Discover Decentro’s 2024 journey—scaling Payment Aggregation, empowering SME lenders, driving global expansion, and redefining fintech with AI-driven debt recovery.

Rewind 2024: Decentro’s Journey of Innovation, Growth, and Breaking Boundaries

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

The end of the year is a time for reflection and celebration. At Decentro, it’s also when we open our metrics to showcase our progress. As 2024 draws to a close, we’re excited to share the story behind our growth, innovations, and lessons learned throughout the year.

A Year of Purpose and Precision

A singular vision drove 2024: scaling smartly and solving deeply. From breaking new ground by being the youngest fintech company to get a PA License to robust product launches to expansive global footprints, we stayed true to our ethos of building impactful solutions while fostering collaboration.

Here’s your exclusive backstage pass to everything that made this year spectacular.

The Year’s Theme: Focus, Scale, Impact

If 2023 was about setting the stage, 2024 was about amplifying every play.

Every move was deliberate and impactful, from scaling business operations to launching cutting-edge product stacks and expanding into new verticals.

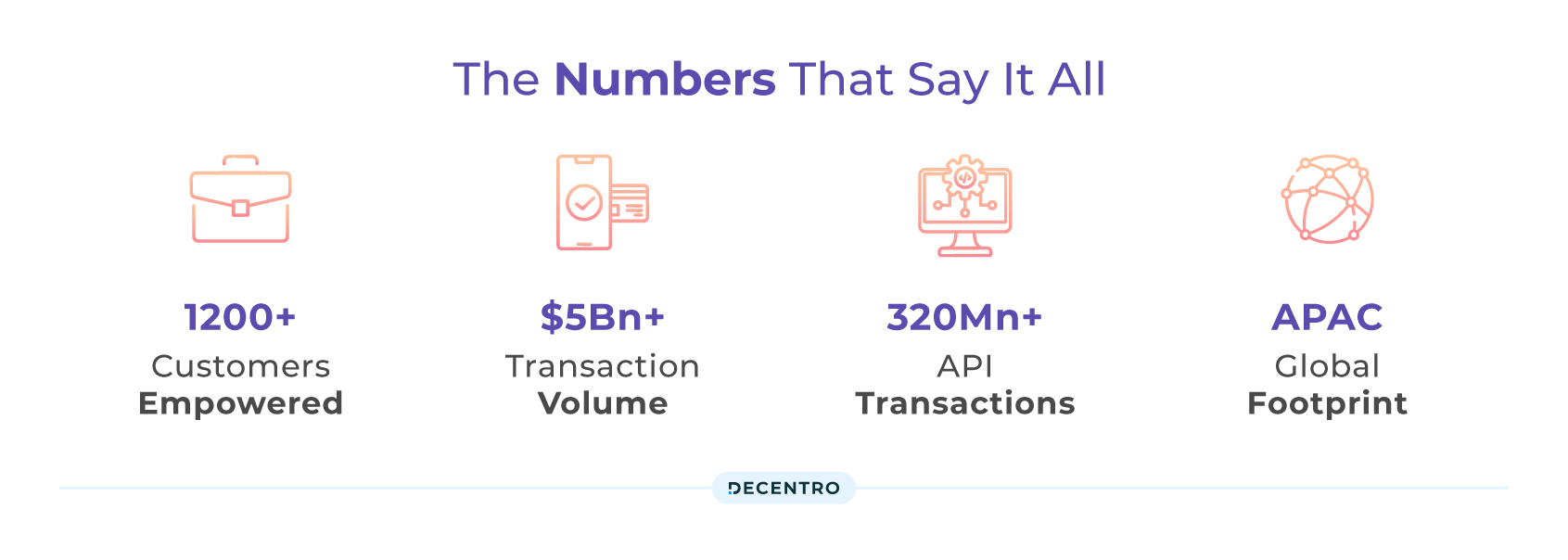

The Numbers That Say It All

Behind the scenes, our metrics tell a story of relentless effort and collaboration:

- Customers Empowered: Over 1,200 large platforms & BFSI players have launched their products with Decentro 12 times faster than the industry average.

