Fraud prevention techniques analyse user behaviour and past data to prevent possible risks before they occur. Explore its function, usage, benefits, and more.

Fraud Prevention: What It Is and Why It’s Crucial

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Data breaches are a global issue, affecting both individuals and businesses through various fraudulent activities.

As per recent data, businesses faced a considerable loss of approximately $4.88 million due to data breaches in 2024. Though this malpractice is prevalent in almost all sectors, banking and other financial sectors are at the highest risk.

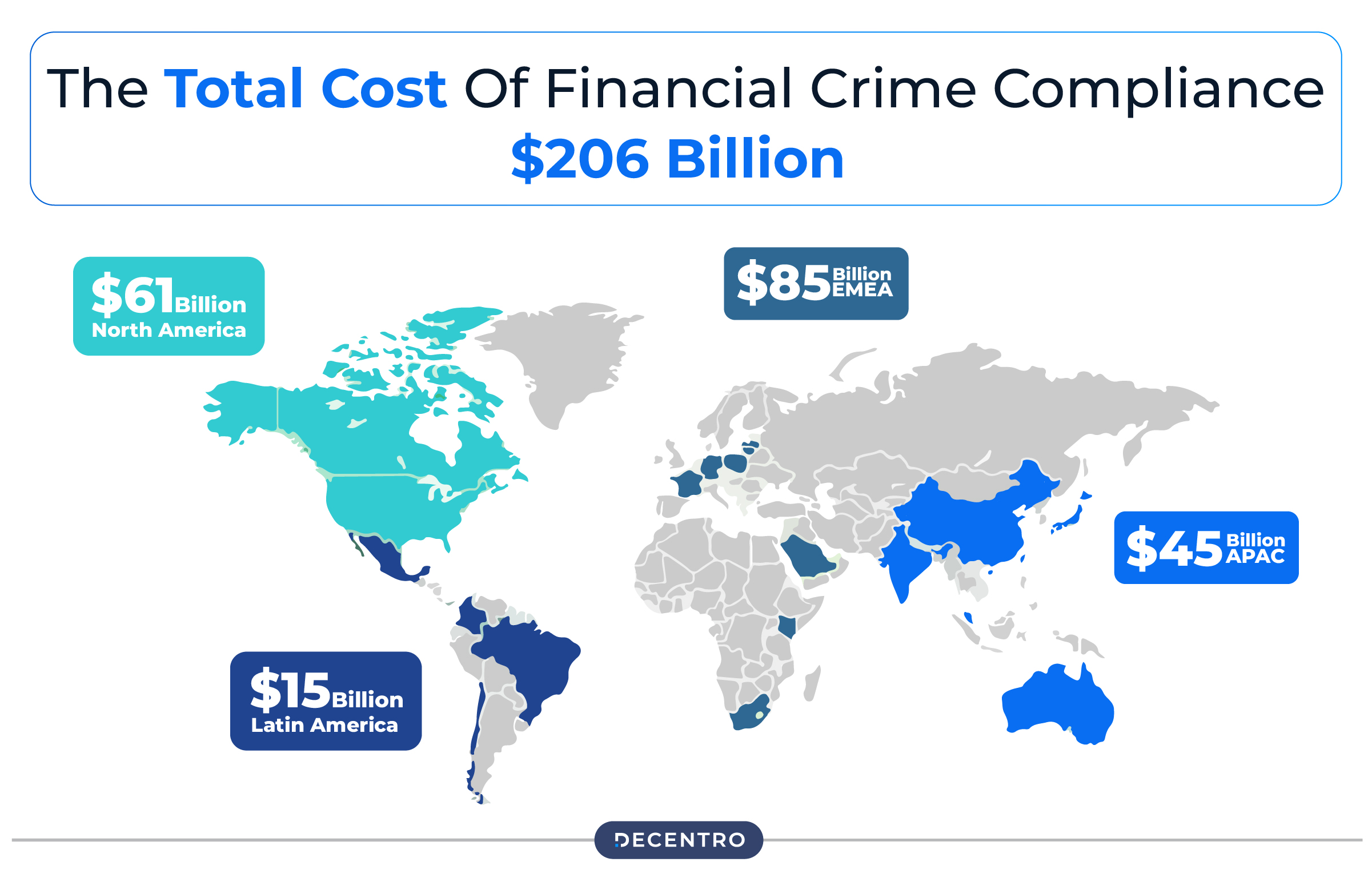

According to the 2024 Global Financial Crimes Report, businesses and consumers have faced a global loss of $485.6 billion due to bank frauds, cyber scams, etc. Considering the severity of the situation, the need for effective cybersecurity is paramount.

Among the various components of cyber security, fraud prevention emerges as an effective one to mitigate cyber risks. Keep reading to learn about its function, usage, importance, and more.

