Learn how Customer Risk Rating (CRR) drives compliance and growth for Indian fintech. Discover models, frameworks, and best practices for effective risk assessment.

Customer Risk Rating: The Ultimate Guide for Indian Fintech

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

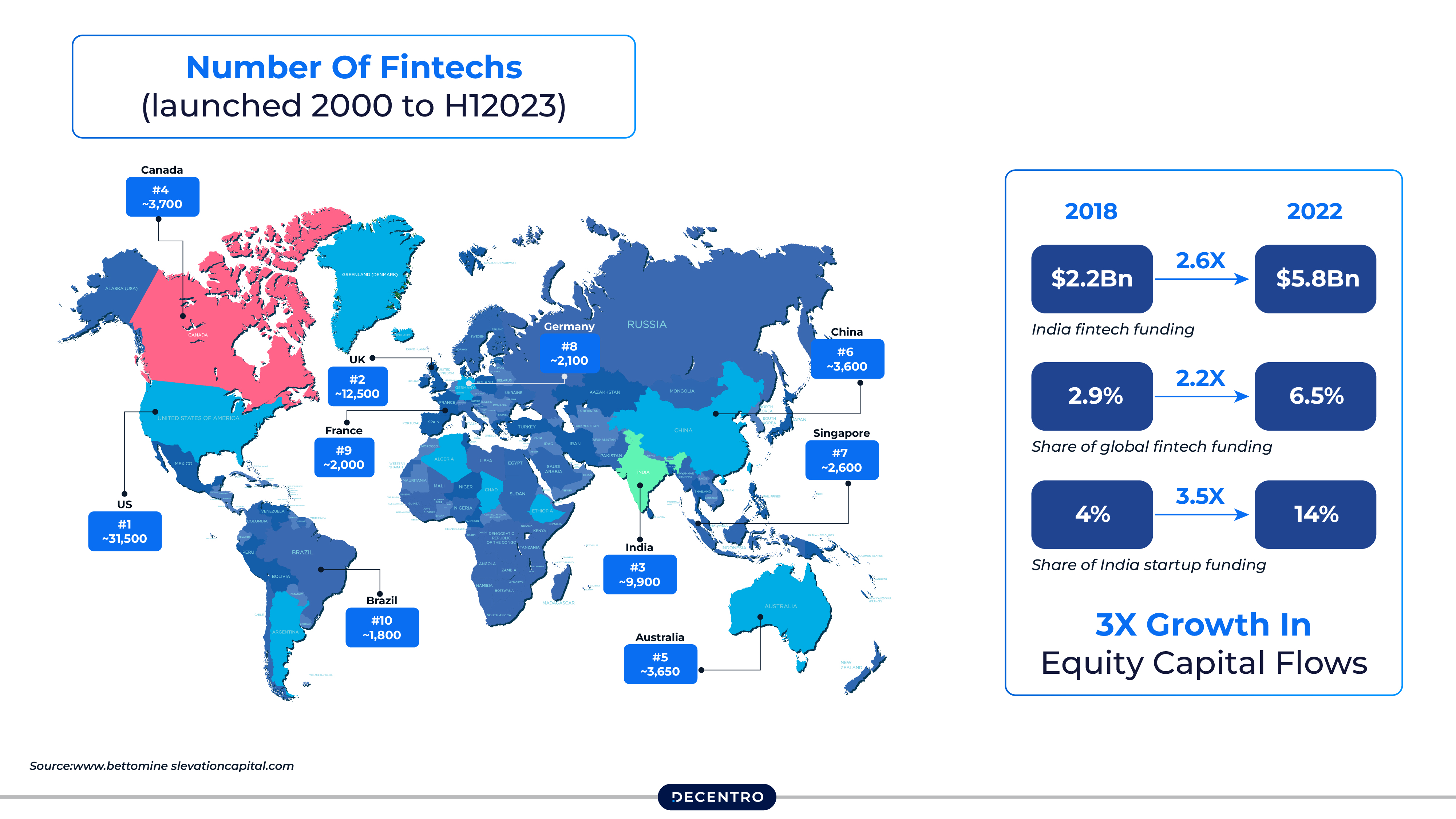

Customer Risk Rating (CRR) has become the backbone of India’s rapidly evolving financial ecosystem. With the country’s fintech market projected to grow from ₹9.61 lakh crore to ₹36.47 lakh crore by 2029 and over a billion people connected digitally, practical risk assessment isn’t just about RBI compliance—it’s about capturing India’s unprecedented.

Picture this: Your fintech startup has gained traction, processing thousands of UPI transactions daily. Then RBI notices gaps in your KYC compliance. The consequences aren’t just monetary penalties—RBI recently imposed ₹5 crore penalty on Federal Bank Limited for non-compliance with KYC and AML requirements—but complete business shutdown, lost customer trust, and years of rebuilding.

In India’s hyper-competitive digital payments landscape, where UPI transactions reached ₹139 trillion in fiscal year 2024 and crypto investor base exceeded 150 million users, Customer Risk Rating serves as your shield against regulatory action while enabling rapid, compliant growth.

Understanding Customer Risk Rating

Customer Risk Rating in India is fundamentally shaped by RBI’s Master Directions on KYC and the Prevention of Money Laundering Act (PMLA). It’s a systematic evaluation of the likelihood that a customer will engage in money laundering, terrorist financing, or other activities that violate Indian financial regulations.

Think of it as an Aadhaar for financial risk—a unique identifier that helps you understand each customer’s compliance profile before engaging in business relationships.

