Learn about the UPI Lite, its importance, uses, how it works, transaction limits, and more to streamline your business operations.

UPI Lite 101: Features, How It Works, Limits, and More

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

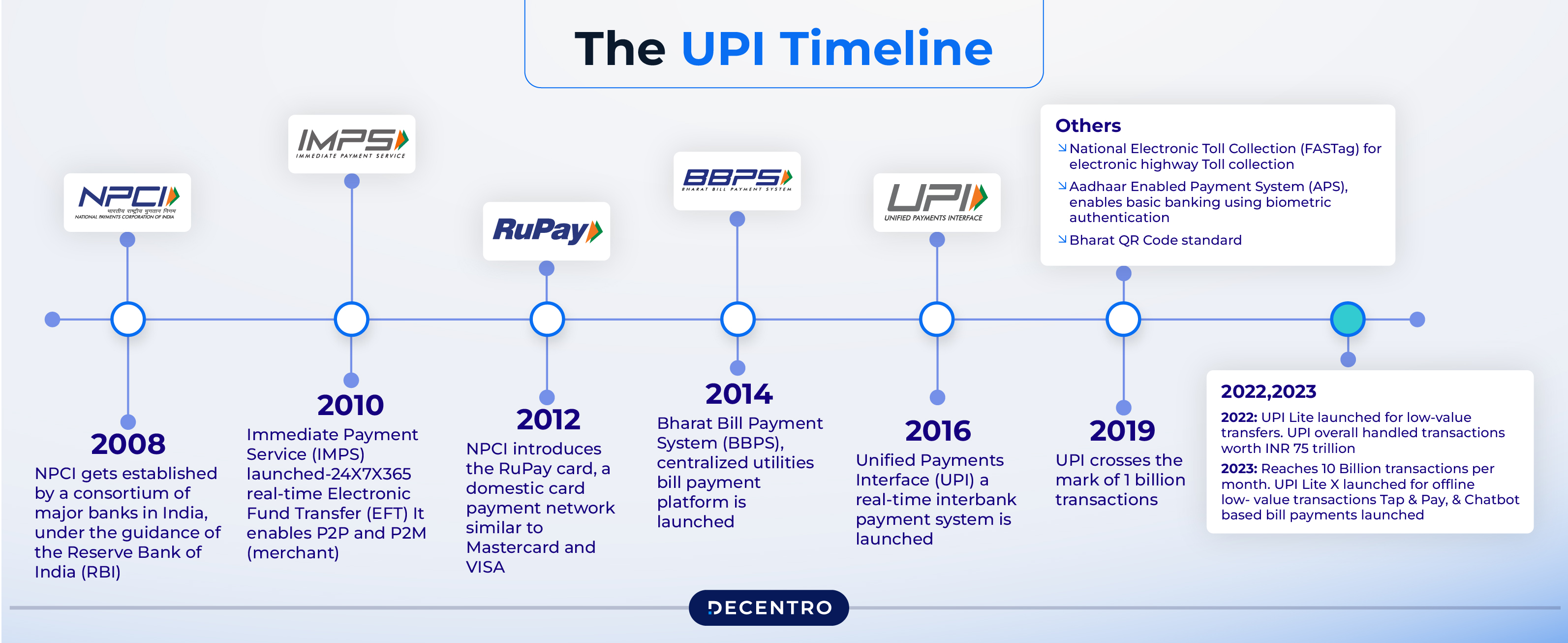

UPI has transformed digital payments in India since its introduction by NPCI in 2016. Initially designed for simple money transfers, it quickly became popular due to its ease of use, secure transactions, and instant processing.

Over time, UPI expanded its features, including bill payments, QR-based transfers, and merchant transactions, making it a go-to solution for everyday financial needs.

In 2022, NPCI introduced UPI Lite to enhance the payment experience further. This simplified version of UPI focuses on low-value transactions, offering a faster and more seamless option for small payments, even in offline settings.

Let’s examine UPI Lite, how it works, and the limitations it addresses. This will offer insights for seasoned users and those new to digital payments.

What Exactly is UPI Lite?

UPI Lite is an online wallet choice in UPI apps developed by NPCI. With UPI Lite, you can send money without entering the UPI PIN. This will allow you to conduct transactions up to ₹1000 and a daily limit of ₹4,000. These features are available on Google Pay, PhonePe, and BHIM, among others.

This new addition to the UPI ecosystem supports a smooth, offline payment experience for users, enabling instant payments without relying on network connectivity. Unlike conventional UPI systems, the UPI Lite system performs its operations using bandwidths and does not require conventional two-step authentication for small-scale transactions.

Market Statistics and Geographical Insights

Since its inception, UPI has been one of the fastest-growing payment systems worldwide. In April-July 2024, Unified Payments Interface (UPI) logged a whopping ₹80.8 lakh crore ($964 billion), reflecting an impressive 37% annual growth.

UPI, or the Unified Payments Interface system, continues mushrooming on Indian soil. It remains the world’s largest marketplace for digital payments. Recently, UPI Lite was developed to simplify the process and make it less dependent on internet connectivity, especially for villages.

The geographical reach of UPI Lite is targeted at better financial inclusion in areas where traditional UPI requirements may be a barrier, such as weak internet and poor mobile network coverage. Although UPI Lite is available across the country, it mainly benefits the rural population, who will experience faster access to digital payment.

As of August 10, 2023, over 63% of the UPI Lite payments have been processed through the Paytm QR codes from the Paytm app. So far, Paytm Payments Bank has seen 50 million transactions in UPI Lite. Also, the total value of Paytm UPI Lite transactions touched ₹280 crore.

