Simplify financial management with integrated accounting & payment tools. Reduce errors, enhance cash flow & automate GST compliance. Read our in-depth guide and get started.

Streamlining Business Operations with Integrated Accounting and Payment Solutions

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Are you a busy business owner juggling multiple responsibilities – managing inventory, maintaining financial records, tracking payments, and meeting compliance requirements while maintaining customer satisfaction? It feels overwhelming with multiple things on your plate, especially when inefficiencies and errors creep into your daily operations.

Among all these, managing financial records and ensuring seamless payment transactions are key tasks in business accounting. This article will discuss how you can manage both with a single solution – The Integrated Accounting and Payment solutions.

By automating financial tasks and ensuring seamless interaction between accounting records and payment systems, the Integrated Accounting and Payment solutions combine accounting functionalities with payment processing capabilities.

They enable businesses to streamline operations, reduce manual errors, and enhance productivity. Let’s try understanding integrated accounting and payment solutions, their importance, benefits, and key considerations for adopting them to create a more streamlined business model.

An Overview of Integrated Accounting and Payment Systems

Integrated accounting and payment solutions combine accounting software with payment processing systems, creating a unified platform to manage financial transactions and records. These solutions eliminate the need for separate systems to handle accounting, invoicing, and payment processing. This enables businesses to automate repetitive tasks and get quality time to focus on other growth activities.

For example, accounting software like myBillBook has gained popularity in India due to its seamless integration capabilities with payment gateways. These tools cater specifically to the needs of Indian businesses, ensuring compliance with GST and other regulatory requirements.

The Need for Integration

- To Simplify Financial Management: Managing finances using manual methods or using separate systems for each process may not be efficient as it might result in errors and consume more time. Integrated solutions bring all financial information together in one place, which helps to keep things accurate and easy to access. This not only improves the reliability of the data but also reduces the amount of paperwork to handle.

- To Stay Compliant with GST Regulations: GST compliance is a significant concern for businesses in India. Integrated solutions ensure accurate GST calculations, timely filing of returns, and generation of GST-compliant invoices, minimising the risk of penalties.

- For Enhanced Customer Experience: Seamless payment options, automated invoicing, and quicker transaction processing enhance the customer experience, fostering trust and loyalty.

- Cost Efficiency: By automating processes and reducing manual intervention, integrated systems help businesses save on operational costs while improving accuracy and efficiency.

Key Benefits of Integrated Accounting and Payment Solutions

1. Automation of Processes

Integration eliminates repetitive tasks by automating processes like invoicing, payment reconciliation, and financial reporting. For agencies handling invoicing, expense tracking, and payment processing, adopting an all-in-one software for managing agencies ensures efficiency, minimizes errors, and enhances financial visibility. This allows business owners to focus on growth while their financial operations run smoothly in the background

2. Real-Time Insights

Integrated solutions provide businesses with real-time data on cash flow, outstanding payments, and financial performance. This visibility enables better decision-making and strategic planning.

3. Improved Cash Flow Management

Businesses can maintain a healthy cash flow by streamlining payment collection and reconciliation. Automated reminders for pending payments ensure timely collections, reducing the risk of bad debts.

4. Enhanced Security

Reputed integrated solutions comply with industry data security standards, ensuring financial information safety. Features like two-factor authentication and encryption provide an additional layer of protection.

5. Scalability

As businesses grow, their financial management needs become more complex. Integrated solutions are scalable, accommodating increased transaction volumes and additional users without significant infrastructure change.

Key Considerations While Adopting Integrated Solutions

1. Assess Your Business Needs

Before investing in an integrated solution, businesses must assess their specific requirements. For instance, a small retail shop may prioritise easy GST invoicing and payment collection, while a manufacturing unit might need inventory tracking alongside accounting.

2. Ease of Use

The solution should be user-friendly, requiring minimal training for employees. A complex system can lead to resistance and underutilisation.

3. Compliance Features

Given the regulatory landscape in India, the solution must support GST compliance, including e-invoicing, GST return filing, and reconciliation with the Goods and Services Tax Network (GSTN).

4. Integration with Existing Systems

The chosen solution should integrate seamlessly with existing business tools, such as CRM software or e-commerce platforms, to ensure smooth operations.

5. Vendor Support and Training

Reliable vendor support and training are crucial for a smooth transition. Businesses should choose vendors offering robust customer service and regular updates.

Challenges in Implementation

While integrated accounting and payment solutions offer numerous benefits, their implementation comes with challenges:

- Initial Costs: The upfront investment in software and training can be significant, especially for small businesses.

