Here’s a comprehensive guide to debt collection in India, exploring the latest trends, overcoming challenges, and unlocking future prospects for lenders and borrowers.

Demystifying Debt Collection: A Comprehensive Guide for Lenders and Borrowers in India

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Is it a borrower’s market?

Or is it a lender’s market?

If you wonder why these questions are imperative in our ecosystem, let us provide some facts and figures.

Lending and borrowing money is critical to a country’s financial health. Banks have traditionally played the role of prime lenders in India, disbursing loans for commercial and personal purposes. However, the extensive due diligence and long processes resulted in individuals turning to the unorganized sector or traditional moneylenders who charged exorbitant interest rates.

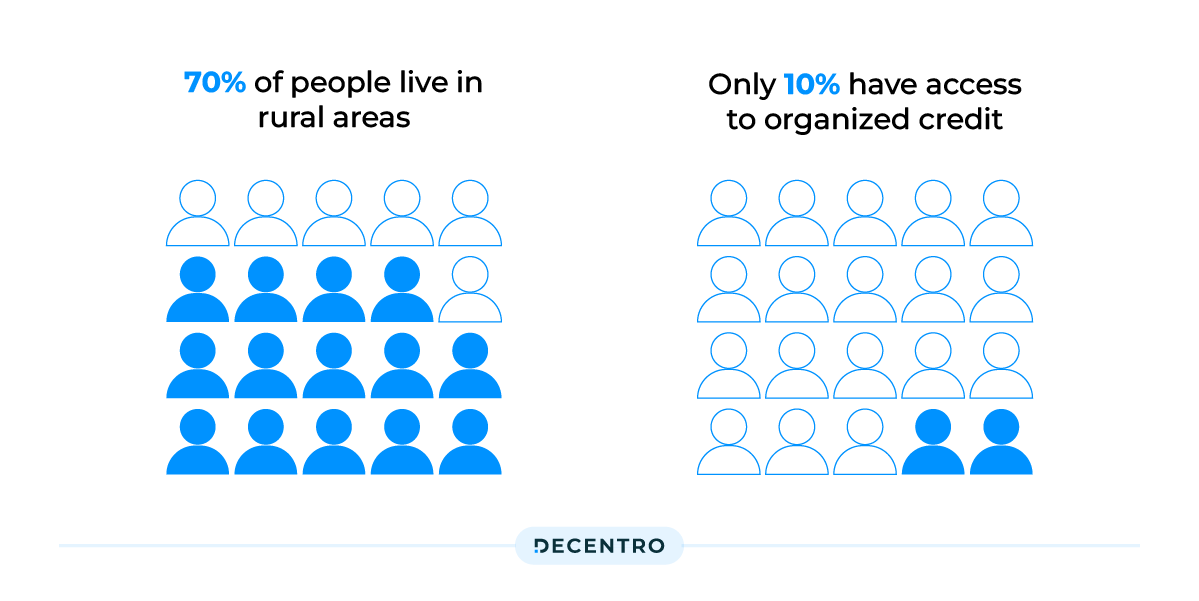

To put things into perspective, in India, more than 70% of people live in rural areas, and only 10% have access to organized credit. Banks are hesitant to give loans to people without credit scores. The reluctance of traditional banking institutions to extend loans to credit-deficient individuals with low incomes led to numerous digital lending platforms filling this gap, including NBFCs, fintech companies, and other such entities.

