Explore how payout APIs help pay global contractors faster, safer, and smarter—no matter the country, currency, or payment method.

Simplifying Contractor Payments for Global Teams Using Payout APIs

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

In days gone by, managing a distributed team would’ve seemed like a niche (or possibly unlikely) scenario. But now, it’s the norm for countless businesses.

And while many of those companies are hiring employees from various geographies, a great deal are turning to global independent contractors.

Why? Because this offers a unique combination of flexibility and cost efficiency. Particularly for companies scaling quickly or entering new markets, this approach offers a low-friction way to access global talent without getting bogged down in compliance.

But while working with global contractors provides access to a diverse talent pool, it isn’t without operational headaches — especially when it comes to payments.

Navigating international banking systems, compliance requirements, currency conversions, and local payout preferences can quickly spiral into a logistical nightmare.

That’s where payout APIs come in. These tools are quietly revolutionizing the way companies pay international contractors, offering speed, scale, transparency and control — without the overhead of building out custom finance infrastructure.

In this post, we’ll explore what payout APIs are, why they matter for global teams, and how they can streamline contractor payments at every step.

What are payout APIs?

Let’s start with the basics. A payout API is a programmatic interface that allows a business to send payments to recipients through various methods — bank transfers, digital wallets, cards, or even cash pickup — across multiple geographies.

These APIs are typically provided by fintech platforms like Payoneer, Wise, or Decentro and they plug directly into your systems to automate and scale your payment operations.

At a glance, a payout API might sound like little more than a fancy replacement for spreadsheets and bank portals. But under the hood, they’re much more powerful. In fact, payout APIs can:

- Automatically convert currencies at favorable rates

- Ensure compliance with local tax and KYC/AML regulations

- Trigger payments in response to events (such as invoice approval)

- Offer real-time payment tracking and status updates

- Handle mass payouts in different methods per contractor preference

In short, they replace friction with functionality. And when you’re managing a global contractor workforce, that’s a big deal.

