Explore how Indian fintech evolves in 2026 as payments go invisible, credit embeds into flows, and compliance becomes a growth lever.

Indian Fintech Trends 2026: Invisible Payments & Embedded Credit

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

Here’s what’s actually changing in Indian fintech this year: finance is becoming invisible. Not in the “we disrupted banking” marketing sense, but in the way electricity works, you flip a switch, lights come on, you don’t think about the wiring.

A map for thinking about fintech in 2026

Rather than a list of trends, think of 2026 as three structural shifts reshaping how digital businesses work:

First, the rails go invisible. Payments have stopped being the destination and have become the foundation. The real transformation in 2026 is how credit, identity, and compliance are being layered onto that payment infrastructure. For founders building online businesses, this means the tools to acquire customers, underwrite risk, and get paid are finally maturing into something that can be actually used.

Second, credit moves to context. It’s no longer a separate product you apply for; it appears exactly where and when people are already transacting, embedded in the purchase flow itself.

Third, compliance becomes a growth tool. Identity verification, data protection, and regulatory frameworks are shifting from overhead to competitive advantage, unlocking new segments and partnerships.

Each section below explores one of these shifts and its implications for how you build.

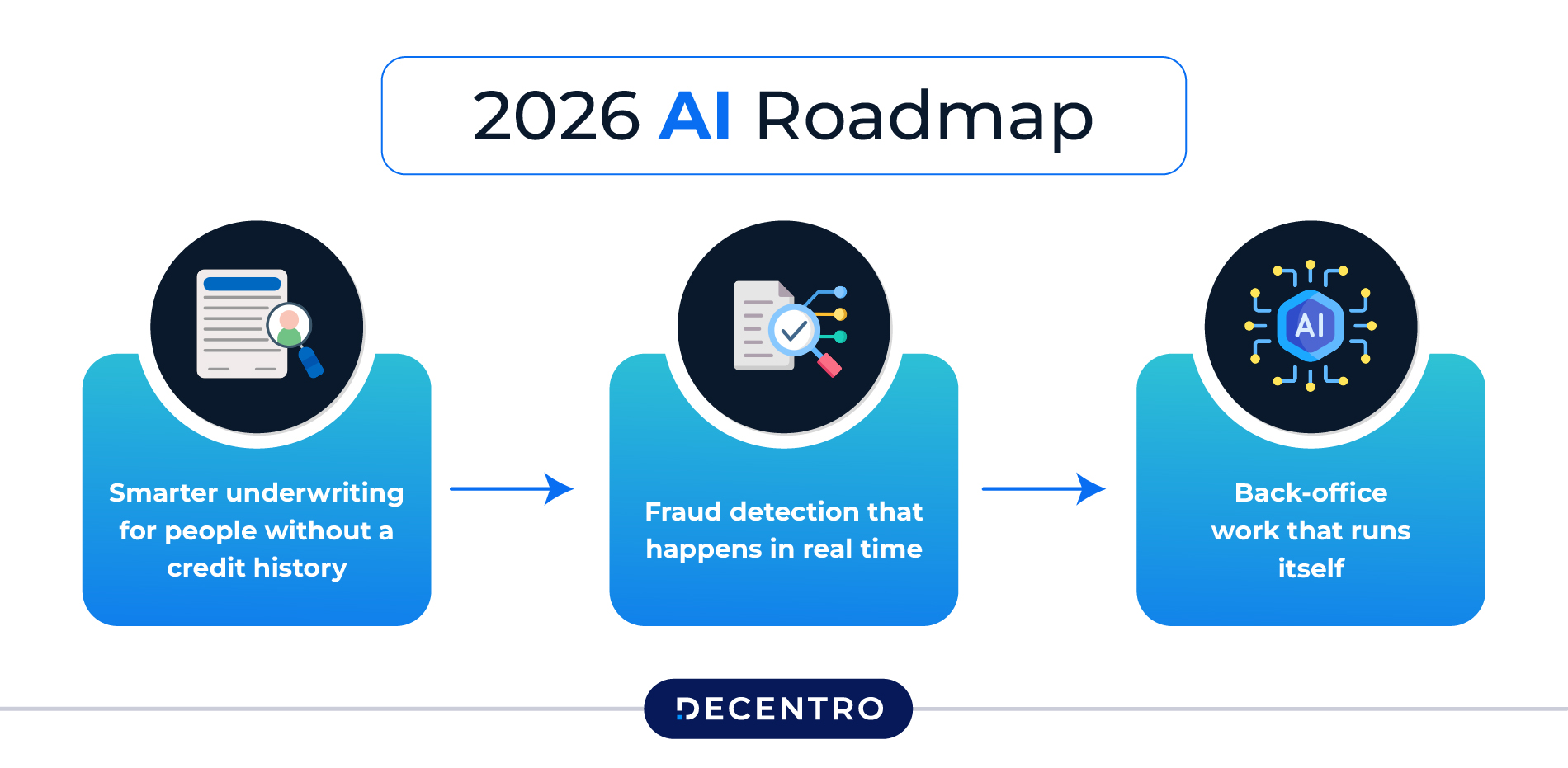

The shift from “AI dashboard” to “AI does the work”

Every fintech has claimed to be AI-powered in the last few years. Most of that meant dashboards with pretty charts. In 2026, AI is transitioning from advising to performing work across risk, operations, and customer journeys.