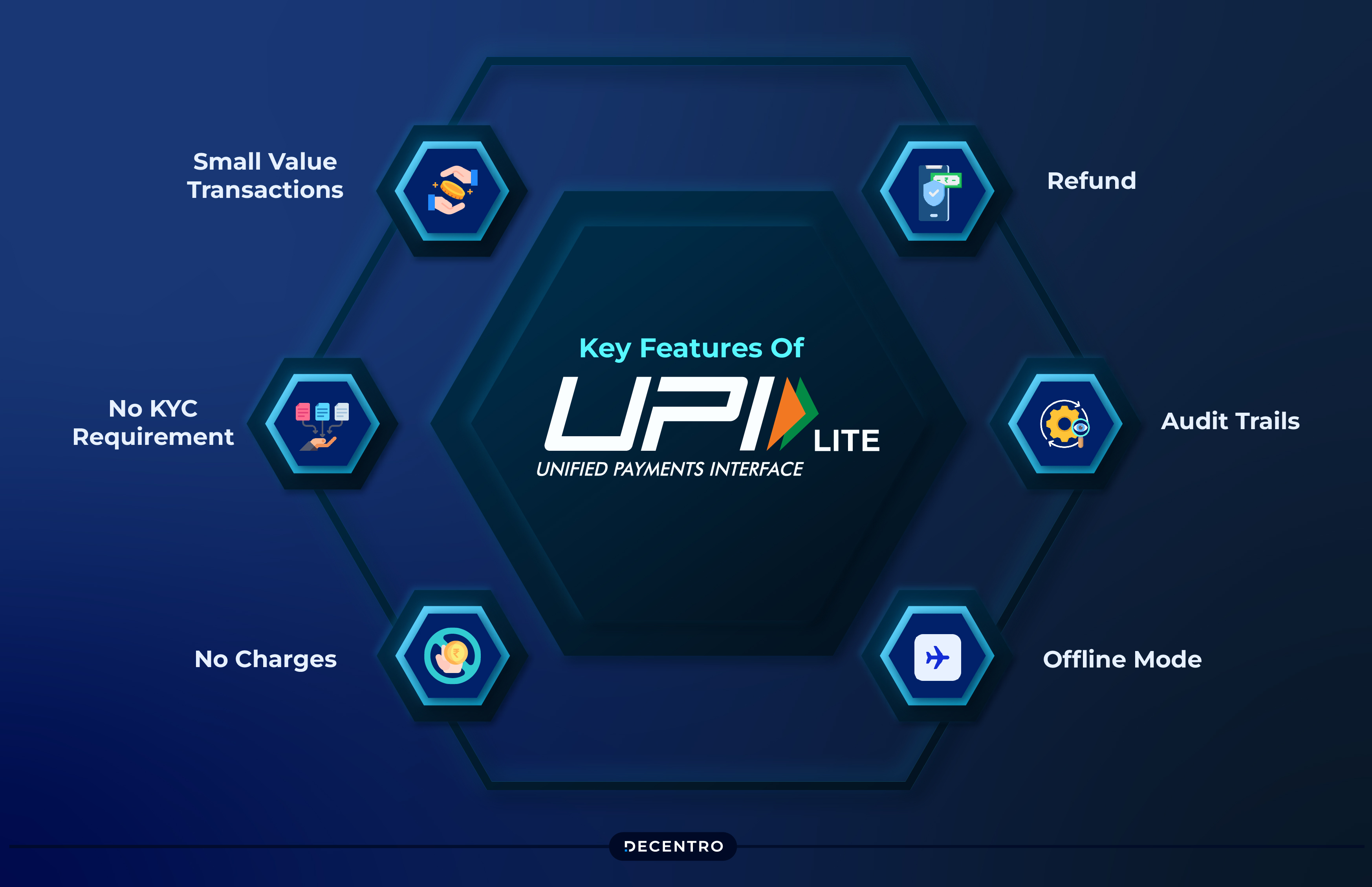

Discover the Key Features of UPI Lite

Here’s a set of unique features that make UPI Lite the go-to choice of users for hassle-free yet efficient management of small-value transactions. Some of these features include:

- Small Value Transactions

Since users can carry out small transactions without inputting a UPI PIN, it is relatively quicker and more convenient for everyday and low-value payments, such as buying groceries or making similar payments at a local store.

- No KYC Requirement

UPI Lite streamlines the onboarding process because it doesn’t require full KYC. This means that users, especially those in rural areas or who lack documentation, can quickly access and use the service.

- No Charges

The primary advantage of UPI Lite is that it eliminates additional charges for making transactions. Unlike other payment methods that often impose transfer fees, UPI Lite ensures a cost-free experience, making it an attractive choice for frequent and smaller transactions.

- Offline Mode

UPI Lite enables users to make payments even without the Internet. The technology utilises mobile NFC, allowing offline credit transactions when the data network is absent or weak. However, in offline mode, users can only make 10 credits and 1 debit within the day.

- Audit Trails

Although the UPI Lite transactions are secured, they are not shown in bank statements. All the details of transactions appear only within the UPI Lite application. This keeps all transactions well-organised and contained within the app for the user’s ease of use.

- Refund

If the user’s device is lost with the UPI Lite balance activated, the amount can be retrieved by applying for a refund through the user’s bank. This ensures that even if the device gets lost or stolen, the user’s balance remains protected, and the money is recovered by completing the refund procedure with the bank.