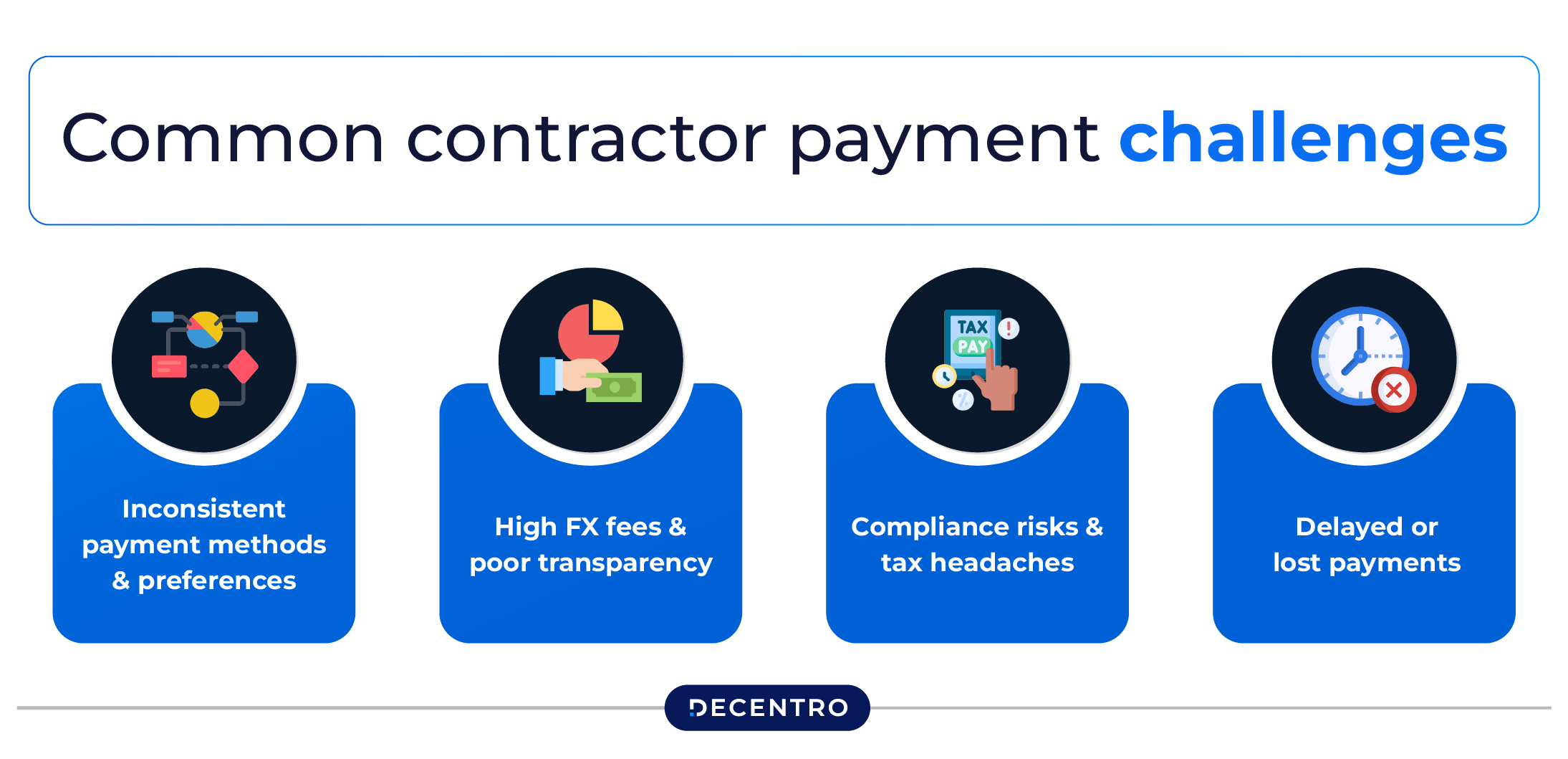

Common contractor payment challenges — and how APIs solve them

Paying international contractors isn’t just about clicking “Send.” The real challenges lie in what happens before, during and after the transfer. Here are a few common issues businesses face, and how payout APIs address them.

1. Inconsistent payment methods and preferences

Picture the situation: Your video editor using Canva in Argentina wants to be paid via Payoneer. Your developer in Poland prefers local bank transfer in PLN. Your content writer in India wants the money in USD, sent to her Wise account.

Without a unified solution, your finance team has to manage multiple platforms, accounts and payout preferences manually.

Payout APIs let you store recipient preferences once and automate the rest. Whether it’s a local ACH, SWIFT wire or digital wallet payout, the API handles it in the background and surfaces only what you need.

2. High FX fees and poor transparency

Traditional bank transfers are riddled with hidden costs — especially foreign exchange markups. Most banks offer poor FX rates and tack on sending and receiving fees, which can eat into a contractor’s earnings or inflate your payroll costs.

Modern payout APIs often tap into more competitive wholesale FX rates and show you the exact fees upfront. Some even allow you to batch-convert currency before payout or lock in rates in advance, giving you full visibility and cost control.

3. Compliance risks and tax headaches

Paying people in other countries means dealing with regulations around money movement, tax reporting, anti-money laundering, and contractor classification. And those rules vary wildly from one jurisdiction to another.

Payout APIs from compliance-first providers typically come bundled with risk mitigation features. You can require contractors to complete onboarding flows that collect tax IDs, upload identification, or submit W-9/W-8BEN forms — then trigger payouts only after verification.

Some platforms even generate annual 1099s or equivalent international reports for you.

4. Delayed or lost payments

Nothing sours a company-contractor relationship faster than a late or missing payment. Unfortunately, with international wires, delays of 3–7 days are still common, especially during holidays or due to intermediary banks.

