Navigating Cross-Border Finances: Understand SWIFT Payments, the backbone of international transactions, and staying ahead in the ever-changing financial landscape.

SWIFT Payments: What is It & How Does It Work?

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Global trade and financing have undergone massive innovation. However, the framework to enable a flow of payments in opposite directions is solid through this time. But how did we arrive at this framework? What is this framework? Let’s break down this system.

Back in the day, if a company needed to pay for an international delivery of goods, its local bank would work with a correspondent bank to connect with the seller’s local bank for a fee. The seller would ship the goods when the correspondent bank received the money, and the funds would be released when the customer confirmed receipt of the goods. Here, the banks primarily communicated by post, telegraph or Telex.

However, these methods were prone to error and misinterpretation as banks exchanged information and authentication using freestyle text. Finalising a transaction required multiple messages, and communication delays meant that funds sat at the correspondent bank as the goods languished in a warehouse. That made processing cross-border payments costly, labour-intensive and time-consuming.

This all changed in the 1970s, when direct electronic communication between banks became the standard, thanks to a network called the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

What is a SWIFT Payment?

SWIFT payments are international electronic transactions facilitated by an intermediary bank. Unlike transferring funds, the SWIFT network acts as a conduit for sending payment orders between banks using SWIFT codes.

So, what is this SWIFT network?

SWIFT, an acronym for the Society for Worldwide Interbank Financial Telecommunication, is a cooperative organisation that provides a standardised platform for financial institutions to send and receive information securely, primarily for money transfers. Established in 1973, SWIFT is the most common and widely adopted wire transfer method globally.

Essentially, SWIFT acts as a messaging network, enabling banks, credit unions, and other financial entities to communicate and exchange vital information about financial transactions.

Inside a SWIFT Money Transfer

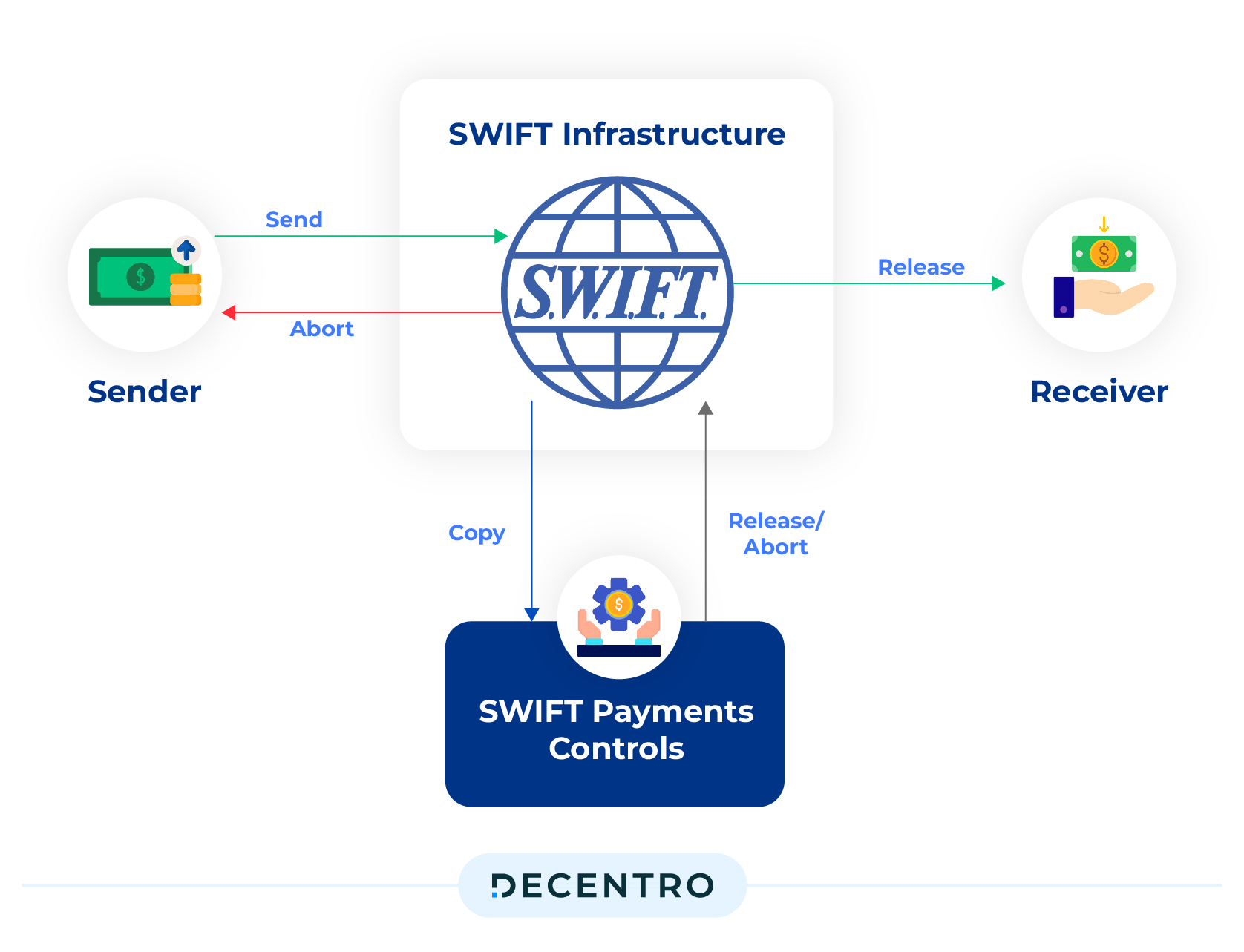

Financial institutions use SWIFT to transmit information and instructions securely through a standardised code system. Although SWIFT is crucial to global financial infrastructure, it’s not a financial institution. SWIFT does not hold or transfer assets but facilitates secure, efficient communication between member institutions.

