What is identity verification? Learn how digital ID verification protects businesses from fraud, ensures KYC compliance, and enables secure onboarding in seconds.

What Is Identity Verification and Why It Matters Today?

Avi is a full-stack marketer on a mission to transform the Indian fintech landscape.

Table of Contents

In a world where anyone can open an account, order a ride, or transfer money online, one question sits at the heart of every transaction:

How do you know someone is who they claim to be?

That’s where identity verification steps in—helping businesses stay compliant, reduce fraud, and protect their users at every touchpoint.

What is Identity Verification?

Identity verification is the process of confirming that a person or a business entity is truly who they claim to be. It plays a critical role in digital interactions, where physical presence and face-to-face validations are absent. The process involves using one or more factors—such as government-issued identity documents, biometric markers (like facial recognition or fingerprints), and cross-referencing personal information against trusted third-party or government databases.

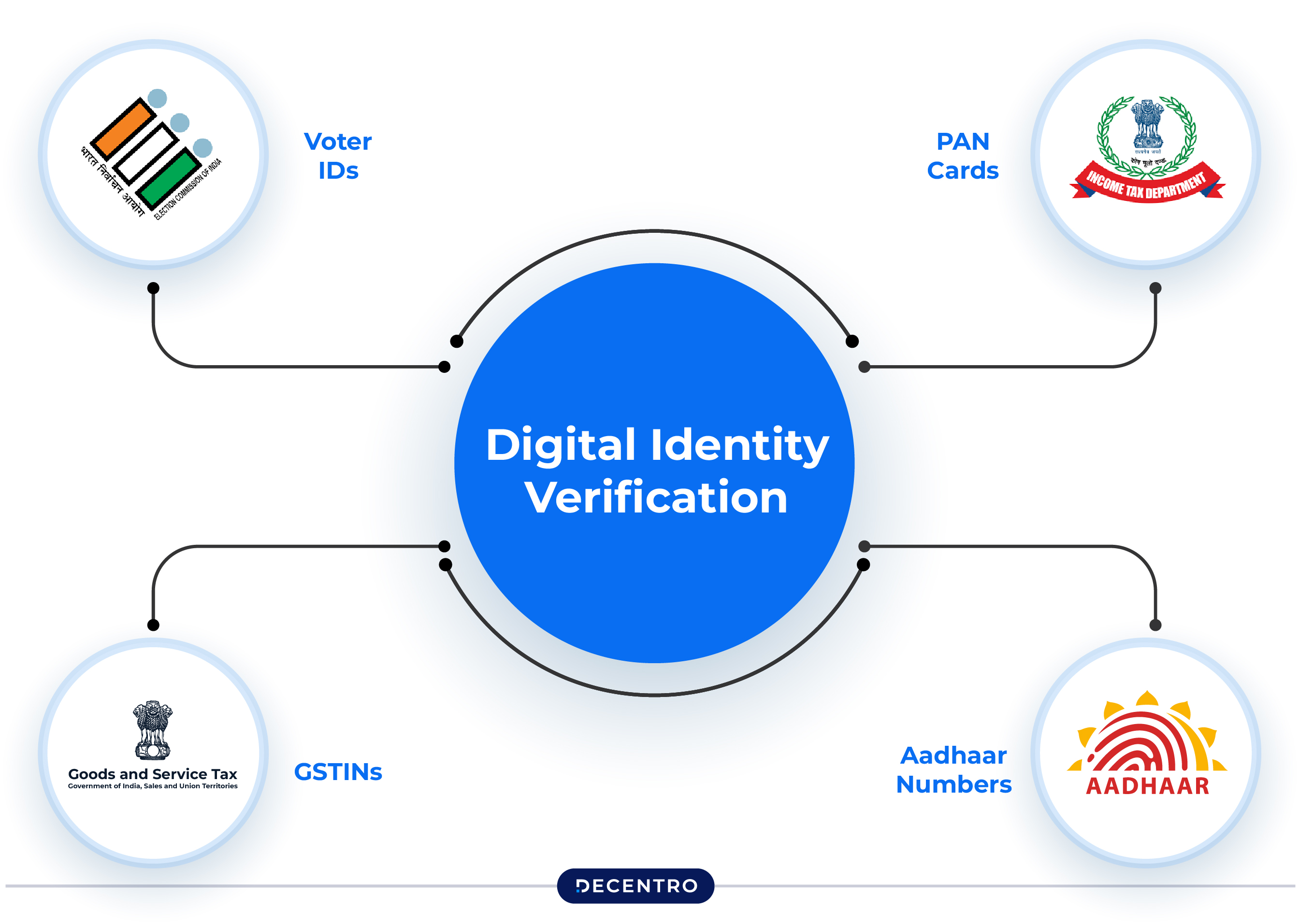

In a country like India, digital identity verification often includes validation of Aadhaar numbers, PAN cards, voter IDs, and GSTINs. Modern systems use AI to check for document authenticity, fraud detection, and liveness—ensuring that the person verifying is present in real time and not spoofed by an image or video.

From opening a new bank account and registering on a fintech app, to applying for a loan or insurance product, identity verification enables compliance with KYC norms and safeguards both users and businesses from fraud, impersonation, and financial loss.

In India, for instance, verifying an Aadhaar number, PAN, or GSTIN, combined with biometric liveness detection, is common. This helps businesses not only meet regulatory KYC norms but also detect fraud, prevent identity theft, and ensure real-time onboarding.