- Resistance to Change: Employees accustomed to traditional methods may resist adopting new systems.

- Data Migration: Transferring data from legacy systems to the new platform can be time-consuming and prone to errors.

- Cybersecurity Concerns: As these solutions handle sensitive financial data, businesses must ensure robust cybersecurity measures are in place.

Popular Integrated Solutions in India

Several integrated accounting and payment solutions are tailored to the Indian market. Here are some noteworthy examples:

1. TallyPrime

TallyPrime is a widely-used accounting software in India, known for its GST compliance features. It integrates with payment gateways, enabling automated payment reconciliation and reporting.

2. Zoho Books

Zoho Books offers a comprehensive suite of tools for accounting, invoicing, and payment processing. Its integration with UPI and other payment systems makes it ideal for Indian businesses.

3. myBillBook

Designed for small and medium businesses, myBillBook simplifies GST invoicing, inventory management, and payment collection. It supports integration with payment gateways like Razorpay and Paytm.

4. QuickBooks Online

QuickBooks Online is another popular choice, offering features like GST compliance, automated invoicing, and real-time financial tracking. It is particularly suitable for startups and small businesses. It also integrates with hundreds of apps, e.g. QuickBooks with Google Sheets, BI tools, or even AI tools, to leverage accounting analytics.

5. Marg ERP

Marg ERP provides solutions for inventory, accounting, and GST compliance. Its integration with e-commerce platforms and payment gateways makes it a versatile choice for retailers and distributors.

6. Decentro

Decentro, a leading Banking-as-a-Service (BaaS) platform in India, offers API-based solutions for businesses to simplify their financial processes. Their services include virtual accounts, real-time payment collections, and KYC verification. By integrating Decentro’s APIs, businesses can automate payments, streamline reconciliation, and ensure compliance. For instance, an e-commerce company can leverage Decentro to set up virtual accounts for customers, enabling faster and error-free transactions.

Steps to Implement Integrated Solutions

1. Identify Pain Points

Analyze existing processes to identify inefficiencies and areas for improvement. This assessment will help select a solution that addresses specific challenges.

2. Research and Shortlist Vendors

Evaluate different solutions based on features, scalability, and cost. Consider seeking recommendations or reading reviews to make an informed decision.

3. Plan Data Migration

Ensure that all financial data from legacy systems is accurately transferred to the new platform. Conduct thorough testing to validate the integrity of migrated data.

4. Train Employees

Provide comprehensive training to employees on using the new system. This step is crucial to ensure smooth adoption and utilization.

5. Monitor and Optimize

Regularly monitor the system’s performance and gather feedback from users. Use this feedback to optimize processes and address any issues. A QR code Generator can simplify this by enabling quick scans for feedback collection, payment confirmations, or invoice tracking. This seamless integration reduces manual errors and enhances efficiency.

