Struggling with FIRC? Learn how to get your e-FIRC automatically, claim GST refunds faster, and stay compliant in 2026. A complete guide for Indian businesses.

FIRC Certificate Explained: Meaning, Uses & How to Get It (2026)

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Quick Glance

| What: Official proof that you received a foreign payment in India. Who needs it: Exporters, freelancers, anyone getting paid from abroad. Why: Claim GST refunds File tax returns Access export benefits Avoid penalties How to get it: Banks: 3-7 days, ₹100-500 Smart platforms: Auto-generated in 24-48 hours Pro tip: Request within 30 days of each payment. Don’t wait for tax season. India’s reality: $824.9B in exports. 15M freelancers. No FIRC = no refunds, no compliance. Use platforms that automate it. Focus on business, not paperwork. |

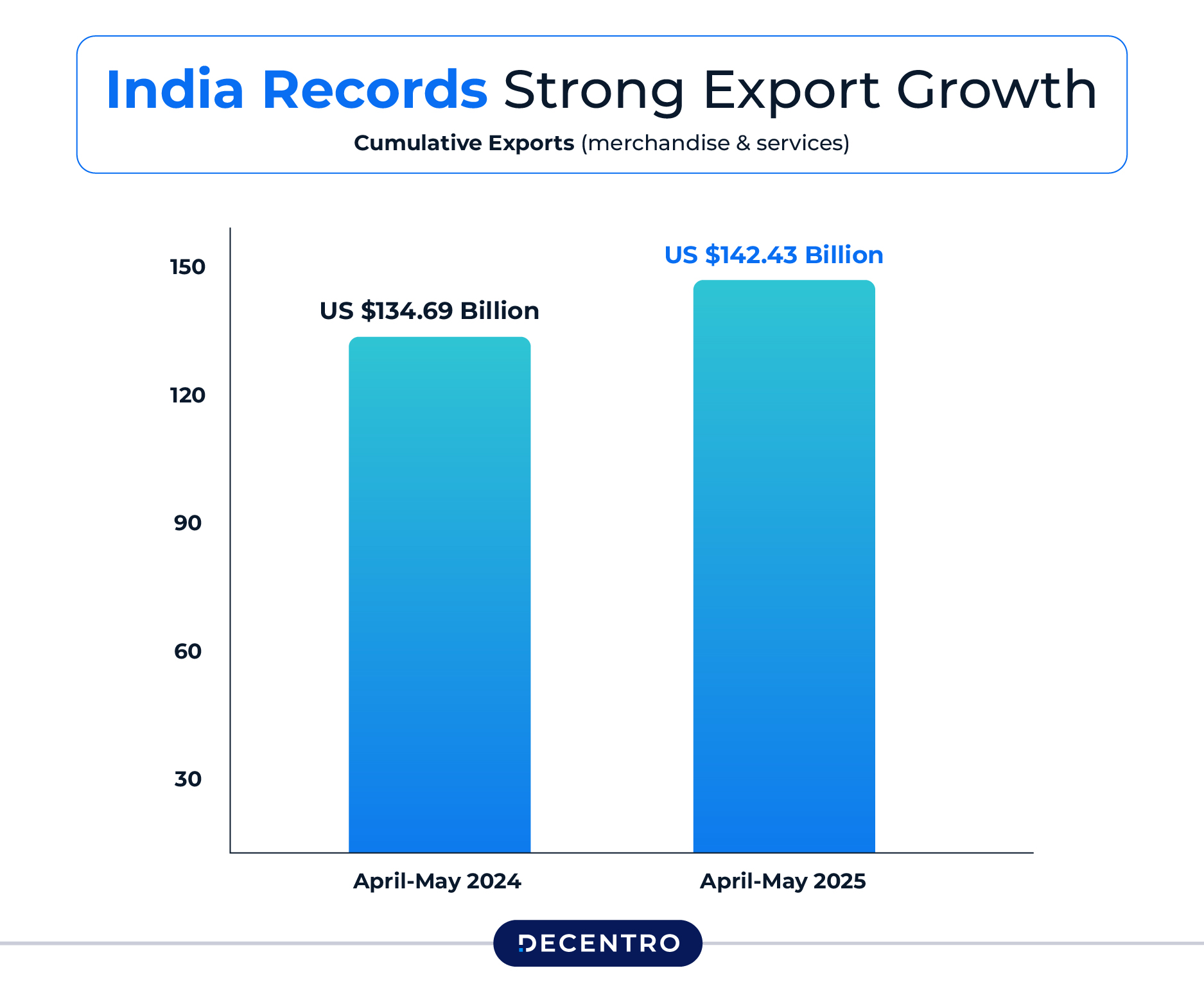

A Foreign Inward Remittance Certificate (FIRC) is an official document issued by authorised banks in India that proves you’ve received payment from abroad. India’s booming export economy has touched an all-time high of US$824.9 billion in the financial year 2024–25, as per the latest data released by the Reserve Bank of India on services trade for March 2025. This certificate is no longer optional. It’s a mandatory compliance document for exporters, freelancers, and businesses receiving foreign payments. This guide walks you through everything you need to know about FIRC in 2026, from understanding what it is to obtaining your e-FIRC seamlessly.

India’s Cross-Border Payment Revolution: Why FIRC Matters Now More Than Ever

India’s export landscape is experiencing unprecedented growth. With 15 million freelancers contributing to a market projected to reach $25 billion by 2025, and services exports alone hitting $387.5 billion in 2024-25 (a remarkable 13.6% growth), the country has firmly established itself as a global services powerhouse.

