Discover how embedded finance helps EdTech startups make quality education more accessible and affordable for learners worldwide.

How Embedded Finance Is Powering the Next Wave of EdTech

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

The world education space is undergoing a seismic and long-overdue change. For decades, the model didn’t change much, but now, fueled by the unrelenting rhythm of technology and an acute societal shift toward flexible, accessible, and skills-oriented learning, a new ecosystem is flourishing: Education Technology (EdTech). From interactive online coding bootcamps and AI-based tutoring platforms to full-service private school management systems, these new players are essentially revolutionizing how, when, and where we learn.

But as these startups revolutionize pedagogy and curriculum, a less headline-grabbing, but no less potent, revolution is taking place within their business models. This one is fuelled by Embedded Finance, a notion that is transitioning away from fintech’s periphery towards the centre of contemporary digital strategy.

Embedded finance is the contextual, frictionless incorporation of financial services, such as payments, loans, credit, and insurance, natively into the native user experience of a non-banking firm’s software or platform. It’s about reaching customers exactly where they are, presenting them with the appropriate financial utility at the right time of need, thus removing friction and improving the user experience. For EdTech startups, this is much more than a convenience; it’s a strong driver for democratizing access, driving sustainable growth, and securing long-term student success.

Breaking Down Barriers: The Core Problem EdTech Solves with Finance

Quality education, particularly the type of technical training needed for today’s most sought-after professions, tends to be very expensive. This cost barrier is often the biggest and most discouraging hurdle keeping a motivated, capable student from pursuing a class that might transform their life.

The conventional route to funding education is one of abrasion. A potential pupil would normally need to:

- Search and apply for the EdTech program.

- Research and find on their own potential lenders, such as banks or credit unions, specialising in making loans.

- Go through a whole different, usually cumbersome, application process with the lender.

- Wait, sometimes for weeks, for an approval decision, creating a time of uncertainty that often results in drop-off.

- If approved, navigate a clunky, disjointed process to transfer the funds to the school.

This disjointed and often intimidating process creates a “leaky funnel” where countless potential students are lost along the way. Embedded finance changes this dynamic entirely. By integrating sophisticated financial solutions directly into their platforms, EdTech companies can absorb this complexity, remove the friction, and make high-quality education more attainable for a much broader audience.