How Does UPI Lite Work? A Simple Breakdown

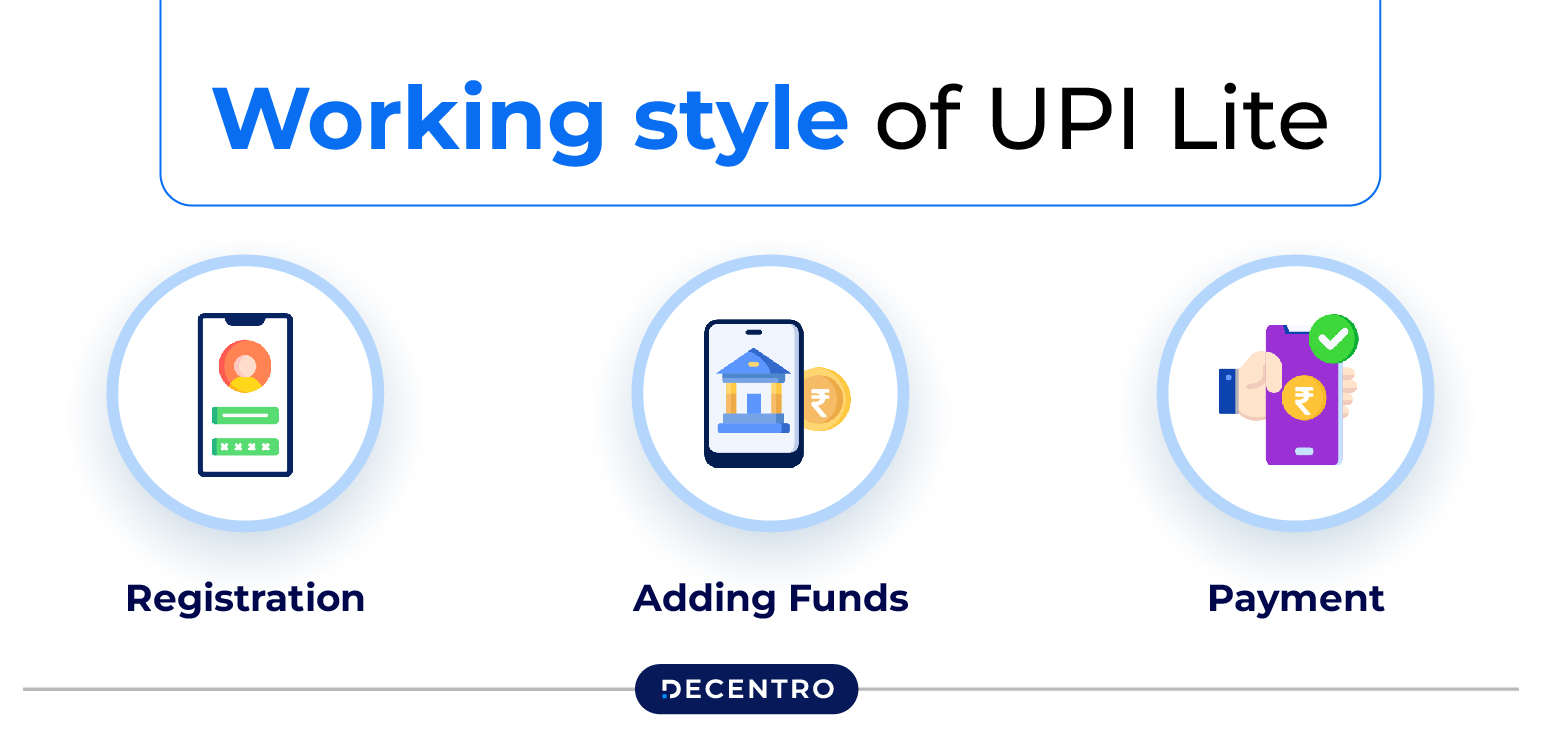

Here is a detailed breakdown of the working style of UPI Lite:

- Registration

To enable the UPI Lite feature, new users must download an app like Google Pay or BHIM and add their bank account. Existing users of these apps can start using the feature immediately by adding funds.

- Adding Funds

To use UPI Lite, a user must top up their UPI Lite wallet. This can be done by transferring money from their linked bank account to the UPI Lite wallet using their chosen app, such as Google Pay or BHIM.

The process is simple and time-effective. Users only need to maintain a balance for small-value transactions. The amount added can be used to make offline payments without an active internet connection.

- Payment

Once funds are added, users can make small transactions of up to ₹1000 each without requiring their UPI PIN. They can also make payments through different means, such as UPI-enabled QR codes or by keying in the recipient’s phone number.

How Can I Operate UPI Lite?

The UPI Lite payment facility is available through numerous payment options in India. Given below are the details of using it with different applications:

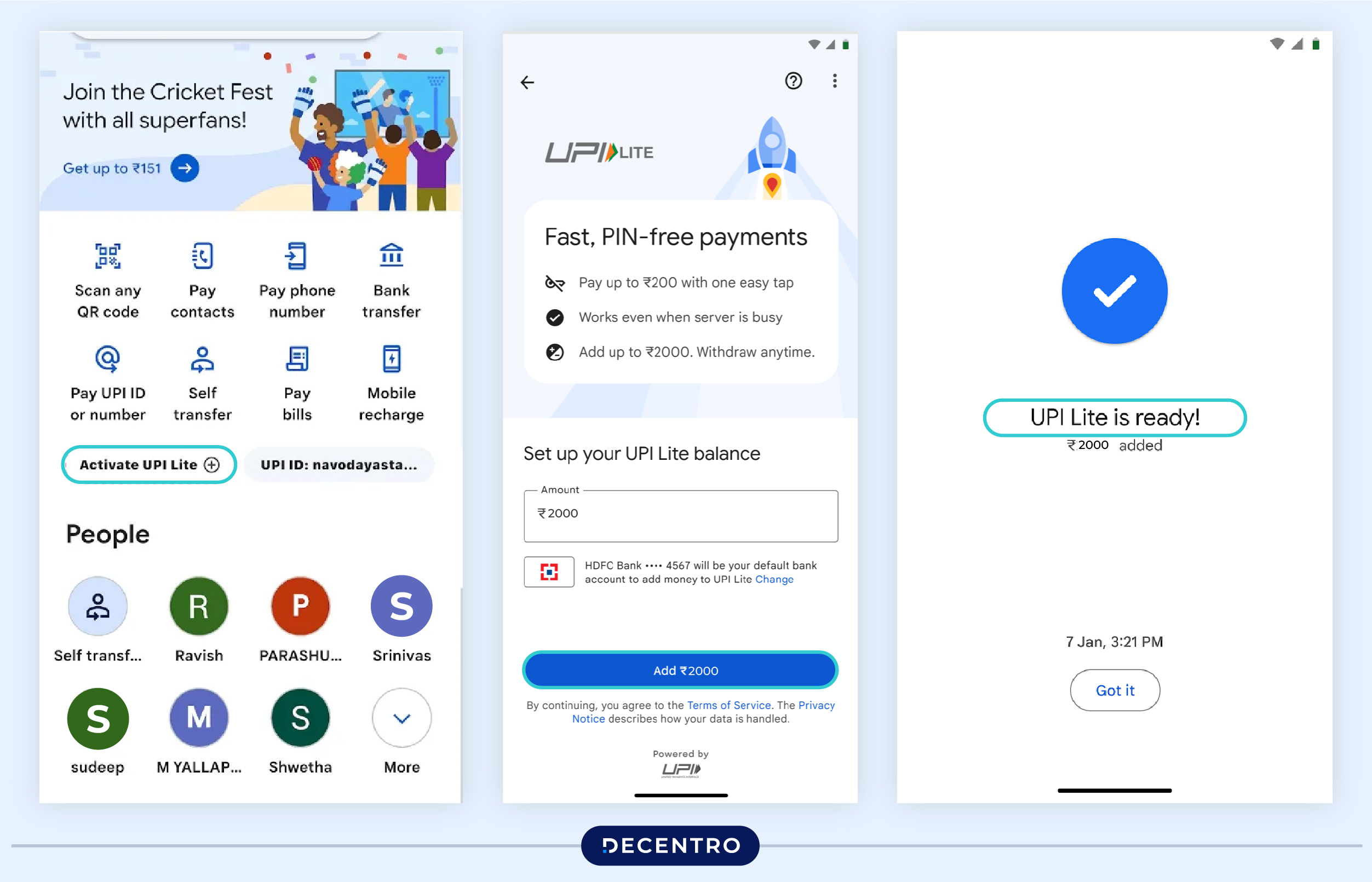

Using Google Pay

Use the steps below to make use of UPI Lite through Google Pay:

Step 1: Download and install the Google Pay app on your device.

Step 2: Open the app and tap on your profile picture at the top right.

Step 3: Choose ‘Pay PIN-free UPI Lite.’.

Step 4: Enter the sum you want to put into this account, with a limit of ₹2,000.

Step 5: Enter your UPI PIN.

Once you follow the steps above, the particular sum will be debited and added to your UPI Lite balance.

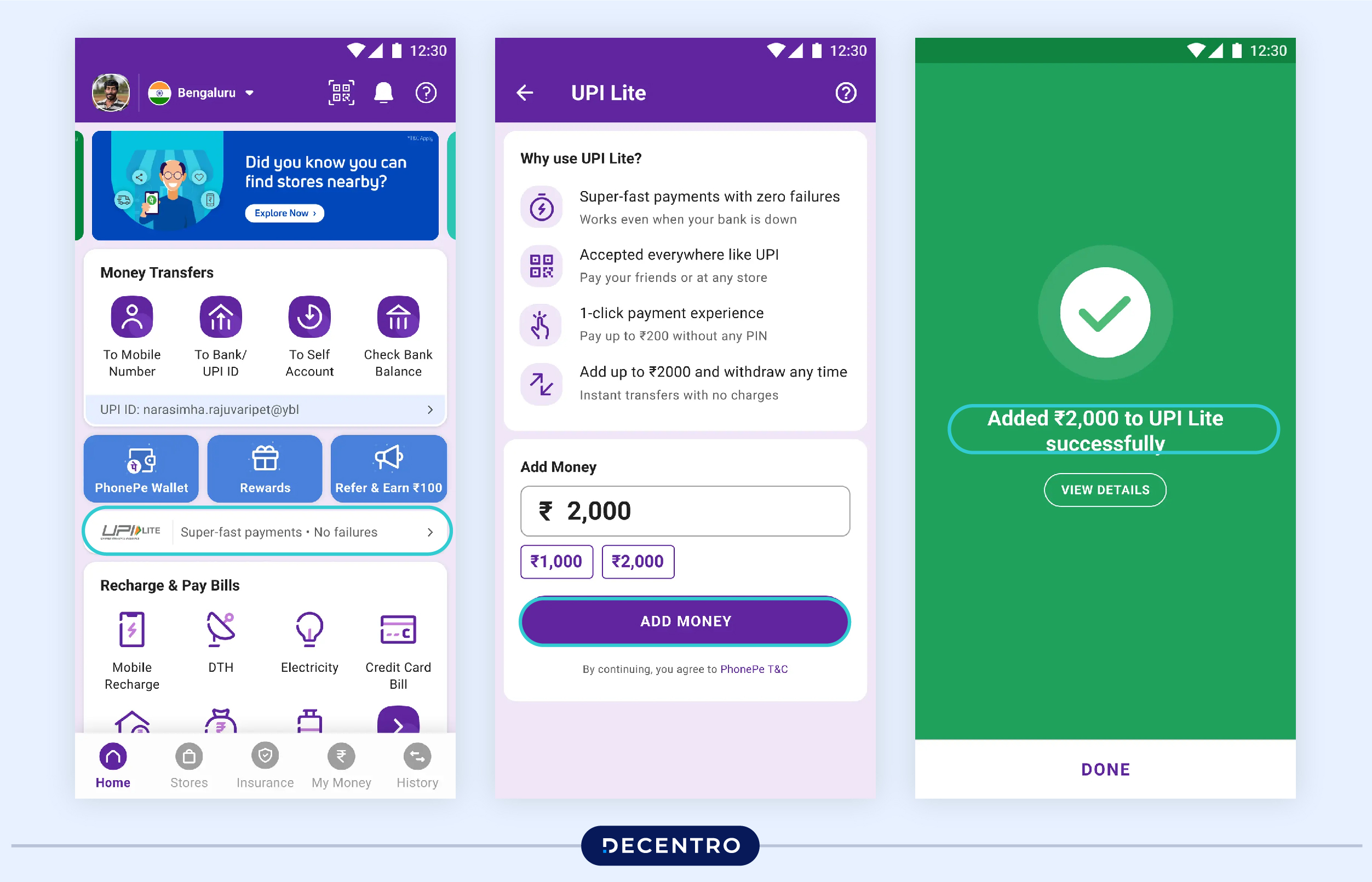

Through PhonePe

To avail of the service of UPI Lite through PhonePe, follow the steps below:

Step 1: Download the PhonePe application on your device.