But here’s the reality: every dollar, pound, or euro that flows into India needs proper documentation. That’s where the FIRC comes in.

Think of it this way: you’ve just closed a major contract with a US client worth $10,000. The payment arrives in your Indian bank account, converted to rupees. Exciting, right? But without a FIRC, you can’t prove this income for tax purposes, claim your GST refunds, or meet compliance requirements. For many businesses, this small piece of documentation is the difference between smooth operations and regulatory nightmares.

What Exactly Is a FIRC Certificate?

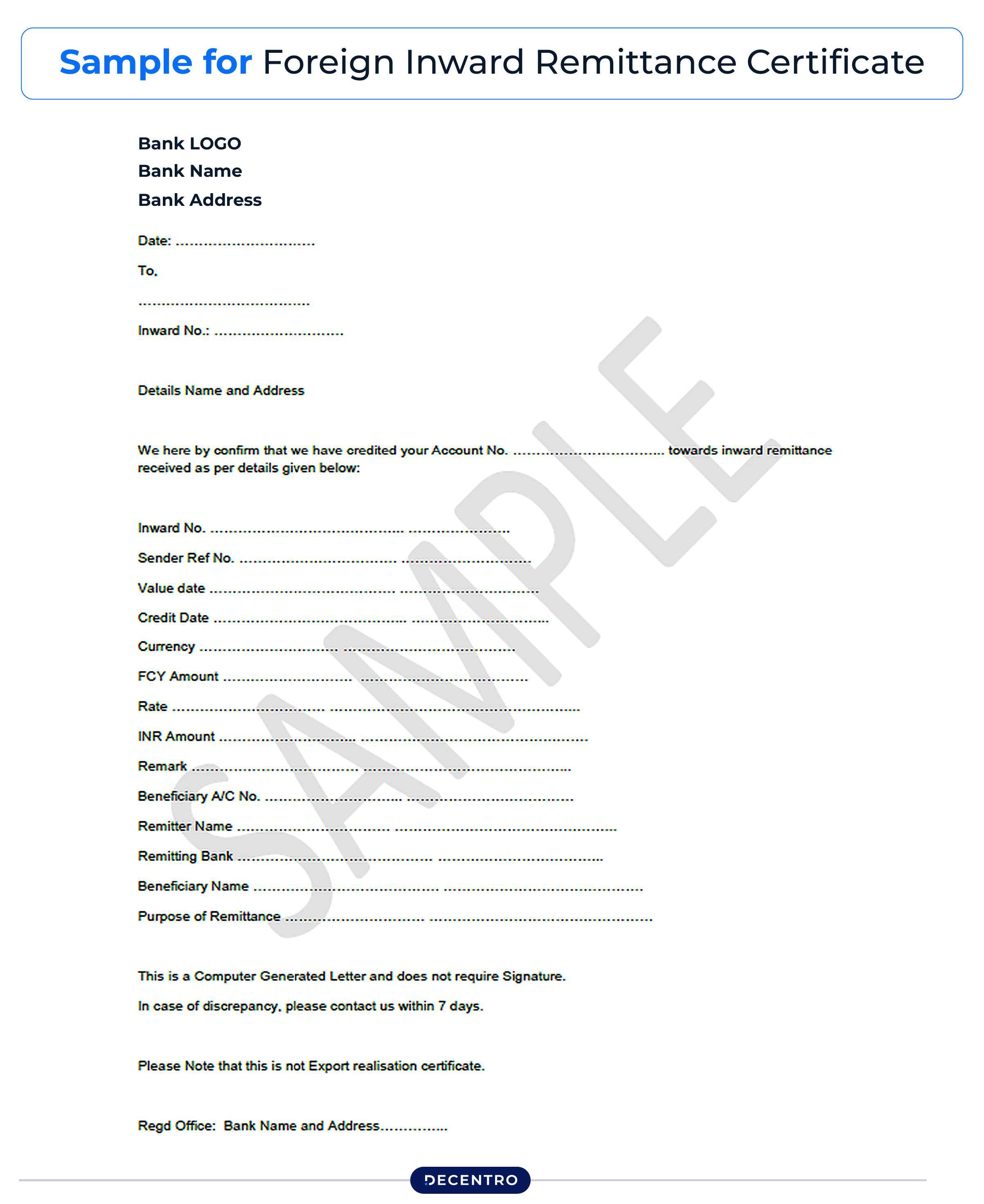

A Foreign Inward Remittance Certificate (FIRC) is an official document issued by Authorised Dealer (AD) banks in India. It serves as concrete proof that you’ve received payment from a foreign source and that this foreign currency has been properly converted into Indian Rupees.

In simple terms, it’s your receipt for international money. But unlike a regular receipt, it’s recognised by government authorities like the Reserve Bank of India (RBI), the Directorate General of Foreign Trade (DGFT), and the Central Board of Indirect Taxes and Customs (CBIC).