Whether you’re opening a bank account, renting a car, or signing up for a new digital service, identity verification forms the bedrock of safe digital engagement.

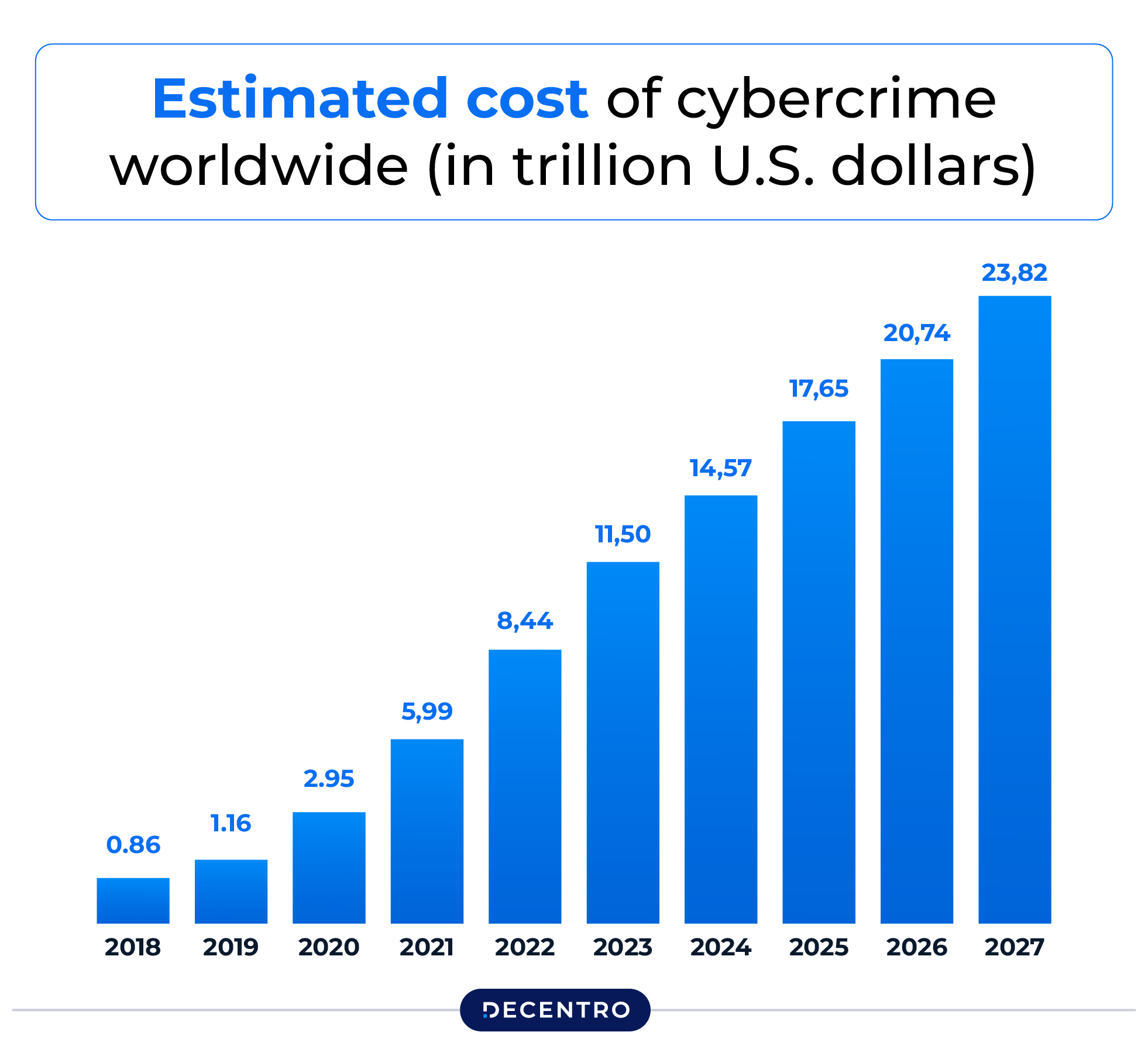

Market Numbers: Why Now Matters

- $9.5 trillion: Projected global cybercrime cost for 2024 (Secureworks)

- $13.75 billion: Size of the global identity verification market in 2025; growing to $39.82 billion by 2032 (Fortune Business Insights)

