Discover the top 30 lending companies in India 2025. Compare NBFCs, fintech lenders & digital platforms offering personal & business loans.

30 Best Lending Companies in India in 2026

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

India’s lending landscape has undergone a dramatic transformation in recent years, with fintech companies revolutionising how individuals and businesses access credit. The digital lending ecosystem has exploded, with fintech companies now commanding a remarkable 52% market share in personal loans, fundamentally changing how Indians borrow money.

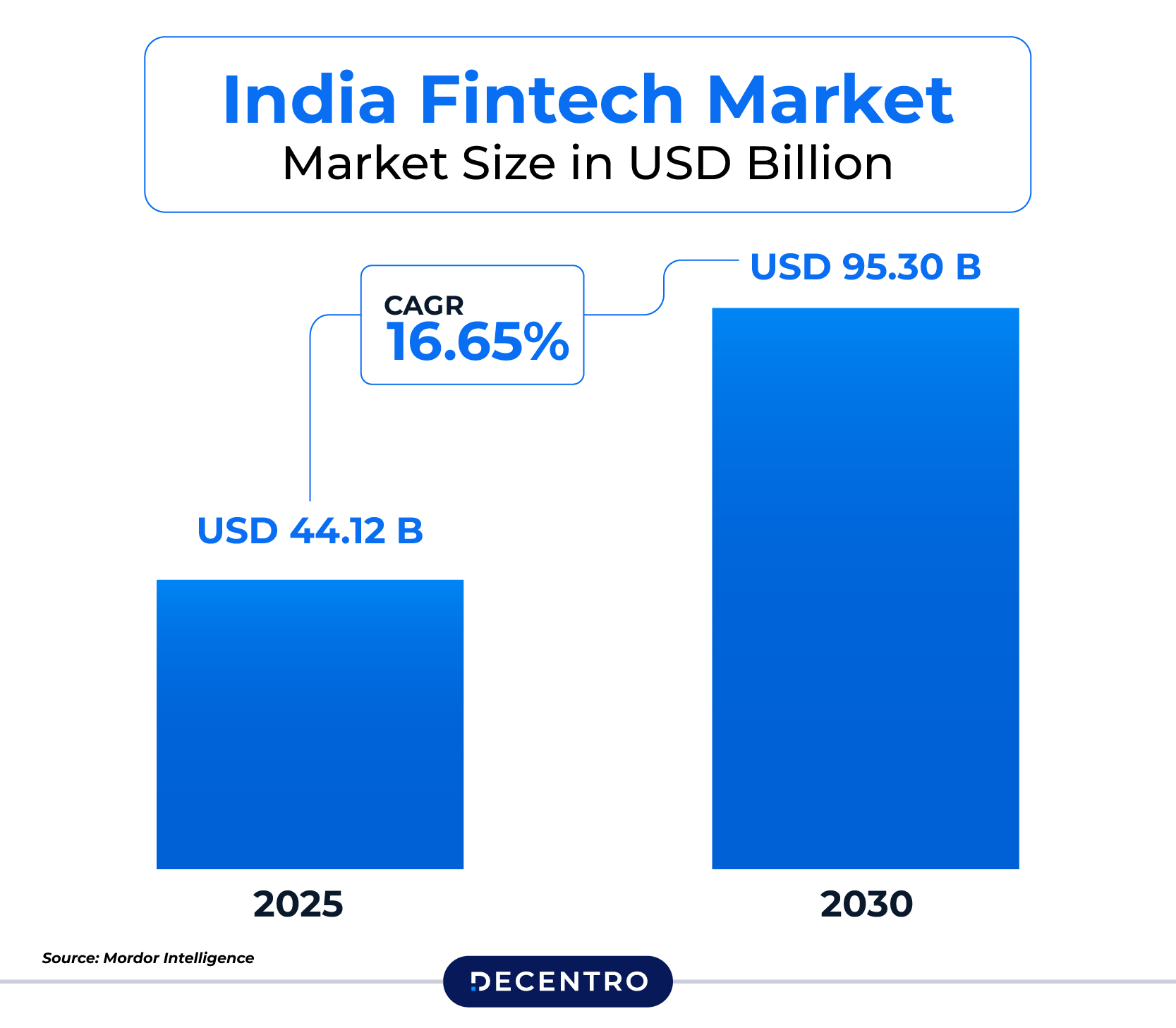

The Indian fintech market, valued at USD 44.12 billion in 2025, is projected to reach USD 95.30 billion by 2030, representing a robust 16.65% compound annual growth rate. This growth is driven by technological innovation, increasing smartphone penetration, and the government’s push toward digital financial inclusion.

A Quick Glance

| Platform | Value Proposition |

| Ugro Capital | Technology-focused SME lending platform with BSE/NSE listing and data-centric approach for loans ₹25K-₹3Cr |

| Paytm | Ecosystem-integrated lending with instant personal loans up to ₹10 lakhs for 350M+ digital wallet users |

| PhonePe | UPI leader offering seamless payment-integrated lending solutions with Walmart backing and instant approvals |

| BharatPe | Merchant-focused fintech providing same-day loan approvals up to ₹7 lakhs with QR code integration |

| FinAgg | AI-powered B2B lending platform trusted by 20+ corporate houses with loans up to ₹5 crores since 2020 |

| Mintifi | Supply chain finance specialist with technology-driven risk assessment and inventory financing for SMEs |

| Choice Finserv | Diversified NBFC with multiple loan products and established regional presence across customer segments |

| Fedfina | Pan-India diversified portfolio across gold, home, business and property loans with strong brand backing |

| Hedge Finance | Group company backing with diverse financial services focus and stable regional operations |

| Muthoot Fincorp Limited | Muthoot Group’s secured lending arm with strong brand trust and extensive physical branch network |

| Laxmi India Finance | 20+ years experience NBFC focusing on MSME, vehicle, business and personal loans with established operations |

| Varthana Finance | Education sector specialist providing loans to schools and educational institutions with niche expertise |