So, what is this standardised code system?

What is a SWIFT Code?

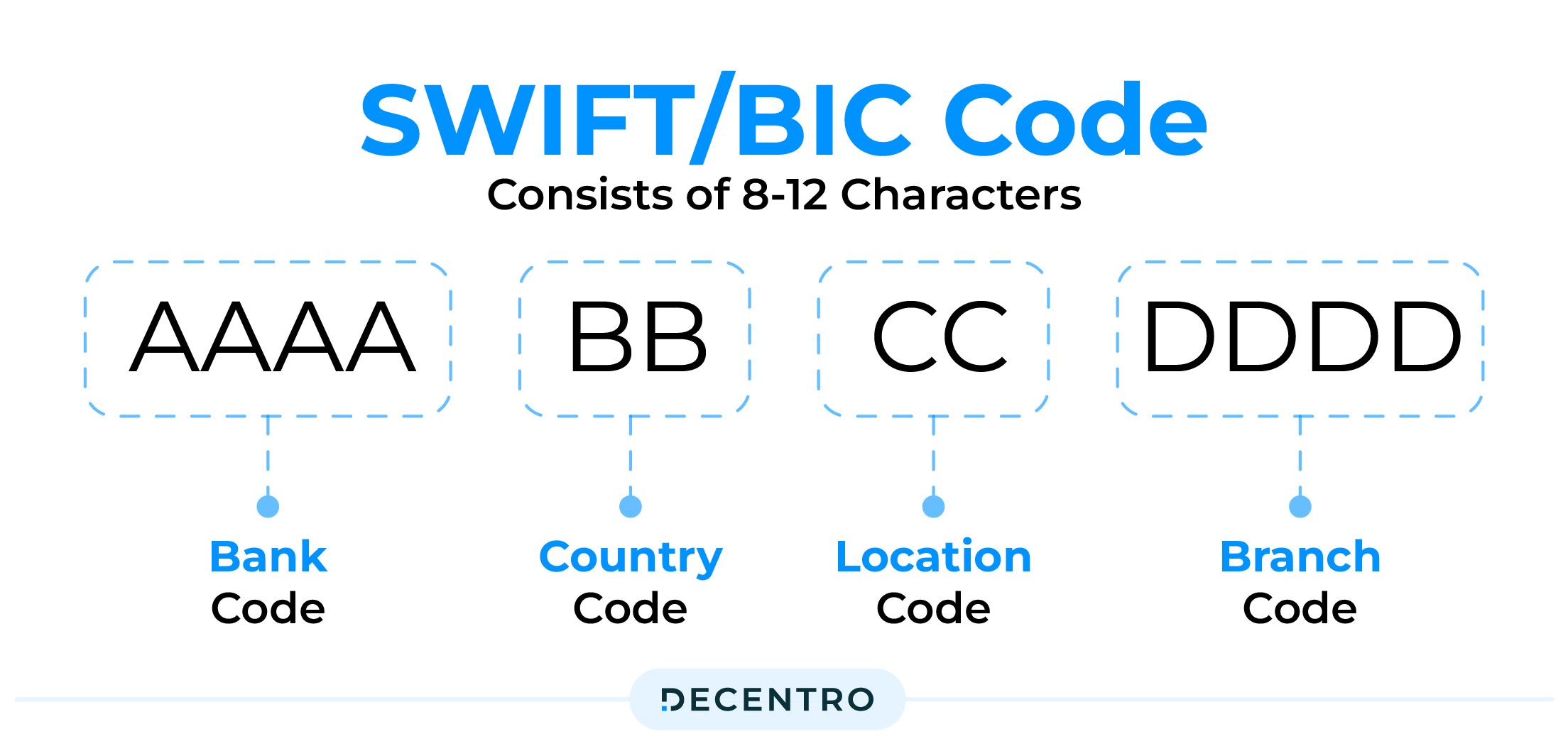

SWIFT codes are unique identifiers that SWIFT assigns to each financial institution using the network. A SWIFT code is unique for every bank and financial institution. It contains eight or eleven characters and is called the bank identifier code (BIC). Some other names for the SWIFT code are the SWIFT ID or ISO 9362 code.

Here’s a breakdown of what the characters represent:

- First four characters: This is the code for the financial institution itself.

- The fifth and sixth characters denote the country where the institution is based.

- Seventh and eighth characters: The seventh and eighth characters are the city code and denote the institution’s location.

- Ninth, tenth, and eleventh characters: These final characters are optional and can be used to identify individual branches of banking institutions.

