Unlock efficiency with API-driven business account management—automate onboarding, access control, compliance, and financial workflows for seamless operations.

The Shift from Manual Processes to API-Driven Business Account Management

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Say goodbye to clunky spreadsheets, email back and forth, and the chaos of outdated portals. Whether you’re managing multiple corporate bank accounts, onboarding new business clients, or juggling specialized dashboards for each department, the demands of modern business account management can quickly overwhelm any team.

Luckily, the digital age has introduced APIs (Application Programming Interfaces): “digital connectors” that break down the silos between your systems, automate repetitive tasks, and streamline user access—all while bolstering security and compliance.

In this article, we’ll explore why shifting from manual processes to an API-driven approach is the key to more efficient, scalable, and secure business account management. Along the way, we’ll highlight practical use cases showing how you can free up your team’s time for more strategic, value-added work.

Why Go API? The Perks

If you’re wondering why APIs have become the star of the show, the answer is agility. APIs deliver:

Faster, Leaner Operations

Manually setting up and maintaining user access for dozens—or even hundreds—of business accounts is inefficient and risky. This is especially true in the financial sector, where access to online banking portals, credit risk dashboards, or customer relationship management (CRM) systems must be provisioned and de-provisioned quickly.

Much like how marketing agencies use social media access-granting apps to centralize permissions for multiple client profiles, APIs offer a unified control panel for all your business accounts. You can instantly create, update, or remove access permissions with a simple API call—no more bloated spreadsheet maintenance or email back-and-forths.

Real-Time Data & Updates

APIs enable real-time synchronization of data across platforms. Whether you need to update a user’s role in your core banking system, reconcile a transaction in your enterprise resource planning (ERP) suite, or verify a compliance check in a specialized dashboard, an API call makes it happen instantly.

Gone are the days of manual data imports, lagging updates, and the ever-present risk of human error. Instead, your teams will always have the freshest information at their fingertips, empowering them to make data-driven decisions faster.

Enhanced Security & Compliance

Manually storing login details in spreadsheets or sending credentials via unsecured email is not just outdated—it’s downright dangerous. Most APIs, by contrast, come with robust authentication and authorization protocols built in: API keys, OAuth tokens, and role-based permissions.

This standardized security framework helps you maintain compliance with regulations. Plus, detailed audit logs track every API call, making it simpler to prove compliance during an audit. Whether you’re onboarding a new corporate client or updating user roles, every change is documented and traceable.

Scalability & Flexibility

As your organization grows, managing multiple systems becomes more complex—think CRMs, payment gateways, ticketing systems, marketing platforms, and more. APIs serve as modular building blocks that let you integrate new services or features without overhauling your existing infrastructure.

Adding or modifying services becomes as easy as snapping new components into your workflow. For instance, an API-based approach can help you integrate their platforms quickly and seamlessly if you expand into new markets and require additional banking partners.

Streamlined Reporting & Insights

APIs can automatically pull transaction data, account usage metrics, onboarding details, and user activity logs into a centralized dashboard or data warehouse. By aggregating these insights, you get a 360-degree view of your operations:

- Which corporate clients are most active?

- How quickly are you onboarding new accounts?

- Where do security exceptions or account lockouts commonly occur?

With all this information at hand, it’s easier to spot trends, allocate resources efficiently, and make strategic decisions that drive business growth.