What this looks like in practice:

Smarter underwriting for people without a credit history

Models now combine traditional credit bureau data with transaction patterns, device behaviour, and payment histories. Early pilots are hitting 85-88% accuracy in predicting risk for thin-file borrowers, gig workers, MSMEs, and first-time credit users that traditional scorecards would simply reject.

Fraud detection that happens in real time

Real-time payments compress the fraud detection window from hours to seconds. AI systems now scan payment patterns as they happen, catching suspicious activity before money leaves the account. This matters more as UPI volumes keep climbing; India now handles over 640 million UPI transactions daily.

Back-office work that runs itself

Reading bank statements, verifying documents, and preparing compliance reports, AI agents now complete these workflows before a human even looks at them. About 60% of digital lenders deployed machine learning to automate document analysis and risk scoring in 2025, cutting approval times from days to minutes.

The takeaway is straightforward: AI is becoming operational infrastructure, not a feature you bolt on. The winners will pair this intelligence with robust payment, verification, and collections systems that respond in real time.

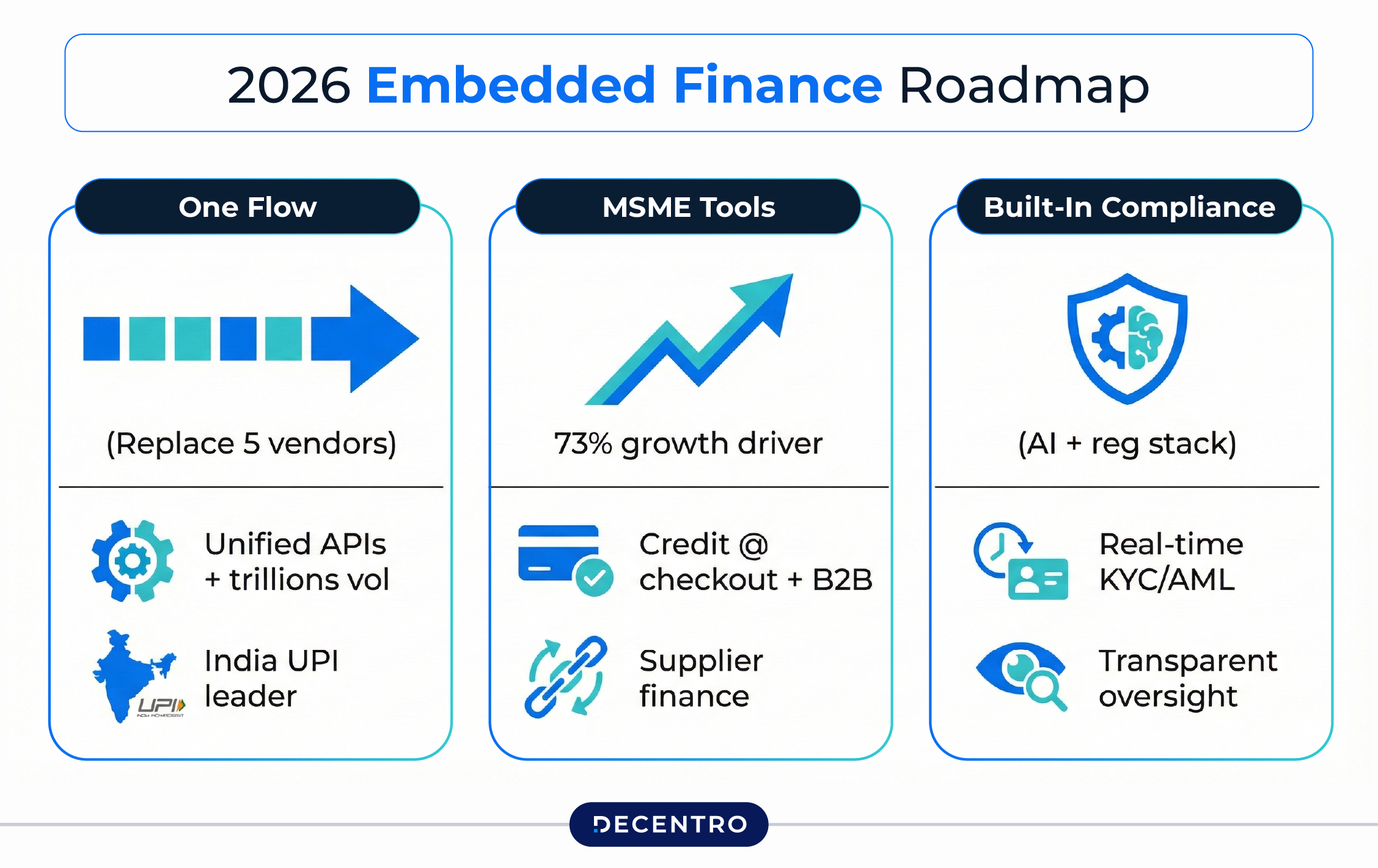

Finance is embedding everywhere (and it’s about time)

Credit and insurance now appear contextually in ecosystems like mobility and healthcare platforms. This isn’t “add a payment button” anymore. It’s full financial journeys—onboarding, verification, payments, credit—stitched directly into your app or platform.

Three shifts worth watching:

One flow instead of five vendors

Businesses increasingly want everything in one integration: payments, identity verification, collections, and credit. Not five separate providers to manage. According to industry forecasts, embedded finance transaction volumes could reach several trillion dollars globally by 2026, with India as one of the fastest-growing markets.

MSMEs are getting real financial tools

73% of MSMEs in semi-urban and rural India reported business growth from digital adoption, driven by UPI and smartphones. In 2026, expect credit-at-checkout, supplier financing, and instant settlements to become standard in B2B marketplaces and business tools, not just consumer apps.

Compliance built in, not bolted on

As regulators tighten oversight, platforms embedding finance take more responsibility for verification, anti-money laundering checks, and customer grievance handling. Real-time monitoring and transparent AI decisions are becoming part of the stack, not optional add-ons.

For ecosystem players, this means moving from a single-product mindset to designing complete financial workflows where users already spend their time.