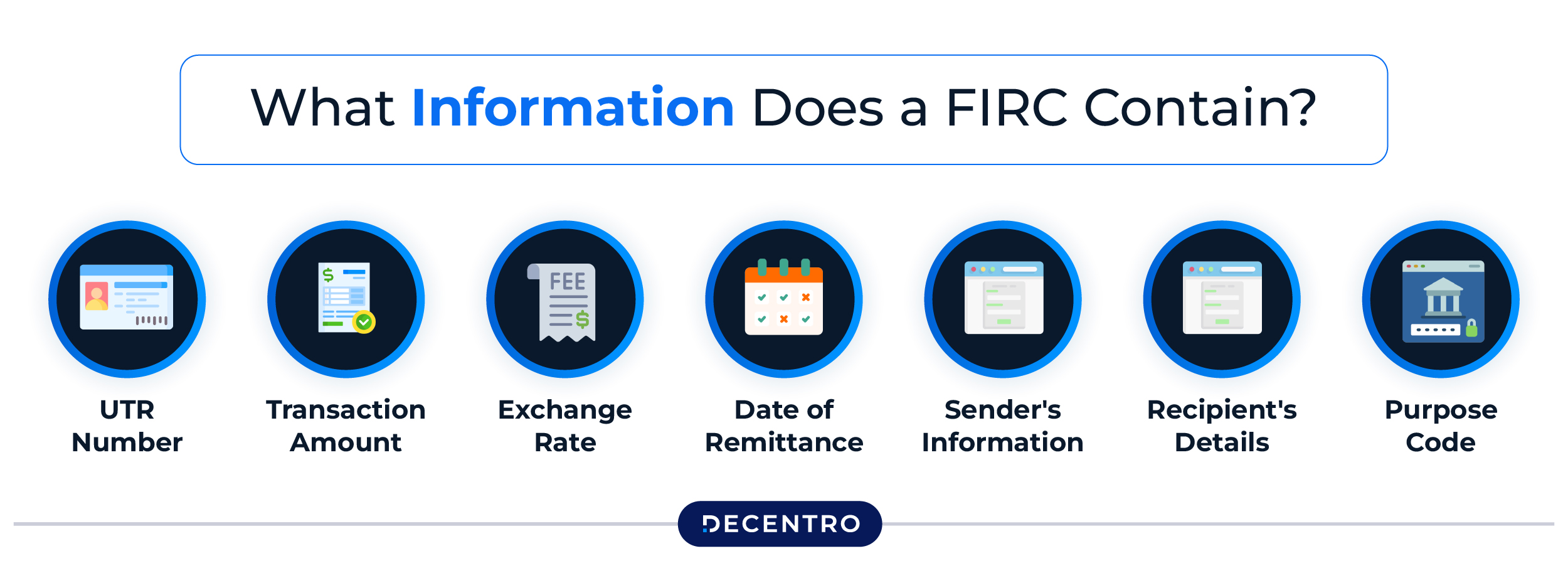

What Information Does a FIRC Contain?

Every FIRC includes these essential details:

- UTR Number: The Unique Transaction Reference that identifies your specific payment

- Transaction Amount: Shown in both the original foreign currency and converted INR

- Exchange Rate: The conversion rate applied to your transaction

- Date of Remittance: When the funds were transferred

- Sender’s Information: Name and country of the person or business sending money

- Recipient’s Details: Your name, address, and bank account details

- Purpose Code: The RBI-designated code explaining the reason for the remittance (for example, “P0802” for software consultancy services)

Think of it as a complete transaction passport—every detail about the money’s journey from abroad to your Indian bank account.

The Evolution of FIRC: From Paper to Digital

The issuance of FIRCs has undergone a dramatic transformation over the past decade, making life easier for businesses and freelancers alike.

Physical FIRC: The Old Way

Before 2016, banks issued physical FIRCs—actual printed certificates that you had to collect, store, and present when needed. The process was slow, involved multiple trips to the bank, and these paper documents could easily get lost or damaged. Imagine waiting weeks for a document, only to have it fade or tear before you could use it for a critical GST refund claim.

e-FIRC: The Modern Standard

In 2016, the RBI revolutionised the system by introducing e-FIRC (electronic FIRC). Here’s how it works now:

When your bank processes an inward remittance, they report the transaction to the RBI’s Export Data Processing and Monitoring System (EDPMS). The system automatically generates an Inward Remittance Message (IRM), which serves as your e-FIRC.

Benefits of e-FIRC include faster processing, online accessibility, easy verification, no risk of physical loss, and instant availability on digital platforms.

Understanding FIRC vs. FIRS

You might hear people use these terms interchangeably, but they’re different:

- FIRC (Foreign Inward Remittance Certificate): A transaction-specific document. You get one FIRC for each payment.

- FIRS (Foreign Inward Remittance Statement): A consolidated statement that lists multiple remittances over a period.

For most compliance purposes—like claiming GST refunds or export benefits—you need the individual e-FIRC for each transaction, not just a FIRS.

Who Needs a FIRC Certificate? (Probably You)

If you’re receiving money from abroad for business purposes, you almost certainly need a FIRC. Here’s who should pay special attention:

Exporters and Businesses

Whether you’re exporting textiles, electronics, or software solutions, FIRCs are mandatory for claiming export benefits under India’s Foreign Trade Policy, complying with GST regulations (especially for zero-rated exports), proving revenue during audits, and accessing government incentives and schemes.

Real-world example: An electronics manufacturer in Mumbai exports goods worth $50,000 to Germany. To claim their GST input tax credit refund, they must provide FIRCs for every payment received. Without these certificates, they lose thousands of rupees in valid refunds.

Freelancers and Service Providers

India’s 15 million freelancers, 60% of whom are under 30, are earning an average of ₹20 lakh annually, with 23% crossing ₹40 lakh. For this growing community, FIRCs are essential for proving income when filing Income Tax Returns, complying with GST if turnover crosses the threshold, claiming GST refunds on export of services, and building a verifiable income track record for loans or credit.