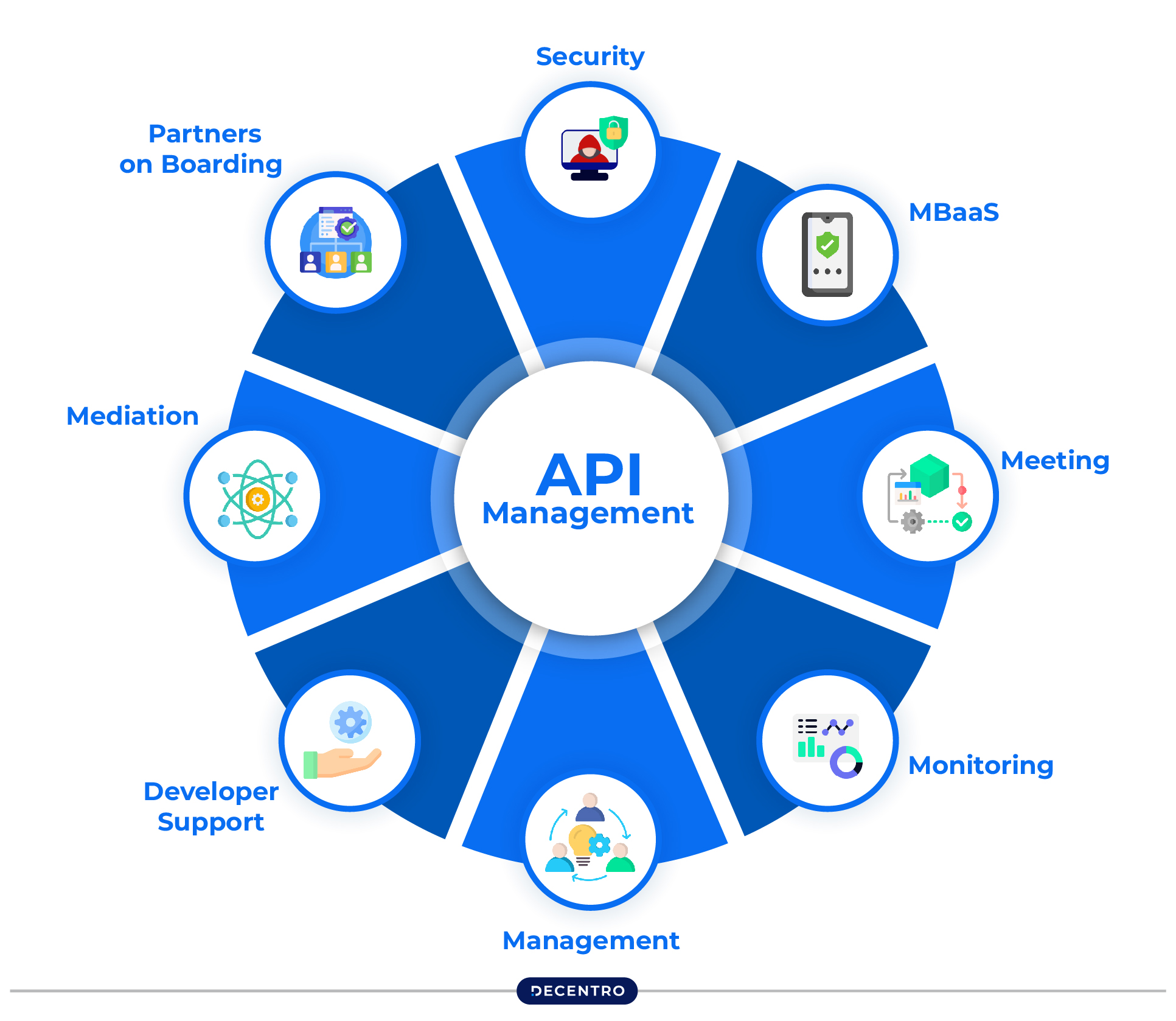

How API-Based Account Management Works

APIs might sound like technical jargon, but the concept is straightforward: they enable different software systems to communicate automatically and securely. Here’s a high-level breakdown of how you’d set up an API-driven workflow for business account management:

1. Laying the Groundwork: Define Your Needs and Identify Endpoints

First, figure out which steps in your account-management process are chewing up the most time. Common pain points include:

- Client onboarding: Collecting and validating corporate documents, setting up user credentials, assigning roles.

- Access management: Granting or revoking privileges to financial dashboards, payment gateways, or internal reporting tools.

- Compliance checks: Documenting approvals, verifying user identities, and meeting reporting requirements.

Once you’ve identified these tasks, map them to the systems you need to integrate, such as CRMs, ERPs, HR databases, and online banking platforms. Each of these systems exposes API “endpoints”—secure URLs where you can send requests to create, update, or retrieve data.

2. Ensuring Security and Building Flows

Securing these API endpoints is critical, especially in heavily regulated industries. Implement robust authentication methods like OAuth tokens, API keys, or role-based access. This ensures that only authorized processes can invoke API calls.