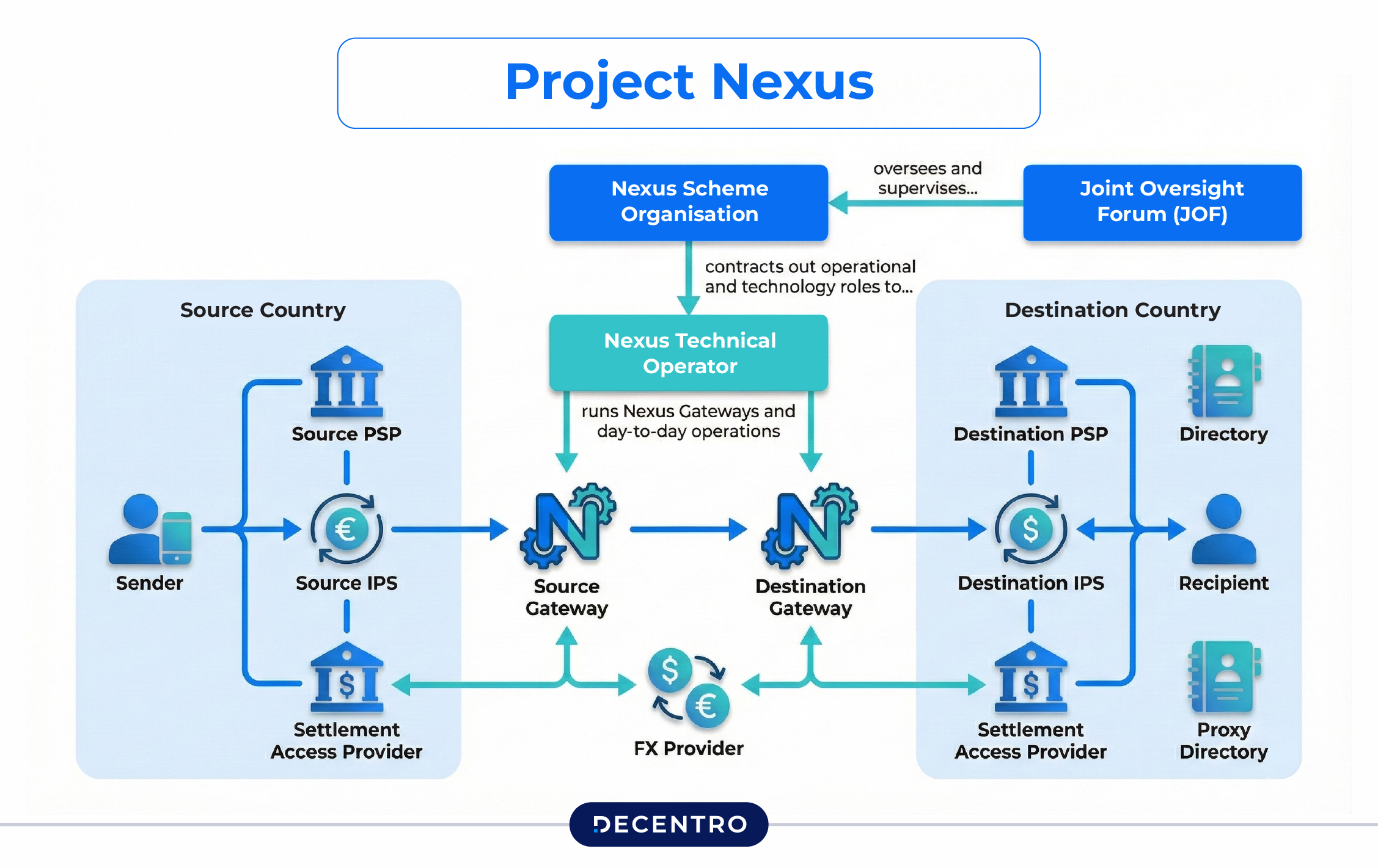

Cross-border payments are becoming instant (finally)

India received a record $125 billion in remittances in 2023. But for years, sending money across borders meant waiting days and losing 5-10% to fees and exchange rate markups. In 2026, that’s changing dramatically.

The next wave will be defined by global interoperability and seamless cross-border commerce, with UPI at the centre of this transformation. Here’s what’s happening:

Project Nexus goes live

Project Nexus, led by the Bank for International Settlements and supported by major regulators, will connect India’s UPI with fast payment systems in Malaysia, the Philippines, Singapore, and Thailand by 2026, serving 1.7 billion people. This means cross-border payments that settle in under 60 seconds, not days.

Indian travellers can already use UPI via QR codes in the UAE, Singapore, France, and several other countries. By the end of 2026, expect this to expand significantly as more merchant acquirers adopt UPI acceptance.

Cross‑Border UPI Volumes

| Metric | FY24 | FY25 | FY26 (Apr–Jul 2025) | YoY Growth (FY25) |

| Transactions | 37,060 | 755,000 | 601,000 | 20x |

| Value (₹ crore) | 0.19 | 258.53 | 169.29 | >60x |

Real impact for businesses

For Indian exporters, freelancers, and service businesses receiving payments from abroad, this shift is massive. Today, international transfers involve multiple intermediaries, currency conversion fees, and unpredictable timelines. With UPI linked to fast payment systems globally, expect:

- Same-day settlement instead of T+3 or T+5

- Transparent FX rates without hidden markups

- Lower transaction costs (potentially under 3% end-to-end)

- Real-time tracking from sender to receiver

| Aspect | Today (Traditional Transfers) | Tomorrow (UPI/Nexus) |

| Settlement | T+3 to T+5 days | Same-day or instant |

| FX Rates | Hidden markups, opaque | Transparent, competitive rates |

| Costs | High fees (5–10%+ via intermediaries) | Under 3% end‑to‑end |

| Tracking | Limited visibility | Real‑time from sender to receiver |

What this enables

Cross-border e-commerce becomes more viable for smaller merchants. Freelancers and consultants can get paid instantly instead of waiting weeks. MSMEs importing goods can settle supplier payments faster, improving cash flow. Study abroad payments and family remittances become as simple as domestic UPI transfers.

The takeaway: If your business has any cross-border element, customers, suppliers, or payments,2026 is the year to redesign those flows around instant settlement.

