Payment reconciliation slows down even the best CAs and accounting firms. See how AI turns this daily headache into a breeze for Indian accounting firms & CAs

Top Payment Reconciliation Challenges And How AI Solves Them

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

You’ve just closed another month. Tally is humming, GST deadlines are looming, clients are pinging, and you wonder: Will reconciliation ever get easier?

If you’re a Chartered Accountant in India, you already know that payment reconciliation is the backbone of accuracy, compliance, and client trust. But too often, it feels like running a marathon on a treadmill: endless, repetitive, and stressful.

Let’s break down the real challenges Indian CAs face in payment reconciliation and find out how AI-powered tools are changing everything.

What’s Really at Stake in Payment Reconciliation?

Every rupee must match. Every statement must tally.

Yet, in today’s digital India, with UPI, IMPS, cash, cards, wallets, and rapid-fire transaction volumes, the old way is no longer enough.

- ₹36,014 crore: Value of bank frauds reported in India in FY 2024-25 (Indian Express)

- Thousands of transactions: Even mid-sized businesses now expect CAs to reconcile payment monthly

- GST, audits, and deadlines: Compliance is non-negotiable

That’s why CAs are now turning to automation and AI not just for relief, but for a strategic advantage.

1. Manual Data Entry: “Not Again in the AI Era!”

How many times have you copied and pasted an entry from one sheet to another? Manual payment reconciliation involves retyping invoice numbers, cheque IDs, payment UTRs, or GST references, often across multiple systems, including Excel, Tally, and client statements. But now, AI accounting solutions allow you to process unlimited bank statements, sales/purchase documents, and item/ledger masters in any format, be it Excel, PDF, or even scanned PDFs; all for under ₹10,000!

2. Multiplying Payment Channels, Multiplying Headaches

Clients pay by UPI one day, NEFT the next, and sometimes hand-deliver a cheque. Now add in wallets, cash, cards, and instant transfers.

Result: Finding and matching records scattered across emails, PDFs, screenshots, and statements becomes a demanding task.

3. The Timesink Trap: Why Does This Take So Long?

Traditional reconciliation isn’t just about accuracy. It’s a race against the clock; closing books in time for GST, financial reporting, or audits means long nights and plenty of stress.

Fact: Manual reconciliation can turn a one-day task into a week-long grind no one wants to repeat.

4. Data Discrepancies: “Bank Says A, Ledger Says B”

One stray entry, a mistyped voucher, or a duplicate payment, and the numbers won’t match.

Symptoms:

- Endless back-and-forth with clients

- Rechecking emails or messaging on WhatsApp

- Sleepless nights before the audit

5. Volume Overload: Growth Shouldn’t Hurt

As your clients scale, the number of transactions explodes. Manually reconciling hundreds or thousands of entries isn’t feasible, even with a big team.

6. Lack of Live Visibility: “Why Am I Always Catching Up?”

You open Excel only to discover last month’s missteps, when it’s already too late. In the digital age, clients and teams expect real-time clarity, not yesterday’s news.

7. Compliance and Audit Worries: “What If We Miss Something?”

India’s GST and audit regulations require impeccable reconciliation, month after month. Missing even a single entry can raise red flags with authorities.

8. Integration Woes: Modern Tech, Old Systems

Many accounting firms still rely on legacy software, making it challenging to adopt new platforms or automate tasks.

The Issue: Data gets siloed, leading to extra manual work and risk of errors.

9. Fraud and Anomaly Blindspots

Without automated alerts and analytics, suspicious transactions can go unnoticed, leaving firms and clients vulnerable to fraud, double payments, or even internal misuse.

10. Rising Costs, Shrinking Margins

More clients and transactions often mean more staff, overtime, and burnout, all of which cut into profit margins for firms looking to grow.

