How do Banking APIs help a business? Are they quintessential? Let’s find out.

API Banking 101: A comprehensive guide to API Banking

Table of Contents

Picture this.

If you could incorporate the best attributes of all the development tools to supercharge your offering, imagine its potential to unlock in such a scenario.

This is exactly what happened in the last decade in banking and financing. We have witnessed APIs disrupt and fundamentally transform your banking experience. This way of securely and efficiently distributing software and sensitive data by combining one application’s functionality with another via APIs has become the new norm.

Where at one point in time, any company, be it a startup or an enterprise, that needed to collaborate with a legacy financial institution has several hurdles to overcome on the way, today there are solutions [case in point – Decentro] that help you go to market within a matter of weeks.

The differentiator?

Banking APIs.

Once a niche, they are slowly transforming towards becoming the new norm of the finance world. Their market size is expected to reach $15,000 mn by FY27, just in India.

So, first things first.

What are Banking APIs?

API or application programming interface helps two entities to transfer data seamlessly.

Banking APIs enable any trusted 3rd party to avail of a banking institution’s services or allow the same for another entity. Fintechs leverage a protocol known as API banking to incorporate various offerings and facilitate the same for their customers.

For example, if you are looking for a convenient way to process your B2B payments and manage your cash flow, API banking might be the answer!

But how do these Banking APIs work?

API Banking is relatively simple and can be explained in a three-step process.

Here Financial Institutions allow limited and secured access to their core banking system to third-party platforms to access data and execute a myriad of banking functions such as transactions, verification, validation, balance queries, and much more.

Due to the complexity of direct integration with the banks and lack of proper documentation, API providers simplify the herculean task of integrating with banks.

According to McKinsey, this ease has paved the way for around 75 percent of the top 100 banks globally to have made public APIs available.

Types of Banking APIs

Currently, three types of APIs provide a gateway to more innovative solutions. These include:

- Private APIs — Most commonly used within the traditional banking organization, private APIs help enhance operational efficiency and are considered essential by most banks.

- Partner APIs — Typically occurring between a third-party partner and a bank, partner APIs allow for expansion, especially for new channels, products, etc. For example, a bank could work with a third-party company to create loan documents about loan applications, increasing efficiency. Most banks will transition from private to partner APIs.

- Open APIs — This set of APIs lately has become quite famous in the banking industry. These APIs make data available for third parties that may not have a formal relationship with banks. This is where fintech solutions, or API banking service providers, thrive and cater to customers’ desire for better digital banking solutions.

Types of Banking API models

The above types of banking APIs form a part of three big models prevalent in the banking space.

- Open Banking

The new “IT” model of the Fintech space makes it one of the most widely adopted API banking models. Open banking is a system where the banks securely share customer banking data with authorized 3rd-party developers via open bank APIs. This data enables them to build applications and services that make banking more fluid and accessible.

Open banking delivers on the promise of:

- Better customer experience

- Transparency and Control of Data

- Exposure to new customer segments via the third-party providers

- Banking as a Service [BaaS]

So, is BaaS the same as open banking?

No, they aren’t the same. The two models often need clarification since open banking involves banks connecting to non-banking institutions via APIs. However, the models serve different purposes.

Open banking uses technology like APIs to offer nonfinancial and financial businesses a network of financial products like accounts and transaction methods. This means third-party providers are allowed access to payment products to design and build new user experiences. From the bank’s perspective, Open Banking is like extending their banking charter to other companies.

An example of open banking would be a personal finance app enabled by banking technology that lets customers view insights into their monthly spending online.

BaaS is an end-to-end approach that enables fintech companies and other third-party organizations to connect with a bank’s system using APIs. This way, even non-bank businesses can offer customers digital banking services without acquiring a license.

BaaS generally has four primary users in the form of banks, fintechs, non-fintech canopies, and end users in the form of customers. For these users, BaaS holds the potential to serve them with

- Lending Opportunities

- Online Banking

- Neo Banking

- Investment Services

Bonus read– We have a complete article elucidating everything you want to know about BaaS. Feel free to indulge.

3. Platform Banking

Platform Banking enables companies and fintechs to offer banking products and services via API banking platforms. Software vendors or the bank’s in-house teams develop applications and workflows to publish APIs. Banks then provide this platform to enrich customer experience and smooth banking. This approach is usually a ploy to compete with innovative fintech solutions.

Banking APIs For Different Growth Stages of Your Company

Let’s trace a company’s lifecycle, right from its nascent stage, with the finest example of metamorphosis!