Next, construct your automation “flows” based on if-then logic. For example:

- If a new corporate client completes registration, then automatically create an account in your CRM, set up their banking portal access, and trigger a welcome email.

- If an employee’s role changes, then adjust permissions across all relevant business accounts to align with the new responsibilities.

3. Testing, Validation, and Ongoing Monitoring

Before you flip the switch, run exhaustive tests to cover both typical and edge scenarios—like missing data or invalid credentials. Once your API-driven workflows go live, keep an eye on performance metrics such as response times, error rates, and latency.

Implementing real-time monitoring lets you catch anomalies—like a sudden spike in failed API calls—before they escalate. This approach maintains system reliability and smooth user experiences, whether you’re onboarding a new corporate client or modifying access for a key partner.

Real-World Processes Ripe for API Automation

While business account management may be your top priority, many of the workflows that connect to these accounts can also benefit from API-driven automation. Below are some high-impact processes to consider.

1. Onboarding and Offboarding Corporate Clients

Onboarding a new corporate client usually involves collecting Know Your Customer (KYC) documents, validating the company’s details, setting up user roles, and integrating them into various financial dashboards or reporting tools. Doing this manually is time-consuming and prone to human error.

How APIs Help:

- Automated ID verification and KYC checks: Validate documents via specialized API services.

- Immediate account and role creation: Trigger multiple system updates—CRM, payment gateways, compliance logs—in one go.

- Seamless offboarding: APIs can systematically revoke all permissions to safeguard data the moment a client ends their engagement or a user leaves the company.

2. Access Controls for Multiple Platforms

In large enterprises, employees often require access to a range of business accounts—banks, HR systems, project management platforms, and more. Granting and revoking this access manually becomes a tangled nightmare.

How APIs Help:

- Centralized user repository: Manage permissions from one console, pushing updates to all connected systems automatically.

- Role-based access: Align users with roles (e.g., Finance Manager, Sales Rep), and let API flows handle who gets access to which accounts.

- Audit-ready logs: Each access change is recorded, making it easy to track user activities for compliance or security investigations.

3. Integrating Financial Workflows

APIs make these integrations seamless, whether it’s tying monthly statements to your ERP or connecting transaction data to an analytics platform for real-time reporting.

How APIs Help:

- Automated transaction posting: The moment a transaction occurs, it’s pushed to your accounting or ERP system for immediate reconciliation.

- Real-time dashboards: Pull data from various business accounts—like multiple bank balances or transaction histories—into a single, up-to-date dashboard.

- Triggered alerts: If a large transaction exceeds a set threshold, notify the compliance or risk department automatically.

4. Payment Approvals and Reconciliations

Handling payments between business units or with external partners often involves multiple touchpoints: verifying invoices, matching them against purchase orders, and updating account balances. Mistakes here can lead to financial discrepancies and strained relationships.

How APIs Help:

- Automatic matching: Connect your procurement, invoice management, and financial accounts via APIs, so that an approved invoice instantly triggers payment actions.

- Real-time status updates: Know exactly which invoices are pending, approved, or paid without toggling between different platforms.

- Reduced manual errors: By eliminating the human factor in data transfer, you lower the risk of costly mistakes.

5. User Activity Monitoring and Reporting

Whether for audit purposes or to optimize internal processes, keeping track of who did what—and when—across various business accounts is crucial.

How APIs Help:

- Activity logs: Consolidate data from multiple business platforms into a single log, making it easy to identify anomalies.

- Real-time insights: Proactively spot patterns that indicate potential fraud or misuse.

- Compliance-friendly: Automated logs simplify audits, giving you a ready-made record of user activities.