The Traditional Path: Manual Reconciliation vs. Automation

| Criteria | Manual Reconciliation | Automated |

| Speed | Slow—hours or days | Real-time: minutes |

| Accuracy | Prone to human error | 98%+ with AI checks |

| Scale | Limited by team size | Scales with your grow |

| Fraud Detection | Weak—basic spotting | AI-driven pattern analysis |

| Cost | High (labor, overtime) | Low (software-backed, pay-as-you-go) |

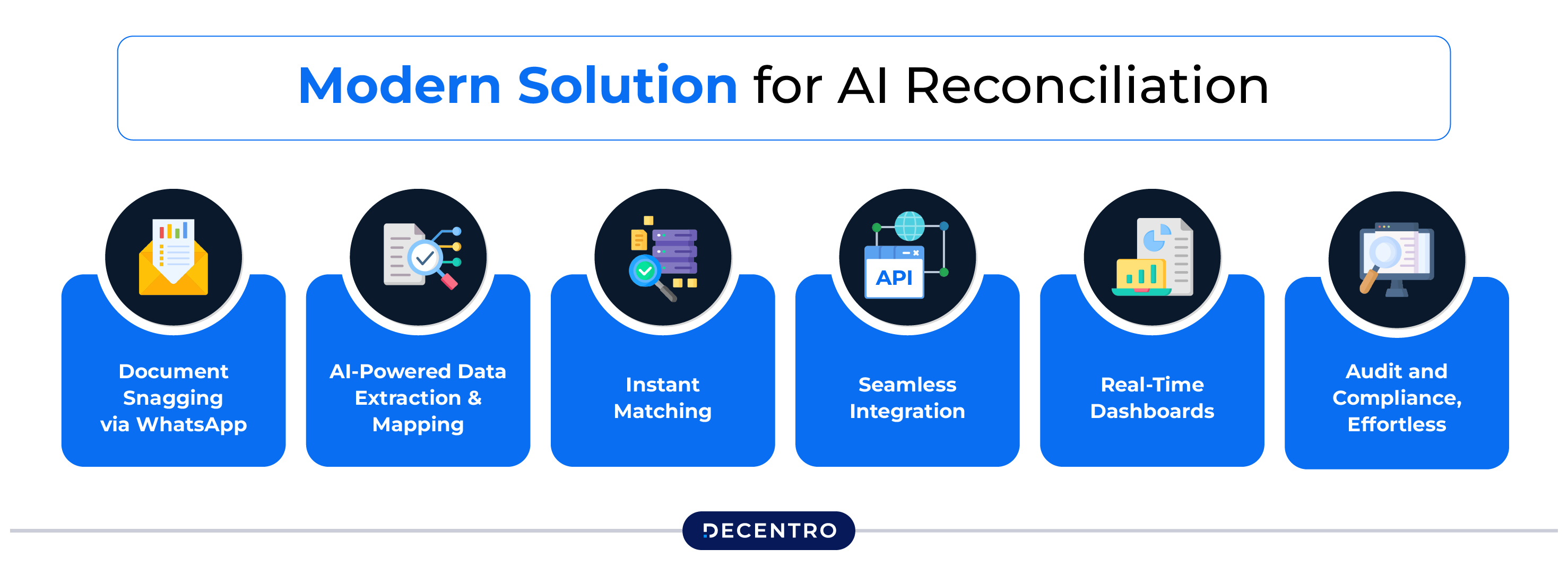

So, What’s the Modern Solution for AI Reconciliation?

If you want to stop fighting fires and start building strategic client relationships, automation is your MVP. India’s AI-driven reconciliation platforms are purpose-built for Chartered Accountants.

How Does it Work?

Document Snagging via WhatsApp: Automated WhatsApp reminders collect client documents, including bank statements, invoices, and more. So you’re not chasing paperwork.

AI-Powered Data Extraction & Mapping: Scans, tags, and aligns payment entries, regardless of format or source.

Instant Matching: With built-in validation rules, it automatically matches entries from client statements to your accounts, highlighting discrepancies in real-time.

Seamless Integration: Compatible with accounting software and other widely used tools in Indian Chartered Accountancy, it seamlessly integrates into your current workflow.

Real-Time Dashboards: Track progress, catch errors, and generate reports in real time before deadlines sneak up on you.

Audit and Compliance, Effortless: Every reconciliation leaves a digital audit trail, eliminating the need to hunt for evidence during assessments or GST time.

