How AI commercial loan underwriting speeds approvals, improves risk scoring, and expands credit access for Indian SMEs. Use cases, and implementation.

AI Commercial Loan Underwriting: Guide & Use Cases

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

India’s commercial lending sector, valued at ₹86.3 trillion ($1 trillion) as of FY2022, stands at a critical juncture. While the consumer lending market is projected to surpass $720 billion in 2025, traditional underwriting methods are struggling to keep pace with demand, leaving significant credit gaps unfilled.

Artificial Intelligence (AI) in commercial loan underwriting represents a paradigm shift that promises to revolutionize how lenders assess risk, process applications, and extend credit to businesses across India. This transformation isn’t just about automation—it’s about creating more accurate, inclusive, and efficient lending systems that can bridge India’s persistent credit gap while maintaining robust risk management standards.

This comprehensive guide examines how AI is transforming commercial loan underwriting in India, the regulatory framework governing these innovations, and practical solutions that are already making a significant impact in the lending ecosystem.

The Current State of Commercial Lending in India

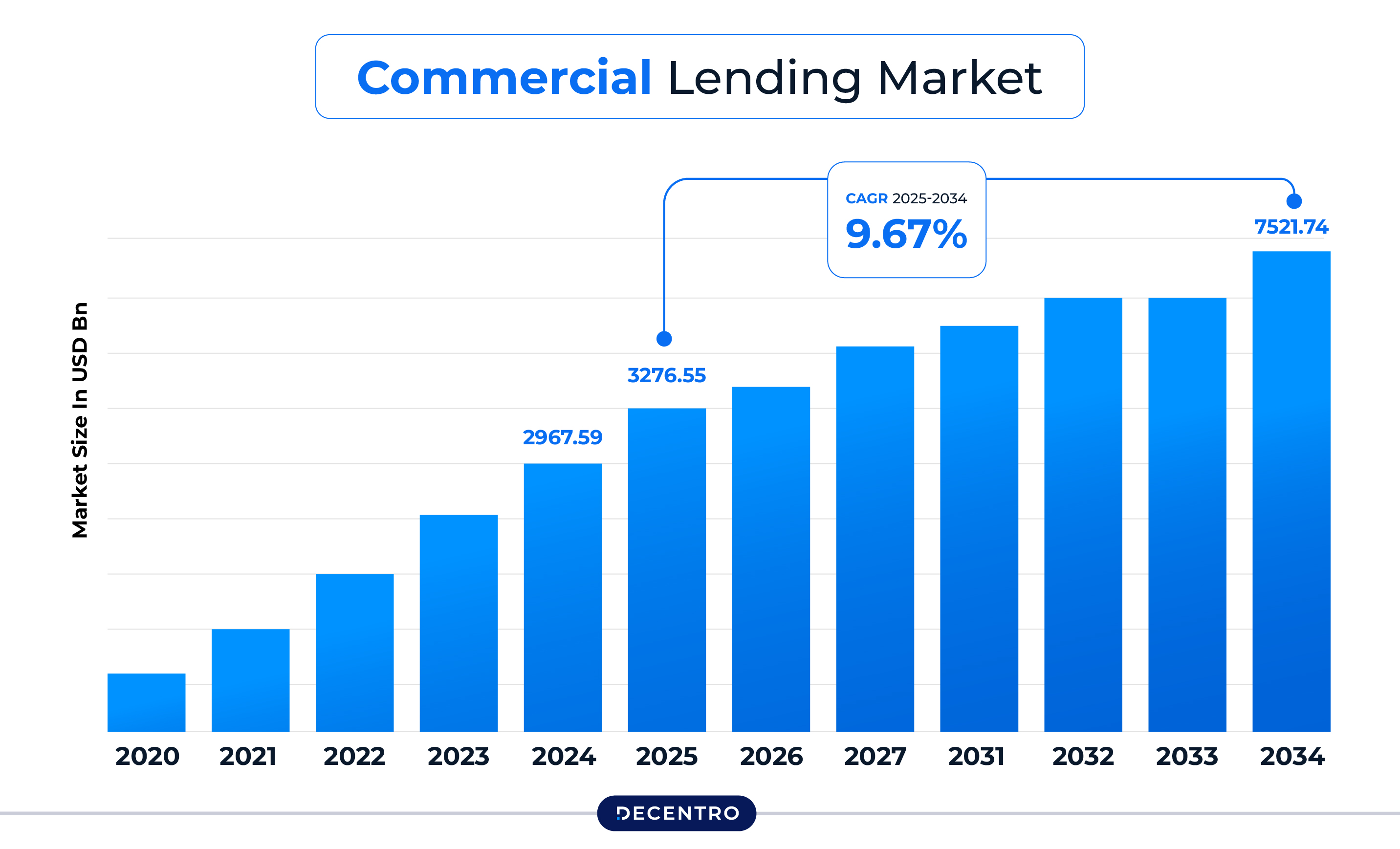

Market Size and Growth Trajectory

India’s lending landscape presents both tremendous opportunities and significant challenges. The banking sector’s interest income reached ₹19.38 trillion ($223.8 billion) in 2024, indicating a robust but evolving market. However, beneath these impressive numbers lies a more complex reality.

The commercial lending sector dominates India’s lending portfolio, but growth patterns reveal emerging challenges. Credit growth is moderating to 12-14% in FY25, with a concerning gap between credit and deposits growth rates of about 3.1%. This gap widens further when factoring in recent banking consolidations, highlighting the urgent need for more efficient lending mechanisms.

The Credit Gap Challenge

India’s credit gap represents one of the most significant barriers to economic growth. Small and medium enterprises (SMEs), which form the backbone of India’s economy, often struggle to access formal credit due to:

Information Asymmetries: Traditional underwriting relies heavily on historical financial data, which many emerging businesses lack or cannot adequately document.

Processing Inefficiencies: Manual underwriting processes can take weeks or months, during which business opportunities may be lost.

Risk Assessment Limitations: Conventional models often fail to capture the true creditworthiness of businesses operating in India’s diverse economic landscape.

Geographic and Demographic Barriers: Rural and semi-urban businesses face additional challenges in accessing formal credit channels.

The Traditional Underwriting Challenge

Conventional commercial loan underwriting in India typically involves a multi-step process that can be both time-consuming and resource-intensive:

- Document Collection: Gathering financial statements, tax returns, bank statements, and business licenses

- Financial Analysis: Manual review of cash flows, profitability ratios, and debt service capabilities

- Collateral Evaluation: Physical assessment of proposed security

- Credit Bureau Checks: Verification of existing credit history

- Risk Rating Assignment: Subjective assessment based on predetermined criteria

- Committee Review: Multiple layers of approval for final decisions

This traditional approach, while thorough, often creates bottlenecks that prevent qualified businesses from accessing timely credit, contributing to India’s persistent credit gap.

Understanding AI in Commercial Loan Underwriting

What is AI Commercial Loan Underwriting?

AI commercial loan underwriting represents the integration of artificial intelligence technologies into the credit assessment and loan approval process. Unlike traditional methods that rely primarily on historical financial data and human judgment, AI-powered systems analyse vast amounts of structured and unstructured data to make more accurate, faster, and often more inclusive lending decisions.

At its core, AI underwriting leverages machine learning algorithms, natural language processing, and predictive analytics to:

- Analyse Alternative Data Sources: Beyond traditional financial statements, AI can evaluate social media presence, transaction patterns, supplier relationships, and market sentiment

- Identify Patterns: Machine learning models can detect subtle correlations between various data points that human underwriters might miss

- Predict Future Performance: AI systems can forecast a business’s likelihood of success and repayment capacity more accurately than traditional models.