Common scenario: A graphic designer in Bangalore works with clients in the US and UK. Each payment arrives via different payment gateways. Come tax season, the designer needs FIRCs for every transaction to accurately report foreign income and claim applicable benefits.

Startups Receiving Foreign Investment

If your startup is raising funds from overseas investors, the FIRCs document the investment trail, ensure compliance with FEMA regulations, and help with regulatory reporting to the RBI.

Individual Recipients of High-Value Transfers

Even individuals receiving substantial gifts, loans, or other payments from abroad benefit from having FIRCs to explain the source of funds if questioned by tax authorities.

Why Is FIRC So Important? The Real Impact on Your Business

Understanding why FIRC matters helps you appreciate its value beyond just compliance:

Tax Compliance and ITR Filing

When you file your Income Tax Return, the tax department needs to see proof of your foreign income. Your FIRC serves as this proof, helping you accurately report earnings, differentiate between taxable income and non-taxable receipts (like gifts from relatives), avoid penalties for underreporting income, and support deductions or exemptions you’re claiming.

GST Compliance: The Zero-Rating Advantage

Under the GST law, exports are “zero-rated supplies”—meaning you don’t charge GST on your export invoices. Better yet, you can claim a refund on the input tax credit you paid on goods and services used to create your export.

But here’s the catch: to claim this refund, you must prove that payment was received in convertible foreign exchange. Your FIRC is this proof.

The numbers: For a business with ₹10 lakh in input tax credits, proper FIRC documentation could mean the difference between recovering this amount or losing it entirely.

Export Benefits and Government Schemes

The Indian government offers various incentives to boost exports—duty drawbacks, the Export Promotion Capital Goods (EPCG) scheme, and advance authorisation schemes. All of these require you to prove your export earnings. Without FIRCs, you can’t access these benefits.

Audit Protection

During statutory audits or tax assessments, authorities scrutinise your foreign transactions. FIRCs provide an unimpeachable audit trail, demonstrating that your international income is legitimate, properly accounted for, and compliant with FEMA regulations.

How to Get Your FIRC Certificate: Two Methods for 2026

Getting your FIRC has become significantly easier with digital transformation, but the process varies depending on how you receive payments.

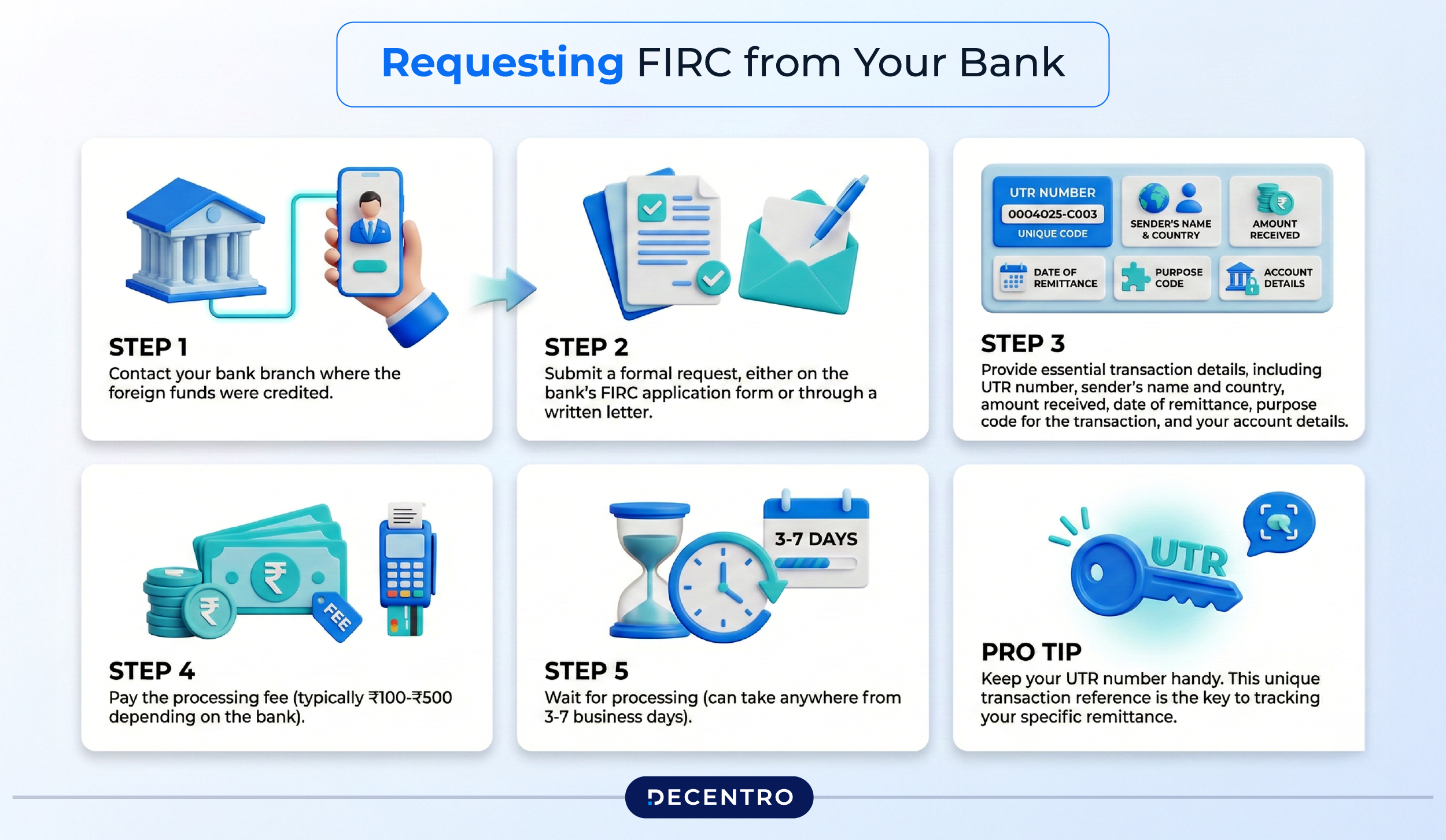

Method 1: Requesting FIRC from Your Bank (Traditional Route)

If you receive payments directly through your bank account, here’s the process:

Step 1: Contact your bank branch where the foreign funds were credited.