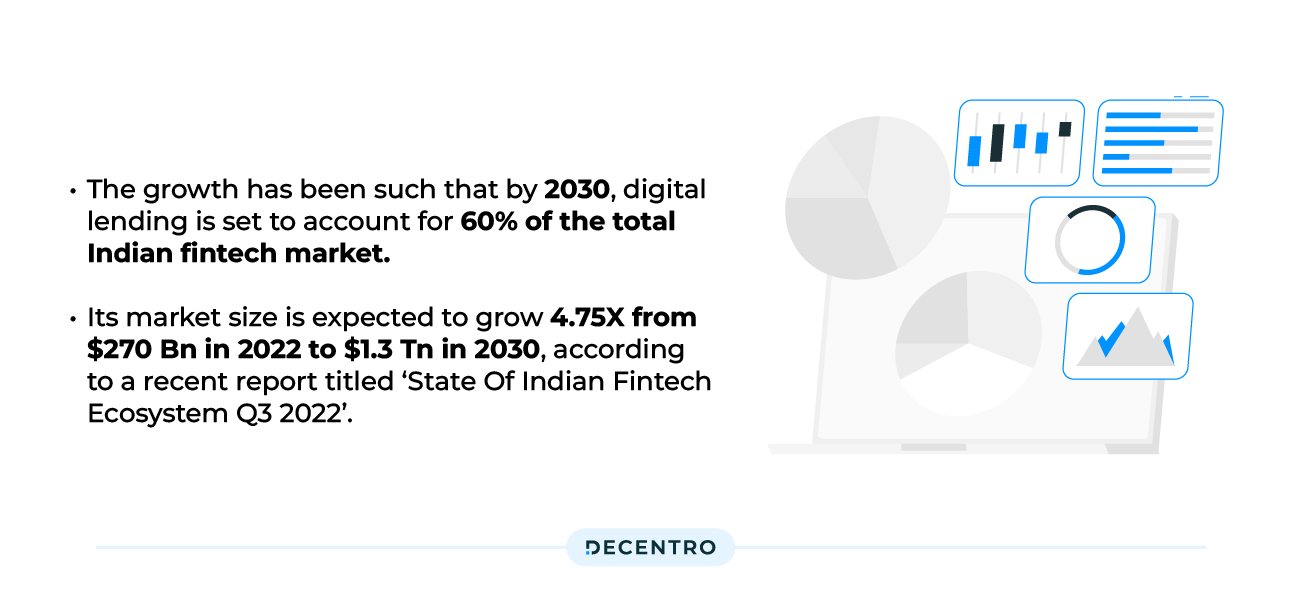

With digital lending platforms, we can reach beyond metro cities with an entirely digital end-to-end credit cycle from origination and underwriting to disbursement and repayment. The growth has been such that by 2030, digital lending is set to account for 60% of the total Indian fintech market, and its market size is expected to grow 4.75X from $270 Bn in 2022 to $1.3 Tn in 2030, according to a recent report titled ‘State Of Indian Fintech Ecosystem Q3 2022’.

So, where does Debt Collection fit in the larger scheme of things?