Fraud Prevention: An Overview

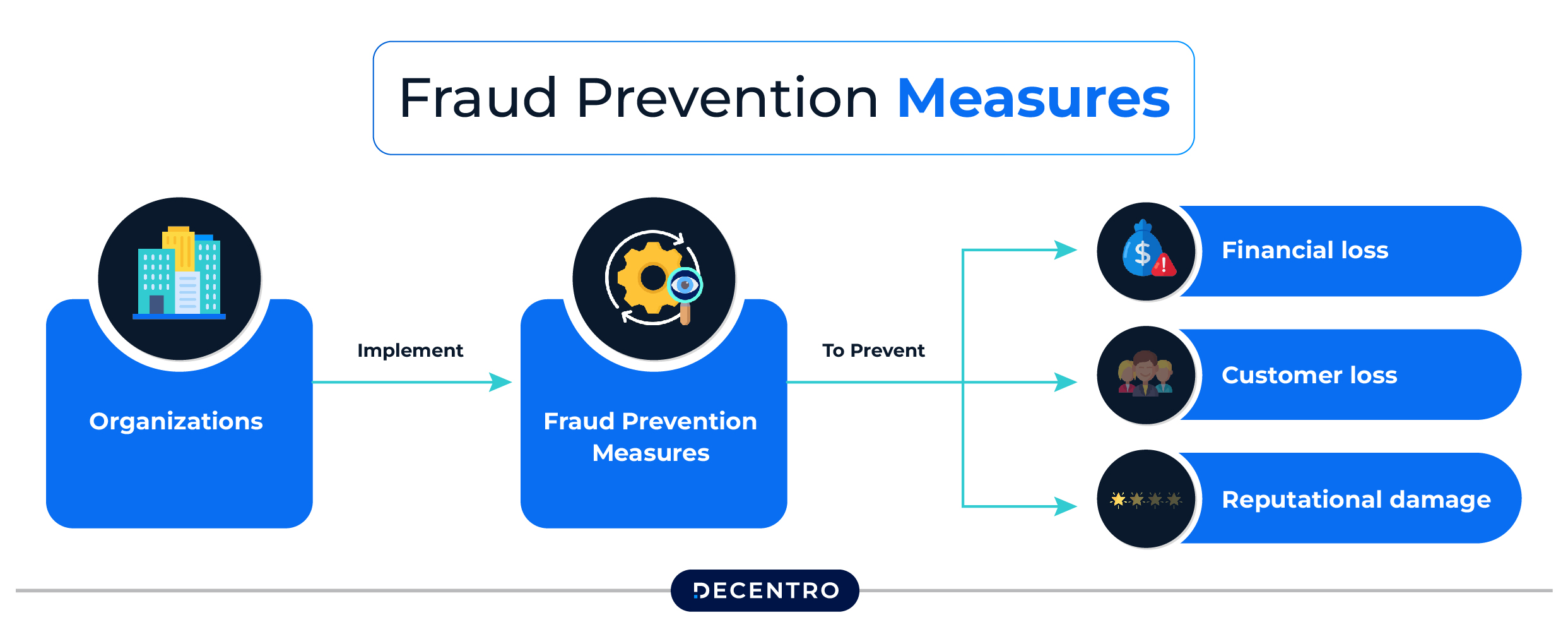

Fraud prevention, as the name suggests, refers to the policies, processes, and functions of a business to prevent any type of fraudulent activity. Firms generally implement advanced strategies to detect fraudulent activities or transactions and prevent reputational and financial damage. This helps them safeguard both their operations and their customers from losses.

Now, with the digitisation of financial operations and convenient online services offered by banking channels, cybercrime is becoming a grave issue. Fraudsters these days maintain a huge network of scammers on the Dark Web that steal and exchange user’s information.

This helps them to generate fake profiles and conduct frauds which can be pretty hard to detect. Thus, advanced fraud prevention strategies that leverage the latest technological innovations are the need of the hour to keep such risks at bay.

In this regard, regular risk assessment techniques can help institutions ensure the timely detection of realistic risks and mitigate them effectively.