Step 2: Submit a formal request, either on the bank’s FIRC application form or through a written letter.

Step 3: Provide essential transaction details, including UTR number, sender’s name and country, amount received, date of remittance, purpose code for the transaction, and your account details.

Step 4: Pay the processing fee (typically ₹100-₹500 depending on the bank).

Step 5: Wait for processing (can take anywhere from 3-7 business days).

Pro tip: Keep your UTR number handy. This unique transaction reference is the key to tracking your specific remittance.

Method 2: Automated e-FIRC Through Modern Payment Platforms (The Smart Way)

Modern payment gateways and fintech platforms have revolutionised FIRC issuance. Platforms that facilitate cross-border payments now automate the entire process.

How it works: When you receive a payment through these platforms, the e-FIRC is automatically generated, available instantly on your dashboard, downloadable in digital format, and verified without manual intervention.

Time savings: What used to take days or weeks now happens automatically within 24-48 hours.

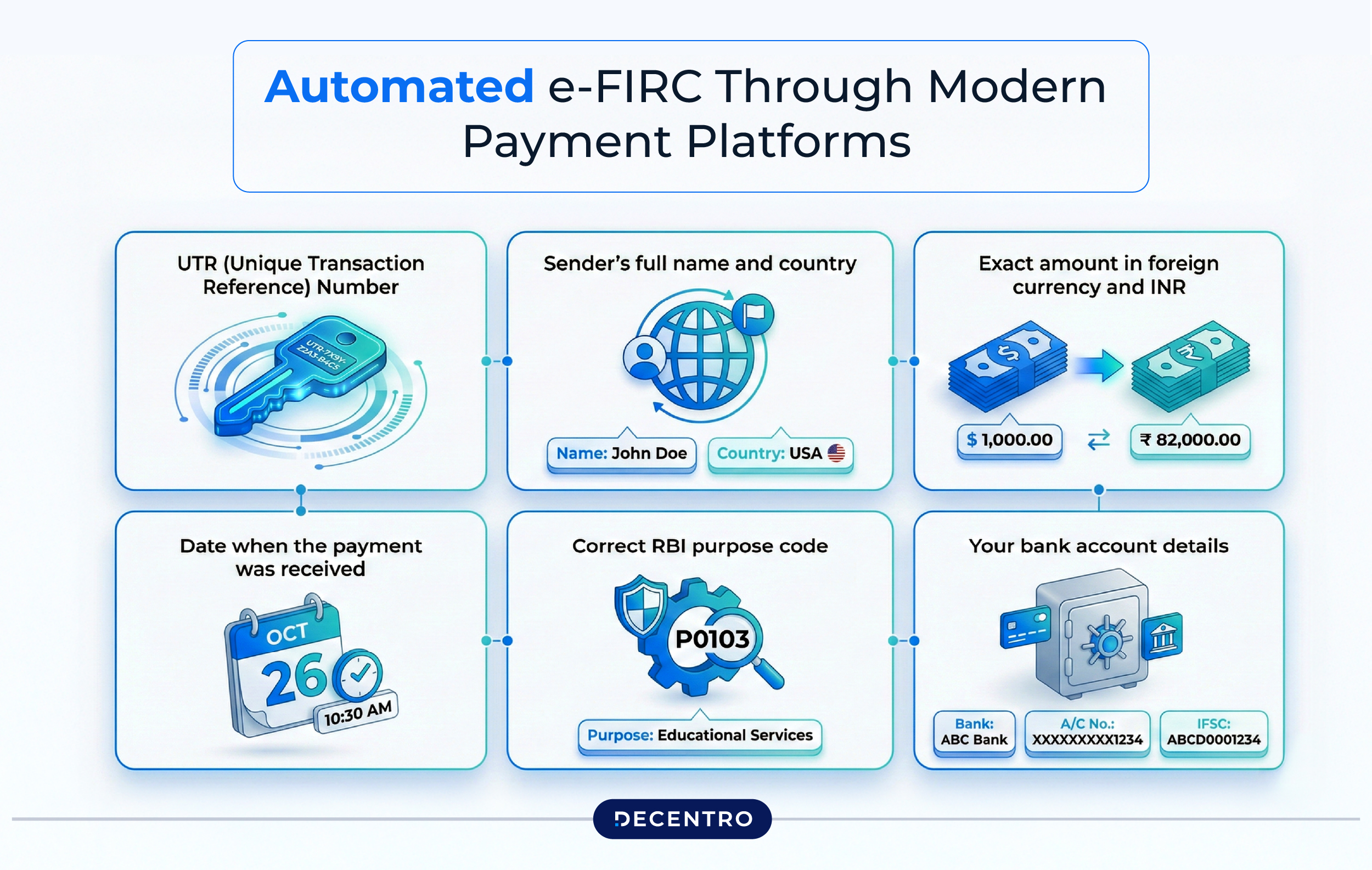

Essential Information You’ll Need

Regardless of which method you use, keep these details ready:

- UTR (Unique Transaction Reference) Number

- Sender’s full name and country

- Exact amount in foreign currency and INR

- Date when the payment was received

- Correct RBI purpose code

- Your bank account details

FIRC and Compliance: Navigating Tax and Regulatory Requirements in 2026

Understanding how FIRC fits into India’s regulatory framework helps you stay compliant and avoid penalties.