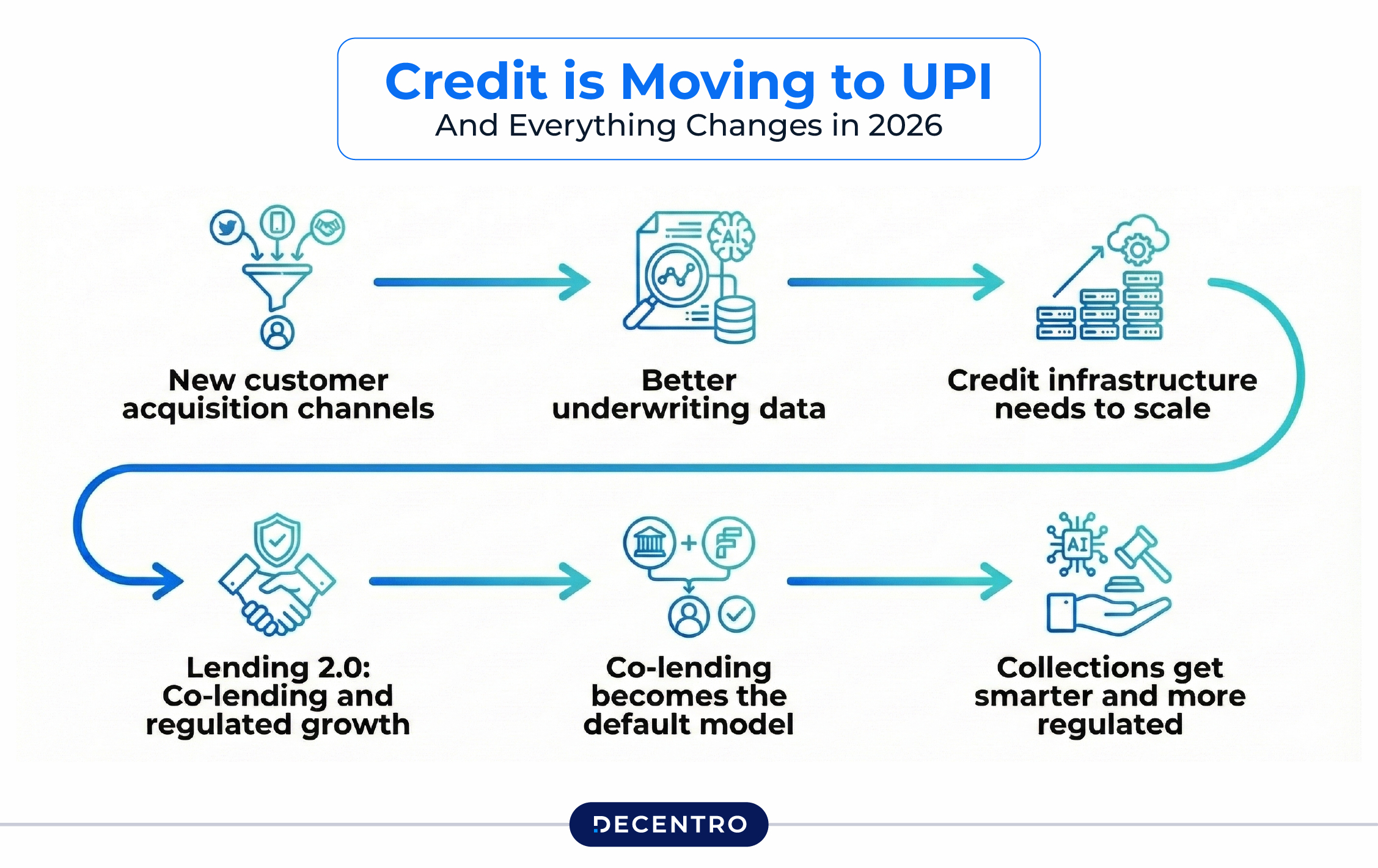

Credit is moving to where people actually pay

Credit Line on UPI is on track to reshape the financial ecosystem in a way no previous credit product has.

UPI processed over 22,000 crore transactions in 2025, worth nearly ₹300 lakh crore. UPI-linked credit card transactions now make up nearly 40% of all credit card transactions by volume. Credit is no longer a separate product you apply for, it’s becoming available at the moment you’re purchasing at the kirana store, pharmacy, or local restaurant.

Why this matters:

New customer acquisition channels

Credit on UPI will emerge as one of the most powerful customer acquisition engines, especially for new-to-credit segments. Your platform could offer instant credit at checkout, turning browsers into buyers.

Better underwriting data

Millions of small merchants and individuals now have digital transaction histories that enable formal credit assessment. UPI data, transaction frequency, merchant categories, and successful vs. declined payments provide a much richer picture of creditworthiness than traditional methods.

Credit infrastructure needs to scale

Banks need modern, cloud-native credit and UPI stacks to keep pace with credit volumes. If you’re building on this infrastructure, make sure your partners can handle the load.

Lending 2.0: co-lending and regulated growth