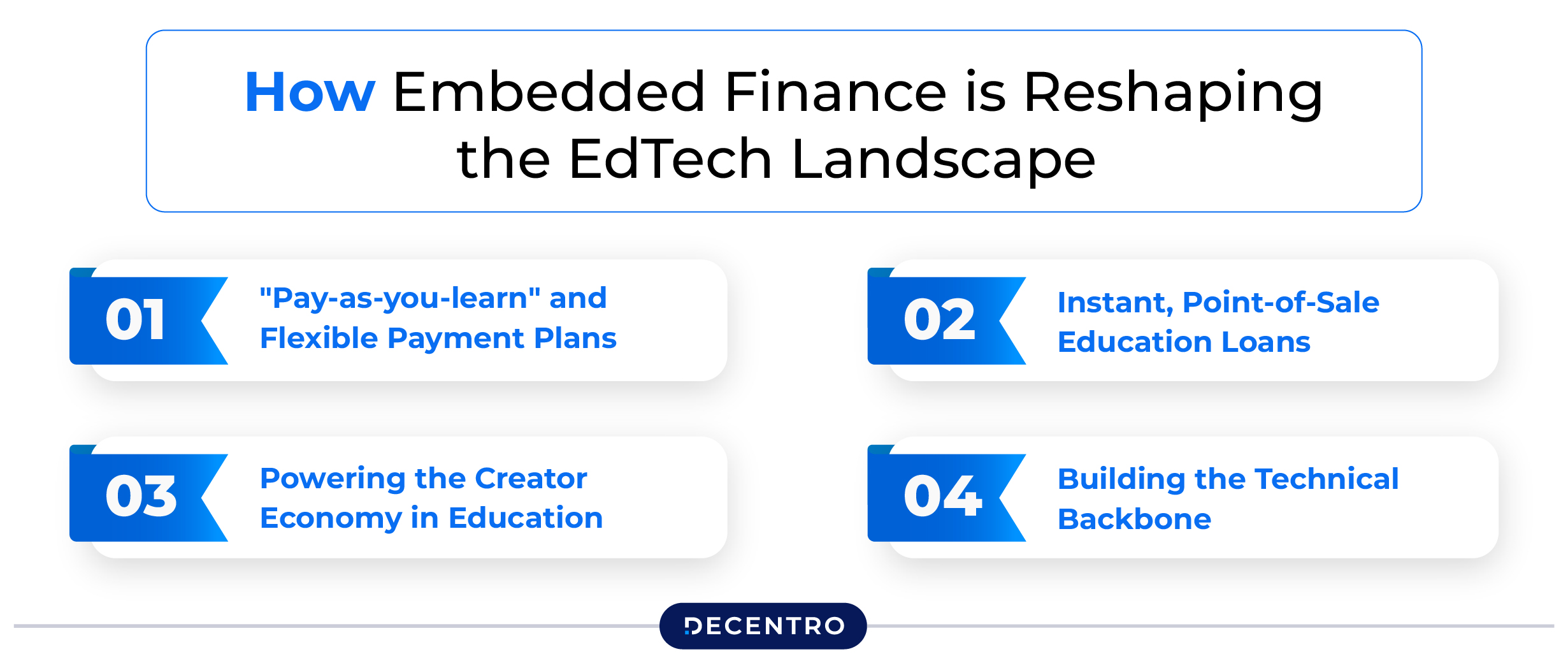

How Embedded Finance is Reshaping the EdTech Landscape

Here are the key ways education startups are leveraging embedded finance to empower the next generation of learners:

1. “Pay-as-you-learn” and Flexible Payment Plans

- The Solution: The most immediate and impactful application is the integration of flexible payment options at the point of sale. Instead of demanding a large, daunting upfront payment, EdTech platforms can programmatically offer integrated instalment plans directly at the digital checkout. With just a few clicks and without ever leaving the enrollment page, a student can choose to split the total cost over three, six, or twelve months. This is often powered by “Buy Now, Pay Later” (BNPL) providers who have built APIs specifically for this kind of seamless integration.

- The Impact: The psychological effect of this is immense. A hefty course fee becomes much more manageable in instalments. This dramatically lowers the initial financial hurdle, making courses accessible to individuals who have the ambition but lack the immediate capital. For the EdTech startup, this translates directly into higher conversion rates, reduced cart abandonment, and a larger addressable market. For the student, it provides crucial financial flexibility and a sense of control over their investment.

2. Instant, Point-of-Sale Education Loans

- The Solution: For more expensive, career-transforming programs like intensive bootcamps or specialized certification tracks, simple installment plans may not be enough. Here, EdTech companies can embed a full, white-labeled loan application process directly into their enrollment flow. Through API partnerships with modern FinTech lenders, they can offer instant underwriting decisions. The student fills out a simple form on the EdTech site, and sophisticated algorithms assess their creditworthiness in seconds.

- The Impact: This seamless experience is a game-changer. It replaces weeks of anxiety and uncertainty with an immediate, transparent decision. This not only boosts enrollment numbers but also significantly improves the student onboarding experience, starting their educational journey on a positive and empowering note. Furthermore, by partnering with lenders who specialise in education finance, startups can often offer more favourable terms (like deferred payments or interest-only periods) than traditional personal loans.

3. Powering the Creator Economy in Education

- The Solution: Many of the most successful EdTech platforms today are not monolithic institutions but vibrant marketplaces that connect thousands of independent instructors with millions of students. Embedded finance is the critical, often invisible, infrastructure that makes this model work at scale. It handles the entire complex financial workflow: securely collecting payments from students in various currencies, automatically splitting those payments according to the platform’s commission structure, and reliably paying out earnings to instructors across the globe. This is often referred to as “payments facilitation” or “PayFac.”