Income Tax Implications

Your FIRC plays a crucial role in your tax filings by providing proof of foreign income for accurate ITR filing, helping distinguish between different types of receipts, supporting exemption claims for genuine gifts from specified relatives, and creating a verifiable paper trail for foreign earnings.

What happens without proper FIRCs: Unexplained foreign deposits in your bank account can trigger notices from the Income Tax Department. In worst cases, you might face penalties or even prosecution for money laundering if you can’t prove the legitimacy of foreign funds.

GST Compliance for Export of Services

The export of services falls under zero-rating in GST, meaning exporters can claim refunds on input tax credit. The process requires filing GST returns with export details, claiming refunds through proper channels, and providing FIRCs as mandatory supporting documents.

According to recent data, service exports contributed 46.91% of India’s total exports in April-August 2025. For these thousands of service exporters, FIRC compliance directly impacts their bottom line.

FEMA Compliance and Foreign Trade Regulations

The Foreign Exchange Management Act (FEMA) governs all foreign exchange transactions in India. FIRCs help you comply with reporting requirements, track foreign exchange inflows, and ensure proper documentation for RBI and DGFT.

Real Consequences of Non-Compliance

Missing or incorrect FIRCs can lead to rejection of GST refund claims (losing thousands in valid refunds), penalties during tax assessments, inability to claim export benefits, complications in future transactions, and, in extreme cases, scrutiny for potential money laundering.

Common FIRC Issues and How to Solve Them

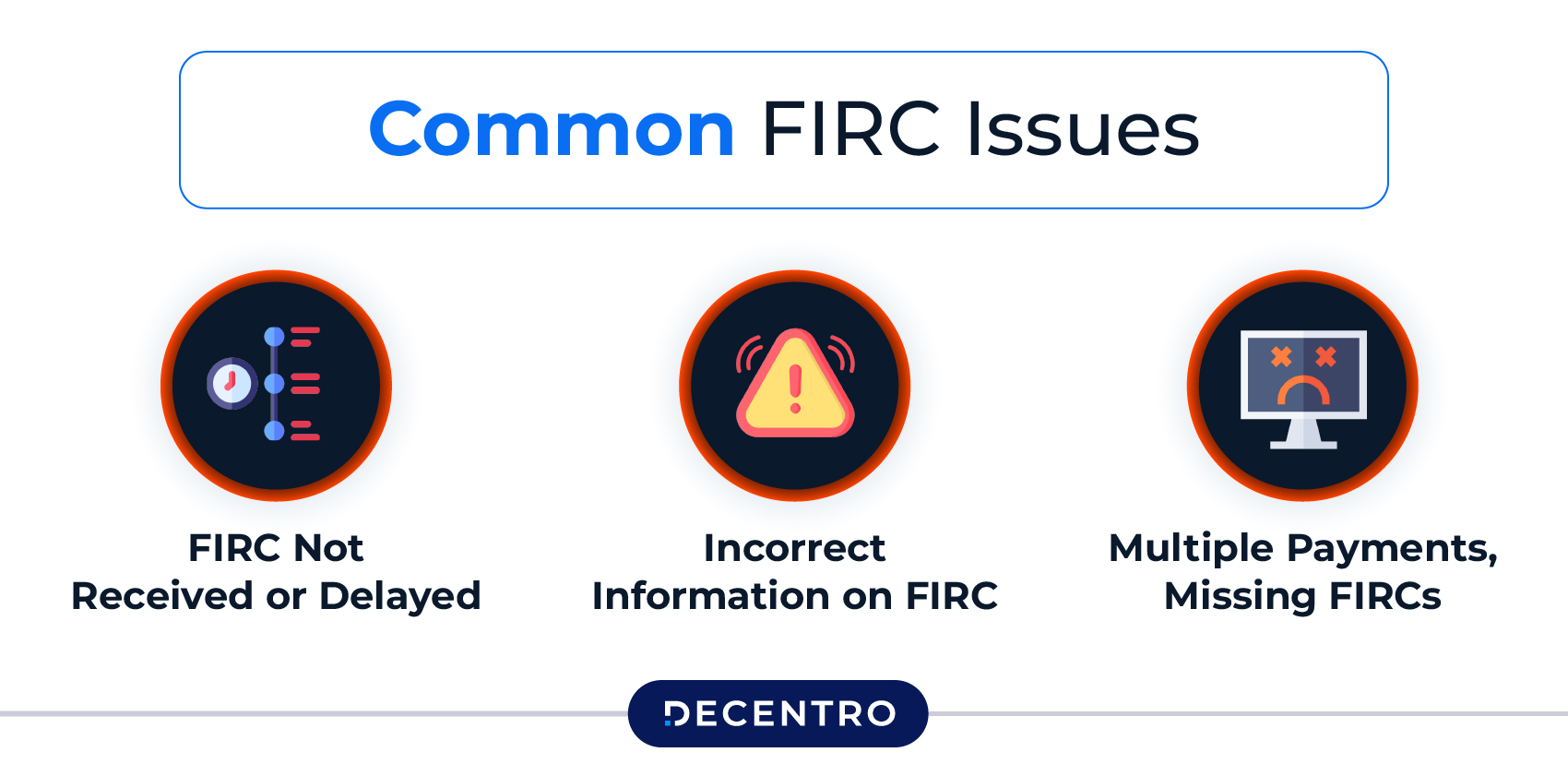

Even with digital systems, problems can occur. Here’s how to handle the most common issues:

Problem 1: FIRC Not Received or Delayed

Possible reasons: Incorrect purpose code provided by sender, missing sender information, bank processing backlogs, technical issues with EDPMS portal.