Payout APIs that integrate with local banking networks offer a more reliable alternative. In many countries, same-day or next-day payments are the norm. And when something goes wrong, the API gives you visibility into the issue — rather than having to file a ticket and wait a week for a bank to respond.

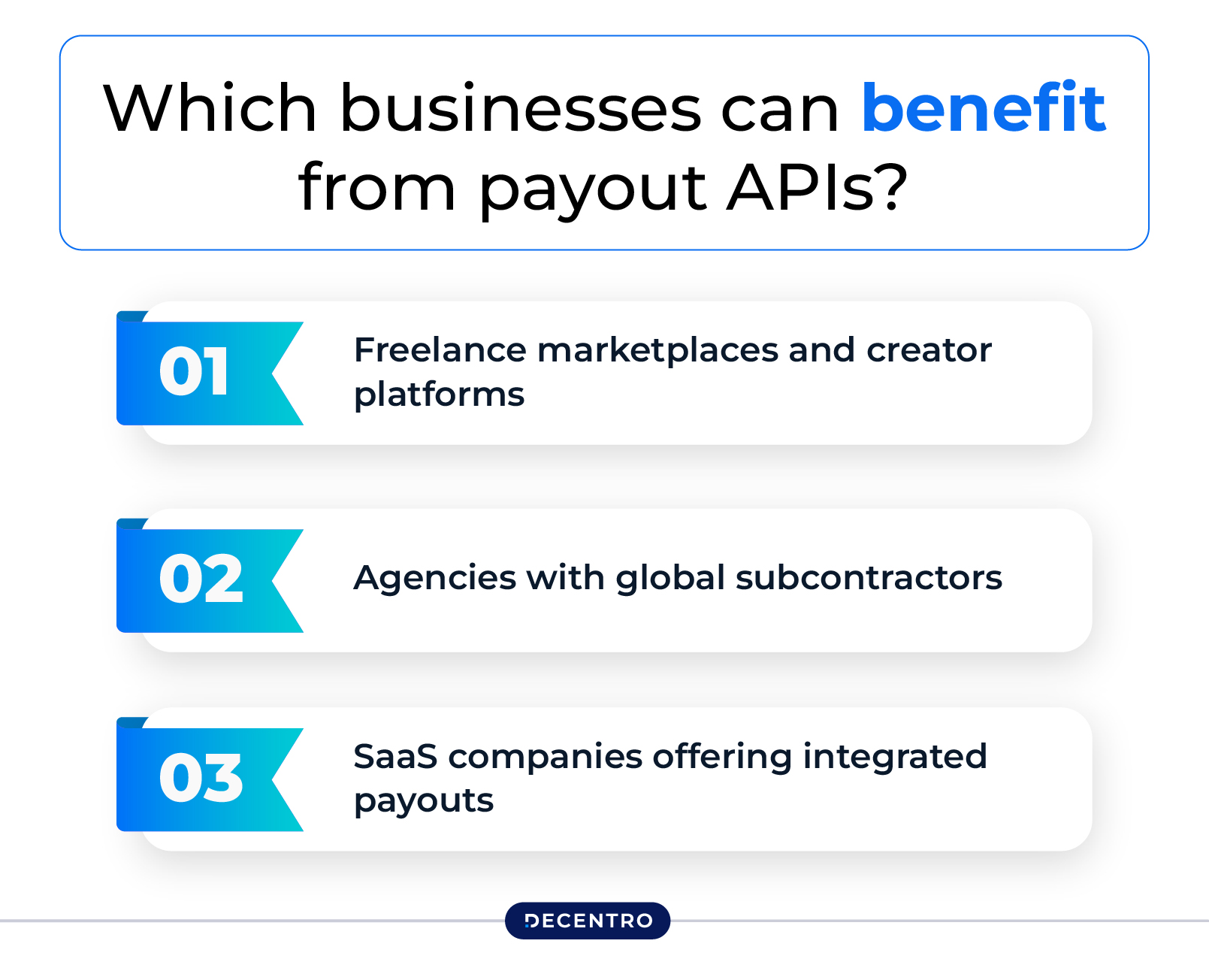

Which businesses can benefit from payout APIs?