Cocoon: In Stealth

Let’s imagine that your company is starting. There’s a lot to do and lots to achieve. Therefore, you’d probably require the following:

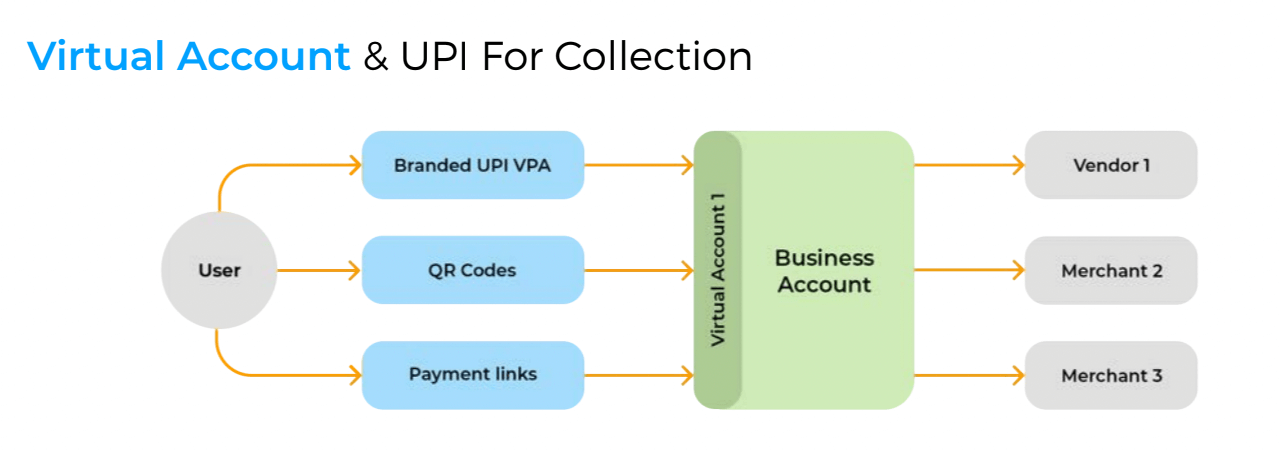

Seamless Payment Collections

Create smooth payment workflows for your customers & partners. While you make money transfers easy, you also get the opportunity to diversify the methods; why limit to simple bank transfers when you can ride the wave of UPI and QR code-backed payments?

Simplified Reconciliation with Business BaaS

Use business banking as a service(BaaS) to perform operations such as facilitating account deposits, linking accounts & aggregating them, money transfers, fetching account statements, and analyzing them! How your cash flow cycle gets simplified with business BaaS is quite underrated, and the Fabric module of Decentro is centered on doing just that.

Smooth User Onboarding

Even if your business doesn’t reside in a fintech or banking domain with strict guidelines for background checks for users, KYC still forms an integral part of a business cycle. While starting, it would be easier to perform this verification. However, when you scale, the need for automation is undisputed.

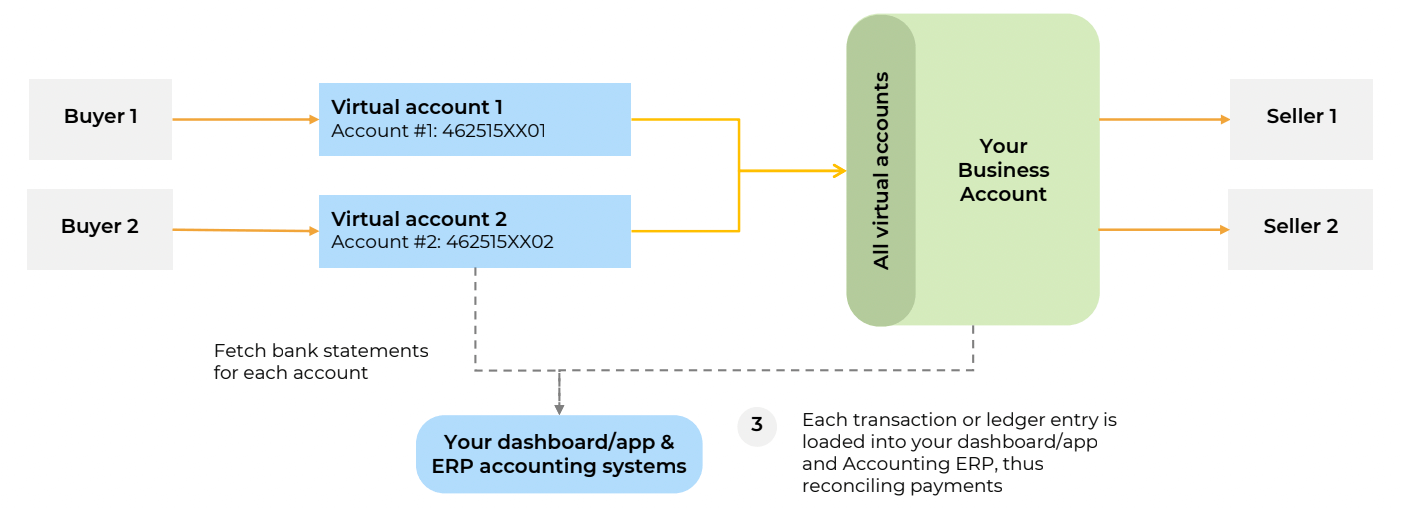

Real-Time Transaction Reconciliation

The amount of time, resources, and money businesses waste reconciling transactions is alarming. With API banking, you can employ virtual accounts to trace the source of every payment via your company. Make your ledgers up to date and the bookkeeping process efficient in real time!