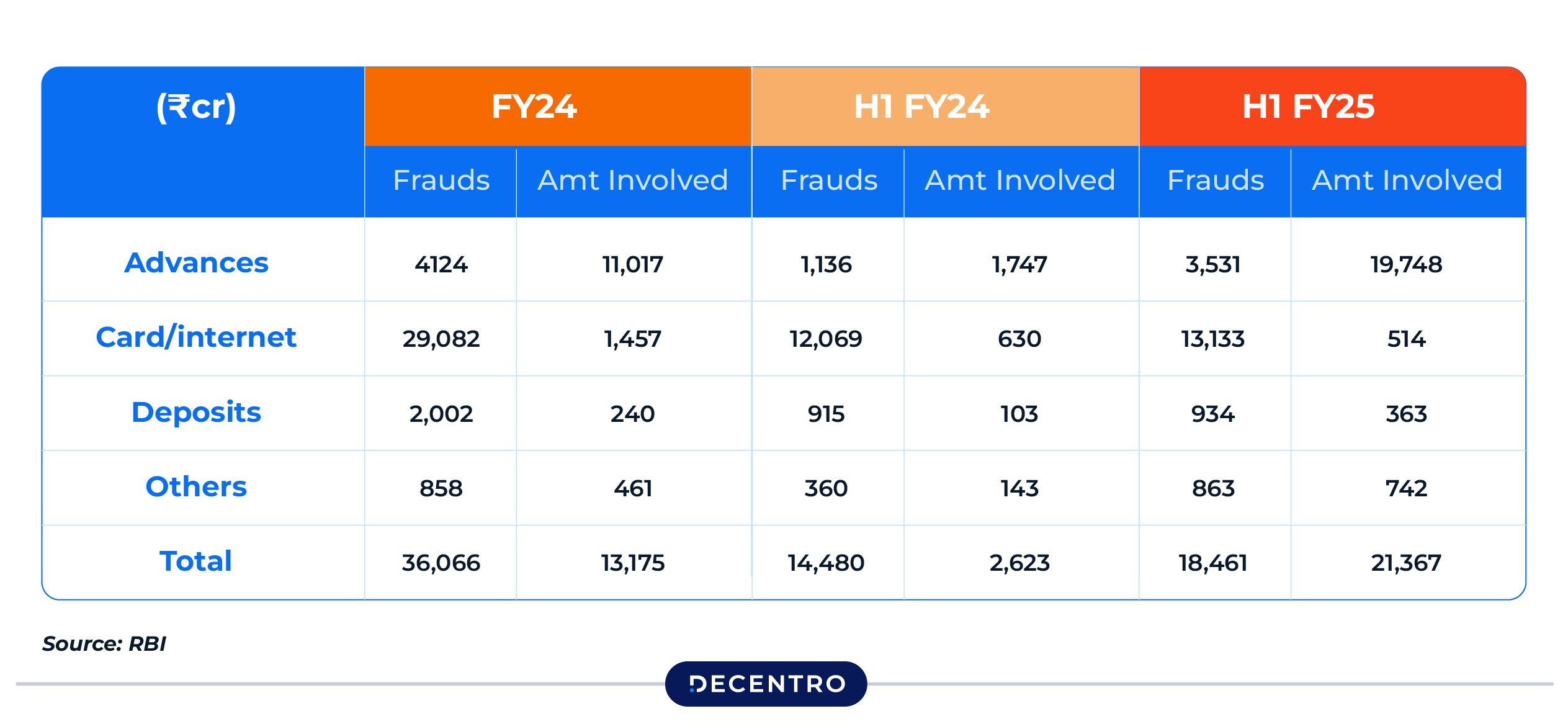

- 18,461 fraud cases / ₹21,367 crore: Logged by Indian banks in H1 FY2024-25 (Mint)

- Every 22 seconds: An identity theft attempt happens globally (Veridas)

Digital fraud is rising fast—making robust identity checks not just “good to have,” but absolutely critical.

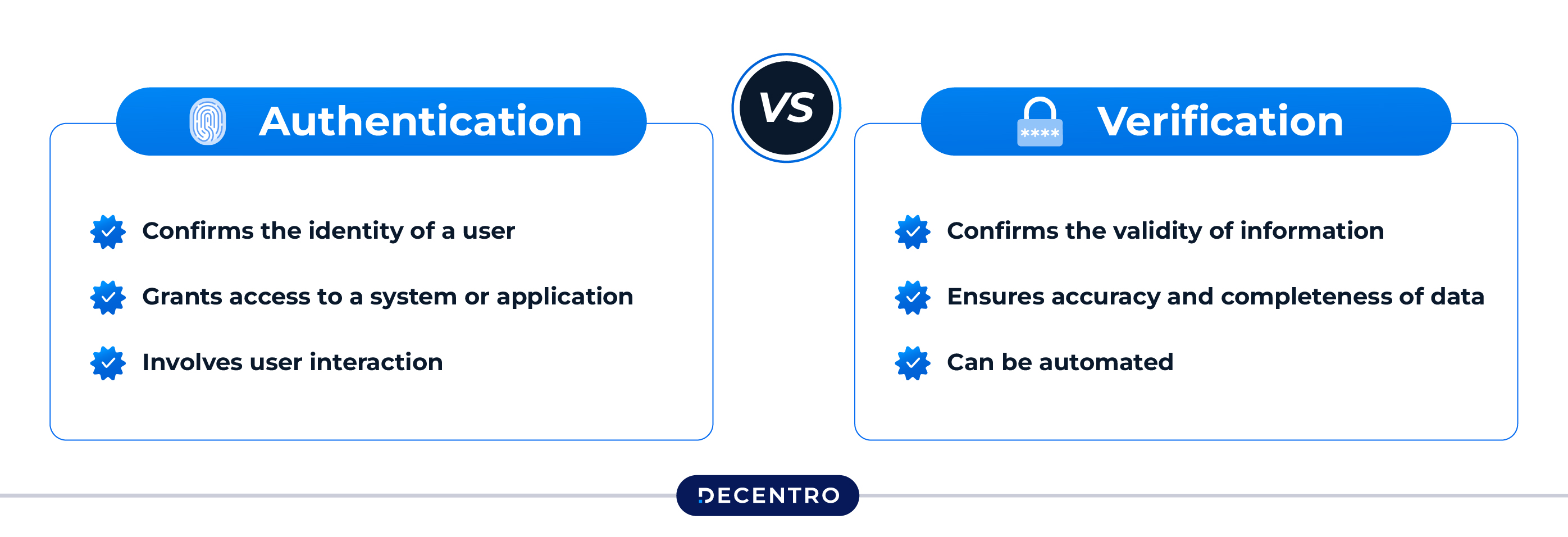

Identity Verification vs Authentication: What’s the Difference?

