Want to improve the conversion rate of your eCommerce platform? Here are the top 15 checkout apps that can enhance customer experience and reduce cart abandonment.

15 Best Checkout Apps for eCommerce Stores in 2026

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

The increasing rate of online shopping demands a quick and safe checkout process to ensure a seamless purchase experience. Thus, eCommerce platforms must integrate user-friendly and efficient checkout apps to make online shopping easier and hassle-free.

Keep reading to explore the top 15 checkout apps that can improve your online shopping experience!

A Quick Glance

| Platforms | Value Proposition |

| GoKwik | Offers one-click checkout, multi-currency support, RTO protection, etc. |

| Shopflo | Offers BNPL integration with top providers |

| Bolt | Compatible with various e-commerce platforms |

| Checkout.com | It has a unified API that supports global payment, detects fraud, processes payments, etc. |

| Checkout Champ | Provides extensive control over site design and structure |

| Shop Pay | Offers flexible payment options through instalments |

| Recharge | Integrates with Shopify and WooCommerce checkout for seamless transactions |

| OneStepCheckout | Use Google Place integration to auto-fill customer address |

| CartHook | Use real-time analytics to track customer behaviour and campaign performance |

| Express Checkout | Enables fast checkout for returning customers with its quick-pay button |

| Nimbbl | Known for its integration with multiple payment gateways and mobile-optimised payment pages |

| PeachPay | One-Click checkout option streamlines transactions for faster purchases |

| Stripe Checkout | Supports multi-currency and accepts international payments in over 135 currencies |

| Amazon Pay | Easily integrates with various e-commerce platforms |

| Shiprocket Checkout | Pre-fills the addresses to increase the conversion rates |

Checkout optimisation is an essential part of e-commerce success since it directly affects conversion rates and customer satisfaction.