- Automate Decision Making: Routine decisions can be automated, allowing human underwriters to focus on complex cases

Key AI Technologies in Commercial Underwriting

Machine Learning (ML): Algorithms that learn from historical loan performance data to predict future outcomes. These models continuously improve as they process more applications.

Natural Language Processing (NLP): Technology that can analyse unstructured text data from business plans, emails, contracts, and even social media to extract meaningful insights about business performance and management quality.

Predictive Analytics: Statistical techniques that use historical data to forecast future events, such as the likelihood of loan default or business growth potential.

Computer Vision: AI systems that can process and analyse visual data, such as satellite imagery for agricultural loans or property images for real estate financing.

Behavioural Analytics: Technology that analyses patterns in digital behaviour, transaction history, and business operations to assess creditworthiness.

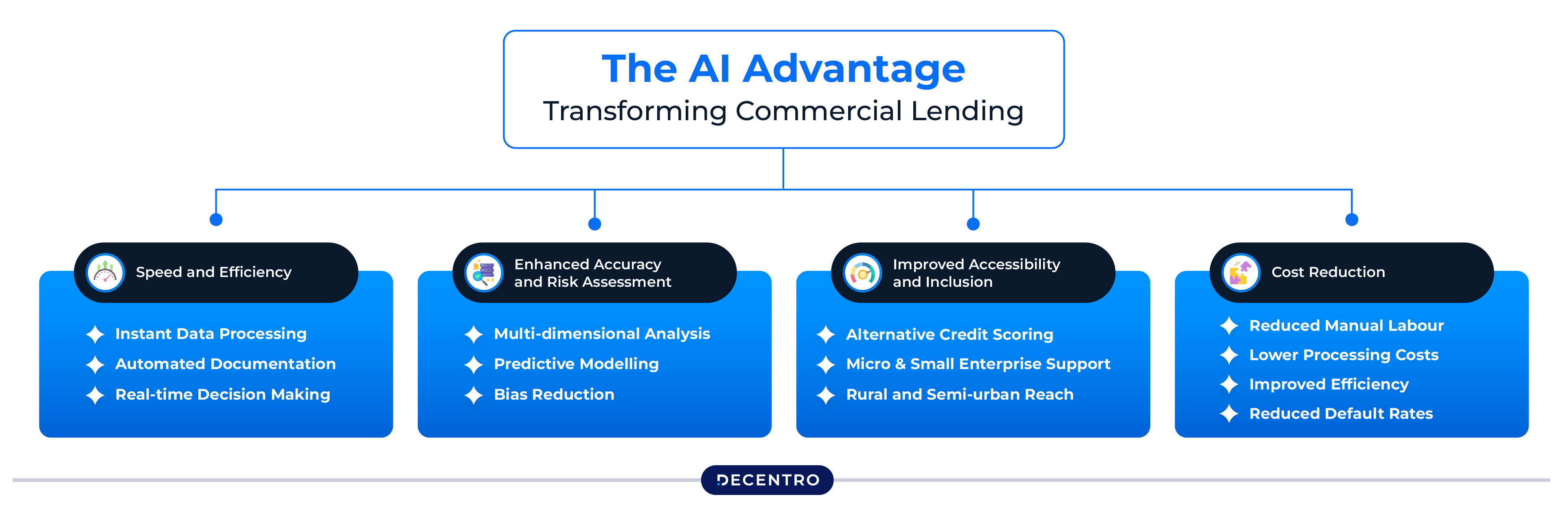

The AI Advantage: Transforming Commercial Lending

Speed and Efficiency

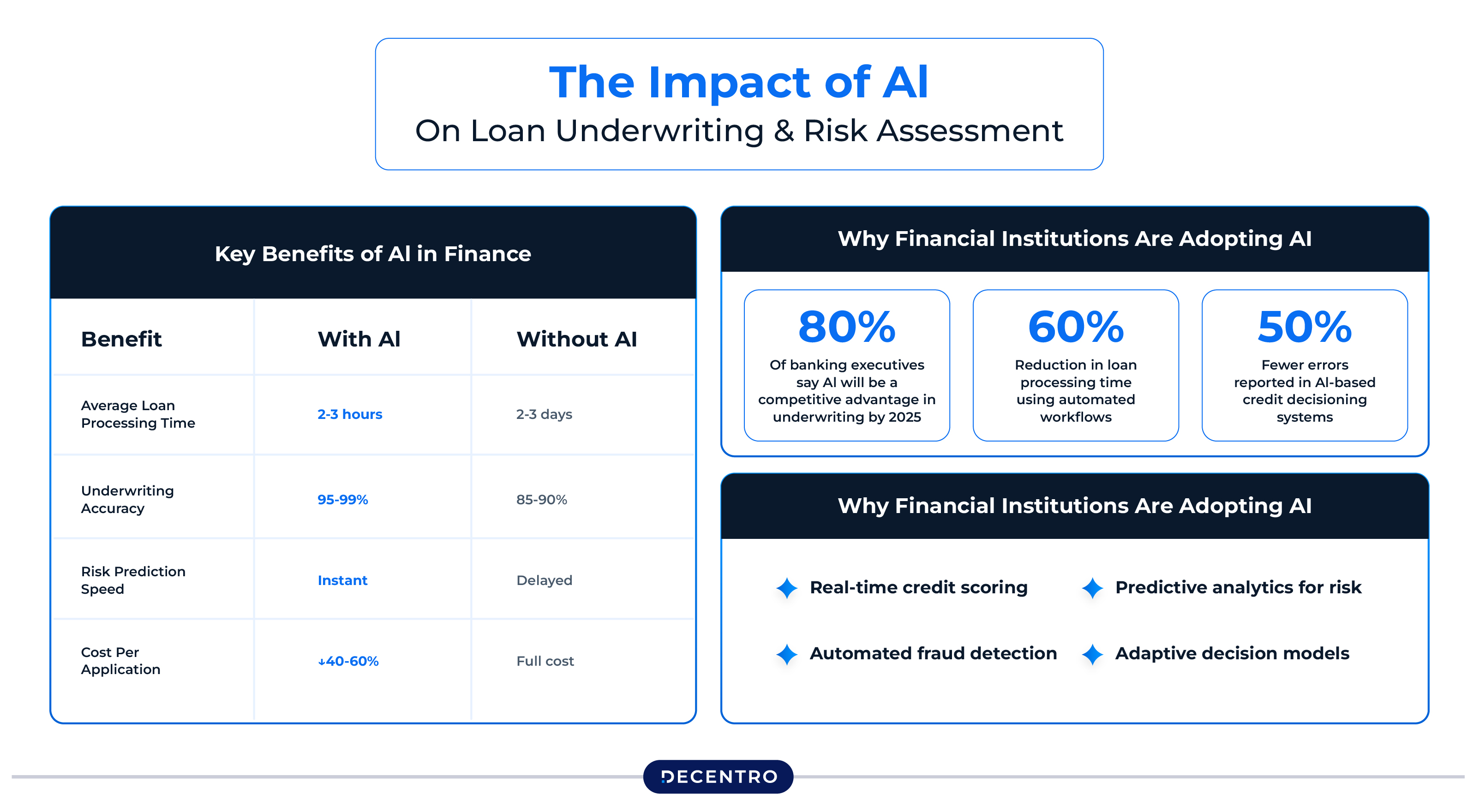

Traditional commercial loan underwriting can take anywhere from several weeks to months. AI dramatically compresses this timeline:

- Instant Data Processing: AI systems can analyse thousands of data points in seconds

- Automated Documentation: Optical Character Recognition (OCR) and document processing eliminate manual data entry

- Real-time Decision Making: Simple applications can receive approval decisions within minutes rather than days

Consider this scenario: A manufacturing company in Chennai needs urgent working capital to fulfil a large export order. Traditional underwriting takes 3-4 weeks, potentially causing the business to lose the opportunity. AI-powered underwriting can process the application, analyse cash flow patterns, verify business credentials, and provide a decision within 24-48 hours.