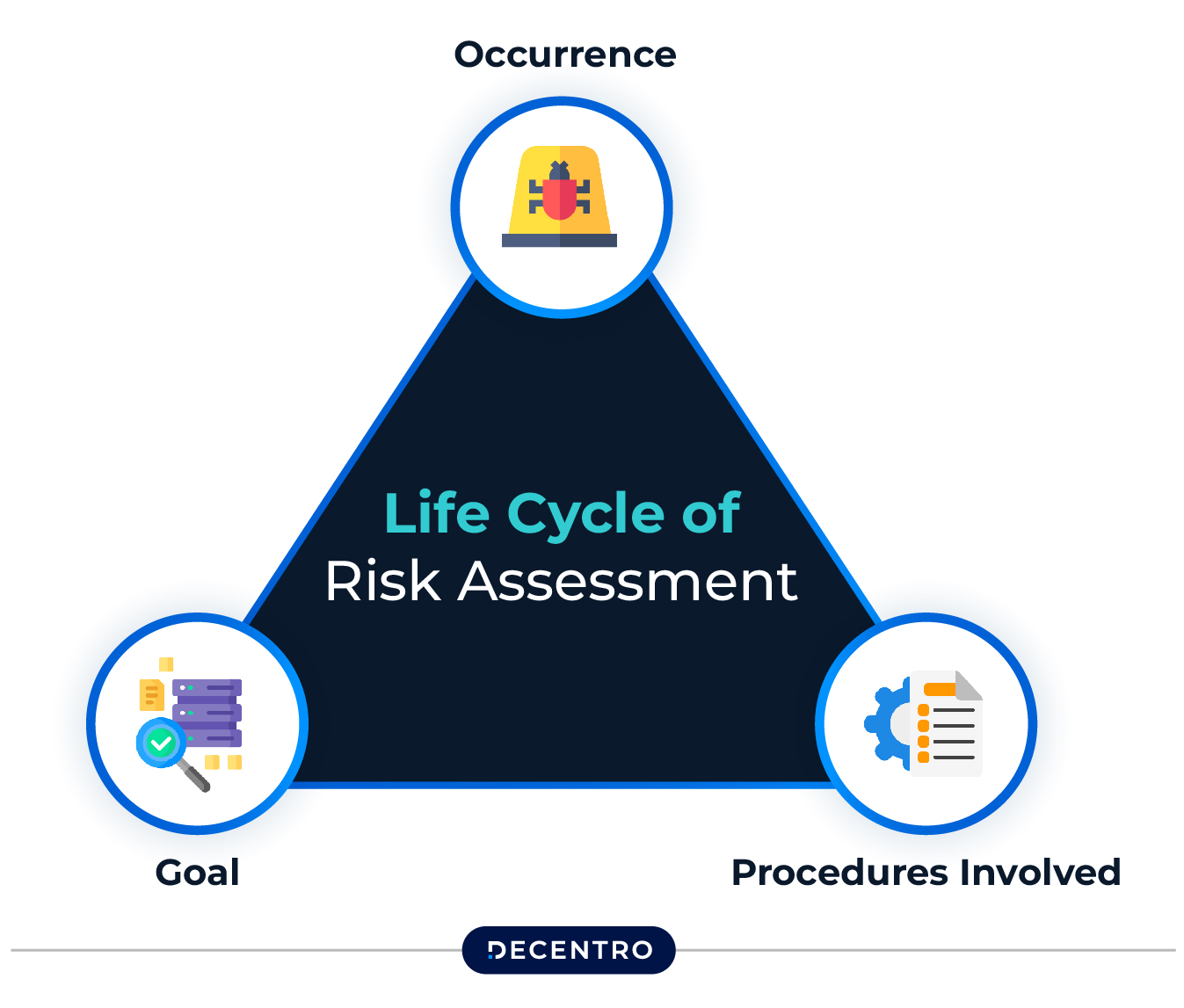

Life Cycle of Risk Assessment

Organisations generally conduct a fraud risk assessment in areas with potential fraud risks. Such processes usually involve both fraud detection and fraud prevention. To efficiently implement such measures, clearly understanding the differences between these two aspects is a must.

- Occurrence

Fraud detection is used to detect and respond to fraud after it has occurred. Alternatively, fraud prevention measures take place beforehand in order to negate the chances of such occurrences.

- Procedures Involved

The steps in fraud detection include monitoring, analysis, and investigation of transactions or behaviour. Meanwhile, fraud prevention entails identity verification, access grants, and user education.

- Goal

Fraud detection acts in response to a fraud incident and assists in reducing losses and preventing future fraud. Alternatively, fraud prevention seeks to actively mitigate the risk of fraud and helps build a strong and fraud-resistant system.

