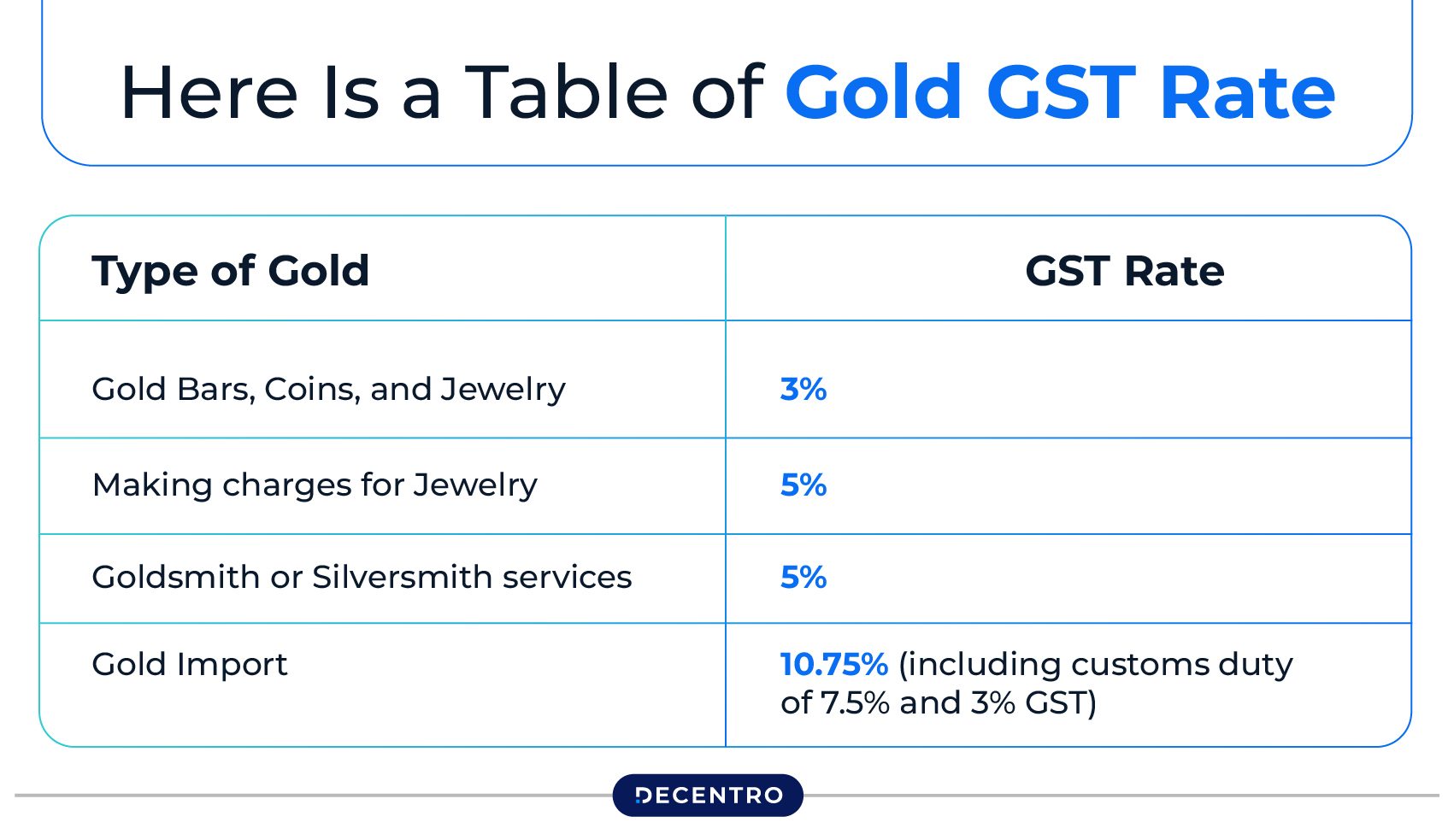

In India, a 3% GST is levied on gold price and 5% on the making charges. Keep reading to learn about the latest updates and implications on the gold GST rate in 2025.