Enhanced Accuracy and Risk Assessment

AI systems excel at pattern recognition and can identify risk factors that human underwriters might overlook:

Multi-dimensional Analysis: While traditional underwriting might focus on financial ratios and credit scores, AI can simultaneously analyse market conditions, industry trends, seasonal business patterns, and competitive positioning.

Predictive Modelling: AI can forecast business performance under various economic scenarios, providing lenders with more comprehensive risk assessments.

Bias Reduction: When properly designed, automated systems can help reduce human biases that might unfairly exclude certain demographic groups or business types from accessing credit.

Improved Accessibility and Inclusion

One of AI’s most significant contributions to commercial lending in India is its potential to extend credit access to previously underserved segments:

Alternative Credit Scoring: For businesses without extensive credit histories, AI can evaluate utility payment patterns, supplier relationships, digital footprints, and other non-traditional data sources.

Micro and Small Enterprise Support: AI can make small loan amounts economically viable by reducing processing costs and improving risk assessment for smaller businesses.

Rural and Semi-urban Reach: Digital-first AI systems can extend formal credit access to businesses in areas where traditional banks have limited physical presence.

Cost Reduction

AI significantly reduces the operational costs associated with loan underwriting:

- Reduced Manual Labour: Automation eliminates many routine tasks performed by underwriters

- Lower Processing Costs: Digital workflows reduce paperwork, printing, and storage costs

- Improved Efficiency: Faster processing means lower overhead costs per loan application

- Reduced Default Rates: Better risk assessment can lead to lower loan losses

AI Commercial Loan Underwriting in India: Market Context

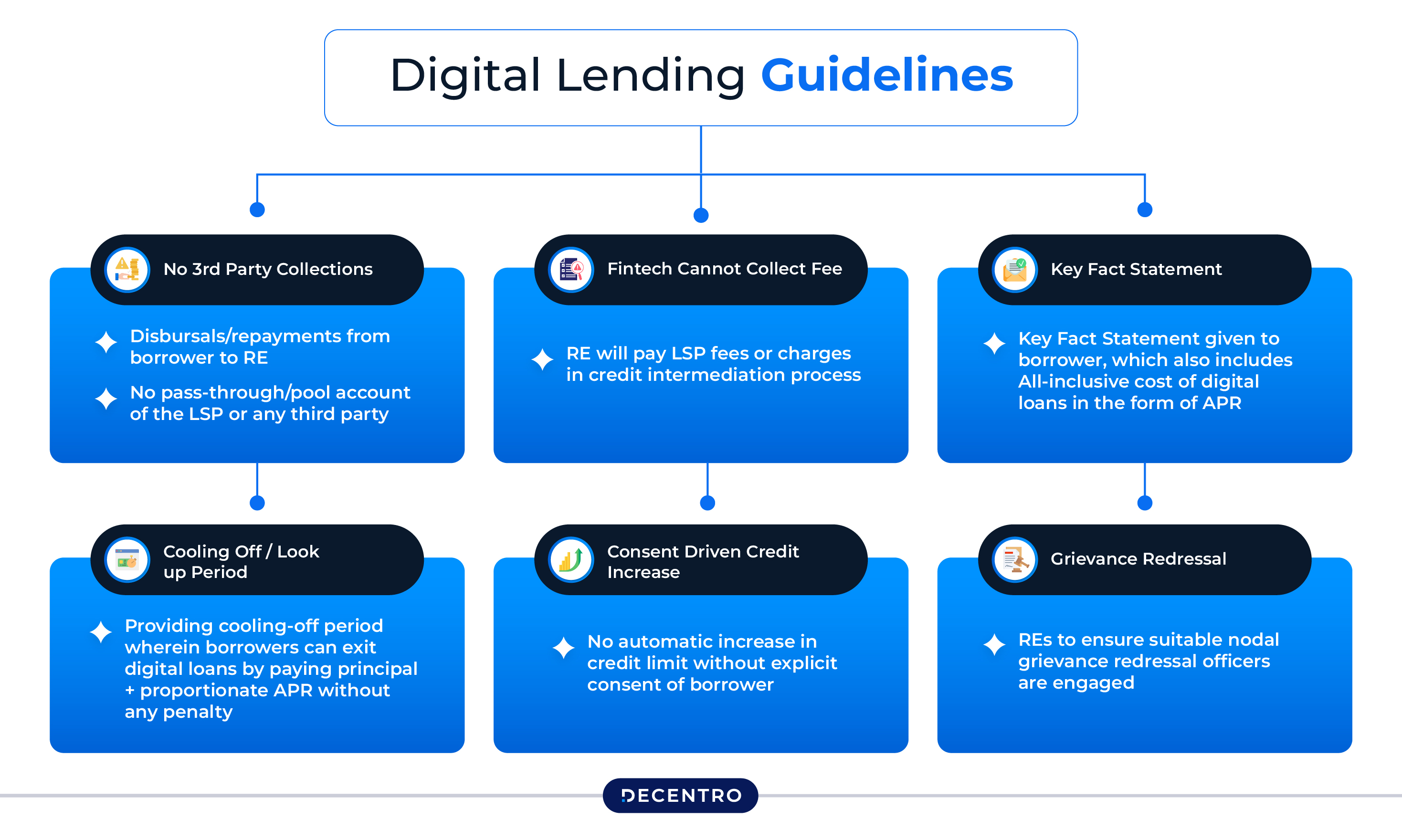

Regulatory Landscape and RBI Guidelines

The Reserve Bank of India (RBI) has been actively addressing the integration of AI in lending practices, particularly through its digital lending guidelines. RBI Governor Shaktikanta Das has emphasised caution, stating that “Banks and NBFCs need to be careful when relying solely on pre-set algorithms” and that “These models should be robust, tested, and re-tested periodically”.

The regulatory framework includes several key considerations:

Digital Lending Guidelines 2025: The RBI’s latest guidelines limit Default Loss Guarantee (DLG) cover to a maximum of 5% of the total disbursed amount and require enhanced transparency in algorithmic decision-making processes.

Model Governance Requirements: Financial institutions must demonstrate that their AI models are:

- Regularly validated and back-tested

- Free from discriminatory bias

- Transparent in their decision-making processes

- Compliant with data privacy regulations

Risk Management Standards: Lenders using AI must maintain human oversight capabilities and establish clear escalation procedures for complex cases.

Current Market Adoption

The adoption of AI in commercial lending across India varies significantly:

Large Private Banks: Leading private sector banks like HDFC Bank, ICICI Bank, and Axis Bank have invested heavily in AI-powered lending platforms, particularly for retail and MSME segments.