Before diving deeper into implementation, it’s important to distinguish between identity verification and identity authentication—two concepts that are closely related but serve distinct purposes in digital security.

Identity verification is the initial process of confirming someone’s real-world identity. This typically occurs during onboarding or account creation. It involves collecting and validating data such as government-issued ID numbers (like Aadhaar or PAN in India), biometric traits (like facial recognition or fingerprints), and personal details like date of birth and address. The goal here is to ensure the user is legitimate and not an imposter or fraudster trying to create a fake account.

Once the identity is verified, authentication kicks in. This is the process of ensuring that the same verified individual is the one accessing the account in future sessions. Authentication happens repeatedly—at every login, transaction, or high-risk action. It relies on something the user knows (password), something they have (OTP, device token), or something they are (biometric match).

Think of it this way:

Verification = “Are you really who you say you are?”

Authentication = “Prove it—again and again.”

Robust digital systems combine for airtight security. Skipping either can expose the business to account takeovers or regulatory penalties.

| Aspect | Identity Verification | Identity Authentication |

| Goal | Prove you’re John Doe | Prove you’re still John Doe every time you log in |

| When? | Onboarding / account creation | Every login, transaction, or sensitive action |

| Inputs | Government IDs, biometrics, trusted data | Passwords, OTPs, device tokens, biometrics |

| Failure Risks | Fake users, money laundering, fraud | Account takeover, session hijack |

Verification is one-time and foundational.

Authentication is ongoing and transactional.

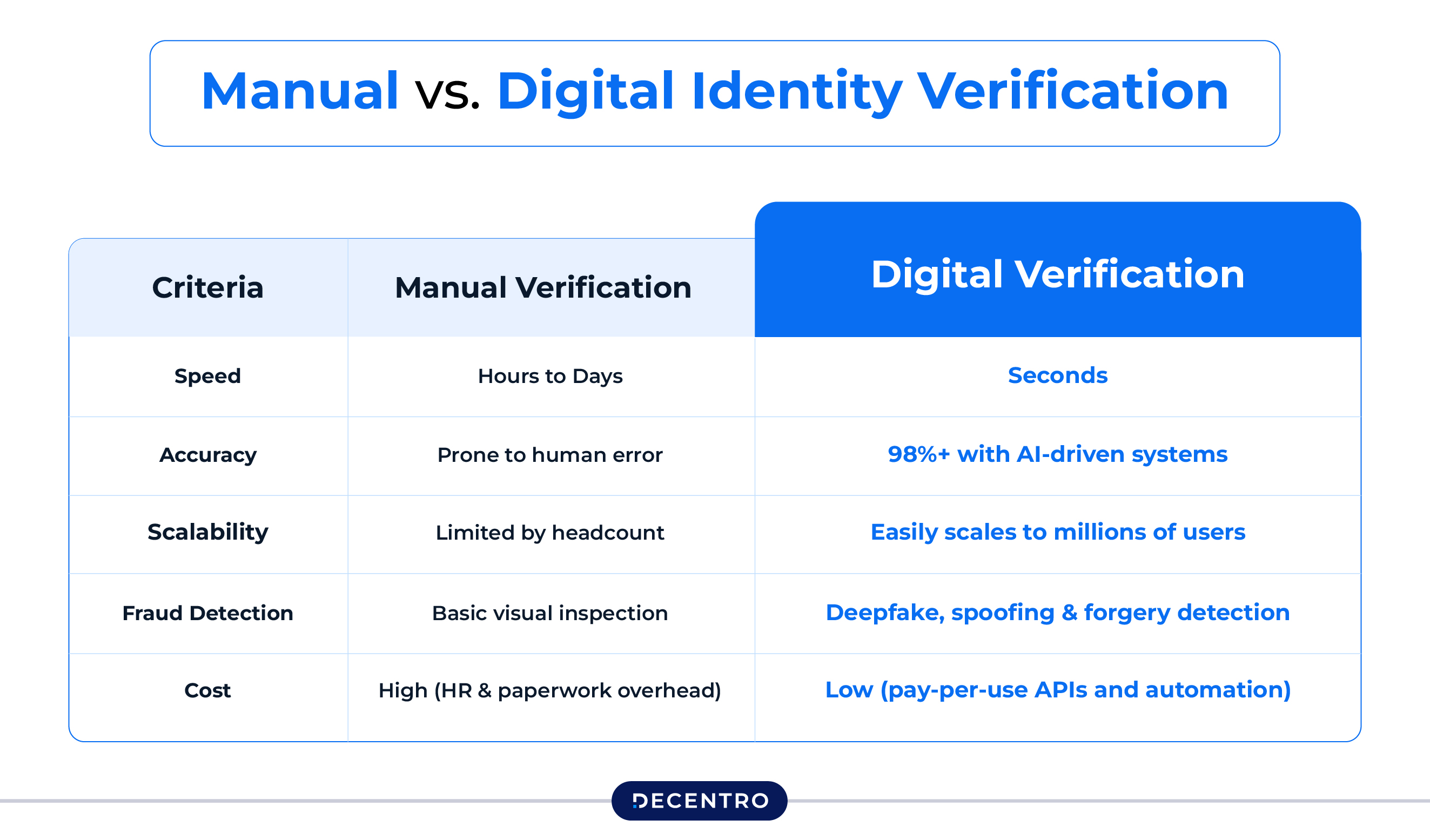

Manual vs. Digital Identity Verification

Until a few years ago, manual verification was the default across industries. Users would fill out forms, upload or scan paper documents, and wait for human agents to verify them. This meant days of delay, higher manpower costs, and susceptibility to human errors and biases.