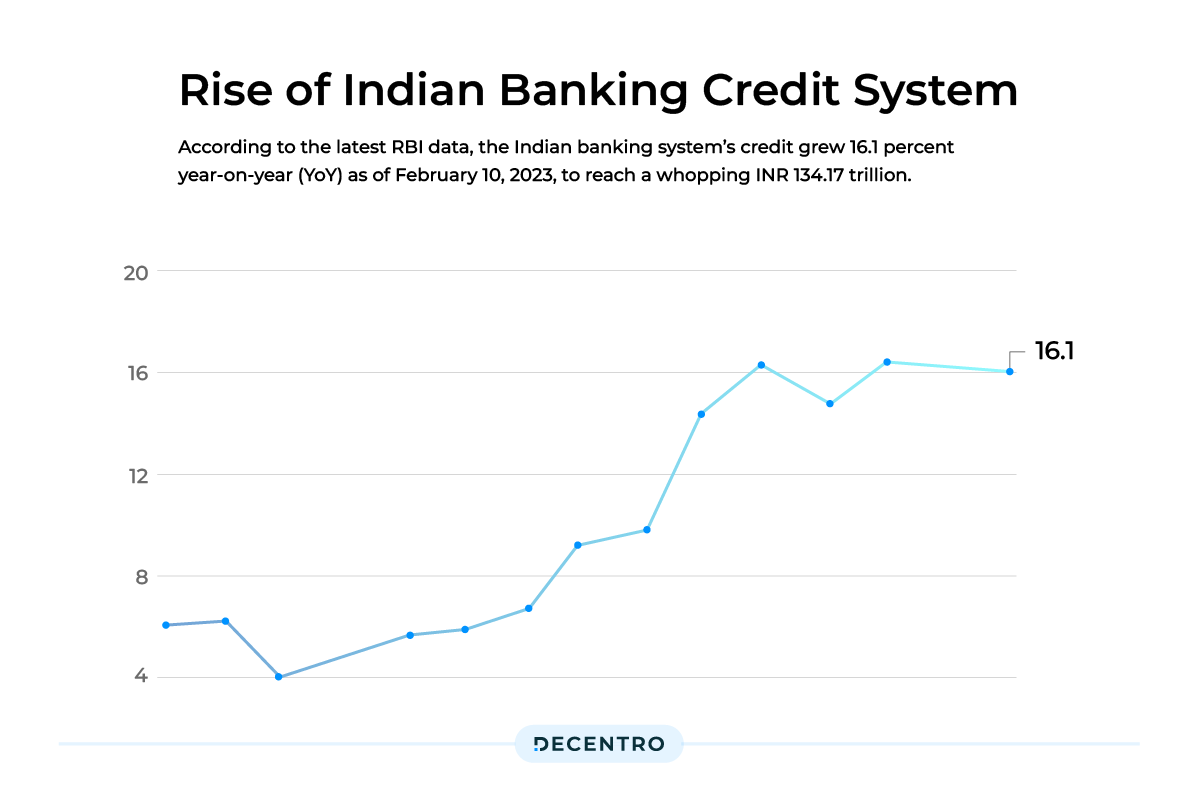

With less than 5% of India’s 1.4 billion population possessing a formal credit card, there is an ever-growing market for credit, cards or otherwise. According to the latest RBI data, the Indian banking system’s credit grew 16.1 percent year-on-year (YoY) as of February 10, 2023, to reach a whopping INR 134.17 trillion. However, debt collection complaints comprise around 50% of all consumer complaints affecting bank ratings.

So, What is Debt Collection?

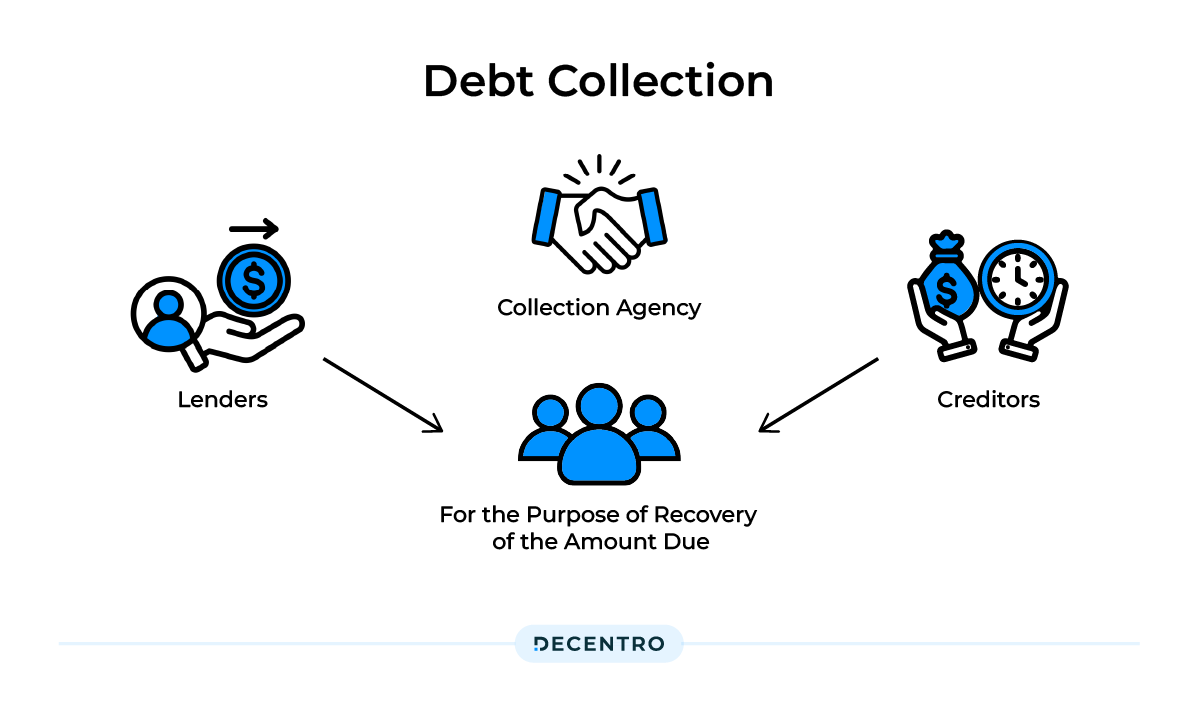

Debt collection is when a collection agency or company tries to collect past-due debts from borrowers. A debt collector might contact you if you haven’t made loan or credit card payments and those payments are severely past due.