Gold GST Rates for 2025 – Rates for Gold Purchases and Ornaments

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

GST, or the Goods and Services Tax, influences several commodities in the Indian market. Gold is not excluded from the list. Moreover, gold is among the few commodities on which GST is levied on different levels. From purchasing gold to its manufacturing, GST on the gold rate applies at every stage.

Knowing the applicable GST rates is essential if you are planning to invest in this asset or make custom-made ornaments for your loved ones. Read on to learn about the detailed overview of the gold GST rate in India and its latest updates!

Latest Update on Gold GST Rate in India

The customs duties on gold and silver have been reduced from 15% to 6% in the Union Budget of 2024-2025. Considering the popularity and demand of gold in domestic and international markets, reducing customs duties is a significant factor influencing the import and export of gold.

The essential customs duty on gold, previously 10%, has been lowered to 5%. Besides, the Agriculture Infrastructure and Development Cess has also been reduced to 1% from 5%.

These changes in custom rates have influenced the overall tax implications and GST on gold and silver. Gold and silver tax, previously 15%, has now been reduced to 6%.

What is the Gold GST Rate in India: A Detailed Breakdown

Individuals buying gold in India must pay GST on the amount purchased. Gold GST rate is applicable on purchasing, importing, and making charges of gold, but not on the sale of gold.

One can also save GST by exchanging old gold for new. Here is a table to illustrate the pre- and post-GST regime gold rates in India:

| Particulars | Pre-GST | Post-GST |

| Sales Tax | 1% | Nil |

| VAT | 1% | Nil |

| GST Rate on Gold Value | Nil | 3% |

| Gold Making Charges | Nil | 5% |

| Import Duty | 12.5% | 12.5% |

Gold Market Size and Consumer Trends

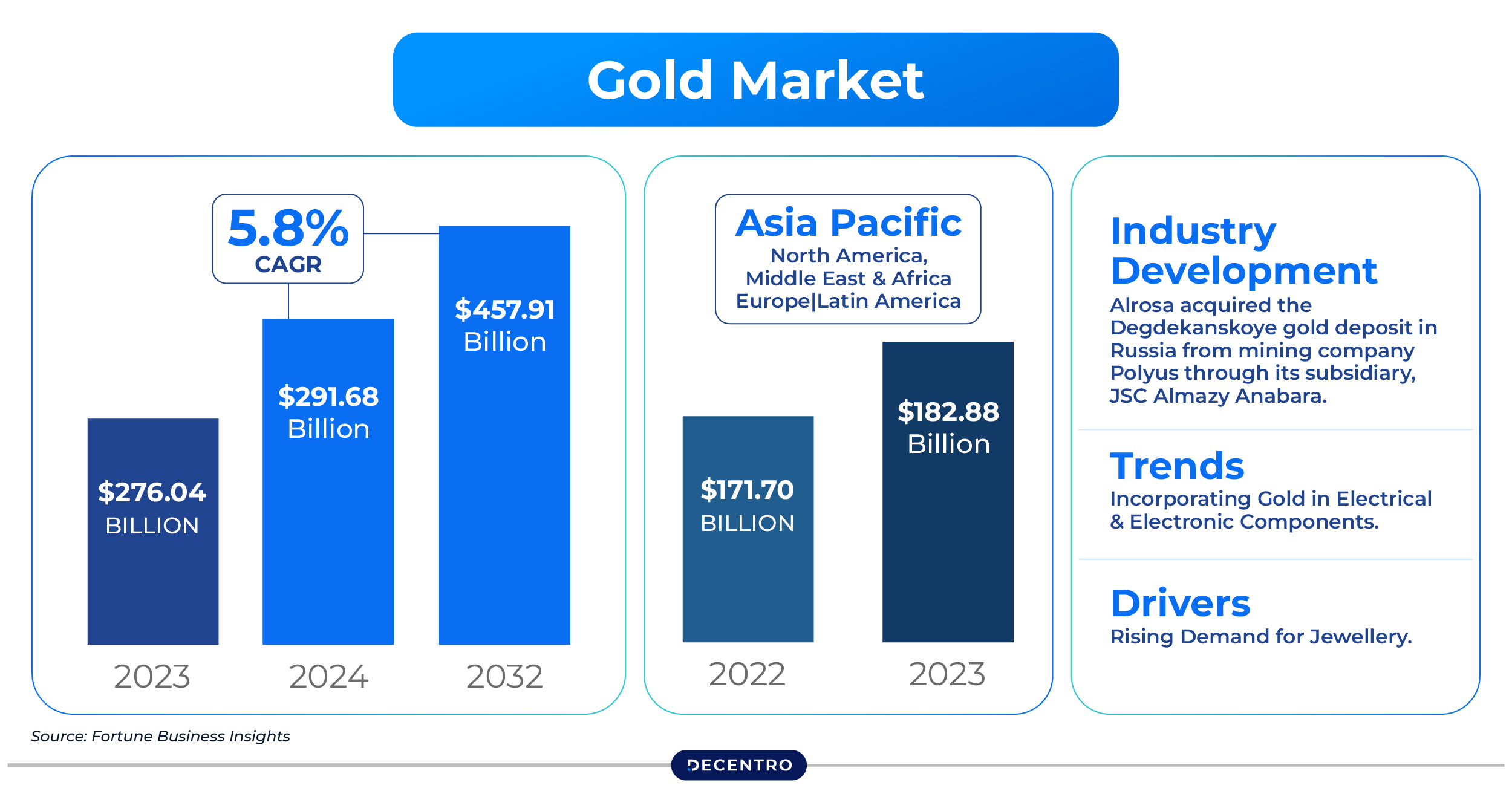

As per studies, the international gold market size is expected to grow to US$ 457.91 billion which records a CAGR of 5.8%. Since November 2024, both global and domestic markets have witnessed a considerable fluctuation in gold rates. The price of gold in international markets was at its peak during October with a price of US$2,670/oz2. It dropped by 4% in November.

The domestic market was not left behind and witnessed a 3% drop in gold rates in November. However, one of the crucial factors influencing this fluctuation in gold prices in India is the 0.8% drop in the Indian Rupee value against the US Dollar.

As a result, the gold rates in the domestic market have fluctuated from ₹78,699 to ₹73,477/10g since the end of October 2024. However, in mid-December 2024, the gold price in India was ₹77,185/10gm.