With businesses now scaling to millions of users—across diverse geographies and platforms—manual methods simply can’t keep up. This is especially true in fast-moving sectors like fintech, gig economy, or digital lending, where delays can cost revenue or user trust.

Enter digital identity verification: a faster, smarter, and more scalable solution. Modern identity APIs, powered by AI and machine learning, can:

- Instantly scan and verify documents using OCR

- Detect signs of forgery or tampering

- Match faces with ID photos in real time

- Confirm a user is physically present using liveness detection

- Cross-check data against government databases (like UIDAI, CERSAI, NSDL, DigiLocker)

Here’s how the two stack up:

| Criteria | Manual Verification | Digital Verification |

| Speed | Hours to Days | Seconds |

| Accuracy | Prone to human error | 98%+ with AI-driven systems |

| Scalability | Limited by headcount | Easily scales to millions of users |

| Fraud Detection | Basic visual inspection | Deepfake, spoofing & forgery detection |

| Cost | High (HR & paperwork overhead) | Low (pay-per-use APIs and automation) |

🔍 In essence, digital verification allows companies to cut onboarding time from days to seconds—while improving accuracy and compliance.

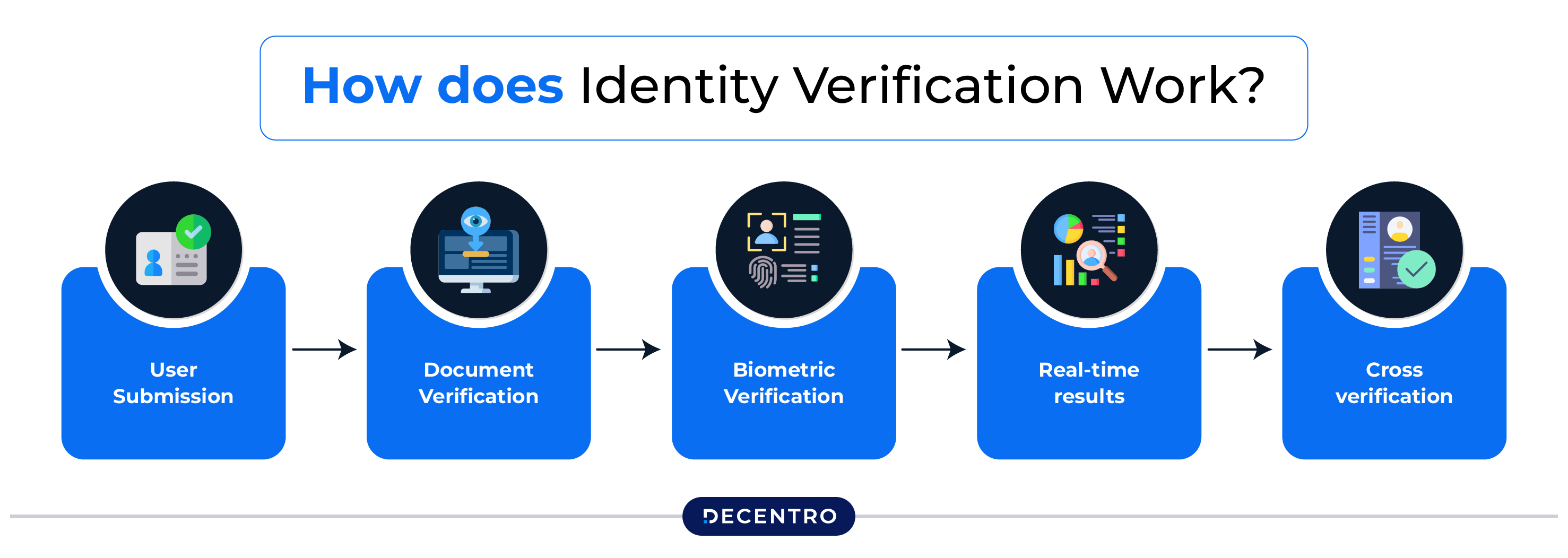

How Does Identity Verification Work?