| WeRize | India’s first socially distributed financial services app reaching 2500+ cities through freelancer network |

| Geojit Credits | Group-backed lending solutions leveraging established Geojit Financial Services expertise and brand recognition |

| Vridhi Housing Finance | Affordable home loans specialist founded in 2022 with $55.8M funding and competitive interest rates |

| Criss Financial | Diverse customer segments with focus on credit solutions and comprehensive financial services |

| mPokket | Youth-focused lending app offering loans up to ₹45,000 for students and young professionals with minimal paperwork |

| TrueBalance | Mobile-first lending approach with instant personal loans and simple user interface for smartphone users |

| PayU Finance | Payment gateway-integrated lending serving 500K+ merchants with data-rich underwriting and platform partnerships |

| Aptus Value Housing Finance | Small business entrepreneur focus with ₹16,923 crore market cap and strong financial performance metrics |

| Rupifi | B2B buy-now-pay-later solutions with flexible payment terms and digital onboarding for trade credit |

| Muthoot Microfin | Muthoot Group’s microfinance arm focusing on women entrepreneurs and rural communities with group lending |

| Bajaj Finserv | India’s leading NBFC with extensive product portfolio, personal loans up to ₹40 lakhs and instant approvals |

| Capital First (IDFC First) | Banking infrastructure support with diverse lending products and regulatory backing post-merger |

| Tata Capital | Trusted Tata Group backing with comprehensive financial services and wide distribution network |

| Kotak Mahindra Bank | Banking infrastructure with personal loans up to ₹40 lakhs and competitive interest rates |

| Yes Bank | Banking regulatory framework with competitive rates, flexible loan terms and online applications |

| IIFL Finance | Diversified NBFC with strong market presence across home, business, personal and gold loans |

| Fullerton India | Established NBFC with diversified portfolio serving both retail and commercial segments nationwide |

| L&T Finance | L&T Group backing with infrastructure finance expertise and diversified financial services portfolio |

In this comprehensive guide, we’ll explore the top 30 lending companies in India that are shaping the future of credit accessibility, from traditional NBFCs embracing digital transformation to pure-play fintech disruptors.