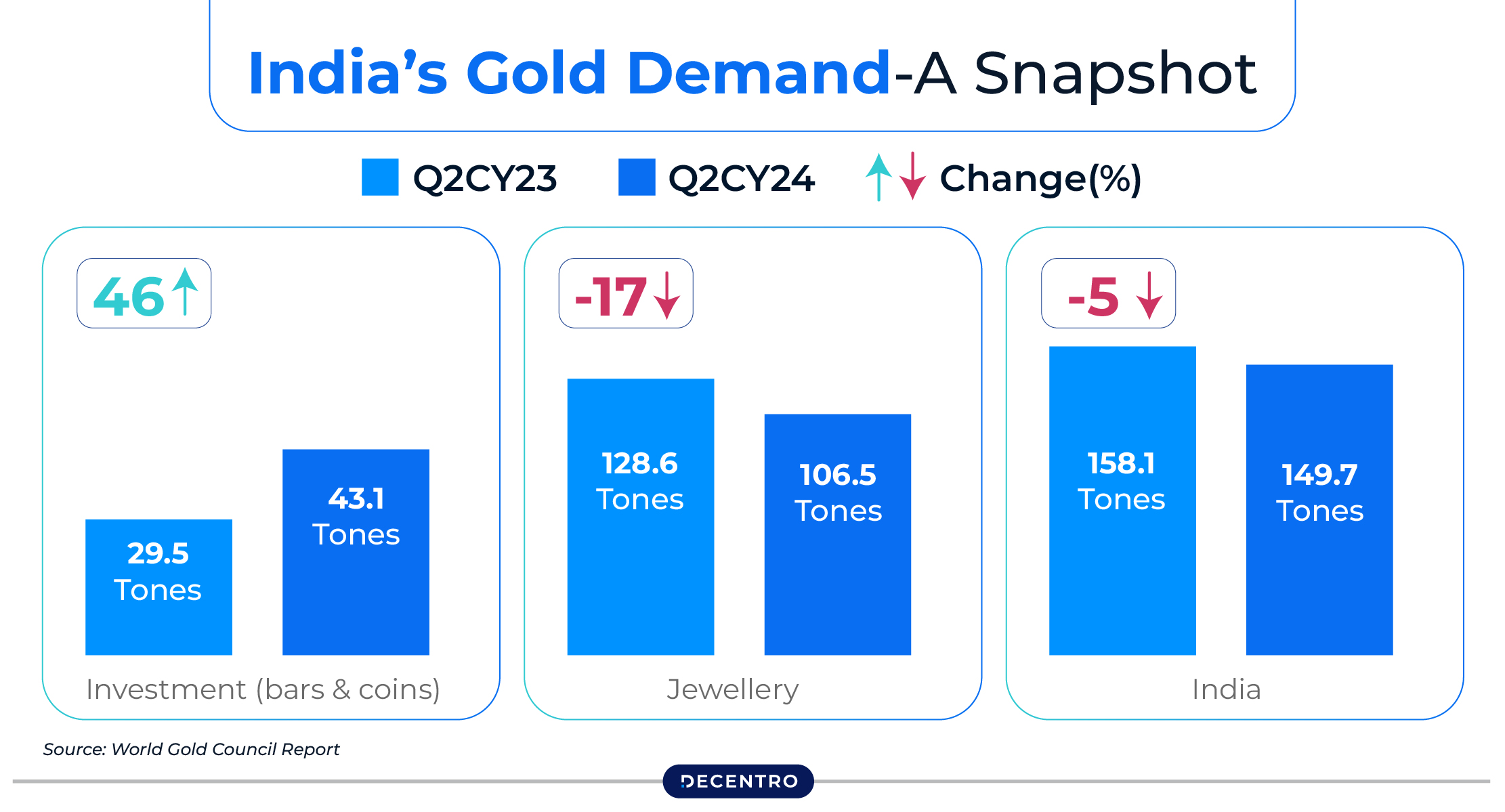

Consumer Trends in the Indian Gold Market

In India, gold is not only an asset; it symbolises status, prosperity, security, and culture. Indians believe it auspicious to buy and gift gold on religious and cultural occasions like Diwali, Dhanteras, Akshaya Tritiya, etc. Moreover, marriages in India are incomplete without golden jewellery.

As per records, 40% of India’s gold demand comes during the wedding season and the remaining 60% comes from rural India, where gold is a symbol of status and savings. Apart from these traditional buying trends, Indian gold buyers are also investing in digital gold.

GST Rates in India for Gold Purchases

The GST rate of 24- and 22-carat gold in India is 3% of the gold’s value, meaning one must pay an additional ₹3 GST on purchasing every ₹100 gold. Moreover, a separate gold GST rate of 5% will be levied on the making charges of gold jewellery.

Physical Gold GST Rate

The GST rate on the total value of physical gold purchases, including gold coins and bars, is 3%. Here’s a detailed illustration of the GST rates:

GST on Ready-Made Jewellery (Ornaments)

Individuals need to pay a GST of 3% on the total value of gold while purchasing gold jewellery. GST is applied to both the gold price and its making charges. Here, the craftsmanship and gold are considered a single product (composite supply) to which taxes are applied.

GST on Gold Bars and Coins

The GST rate on gold bars and coins is the same, i.e., 3%, which is applied entirely to the value of gold. Tax calculation for gold bars and coins is straightforward since there are no additional charges such as making or service charges.