Example of a SWIFT code:

To understand how a SWIFT code is assigned, let’s use the example of Deutsche Bank. The SWIFT code for Deutsche Bank is DEUTDEFFXXX. Below is the SWIFT code breakdown:

- Bank code: This part usually looks like a shortened version of the bank’s name (i.e., DEUT).

- Country code: This part of the SWIFT code identifies the country the bank is based in (i.e. DE).

- Location code: This part of the code usually identifies what area of the country the bank is located in (i.e. FF).

- Branch code: this part of the code indicates what part of the bank you’re accessing.

SWIFT codes are at the core of the SWIFT system’s functionality. This standardised code structure enables financial institutions to communicate in a universal language and send and receive transactional messages accurately.

Customers should know and use the SWIFT code for the bank they’re trying to send money to when making an international money transfer using SWIFT. This ensures the money goes to the correct bank without unforeseen interruptions when making cross-border payments.

How does a SWIFT Payment Work?

Let’s dive deeper into how SWIFT payment works and break down the steps involved in a typical SWIFT money transfer:

Initiate Transaction:

The process begins when a customer or an entity, such as a business or financial institution, initiates a financial transaction. This could be anything from a cross-border wire transfer to a currency exchange.

Bank Deducts Money:

Once the transaction is initiated, the customer’s (sender’s) bank deducts the specified amount from the customer’s account. This step is crucial as it ensures the funds are available for the intended transaction.

Prepare a SWIFT Message and Send It to Other Banks:

The sender’s bank prepares a SWIFT message after deducting the money. This message contains critical information about the transaction, including details about the sender, recipient, transaction amount, currency exchange rates (if applicable), and other relevant information.

Other Bank Gives Money to Your Bank:

Upon receiving the SWIFT message, the recipient’s bank processes the transaction based on the information provided. This includes verifying the details, checking for compliance with regulatory requirements, and ensuring that the recipient’s account is credited with the specified amount.

If everything is in order, the recipient’s bank releases the funds to the recipient’s account, making the money available for withdrawal or further transactions.

So, if we drill this deeper, SWIFT is designed to move messages, not money, between institutions. These messages, however, are instrumental in the movement of funds, as they enable banks and other financial entities to quickly and securely communicate with each other about fund transfers.

Formatting SWIFT Messages: ISO 20022 Standard

One of the most significant developments in SWIFT messaging is the transition to the ISO 20022 standard. The coexistence period is scheduled to end on 22 November 2025, and this date was reconfirmed by the Swift Board for cross-border FI-to-FI payment instructions.

What is ISO 20022?

ISO 20022 is a global messaging standard that provides a common language for financial institutions worldwide. Unlike the traditional MT (Message Type) format, ISO 20022 uses XML-based messages that can carry much richer data and provide enhanced transparency for cross-border payments.

Key Benefits of ISO 20022:

- Richer Data: More detailed information about payments, including purpose codes and structured addresses

- Enhanced Transparency: Better tracking and reporting capabilities

- Improved Compliance: Better support for regulatory requirements and sanctions screening

- Future-Proof: Modern standard that can accommodate future innovations

Migration Timeline:

- Current State: Coexistence period where both MT and ISO 20022 formats are accepted

- November 22, 2025: With the coexistence period ending on 22 November 2025, Swift is committed to supporting the community’s migration to this key milestone

- Post-2025: All cross-border payment instructions must use ISO 20022 format

Financial institutions must prepare for this transition by updating their systems, processes, and testing procedures to ensure seamless adoption of the new messaging standard.

2025 SWIFT Customer Security Controls Framework (CSCF) Update

The SWIFT Customer Security Programme (CSP) continues to evolve to address growing cybersecurity threats. The 2025 CSCF update represents a strategic stabilisation phase with several important changes:

Key Changes in CSCF v2025:

1. Stabilization Phase: The 2025 SWIFT CSP update introduces no new mandatory controls. Swift has deliberately chosen to stabilize the framework after several years of increasing security requirements.

2. Control 2.4A – Back Office Data Flow Security:

- Remains advisory in 2025 but will become mandatory by 2026

- New milestone timelines introduced:

- 2026: Bridging servers between secure zones and back-office systems must be protected

- 2026: New direct flows must adopt security-by-design principles

- 2028 (tentative): Legacy flows will also require protection

3. Expanded Scope:

- Introduction of “customer client connector” as a new advisory component

- Includes endpoints like API consumers, middleware, or file transfer clients

- Will become mandatory in CSCF v2026

4. Enhanced Implementation Guidance:

- Clarified co-hosting rules for environment protection controls

- Updated virtual desktop references for Architecture B

- Reinforced that flows may span on-premise and cloud environments

Strategic Recommendations:

- Conduct gap analysis for Control 2.4A implementation

- Identify and assess all customer client connectors

- Ensure compliance with existing mandatory controls

- Plan for 2026 and beyond changes

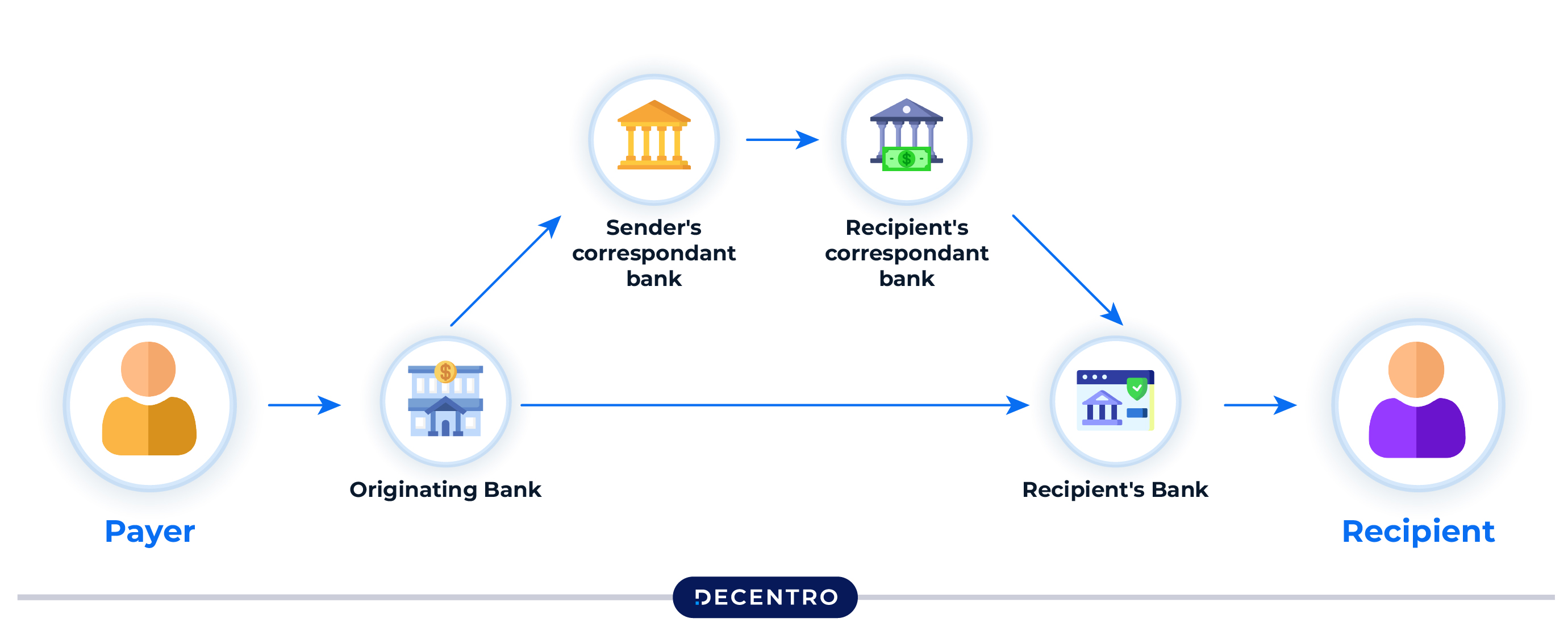

Example of a SWIFT Transaction

Think of SWIFT as an electronic messenger between banks. The sender and the recipient each have accounts set up for the other. For instance, Bank of America will open an account with Deutsche Bank, depositing funds to cover any SWIFT payment requests. Deutsche Bank will, in turn, open an account at Bank of America.

The account holding the money is called a “Nostro” account by the bank depositing the money. The recipient institution calls that account a “Vostro” and keeps a matching ledger. Each member institution has its own Nostro account. The SWIFT network is used to send messages to transfer money.

This process does not require International wire transfers because the funds to cover SWIFT payments have already been deposited in the recipient bank. Completing the transfer request moves funds from one Nostro to another and distributes them to the end recipient.

Example #1: Two-party SWIFT transaction

For the sake of simplicity, let’s call this a transaction between a US and a UK bank. The trade relationship between the two countries was estimated at $273 billion in 2019, so this is a common occurrence. A SWIFT communication initiates the following:

- Bank US debits the client’s bank account

- Bank US credits their Bank UK Nostro account

- Bank UK debits Bank US Nostro account

- Bank UK credits end-user (customer) account

Bank UK will register the transaction in their Vostro account ledger, which should match the corresponding Nostro ledger kept by Bank US. This provides instructions and a set of checks and balances to ensure the account is balanced correctly.

Example #2: Three-party SWIFT transaction:

In cases where the two institutions are not SWIFT members, the SWIFT network can still be used if a third party, a member, is brought in. There are additional fees charged for this, of course. Here’s a scenario like that:

- Bank US debits the client’s bank account

- Bank US credits Nostro account opened at Deutsche Bank (our third party)

- Deutsche Bank debits new Bank US Nostro account

- Deutsche deducts a fee for its services.

- Bank UK debits Deutsche Bank’s Nostro account (minus the fee)

- Bank UK credits end-user (customer) accounts

In this case, Deutsche Bank keeps the Vostro account ledger. Opening a Nostro account at Deutsche Bank allows Bank US to do additional business with other SWIFT Network members.

This is basically how the network has grown over the years.