Ugro Capital

Ugro Capital is a BSE and NSE listed, technology-focused small business lending platform that specializes in addressing the capital needs of small businesses across eight select sectors. The company uses customized loan solutions and data-centric approaches to serve underserved SME segments.

Pros:

- Technology-driven underwriting process

- Quick loan approvals for SMEs

- Sector-specific expertise

- Listed company with transparent operations

Cons:

- Limited to business lending only

- Focused primarily on select sectors

- Higher ticket sizes may not suit micro-businesses

Top Features:

- Loan amounts ranging from ₹25,000 to ₹3 crores

- Tenure options up to 12 months

- Secured and unsecured business loans

- Data-centric approach to risk assessment

Paytm

Paytm, one of India’s largest digital payment platforms, has expanded into lending services, offering personal loans, merchant cash advances, and buy-now-pay-later solutions. The company leverages its extensive ecosystem and massive user base to provide integrated financial services.

Pros:

- Massive user base and brand recognition

- Integrated ecosystem approach

- Quick loan processing through digital wallets

- Strong merchant network for business lending

Cons:

- Regulatory challenges in recent years

- Limited loan amounts for personal lending

- Higher interest rates compared to traditional banks

Top Features:

- Instant personal loans up to ₹10 lakhs

- Postpaid services and EMI options

- Merchant lending solutions

- Integration with Paytm ecosystem

PhonePe

PhonePe, backed by Walmart, is primarily known for UPI payments but has ventured into lending through partnerships, offering personal loans and merchant financing solutions. The company leverages its position as the largest UPI player to expand into financial services.

Pros:

- Largest UPI player with a massive user base

- Strong backing from Walmart

- Seamless integration with the payment ecosystem

- Quick loan approvals

Cons:

- Limited direct lending products

- Relies heavily on partner lenders

- Newer entrant in the lending space

Top Features:

- Personal loans through partner NBFCs

- Instant approval process

- UPI-integrated lending solutions

- Gold investment and lending options

BharatPe

BharatPe is a fintech company focused on merchant payments and lending, providing QR code-based payment solutions and working capital loans to small merchants and retailers. The company has built a strong presence in the merchant lending segment.

Pros:

- Strong focus on merchant segment

- Quick loan processing

- No collateral required for most products

- Simple onboarding process

Cons:

- Recent management and regulatory challenges

- Limited to small ticket loans

- Geographic concentration in urban areas

Top Features:

- Merchant cash advances up to ₹7 lakhs

- QR code payment acceptance

- Same-day loan approvals

- Flexible repayment options

FinAgg

FinAgg is a Series A company founded in 2020, operating as a developer of AI-based financial platforms focused on providing credit solutions for small and medium-sized businesses. The company is on a path to create and help finance India’s largest distributor and retailer network, with its platform trusted by over 20 of the largest corporate houses in India.

Pros:

- AI-powered lending decisions

- Strong corporate partnerships

- Focus on MSME and retailer segments

- Innovative “Stock Now Pay Later” model

Cons:

- Relatively new company (founded 2020)

- Limited geographical presence

- Dependent on corporate partnerships

Top Features:

- AI-based financial platform

- Supply chain financing solutions

- Invoice-based financing for MSMEs

- Loan amounts up to ₹5 crores

Mintifi

Mintifi is a supply chain finance platform that provides inventory financing and working capital solutions to SMEs, focusing on data-driven lending decisions. The company specializes in addressing the financing needs of businesses in the supply chain ecosystem.