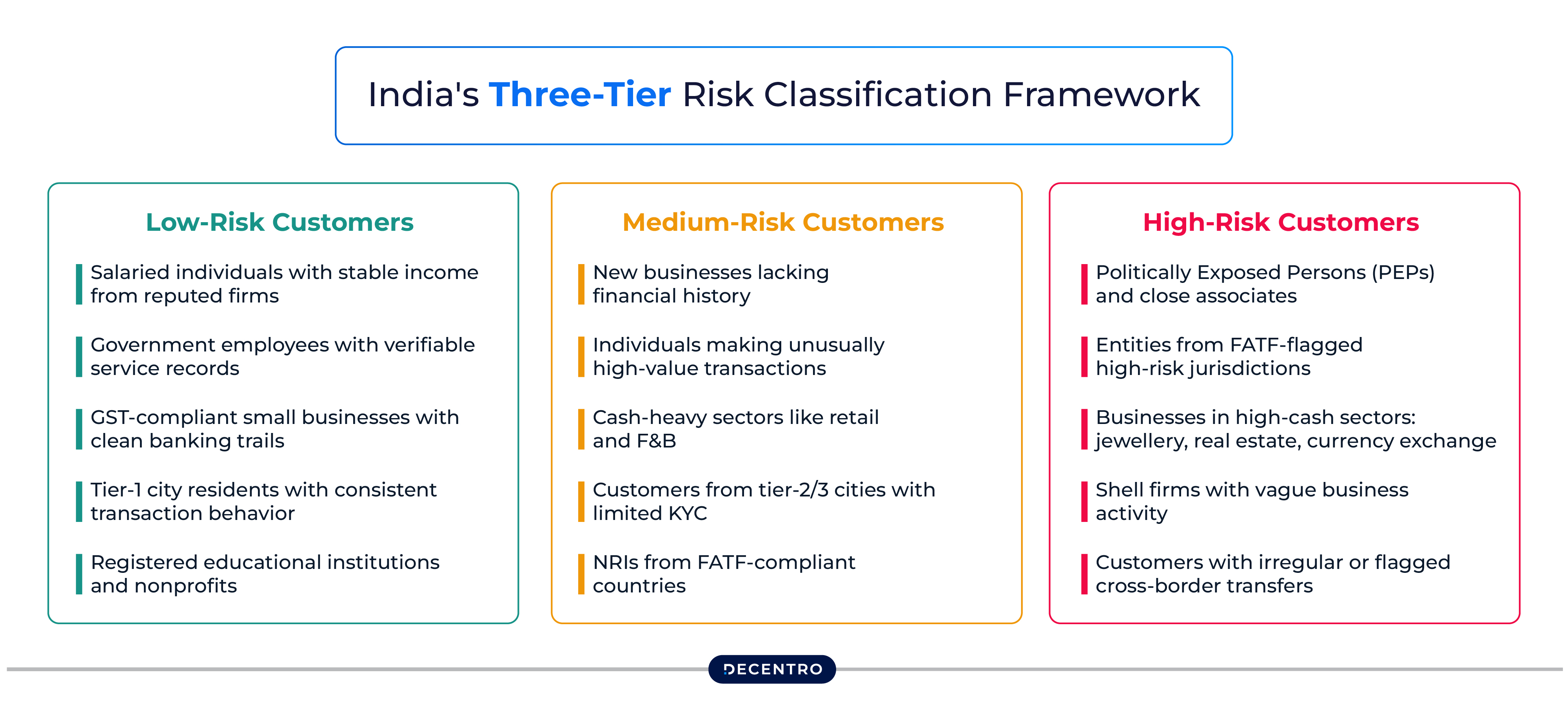

India’s Three-Tier Risk Classification Framework

Following RBI guidelines, most Indian financial institutions use this framework:

Low Risk Customers:

- Salaried employees with regular income from established companies

- Government employees with verifiable service records

- Small businesses with consistent GST filings and banking history

- Customers from tier-1 cities with stable transaction patterns

- Educational institutions and charitable organizations with proper registrations

Medium Risk Customers:

- New businesses without established banking history

- High-value transactions by individual customers

- Cash-intensive businesses like retail stores or restaurants

- Customers from smaller cities with limited documentation

- Non-resident Indians (NRIs) from standard countries

High Risk Customers:

- Politically Exposed Persons (PEPs) including government officials, politicians, and their families

- Customers from high-risk countries as per FATF guidelines

- Cash-intensive businesses like money changers, jewellery dealers, or real estate

- Shell companies with unclear business purposes

- Customers involved in cross-border transactions with suspicious patterns

Why Customer Risk Rating Is Critical for Businesses

India’s regulatory environment has become increasingly stringent. Recent amendments mandate reporting entities to disclose beneficial owners and impose stricter KYC norms, extending to cryptocurrency and virtual digital assets.