Ownership and Usage of SWIFT

SWIFT is not owned by any single entity. Instead, it is a member-owned cooperative whose shareholders represent around 3,500 member organisations. Headquartered in La Hulpe, Belgium, the system is overseen by the central banks of the G10 countries, the European Central Bank, and the National Bank of Belgium. SWIFT shareholders elect a board of 25 directors who govern the organisation and oversee the management of the SWIFT system.

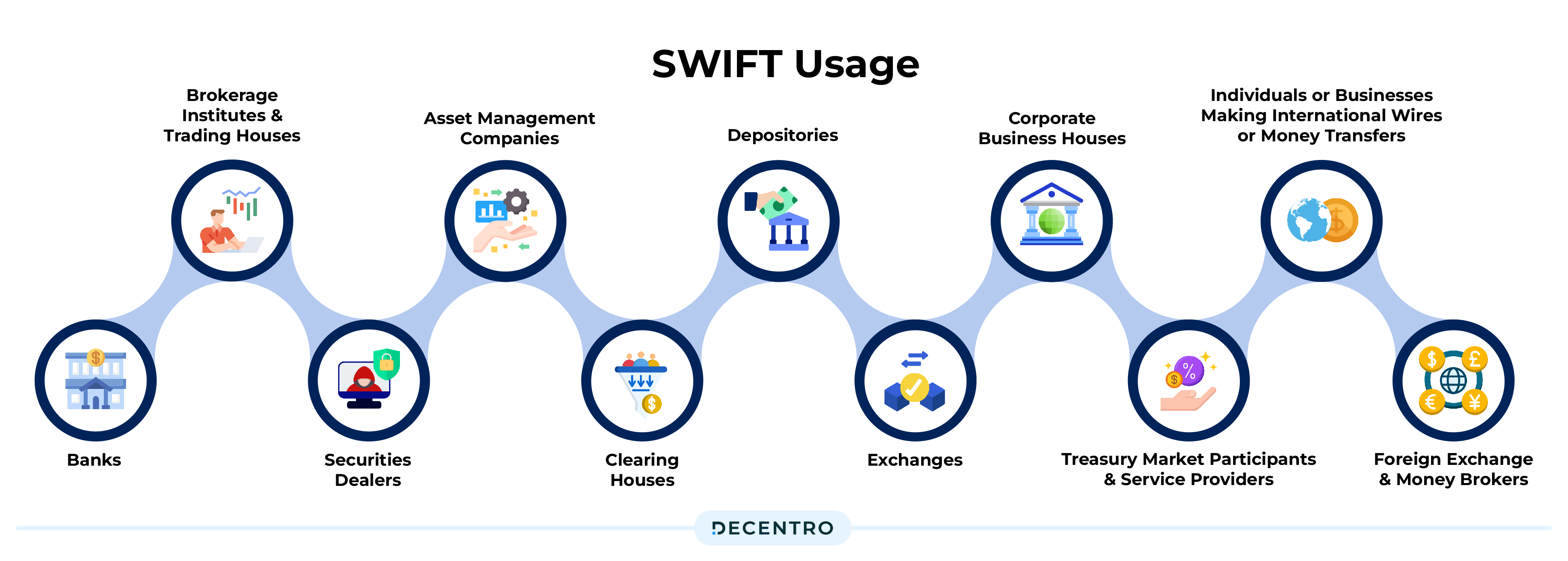

Initially, SWIFT founders designed the network to facilitate communication only about treasury and correspondent transactions. The robustness of the message format design allowed for the considerable scalability through which SWIFT gradually expanded to provide services to the following:

- Banks

- Brokerage institutes and trading houses

- Securities dealers

- Asset management companies

- Clearinghouses

- Depositories

- Exchanges

- Corporate business houses

- Treasury market participants and service providers

- Individuals or businesses making international wires or money transfers

- Foreign exchange and money brokers

Revenue streams for SWIFT

SWIFT generates revenue from membership fees, service fees, and additional subscription services such as screening, business intelligence, reference data, and compliance auditing.

Membership fees

When joining SWIFT, all members must pay a one-time joining fee. Additionally, they are subject to annual support charges that vary based on their member class. The annual fees range from 6,000 to 15,000 EUR and are determined by the volume ranges and degree of assistance contracted with SWIFT.

Service fees

Apart from membership fees, financial institutions pay service fees to SWIFT.

These fees are charged for each message sent or received through the SWIFT network. The charges are based on factors such as the message type and length. The volume of messages generated by each bank also influences the fees. Different charge tiers exist to accommodate banks with varying message volumes.

Additional services

SWIFT offers various services that financial institutions can subscribe to for an extra fee. These services include access to sanctions screening, business intelligence, reference data, and compliance services.

Financial institutions may utilise these supplementary services to enhance their operational capabilities and regulatory compliance efforts. The fees associated with these additional services provide SWIFT with additional revenue streams beyond its core messaging services.

By diversifying its revenue sources through membership fees, service fees, and additional services, SWIFT maintains its financial sustainability while innovating and offering valuable solutions to the global financial industry.