Pros:

- Specialized in supply chain financing

- Quick turnaround times

- Technology-driven risk assessment

- Focus on underserved SME segment

Cons:

- Limited product portfolio

- Requires strong business fundamentals

- Higher cost of capital for some segments

Top Features:

- Inventory financing solutions

- Working capital loans

- Supply chain finance

- Digital onboarding process

Choice Finserv

Choice Finserv is an NBFC providing various lending solutions including personal loans, business loans, and other financial services. The company focuses on serving diverse customer segments with multiple loan products.

Pros:

- Diverse product portfolio

- Established NBFC operations

- Regional presence

- Multiple loan categories

Cons:

- Traditional approach in digital age

- Limited fintech innovation

- Regional concentration

Top Features:

- Multiple loan products

- NBFC backing

- Regional focus

- Traditional lending approach

Fedfina

Fedfina offers easy loans through its diversified product portfolios spread across Gold Loan, Home Loan, Business Loan & Loan Against Property. Fedbank Financial Services Ltd is committed to provide best products and services to its valuable customers with its dedicated team.

Pros:

- Diversified loan portfolio

- Multiple product categories

- Pan-India presence

- Strong brand backing

Cons:

- Traditional lending approach

- Limited digital innovation

- Dependency on physical branches

Top Features:

- Gold loans

- Home loans

- Business loans

- Loan against property

Hedge Finance

Hedge Finance is part of the Hedge Group, focusing on providing financial services and lending solutions. The company operates in the financial services sector with a focus on various lending products.

Pros:

- Group backing and stability

- Diverse financial services

- Regional presence

Cons:

- Limited public information available

- Traditional business model

- Regional concentration

Top Features:

- Group company backing

- Financial services focus

- Regional operations

Muthoot Fincorp Limited

Muthoot Fincorp Limited is part of the Muthoot Group, providing personal loans, business loans, and other financial services with a focus on secured lending. The company leverages the strong brand recognition and trust of the Muthoot Group.

Pros:

- Strong group backing and brand trust

- Diversified loan portfolio

- Physical branch network

- Established market presence

Cons:

- Traditional approach in digital age

- Limited fintech innovation

- Dependency on physical infrastructure

Top Features:

- Personal and business loans

- Secured lending options

- Branch network support

- Group brand strength

Laxmi India Finance

Laxmi India Finance is a financial service firm that offers MSME, vehicles, business loans, personal loans, and financial services. The company is a reputed Non-Banking Finance Company built with the vision of making the process of providing loan and advances easy and robust, with 20+ years of experience.

Pros:

- 20+ years of experience

- Diverse loan portfolio

- MSME focus

- Established operations

Cons:

- Traditional business model

- Limited digital presence

- Regional concentration

Top Features:

- MSME loans

- Vehicle financing

- Business loans

- Personal loans

Varthana Finance

Varthana Finance specializes in education sector financing, providing loans to educational institutions and supporting the growth of private schools across India. The company has carved a niche in the education financing space.

Pros:

- Sector specialization in education

- Understanding of education ecosystem

- Growing demand for education financing

- Niche market focus

Cons:

- Limited to education sector

- Dependent on education industry growth

- Sector-specific risks

Top Features:

- Education sector loans

- School infrastructure financing

- Specialized underwriting

- Education ecosystem focus

WeRize

WeRize is India’s first socially distributed full stack financial services app that manufactures & distributes customized lending, banking, group insurance, & savings products for 300Mn customers across India. Founded in 2019, WeRize is a fast-growing non-banking financial company (NBFC) that operates across India, offering tailored financial solutions to underserved and underbanked segments of the population.

Pros:

- Unique social distribution model

- Focus on underserved segments

- Full-stack financial services

- Innovative freelancer network

Cons:

- Relatively new company

- Dependent on freelancer network

- Complex business model

Top Features:

- Social distribution network

- Customized financial products

- 2500+ cities presence through freelancers

- Focus on underbanked segments

Geojit Credits

Geojit Credits is part of the Geojit Financial Services group, offering various lending and credit solutions. The company leverages the group’s financial services expertise to provide lending products.

