel, Small Appliances & electronics, and more!

ICICI PayLater

PayLater is the BNPL service offered by ICICI Bank. It helps customers to shop online, pay bills, recharge prepaid, and even scan & pay at a go in offline stores.

The repayment tenure is within 45 days, and it comes with zero interest until then. Post that, the PayLater dues will be debited automatically from a user’s ICICI Bank Savings Account.

The BNPL space is rapidly growing, and the sheer volume of players stands the testimony to that.

We’re happy to do our bit to help businesses like yours launch custom BNPL products in 2 weeks and at 90% reduced capital expenditure. If you wish to hop on board, we’d be happy to help!

Do you have any further suggestions that we can add to this list? Drop a reply to this blog! Or, do you wish to put your BNPL wheels in motion? Ping us at hello@decentro.tech!

Until we see you next time with yet another read.

Cheers!

Frequently Asked Questions

Buy Now Pay Later [BNPL] is a financial offering that allows consumers to purchase products/services without paying the entire money upfront. An extended repayment period is offered, making purchase decisions faster for customers. BNPL aims to lower payment friction.

Generally, there are two types of BNPL loans:

1. No-interest loans. With these types of loans, the merchant pays a fee to the third-party lending company rather than the consumer paying interest.

2. Loans with interest.

Customers with no credit scores can also avail of this facility. Customers are not eligible for credit cards can avail of the BNPL facility. Lower interest rates for late payments compared to credit cards. Easy and safe transaction process.

BNPL is an interesting and attractive way to access credit for consumers that may not have other forms of payment; perhaps a lack of credit history has precluded them from getting a credit card. Consumers get quick credit decisions from the BNPL provider so they can focus on the shopping experience.

If you don’t pay the BNPL, you may be charged a late payment fee.

Drop a Comment