- Transaction Volume: $5 Billion+ processed annually, with a 300% growth in UPI-based payments.

- API Transactions: 320 Million+ Transactions & Identity verifications processed, with 98%+ uptime across modules.

- Global Footprint: Expanded operations across Singapore and SEA, with marquee customers onboarded across payments.

New Initiatives Highlights: Breaking Barriers

2024 was a year of collaboration, innovation, and inclusion.

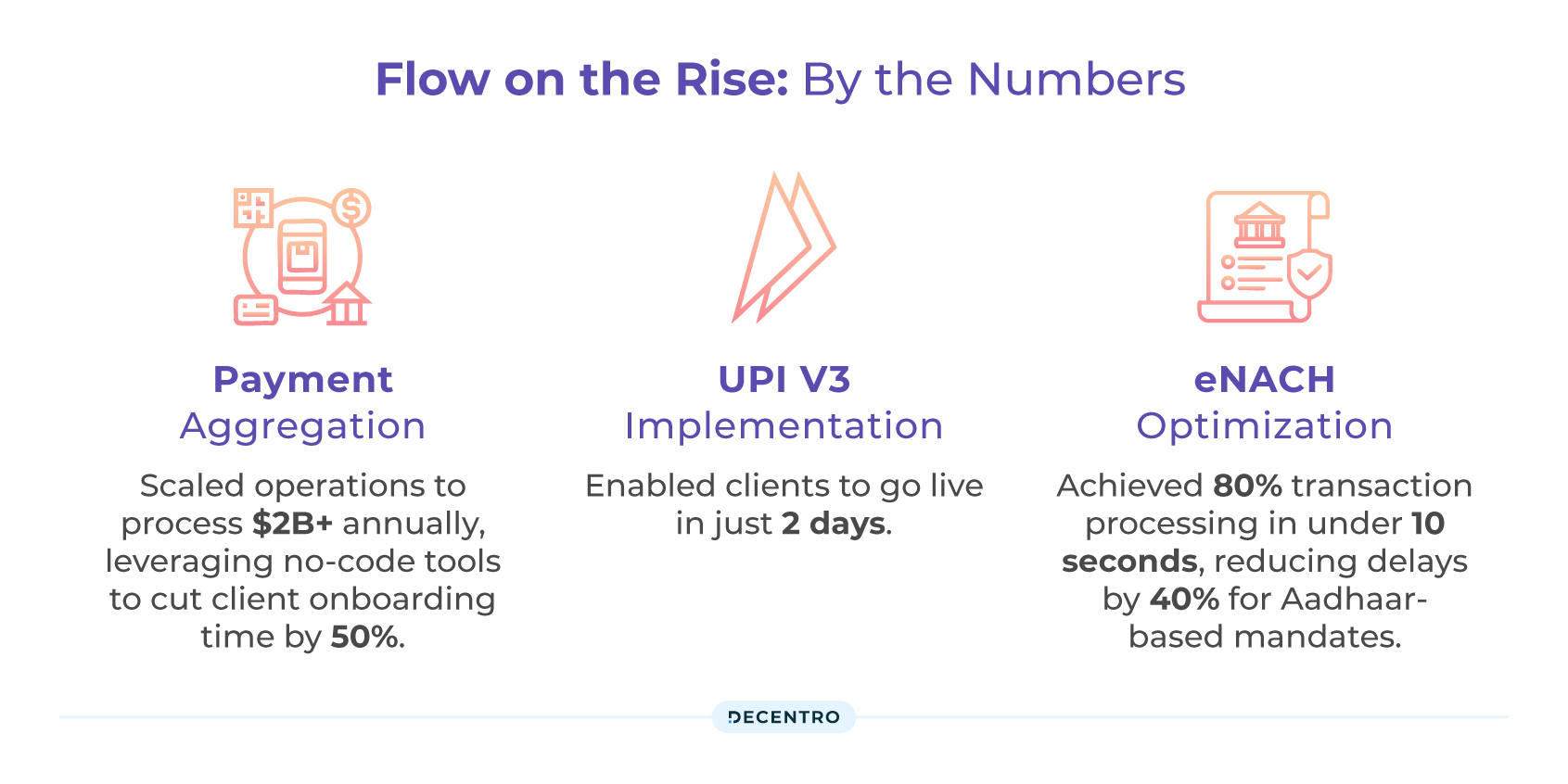

Flow: On the Rise

This year marked the successful scale-up of our Payment Aggregation (PA) operations. With no-code tools and streamlined workflows, we managed high transaction volumes for multiple customers while reducing onboarding time.

With our advanced UPI payment aggregator stack, we took payment collections to the next level, allowing customers to go live in just two days—a game-changer for speed and efficiency.

Our team also streamlined eNACH processes for Aadhaar-based mandates, reducing frustrating payment delays. And here’s the kicker: 80% of transactions get processed in under 10 seconds.