Pros:

- Group backing from established financial services company

- Brand recognition

- Financial services expertise

Cons:

- Limited standalone presence

- Dependent on group operations

- Traditional approach

Top Features:

- Group company backing

- Financial services integration

- Credit solutions

Vridhi Housing Finance

Vridhi Home Finance is a Housing Finance Company (HFC) that offers various affordable home loans at best interest rates for every individual. The company was founded by Sunil Mehta and Ram Naresh Sunku in 2022 and has raised $55.8M in funding.

Pros:

- Specialized housing finance focus

- Affordable home loan products

- Recent funding for expansion

- Focus on individual customers

Cons:

- Limited to housing finance

- New company (founded 2022)

- Niche market focus

Top Features:

- Affordable home loans

- Housing finance specialization

- Individual customer focus

- Competitive interest rates

Criss Financial

Criss Financial operates as a lending company providing various financial services and credit solutions. The company focuses on serving diverse customer segments with financial products.

Pros:

- Diverse customer segments

- Financial services focus

- Credit solutions

Cons:

- Limited public information available

- Traditional business model

- Regional operations

Top Features:

- Credit solutions

- Financial services

- Customer segment focus

mPokket

mPokket is a personal loan app targeting college students and young working professionals, offering quick credit up to ₹45,000 with minimal documentation requirements. The company has created a niche in youth-focused lending.

Pros:

- Focus on underserved young demographic

- Quick approval process

- Minimal documentation

- Educational and age-appropriate lending

Cons:

- Limited loan amounts

- Higher interest rates

- Strict eligibility criteria

- Limited repayment tenure options

Top Features:

- Loans up to ₹45,000

- Quick approval within hours

- Minimal paperwork

- Student-friendly products

TrueBalance

TrueBalance offers instant personal loans and financial services through its mobile app, targeting smartphone users with quick credit solutions. The company operates with a mobile-first approach to lending.

Pros:

- Mobile-first approach

- Quick loan processing

- Simple user interface

- Growing user base

Cons:

- Limited loan amounts

- Higher interest rates

- App-dependent services

- Limited product range

Top Features:

- Instant personal loans

- Mobile app-based services

- Quick approval process

- Flexible repayment options

PayU Finance

PayU Finance leverages PayU’s payment gateway infrastructure serving over half a million merchants to provide credit solutions, focusing on MSME lending through data-driven approaches. The company uses payment data to make informed lending decisions.

Pros:

- Strong payment gateway integration

- Data-rich underwriting model

- Partnerships with major platforms

- Quick processing times

Cons:

- Relatively new in direct lending

- Limited product range

- Depends on payment gateway performance

Top Features:

- MSME-focused lending

- Payment gateway data integration

- Partnerships with PhonePe, BharatPe, Meesho

- Unsecured personal loans

Aptus Value Housing Finance

Aptus Finance India Private Limited is an NBFC registered with the Reserve Bank of India, focused on creating new economic opportunities for deserving small business entrepreneurs by giving loans for their business purposes. The company has a market capitalization of ₹16,923 crores and generates revenue of ₹1,876 crores with a profit of ₹799 crores.

Pros:

- Strong financial performance

- Focus on small business entrepreneurs

- RBI registered NBFC

- Established market presence

Cons:

- Limited to business lending

- Regional concentration

- Traditional business model

Top Features:

- Small business entrepreneur focus

- NBFC registration with RBI

- Strong financial metrics

- Business-focused lending

Rupifi

Rupifi provides B2B buy-now-pay-later solutions and working capital financing for businesses, focusing on trade credit and supplier financing. The company addresses the growing demand for B2B credit solutions.