Public Sector Banks: Traditional PSBs are gradually adopting AI technologies, often starting with fraud detection and moving toward underwriting applications.

NBFCs and Fintech: Non-banking financial companies and fintech startups are often at the forefront of AI adoption, leveraging technology to compete with established players.

Regional and Cooperative Banks: Smaller institutions are increasingly partnering with technology providers to access AI capabilities without significant upfront investments.

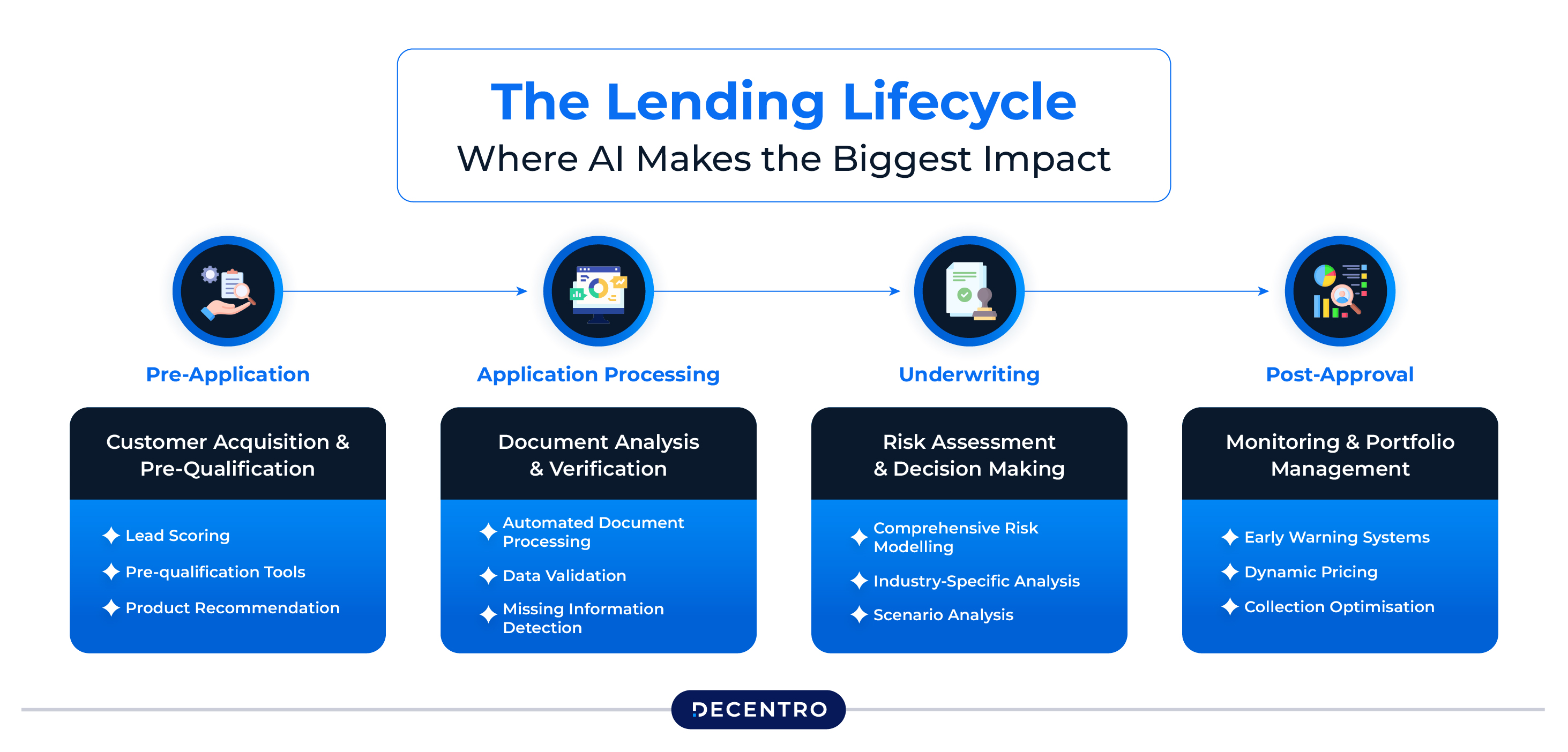

The Lending Lifecycle: Where AI Makes the Biggest Impact

Pre-Application: Customer Acquisition and Pre-Qualification

AI’s influence begins before a formal loan application is even submitted:

Lead Scoring: AI analyses digital behaviour patterns to identify potential borrowers most likely to qualify for and benefit from commercial loans.

Pre-qualification Tools: Businesses can receive instant preliminary assessments of their borrowing capacity based on basic financial information.

Product Recommendation: AI systems can suggest the most appropriate loan products based on a business’s profile and needs.

Application Processing: Document Analysis and Verification

This stage represents one of the most significant opportunities for AI improvement:

Automated Document Processing: Advanced OCR technology can extract and verify information from financial statements, tax returns, and business licenses with minimal human intervention.

Data Validation: AI systems cross-reference information across multiple sources to identify discrepancies and potential fraud indicators.

Missing Information Detection: Automated systems can immediately flag incomplete applications and request specific additional documentation.

Underwriting: Risk Assessment and Decision Making

The heart of the lending process, where AI delivers its most substantial value:

Comprehensive Risk Modelling: AI analyses traditional financial metrics alongside alternative data sources to create more accurate risk profiles.

Industry-Specific Analysis: Machine learning models can be trained on sector-specific data to gain a deeper understanding of the unique risks and opportunities in various industries.

Scenario Analysis: AI can model how businesses might perform under various economic conditions, providing lenders with more robust risk assessments.

Post-Approval: Monitoring and Portfolio Management

AI’s value extends well beyond the initial loan decision:

Early Warning Systems: Continuous monitoring of borrower financial health can identify potential problems before they become serious defaults.

Dynamic Pricing: AI can support risk-based pricing adjustments throughout the loan lifecycle.

Collection Optimisation: For accounts that do experience difficulties, AI can optimise collection strategies based on borrower profiles and behaviour patterns.

Behavioural Insights and Alternative Data in AI Underwriting

The Power of Behavioural Analytics

Traditional underwriting focuses heavily on backwards-looking financial data. AI enables lenders to incorporate forward-looking behavioural insights that can provide much more accurate assessments of creditworthiness:

Digital Payment Patterns: Analysing UPI transactions, digital wallet usage, and online payment behaviours can reveal cash flow consistency and business stability patterns that traditional financial statements may miss.

Supply Chain Relationships: AI can analyse a business’s relationships with suppliers and customers through various data sources, providing insights into business stability and growth potential.

Operational Consistency: Regular patterns in utility payments, rent, and other operational expenses can indicate business discipline and financial management capabilities.

Growth Indicators: AI can identify early signals of business growth or decline through changes in digital activity, hiring patterns, and market engagement.

Alternative Data Sources Revolutionising Credit Assessment

Geospatial Data: For location-dependent businesses, AI can analyse foot traffic patterns, demographic changes, and regional economic indicators to assess business viability.

Social Media and Digital Presence: While respecting privacy concerns, AI can analyse public business social media activity to gauge customer satisfaction, market positioning, and business growth trajectory.

Industry and Market Data: Real-time analysis of industry trends, competitive positioning, and market conditions provides context that traditional underwriting methods often lack.

Regulatory and Compliance Data: AI can continuously monitor businesses’ compliance status across various regulatory requirements, providing early warning indicators of potential issues.