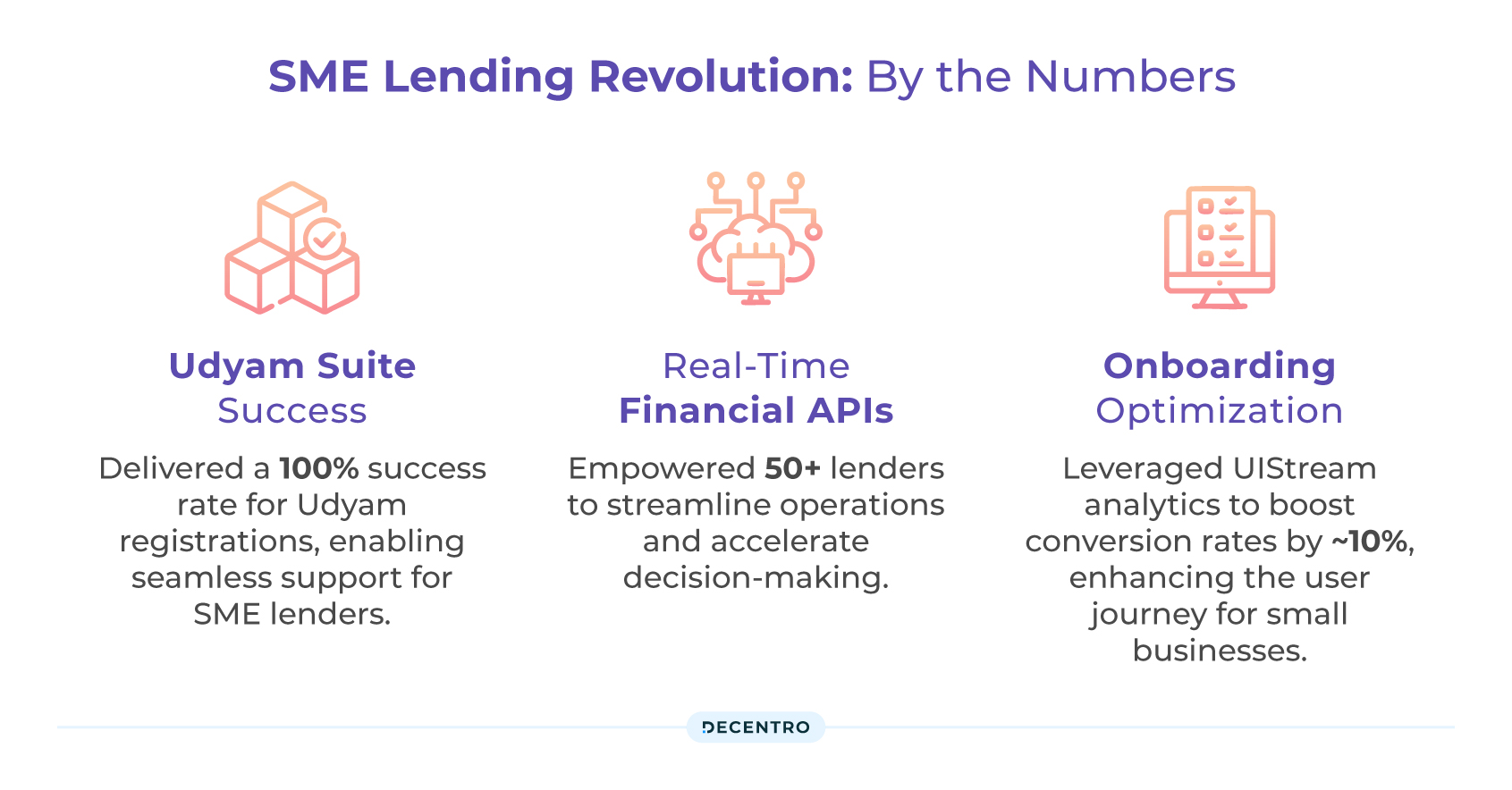

Empowering SME Lenders: Financial Inclusion

Small businesses need considerable support, and that’s precisely what we delivered with our new & state-of-the-art Udyam API Suite.

With real-time financial APIs that give a detailed business profile and a 100% success rate for Udyam registrations, SME lenders are now more empowered than ever.

We also fine-tuned the onboarding experience using UIStream analytics, boosting conversion rates by ~10%.

Debt Recovery: Reimagined with AI

Through our collaboration with Neowise, we expanded our offerings to include a debt recovery stack. This fully integrated module now supports last-mile credit lifecycle management, bringing new efficiencies to the collections industry.