Pros:

- B2B focus with growing demand

- Flexible payment terms

- Quick approval process

- Industry-specific solutions

Cons:

- Limited market penetration

- Dependent on B2B adoption

- Higher risk in economic downturns

Top Features:

- B2B buy-now-pay-later

- Trade credit solutions

- Supplier financing

- Digital onboarding

Muthoot Microfin

Muthoot Microfin is the microfinance arm of the Muthoot Group, providing small loans to women entrepreneurs and rural communities across India. The company focuses on financial inclusion and women empowerment through microfinance.

Pros:

- Strong rural presence

- Focus on financial inclusion

- Group backing and stability

- Women-centric lending approach

Cons:

- Limited to microfinance segment

- Lower ticket sizes

- Geographic concentration in South India

Top Features:

- Microfinance loans

- Women-focused lending

- Rural penetration

- Group lending model

Bajaj Finserv

Bajaj Finserv is one of India’s leading NBFCs, offering a wide range of lending products including personal loans, business loans, and consumer durable financing. The company is known for its quick approval processes and extensive product portfolio.

Pros:

- Strong brand recognition

- Extensive product portfolio

- Quick approval processes

- Wide distribution network

Cons:

- Higher interest rates

- Strict eligibility criteria

- Traditional business model

Top Features:

- Personal loans up to ₹40 lakhs

- Business loans

- Consumer durable financing

- Instant approval

Capital First (now IDFC First Bank)

Originally Capital First, now part of IDFC First Bank, this entity continues to provide various lending solutions including personal loans, business loans, and consumer financing. The merger has strengthened its position in the lending market.

Pros:

- Banking infrastructure support

- Diverse lending products

- Strong market presence

- Regulatory backing

Cons:

- Integration challenges post-merger

- Traditional banking approach

- Higher operational costs

Top Features:

- Personal and business loans

- Consumer financing

- Banking integration

- Multiple product categories

Tata Capital

Tata Capital is the financial services arm of the Tata Group, offering personal loans, business loans, consumer durable loans, and other financial services. The company leverages the trust and brand recognition of the Tata brand.

Pros:

- Strong brand trust (Tata Group)

- Comprehensive financial services

- Wide distribution network

- Established market presence

Cons:

- Traditional lending approach

- Limited digital innovation

- Higher interest rates in some segments

Top Features:

- Personal loans

- Business loans

- Consumer durable financing

- Tata brand backing

Kotak Mahindra Bank (Personal Loans)

Kotak Mahindra Bank’s personal lending division offers various loan products including personal loans, home loans, and consumer financing. The bank has established itself as a significant player in the retail lending space.

Pros:

- Banking infrastructure

- Regulatory backing

- Strong market presence

- Competitive interest rates

Cons:

- Traditional banking processes

- Lengthy approval procedures

- Strict documentation requirements

Top Features:

- Personal loans up to ₹40 lakhs

- Home loans

- Consumer financing

- Banking services integration

Yes Bank (Personal Loans)

Yes Bank offers personal loans and other lending products as part of its retail banking services. The bank focuses on providing competitive rates and flexible terms to its customers.

Pros:

- Banking regulatory framework

- Competitive interest rates

- Flexible loan terms

- Online application process

Cons:

- Past financial challenges

- Traditional banking processes

- Limited innovation

Top Features:

- Personal loans

- Flexible terms

- Online applications

- Banking integration

IIFL Finance

IIFL Finance is a diversified NBFC offering home loans, business loans, personal loans, and gold loans. The company has established itself as a significant player in the Indian lending market with a focus on multiple product categories.

Pros:

- Diversified loan portfolio

- Strong market presence

- Multiple product categories

- Established NBFC operations

Cons:

- Traditional business model

- Limited digital innovation

- Regional concentration in some products

Top Features:

- Home loans

- Business loans

- Personal loans

- Gold loans

Fullerton India

Fullerton India is an NBFC offering personal loans, business loans, and commercial vehicle financing. The company focuses on serving both retail and commercial segments with customized financial solutions.