Solution: Contact your bank or payment provider immediately, provide your UTR number for tracking, verify all transaction details are correct, and follow up regularly until resolved.

Prevention: Always communicate the correct purpose code to your sender before they initiate the payment.

Problem 2: Incorrect Information on FIRC

If you notice errors in your FIRC (wrong amount, incorrect purpose code, misspelt name), immediately contact the issuing bank, submit a request for amendment with supporting documents, keep records of your correction request, and follow up until the corrected FIRC is issued.

Important: Don’t use an incorrect FIRC for compliance purposes—it could lead to rejection of your claims.

Problem 3: Multiple Payments, Missing FIRCs

Challenge: You’ve received numerous payments throughout the year, but can’t track which ones have FIRCs.

Solution: Maintain a detailed spreadsheet tracking date of payment, amount, sender, UTR number, and FIRC status. Set reminders to request FIRCs within 30 days of receiving each payment. Use payment platforms that provide automatic FIRC tracking.

Best Practices for FIRC Management in 2026

Smart businesses and freelancers follow these practices to stay ahead:

1. Choose the Right Payment Partners

Work with banks or fintech platforms known for reliable FIRC issuance. Automated e-FIRC generation saves time and headaches. Platforms with built-in compliance features are worth their weight in gold.

2. Communicate with Your Clients

Educate international clients about providing the correct purpose codes. Share your bank details clearly to avoid payment errors. Request notifications when payments are initiated.

3. Maintain Organised Records

Create a dedicated folder (digital or physical) for all FIRCs. Match each FIRC with the corresponding invoices and contracts. Update your records monthly, not just during tax season. Keep backups of all digital FIRCs.

4. Stay Updated on Regulations

RBI and DGFT guidelines can change. Subscribe to updates from your bank or payment platform. Consult with a CA or tax advisor annually. Join industry forums where compliance topics are discussed.

5. Act Promptly

Don’t wait until tax filing season to collect FIRCs. Request FIRCs within 30 days of receiving payment. Address discrepancies immediately when you spot them.