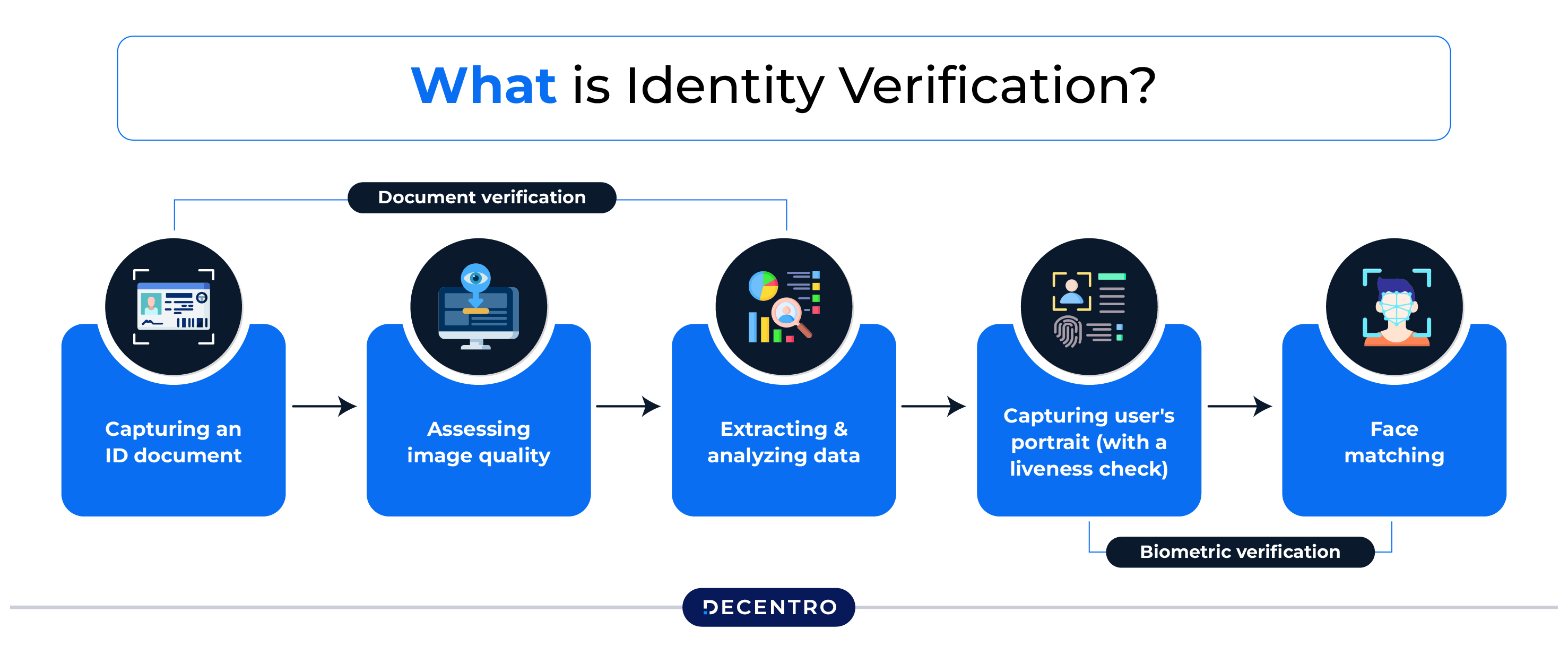

Digital identity verification is not a single action but a multi-layered workflow that blends document checks, biometric analysis, and data validation—often completed in just a few seconds. Here’s how it works in most modern systems:

- Submission

The process begins when the user submits an identity document—like Aadhaar, PAN, Passport, or Voter ID—by uploading a photo or scanning it via a mobile/web app. In some cases, the user also captures a selfie or live video for biometric comparison. - Document Review

AI-based OCR (Optical Character Recognition) scans and extracts key data points from the ID—name, date of birth, document number, and photo. Advanced systems also check for:- Tampering or forgery (e.g., mismatched fonts, altered fields)

- Expired or blacklisted documents

- Watermark and hologram presence

- Tampering or forgery (e.g., mismatched fonts, altered fields)

- Biometric Match & Liveness Detection

The user’s selfie is compared to the photo on the ID using facial recognition algorithms. Liveness detection ensures that the selfie is not a static image or deepfake by asking the user to blink, turn their head, or smile. - Data Validation with Official Sources

The extracted data is cross-verified with trusted databases such as:- UIDAI (Aadhaar)

- NSDL (PAN)

- CERSAI (Loan defaulter checks)

- DigiLocker (for verified digital docs)

- UIDAI (Aadhaar)

- Decision Engine

Based on a risk score or confidence threshold, the system either:- Approves the verification,

- Flags it for manual review, or

- Rejects it with a retry option.

- Approves the verification,

All of this can happen in under 2 seconds with Decentro’s verification suite, even for high volumes.