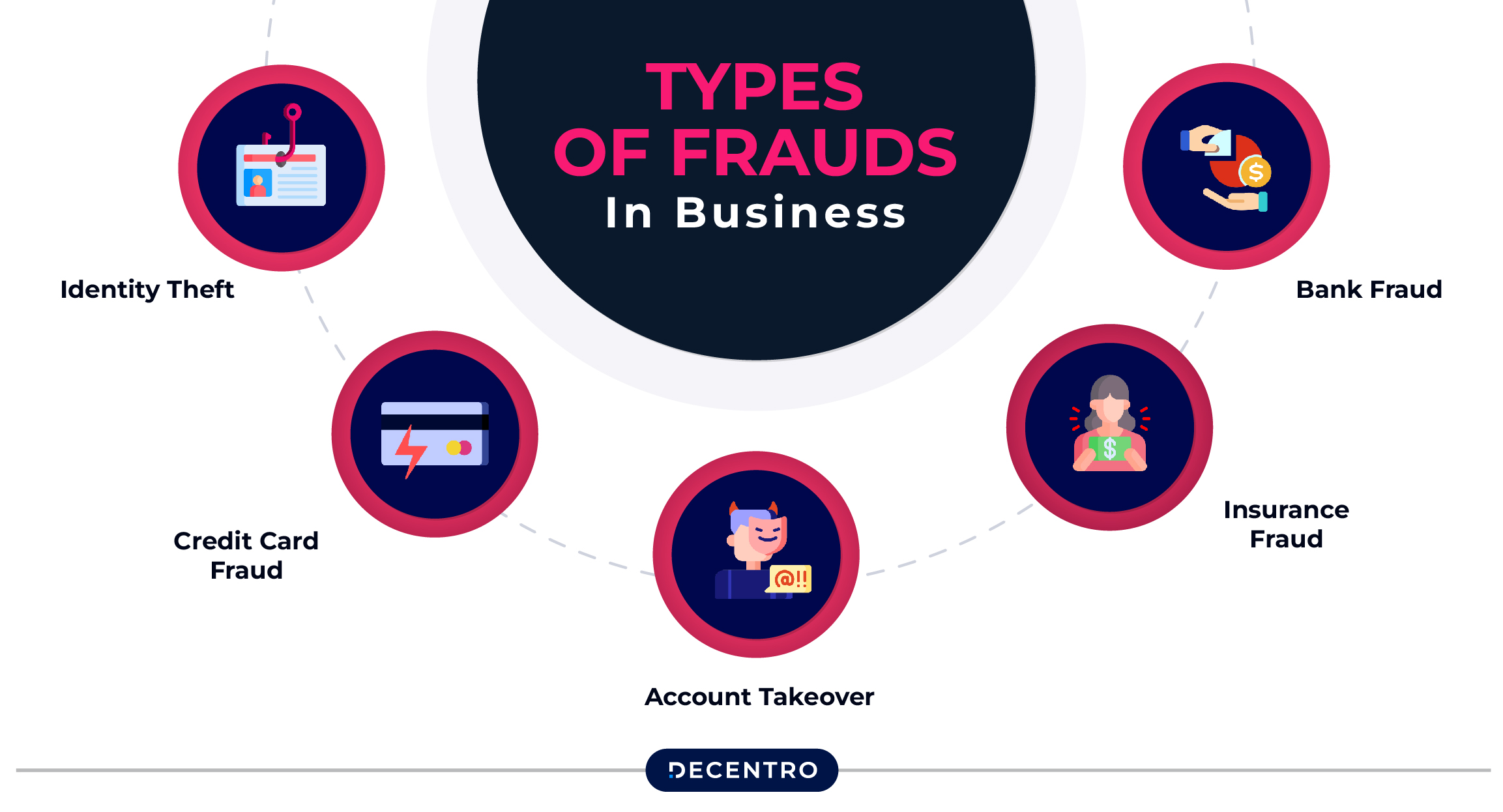

Common Types of Frauds That Affect Businesses

Here are some of the common fraudulent activities that affect a business:

- Identity Theft

Using the personal information of another person without their consent is considered identity theft. They include an individual’s name, credit card number, social security number, etc. Fraudsters use this information to open new accounts, borrow loans in someone else’s name, make purchases, transfer funds, and more.

- Credit Card Fraud

When a stolen or duplicated credit card is used for unauthorised purchases, it is called credit card fraud. Fraudsters can use the card for online purchases through mobile phones or in person.

- Account Takeover

It is a type of identity theft in which cyber criminals gain access to an individual’s account and use it for conducting fraudulent activities. They usually steal the user’s login credentials or trick them into handing over such details using social engineering attacks.

- Insurance Fraud

Deliberately lying or withholding information to avail of insurance coverage or benefits unethically is termed as insurance fraud. The scammer may fake injuries, exaggerate the damages and their value, or stage an accident to claim insurance benefits.

- Bank Fraud

Obtaining money illegally from banks or financial institutions is termed as bank fraud. Fraudsters generally use methods like forging signatures, stealing bank account information, or creating duplicate documents to perform such activities.