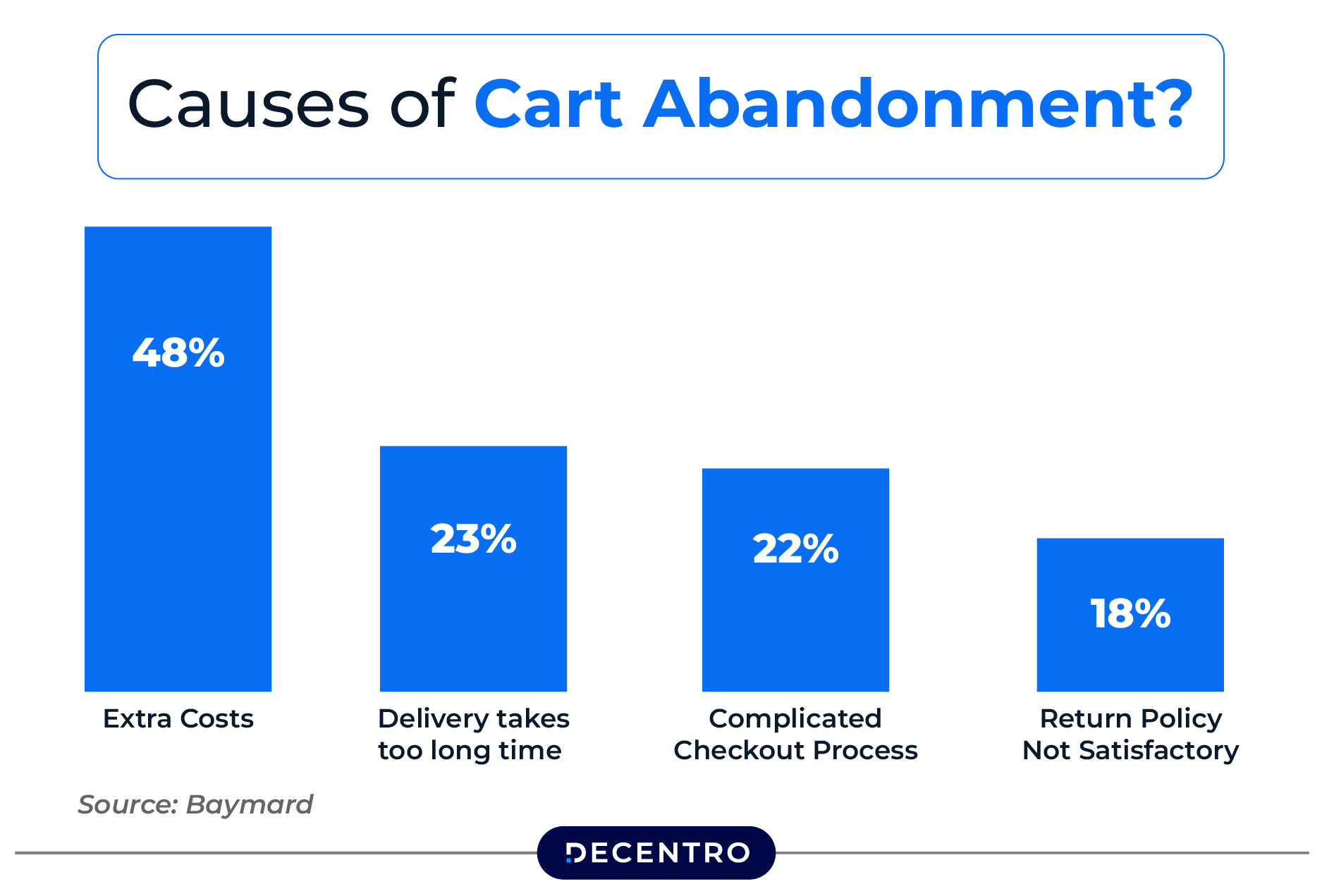

Based on several studies, a simplified checkout process can drastically decrease cart abandonment rates, usually as high as 70.19% worldwide. As per records, checkout optimisation can increase the conversion rate by nearly 35%.

Successful checkout apps are central to this optimisation by delivering features, including one-click payment, editable checkout workflows, and the mobile checkout experience. Additionally, they can enhance merchants’ selling experience with added features such as hidden payment rules, upselling opportunities, and one-click selling, making them a crucial consideration during e-commerce website development.

In addition, other checkout-free store solutions are beginning to emerge, using AI and mobile apps to eliminate traditional checkout lines altogether.

Read on to explore the top 15 checkout apps that can revolutionise your e-commerce website’s checkout process. These apps prioritise speed, security, customisation, and mobile friendliness. These apps increase conversions and improve customer happiness, making them must-have tools for any online business looking to succeed in today’s competitive market.

Top 15 Checkout Apps for eCommerce in 2026

Here are the best checkout apps to enhance the customer experience on eCommerce platforms:

GoKwik

GoKwik is a commerce enablement firm that aims to enhance the shopping experience, especially checkout. It helps solve crucial issues such as excessive Return to Origin (RTO) and poor conversion rates, which are essential pain points for e-commerce merchants. GoKwik provides solutions like minimising RTO via risk analysis and improving conversion rates by streamlining the checkout process, making it an essential tool for dropshipping and ecommerce businesses looking to maximize efficiency and sales.

They employ AI and machine learning to analyse user behaviour and transaction data to deliver a smoother, more consistent checkout experience.

Features:

- Utilises AI-driven risk assessment to minimise return to origin orders

- Offers streamlined checkout process to increase conversion rates

- Provides insights into user behaviour and transaction patterns

Pros:

- Optimises checkout to reduce cart abandonment and increase conversion rates

- A smoother checkout process and cash-on-delivery (COD) enhance customer satisfaction

Cons:

- It relies heavily on data, which may raise privacy concerns

Shopflo

Shopflo aims to revolutionise eCommerce checkouts by reducing friction and enhancing user experience. Their platform focuses on creating tailor-made checkout experiences with a network of over 100 million users, offering features like gamified promotions and customisable UI.

Brands using Shopflo have significantly increased conversion rates and average order values. The platform emphasises data-backed strategies, providing easy-to-use dashboards to monitor key metrics. It integrates with various tools to facilitate easy task management, aiming to boost customer lifetime value through improved and streamlined processes.

Features:

- Provides access to a network of over 30 million users for reduced friction

- Offers gamified promotions through discount ladders and intuitive UI to drive sales

- Facilitates BNPL integrations with top platforms like BharatX, snapmint, and Simpl

Pros:

- Easy-to-use dashboards to track and optimise checkout metrics

- Customisable UI tailors the checkout experience to reflect the brand identity

Cons:

- New users may require time to utilise all features fully

Bolt

Bolt aims to revolutionise online checkout by providing shoppers with a seamless, one-click experience. With a network of over 80 million shoppers, Bolt focuses on reducing friction and cart abandonment, thus boosting retailers’ conversion rates. Being payment—and platform-agnostic, this company ensures seamless compatibility with various systems and payment methods.