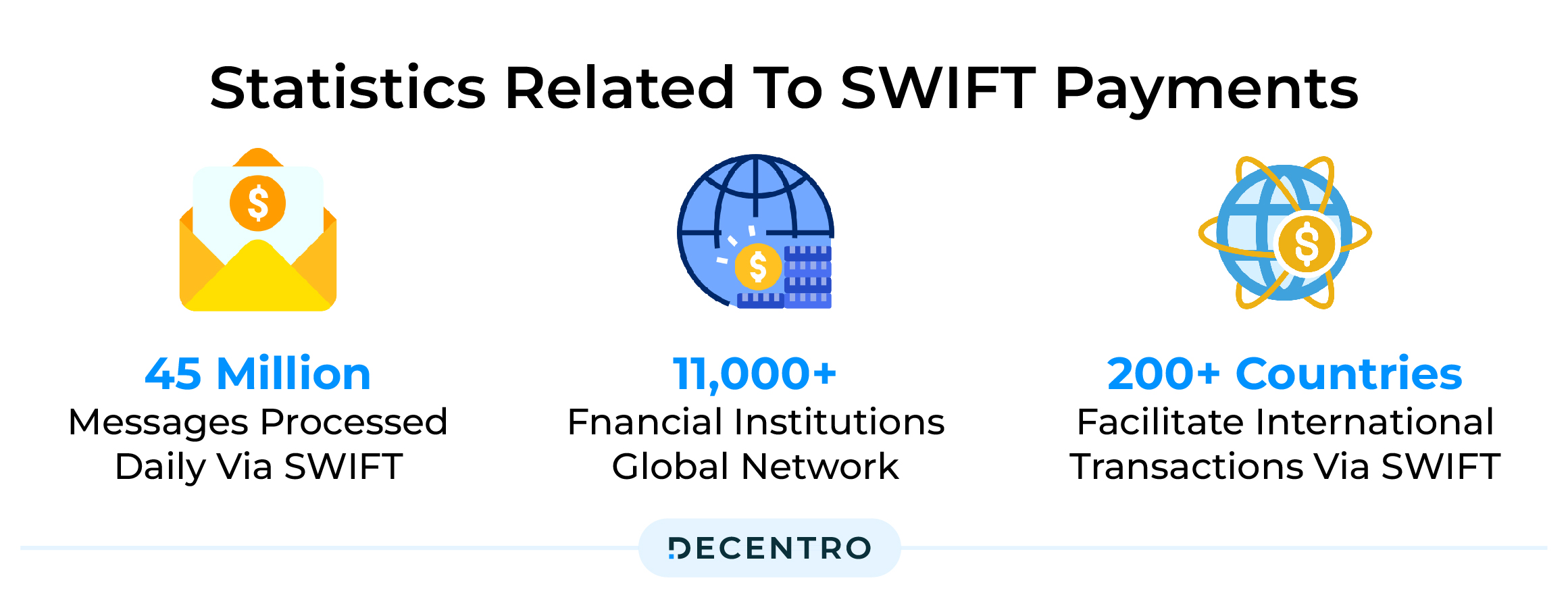

Statistics related to SWIFT Payments

To further emphasise the magnitude of SWIFT’s role in global finance, let’s look at some key statistics:

- SWIFT processes an average of 45 million daily messages, demonstrating its platform’s immense volume of financial transactions.

- Over 11,000 financial institutions are connected to SWIFT, making it a global network.

- SWIFT’s presence extends to more than 200 countries and territories, facilitating international transactions globally.

- As of December 2022, Swift had recorded an average of 44.8 million FIN messages (payments and securities transactions) per day during the year, a year-on-year rise of 6.6%.

Why are SWIFT Payments dominant?

When you standardise a process, its adoption is a given. With over 50 years of operation, SWIFT remains integral to the global financial system. As the world of finance continues to evolve with new technologies and challenges, SWIFT is adapting, ensuring that it remains relevant in a rapidly changing environment.

Additionally, SWIFT is also expanding its scope. Although it started primarily for simple payment instructions, SWIFT now sends trillions of messages for actions ranging from security and treasury transactions to trade and system transactions.

A SWIFT report from January 2022 showed that only 44.5% of SWIFT traffic is still for payment-based messages, while 50.6% represents security transactions. The remaining traffic flows to treasury, trade and system transactions.

However, there is a catch.

Comparison: SWIFT vs SEPA vs ACH

Understanding different payment systems helps businesses and individuals choose the right method for their needs:

| Feature | SWIFT | SEPA | ACH |

| Geographic Scope | Global (200+ countries) | European Union + associated countries | United States |

| Processing Time | 1-5 business days | Instant to 1 business day | Same day to 3 business days |

| Cost | High ($15-50+ per transaction) | Low (€0.01-2 per transaction) | Low ($0.20-1.50 per transaction) |

| Currency | Multi-currency | Euro (EUR) only | US Dollar (USD) primarily |

| Transaction Limits | No standard limit | €100,000 for instant payments | $1,000,000 for same-day ACH |

| Use Cases | International wire transfers | European payments | Domestic US payments |

| Settlement | Real-time gross settlement | Real-time or batch | Batch processing |

| Regulatory Oversight | Various national regulators | European Central Bank | Federal Reserve |