Beyond avoiding RBI penalties, effective customer risk rating:

- Enables faster onboarding: Automated risk assessment reduces customer acquisition time from weeks to hours

- Supports UPI scale: Handle thousands of daily payment requests without manual review bottlenecks

- Protects banking partnerships: Clean compliance records help maintain relationships with partner banks

- Enables rural expansion: Assess customers from smaller towns and villages where traditional credit data is limited

- Supports government initiatives: Align with Digital India and financial inclusion objectives while maintaining security

Key Risk Factors

Understanding India-specific risk factors helps build more effective assessment frameworks tailored to local market conditions:

Geographic and Demographic Factors

High-Risk States and Regions:

- Border areas with Pakistan, Bangladesh, or Myanmar

- States with higher hawala activity or cash economies

- Regions with significant mining or natural resource extraction

- Areas with frequent cross-border trade

Urban vs Rural Considerations:

- Metropolitan customers generally have more documentation but higher transaction values

- Rural customers may have limited formal documentation but stronger community verification

- Tier-2 and Tier-3 city customers often represent the sweet spot of growth with manageable risk

Indian Business and Industry Risks

High-Risk Industries:

- Import/Export: Especially with countries having trade tensions or sanctions

- Real Estate: Large cash components and complex ownership structures

- Jewellery and Precious Metals: Traditional cash-heavy businesses

- Money Service Businesses: Currency exchange, remittance services

- Gaming and Gambling: Online platforms and fantasy sports

- Cryptocurrency: Despite growing acceptance, still carries regulatory uncertainty

Emerging Sectors with Moderate Risk:

- E-commerce Marketplaces: Rapid transaction volumes but increasing regulatory clarity

- EdTech Platforms: High growth but generally lower risk profiles

- HealthTech: Moderate risk with increasing regulatory framework

- AgriTech: Government support but rural complexity

Documentation and Identity Verification

Strong Identity Indicators:

- Aadhaar verification with biometric authentication

- PAN card linkage with income tax returns

- GST registration with consistent filing history

- Bank account history with major Indian banks

- Mobile number linked to Aadhaar (for OTP verification)

Red Flags in Documentation:

- Recently issued identity documents

- Mismatched addresses across documents

- Reluctance to provide Aadhaar or PAN details

- Use of prepaid mobile numbers for primary contact

- Corporate entities without clear business address

Transaction Pattern Analysis

Normal Patterns for Indian Customers:

- Salary credits on consistent dates

- UPI transactions aligned with spending patterns

- EMI payments for loans or credit cards

- Festival season spending spikes

- Investment in mutual funds or fixed deposits

Suspicious Patterns:

- Large cash deposits inconsistent with declared income

- Rapid movement of funds across multiple accounts

- Transactions with known high-risk merchants

- Unusual international transfer patterns

- Structured transactions just below reporting thresholds

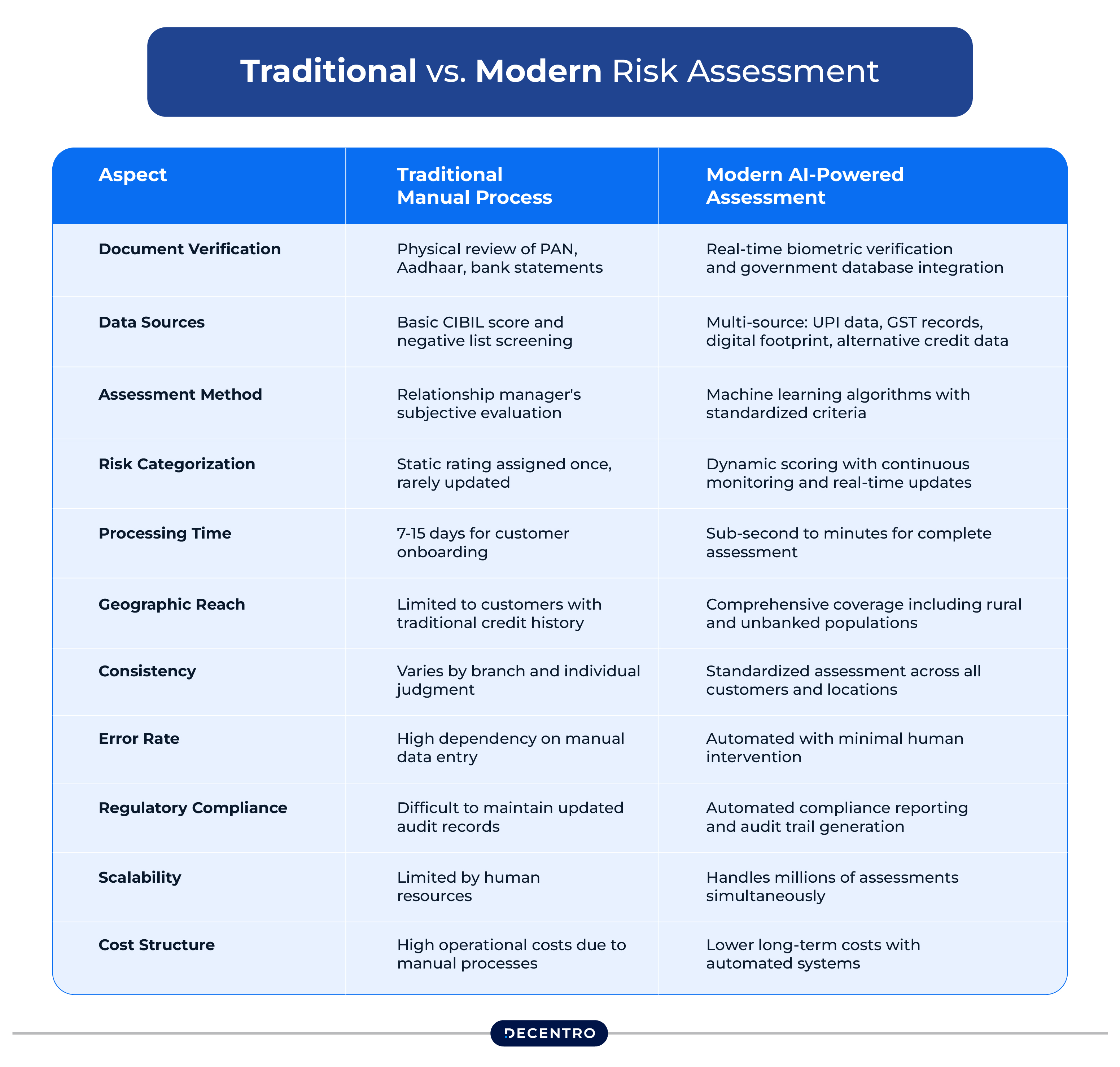

Traditional vs. Modern Risk Assessment

| Aspect | Traditional Manual Process | Modern AI-Powered Assessment |

| Document Verification | Physical review of PAN, Aadhaar, bank statements | Real-time biometric verification and government database integration |

| Data Sources | Basic CIBIL score and negative list screening | Multi-source: UPI data, GST records, digital footprint, alternative credit data |

| Assessment Method | Relationship manager’s subjective evaluation | Machine learning algorithms with standardized criteria |

| Risk Categorization | Static rating assigned once, rarely updated | Dynamic scoring with continuous monitoring and real-time updates |

| Processing Time | 7-15 days for customer onboarding | Sub-second to minutes for complete assessment |

| Geographic Reach | Limited to customers with traditional credit history | Comprehensive coverage including rural and unbanked populations |

| Consistency | Varies by branch and individual judgment | Standardized assessment across all customers and locations |

| Error Rate | High dependency on manual data entry | Automated with minimal human intervention |

| Regulatory Compliance | Difficult to maintain updated audit records | Automated compliance reporting and audit trail generation |

| Scalability | Limited by human resources | Handles millions of assessments simultaneously |

| Cost Structure | High operational costs due to manual processes | Lower long-term costs with automated systems |

The Old Way: Manual Processes and Basic Checks

Traditional risk assessment relied heavily on:

- Physical document verification: Manual review of PAN, Aadhaar, and bank statements

- Basic database checks: Simple CIBIL score lookup and negative list screening

- Relationship manager assessment: Subjective evaluation based on personal interaction

- Static risk categorisation: Risk rating assigned once and rarely updated

Problems with Traditional Methods:

- Time-intensive: Customer onboarding took 7-15 days

- Limited rural reach: Difficult to assess customers without traditional credit history

- Inconsistent application: Different branches might reach different conclusions for similar profiles

- Manual errors: High dependency on individual judgment and data entry accuracy

- Regulatory gaps: Difficult to maintain updated records for audit purposes

The New Way: AI-Powered Risk Assessment for Digital India

Modern solutions leverage India’s digital infrastructure to transform risk assessment:

Aadhaar Integration: Real-time biometric verification ensures identity authenticity while maintaining compliance with privacy regulations.

UPI Transaction Analysis: Machine learning algorithms analyse spending patterns across India’s unified payments infrastructure to build comprehensive behavioural profiles.

GST and ITR Integration: Automated verification of business income and tax compliance through government databases.

Digital Footprint Analysis: Evaluation of mobile phone usage patterns, app installations, and digital behaviour indicators.

Regional Intelligence: AI systems trained on India-specific fraud patterns, from urban sophistication to rural innovation.

Decentro’s Scanner represents this new generation, specifically designed for Indian market conditions. It integrates with:

- NPCI systems for real-time UPI verification

- GSTN for business verification and tax compliance

- MCA databases for corporate entity verification

- RBI databases for regulatory compliance checking

- Multiple identity databases including Aadhaar, PAN, and Voter ID verification

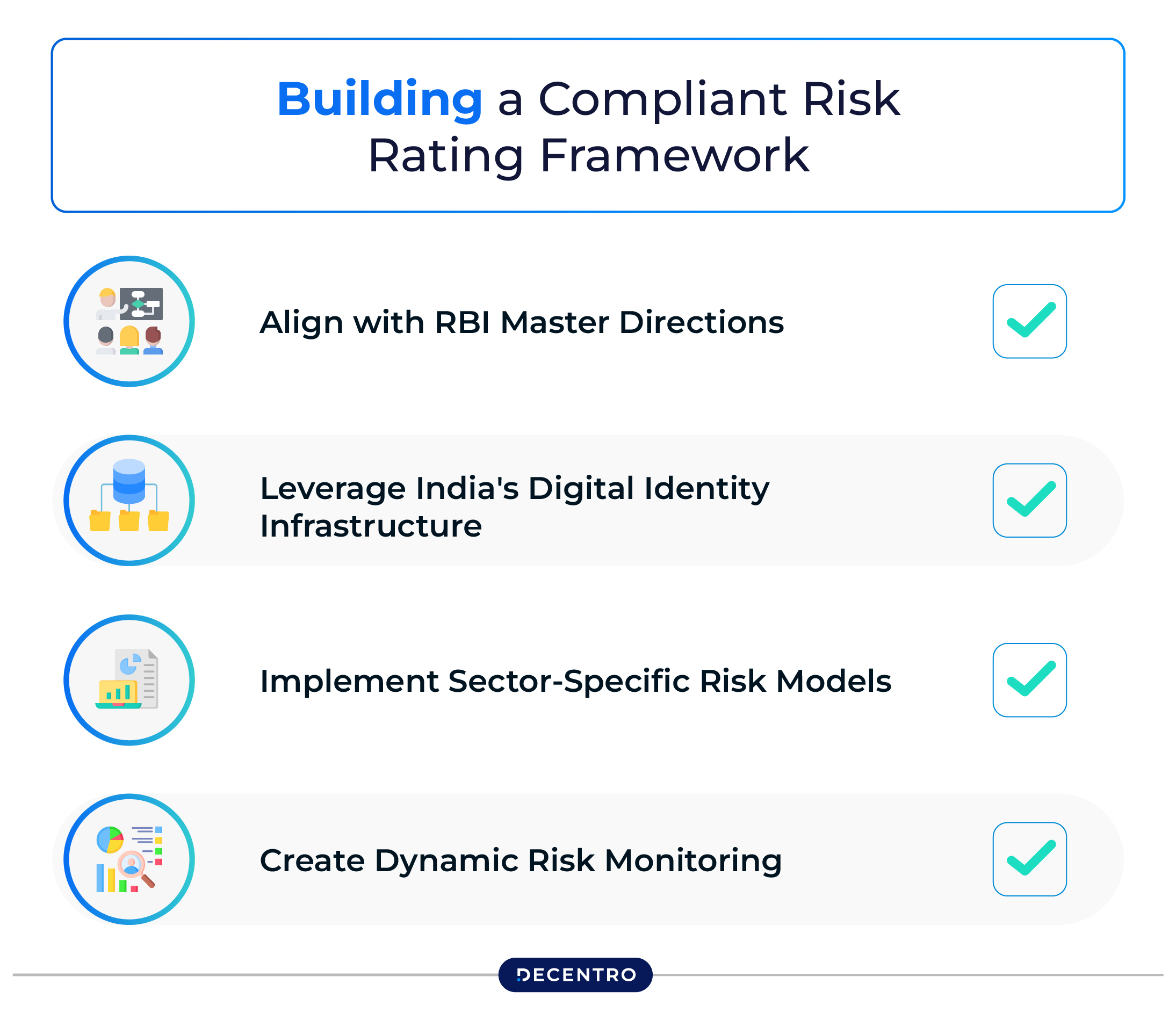

Building a Compliant Risk Rating Framework

Creating effective risk rating requires understanding both RBI regulations and practical business needs:

Step 1: Align with RBI Master Directions

Your risk rating system must comply with RBI’s Master Direction on KYC, which requires:

Simplified Due Diligence (SDD): For low-risk customers like government employees or those with small account balances

Basic Know Your Customer (KYC): Standard verification for most individual and business customers

Enhanced Due Diligence (EDD): Additional verification for high-risk customers, PEPs, and large transaction accounts

Step 2: Leverage India’s Digital Identity Infrastructure

Aadhaar-Based Verification:

- Biometric authentication for identity confirmation

- Address verification through Aadhaar database

- Mobile number verification through OTP

- eKYC for instant customer onboarding

PAN-Based Income Verification:

- Cross-reference with income tax databases

- Verify consistency between declared and actual income

- Check for multiple PAN cards or suspicious tax filings

GST Integration for Businesses:

- Verify business registration and tax compliance

- Analyze revenue patterns through GST filings

- Confirm business address and operational status

Step 3: Implement Sector-Specific Risk Models

Fintech and Payment Companies:

- Focus on transaction velocity and pattern analysis

- Monitor merchant onboarding for suspicious entities

- Track cross-border payment patterns

- Implement real-time transaction monitoring

NBFCs and Lending Platforms:

- Emphasise income verification and debt-to-income ratios

- Monitor for over-leveraging across multiple platforms

- Analyse repayment patterns and behavioural indicators

- Assess collateral authenticity for secured loans

Cryptocurrency and Digital Asset Platforms:

- Enhanced verification for all users due to regulatory uncertainty

- Monitor source of funds for significant investments

- Track patterns that might indicate speculation vs. investment

- Maintain detailed audit trails for regulatory reporting

Step 4: Create Dynamic Risk Monitoring

Indian customers’ risk profiles change rapidly due to:

- Economic mobility: Rural customers moving to urban areas

- Business evolution: Small businesses growing rapidly or facing difficulties

- Regulatory changes: New compliance requirements affecting customer status

- Seasonal patterns: Agricultural customers with harvest-based income cycles

Effective monitoring systems should:

- Update risk scores when significant life events occur (job changes, business expansion)

- Monitor seasonal patterns, especially for agricultural and festival-driven businesses