The beauty of payout APIs lies in their flexibility. You can use them as a standalone payment engine or integrate them into your product or workflow. Here are a few real-world use cases that show the breadth of what’s possible:

1. Freelance marketplaces and creator platforms

Sites like Upwork, Fiverr, or even more niche communities (such as a marketplace for voice-over artists) rely on seamless contractor payouts to retain talent. Rather than managing payments internally, they use APIs to programmatically distribute earnings based on milestones, tips or subscriptions — often giving users the option to cash out at will.

2. Agencies with global subcontractors

Marketing, design and dev agencies that work with contractors worldwide often use payout APIs to automate monthly payments. By connecting project management or invoicing software to the API, they can eliminate manual steps — for instance, once an invoice is marked “approved,” the system auto-triggers a payment in the contractor’s preferred currency and method.

3. SaaS companies offering integrated payouts

Some platforms offer payout features as part of their product, such as affiliate commissions, cashback, or gig earnings. Rather than becoming a financial middleman themselves, they use payout APIs to handle the heavy lifting securely and compliantly, letting them focus on user experience.

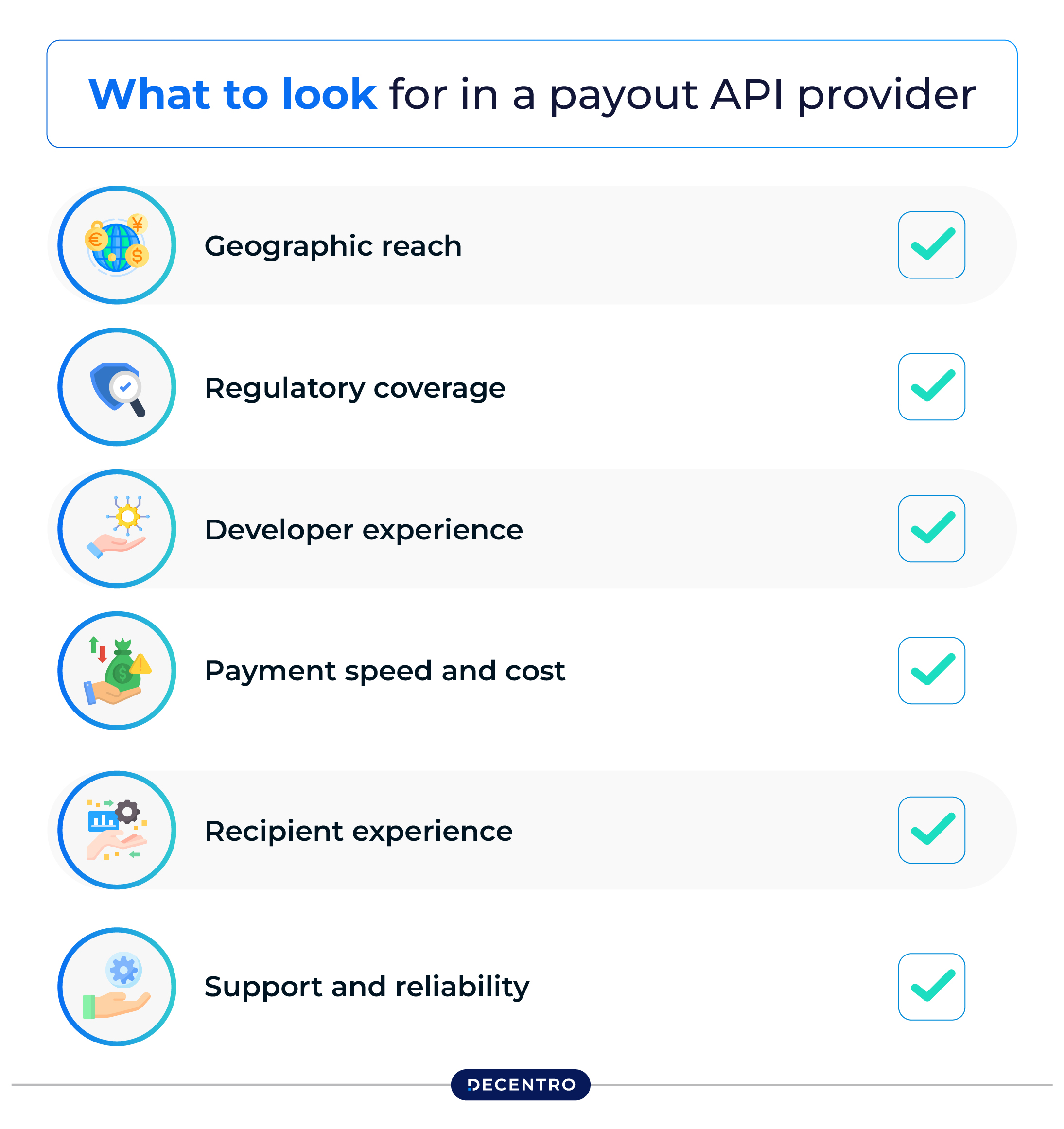

What to look for in a payout API provider?

As with any software tool, not all payout APIs are created equal. Depending on your team internal infrastructure and the geography of the contractors you’re working with, you’ll want to evaluate providers on several dimensions:

Geographic reach: Does the API support payouts in all the countries where your contractors live? If you hire in Spain, for example, can it deliver funds in local currency using a local method (not just international wires)?

Regulatory coverage: Does the provider handle KYC/AML requirements? Can it collect tax forms or generate reports? Look for one with a strong compliance reputation if you’re operating in regulated industries.

Developer experience: Good APIs come with clear documentation, sandbox environments, webhooks, and SDKs. Avoid providers with clunky, opaque integrations — they’ll just end up costing more in dev time.