GST on Second-Hand Gold

The GST rate on second-hand gold may vary depending on the seller’s identity. There are two types of sellers:

- Individual Seller

Individual sellers do not need to pay any GST for selling second-hand gold, but the buyers need to pay a GST on the purchase of gold.

- Registered Seller

A 3% GST is applied on the sale price of second-hand gold in the case of registered sellers.

Applicable GST Rate on Gold Jewellery Making Charges

The gold GST rate applied on the making charges of gold jewellery is 5%, along with an additional 3% on the gold value in the case of custom-made jewellery. Here is a detailed explanation of the GST rates:

Gold GST Rate for Custom-Made Jewellery

For custom-made jewellery, the GST calculation is based on two components: gold and making charges. As per the rules, a 3% GST is levied on the gold value, and a 5% GST is levied on the making charges. For instance, if a customer provides 10 grams of gold valued at ₹70,000 and the making charge for customised jewellery is ₹10,000, the customer will pay a GST of ₹2,600. The calculation goes as follows:

GST on gold value: 3% of ₹70,000 = ₹2,100

GST on making charge: 5% of ₹10,000 = ₹500

Therefore, GST on custom-made jewellery = ₹2100 + ₹500 = ₹2,600

Gold GST Rate for Jewellery Repairs

A 5% GST is applied to the jewellery repair charges. This is separate from the GST charged on ready-made jewellery purchases.

Gold GST Rate for Reverse Charge Mechanism

As per the reverse charge mechanism, the jeweller or gold merchant needs to pay a GST of 5% on the making charges when the goldsmith does not have a GST registration.

Example of GST Calculation on Gold Purchase

Every Indian city has a jewellery association that informs all the jewellers about the daily gold rate, price fluctuations, etc. Considering the differences in billing systems among the jewellers in various Indian cities, it is not possible to maintain a standard invoicing pattern for GST calculation on gold purchases. However, here is a basic formula that every jeweller across the country needs to follow:

Gold Price x Gold Weight (in grams) + Making Charges + 3% GST applied on jewellery price and its making charges.

Here’s an example to explain the calculation process in detail:

Let’s assume that the price of gold is ₹50,000/10 grams and the making charge is ₹10,000. 5% GST is applied on making charges. If Rahul wants to buy 25 grams of raw gold, how much does he need to pay with and without GST?

As per the formula of GST calculation, Rahul needs to pay

₹5,000(price of 1gm gold) x 25 (gold weight in grams) + ₹500 (5% of ₹10,000) + ₹3750 (3% of ₹125,000) = ₹129,250

Let’s break down the calculation:

GST on gold= 3% of gold value

Here, gold value is 25 x ₹5000 (value of per gram) = ₹125,000

Therefore, GST on gold value is 3% of ₹125,000 = ₹3750

GST on making charge = 5% of making charge

Here, making charge is ₹10,000

Therefore, GST on making a charge is 5% of ₹10,000 = ₹500

As per calculation, the total GST for 25 gm gold purchase is ₹3,750 + ₹500 = ₹4,250

So, Rahul has to pay a total of (₹125,000 + ₹4,250) ₹129,250 for purchasing 25 gm of gold.

Applicable GST Rate on Gold Investment Schemes

The GST rate levied on various gold investment schemes is discussed below:

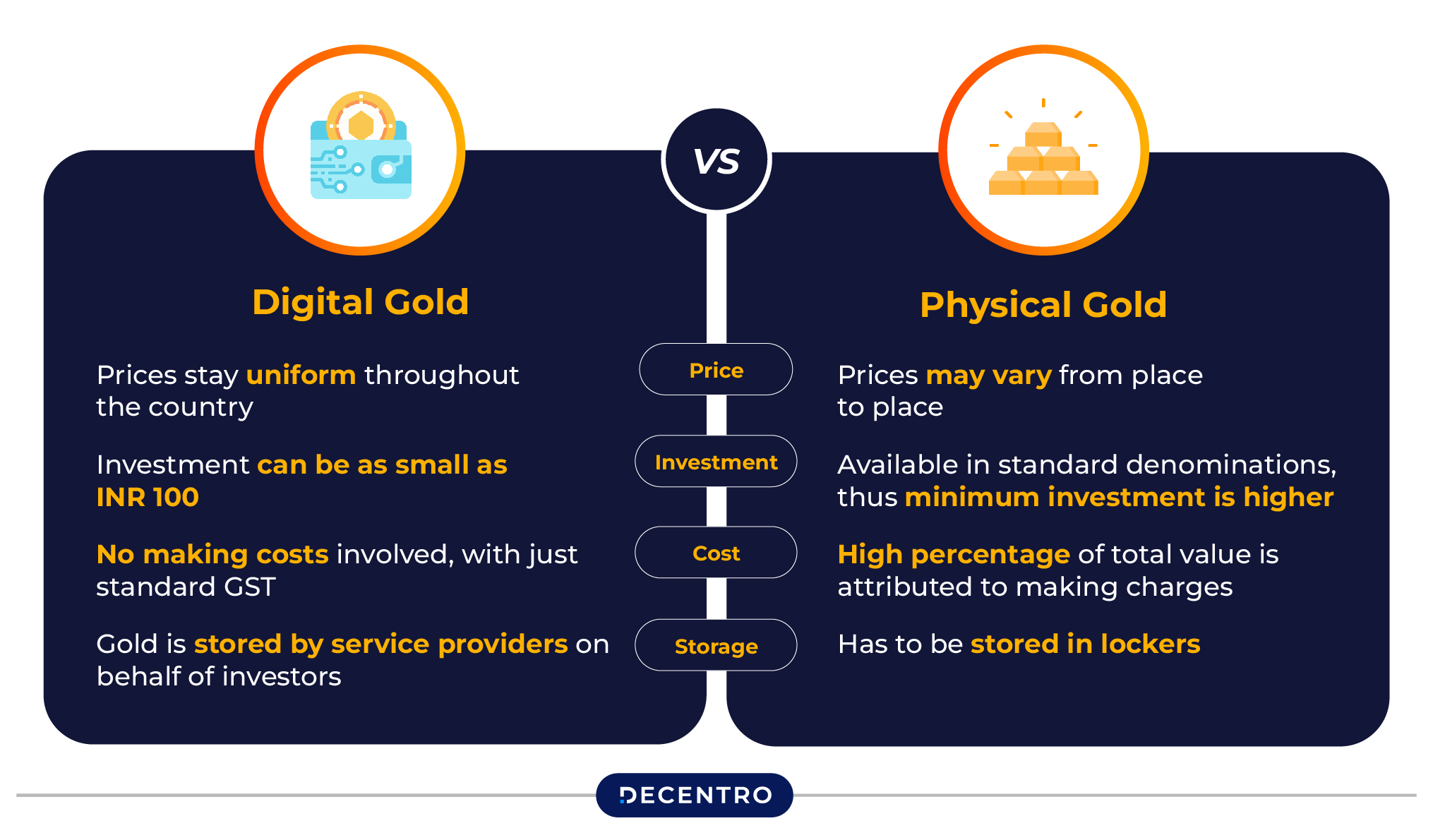

GST Rate on Digital Gold Purchase

Individuals investing in digital or paper gold must pay 3% of the investment amount. For instance, if you invest ₹10,000 in digital gold, you are actually investing ₹9,700; the remaining 3% is deducted as GST.

Other charges on gold investment besides GST include trustee fees, storage charges, transaction fees, processing charges, maintenance charges, etc. However, these costs vary depending on the investment platform and are covered by the difference between the selling and buying price of digital gold.

GST Rate on Gold Mutual Funds

No GST is levied on gold mutual fund investments, but a 3% GST applies to the underlying gold asset. Investors do not need to pay GST to purchase or sell gold mutual funds. However, the investor is subjected to short-term capital gains if the fund units are held for less than 3 years. Meanwhile, in case of more than 3 years, they are subjected to long-term capital gains.