Privacy and Ethical Considerations

The use of behavioural insights and alternative data raises essential considerations:

Data Consent and Transparency: Borrowers must be fully informed about what data is being collected and how it’s being used in lending decisions.

Bias Prevention: AI models must be carefully designed and regularly audited to prevent discriminatory outcomes based on demographic characteristics.

Data Security: Enhanced data usage requires robust cybersecurity measures to protect sensitive business information.

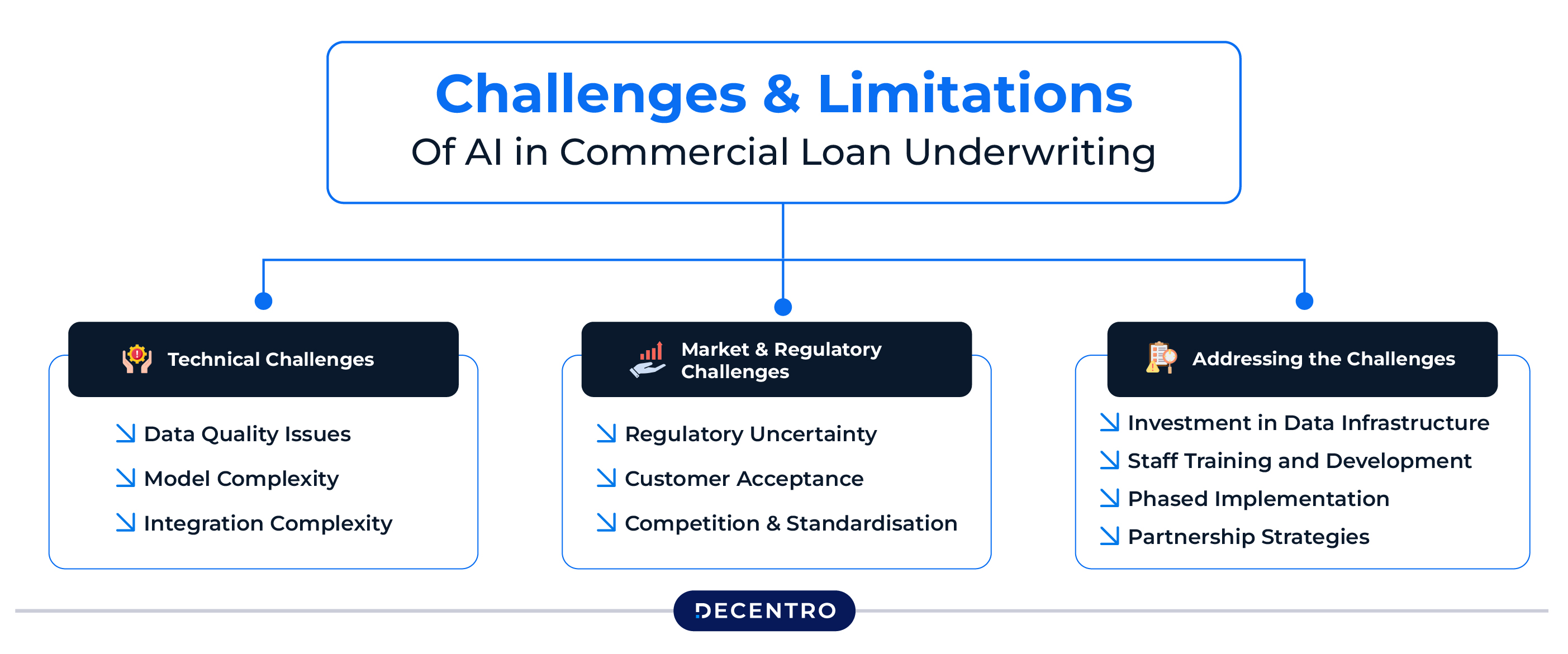

Challenges and Limitations of AI in Commercial Loan Underwriting

Technical Challenges

Data Quality Issues: AI models are only as good as the data they’re trained on. Poor quality, incomplete, or biased historical data can lead to flawed lending decisions.

Model Complexity: As AI models become more sophisticated, they can become “black boxes” that are difficult to interpret or explain, creating regulatory and customer communication challenges.

Integration Complexity: Implementing AI systems within existing banking infrastructure requires significant technical coordination and often substantial system upgrades.

Market and Regulatory Challenges

Regulatory Uncertainty: The regulatory landscape for AI in financial services continues to evolve, creating uncertainty for institutions planning long-term AI investments.

Customer Acceptance: Some borrowers may be hesitant about automated decision-making, especially for large loan amounts.

Competition and Standardisation: As AI becomes more widespread, lenders may find it challenging to maintain competitive advantages solely through technology.

Addressing the Challenges

Investment in Data Infrastructure: Successful AI implementation requires substantial investment in data collection, cleaning, and management systems.

Staff Training and Development: Banks must invest in training their staff to work effectively with AI systems and accurately interpret AI-generated insights.

Phased Implementation: Many successful AI adoptions start with specific use cases (such as fraud detection) before expanding to full underwriting automation.

Partnership Strategies: Many institutions are partnering with specialised AI vendors rather than building all capabilities in-house.