- Track regulatory changes and automatically reassess affected customer segments

- Alert for behavioural deviations from established patterns

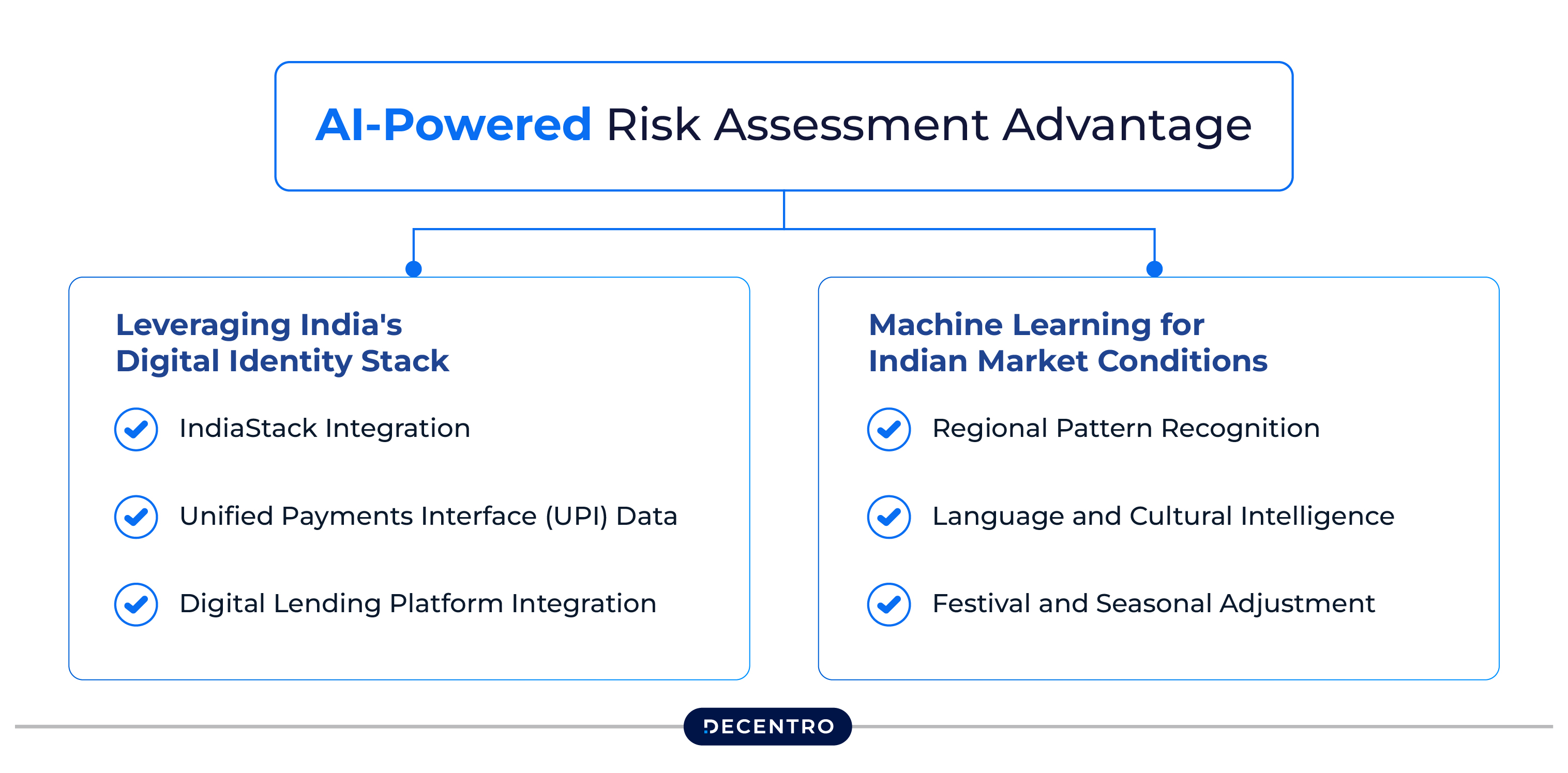

AI-Powered Risk Assessment Advantage

India’s unique digital infrastructure creates opportunities for sophisticated risk assessment:

Leveraging India’s Digital Identity Stack

IndiaStack Integration: Modern risk platforms can access multiple government databases through APIs, enabling the creation of comprehensive risk profiles within seconds, rather than days.

Unified Payments Interface (UPI) Data: Transaction patterns across India’s UPI network provide rich behavioural data for risk assessment.

Digital Lending Platform Integration: Access to credit bureau data, alternative credit scoring, and peer-to-peer lending patterns.

Machine Learning for Indian Market Conditions

Regional Pattern Recognition: AI systems trained on Indian data can identify region-specific fraud patterns, from urban financial sophistication to rural innovation schemes.

Language and Cultural Intelligence: Natural language processing systems that understand Indian languages and cultural contexts in adverse media screening.

Festival and Seasonal Adjustment: Algorithms that account for Indian cultural patterns like Diwali spending, wedding season transactions, or harvest cycles.