Step 2: Open the app and tap on your profile picture.

Step 3: Select the ‘UPI Lite’ option under ‘Payment Methods.’

Step 4: Enter the amount you want to add, with a maximum of ₹2,000.

Step 5: Choose your bank account and then provide your UPI PIN correctly.

Your UPI Lite account will be ready for transactions.

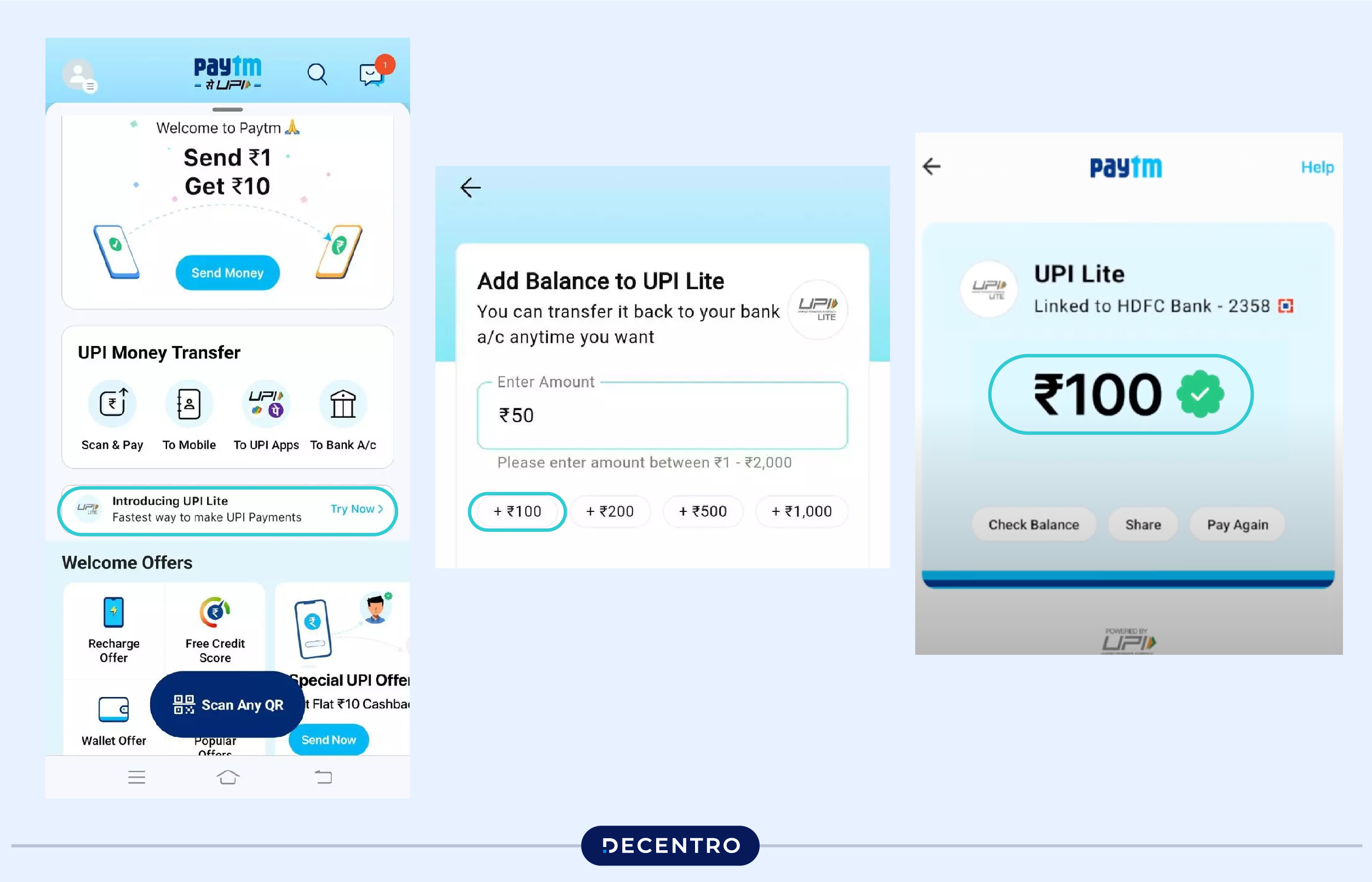

Using Paytm

Here’s how to access UPI Lite through Paytm:

Step 1: First, open the Paytm application on your smartphone.

Step 2: Click on your profile at the top-left corner.

Step 3: Navigate to ‘UPI & Payment Settings’ and select the ‘UPI Lite’ option under ‘Other Settings’.

Step 4: Select a bank account that features the UPI Lite option.

Step 5: Enter the amount you wish to add and click on the ‘Add Money to UPI Lite’ button.

Step 6: Input your MPIN.

Your UPI Lite account will be successfully activated on Paytm.

How Can I Transfer Money from UPI Lite to a Bank Account?

Following is the simple step-by-step procedure to transfer all your funds from the UPI Lite to your bank account:

Step 1: Open the UPI application where you have already registered for UPI Lite.

Step 2: Navigate to the ‘UPI Lite Settings’ and tap on the ‘Deregister UPI Lite’

Step 3: Input your UPI PIN for the final confirmation.

After a few minutes, the remaining balance in your UPI Lite account will be automatically transferred to the bank account from where you fund it.