For decades, debt collection by lending firms and banks has been manual, long, and tedious. The traditional approach relied on collection agencies involving recovery agents, persistent calls, repeated messaging, generalized communications, and outstretched dispute resolution, which appeared to be a crude attempt to push the borrowers into paying their dues.

However, the scenario is changing very fast. The debt collection market in India is a whopping Rs 40,000-crore industry growing at 18% annually. With the looming threat of non-performing assets (NPA), digitizing debt collections has become a significant trend in the banking sector.

The impact of NPAs on debt collection

The surge in non-performing assets (NPAs) within the Indian financial landscape has profound implications for the broader economy and lending institutions. NPAs, essentially loans or advances that have ceased generating income for banks, are a barometer of financial health for the banking sector and, by extension, the economy. As NPAs climb, the ripple effects are felt far and wide, affecting everything from banks’ liquidity to the overall investment climate. Recently, the RBI increased consumer loan weight to keep a check on unsecured lending and manage ‘credit risks’.

An uptick in NPAs signifies a reduction in profitable assets for lending institutions, directly impacting their bottom line. The capital that could have been used for further lending is instead tied up, limiting the institution’s ability to generate new business and stifling growth. Moreover, the higher the NPAs, the more capital banks must set aside as provisions to cover potential losses, further eroding their profitability and operational efficiency.

Debt collection, therefore, plays a significant role in the lending sector, and the right approach is of utmost significance for lending institutions to maintain healthy margins and for the larger economy to remain robust.

The Advent of Digitisation of Debt Collection

With the borrowers getting digitally savvy, banks and other financial institutions have realized the importance of engaging them digitally. Additionally, according to TU Cibil, consumers from the 18-30-year-old group accounted for 43% of retail credit inquiries, indicating a significant milestone in the evolution of India’s credit market, which now has more substantial participation of younger consumers in the credit ecosystem. As lending volumes increase and instant loans with smaller ticket sizes grow, bringing down the cost of collections becomes a key priority. Digitization is the only way to achieve this at scale.

India’s Debt Collection Software Market is estimated to be USD 190.78 Mn in 2023 and is expected to reach USD 296.08 Mn by 2028, growing at a CAGR of 9.18%.

Banks and non-banking lending companies are increasingly investing in developing models for digital collections, automated communications, predictive analytics, and cashless collections without touching or ringing a bell. This intentional shift of the ecosystem’s players towards adopting innovative debt-collection software platforms is quite evident in the increase in the market share of Debt Collection Solutions.

The Process of Debt Collection

The debt collection process involves various steps, including:

- Communication: The creditor/debt collector contacts the debtor to remind them of the unpaid debt. This communication can occur through letters, phone calls, or electronic means.

- Negotiation: The creditor/ debt collector may negotiate with the debtor to explore possible repayment arrangements or settlement options. This can involve discussions on payment plans, reduced settlement amounts, or restructuring the debt to make it more manageable for the debtor.

- Documentation: Throughout the debt collection process, the creditor/debt collector and debtor may maintain communication records, payment agreements, and other relevant documentation to ensure clarity and legal compliance.

- Legal Action: If the debtor fails to respond or make satisfactory payment arrangements, the creditor/ debt collector may escalate the matter to collection agencies by taking legal action. This can involve filing a lawsuit, obtaining a judgment, and potentially seeking court-ordered remedies such as garnishing wages or placing liens on assets.