The Limitations of Cross-Border Payments

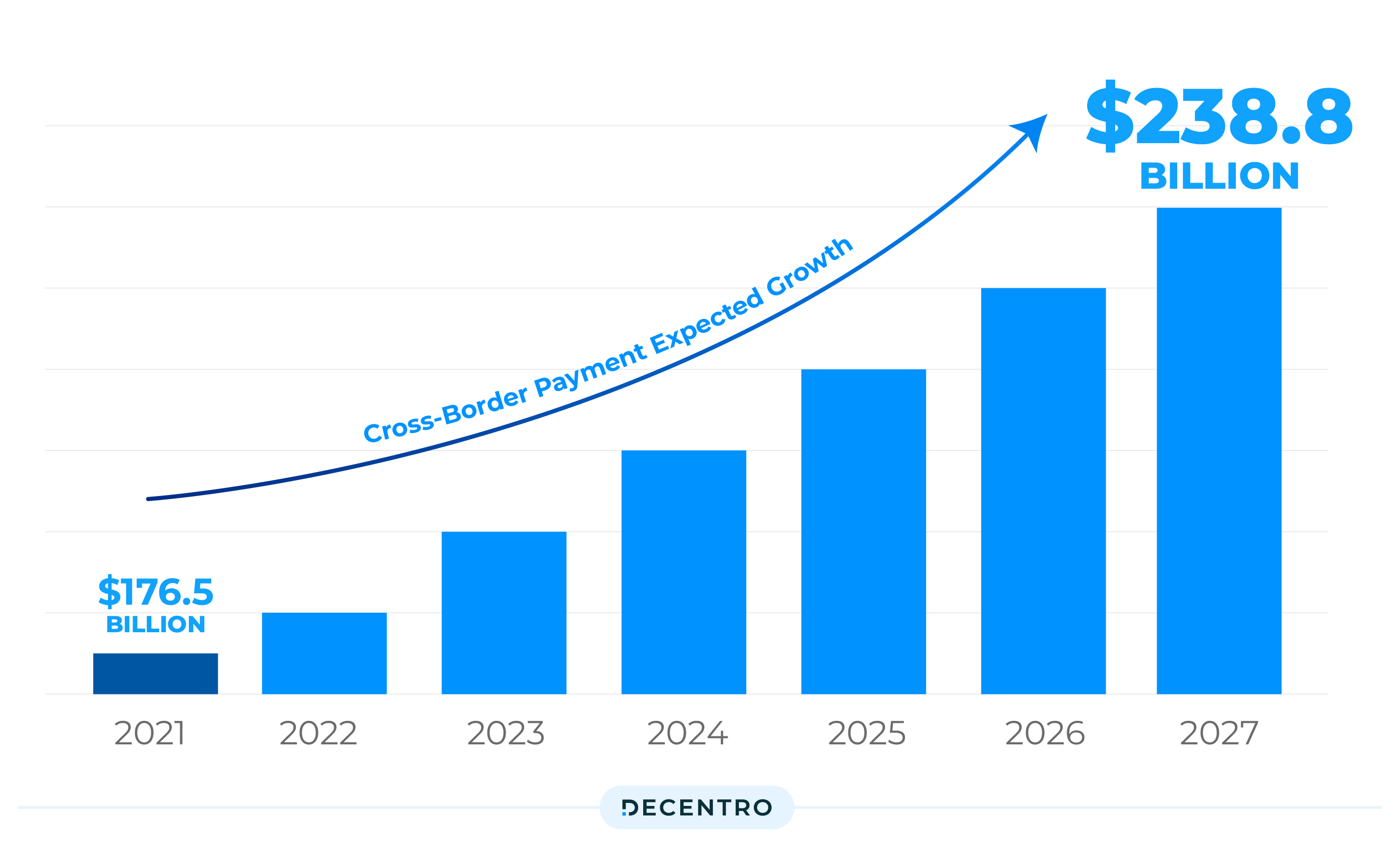

The modern economy heavily relies on cross-border payments. The cross-border payment volume is expected to grow from $176.5 billion in 2021 to $238.8 billion in 2027. The compound annual growth rate (CAGR), in turn, has the potential to reach 5.3%.

When you involve the cross-border game, a few limitations of this seemingly unshaken transmission network emerge.

High fees are one of the main concerns. Banks typically charge commissions for international money transfers. Sometimes, the costs can be significant, especially for smaller transfers or transfers involving less common currency pairs.

Transfer time is another widespread concern. Cross-border transfers via SWIFT can take several days to complete, as they have to go through numerous intermediary banks and undergo lengthy reviews and processing.

So, what is the Road Ahead?

The continued development of efficient, cost-effective, and secure global payment systems is vital for sustaining and enhancing the interconnectedness of economies worldwide. Thus, it’s only fair that the old models adopt advanced tech or fall behind in this race to enable hassle-free transactions.

First, we have Distributed Ledgers

With its ability to enable transactions with minimal fees, blockchain poses a potential disruptor for cross-border funds transfer systems like SWIFT so much that we have had multiple challengers from the crypto world, consistently working to make transactions cheaper and faster between borders.

For example, Ripple markets a faster and cheaper cross-border payment system through its token XRP; Meta tried to break in with its stablecoin Libra; and central banks worldwide are looking into their digital currencies as a potential solution to inefficient cross-border payments.