Additionally, Bolt emphasises a checkout experience tailored to each brand without adding extra buttons or complexities. It strives to offer a streamlined, secure, and fast checkout process to improve overall customer satisfaction and drive revenue growth for merchants.

Features:

- Simplifies the checkout process with a one-click checkout

- Protects against fraudulent transactions

- Offers auto-fill features for returning customers

Pros:

- Provides a smoother, more convenient checkout process for enhanced customer experience

- Supports multiple payment methods for faster guest checkout

Cons:

- It can be more expensive than standard checkout solutions

Checkout.com

Checkout.com is a global payment platform that helps businesses optimise payment processes and boost revenue. Focusing on high performance, it offers a unified API to accept payments, manage risk, and streamline payouts.

Furthermore, it uses AI and advanced technology to increase acceptance rates, fight fraud, and provide a seamless customer experience. The platform’s modular approach ensures scalability and flexibility for businesses of all sizes.

Features:

- Streamlines payment processing through a single integration point

- Includes AI-powered tools to detect and prevent payment fraud

- Supports payments in over 150 currencies

Pros:

- Boosts acceptance rates with AI-powered optimisations

- Supports multiple currencies and local payment methods

Cons:

- The pricing structure may be complex for smaller businesses

Checkout Champ

Checkout Champ is a performance e-commerce platform that optimises online sales through fast checkouts, customisation, and flexible payments. It enhances the buyer experience, providing features like single-step checkouts and customisable cart designs.

The platform also emphasises subscription management, offering tools to reduce churn and increase customer lifetime value. With a centralised dashboard, Checkout Champ aims to streamline e-commerce data and functions, making it scalable for businesses of all sizes.

Features:

- Enables lightning-fast transactions through single-step checkouts

- Allows complete control over the checkout experience through customisable cart design

- Manages subscriptions and customer interactions effectively

Pros:

- Offers customisable checkout options to reduce cart abandonment

- Suitable for both startups and large enterprises

Cons:

- Extensive features may require a learning curve

Shop Pay

Shop Pay, an accelerated checkout option, aims to streamline the online buying process. It allows customers to save their email, credit card, and shipping information for quicker transactions across various Shopify stores.

With a focus on speed and security, Shop Pay offers a seamless experience, often boosting business conversion rates. It also provides features like instalment payments, enhancing flexibility for shoppers. The platform integrates smoothly with Shopify, providing a convenient solution for merchants and consumers to expedite online purchases.

Features:

- Saves customer information for one-click purchases

- Offers cash rewards on spends

- Ensures secure and encrypted transactions for fraud protection

Pros:

- Streamlined checkout reduces cart abandonment

- Protects customer data through secured and encrypted transactions

- Simplifies the payment process through interest-free instalments

Cons:

- Primarily designed for Shopify stores

Recharge

Recharge is a Shopify app designed to streamline subscription management for e-commerce stores. It addresses the challenge of managing recurring payments and subscriptions, which Shopify doesn’t natively support.

With the subscription e-commerce market rapidly growing, Recharge provides tools to create, scale, and customise subscription offerings. It integrates smoothly as a Shopify checkout extension, managing recurring orders and billing efficiently, helping businesses turn one-time visitors into loyal, repeat customers.

Features:

- Provides extended customisation and flexibility for customer portals

- Works with apps like Klaviyo, Gorgias, and LoyaltyLion with optimised features for mobile devices

Pros:

- Simplifies the checkout process to increase conversion rates

- Subscription and membership management features are mobile-optimised and customisable

- Customers can easily add or swap products

Cons:

- The Pro plan can be expensive

OneStepCheckout

OneStepCheckout for Magento simplifies the checkout process by condensing multiple steps into a single, user-friendly page. Designed to reduce cart abandonment, it addresses key issues like form complexity and page loading speed.

This platform also enhances the user experience and increases conversion rates by presenting all necessary information upfront, including costs, shipping options, and payment methods. It has over 20,000 merchants globally who trust the extension. Thus, OneStepCheckout remains a popular choice for Magento stores.