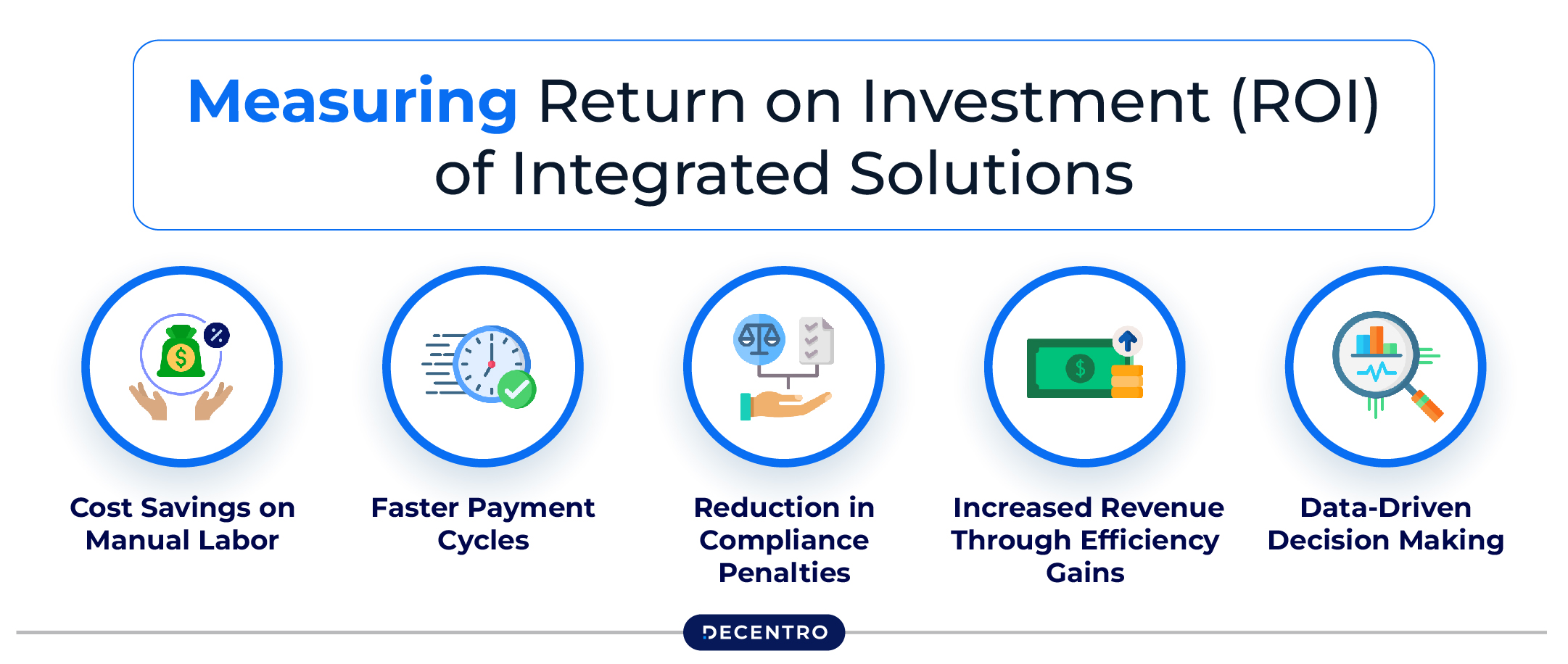

Measuring Return on Investment (ROI) of Integrated Solutions

Implementing an integrated accounting and payment solution requires an upfront investment, but businesses must evaluate its long-term financial impact. Understanding the return on investment (ROI) can help justify the costs and ensure strategic alignment with business goals.

1. Cost Savings on Manual Labor

Automating accounting and payment processes reduces the need for manual data entry, invoice management, and reconciliation. Businesses save on labor costs while minimizing human errors that could lead to financial discrepancies.

2. Faster Payment Cycles

Integrated systems streamline payment collection, reducing the time between invoice generation and actual payment receipt. Businesses can experience improved cash flow and reduced outstanding receivables, which positively impacts working capital.

3. Reduction in Compliance Penalties

With automated GST calculations and timely filing reminders, businesses can avoid penalties for late or incorrect tax filings. This not only ensures regulatory compliance but also prevents unnecessary financial losses.

4. Increased Revenue through Efficiency Gains

By improving operational efficiency, businesses can allocate more resources to revenue-generating activities. Time saved on financial management allows entrepreneurs to focus on business expansion and customer acquisition.

5. Data-Driven Decision Making

Real-time financial insights enable business owners to make informed decisions, reducing risks and optimizing resource allocation. This leads to smarter investments and sustainable growth.

Future Trends in Integrated Solutions

1. Artificial Intelligence (AI) Integration

AI-powered features like predictive analytics and automated fraud detection are becoming increasingly common, enhancing the efficiency and security of integrated solutions.

2. Blockchain Technology

Blockchain has the potential to revolutionize payment processing by providing a secure and transparent platform for transactions.

3. Cloud-Based Solutions

Cloud technology enables businesses to access their financial data anytime, anywhere. As more organizations adopt cloud-based accounting platforms, it’s crucial to ensure that these digital environments remain secure from emerging cyber threats. Exploring modern AI security solutions can help proactively protect sensitive financial data and support safe integration of intelligent automation features. Cloud-based solutions also facilitate collaboration and reduce infrastructure costs.

4. Industry-Specific Solutions

As businesses demand more tailored features, industry-specific integrated solutions are expected to gain traction. For example, solutions for retail, healthcare, and manufacturing sectors will address unique operational needs.

Integrated accounting and payment solutions are transforming the way businesses manage their finances. By automating processes, improving accuracy, and ensuring compliance, these systems empower businesses to focus on growth and innovation.

While the initial investment and implementation challenges may seem daunting, the long-term benefits outweigh the costs. For Indian businesses navigating the complexities of GST and a dynamic market landscape, adopting integrated solutions is not just a convenience but a necessity.

Embracing these tools with careful planning and execution can unlock new levels of efficiency and competitiveness, paving the way for sustained success in an ever-evolving business environment.

In case you wish to solve a specific use case for your banking and infrastructure needs feel free to reach out to us at hi@decentro.tech