The regulatory environment around digital lending has matured significantly. RBI’s stricter digital lending norms, covering fair practices, data privacy, and grievance redressal, are reshaping how lenders operate. This isn’t slowing growth; it’s making it more sustainable.

Co-lending becomes the default model

Banks and NBFCs are increasingly partnering through co-lending arrangements to expand balance sheets while managing risk. This allows fintechs to leverage bank capital and regulatory cover while banks access new customer segments and tech-driven underwriting. Expect co-lending to become the standard way to scale lending operations in 2026, not the exception.

Collections get smarter and more regulated

With stressed portfolios rising across the industry, digital and AI-managed collections are moving from nice-to-have to essential. Regulated collection practices, automated nudges based on borrower behaviour, and transparent repayment options are becoming table stakes. The winners will combine empathy with efficiency, using AI to determine the right intervention at the right time while staying compliant with regulatory guidelines on collection practices.

The bottom line: by 2026, most digital credit in India will flow through UPI rails, backed by co-lending partnerships and intelligent collections. Design your products accordingly.

Real-time everything isn’t optional anymore

UPI turned instant payments into a daily habit. In 2026, systems can handle volume without fragility, with cloud-native stacks, resilient orchestration layers, and compliance-aware architecture no longer “nice to have” but prerequisites.