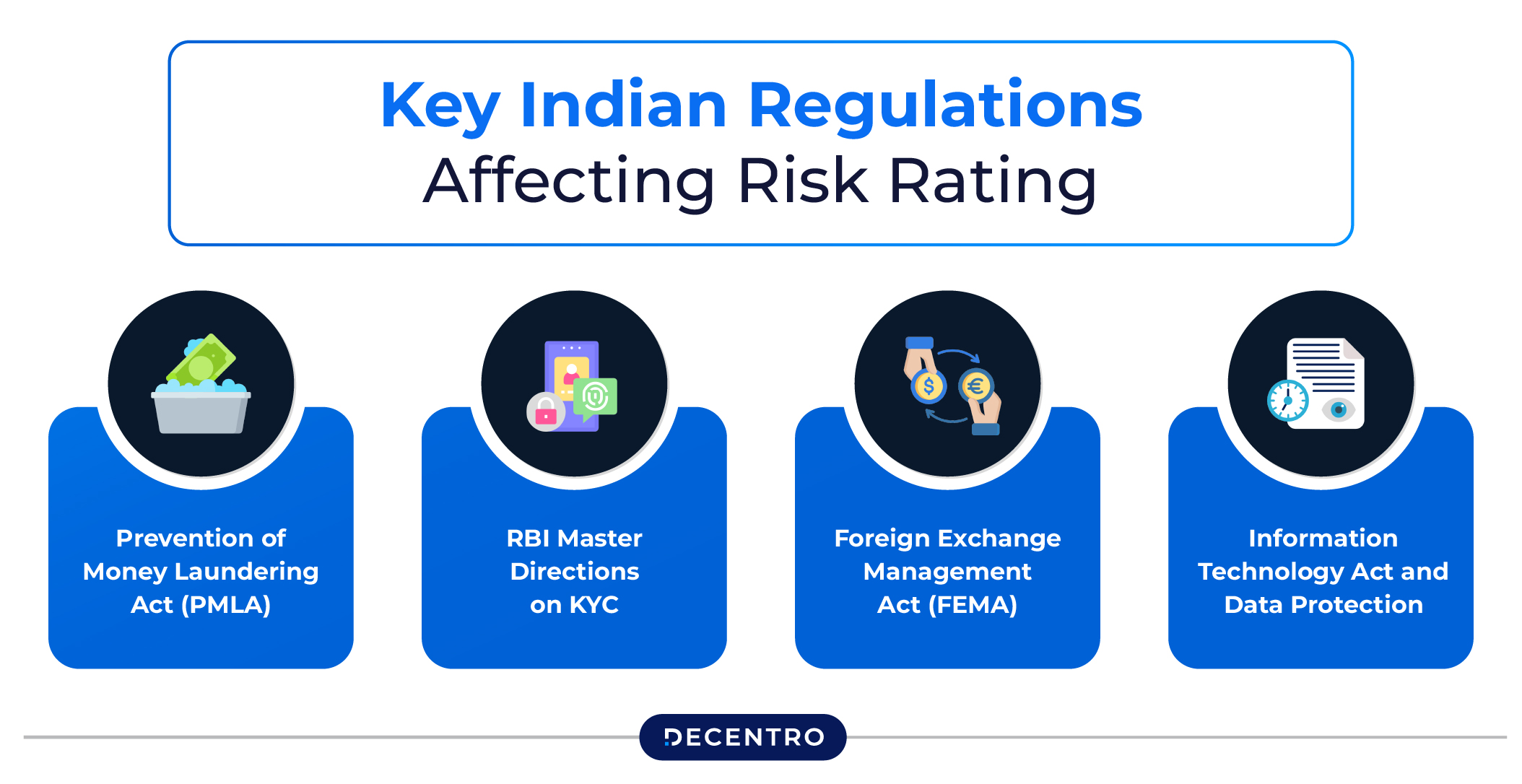

Regulatory Compliance in the Indian Context

Key Indian Regulations Affecting Risk Rating

Prevention of Money Laundering Act (PMLA):

- Requires comprehensive customer due diligence

- Mandates suspicious transaction reporting

- Imposes record-keeping requirements for specified periods

- Regular compliance audits and reporting to FIU-IND

RBI Master Directions on KYC:

- Updated as recently as June 12, 2025, showing the dynamic nature of compliance requirements

- Specifies risk categorization methodologies

- Details ongoing due diligence requirements

- Outlines technology standards for digital verification

Foreign Exchange Management Act (FEMA):

- Governs cross-border transactions and remittances

- Requires enhanced scrutiny for international payments

- Mandates reporting for transactions above specified limits

Information Technology Act and Data Protection:

- Governs how customer data can be collected, stored, and processed

- Requires consent mechanisms for data usage

- Mandates data localization for certain types of information

Working with Indian Regulators

RBI Expectations:

- Clear, documented risk assessment methodologies

- Regular system validation and testing

- Comprehensive audit trails

- Prompt reporting of suspicious activities

- Technology systems that can handle regulatory reporting requirements

FIU-IND Reporting:

- Suspicious Transaction Reports (STRs) within prescribed timelines

- Cash Transaction Reports (CTRs) for large cash transactions

- Non-Profit Organization Transaction Reports for relevant entities

- Border Currency Reports for international transactions

State-Level Compliance:

- Different states may have additional compliance requirements

- Local registration and licensing considerations

- Regional language requirements for customer communication

Common Pitfalls and Solutions

Over-Reliance on Traditional Credit Scoring

Many Indian customers, particularly in rural areas or among the unbanked population, lack traditional credit histories. Relying solely on CIBIL scores creates significant exclusion.

Solution: Implement alternative scoring mechanisms using UPI transaction data, utility payment history, mobile usage patterns, and social indicators.

Ignoring Regional and Cultural Differences

A risk model designed for Mumbai customers might completely misinterpret the behaviour of rural Punjab customers.

Solution: Develop region-specific risk models that account for local economic patterns, cultural practices, and the availability of documentation.

Inadequate Technology Infrastructure

Many organisations underestimate the technical requirements for real-time risk assessment at Indian scale.

Solution: Partner with platforms like Decentro that have already built the infrastructure to handle millions of assessments while maintaining regulatory compliance.

Static Risk Assessment

Customer circumstances in India can change rapidly—a small business owner might suddenly receive a large government contract, or a salaried employee might start a side business.

Solution: Implement continuous monitoring that tracks changes in customer profiles and updates risk assessments accordingly.

Compliance Complexity Management

Indian regulations are complex and frequently updated, making it difficult for smaller organizations to maintain compliance.

Solution: Use automated compliance platforms that track regulatory changes and automatically update risk assessment criteria.

Decentro’s Innovation for Customer Risk Rating with Scanner

Decentro’s Scanner, along with OmniScore, represents the next generation of customer risk rating, engineered explicitly for Indian market conditions and regulatory requirements. These solutions transform traditional risk assessment by leveraging India’s digital infrastructure to deliver real-time, comprehensive risk evaluation.