In-House Infrastructure from APAC:

In Asia, central banks are working tirelessly to build bilateral real-time cross-border payment rails, making it possible to send retail payments internationally using a mobile number.

In-house technology and infrastructure built on nation-to-nation partnerships have proven fruitful in the last few years, especially in the APAC region.

The first global event was the May 2021 linkage of Singapore’s and Thailand’s respective QR code-based real-time retail payment systems, PayNow and PromptPay. A month later, Thailand and Malaysia completed the first phase of connecting their respective PromptPay and DuitNow systems. PayNow and DuitNow will be linked in phases. Further, Singapore linked PayNow to India’s United Payments Interface (UPI) in February of 2023.

However, building a faster and more efficient alternative to SWIFT is ongoing. As mentioned, SWIFT has also been evolving and adapting to remain relevant in the ecosystem.

What’s next for SWIFT payments?

One positive development from SWIFT’s rising competition is that the organisation has had an impetus to address some of the consistent pain points of its services. As a result, we have the following initiatives to address the cost-effectiveness and flow of money issues with the network.

SWIFT GPI

SWIFT introduced the Global Payments Innovation (GPI) initiative 2017, recognising the

need for faster and more transparent cross-border payments. With SWIFT GPPI, the payments are carried out on the same day the payment process is initiated (depending on operating hours); most of the time, it takes minutes or seconds. Nearly half of GPI payments are completed within 30 minutes, 40% in under 5 minutes, and almost all GPI payments are credited within 24 hours.

SWIFT Go

Subsequently, In 2021, it launched SWIFT Go for low-value cross-border SME payments. Swift Go is similar to Swift GPI, with one key distinction: Where Swift GPI is designed to support high-value payments and all the various fees applied to them, Swift Go supports low-value payments, guaranteeing that the ultimate beneficiary receives the instructed principal amount. As a result, the target audience for Swift Go is individuals and small- and medium-sized businesses.

Because this is a SWIFT initiative, it was easy to get banks to sign on: About 600 lenders in 120 countries are currently part of the network. 85% of the payments made on SWIFT Go are completed in three minutes or less.

CBDC Connect

Amid the Distributed Ledgers chaos, SWIFT has been busy testing an interoperability solution to enable domestic central bank digital currencies (CBDCs) for cross-border payments. It recently ran 12 weeks of successful sandbox simulations with the French, German and Singaporean central banks and 15 commercial banks. SWIFT’s role in the initiative is to offer a hub for the interlinking solution in which messages are sent between parties. CBDCs never leave their domestic networks.

The next step is a beta phase. Meanwhile, the sandbox will focus on different use cases, such as settlement of securities transactions, trade finance and conditional payments.

How do you, as a business, foray into Global Payments?

Across the three developments, the underlying robustness of this now 50-year-old network shines through. Whether banking on its rails or leveraging the network that comes with it, SWIFT remains indispensable for cross-border transactions.

Now, if you as a business want to expand into the territory of global payments, understanding how cross-border transactions work, including any infrastructure developments and current regulations attached to them, is integral to successfully expanding your global footprint.

However, international payments can be complicated when a business manages them by itself, so getting a reliable and dedicated partner on board is worth ensuring you’re on the right track to being compliant and efficient with your fund flow.

Decentro’s payment products empower platforms to send and accept money via domestic and SWIFT payment methods in the supported countries.

Leverage Payout APIs to disburse funds to vendor accounts in different countries/currencies. Use our FX Calculator to get real-time exchange rates and plan your international transfers effectively.

How can we enable your cross-border payment flow?

Frequently Asked Questions

How does a SWIFT transaction work?

A SWIFT transaction works through a secure messaging network where banks communicate payment instructions. The sending bank initiates the transaction by debiting the customer’s account and sending a standardised SWIFT message containing transaction details to the receiving bank. The receiving bank then credits the beneficiary’s account. SWIFT doesn’t transfer money directly but facilitates secure communication between financial institutions through pre-established correspondent banking relationships.

What are the disadvantages of SWIFT payment?

The main disadvantages of SWIFT payments include high transaction fees ($15-50+ per transfer), slow processing times (1-5 business days), limited transparency during processing, potential for delays due to intermediary banks, compliance and regulatory scrutiny, and cut-off times that can delay same-day processing. Additionally, smaller transactions may be cost-prohibitive due to fixed fees, and the system relies heavily on correspondent banking relationships.

How do you make a SWIFT payment?

To make a SWIFT payment, you need to provide your bank with the beneficiary’s full name and address, the receiving bank’s SWIFT/BIC code, the beneficiary’s account number or IBAN, transaction amount and currency, and the purpose of payment. Visit your bank branch or use online banking, fill out the international wire transfer form, pay the associated fees, and receive a reference number for tracking. The bank will then send the SWIFT message to process your payment.

Can money be lost in a SWIFT transfer?

While rare, money can be delayed or misdirected in SWIFT transfers due to incorrect beneficiary information, invalid SWIFT codes, compliance holds for sanctions screening, or technical issues. However, SWIFT transfers are generally secure and traceable. If funds don’t reach the intended recipient, banks can initiate a trace to locate the funds. The money isn’t typically “lost” permanently but may be returned to the sender after investigation, though this process can take several weeks.