Making the Shift

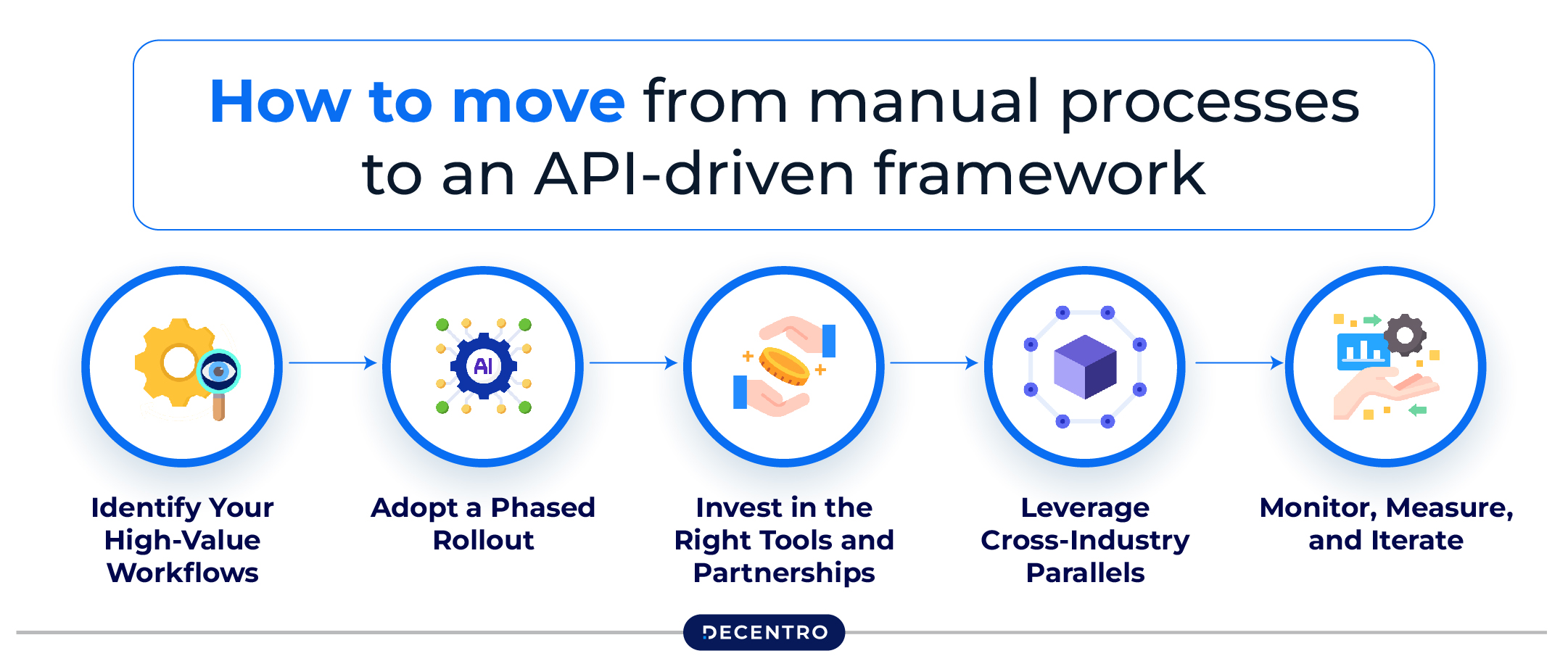

Moving from manual processes to an API-driven framework for business account management isn’t just about flipping a switch—it’s a strategic overhaul that demands planning, collaboration, and the right technology stack. Below are some tips and best practices to guide you through this transformation:

1. Identify Your High-Value Workflows

Not all processes warrant the same level of automation. Pinpointing the tasks that consume the most resources—like managing corporate banking portals or provisioning user access for complex systems—delivers a faster return on your investment.

- Audit Current Workflows: Document each step in your existing processes to uncover repetitive tasks, bottlenecks, and inefficiencies.

- Set Clear Goals: Decide on concrete KPIs—such as reduced onboarding time or fewer security incidents—to measure the success of your API rollout.

- Start Small, Think Big: Automate the most “painful” processes first, then expand to other areas once you’ve proven the model.

2. Adopt a Phased Rollout

A wholesale switch to API-based processes can overwhelm your teams if they’re accustomed to manual workflows. Break the transformation into manageable phases instead of automating everything in one fell swoop. Start with a high-impact area—like corporate client onboarding or access control for critical financial dashboards—and build momentum from there.

- Pilot programs: Launch small-scale trials to gather feedback and fine-tune your API workflows.

- Gradual expansion: Once you’ve ironed out the kinks, extend the automation to other business units or processes—like payment reconciliations or compliance audits.