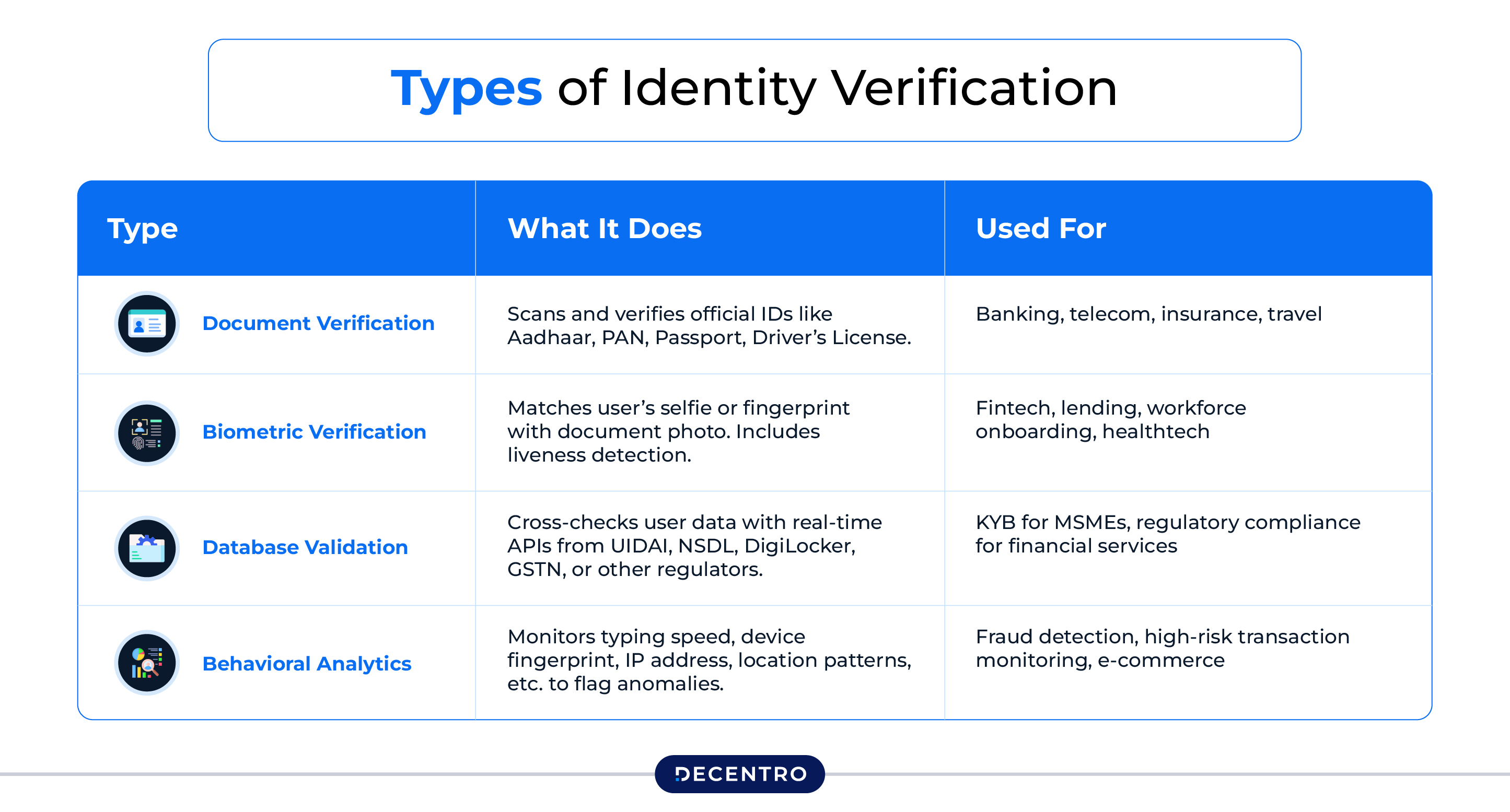

Types of Identity Verification

Depending on the business need and user segment, identity verification can be carried out in different ways. Let’s break down the major types:

| Type | What It Does | Used For |

| Document Verification | Scans and verifies official IDs like Aadhaar, PAN, Passport, Driver’s License. | Banking, telecom, insurance, travel |

| Biometric Verification | Matches user’s selfie or fingerprint with document photo. Includes liveness detection. | Fintech, lending, workforce onboarding, healthtech |

| Database Validation | Cross-checks user data with real-time APIs from UIDAI, NSDL, DigiLocker, GSTN, or other regulators. | KYB for MSMEs, regulatory compliance for financial services |

| Behavioral Analytics | Monitors typing speed, device fingerprint, IP address, location patterns, etc. to flag anomalies. | Fraud detection, high-risk transaction monitoring, e-commerce |

Real-world example: A lending app can use PAN and Aadhaar for document validation, match a selfie to PAN photo, validate details via NSDL, and use device behavior analytics to detect mule activity—all in a seamless, single flow.

Each of these methods can be layered together depending on your industry, risk appetite, and regulatory needs.

Why Do Businesses Need Identity Verification?

Identity verification isn’t just a compliance checkbox. Here’s why forward-looking businesses prioritize it:

- Compliance: Adhere to RBI, SEBI, IRDAI, FATF, and other KYC/AML/CDD regulations.

- Fraud Prevention: Keep bad actors out. Prevent money laundering, fake accounts, and mule networks.

- Customer Trust: Smooth and secure onboarding builds confidence and reduces drop-offs.

- Operational Efficiency: Reduce manual work. Automate verifications to scale faster.

Biometrics & Liveness: The Human Touch

Biometrics have become the gold standard for ID verification. A selfie or fingerprint can replace lengthy forms. But it’s not foolproof.

Liveness detection plays a crucial role in ensuring that the data submitted is from a live human being. This helps prevent spoofing attacks using photos, videos, or masks.

Most modern systems combine biometric matching with AI-based liveness checks to ensure safety without compromising user experience.

Where Does ID Verification Fit In?

Identity verification isn’t a standalone task—it’s a part of a broader trust and compliance ecosystem.

A robust identity verification stack combines:

- Document checks (PAN, Aadhaar, Passport)

- Biometric + liveness detection

- Cross-validation with government & financial databases

- Behavioural signals like device & network intelligence

This layered approach helps businesses balance speed and security, while meeting compliance needs.