- The Impact: This automated financial plumbing allows the platform to scale rapidly without being crushed by the operational overhead of managing thousands of individual financial relationships. For instructors, it provides a reliable, transparent, and hassle-free way to monetise their expertise, fostering a loyal and thriving community of educators who are essential to the platform’s success.

4. Building the Technical Backbone

- The magic of embedded finance, its seamlessness, speed, and reliability, rests on a foundation of robust, secure, and scalable technology. Achieving this requires the smooth integration of payment gateways, lending APIs, identity verification systems, and user-friendly financial dashboards, all of which demand precision engineering. Skilled developers must work across the full technology stack, from secure backend infrastructure to intuitive frontend interfaces.

- Today, AI is making it easier for developers to design and deploy these complex systems, especially dynamic, user-facing dashboards that adapt in real time to customer needs. A generative AI course can equip professionals with the ability to rapidly prototype interfaces, auto-generate code components, and personalize financial experiences at scale. By leveraging AI-driven automation and intelligence, developers can focus on creating seamless, secure, and engaging embedded finance applications faster and more efficiently than ever before.

The Win-Win-Win Scenario

Embedded finance is not a zero-sum game; it creates a powerful, virtuous cycle that delivers clear and compelling benefits to every stakeholder in the ecosystem.

- For Students: It provides dignified, frictionless access to financing, breaking down financial barriers and empowering them to invest in their own futures. The transparency and convenience foster a sense of trust and reduce the anxiety associated with educational expenses.

- For EdTech Startups: It is a powerful lever for growth. It directly increases student enrollment, boosts revenue, and improves customer loyalty. By outsourcing the complexity of financial services, it allows the startup to focus on its core mission: delivering a world-class educational experience.

- For Financial Partners (Lenders & Banks): It provides highly efficient access to a new, targeted, and often lower-risk channel of high-quality borrowers. Instead of spending heavily on marketing to find customers, they can acquire them directly at their point of need, significantly reducing customer acquisition costs.

The Future: From Payments to Full Financial Wellness

The journey is just beginning. The future of embedded finance in EdTech will move beyond simple payments and loans. Imagine a platform that also offers:

- Integrated Tuition Insurance: Offering an embedded insurance product that protects a student’s financial investment if they have to withdraw from a course due to unforeseen medical or personal reasons.

- Smart Student Bank Accounts: Providing students with an integrated, low-fee digital bank account that helps them budget for living expenses, manage their loan disbursements, and learn financial literacy skills.

- Intelligent Income Share Agreements (ISAs): An embedded financing model where students pay no upfront tuition, but instead agree to pay a small percentage of their income for a fixed period after they land a job. The platform could manage this entire lifecycle, from underwriting the ISA to facilitating the income-based repayments.

- AI-Driven Career and Financial Coaching: Leveraging data to provide personalised advice. An AI model could analyse a student’s progress and career goals to recommend part-time jobs or internships, and then use that income data to offer personalised financial planning advice.

To build these more sophisticated and secure financial products, EdTech companies will continue to need highly skilled engineers. A comprehensive Java development course provides the deep, project-based learning required to architect these reliable and scalable systems, ensuring that the technology can support the next wave of innovation in educational finance.

Conclusion: Investing in a Smarter Future

Embedded finance is more than just a business strategy for education startups; it’s a powerful tool for social mobility. By removing financial friction and making high-quality education more accessible, these companies are not just building successful businesses; they are empowering individuals to acquire the skills they need to thrive in the modern economy. It’s a testament to how thoughtful technology, applied with a human-centric approach, can create a smarter, more equitable, and more prosperous future for everyone.

The question for EdTech leaders is no longer if they should adopt this technology, but how quickly they can implement a robust solution to unlock their full potential. The future of education is accessible, seamless, and financially empowered.

With Decentro, you can build that future today, offering your students the flexible financing they need and unlocking the growth your platform deserves.