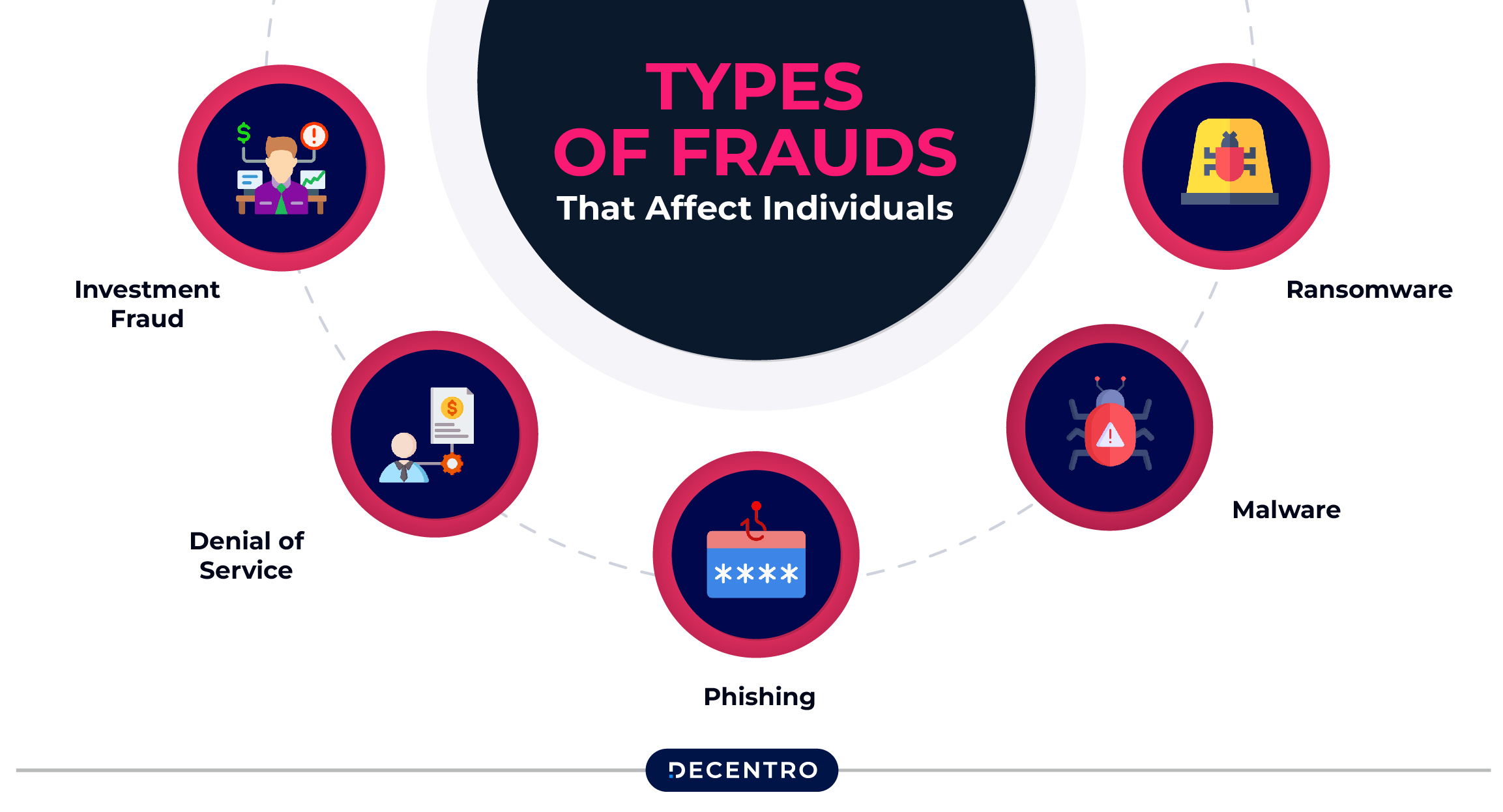

Common Types of Frauds That Affect Individuals

Check out the fraudulent activities that generally affect individuals:

- Investment Fraud

Using false information to convince someone to invest in a specific product or company is termed investment fraud. Scammers perform such activities by misinterpreting facts, insider trading, or making false advertising.

- Denial of Service

DoS or denial of service is an attack to crash websites by overwhelming their computing resources. Here, fraudsters use numerous zombie computers and botnets to conduct fraudulent activities. It includes continuously completing the Contact Us form until the website stalls to try to process the influx of requests.

- Phishing

This technique helps scammers extract valuable information from an individual or organisation in order to exploit them. They send phishing messages through e-mail, phone calls, or text messages to trick users into revealing their confidential information or make them download malware on their devices.

- Malware

Malware or malicious software refers to multiple harmful software, like spyware, viruses, ransomware, etc. They are usually spread via e-mail attachments and visits to malicious websites. Cybercriminals can use them to disable computer parts, take control of systems, and extort the user for money. Using tools like DMARC to monitor your domains can help prevent email spoofing and ensure that malicious actors can’t impersonate your organization via phishing campaigns.

- Ransomware

It is a type of malware that encrypts a user’s local files on their infected devices. The fraudster then asks for payments in exchange for the encryption key that enables the individual to regain access to their files. However, there is no guarantee that the cybercriminal will provide the user with their encryption key even after getting the ransom. Instead, they may cease all contact sources after receiving the payment.

Why is Fraud Prevention Essential for Businesses?

As per studies, more than 60% of firms experience financial losses due to fraudulent activities, with the figures reaching above $1 million for 30% of them. Thus, fraud prevention becomes a crucial aspect of business security in this scenario. Here’s more on the impact and importance of fraud prevention on business security:

- Protecting Business Assets and Finances

Fraud prevention helps safeguard the assets and financial resources of a company. Firms can use these robust measures to mitigate fraudulent activities and financial loss risks.

- Safeguarding Company Reputation

Implementing fraud prevention strategies in businesses provides financial security and safeguards their reputation. It helps preserve the credibility and trust among an entity’s partners, stakeholders, and customers.

- Ensuring Continuous Operations

Normal business operations can get disrupted due to fraudulent activities, causing operational setbacks and chaos. Fraud prevention minimises such risks and ensures seamless workflow for smooth operations.

- Compliance With Legal Regulations

Based on their industry, companies need to comply with several laws and regulations laid down by the authorities. Having robust fraud prevention measures can mitigate the risks of penalties and regulatory fines that result due to non-compliance.

- Upholding Ethical Standards and Customer Loyalty

Fraud prevention helps maintain a company’s integrity and ethical conduct by defending against fraudulent activities. It allows businesses to demonstrate adherence to moral principles, transparency, and accountability.

- Protecting Confidential Information and IP Rights

Valuable company assets, like confidential data, intellectual property (IP), etc., need efficient protection and security. With fraud prevention, businesses can prevent the misuse of sensitive data and unauthorised access.

- Maintaining a Competitive Edge

With enhanced reliability and security, businesses can differentiate themselves from other competitors and attract potential customers to enhance their market positioning. Thus, with fraud prevention, companies can maintain a competitive edge in their respective sectors.

Which Type of Business Use Fraud Protection?