What this means practically:

24/7 settlement expectations

Users expect money to move instantly, between banks, wallets, and platforms, across peer-to-peer, consumer, and business flows. Your treasury and cash-flow tools need to be updated in real time, not at end-of-day batch processing.

Millisecond fraud controls

When payments happen instantly, fraud detection can’t wait until tomorrow’s batch review. You need systems that make risk decisions in the moment, not hours later.

Automated collections

With instant debits and recurring mandates, collections become an invisible layer running underneath subscriptions, EMIs, and invoices. AI determines who gets a reminder, who gets a call, and who needs a repayment plan, all in real time.

In 2026, “we’ll reconcile tomorrow” is a competitive disadvantage. Ecosystem players need real-time money movement and reconciliation in their core architecture.

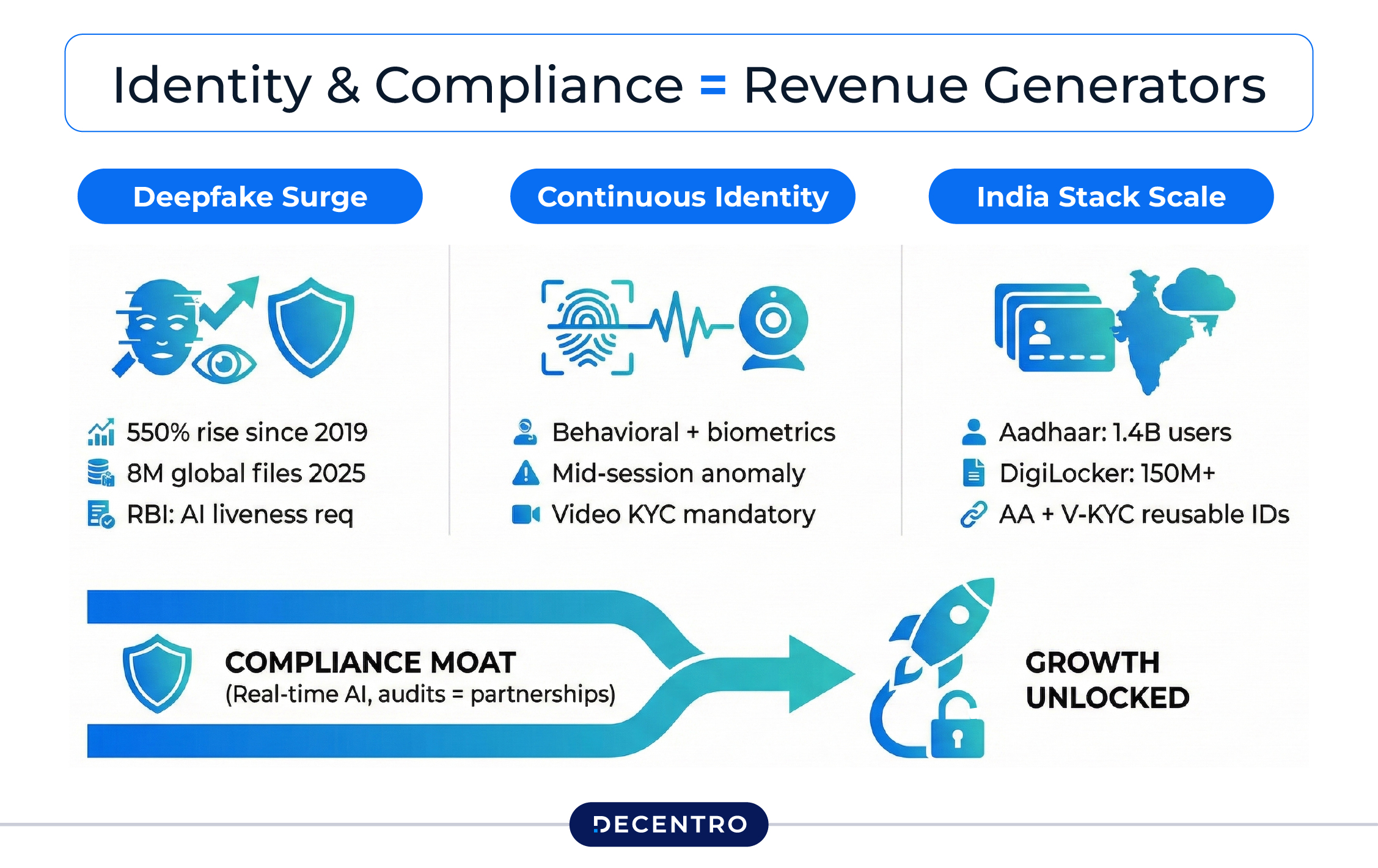

Identity and compliance are revenue generators

The Digital Personal Data Protection Act, mobilised through sector-specific guidelines, is shaping how financial institutions architect data flows, consent, and vendor relationships. But instead of just being compliance overhead, smart companies are turning this into a competitive advantage.