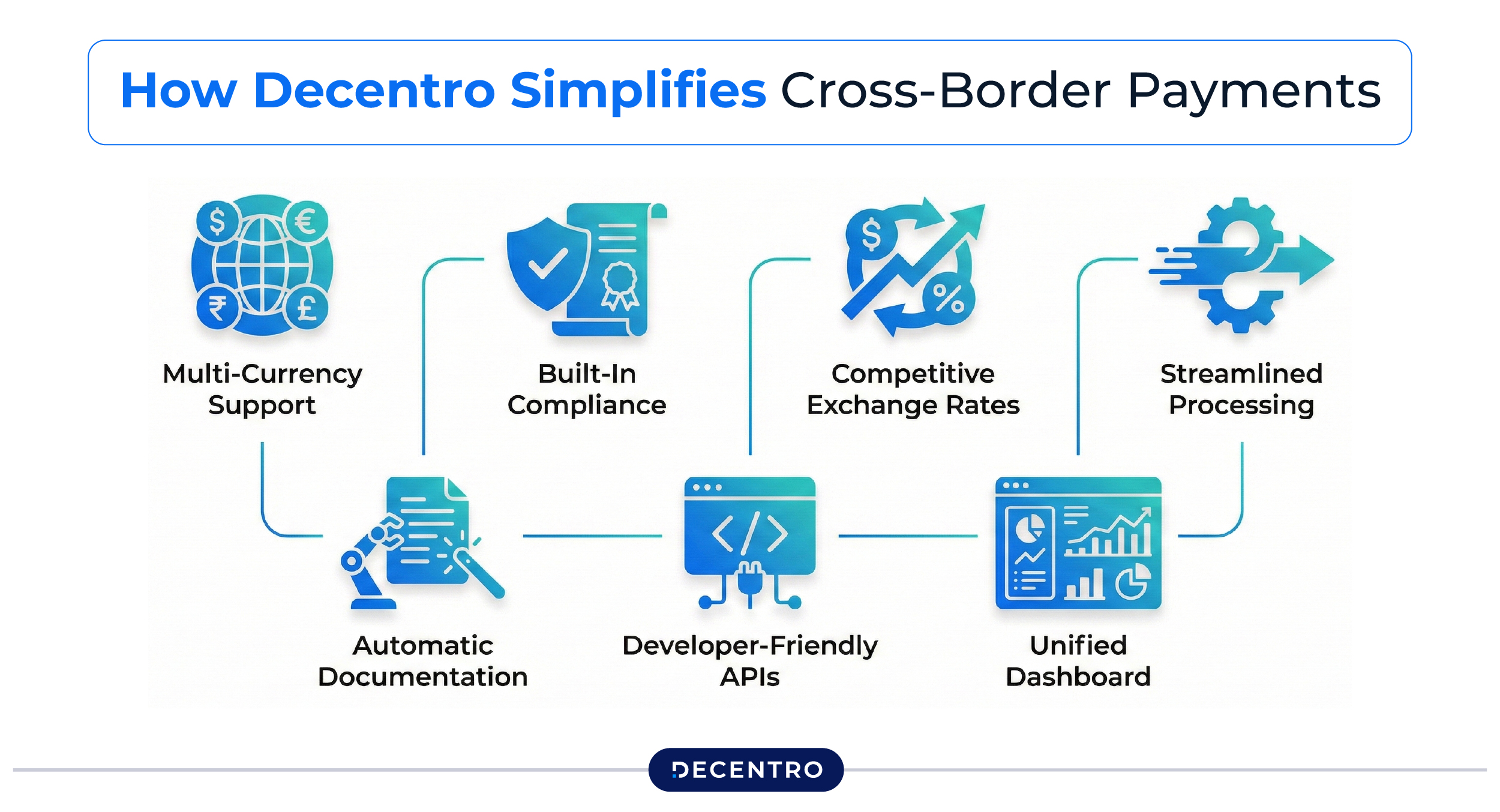

Simplifying Cross-Border Payments with Decentro

Managing international payments shouldn’t mean drowning in paperwork and bank visits. As India’s export economy continues to surge, targeting $850 billion in total exports for 2025-26, businesses need solutions that keep pace with growth.

Decentro’s cross-border payment platform is built for this new reality. We understand that your time is better spent growing your business than chasing banks for FIRCs or worrying about compliance.

How Decentro Makes Cross-Border Payments Effortless

Seamless Integration: Connect with your existing systems through simple APIs—no complex technical setups required.

Real-Time Tracking: Know exactly where your payment is at every stage, from initiation to receipt and FIRC generation.

Compliance Built-In: Our platform ensures you’re always compliant with RBI, FEMA, and GST regulations without extra effort.

Competitive Exchange Rates: Get better rates than traditional banks, maximising the value of every foreign payment.

Dedicated Support: Our team understands the unique challenges of cross-border payments and is here to help.

Who Benefits from Decentro?

Whether you’re a freelancer receiving payments from global clients, an exporter shipping products worldwide, a startup with international customers, a service provider working with overseas companies, or an agency managing multiple cross-border transactions, Decentro simplifies your payment operations so you can focus on what matters—growing your business.

Ready to simplify your cross-border payments? Explore how Decentro can help you receive international payments faster, with automatic FIRC generation and full compliance support.

Conclusion: Your FIRC Checklist for 2026

As India’s export economy booms and more professionals join the global workforce, the FIRC has evolved from a bureaucratic requirement to a strategic business tool. Here’s your action plan:

Immediate Actions:

- Verify you have FIRCs for all foreign payments received in the last 6 months

- Set up a tracking system for future FIRCs

- Review your current payment methods—are they FIRC-friendly?

For Ongoing Compliance:

- Request FIRCs within 30 days of receiving each payment

- Maintain organised digital and physical records

- Stay updated on RBI and DGFT guidelines

For Better Efficiency:

- Consider switching to platforms that automate e-FIRC generation

- Educate your international clients about correct payment procedures

- Consult with a CA or tax advisor to ensure you’re maximising your benefits

Remember: In 2026’s cross-border payment landscape, a FIRC isn’t just a certificate, it’s your proof of legitimate income, your ticket to tax refunds, your access to government benefits, and your protection during audits.

With India targeting unprecedented export growth and the freelance economy expanding rapidly, getting your FIRC documentation right isn’t optional anymore. It’s the foundation of sustainable, compliant, and profitable cross-border business.

The good news? With modern payment platforms and e-FIRC systems, what once took weeks now happens automatically. Your job is to choose the right partners, stay organised, and keep building your global business with confidence.

Frequently Asked Questions

1. Can I get a FIRC for payments received through PayPal or other payment gateways?

Yes, but it depends on how the payment gateway operates. If they use an AD (Authorised Dealer) bank in India to process your payment, you’ll get an e-FIRC. Modern platforms like Decentro automate this. For PayPal, you typically need to withdraw funds to your Indian bank account and then request the FIRC from your bank using the transaction details.

2. How long is a FIRC valid?

FIRCs don’t expire. Once issued, they remain valid indefinitely as proof of that specific transaction. However, for GST refund claims, you typically need to submit FIRCs within the relevant financial year or filing period.

3. What if my foreign client sends multiple small payments instead of one large payment?

You’ll need a separate FIRC for each transaction. This is why many freelancers and businesses consolidate invoices or use payment platforms that automate FIRC generation for multiple transactions. Tracking becomes crucial—maintain a spreadsheet linking each payment to its FIRC.

4. Is FIRC required for gifts from relatives abroad?

Technically, yes—any foreign inward remittance generates a transaction record. However, for genuine gifts from specified relatives (parents, siblings, spouse), while you’ll receive the documentation from your bank, these are typically exempt from tax under Section 56 of the Income Tax Act. Still, keep the FIRC as proof in case of scrutiny.

5. What’s the difference between a FIRC and a bank statement showing foreign credit?

A bank statement only shows that money was credited to your account. A FIRC proves the money came from abroad, shows the foreign currency amount, exchange rate, sender details, and purpose code—all critical for tax compliance, GST refunds, and regulatory requirements. Tax authorities don’t accept bank statements as substitutes for FIRCs.