Over the years, a wide range of organisations have embraced fraud prevention technologies to safeguard their business. Here are some of them:

- Banking

Financial crimes like account takeovers, unauthorised digital authentication and payment, nefarious applications, etc., may occur in banks and other financial institutions. Fraud prevention technologies enable real-time detection of such suspicious transactions. Additionally, banks can use this technology to detect terrorist financing, money laundering, and other fraudulent activities.

- Insurance

Application and claim fraud are dominant in the insurance sectors. Integrating fraud prevention measures can help firms detect the patterns and anomalies of a customer with the help of algorithms. This, in turn, can help prevent fraud by analysing the factors that determine the perpetration of claim fraud.

- Public Sector

By combining siloed data, governments can predict fraudulent intrusions, identify behavioural abnormalities, catch tax-related frauds, and stop future and real-time threats. This fraud prevention technique helps gather intelligence to enforce laws, ensures child safety by monitoring opioid abuse, and enhances border security.

- Health Care

Healthcare organisations are using advanced analytics to strengthen payment integrity and cost containment. Such an innovative approach helps mitigate fraudulent activities related to healthcare claims.

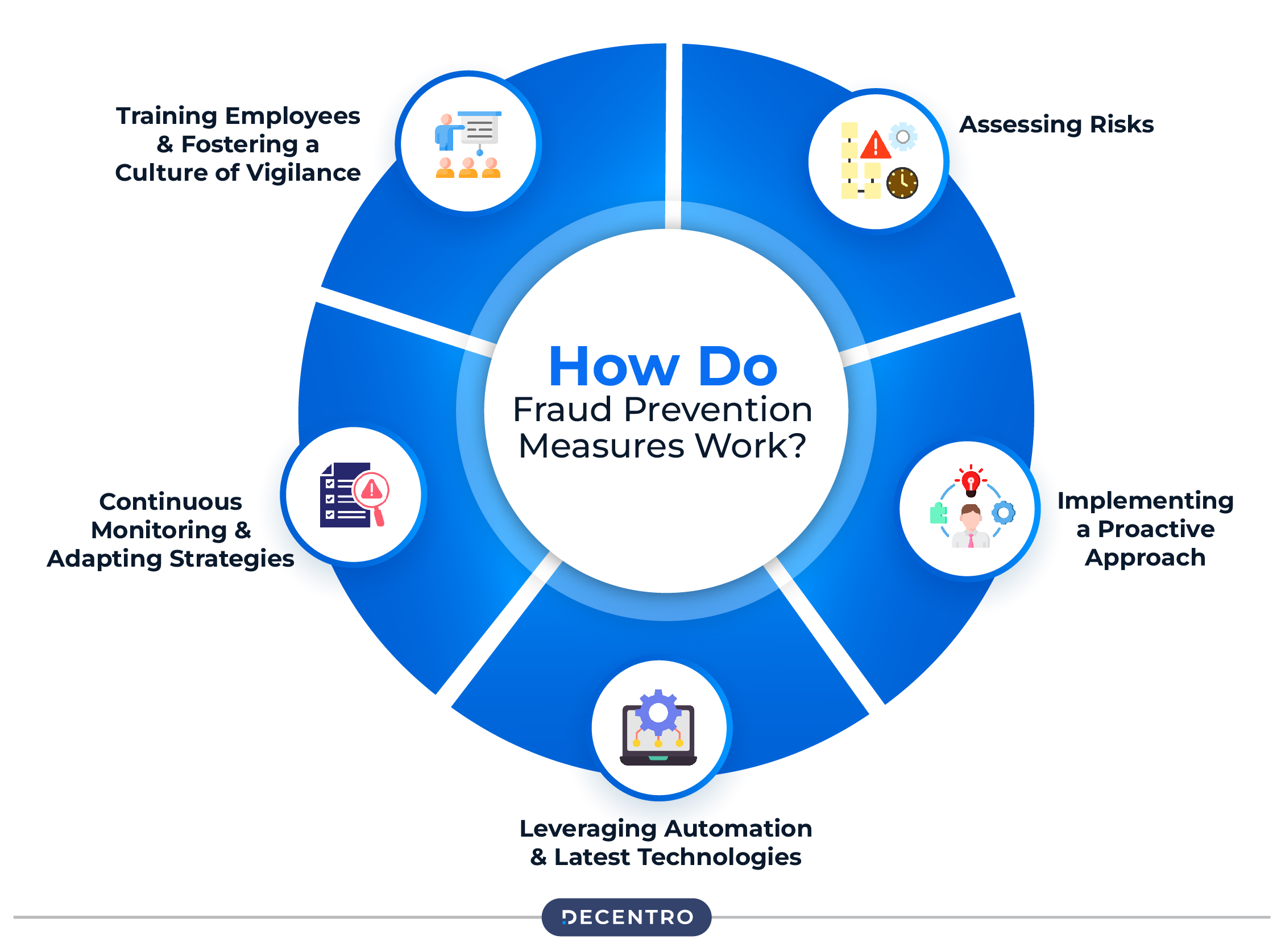

How Do Fraud Prevention Measures Work?

In general, fraud prevention measures work in the following way:

- Assessing Risks

An organisation may face various risks in customer interactions, financial processes, vulnerabilities in operation, and more. It is essential to identify such risks accurately for effective fraud detection. Thus, firms should analyse the recent industry trends and past incidents to understand the types of fraud they may encounter.