Key directions:

Identity beyond the signup screen

Identity now extends through the entire user session. Behavioural patterns, device signals, and biometric checks work together to spot anomalies mid-journey. This is critical in an era of deepfakes and synthetic IDs where one-time verification isn’t enough.

Deepfake and synthetic fraud attempts have surged dramatically—industry reports suggest a 700-900% increase in sophisticated impersonation attacks over the past year. In response, RBI has tightened expectations around Video KYC, requiring AI-driven liveness detection and multi-factor fraud checks. What was once a one-time verification box to tick is now a continuous, board-level risk and product concern for 2026. Companies that treat deepfake defence and AI-powered identity verification as core product features, not compliance afterthoughts, will have a decisive advantage in trust and regulatory readiness.

India’s digital identity stack is maturing

Aadhaar-based verification, DigiLocker, video verification, and Account Aggregator are enabling reusable, privacy-aware digital identities. The RBI’s framework for responsible and explainable AI is pushing platforms to build compliance into the product from day one.

Compliance as a selling point

Real-time monitoring, audit trails, and explainable decisions are becoming features that enterprise customers and partner banks actually look for. Compliance is no longer just legal overhead; it’s what lets you unlock new segments and partnerships.

The script has flipped. Winners treat identity, consent, and compliance as product features that enable growth, not requirements that slow it down.

Open, tokenised, and green: the next rails

Beyond the immediate rails of UPI and eKYC, a new foundation is quietly being laid that will matter more as your business scales.

Three themes stand out:

Open finance and data portability

Globally, open banking is evolving into open finance, covering payroll, pensions, investments, and tax data. In India, frameworks like Account Aggregator are early steps in the same direction, enabling consent-driven access to financial data for smarter underwriting and personalised products.

Tokenisation and programmable money

Worldwide, tokenised real-world assets are already worth tens of billions of dollars and could climb into the trillions over the next decade. India’s pilots around the digital rupee and programmable features show how settlements, payouts, and conditional disbursements could become more automated and transparent.

Sustainability and inclusion are built into products

AI-enabled ESG and green finance tools are moving from “nice to have” to basic expectations, especially from global investors. At the same time, hardware plus software at the last mile, micro-ATMs, AEPS devices, QR, and vernacular UX, will remain critical to serving Bharat, not just India.

For an ecosystem player, this is the moment to design for future rails, even if you do not switch them on from day one. Being API-first and modular will make it far easier to plug into open finance, tokenisation, or CBDC-based use cases when they go mainstream.

Where Decentro fits into this picture

All of these trends are powerful, but they are also complex. Most founders and businesses do not want to become experts in banking regulation, switching, or reconciliation. They want one thing: infrastructure that just works, so they can focus on customers.

That’s exactly where Decentro is building for 2026, and already delivering at scale.

One provider for all Indian financial rails

Instead of separate integrations for banks, payment gateways, verification providers, and collections systems, plug into a single modular platform. UPI, bank transfers, identity verification, recurring mandates, all available as simple building blocks you can mix and match.

Example – How AltDRX, a leading Digital Real-Estate marketplace, simplified real estate investing using Decentro’s APIs—achieving 99.8% uptime and automating KYC, UPI Collections, and Autopay flows.

Pre-built journeys for common use cases

Ready-to-use flows for marketplace payouts, buy-now-pay-later, SME lending, salary advances, or subscription collections. Launch faster with fewer moving parts. Each workflow comes with compliance checks, risk rules, and audit trails aligned to evolving RBI guidance.

Example – How SalarySe, a salary-powered fintech platform, onboarded and verified their users faster, enabling salaried employees with their Credit-on-UPI Platform.

AI-native risk and collections

As AI becomes central to fraud detection and underwriting, Decentro is building intelligence directly into the rails. Every payment, mandate, or repayment carries a risk signal and proprietary score, helping partners reduce fraud and improve approval rates with fewer manual steps.

Example – How FlexiLoans, a digital lender, improved DPD 1-30 recovery rates by 1.25% and slashed operational costs using Neowise’s hybrid AI-bot and human collections model.

Ecosystem-first, not just API-first

Decentro’s ambition is to be the connective tissue between banks, NBFCs, fintechs, and large platforms, making it as easy to launch a co-branded financial product as it is to launch a new feature. That means standardised integrations, faster partner onboarding, and shared best practices on risk, compliance, and customer experience across the ecosystem.

The promise is simple: if you can imagine a financial journey for your users, you should be able to ship it quickly, safely, and at scale, without assembling the plumbing yourself.