UPI Lite Supported Banks List

Here is a list of banks and financial institutions in India that are supporting UPI Lite as the sending party:

sending party:

| Financial Institution/Bank | Type of Financial Institution/Bank |

| Axis Bank Limited | Private sector bank |

| AU Small Finance Bank | Public bank |

| Bank of India | Public sector bank |

| Bank of Baroda | Public sector bank |

| Canara Bank | Public sector bank |

| Cosmos Bank | Private sector bank |

| Central Bank Of India | Public sector bank |

| Equitas Bank | Public sector bank |

| Fincare Small Finance Bank Limited | Public sector bank |

| Federal Bank | Private sector bank |

| ICICI Bank | Private sector bank |

| HDFC Bank Limited | Private sector bank |

| Indian Overseas Bank | Public sector bank |

| Karnataka Bank | Private sector bank |

| Indian Bank | Public sector bank |

| Paytm Payments Bank | Public Company |

| Kotak Mahindra Bank | Private sector bank |

| Janata Sahakari Bank Limited Pune | Scheduled co-operative bank |

| Punjab National Bank | Public sector bank |

| Punjab and Sind Bank | Public sector bank |

| Saraswat Bank | Multi-State co-operative bank |

| State Bank Of India | Public sector bank |

| Tamilnad Mercantile Bank | Private Sector bank |

| Shamrao Vithal Co-operative Bank | Co-operative bank |

| Union Bank of India | Public sector bank |

| UCO Bank | Public Sector bank |

| Yes Bank | Private sector bank |

| Utkarsh Small Finance Bank | Scheduled commercial bank |

Understanding Transaction Limits in UPI Lite

A user could actually transact with a limit of ₹4,000 per day in ₹500 per transaction under UPI Lite. Users can also keep up to a maximum balance of ₹2,000 a day in their UPI Lite accounts. These limits exist to keep UPI Lite a low-value, quick-transaction system, preventing large amounts from being processed in offline payments.

Why You Should Consider Using UPI Lite?

Here are the major reasons for choosing UPI Lite as your payment option:

- Using UPI Lite has increased the success rate of transfer payments.

- Single-factor authentication for all transactions up to ₹500 would relieve the infrastructure load on the Remitter Bank’s Core Banking System.

- Transactions made through UPI Lite will not be reflected in the user’s passbook, thereby giving a cleaner bank statement.

- UPI Lite comes with easy-to-use interfaces that make quick transfers.

UPI Lite vs. Regular UPI: What’s the Difference?

Following are the major differences between UPI Lite vs. Regular UPI:

| Aspects | UPI Lite | Regular UPI |

| Product | UPI Lite is an in-device payment method by which a user can send funds from their UPI Lite account to a recipient’s bank account. | UPI is a real-time payment gateway that allows transactions between two bank accounts 24/7. |

| Transfer Limit | UPI Lite allows you to transfer up to ₹4,000 in 24 hours. | The number of transactions allowed per day via UPI is set at ₹1 Lakh. |

| Number of Transactions | There is no such limit of transactions per day in UPI Lite, though each transaction is limited to up to ₹500. | Contrariwise, in UPI, users are allowed to make up to 20 transactions in a 24-hour day. |

| Money Transfer | UPI Lite permits only money transfers. Money received through it shall be routed to the customer’s bank account, not to the UPI wallet. | A user is allowed to transfer and accept money through UPI. It doesn’t have a wallet for offline transfers. |

| PIN Constraint | UPI Lite does not require a PIN to conduct funds transfers. | To conduct a fund transfer through UPI, the user must enter a 4-6-digit PIN. |

| Record | Transactions carried out through UPI Lite are not recorded in the bank’s passbook, but the transaction status is confirmed to the user through an SMS. | The issuing bank records All transactions through UPI in the user’s passbook. |