Features:

- Auto-completes address fields using Google Places Integration

- Supports secure payment processing through 3D-Secure Iframe Support

Pros:

- Offers multiple payment gateways

- Improves the checkout experience with a single-page layout

Cons:

- Requires careful integration with third-party extensions

CartHook

CartHook is a platform that maximises e-commerce revenue by optimising the post-purchase journey. It allows businesses to create personalised one-click upsell offers, enhancing average order value and customer lifetime value.

With its no-code, drag-and-drop builder, setting up visually appealing offer flows is quick and easy. CartHook helps businesses gain insights into customer behaviour, elevate A/B testing, and set up advanced targeting, creating a seamless, effective upsell experience.

Features:

- A/B testing to optimise campaigns for maximum impact

- Personalise offers based on the purchase history of the customers

Pros:

- Boosts average order value through one-click upsells

- Checkout pages can be customised for personalised experiences

- Easy to set up and manage campaigns

Cons:

- Designed primarily for Shopify stores

Express Checkout

Klarna’s Express Checkout streamlines the online buying process by allowing returning customers to complete purchases quickly. By pre-filling customer information, it reduces friction and cart abandonment. Retailers can strategically place the “Pay with Klarna” button on product or cart pages to expedite transactions.

This solution integrates seamlessly with platforms like Shopify, WooCommerce, etc., and payment gateways like Stripe. It enhances the overall shopping experience and increases conversion rates for businesses.

Features:

- Integrate fraud protection features to enhance customer’s security

- Compatible with eCommerce platforms like Shopify, WooCommerce, etc.

Pros:

- Allows customers to pay in 4 monthly instalments with zero interest

- Offers a faster, more convenient purchase process

Cons:

- Only essential data is used, but some customers may have privacy concerns

Nimbbl

nimbbl. aims to simplify digital commerce through its one-click checkout experience. It provides access to BNPL and UPI providers and integrates with payment gateway aggregators.

nimbbl. offers mobile-optimised payment pages without coding and enables easy payments through shareable links. The platform targets improved customer experience and higher conversions, with developer-friendly payment integrations. nimbbl. also provides a referral program and educational resources on checkout processes.

Features:

- It is integrated with multiple payment gateways

- Payments are done via shareable links

Pros:

- Simplifies the payment process through mobile-optimised payment page

- User friendly features to enhance customer experience and increase conversion rates

Cons:

- Limited information on specific security measures

PeachPay

PeachPay is an ultrafast checkout solution designed to reduce cart abandonment and enhance customer experience for WooCommerce-powered stores. It simplifies the checkout process by offering one-click payments, saving users’ information for future transactions.

This platform supports over 20 payment methods and allows merchants to sell in 135+ currencies. Its post-checkout mobile app encourages repeat purchases by enabling customers to reorder items easily. With seamless integration, customisable fields, and advanced upselling features, PeachPay boosts average order value and conversion rates.

Features:

- Enables the Buy Now, Pay Later option and supports wallet payments

- Customises checkout forms as per business needs

Pros:

- Reduces friction in the checkout process through one-click checkout

- Supports multi-currency and international payments

Cons:

- Primarily built for WooCommerce stores

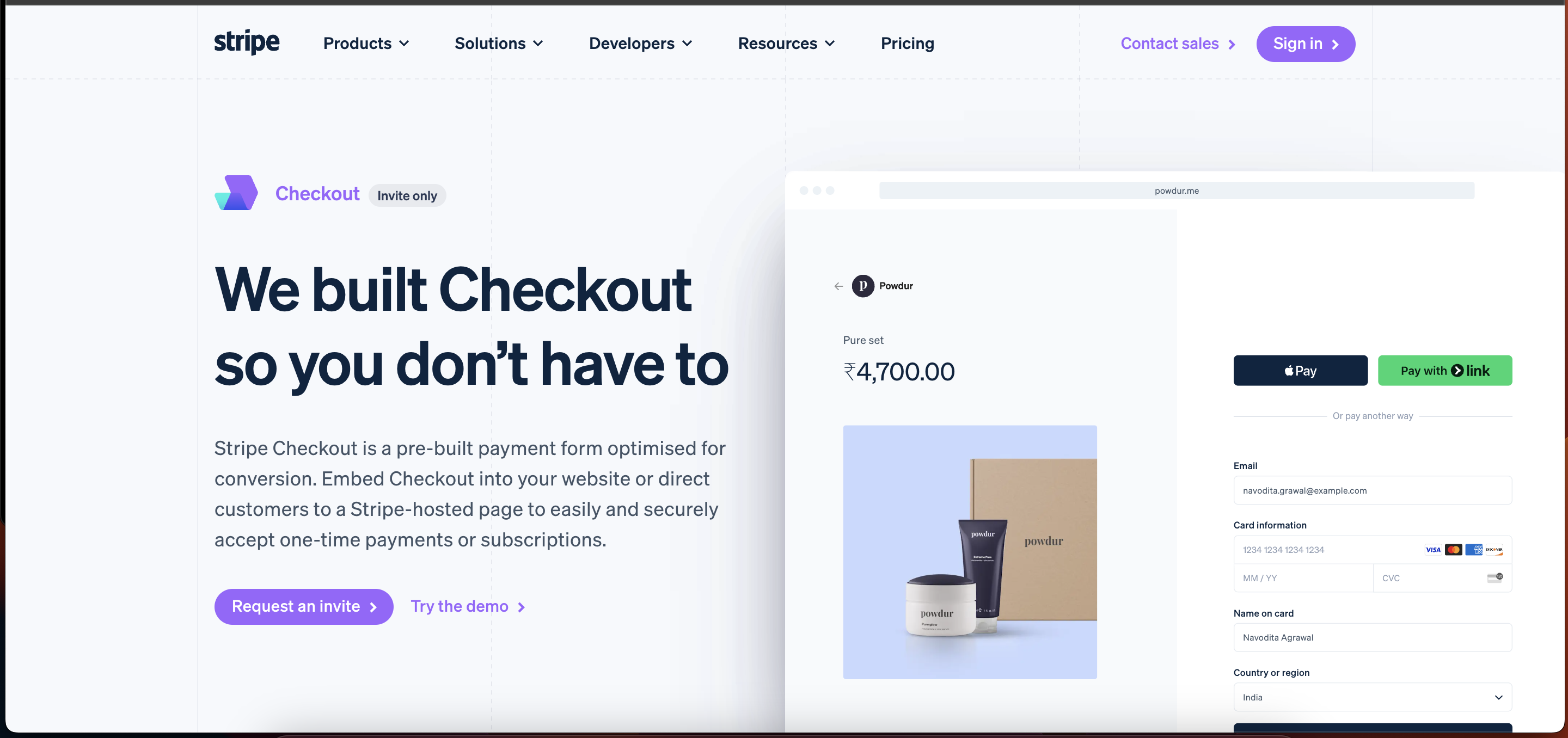

Stripe Checkout

Stripe Checkout is a pre-built payment solution that simplifies online transactions while boosting conversion rates. It supports global payment methods, digital wallets, and subscription billing, making it versatile for various business models. Additionally, it is optimised for mobile and desktop platforms, ensuring a seamless user experience.

This platform also provides advanced security features like PCI compliance and fraud detection. Businesses benefit from its customisable branding options and responsive design, allowing them to tailor the checkout process to their needs while maintaining efficiency and security.

Features:

- Compatible with Apple Pay, Google Pay, and Link

- Supports recurring payments for subscription-based businesses

Pros:

- Advanced reporting and analytics, simplifying the checkout process to reduce cart abandonment

- Responsive, mobile-optimised design enhances the user experience on all devices

Cons:

- Transaction fees can be high for small businesses

Amazon Pay

Amazon Pay is a convenient checkout solution that allows customers to use their existing Amazon account information to purchase on third-party websites. This service simplifies the payment process, enabling users to complete transactions without repeatedly entering payment details or shipping addresses.

Customers can shop confidently with robust security measures, including fraud protection and the Amazon A-to-Z Guarantee. Additionally, Amazon Pay supports a variety of payment methods and currencies, making it a versatile option for both consumers and merchants.

