Cashless, seamless, and secure – UPI is the future of payments. Explore how businesses can leverage UPI payment gateways to improve transactions.

Streamlining Payment Processes: The Role of UPI Payment Gateways in Modern Transactions

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Neither the sales talk nor the product marketing is the most important aspect of every business transaction—it’s the payment process. It’s the lifeblood that sustains the business and how trade has been done since time immemorial.

Obviously, as times have changed, so has the payment process. Since the introduction of UPI, the digital payment system has literally transformed many procedures for the better—more accessible, convenient, and secure. And with minimal transaction fees, many business owners have adapted this payment option for modern transactions.

But how advantageous really is UPI? What are its features, and how can you integrate it into your business operations? Well, let’s answer your questions one by one.

First, What is UPI?

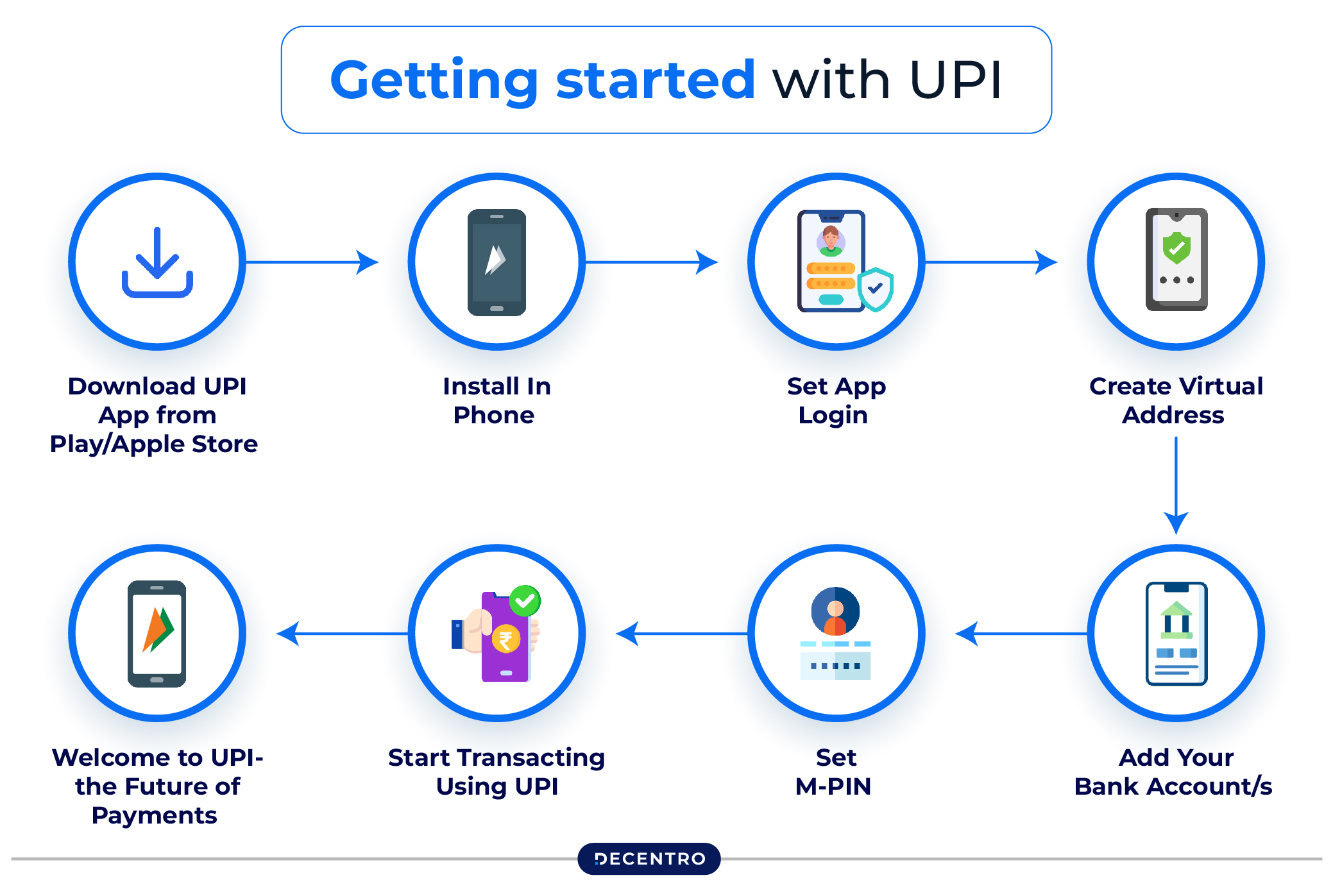

Cashless economy—that’s probably the simplest way to encapsulate the main concept of UPI. Short for Unified Payments Interface, this digital system has allowed users to make payments and access multiple bank accounts through mobile apps.

Introduced in 2016, UPI has been such a user-friendly payment system that provides seamless fund routing and merchant payments across industries without needing the use of physical cards or doing all those complex procedures that would require several steps to follow.