GST Rate on Gold ETFs

As with mutual funds, GST does not apply to gold ETFs, except for a 3% GST on the underlying gold asset. However, capital gains are applicable (depending on the holding period) on the profit earned from selling the gold ETF units.

Long-term capital gains are applicable if the units are held for more than 3 years, and short-term capital gains are applicable if they are held for less than 3 years.

GST Rate on Sovereign Gold Bonds

GST does not apply to Sovereign Gold Bonds (SGB), but an 18% GST applies to the brokerage fee while purchasing. Like mutual funds and ETFs, capital gains apply to the profit earned from selling these assets.

GST Rates on Gold Exemptions

The 31st GST Council meeting declared that if a notified agency supplies gold to the registered jewellery exporters, it will be exempted from GST. It aims to reduce the burden of GST on the exporters of gold jewellery so that the Indian gold export sector gets a competitive position in the international market.

Only a sharp 5% GST is levied on the making charges of gold. Registered jewellers can claim a 2% Input Tax Credit on these expenses. However, this exemption does not apply to domestic buyers; only gold jewellery exporters are benefitted from it.

Impact of GST Rate on Gold Prices

The introduction of GST rates on gold price has increased the price of gold and lowered its demand. Discussed below are the impact of gold GST rates on its prices:

- Increase in Gold Rates

As mentioned, the price of gold has increased after implementing GST. The GST on gold rates has risen to 3% from 1.2%, which has lowered the demand for this precious metal, influencing the liquidity of gold investments.

- Pricing of Gold Jewellery

Since 2022, a 5% GST has been levied on the making charges of gold. GST on gold is generally a fixed charge or a fixed percentage of the gold purchased. Thus, GST on gold jewellery and gold coins often vary as making charges are not the same among all the jewellers.

- Changes in Gold Imports and Exports

Previously, gold imports in India increased more than gold exports. The government has increased the customs duty on gold imports to address this issue. It aimed to lower the smuggling of gold and input costs, uplift domestic gold manufacturing, and increase the competitiveness in gold exports.

- FTA Benefits

India has FTA (Free Trade Agreement) advantages with some countries like South Korea. As per the agreement, GST-registered importers do not need to pay an additional 10% customs duty to ship gold.

Summing Up

Several factors, such as currency fluctuations, import duty, demand and supply, regulations of the Indian jewellery market, etc., influence gold prices. This affects the gold GST rate and the cost of gold in India. Both investors and sellers must have a sound knowledge of this taxation on gold prices to make informed decisions.

If you are a business enabling the exchange of Digital Gold and need assistance with your banking infrastructure needs, drop us a hi at hello@decentro.tech, and we will get in touch.

Frequently Asked Questions

What is the GST rate on gold in India in 2025?

As of 2025, the GST rate on gold is 3% of the gold’s value. Additionally, there is a 5% GST applied to the making charges of gold jewellery. Together, this increases the final purchase price of gold ornaments for consumers.

Is GST applicable to custom gold jewellery making charges?

Yes, a 5% GST is levied on the making charges of gold jewellery. For custom-made ornaments, this charge is applied separately from the 3% GST on the price of the gold used in the item.

How is GST calculated on buying gold in India?

GST on gold is calculated based on two components:

- 3% on the gold value (e.g., weight in grams × gold rate per gram)

- 5% on making charges. For example, if a gold item is priced at ₹1,00,000 with ₹10,000 as making charges, the total GST will be ₹3,500.

Do digital gold and gold investment schemes attract GST?

Yes, a 3% GST is applicable when purchasing digital or paper gold. However, gold mutual funds and ETFs do not attract GST directly on transactions, though the underlying gold asset is taxed at 3%. Sovereign Gold Bonds are GST-exempt, but an 18% GST applies to brokerage fees for their purchase.

Is there any GST exemption on gold for exporters?

Yes, as per the 31st GST Council meeting, gold supplied by notified agencies to registered gold jewellery exporters is exempt from GST. This measure supports Indian exporters by reducing their tax burden, but it does not apply to domestic gold purchases.