Features:

- Accepts payments in multiple currencies

- Supports subscription-based billing and voice-based payments

Pros:

- Fast and secure checkout process to reduce cart abandonment

- Many merchants accept Amazon Pay, broadening its usability

Cons:

- Not all online retailers accept Amazon Pay, limiting its use

Shiprocket Checkout

Shiprocket Checkout focuses on reducing cart abandonment and improving conversion rates through a streamlined, one-click checkout experience. It offers features like pre-filled addresses, multiple payment options, and a customisable UI to enhance brand visibility. The platform provides analytics to understand customer behavior and optimize ad campaigns. It also includes a discount engine and tools to minimise returns, such as discouraging COD orders.

Features:

- Enables auto-filling of addresses for existing customers to facilitate one-click checkout

- Provides customisable UI and multiple payment options

Pros:

- Allows integration with existing systems to enhance customer experiences

Cons:

- Customisations may require technical expertise

Key Features to Look for in a Checkout App

When selecting a checkout app, several key features are crucial for maximising conversions and enhancing customer satisfaction. Here are some of them:

- Speed & Efficiency

A quick checkout process is necessary to reduce cart abandonment and increase conversion rates. When shoppers can quickly complete orders, they’re more likely to complete transactions. This includes reducing the number of steps needed to make a purchase. One-click checkout or saved payment details can greatly improve efficiency.

- Security & Fraud Prevention

A checkout app should provide secure transactions to gain customers’ trust. Adherence to security standards such as PCI DSS is necessary to safeguard sensitive payment data. In addition, adopting strong fraud detection software prevents unauthorised transactions, protecting merchants and customers.

- Flexible Payment Options

Checkout apps must provide multiple payment options to suit varying customer needs. These include features such as BNPL, digital wallets (e.g., Apple Pay, Google Pay), UPI, and regular credit/debit cards.

By accepting global customers, multiple currencies and payment options can increase a company’s international market reach.

- Mobile Optimisation

Since most purchases are made on smartphones, a checkout app has to be optimised for mobile use. This includes responsive design, simplicity of navigation, and quick loading speeds to ensure ease of use. Mobile optimisation also ensures that all the payment options should seamlessly function on mobile, providing ease of convenience for the users.

- Customisation & UX

The checkout process must be consistent with the brand identity to ensure a consistent user experience. This involves customisable fields, colours, and fonts.

A well-designed checkout process can minimise friction and enhance customer satisfaction. Auto-fill options and clear payment summaries are some features that help create an excellent UX.

The Future of eCommerce Checkout in 2026 & Beyond

Various evolutionary trends will influence the eCommerce checkout in 2026 and the upcoming years:

- AI-powered Fraud Detection

eCommerce platforms will witness AI-powered fraud detection features. Using machine learning to sift through massive amounts of data and determine deviations from the norm, these features will strengthen security and trust in online payments.

AI will also be used in personalised checkout experiences, tailoring offers and suggestions for individual customers, which can greatly enhance conversion rates.

- Mobile and Social eCommerce

The mobile eCommerce market is anticipated to grow to $1.54 trillion by 2026, emphasising the significance of mobile optimisation in checkout processes. Additionally, social commerce revenue is anticipated to grow to $6.2 trillion by 2030, highlighting the potential of social media platforms in fuelling eCommerce growth.

- BNPL and Other Advanced Payment Options

Buy Now, Pay Later (BNPL) products and digital wallets will increase, providing customers with more flexible payment terms and convenience. Voice payments and biometric payments will also pick up steam.

Voice assistants such as Alexa and Google Assistant will facilitate voice-enabled purchases, while biometric authentication technologies such as facial recognition and fingerprint scanning will improve security and convenience.

Finally, one-click checkout options will become even more frictionless, using AI to pre-populate customer data and minimise checkout time to seconds, dramatically increasing conversion rates.

To enhance the efficiency of checkout apps, companies can focus on streamlining the payment procedures using payment APIs from Decentro. They can use Multi-Collect API to collect seamless payments from partnering eCommerce websites. Moreover, the Professional Verification API will ensure the reliability of the businesses they are partnering with.

That’s not all! Decentro offers a plethora of APIs to offer you a seamless business experience.

Frequently Asked Questions

In 2026, the top checkout apps include Shopify Pay, GoKwik, Bolt, and Shopflo. These platforms offer streamlined experiences with features like fast transactions and personalised checkouts.

Checkout apps improve customer experience by providing one-click checkout, mobile compatibility, and customised messages.

One-click checkout apps are favoured for how fast and convenient they are, cutting down cart abandonment and increasing conversions.