- Iterative improvements: Treat each rollout as a learning opportunity. Collect metrics on speed, error rates, and user satisfaction, then make incremental enhancements before moving on to the next phase.

This incremental approach helps your teams adapt to new tools and reduces the risk of widespread disruption.

3. Invest in the Right Tools and Partnerships

A successful API-driven transformation isn’t just about having clean code—it requires the right infrastructure, tools, and partnerships to support it. Choosing the right technology stack ensures your automation efforts are secure, scalable, and adaptable to future needs. Cloud-based integration platforms offer pre-built connectors for major banking, ERP, and CRM systems, reducing development time and simplifying deployment.

Security should also be a top priority, so working with API providers that offer role-based access controls, advanced threat detection, and built-in compliance features is critical. Additionally, collaborating with experienced SaaS vendors or niche consultancies specializing in financial automation can accelerate implementation and ensure your API solutions are aligned with industry best practices.

By investing in the right mix of platforms and strategic partnerships, businesses can build a resilient and future-proof API ecosystem that drives efficiency, security, and seamless business account management.

4. Leverage Cross-Industry Parallels

Study how other sectors solve complex data flows or compliance hurdles via APIs. By mapping those proven solutions to your own business account workflows, you’ll not only accelerate adoption but also avoid reinventing the wheel.

For example, in industries like telecom and construction, companies often face enormous inventory management challenges that need solving—from tracking hardware in remote locations to coordinating multiple stakeholders and suppliers. Similar to business account management, these tasks involve intricate data exchanges, security protocols, and user-access controls.

Adopting the same software-focused and API-driven strategies for centralized oversight and real-time updates can streamline everything from account provisioning to compliance checks.

In healthcare, for example, APIs ensure seamless data exchange between electronic health records (EHRs), insurance systems, and regulatory databases. Patient data must be securely shared across multiple platforms in real-time, much like corporate account credentials need to be instantly updated across banking, compliance, and finance software. By implementing API-based automation, businesses can ensure real-time account access while maintaining airtight security—a necessity in regulated industries.

E-commerce and logistics offer another playbook. Global retailers rely on APIs to sync inventory levels, update pricing dynamically, and automate refunds or chargebacks across multiple payment gateways. This same logic applies to managing business accounts in finance—where APIs can automate reconciliations, trigger fraud alerts based on suspicious activity, and facilitate compliance checks without manual intervention.

Looking outward in this way empowers you to integrate best practices that have already been tested under demanding conditions.

5. Monitor, Measure, and Iterate

Once you’ve rolled out an API-driven strategy, the journey isn’t over—it’s a continuous process of monitoring and optimization.

- Real-time analytics: Track metrics such as response times, error rates, and data throughput. Spikes or anomalies can signal workflow bottlenecks or security concerns.

- User feedback loops: Encourage teams to report any pain points quickly. Promptly address them and update workflows to maintain user trust.

- Governance and version control: As you expand your API ecosystem, maintain clear rules around versioning, security patches, and deprecation. A strong governance model ensures that older endpoints don’t create vulnerabilities.

By combining robust monitoring with a willingness to iterate, you’ll keep your system agile, secure, and aligned with evolving business needs. Each new insight helps you refine user experiences, tighten security measures, and ultimately deliver greater value—to your internal teams and your external partners alike.