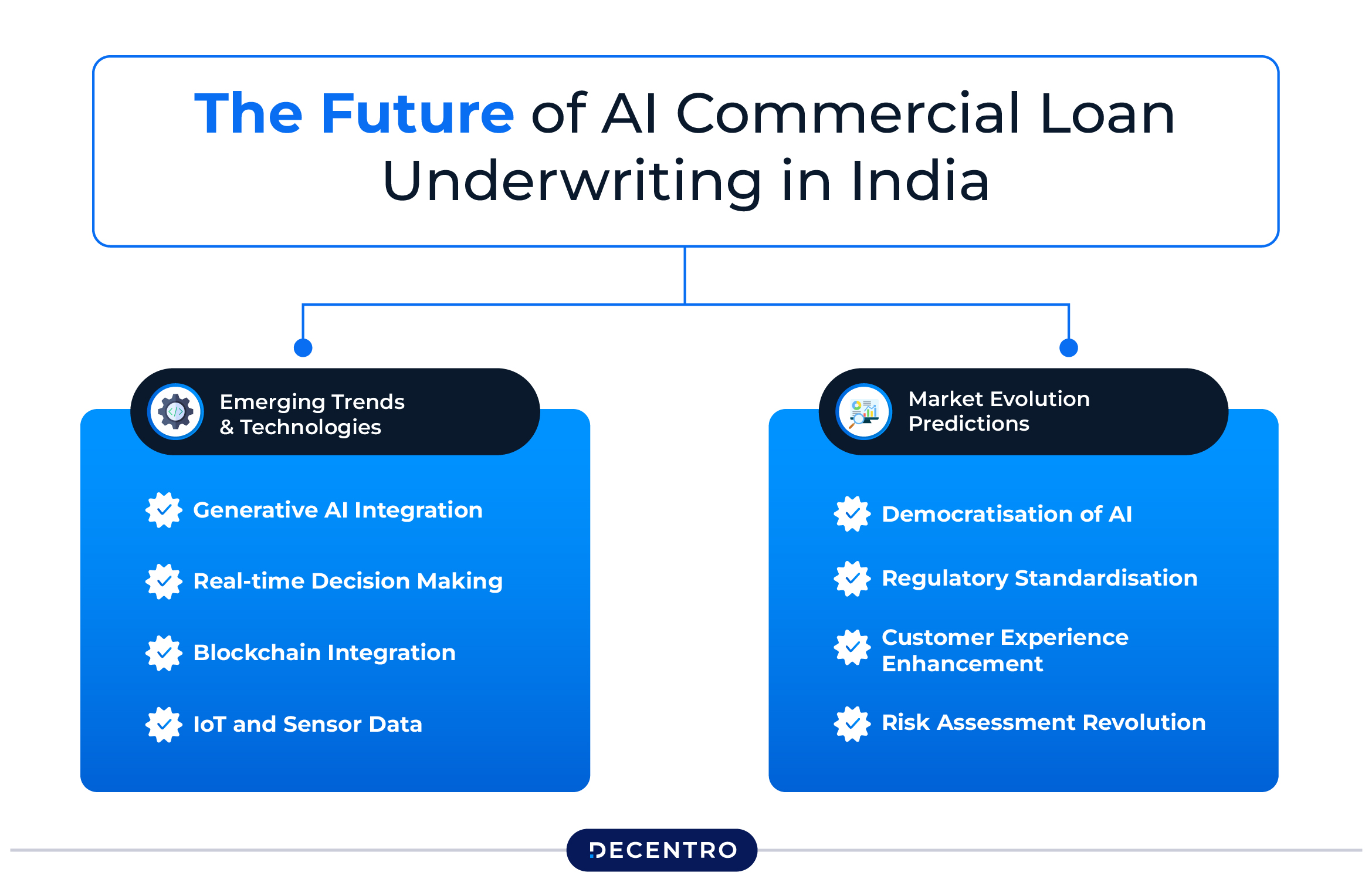

The Future of AI Commercial Loan Underwriting in India

Emerging Trends and Technologies

Generative AI Integration: Large language models and generative AI are beginning to play roles in analysing unstructured data sources and generating detailed risk reports.

Real-time Decision Making: Advances in edge computing and real-time data processing are enabling instant loan decisions for qualified applications.

Blockchain Integration: Distributed ledger technology may enhance data security and verification processes in AI-powered underwriting.

IoT and Sensor Data: Internet of Things devices can provide real-time operational data about businesses, enabling more dynamic risk assessment.

Market Evolution Predictions

Democratisation of AI: As AI tools become more accessible, smaller banks and NBFCs will gain access to sophisticated underwriting capabilities previously available only to large institutions.

Regulatory Standardisation: Expect more detailed and standardised regulatory frameworks for AI in lending, providing more explicit guidance for implementation.

Customer Experience Enhancement: AI will enable more personalised and responsive lending experiences, with faster decisions and more tailored product offerings.

Risk Assessment Revolution: The combination of traditional financial data with alternative data sources will create fundamentally more accurate risk assessment capabilities.

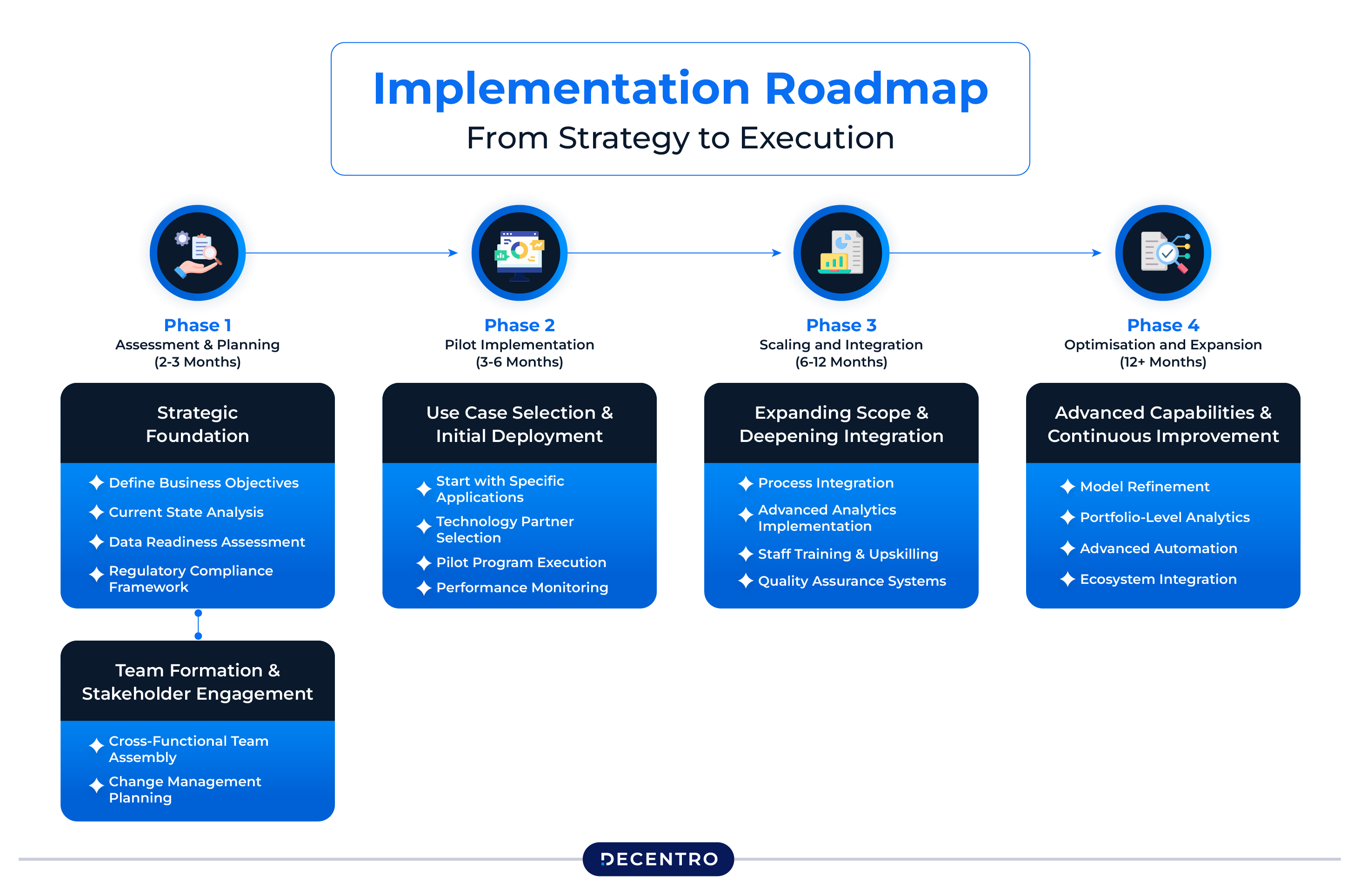

Implementation Roadmap: From Strategy to Execution

Successfully implementing AI in commercial loan underwriting requires a structured, phased approach that balances innovation with risk management. Based on successful deployments across financial institutions globally, this roadmap provides a practical framework for Indian lenders to achieve sustainable AI transformation.

Phase 1: Assessment and Planning (2-3 Months)

Strategic Foundation

The first phase focuses on establishing clear objectives and building organisational readiness for the adoption of AI.

Define Business Objectives: Align AI initiatives with specific business goals such as reducing loan processing times by 50%, improving risk assessment accuracy, or expanding credit access to underserved segments. The Reserve Bank of India emphasises that financial institutions must have comprehensive strategies in place for AI adoption, with clear policies and governance frameworks.

Current State Analysis: Conduct a thorough evaluation of existing underwriting processes, identifying bottlenecks, manual tasks, and areas where human judgment adds the most value: document current processing times, error rates, and resource allocation across different loan types.