What are the Key Features of UPI?

As society begins to embrace this shift toward online transactions, it is important for a business owner to know the role of UPI payment gateways in modern transactions—how they optimize payment experiences for both merchants and customers, thereby streamlining the payment process.

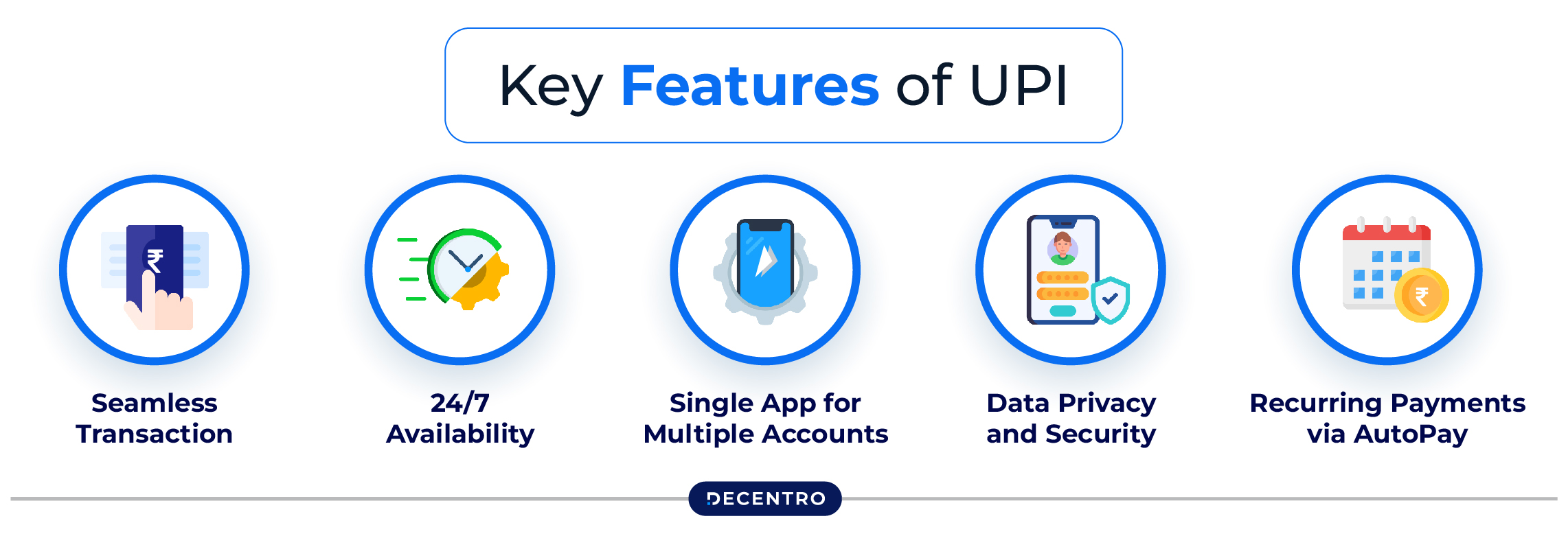

- Seamless Transaction.

We’ve probably all been in that situation: getting stressed out because you didn’t bring enough cash to make your purchase or fumbling with entering lengthy card details and a complex checkout process, only to repeat it repeatedly because of failed attempts.

Now, you can bid goodbye to these worries because, with UPI, you can instantly transfer money between bank accounts in just a few taps. Apart from making purchases, this also makes sending and receiving money to friends and family members effortless and efficient, removing the hassle of traditional banking methods.

- 24/7 Availability

You can finally ditch those long banking hours to make that transfer. Whatever time of the day, whatever you are doing, UPI transactions can finally be done at your most available time—be it night, day, weekend, or even holidays! Its round-the-clock availability allows users the flexibility to complete their purchases or complete the payment process at their most convenient time.

- Single App for Multiple Accounts

Considered one of the standardized payment processes across banks, now you don’t have to stress yourself from jumping from one banking app to another as you can navigate them all in UPI. Simply link all your bank accounts to a single UPI ID, and then you’re off to go. Managing your finances and transacting from one bank account to another has never been this smooth and convenient.

- Data Privacy and Security.

With more than 1.7 billion individuals having had their personal data compromised in 2024, experts from Cybernews have been emphasizing the importance of good cybersecurity practices, such as not reusing the same passwords, using VPNs for transactions, and utilizing the best password managers to avoid security breaches and hackers exploiting your data—most especially your banking accounts.

To enhance data privacy and security measures, UPI ensures users are protected through two-factor authentication (2FA) security protocols for logins and transactions and privacy policies that outline how the service collects and uses user data. UPI also guarantees that all this information is safeguarded and encrypted. Moreover, since data is already saved, there’s no need for users to repeatedly enter bank or card credentials, which can reduce the risk of hackers compromising your information. Payments are completed securely with a PIN, addressing concerns about data breaches and enhancing customer confidence.