Butterfly: In Flight

Now, imagine where your company is earning revenue and helping more customers. You can use banking APIs and optimize your cash flow cycles.

Turbocharge with Automation

Furthermore, you can sit back to automate all those mundane tasks and pivot your team & resources for more important things. For example, automate the process of collections and disbursals, taking the rut out of it.

Dip Toes into Embedded Finance

Embedded finance helps your business to step into new vertical markets without burning a lot of investment and unlocking new revenue opportunities. Thus, once you have your roots firmly in your target market, dip toes in new sectors, explore new verticals, and build new business models. One of the finest examples would be making your BNPL product with banking APIs.

Streamline Credit

If you are an NBFC or fintech lender offering lending services as a core product or as an extension by leveraging embedded finance, banking APIs will simplify the process.

- Want to know the credit score of users before providing loans? Check! ✅

- Want to disburse loans quickly for a great customer/partner experience? Check! ✅

- Want to streamline & speed up the process of collections from users? Check! ✅

How can Decentro Empower Your Business?

When our Founder & CEO, Rohit, was running his previous venture Mypoolin (that got acquired by Wibmo, & later PayU), he encountered repetitive hurdles related to banking integrations.

- Long waiting & compliance cycles,

- Incomplete documentation,

- No sandbox to test without business approvals,

- Lack of a single business POC within the bank to take the final call,

… the list went on.

That’s how Decentro was born- to help businesses resolve the challenge of long-drawn & exhausting banking API integrations. Let’s see how!

Launch Products 10X faster

… and at 90% lesser overhead expenditure. Skip the pendulum between various departments for approvals, compliance checks, and clarifications. We take care of all this so that your business can achieve faster go-to-market timelines and you can focus on what’s important for your business.

Milliseconds Response Times & > 99.9% Uptime

We understand that some businesses could suffer massive losses even for a short downtime. Therefore, we want to build APIs that help your developers just as much as it helps your business. With more than 99.9% uptime, our APIs bring you response times up to a few milliseconds to make any workflow you build efficient.

Multi-Bank Architecture in the Backend

Unexpected downtimes, black swan events, or volume spikes? No worries! We’ve built a multi-bank architecture to handle any of these. If one service provider faces any glitch, we’ll re-route the operations so your business can run uninterrupted without any adverse effects.

95% Faster Customer Onboarding

Provide a smooth customer onboarding experience to your customers with our KYC APIs. Run comprehensive background checks on your customers/partners using national documents, and onboard them in real-time.

Minimize your Customer Acquisition Cost

Bank customer acquisition cost is one of the most significant expenses in the industry, as most banks and lenders spend around $200 per acquired customer. Don’t compromise on customer experience, and ensure that you cater to all your customer needs, which eventually stem from the need for efficiency. Let your customers tap into various verticals with Decentro’s API banking platform. We can do everything from business banking for accounts linking, aggregation, statement fetching, or simplifying payments, optimizing lending workflows & launching your own custom BNPL product.

In a hyper-personalized world, companies have started differentiating themselves by building personalized user workflows using APIs. At Decentro, besides absorbing the complex banking workflows, our platform handles the underlying regulations while dealing with each banking product.

Is it an investment you are ready to make for your business?

Frequently Asked Questions

API or application programming interface helps two entities to transfer data seamlessly. API banking refers to protocols that make a bank’s services available to other third-party companies via these APIs.

While the common goal of delivering a better banking experience for customers and overall efficiency remains a constant across banking APIs. There is also the added benefit of access to the richer database, streamlining administrative tasks, and transparency.

Very. API usage has been instrumental in improving security for banking transactions by providing a secure way for different systems and applications to communicate and share data. This makes it much harder for hackers to access sensitive financial information.

A few key examples of banking APIs include analytics, account authentication, account information, payment processing, and even loyalty programs.

As API Banking adoption grows, so does the concern around the following factors increases

1. API Standardization and Documentation

2. API Security

3. API Compliance and privacy regulations

4. API Reliability & Performance

Drop a Comment