Data Readiness Assessment: Evaluate data quality, availability, and structure across existing systems. High-quality, well-organized data is crucial for AI success, and many institutions discover that data preparation represents 60-80% of implementation effort.

Regulatory Compliance Framework: Establish governance structures that ensure AI implementations meet RBI guidelines, particularly regarding algorithmic transparency, bias prevention, and audit trail requirements. RBI Deputy Governor emphasises the need for explainable AI frameworks that provide clear, auditable reasons for loan decisions.

Team Formation and Stakeholder Engagement

Cross-Functional Team Assembly: Form implementation teams including credit officers, risk managers, technology specialists, and compliance experts. Early involvement of business users is critical for success.

Change Management Planning: Develop communication strategies to address employee concerns about AI automation and emphasise how technology will enhance rather than replace human expertise.

Phase 2: Pilot Implementation (3-6 Months)

Use Case Selection and Initial Deployment

Rather than attempting enterprise-wide transformation immediately, successful implementations begin with focused, high-impact use cases.

Start with Specific Applications: Select initial use cases such as automated document processing for SME loans under ₹50 lakhs, financial spreading for commercial real estate applications, or fraud detection in loan applications. This focused approach allows organisations to demonstrate value quickly while building internal expertise.

Technology Partner Selection: Evaluate AI solutions based on their ability to handle Indian document formats, regulatory compliance features, and integration capabilities with existing systems. Consider factors like multi-language support for regional applications and familiarity with Indian accounting standards.

Pilot Program Execution: Deploy AI solutions in a controlled environment, processing actual loan applications alongside traditional methods to validate accuracy and identify areas for improvement. This parallel processing approach reduces risks while building confidence in AI capabilities.

Performance Monitoring: Establish KPIs, including processing time reduction, accuracy improvements, and user satisfaction scores. Continuous monitoring allows for system refinement and optimisation.

Phase 3: Scaling and Integration (6-12 Months)

Expanding Scope and Deepening Integration

Based on the pilot’s success, gradually expand AI implementation across various loan types and processing stages.

Process Integration: Move beyond standalone applications to integrate AI throughout the lending lifecycle, from pre-qualification through portfolio monitoring. This integrated approach maximises efficiency gains and provides comprehensive risk assessment capabilities.

Advanced Analytics Implementation: Incorporate behavioural analytics, alternative data sources, and predictive modelling to enhance risk assessment accuracy. This includes analysing UPI transaction patterns, GST filings, and digital footprint data relevant to Indian SMEs.

Staff Training and Upskilling: Develop comprehensive training programs that help underwriters work effectively with AI systems, interpret AI-generated insights, and know when human judgment should override automated recommendations.

Quality Assurance Systems: Implement robust validation processes for AI outputs, including regular back-testing of models against actual loan performance and bias detection mechanisms.

Phase 4: Optimisation and Expansion (12+ Months)

Advanced Capabilities and Continuous Improvement

The final phase focuses on maximising AI value and preparing for future innovations.

Model Refinement: Continuously improve AI models using actual loan performance data, seasonal patterns, and changing market conditions. Machine learning systems require ongoing refinement to maintain accuracy.

Portfolio-Level Analytics: Implement AI capabilities for portfolio monitoring, concentration risk analysis, and early warning systems that identify potential issues before they impact performance.

Advanced Automation: Explore emerging technologies such as generative AI for report generation, blockchain integration for document verification, and IoT data incorporation for asset-based lending.

Ecosystem Integration: Develop API capabilities that allow integration with external data providers, credit bureaus, and fintech partners to create comprehensive lending ecosystems.

Success Factors and Risk Mitigation

Critical Success Elements

Human-AI Collaboration: The most successful implementations strike a balance between automation and human expertise, leveraging AI to handle routine tasks while preserving human judgment for complex decisions.

Data Governance: Maintain strong data standards, validation processes, and regularly monitor model performance to ensure sustained accuracy over time.

Regulatory Compliance: Implement continuous compliance monitoring and maintain detailed audit trails that meet evolving regulatory requirements.

Risk Management Strategies

Phased Risk Exposure: Gradual implementation allows institutions to identify and address issues before they impact large volumes of loans. Start with lower-risk loan segments and gradually expand.

Model Validation: Regular back-testing against actual outcomes ensures models remain accurate and identifies potential bias or performance degradation.

Fallback Procedures: Maintain ability to process loans manually when AI systems are unavailable, ensuring business continuity during system updates or technical issues.

This roadmap provides a structured approach for Indian financial institutions to successfully implement AI commercial loan underwriting while managing risks and ensuring regulatory compliance. The key to success lies in taking measured steps, learning from each phase, and building capabilities systematically rather than attempting wholesale transformation immediately.