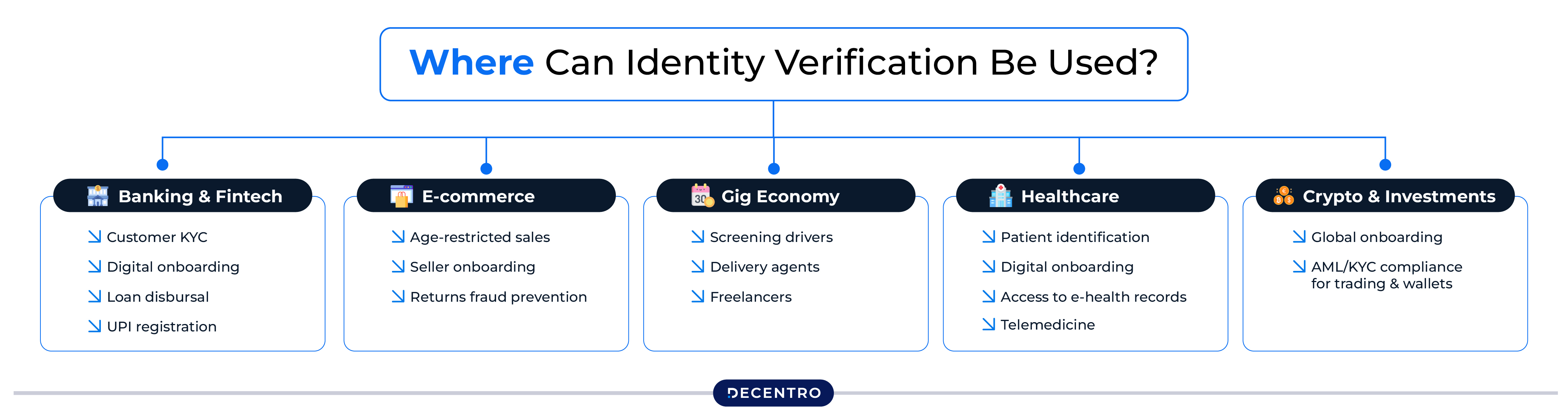

Where Can Identity Verification Be Used?

| Industry | Use Case |

| Banking & Fintech | Customer KYC, digital onboarding, loan disbursal, UPI registration |

| E-commerce | Age-restricted sales, seller onboarding, returns fraud prevention |

| Gig Economy | Screening drivers, delivery agents, and freelancers |

| Healthcare | Patient identification, access to e-health records, telemedicine |

| Crypto & Investments | Global onboarding, AML/KYC compliance for trading & wallets |

Deploying Identity Verification: The Decentro Advantage

Modern businesses can’t afford trade-offs between speed, security, and compliance. With Decentro’s Identity Verification Suite, you can:

- Onboard users in <2 seconds

- Run document, biometric, and data checks in a single API flow

- Plug into 50+ ID types including Aadhaar, PAN, Passport, GSTIN, and more

- Achieve 99.99% uptime, with 2000+ ID validations/hour and 10,000+ data points fetched daily

Decentro’s Products That Power Verification

- Fabric – All-in-one KYC/KYB stack for individual and business onboarding

- Complete individual and business onboarding solution

- Supports all photo-based national IDs, including Driver’s Licence (DL), PAN, Voter ID, Passport & Aadhaar card

- Bank account verification and GSTIN verification capabilities

- Single platform to cater to all your KYC needs across ID verification, KYC OCR, CKYC, and DigiLocker

- Hyperstreams – The fastest ID verification experience ever

- Enable complete user verification and build seamless onboarding experiences with our pre-built SDKs & APIs

- End-to-end user identity verification

- Pre-built SDKs for faster integration

- Scanner – Smart document OCR and forgery detection through Omniscore

- Extract KYC ID from customers’ and business’ documents and reduce manual workload

- Advanced Omniscore technology for forgery detection

- Automated document processing to reduce manual workload

- UI Stream – Ready-to-use, embeddable UI flows for quick customer journeys

- Build a fully-native user verification & KYC experience

- Embeddable UI components for quick customer journeys

- Native user verification experience

Trusted by 1500+ Indian businesses, including lenders, neobanks, e-commerce, and investment platforms.

Book a Free Demo with Decentro

Standards & Regulations

Businesses operating in or expanding to India need to comply with:

- RBI Master Directions (Digital Lending, KYC, eKYC)

- SEBI & IRDAI guidelines (Investor and Insurance Onboarding)

- DPDP Act – India’s new privacy law

- CERSAI & UIDAI norms – For document and ID checks

And if you operate globally:

- FATF Recommendations

- PSD2 (Europe)

- GDPR (EU)

- CCPA (US)

Ensure your identity provider is compliant with both domestic and global regulations.

The Future: Smarter, Seamless, More Secure

As India’s digital stack matures (e.g., Aadhaar, DigiLocker, UPI, Account Aggregator), identity verification is evolving into a real-time trust engine.

Expect:

- AI-powered decisions with fraud scoring

- DPI integrations with Aadhaar, DigiLocker, PAN

- Context-aware onboarding using location, device, and behaviour

The future is fast, frictionless, and fraud-proof.

Frequently Asked Questions

1. What is identity verification, and why is it important?

It confirms that a person is who they claim to be—using documents like Aadhaar or PAN, selfies, and database checks. It’s essential to comply with RBI/SEBI norms and avoid financial fraud.

2. How does digital verification work in India?

Users upload Aadhaar/PAN, click a selfie, and the system checks for authenticity, biometric match, and presence via liveness detection.

3. Is identity verification required for UPI or digital lending?

Yes. RBI mandates digital KYC for onboarding customers in UPI, lending, and prepaid instruments.

4. What documents are accepted?

Typically Aadhaar, PAN, Passport, Voter ID. Businesses may ask for GSTIN for KYB (business verification).

5. Is my data secure with identity providers?

Yes—leading providers like Decentro encrypt your data and follow privacy laws like India’s DPDP Act.

6. What happens if my KYC fails?

You may be asked to re-upload clearer photos or alternate IDs. Continuous failure means you won’t be able to use the service.