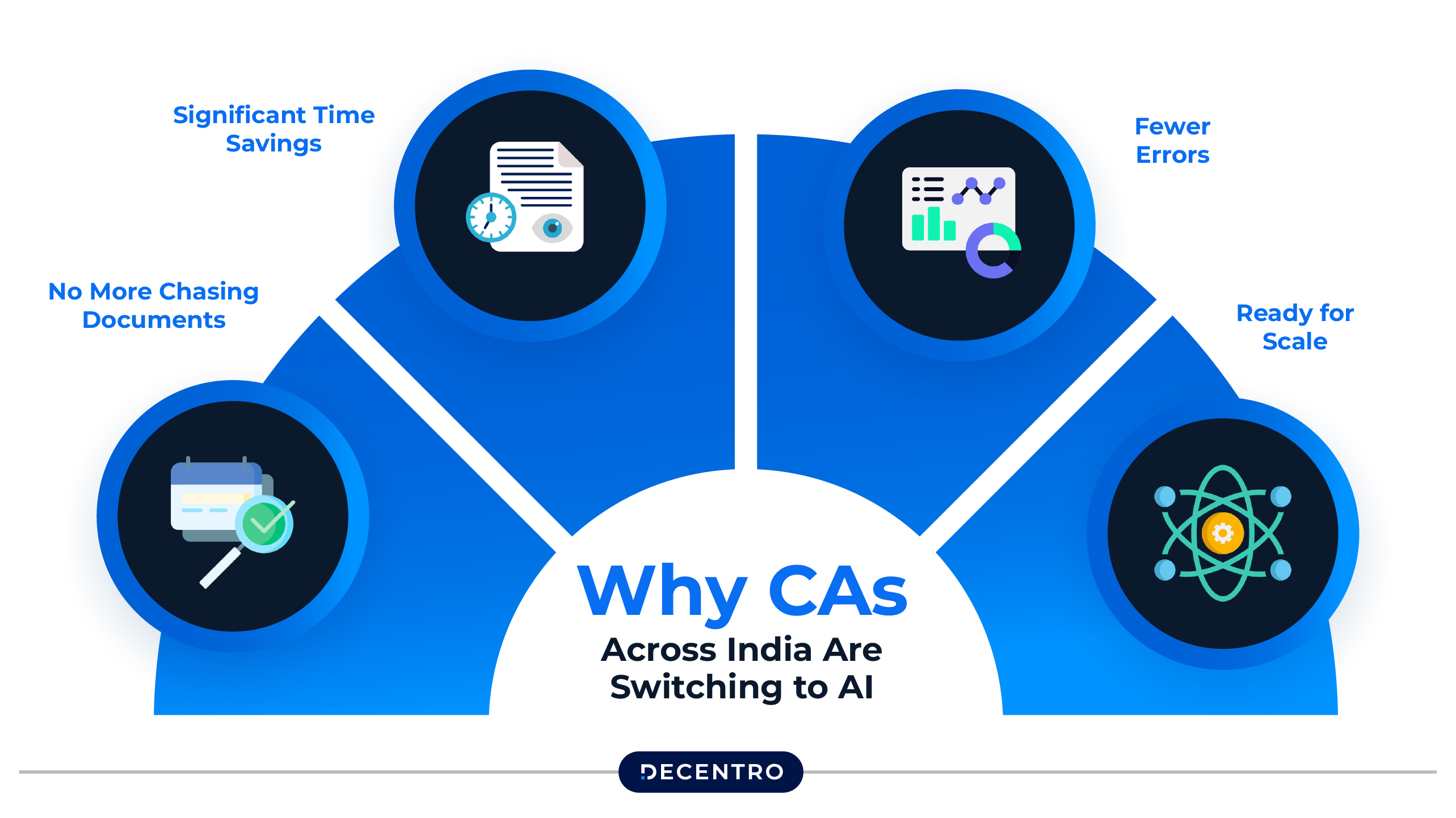

Why CAs Across India Are Switching to AI

- No More Chasing Documents: Automated reminders and uploads streamline the entire process.

- Significant Time Savings: Reconciliation that once took days now takes minutes, leaving more time for high-value work.

- Fewer Errors: AI validation means less risk, fewer compliance scares, and happy auditors.

- Ready for Scale: Whether you handle 10 clients or 100, it grows with you, without needing a bigger team.

How AI Tackles Each Challenge

| Challenge | AI Advantage |

| Manual entry | Auto-capture and entry from multiple sources |

| Time delays | Real-time recon, instant alerts |

| Data mismatches | Flags, suggests corrections |

| High volume | Handles thousands, no extra effort |

| Visibility | Live dashboards, mobile-ready insights |

| Compliance | Digital logs, GST integration |

| System integration | Plug-and-play with existing accounting software |

| Fraud/anomalies | AI flags outliers, duplicate payments |

| Rising costs | Reduces manual hours, overtime requirements |

The Future: Smarter, Effortless, and More Strategic

Indian CAs who adopt automation, not just as a tool, but as a practice philosophy, position themselves as trusted digital advisors, not just bookkeepers.

Imagine:

- Clients getting reconciled books within hours of month close.

- No late-night calls over missing entries.

- Zero compliance worries, even as regulations change.

All thanks to automation and an India-first design in AI tools for accounting.

Frequently Asked Questions

1. Can AI handle Excel, PDF, images, and bank statements data?

Absolutely. AI tools built for Indian firms handle diverse formats and reconcile payments using these formats.

2. How secure are AI Platforms for Payment reconciliation?

AI platforms use strict data encryption and comply with Indian financial data norms. Your data is safe and confidential.

3. Will AI tools work with my current Tally/Excel setup?

Yes, AI-powered tools easily integrate with Tally and export from Excel.

4. Are AI tools expensive for smaller firms?

Most AI tools work as a pay-as-you-go model for firms of all sizes. Most practices save money by cutting reconciliation hours.

5. Can AI help during audits?

Definitely! Its digital logs, reports, and payment gateways integrations make audits much smoother.

6. How does AI-powered payment reconciliation improve accuracy compared to manual methods?

AI-driven tools automatically detect discrepancies, match transactions across multiple sources, and learn from past data, drastically reducing human errors and ensuring highly accurate reconciliation.

7. Is training required for teams to use AI reconciliation software?

Most AI-powered platforms are designed with user-friendly interfaces and intuitive workflows, requiring minimal training. Support resources and onboarding assistance are typically available to help teams transition smoothly.

Transform Reconciliation, Win Client Loyalty

Reconciliation is no longer just a back-office function; it’s the core of smart, strategic accountancy. By switching to AI-powered automation tools, CAs across India are freeing their teams, delighting clients, and staying ahead in a world where digital payments are growing daily.