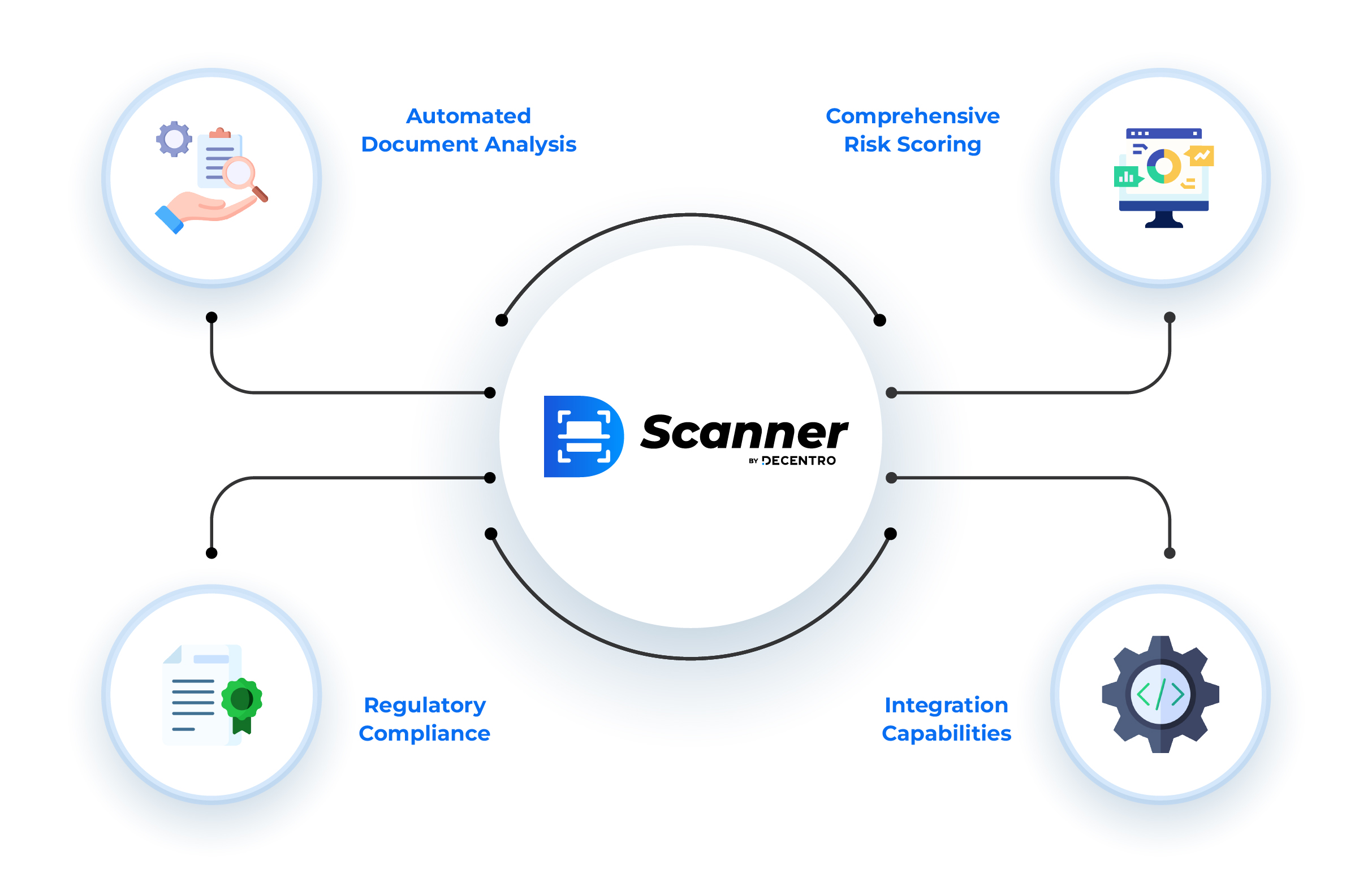

Technology Solutions: Decentro’s Approach to AI-Powered Risk Assessment

As the commercial lending landscape evolves, specialised technology solutions are emerging to help lenders implement AI-powered underwriting effectively. Among these solutions, tools that combine document processing capabilities with sophisticated risk assessment represent the cutting edge of lending technology.

Advanced Document Processing and Risk Assessment

Modern AI solutions in lending typically combine several key capabilities:

Intelligent Document Processing: Advanced OCR and machine learning systems can extract and verify information from a wide range of financial documents, including bank statements and tax returns, with high accuracy and speed.

Behavioural Analysis Integration: By analysing patterns in financial transactions, payment behaviours, and business operations, AI systems can develop comprehensive risk profiles that go far beyond traditional credit scoring.

Multi-source Data Integration: The most effective AI underwriting systems combine traditional financial data with alternative data sources to create comprehensive borrower profiles.

Real-time Risk Scoring: Dynamic risk assessment capabilities that can continuously update borrower risk profiles based on new information and changing market conditions.

The Role of Specialised Risk Assessment Tools

Solutions like Decentro’s Scanner module and OmniScore demonstrate how specialised tools can address specific challenges in AI-powered underwriting:

Automated Document Analysis: Advanced scanner technology can instantly process various document types, extracting relevant financial information and identifying potential inconsistencies or fraud indicators.

Comprehensive Risk Scoring: Sophisticated scoring algorithms that combine traditional credit metrics with behavioural insights to provide more accurate and nuanced risk assessments.

Regulatory Compliance: Built-in compliance features ensure that AI-powered decisions meet regulatory requirements and can be appropriately documented and explained.

Integration Capabilities: Modern solutions are designed to integrate seamlessly with existing banking and lending platforms, minimising implementation complexity.

Practical Implementation Benefits

Organisations implementing advanced AI underwriting solutions typically experience:

- Dramatic reduction in processing times for loan applications

- Improved accuracy in risk assessment, leading to better portfolio performance

- Enhanced ability to serve previously underserved market segments

- Significant cost reductions in underwriting operations

- Better regulatory compliance and audit trail capabilities

The combination of document processing automation and sophisticated risk scoring represents a practical approach to implementing AI in commercial lending, providing immediate benefits while building toward more advanced capabilities.

Conclusion: The Path Forward for AI Commercial Loan Underwriting

The transformation of India’s commercial lending landscape through AI represents one of the most significant opportunities to address the country’s persistent credit gap while improving the efficiency and accuracy of financial services. With India’s consumer lending market projected to surpass $720 billion by 2025 and commercial lending accounting for ₹86.3 trillion of the total lending portfolio, the potential impact of AI implementation is substantial.

Key Takeaways

Immediate Opportunities: The AI technologies available today can significantly improve processing times, reduce costs, and enhance the accuracy of risk assessment for commercial lenders across India.

Regulatory Support: While emphasizing caution and proper governance, regulatory authorities acknowledge AI’s transformative potential and are developing frameworks that support innovation while protecting consumers.

Market Readiness: The combination of India’s digital infrastructure growth, increasing data availability, and competitive pressure in the lending market creates an ideal environment for AI adoption.

Inclusive Growth Potential: AI’s ability to analyze alternative data sources and behavioral patterns offers unprecedented opportunities to extend credit access to underserved businesses and regions.

Strategic Recommendations for Lenders

Start with Specific Use Cases: Rather than attempting a comprehensive AI transformation immediately, focus on specific applications like document processing, fraud detection, or portfolio monitoring.

Invest in Data Infrastructure: Success with AI requires high-quality, well-organised data. Prioritise data collection, cleaning, and management systems.

Develop Human-AI Collaboration: The most successful implementations combine AI efficiency with human judgment and oversight, particularly for complex cases.

Partner with Technology Providers: Specialised solutions like Decentro’s Scanner and OmniScore can provide immediate capabilities while organisations build internal AI expertise.

Focus on Regulatory Compliance: Ensure that AI implementations meet current regulatory requirements and can adapt to evolving guidelines.

Final Thoughts

The question is no longer whether AI will transform commercial loan underwriting in India, but how quickly and effectively the transformation will occur. Organisations that begin implementing AI solutions today, starting with proven technologies and gradually building more sophisticated capabilities, will be best positioned to capitalise on this transformation while contributing to India’s broader economic development goals.

The future of commercial lending in India is being written now, driven by artificial intelligence and fueled by the urgent need to expand credit access to the millions of businesses that form the backbone of India’s economy. The tools and technologies needed for this transformation are available today—the opportunity is to act on them decisively and responsibly.

For lenders ready to embark on their AI transformation journey, solutions like Decentro’s Scanner module and OmniScore provide practical starting points that combine advanced document processing with sophisticated risk assessment capabilities, offering immediate value while laying the groundwork for more comprehensive AI implementation.

Frequently Asked Questions

What is AI commercial loan underwriting?

AI commercial loan underwriting uses machine learning algorithms to automatically assess business loan applications, analyzing multiple data points to determine creditworthiness and loan approval decisions without manual intervention.

How does AI improve commercial lending decisions?

- Speed: Reduces approval time from weeks to hours

- Accuracy: Analyzes 1000+ data points vs. traditional 20-30 factors

- Risk Assessment: Identifies patterns humans miss, reducing default rates by 15-25%

- Consistency: Eliminates human bias and emotional decision-making

- Cost Efficiency: Reduces processing costs by up to 40%

Is AI underwriting compliant with RBI regulations?

Yes, when properly implemented. RBI requires human oversight for final decisions, explainable AI models, audit trails, and board approval for AI systems. Banks must demonstrate algorithmic accountability and maintain grievance mechanisms.

What data sources do AI underwriters use?

- Traditional: Financial statements, credit scores, cash flow records

- Alternative: Bank transaction data, GST returns, digital footprints, social media activity, supplier/customer relationships, utility payments, market trends

- Real-time: Live bank account analysis, current market conditions

How do lenders prevent bias in AI underwriting?

- Regular algorithm auditing and testing for discriminatory patterns

- Diverse training datasets representing all demographics

- Bias detection tools and fairness metrics monitoring

- Human oversight for sensitive decisions

- Transparent model validation processes

- Regular retraining with updated, balanced data