Payment speed and cost: Ask about average payout times per country, FX margins, and transaction fees. Look for options that let you preview fees and estimated delivery times before confirming.

Recipient experience: A polished contractor-facing experience is crucial. Can contractors choose how they’re paid, track status, or get help easily if something goes wrong?

Support and reliability: Don’t underestimate the value of responsive support and robust uptime. Downtime can delay payments, which damages trust with contractors quickly.

Providers like Wise Business and Payoneer are popular for contractor payouts. Others, like Tipalti and Airwallex, cater more to mid-sized and enterprise firms that need deeper automation and reporting features.

Making the switch to a payout API

Transitioning to a payout API-based system doesn’t need to be disruptive. The first step is auditing your current process: how many platforms are you using; how many hours per week go into manual payments; where are your biggest bottlenecks?

From there, you can start small. Pilot a payout API for one region or contractor type, monitor the time and cost savings, and then scale up. Most businesses find that once they start automating payouts — even partially — they rarely go back.

For finance teams, the benefits are immediate: fewer errors, lower costs, better cash flow forecasting, and so on.

For contractors, it’s about trust. Getting paid on time and in their preferred way shows you value their work. And in today’s competitive market for top-tier remote talent, that can be the difference between retaining a great contractor or losing them to someone who pays faster.

The shift to global contractor-based workforces is only accelerating. But outdated payment systems haven’t kept pace. Payout APIs offer a much-needed upgrade: the ability to pay anyone, anywhere, reliably and at scale.

For teams that care about efficiency and compliance as much as contractor satisfaction, it’s time to ditch the spreadsheets and start thinking API-first.

If you’re looking for an efficient payouts partner, drop us a line and we’ll get in touch.