Pros:

- Established NBFC presence

- Diversified product portfolio

- Both retail and commercial focus

- Strong operational network

Cons:

- Traditional lending approach

- Limited digital presence

- Higher interest rates in some segments

Top Features:

- Personal loans

- Business loans

- Commercial vehicle financing

- Customized solutions

L&T Finance

L&T Finance is the financial services arm of Larsen & Toubro, offering home loans, personal loans, business loans, and infrastructure financing. The company leverages the L&T brand strength and focuses on both retail and institutional lending.

Pros:

- Strong brand backing (L&T Group)

- Diversified financial services

- Infrastructure financing expertise

- Established market presence

Cons:

- Traditional business model

- Limited fintech innovation

- Focus on larger ticket sizes

Top Features:

- Home loans

- Personal loans

- Business loans

- Infrastructure financing

The Future of Lending in India

The Indian lending landscape is rapidly evolving with several key trends shaping the industry:

Digital Transformation: With fintech companies capturing 52% of the personal loans market, traditional lenders are being forced to digitize their operations and offer more competitive products. This transformation is creating a more competitive and customer-friendly lending environment.

Financial Inclusion: Digital lending platforms are reaching previously underserved segments, including rural areas, young professionals, and small businesses that struggled to access formal credit. Companies like WeRize and mPokket are specifically targeting these underbanked populations.

Regulatory Evolution: The Reserve Bank of India continues to refine regulations around digital lending, ensuring customer protection while fostering innovation. This balanced approach is crucial for sustainable growth in the sector.

Technology Integration: Artificial intelligence, machine learning, and alternative data sources are revolutionizing credit assessment, making lending more accurate and inclusive. Companies like FinAgg are leading this transformation with AI-powered platforms.

Sector Specialization: Many lending companies are focusing on specific niches – from education financing (Varthana) to supply chain finance (Mintifi) – allowing them to develop deep expertise and better serve targeted customer segments.

Social and Alternative Distribution: Innovative distribution models like WeRize’s freelancer network are making financial services accessible in remote areas without traditional banking infrastructure.

How Decentro Empowers the Lending Revolution

As India’s lending ecosystem continues to evolve, companies need robust financial infrastructure to build and scale their lending operations efficiently. The complexity of managing multiple banking relationships, compliance requirements, and payment processing can overwhelm growing lending companies.

Decentro provides comprehensive API-based financial infrastructure that enables lending companies to focus on their core business while we handle the technical complexity:

Streamlined KYC and Onboarding: Reduce customer acquisition costs with instant verification solutions that can process documents and validate customer information in real-time, helping companies like those featured in this list onboard customers faster.

Automated Payment Processing: Handle loan disbursals and collections seamlessly with our payment APIs that integrate with multiple banks and payment gateways, ensuring money moves efficiently throughout the lending lifecycle.

Access Real-time Financial Data: Make better lending decisions with enriched financial data APIs that provide comprehensive customer profiles, helping reduce default rates and improve portfolio quality.

Ensure Regulatory Compliance: Stay compliant with evolving RBI regulations through built-in compliance features that automatically adapt to regulatory changes, reducing compliance burden.

Scale Operations Effortlessly: Handle growing transaction volumes without infrastructure concerns, supporting lending companies from startup to enterprise scale.

Multi-banking Integration: Access multiple banking partners through a single API, providing redundancy and competitive pricing for lending operations.

Whether you’re a traditional NBFC looking to digitise like Muthoot Fincorp, or a fintech startup building the next lending unicorn like FinAgg, Decentro’s financial infrastructure APIs provide the foundation for sustainable growth in India’s $2.1 trillion fintech opportunity.

The lending companies featured in this guide are reshaping how Indians access credit, and with the right infrastructure partner, your company can be part of this transformation too.

Ready to revolutionize your lending operations?

Explore how Decentro can power your financial services platform and help you tap into the massive opportunity in India’s evolving lending landscape.