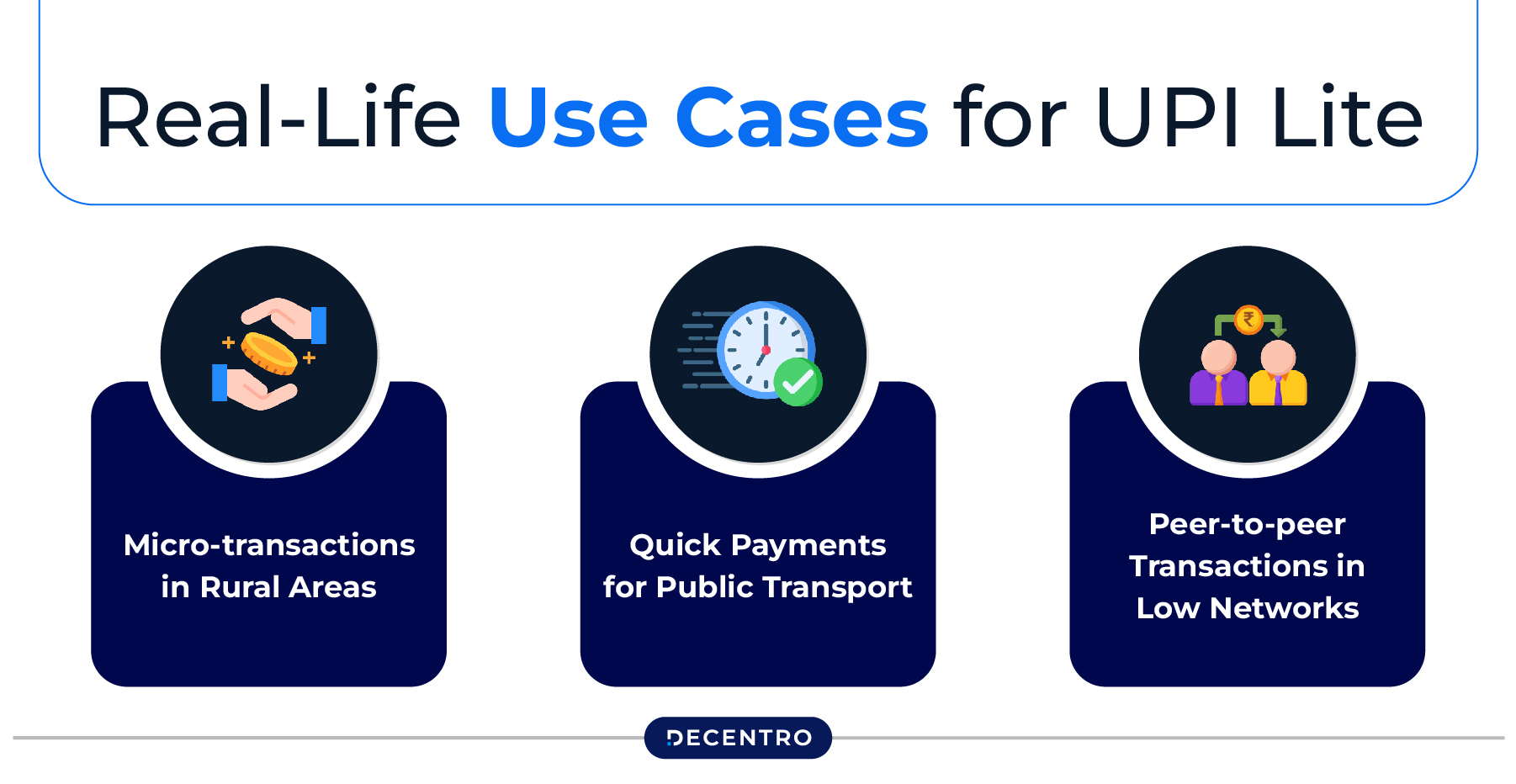

Real-Life Use Cases for UPI Lite

UPI Lite is changing the whole game in terms of digital transactions, and it can make payment a lot easier during most of its use cases with segments of the country that are underserved by the Internet. Here’s how it works for individuals:

- Micro-transactions in Rural Areas

UPI Lite can be the lifeline for these small vendors or shopkeepers in rural areas where internet access is sporadic

Consider a farmer in a village selling fresh produce. With UPI Lite, such a person is able to get cash from customers even without a stable internet connection and do away with cash payments, speed up transactions, and reduce the need to personally carry currency, thus making it easier for both vendors and buyers to do business.

- Quick Payments for Public Transport

UPI Lite is a huge time saver in ticketing processes for these daily commuters who mostly travel by public trains. Most of the fares incurred are less than ₹200 for buses, metros, and trains, giving rise to a situation where you are supposed to waste time waiting for at least an internet connection or for issues related to phone data.

With UPI Lite, everything goes pretty easily. It helps you quickly board the transports, even during rush hours or at stations where signals tend to be weak.

- Peer-to-peer Transactions in Low Networks

UPI Lite will become critical in rural areas because sending money to relatives in many rural communities becomes impossible at certain times or even at different times of the year.

Keeping Your Transactions Safe: Security Measures in UPI Lite

UPI Lite carries out two-factor authentications and robust security measures on transactions.

- Biometric Authentication

It uses fingerprint recognition or iris scanning to authenticate payment processes.

- One-Time Password (OTP)

A different password for a different transaction ensures the process ends securely.

- No Retention of Sensitive Information

UPI Lite does not store sensitive information or transaction records on the device. All data is deleted once a payment is confirmed, reducing the risk of data breaches or misuse.

Busting Myths: Common Misconceptions About UPI Lite

- UPI Lite is Less Secure

Although UPI Lite works without internet connectivity, it has all its security features, just like traditional UPI transactions. The system applies cryptography, secures PIN-based authentications, and limits transactions to ensure that money is saved safely, totally against the idea of insecurity concerns.

- UPI Lite Is Only Suitable for Small Payments

Many believe that UPI Lite is only limited to micro-transactions under ₹200. That’s true, but the utility of these small payments is immense, especially in public transport, rural markets, and micro-merchants. It helps in having a digital-first economy for even the smallest transactions.

- You Can’t Track UPI Lite Transactions

Another widespread misconception is that UPI Lite payments need to be traced. In fact, any UPI Lite payment is recorded in the user’s bank statement. The transaction history, too, is available via the UPI app, which the customer can easily access.

- UPI Lite Is Not Available for All Users

Only some user account segments were initially available to use the UPI Lite, but as it becomes more prevalent, it is gradually being offered to a wider user group with a UPI-enabled account.