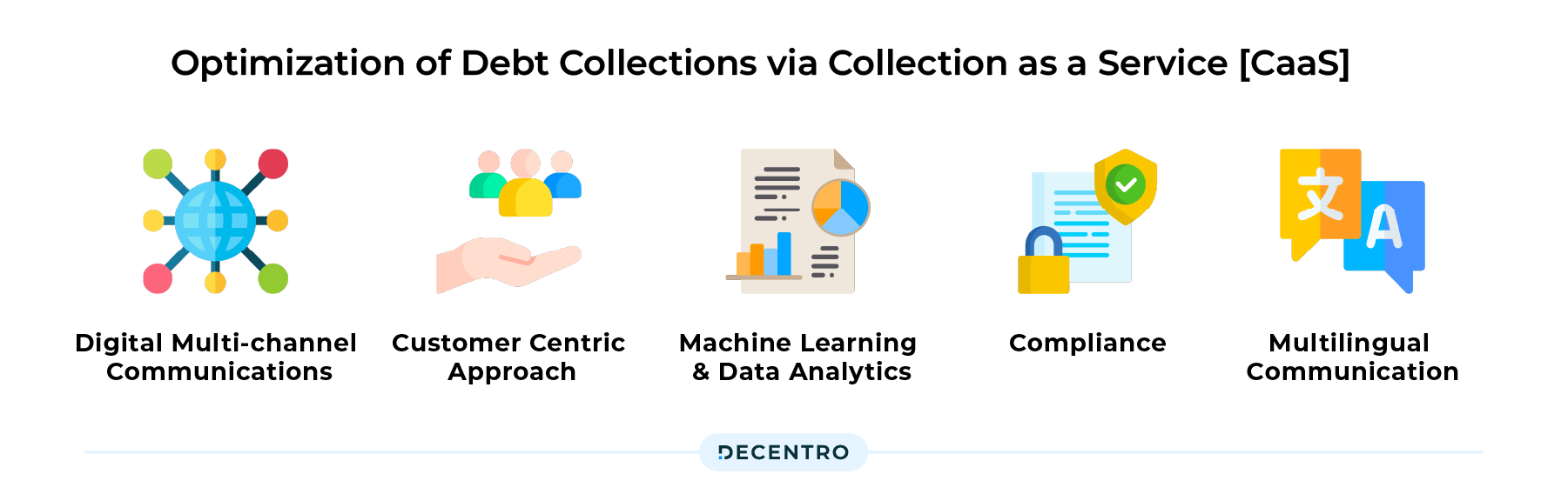

Optimization of Debt Collections via Collection as a Service [CaaS]

Lenders can leverage technology to optimize the end-to-end loan recovery workflow, including communications, litigations, billings, payments, and field collections.

An effective CaaS solution completes that digital lending workflow by automating lenders’ debt recovery and collection pipeline while allowing customers to streamline and manage their loan recovery workflow.

This can be leveraged with the following:

Digital Multi-channel Communications

The multi-channel approach extends to debt collection landscape, where customers prefer to be contacted via SMS or email rather than phone calls or letters. Financial institutions must understand this and formulate a communications strategy for each channel. Debt collection processes should embrace the multi-channel approach and reach customers according to channel preferences.

Customer Centric Approach

Customers are accustomed to personalized service and offerings when they access products and services. In the context of debt recovery, the onus lies in providing the two things that have been primarily missing from the entire collection lifecycle – empathy and availability of an end-to-end self-service model for the same. This ethos is ultimately in line with the fair debt collection practices that have been the focus of most of the debt collection software in the market right now. A solution that understands not only the lender’s sentiments but also serves the borrower’s journey. Customer self-service options and empathy are paramount in crafting customer-centric journeys for debt collection. Borrowers in delinquency can use a medium to resolve their debt problems.

Machine Learning and Data Analytics

Advanced debt collection software that harnesses the power of analytics can unlock the potential of AI and ML for segmentation, deep behavioral analysis, predictive models, and relevant strategies. The accurate data-based insights can also help identify early warning signals for possible delinquencies and defaults. The ability to predict that someone might miss payments can help build customized solutions that can be extremely helpful for lenders.

Compliance

Automation can play a significant role in streamlining and optimizing the compliance process in debt collection. Automated systems can capture and maintain an audit trail of all collection activities, including communication logs, payment arrangements, dispute resolutions, and other relevant interactions. This comprehensive record-keeping assists in demonstrating compliance efforts, resolving disputes, and providing evidence in case of regulatory inquiries or legal proceedings, working in favor of lenders extensively.

Multilingual Communication

The diverse demographics of Indian states, cultural backgrounds, and linguistic variations make end users relate more to digital platforms that communicate with them in their native language. In debt collections, communicating with customers in a language of their choice helps them understand their obligations better, ensuring timely payments. Adopting a nuanced approach to reach all sections of society is a crucial step for financial institutions toward driving financial inclusivity.