- Recurring Payments via AutoPay

Guess we can all agree how tedious it is to manually pay bills—from identifying what needs to be paid, setting up the payment method, entering the payment details, and repeating this every week, month, or quarter. Even worse, you might miss a payment because of all the tasks you have to juggle!

To save you from this hassle, UPI has introduced its AutoPay functionality. Now, you can set up recurring payments in advance for things like mobile bills, electricity bills, subscriptions, insurance, funds, and more. With AutoPay, there’s no reason to miss a due date again, allowing you to go about your day like any other, living a hassle-free life without overthinking whether you’ve paid everything you need to pay.

What is the Role of UPI Payments in Your Business?

Streamlining the payment process, UPI has definitely revolutionized business transactions—and if your company is still not tapping into this powerful digital payment system, you’re missing out on a great opportunity to enhance efficiency and customer satisfaction.

So, what role do UPI payment gateways play in modern transactions?

- Efficiency.

The last thing you want is for your customers to get stressed during the payment process by having to input sensitive card details repeatedly. That’s why the UPI payment gateway has emerged as one of the most preferred methods among businesses due to its efficiency in handling transactions through QR codes.

When the payment process is easy and efficient—especially for customers who are in a hurry—they are encouraged to return and make repeat purchases, which eventually leads to higher conversion rates and more positive customer insights.

Whether you’re operating restaurants, shops, pharmacies, agencies, or managing departments and institutions like hospitals, schools, universities, and companies, generating QR codes streamlines the payment process, making it seamless and convenient in just seconds.

- Lower Transaction Fees.

While there are no charges for personal UPI payments, payments made directly from bank accounts to businesses for services or products can incur costs, especially when conducted. However, by leveraging UPI’s zero Merchant Discount Rate (MDR), businesses can save significantly on every transaction made through payment gateways or Payment Service Providers (PSPs). As a business owner, you know quite well how this can lead to substantial cost savings and improve the efficiency of the business.

- Secure and Fully Compliant

Since UPI transactions fully comply with the Reserve Bank of India’s regulations, you can be assured that all payments made are secure, reliable, and adhere to strict guidelines. As a business owner, building trust is crucial. Hence, transactions that are handled safely, efficiently, and transparently—monitored to prevent issues—instill a sense of confidence in your customers.

Additionally, in terms of fund settlement delays—let’s admit, these can happen for certain reasons—UPI helps avoid such delays by enabling instant fund settlements for merchants, vendors, and customers. Yes, you can finally say goodbye to days of long waits.

- Cashless and Contactless Transactions.

Providing numerous payment options to consumers widens your customer market, allowing them to make purchases based on what’s convenient for them. Because, let’s face it, who always carries cash these days?

Cashless options enable customers to purchase anything they like—even items they didn’t initially plan on buying but found interesting or necessary while shopping. And because they might only have brought a limited amount of cash, offering alternative payment methods is definitely a plus. Moreover, if you’re running cash-on-delivery orders, this also helps facilitate smooth, contactless payments—allowing transactions to be completed quickly and securely without physical exchange.

- Increased Success Payment Rates.

Because payments are transferred in real-time, UPI helps increase success payment rates in businesses. With such a user-friendly and instant payment method, you can expect fewer transaction failures and a smoother customer experience, eventually leading to higher conversion rates and increased customer satisfaction.

By eliminating long and complex payment processes using QR codes, instant confirmation, and in-app integration within mobile apps, transactions have become seamless, more secure, and easier to monitor. In fact, this could lead to an overall success rate of beyond 98% with UPI.

- Seamless and Easy to Set Up.

Now, to further maximize the wonderful benefits that UPI has brought to the industry, you can integrate Decentro’s API to streamline payment collections from customers or enable partner businesses and SMEs to do the same.

Decentro supports multiple methods, including Dynamic UPI QR codes, payment links, or app-specific links, allowing flexible payment experiences via any UPI app on your customer’s device. Additionally, you can enable UPI Autopay for recurring payments and Split Payments APIs to simultaneously settle money matters with multiple vendors. Most importantly, for security purposes, you can validate UPI IDs before transfers to enhance success rates and track all transactions in a dedicated dashboard solely for your business.

The Role of UP Payment Gateways in Modern Transactions: In a Nutshell

Much has changed in the business landscape, most especially with the introduction of UPI payment gateways. Offering a multitude of advantages for both business owners and customers, it has made transactions seamless, more secure, and accessible to a broad audience.

UPI payment gateways have literally transformed how businesses operate—whether small or enterprise-level. With the right partner to help you integrate and utilize these advanced features, you can customize the system to your business processes and achieve your goals for 2025. According to Uniqode, “68% of payments are now completed via mobile apps through a QR code touchpoint”—highlighting just how integral QR-enabled transactions have become to today’s customer journey

Don’t let a subpar payment experience hold your business back. Are you ready to elevate your payment system this year?