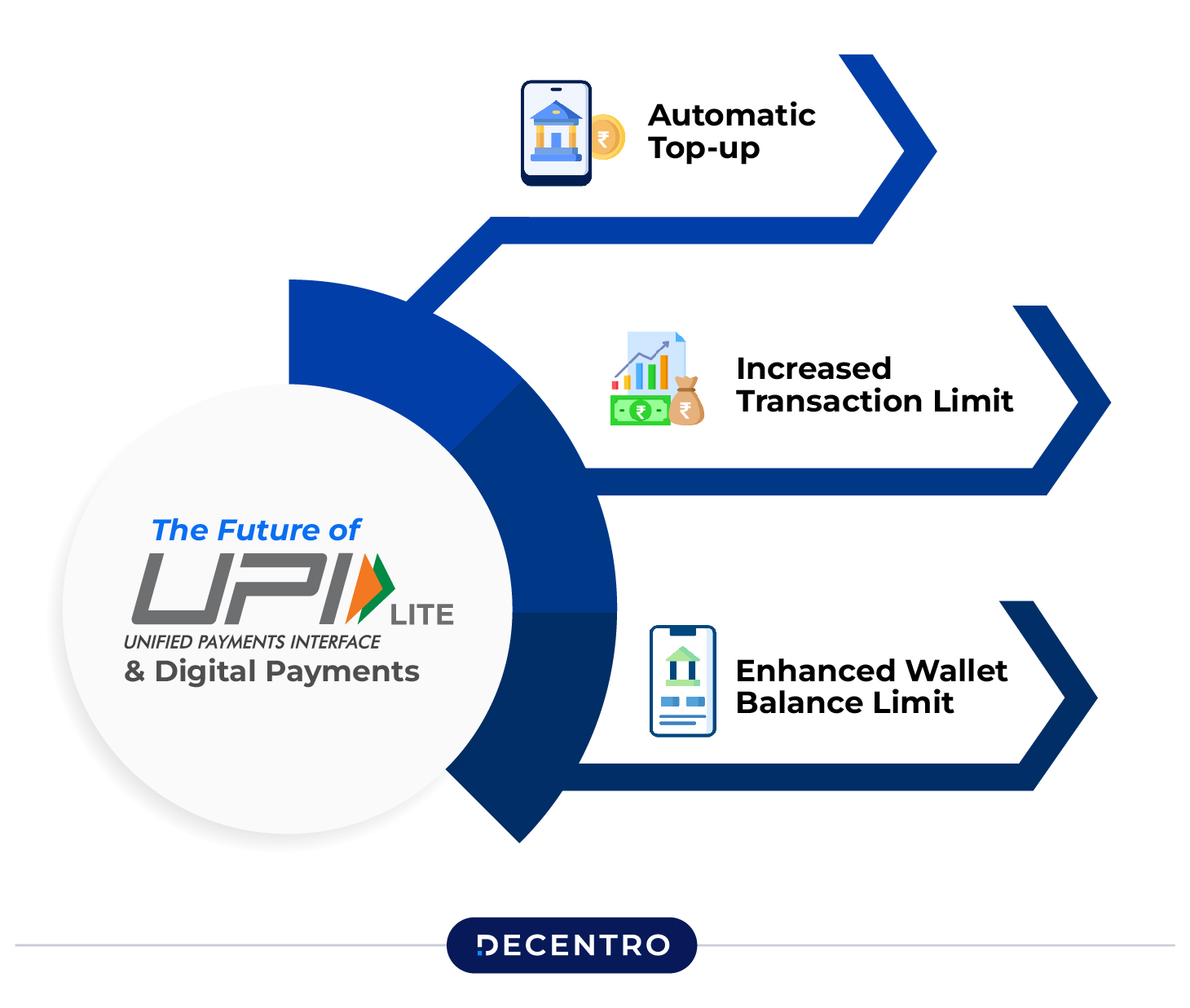

The Future of UPI Lite and Digital Payments: What’s Next?

The outlook for UPI Lite and digital payments in India is hopeful as substantial improvements to the UPI framework are being enforced by the NPCI and RBI. An announcement regarding the improvements for UPI Lite has taken effect since November 1, 2024:

- Automatic Top-up

The user can pre-designate a certain amount of credit and have the wallet automatically top itself up when the balance reaches a particular level.

- Increased Transaction Limit

The transaction limit on UPI Lite will be raised from ₹500 to ₹1,000 per transaction.

- Enhanced Wallet Balance Limit

The maximum permissible balance in the wallet will be increased from ₹2,000 to ₹5,000.

With successive innovations, UPI Lite is expected to play a central role in India’s cashless economy while promoting acceptability and ease. The future will also involve collaborating with fintech firms and local merchants to improve its capabilities, ensuring quicker adoption in underserved regions.

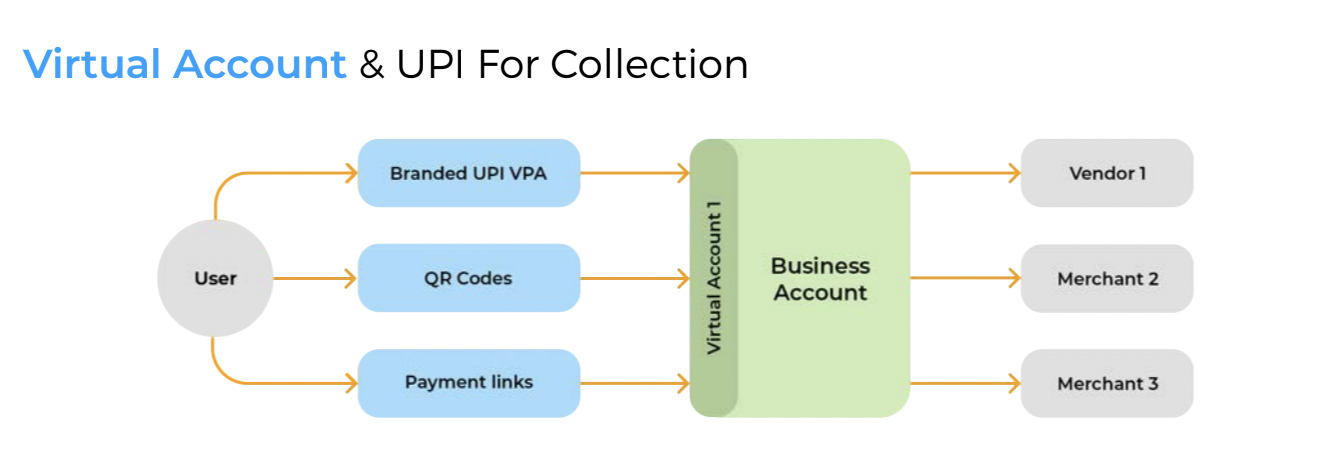

Decentro’s Payment APIs: Enhancing Digital Payment Solutions

A new generation of payment APIs launched by Decentro will revolutionise any business by adopting the best practices for using and optimising digital payments.

Imagine a solution that supports real-time bank transfers and offers customisable features tailored to your business needs. This is precisely what UPI Collect does; it helps simplify in-app payments with instant settlements and supports last-mile collections for your logistics or eCommerce operations.

With UPI Collect, managing recurring payments for loans, insurance premiums, and investment plan instalments becomes easier. You can also engage customers through conversational banking by sending automated payment requests via messaging apps.

Using Decentro’s APIs can improve operational efficiency and reduce transaction times while maintaining security across your digital payment channels. This lets you focus on what truly matters: growing your business and providing an exceptional customer experience.

To learn more about how Decentro’s payment solutions can change your world of business, feel free to reach out to us at hello@decentro.tech