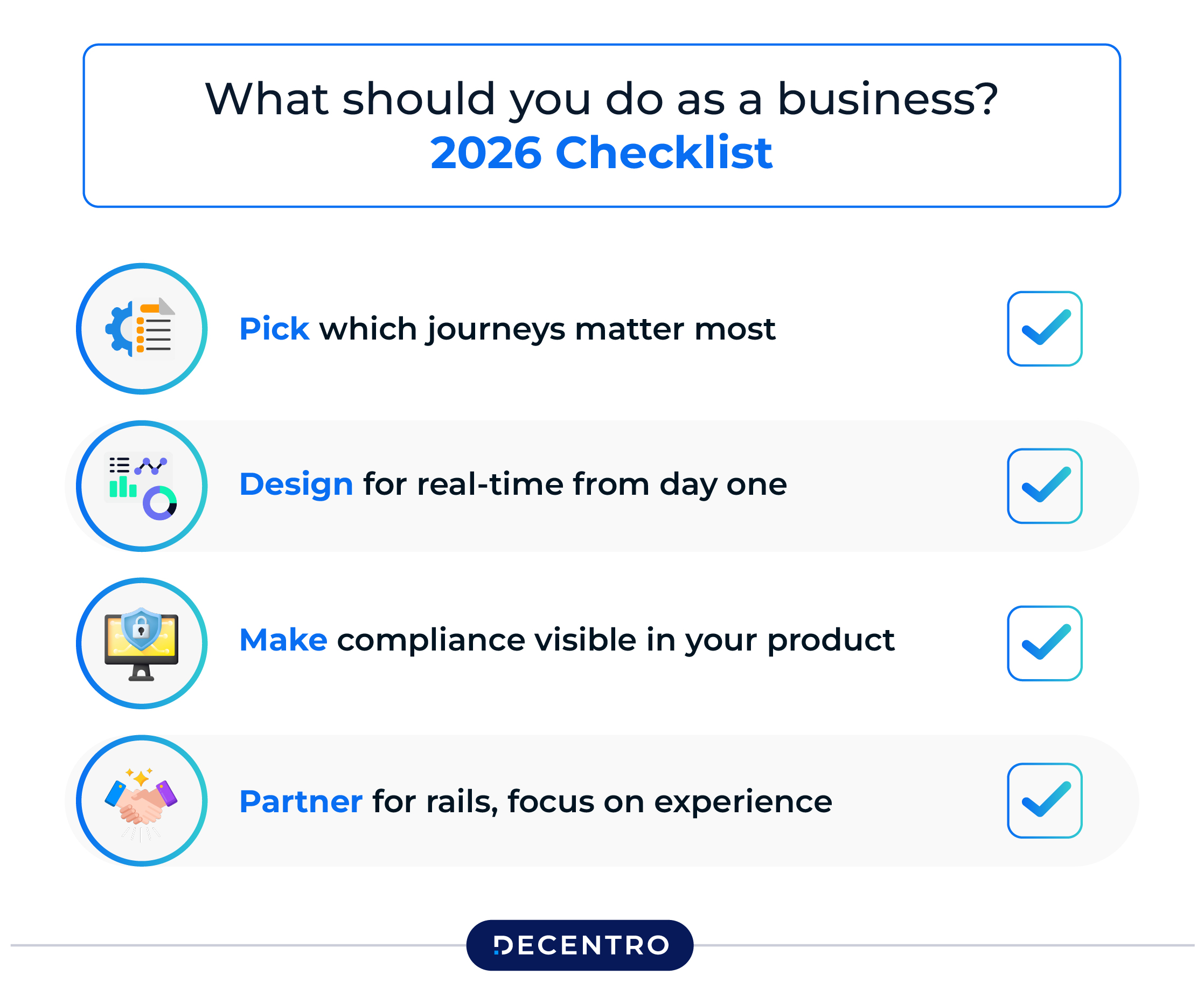

How to prepare (without overthinking it)

You don’t need a 50-page strategy deck. You need clarity on a few key decisions:

Pick which journeys matter most

Is your biggest opportunity checkout conversion? MSME credit? Retention through rewards? Choose 1-2 financial journeys to own and go deep.

Design for real-time from day one

Assume payments, risk decisions, and collections all happen instantly. Choose infrastructure partners who support this across both technology and operations.

Make compliance visible in your product

Don’t hide consent and security in legal fine print. Make transparency part of your user experience. This builds trust with both customers and banking partners.

Partner for rails, focus on experience

Use ecosystem players like us for infrastructure and compliance. Let your team focus on design, differentiation, and distribution—the things only you can do well.

2026 is set to reward builders who see finance not as a separate industry, but as infrastructure running quietly underneath every digital experience. The founders who win will design that layer deliberately, modular, data-driven, and ecosystem-ready from day one.

The rails are here. The question is what you’ll build on top of them.