- Implementing a Proactive Approach

Fraud prevention refers to stopping fraudulent activity before it occurs. Thus, companies must use a continuous monitoring system to flag any possible risks early and maintain a clear protocol to address any suspicious activity.

- Leveraging Automation and Latest Technologies

Fraudsters keep on evolving their techniques to increase fraudulent activities. Thus, it is essential to implement advanced technologies to prevent such hazards. Businesses can use automated systems to monitor real-time transactions, alert the required individuals, detect anomalies, etc., to prevent fraud.

Besides, such practices also help speed up responses and reduce human errors.

- Continuous Monitoring and Adapting Strategies

Implementing preventive measures against fraud is not enough. Organisations must implement continuous monitoring to prevent fraud. They should also regularly update risk assessments, review fraud detection systems, and adapt new strategies to tackle the latest threats.

- Training Employees and Fostering a Culture of Vigilance

Lastly, businesses should train their employees, stakeholders, and partners regarding fraud prevention techniques. They should be aware of their role in preventing fraud and learn to report suspicious activities whenever required.

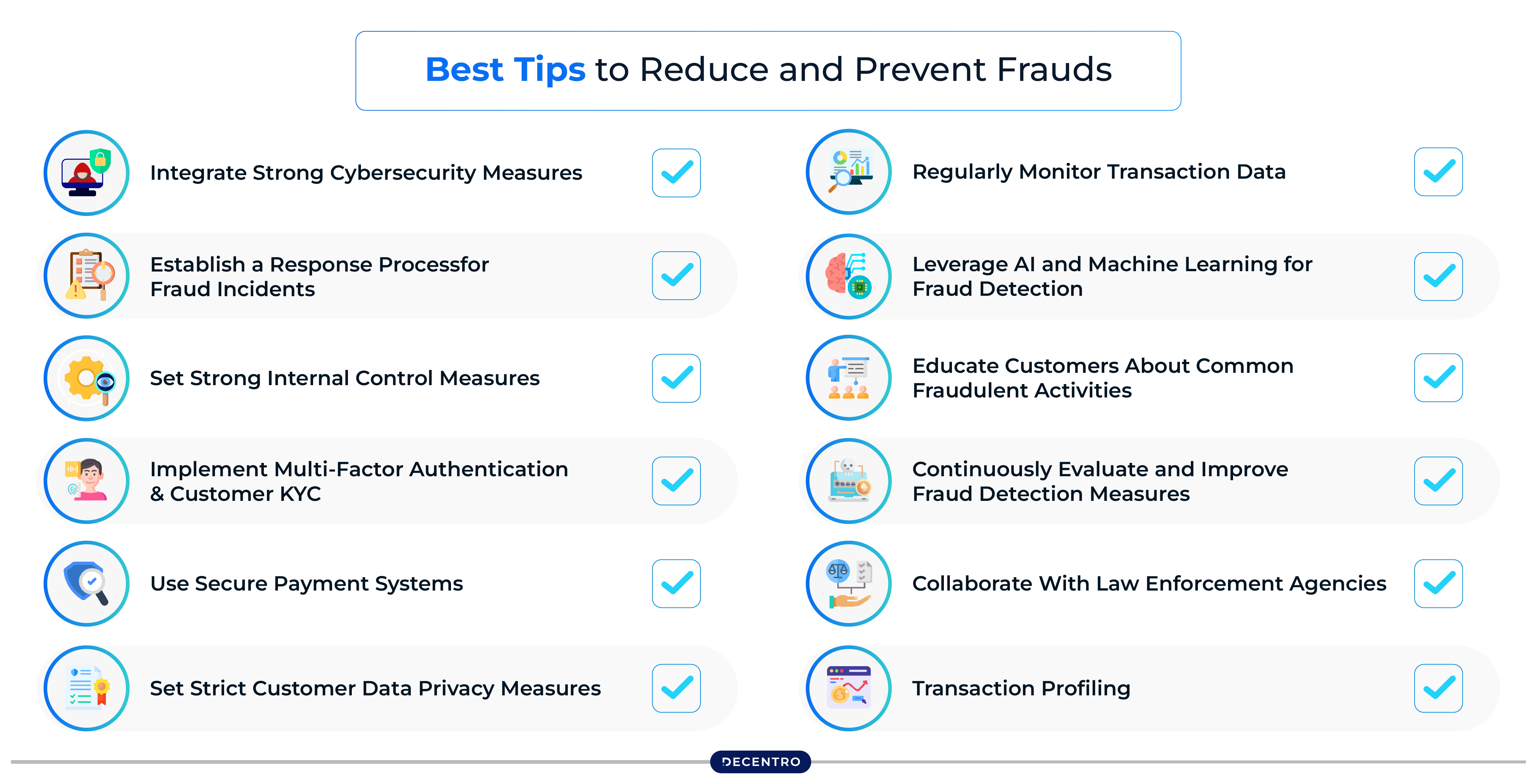

Best Tips to Reduce and Prevent Frauds

Fraud prevention is essential for safeguarding businesses and their customers. Implementing robust strategies can significantly mitigate risks and protect against financial losses. Here are some of the best tips to reduce and prevent fraud:

- Integrate Strong Cybersecurity Measures

Establishing a solid cybersecurity framework is crucial. This includes using encryption for sensitive data, regularly updating software to patch vulnerabilities, and employing firewalls to block unauthorised access. A key component of this strategy is to deploy a VPN, ensuring secure connections for remote teams and preventing exposure to cyber threats.