The Future of Debt Collections

A well-thought-out loan collection strategy will be a collaborative approach between existing automation and behavioural pattern predictions courtesy of AI and ML capabilities. Given below are a few of the places where AI and ML hold the potential to disrupt the debt collection lifecycle:

Classification of Borrowers

AI and ML tools have the potential to aid lenders in understanding their borrowers by giving them access to valuable customer data. Breaking away from the traditional profiling dependent on industry/ income groups, data-driven ML solutions can present in-depth customer behavior and history, which can help categorize them into specific market segments. Using these insights, lenders can also build borrower profiles to determine who will likely resolve delinquencies and who could need a modified approach, like debt restructuring or alternate repayment facilities. This will help lenders explore new options to optimize their collections, offer customer satisfaction, and boost recovery and profitability.

Personalizing Customer Experience

Whether a lender opts for traditional debt collection methods or new-age digital strategies, the ultimate goal is to retain the human element in the collection process and stick to fair debt collection practices while improving customer response. This can be achieved using AI-backed debt collection software that uses bots with human-like voices and extracts customer data from multiple sources. Depending on their preferences and needs, lenders can employ an omnichannel communication strategy, such as emails, voice calls, text messages, and WhatsApp, to optimize the impact of the collection process. Adopting a hyper-personalized approach can help reinforce customer engagement and avert loss of ownership and complete debt default.

Predicting Default Probability

One critical reason for overdue receivables is lenders’ inability to identify distressed accounts that show signs of default. Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP) can source structured and unstructured data and analyze it in real-time to predict potential defaulters.

Hyper Personalised Debt Recovery Process

Robustness, personalized communications, and innovation are the key factors that pave the way for an ethical and holistic debt recovery ecosystem. While the existing ecosystem holds the potential to cater to the first two needs of robustness and personalization, it is Innovation where AI/ML tends to add that extra edge in the lifecycle. Tech-based innovation strategies like robust mobile applications enable debtors to make payments with a few clicks, automate custom messaging, set payment reminders, and much more, which stand to disrupt the collection agency space.

In Conclusion

2022 will remain etched as the transformative year for the fintech space in India. With new guidelines introduced by the RBI almost every few months, the ethical money movement remained the primary focus of these litigations. Policy interaction across the breadth of data petition, grievance redressal, prepayment of the loan, and reporting for the lenders and borrowers were all introduced to ensure that all transactions were carried out per regulations.

So, where does the debt collection landscape fare in all this? It should come as no surprise that India’s Debt collection business is primed for even more significant transformation in the subsequent years. The future depends on a robust debt collection system, vital for India’s economic growth, financial stability, and the overall well-being of creditors and borrowers. Whether disrupting the collection agency space or enabling an end-to-end digital lending lifecycle, the need of the hour is a complaint and scalable tech bridge that ideally serves both use cases.

Talk about a match made in Lending Heaven.

We at Decentro have partnered with NeoWise to help you seamlessly set up debt collection systems & processes so that you can focus on creating smooth lending experiences for your users.

With Neowise’s AI-Powered Platform Capabilities, You Get:

Integrated AI Intelligence

- Single AI-enhanced platform for all collection activities with unified intelligence across all touchpoints

- Real-time decision-making powered by machine learning algorithms and predictive analytics

Superior Recovery Performance

- Better recovery rates through AI-optimised automated rules and intelligent prioritisation

- ~5% improvement in recovery rates through AI-powered pre-due engagement strategies

- 40% boost in collection efficiency through advanced AI automation

Intelligent Automated Conversations

- AI-powered conversations that adapt to borrower behaviour and preferences in real-time

- 20% increase in customer engagement through personalised, multilingual AI interactions

- Automated sentiment analysis and response optimisation for better recovery outcomes

Enhanced Compliance & Quality Control

- AI-powered monitoring ensures regulatory compliance with real-time quality checks.

- Automated compliance reporting and risk assessment across all communication channels

- Multilingual compliance verification and ethical collection practice enforcement

Elevated Borrower Experience

- AI-driven flexible repayment options based on individual financial profiles

- Transparent, personalised communication that adapts to borrower preferences and circumstances

- Predictive support systems that identify and address borrower concerns proactively

Optimised Operational Efficiency

- Reduced operational costs through intelligent automation of routine tasks

- AI-powered resource allocation and task prioritisation for maximum efficiency

- Continuous learning algorithms that improve performance over time

Managed Services Excellence

- 24/7 AI-powered monitoring and optimisation of collection campaigns

- Dedicated support teams leveraging AI insights for strategic guidance

- Seamless integration with existing systems through intelligent API management

Curious to know more?