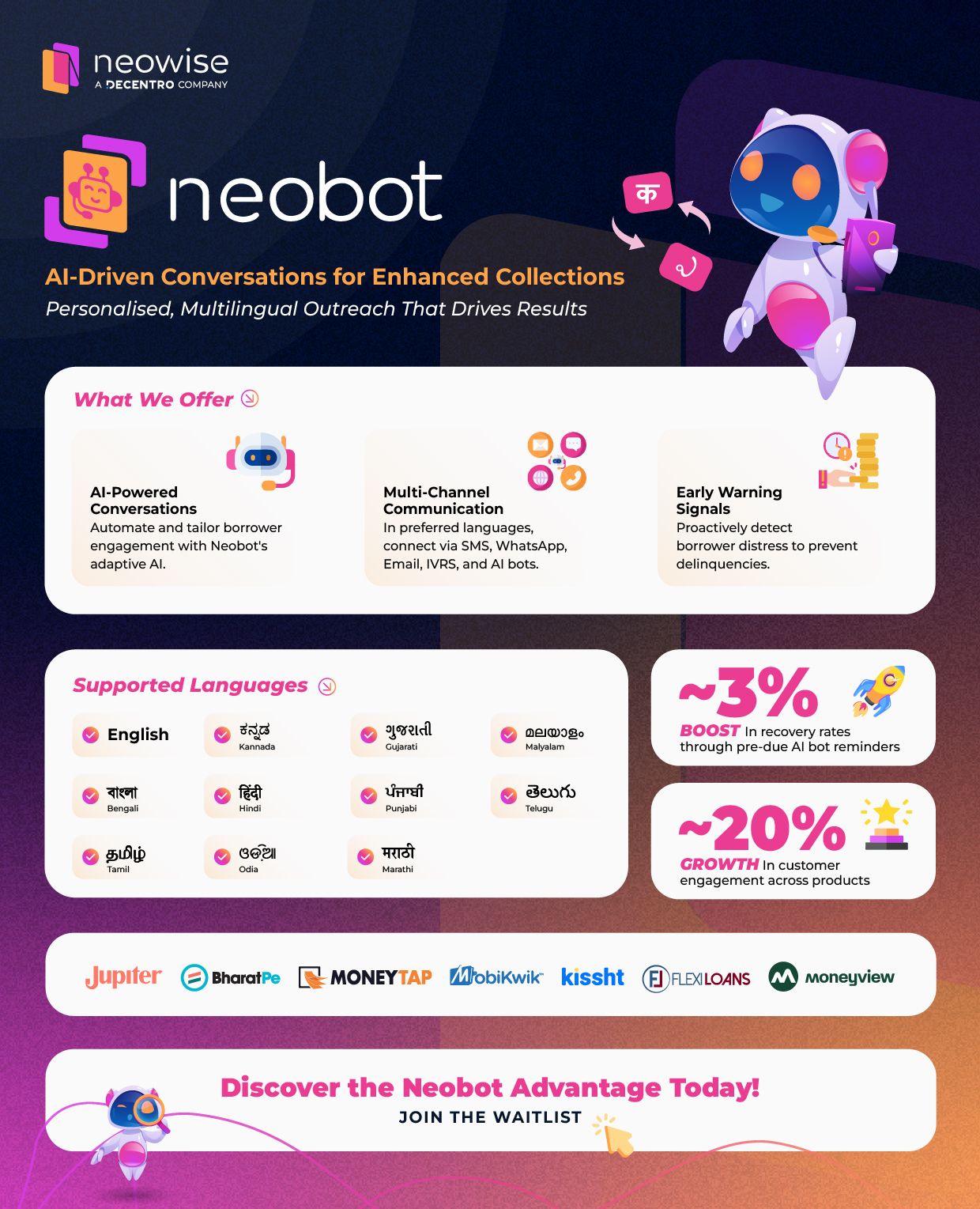

We redefined debt recovery with the launch of Neobit and Neosight, supercharging financial institutions with cutting-edge tools. At the heart of it all is Neobot, our AI-powered conversational bot designed to revolutionise collections:

- AI-Powered Conversations: Automate and personalise borrower engagement with adaptive AI.

- Multi-Channel Communication: Connect with borrowers via SMS, WhatsApp, Email, IVRS, and AI bots—in 10+ languages, including Hindi, Tamil, Bengali, and Marathi.

- Early Warning Signals: Proactively detect borrower distress to prevent delinquencies.

Proven Impact:

- ~5% boost in recovery rates through pre-due AI bot reminders.

- 20% growth in customer engagement across financial products.

Global Expansion: Payments Beyond Borders

- We strengthened our presence in Singapore and became the go-to partner for fintechs scaling up globally for cross-border payments.

- We also launched and announced our ability to onboard US-domiciled companies that wish to scale up and use cross-border payments for collections and payouts.

- We now support 12+ currencies (including all major ones like USD, EUR, SGD, etc.) for bank-to-bank or card-based payment collections and 45+ currencies across payouts.

Engineering: Building for Tomorrow

2024 was the year of pushing boundaries for our engineering team, guided by the mantra: “Optimise, secure, and scale.” From eliminating bottlenecks to deploying cutting-edge tools, we made every effort count:

- Reducing TATs by 2X: Revamped infrastructure to enhance visibility and optimise the performance by approximately 55% across our payments stack.

- Fortified Security: Introduced advanced upgrades to counter emerging threats and ensure data integrity across primary & backup databases.

- No-Code Efficiency: Leveraged no-code tools to accelerate development and deploy workflows faster, with AI-based code reviews being used by the team.

- Scaling Operations: Seamlessly handled complex transaction flows at an average TPS of 100+ with better intelligence, proving our systems’ resilience and agility.

Every milestone we achieved reflected our commitment to building for tomorrow.