Strong cybersecurity measures create a formidable barrier against potential fraudsters, making it difficult for them to exploit weaknesses in a company’s systems.

- Establish a Response Process for Fraud Incidents

Having a well-defined response plan is essential for addressing fraud incidents swiftly. It should outline the steps to take when fraud is suspected, including how to investigate, report, and mitigate damages. A prompt response can minimise losses and help restore trust among stakeholders.

- Set Strong Internal Control Measures

Implementing internal controls such as segregation of duties, transaction authorisations, and regular audits can significantly reduce opportunities for fraud. Organisations can create a system of checks and balances that deters fraudulent activities by ensuring that no single individual has unchecked control over financial transactions.

- Implement Multi-Factor Authentication and Customer KYC

Multi-factor authentication (MFA) adds an extra layer of security by requiring users to provide two or more verification factors before gaining access to sensitive information. Coupled with Know Your Customer (KYC) procedures, which verify the identity of clients, these measures enhance security by making it harder for fraudsters to impersonate legitimate users.

- Use Secure Payment Systems

Secure payment systems that comply with industry standards protect sensitive financial information during transactions. Secure payment gateways encrypt data, reducing the risk of interception by unauthorised parties.

- Set Strict Customer Data Privacy Measures

Establishing stringent data privacy policies ensures customer information is handled securely and responsibly. Organisations should limit access to sensitive data, implement data retention policies, and regularly train employees on data protection practices to prevent unauthorised access or breaches.

- Regularly Monitor Transaction Data

Continuous monitoring of transaction data allows organisations to detect unusual patterns or anomalies that may indicate fraudulent activity. Automated systems can analyse real-time transactions, flagging suspicious activities for further investigation.

- Leverage AI and Machine Learning for Fraud Detection

Artificial intelligence (AI) and machine learning (ML) technologies can analyse vast amounts of data quickly and efficiently. These tools can identify complex fraud patterns that traditional methods might miss, enabling organisations to respond proactively to potential threats. Organisations aiming to strengthen their fraud detection efforts can significantly benefit from upskilling teams on AI-driven methodologies. Those looking to study artificial intelligence through practical, industry-focused online courses will find resources that provide foundational knowledge in machine learning, large language models, and real-world applications critical for developing robust fraud prevention strategies.

- Educate Customers About Common Fraudulent Activities

Raising awareness among customers about common fraud schemes empowers them to recognise suspicious activities. Providing educational resources on identifying phishing attempts or scams can help consumers protect themselves and report any concerns promptly.

- Continuously Evaluate and Improve Fraud Detection Measures

Fraud prevention is an ongoing process that requires regular assessment of existing measures. Organisations should conduct periodic reviews of their fraud detection systems, update risk assessments based on emerging threats, and adapt strategies accordingly to stay ahead of potential fraudsters.

- Collaborate With Law Enforcement Agencies

Building relationships with local law enforcement agencies can enhance an organisation’s ability to combat fraud effectively. Collaboration allows businesses to share information about trends in fraudulent activities and receive guidance on best practices for prevention.

Developing the Best Fraud Prevention Framework

An effective fraud prevention framework combines robust security measures, proactive monitoring, and customer education to mitigate risks. Organisations should integrate strong cybersecurity protocols, such as encryption, firewalls, and regular software updates, to develop the best fraud prevention framework.

All these measures help protect sensitive data. Implementing internal controls like segregation of duties and regular audits helps deter fraudulent activities. Moreover, multi-factor authentication and KYC processes further enhance security by verifying user identities and adding layers of protection.

Businesses should also introduce advanced technologies such as AI and machine learning to analyse large datasets and detect complex fraud patterns in real time. Monitoring transaction data for anomalies and evaluating fraud detection strategies help adapt to emerging threats.

Furthermore, organisations should educate customers about common scams and empower them to recognise and report suspicious activities.

Finally, collaborating with law enforcement agencies ensures access to resources and information that strengthen fraud prevention efforts. Together, these steps create a comprehensive framework for minimising fraud risks.

Leveraging Decentro’s APIs for Fraud Prevention

Decentro’s Scanner API suite can maximise the security of user profiles in various sectors. It combines Mule Detector API and Data Forensics to enhance fraud prevention and detection. These APIs not only help detect and prevent financial crime but also ensure AML (anti-money laundering) compliance. It is designed to streamline the process of verifying and validating user data for businesses. Additionally, it provides a comprehensive solution for identity verification, enabling organisations to efficiently assess the authenticity of documents and user information.

The API suite supports various document types and integrates seamlessly with existing systems. It enhances operational efficiency while ensuring compliance with regulatory standards. Furthermore, leveraging machine learning and computer vision, the Scanner API suite helps businesses mitigate fraud and identity theft risks, providing a secure transaction environment.

Want to know more about our APIs and their effective usage in your business?