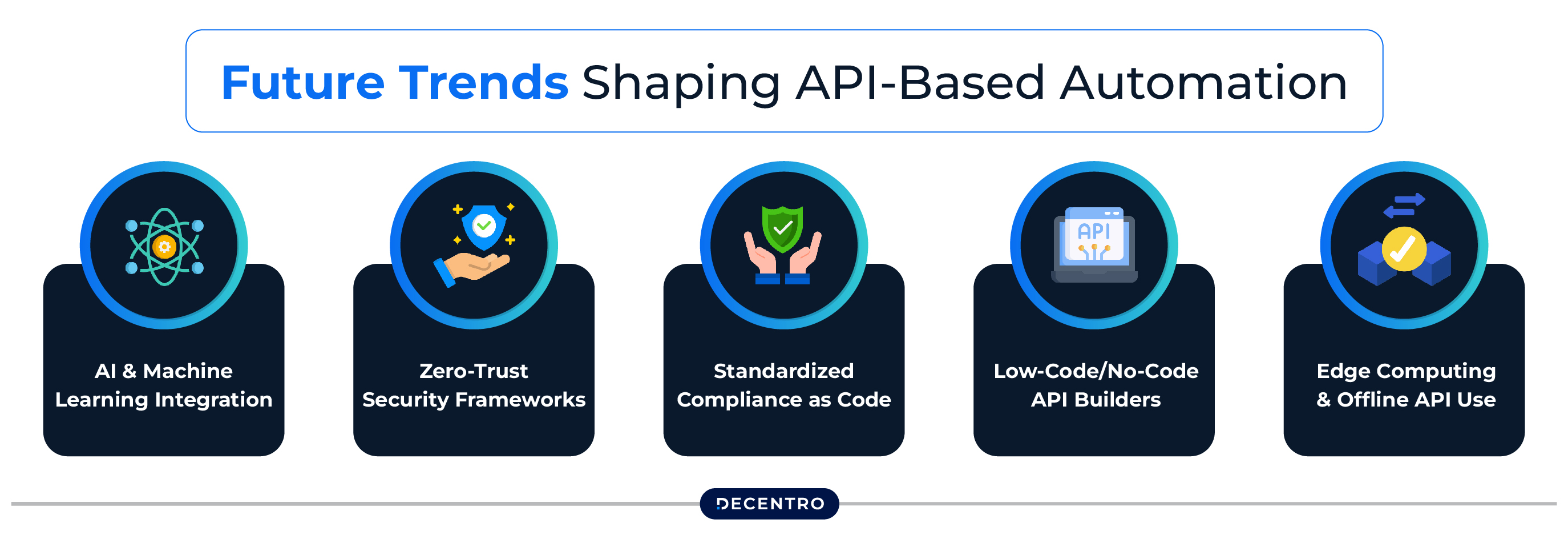

Future Trends Shaping API-Based Automation

APIs are already revolutionizing business account management, but the landscape is evolving rapidly. Here are some trends on the horizon that promise to make these systems even more powerful and secure.

1. AI & Machine Learning Integration

Trend: AI algorithms plug into APIs for predictive analytics and dynamic decision-making.

Impact: Envision a system that automatically adjusts user permissions based on real-time risk assessment or predicts if a newly onboarded client will require specialized services. By analyzing historical data, AI-powered APIs can flag anomalies—like a sudden spike in transactions—before they become liabilities.

2. Zero-Trust Security Frameworks

Trend: As cyber threats get more sophisticated, organizations move to zero-trust security models, where no user or device is automatically trusted.

Impact: APIs that implement zero-trust policies require continuous authentication, strong encryption, and real-time monitoring. This is especially valuable in high-stakes environments like corporate banking, where a single breached account can lead to severe financial and reputational damage.

3. Standardized Compliance as Code

Trend: Frameworks that translate compliance requirements—like PCI-DSS, GDPR, or SOX—into machine-readable rules.

Impact: Compliance checks become an automated feature within API-driven workflows. Each data transfer, role change, or transaction is verified against a digital checklist, reducing manual compliance overhead and drastically lowering audit risks.

4. Low-Code/No-Code API Builders

Trend: Platforms offering drag-and-drop interfaces for building API integrations, reducing the technical barrier.

Impact: Non-developers—like business analysts or project managers—can craft basic API flows for tasks like user access management or client onboarding. This democratizes automation and accelerates digital transformation initiatives.

5. Edge Computing & Offline API Use

Trend: Edge computing environments, where data processing happens near the source—think remote branches of a bank or localized data centers for a global enterprise.

Impact: Some API calls may occur offline or with limited connectivity. As this becomes more common, robust caching and sync mechanisms will ensure that business account updates remain consistent, even when network stability fluctuates.

Ready to Level Up with API-Driven Automation?

The future of business account management belongs to those who integrate smart, automated workflows into their operations. By adopting an API-first approach within a structured BPM framework, businesses can streamline processes, reduce risks, and unlock new levels of agility—ensuring long-term efficiency and growth.

Ready to level up your business account management strategy? Start integrating API-driven business account management solutions today and watch your operational efficiency soar.