Alternative Credit Scoring with OmniScore

OmniScore goes beyond traditional credit scores to assess customers without conventional credit history:

- Mobile phone usage pattern analysis evaluating communication behaviour and device usage

- Utility payment history evaluation including electricity, water, gas, and telecom payments

- Digital app usage behavioural scoring analyzing financial app engagement and digital literacy

- Social network analysis for creditworthiness assessment (with consent)

- E-commerce transaction history understanding spending patterns and financial discipline

- Educational and employment verification through digital footprints and official records

Industry-Specific Risk Models

Scanner provides tailored risk assessment for different sectors:

Banking and NBFC:

- Loan default probability scoring using alternative data

- Cross-borrowing analysis across multiple lending platforms

- Collateral verification and valuation for secured lending

- KYC refresh automation for existing customers

Fintech and Payment Platforms:

- Merchant onboarding risk assessment with business verification

- Transaction monitoring for payment aggregators

- Wallet and prepaid instrument compliance

- Cross-border transaction risk evaluation

Insurance and Investment:

- Policy fraud detection using behavioral analysis

- Investment suitability assessment based on risk profile

- Anti-money laundering screening for high-value policies

- Beneficiary verification and PEP screening

Cryptocurrency and Digital Assets:

- Enhanced KYC for crypto exchange onboarding

- Source of funds verification for large transactions

- Wallet address risk scoring and sanctions screening

- Regulatory reporting for digital asset transactions

The Future of Customer Risk Rating

Technology Trends Shaping the Market

Central Bank Digital Currency (CBDC): As India rolls out the digital rupee, new transaction patterns and risk factors will emerge.

Open Banking Evolution: RBI’s account aggregator framework will enable more comprehensive financial data analysis.

AI and Machine Learning Advancement: More sophisticated models will emerge as more Indian transaction data becomes available.

Blockchain Integration: Distributed ledger technology can offer new methods for verifying customer identities and tracking transaction histories.

Regulatory Evolution

Real-Time Compliance: Regulators increasingly expect instant reporting and monitoring rather than periodic compliance checks.

Cross-Border Coordination: Enhanced cooperation with international regulators for customers with global financial activities.

Technology Standards: More specific requirements for AI and automated decision-making systems in financial services.

Market Opportunities

Rural and Semi-Urban Expansion: Enhanced risk assessment capabilities will enable the expansion of financial services into previously underserved rural and semi-urban markets.

MSME Focus: Better risk models for small and medium enterprises will support economic growth.

Digital Asset Integration: As cryptocurrency regulations solidify, integrated risk assessment across traditional and digital assets will become a standard practice.

Export and International Business: Enhanced risk assessment for Indian businesses engaging in global trade.

Customer Risk Rating Checklist

Use this quick checklist to ensure your customer risk rating (CRR) process meets Indian regulatory and operational standards:

- Customer identification verified

- KYC documents (Aadhaar, PAN, etc.) collected

- Risk classification applied as per RBI guidelines

- Enhanced due diligence (EDD) done for high-risk profiles

- Ongoing monitoring implemented

- Risk scores are dynamically updated

- Audit trails are maintained for all assessments

Conclusion

Customer risk rating represents more than regulatory compliance—it’s your gateway to India’s digital economy. With the fintech market expected to reach ₹36.47 lakh crore by 2029, organisations mastering risk assessment will capture the largest growth share.

India’s unique digital infrastructure creates globally competitive, locally optimised opportunities. The question isn’t whether to upgrade your capabilities—it’s whether you’ll lead this transformation or struggle to catch up.

The future belongs to organisations balancing innovation with compliance, speed with security, and growth with responsibility. Customer risk rating is where that balance begins. India’s time is now—make sure your risk rating capabilities are ready to capture it.

Ready to transform your customer risk assessment for the Indian market? Discover how Decentro’s Scanner and OmniScore can help your organisation build more effective, India-specific risk rating processes that scale with the country’s digital revolution.

Frequently Asked Questions

1. What factors determine the customer risk rating?

Customer risk rating is determined by analysing multiple data points:

Identity & Documentation: Aadhaar/PAN authenticity, address verification, document consistency across sources

Financial Behavior: UPI transaction patterns, income stability, credit history, investment behavior

Business Profile: Industry type (cash-intensive businesses = higher risk), GST compliance, revenue patterns

Geographic Risk: Location-based assessment, politically exposed person (PEP) status, sanctions screening

Digital Footprint: Mobile usage patterns, app engagement, device information, behavioral indicators

2. How does CRR benefit fintech companies in India?

CRR provides four key advantages for fintech companies:

Speed & Scale: Reduce onboarding from weeks to minutes, handle thousands of customers daily without manual bottlenecks

Regulatory Compliance: Ensure RBI/PMLA adherence, maintain audit trails, automate suspicious transaction reporting

Business Growth: Secure banking partnerships, access rural markets, build customer trust through transparent processes

Risk Management: Prevent fraud early, improve portfolio quality, enable dynamic monitoring of customer behavior

3. Is customer risk rating only for banks?

No, CRR is mandatory across India’s entire financial ecosystem:

Required Sectors: NBFCs, payment aggregators, cryptocurrency exchanges, insurance companies, mutual funds, fintech lenders, digital wallets

Business Applications: E-commerce seller onboarding, gaming platforms, investment platforms, B2B financial services

Regulatory Scope: Any entity handling customer funds, processing payments, or offering financial services must comply with PMLA and sectoral regulations (RBI, SEBI, IRDAI)