Learnings: What 2024 Taught Us

This year wasn’t just about delivering but understanding the “why” behind the wins. Here’s what we took away:

- Verticalisation Unlocks Value

Our focused approach to SME lending through the Udyam Suite demonstrated the power of niche solutions. By enabling real-time API integrations and achieving a 100% success rate for Udyam registrations, we empower lenders to drive efficiency and expand their reach. - Developer Experience is Non-Negotiable

Clear SDKs and robust documentation proved critical for seamless adoption. Case in point: our UPI V3 stack helped customers go live in just two days, setting a benchmark for speed and usability in the fintech industry. - Compliance Builds Trust

Regulatory adherence was more than a checkbox—it was a cornerstone of customer confidence. Our Payment Aggregation (PA) license, achieved as the youngest fintech company in the space, underscored our commitment to compliant innovation. - Looking Beyond Traditional Data

Alternate intelligence streams became game-changers. For instance, incorporating social intelligence insights into our data aggregation modules allowed us to address underserved markets more effectively, enhancing businesses’ and lenders’ decision-making. - Future-First Solutions Drive Scale

Global expansion required more than scaling existing systems—it demanded foresight. By tailoring our solutions to diverse regional needs, such as streamlining cross-border payments and addressing unique compliance frameworks in emerging markets, we positioned Decentro as a trusted global fintech partner. These strategies kept us ahead of market demands and strengthened our role in enabling seamless financial ecosystems worldwide.

These lessons have become the foundation for our 2025 vision: to innovate boldly, scale sustainably, and create lasting impact.

Marketing: The Voice Behind the Numbers

For the marketing team, 2024 was a year of bold experiments and meaningful connections. Here’s how we made an impact:

Strategic Partnerships

This year, we took collaboration to the next level. Managing the dual branding for Decentro and Neowise, our AI-driven debt collections brand, was a standout achievement. Neowise stole the spotlight with PR releases, engaging social campaigns, and a distinct narrative that resonated across the fintech space.

Content Creation That Clicked

We created content that made waves—blogs, product pages, newsletters, and one-pagers that truly delivered. Our repository of 170+ FAQs and blogs became a go-to for users.

Campaigns That Stuck

From #TestimonialTuesdays to #DemoDives and #DecentroDigest, our campaigns didn’t just create buzz—they built a stronger brand identity. Email campaigns like Fintalks and Neowisdom struck a chord with the right audiences. Data-driven efforts also pushed our website traffic to 450,000+ YTD.

SEO That Delivered

Our SEO game hit new heights! We earned top spots for keywords like:

- “UPI API” – Rank 5.4

- “Best app to invest in gold” – Rank 2.9

- “Debt collection platform” – Rank 4

The result? There was a 148% surge in organic traffic and 140% more new users.

Social Media That Thrived

We levelled up on LinkedIn, hitting 1.28 million impressions YTD and consistently exceeding 11% WoW engagement rates. Thanks to campaigns like Fintech Focus and DemoDive, our follower base grew to 17 K.

Visuals That Spoke

We brought stories to life with fresh visual content. We explored new formats, from Demo Dives (product walkthroughs) to Decentro Talkies (customer testimonials). Vibrant video edits showcasing mixers, testimonials, and HQ activities boosted cultural storytelling.

2024 was the year we didn’t just market—we connected, engaged, and made an impact.

The result? A stronger brand presence, deeper engagement, and a marketing playbook built for scale.

As we celebrate the milestones of 2024, our vision for 2025 is clear: to innovate boldly, scale sustainably, and most importantly, lead with purpose.

We aim to deepen our impact across fintech ecosystems, expand our global footprint further, and continue building solutions that empower businesses to thrive. The possibilities are endless, from strengthening our product suite to fostering meaningful collaborations and setting new benchmarks in customer experience.

2025 is not just about growth—it’s about creating value, staying adaptable, and shaping the future of finance together.

To our customers, partners, and the Decentro family, thank you for being part of our journey. Let’s make 2025 even more extraordinary!

Here’s to new opportunities, bigger wins, and an exciting road ahead.

Stay connected and be the first to know about all things Decentro—innovations, insights, and exclusive updates.

Here’s to making Fintech Great Again!