Deep-dive into the differences between Nodal, Current, and Escrow accounts for businesses in India and find the perfect fit for your financial needs.

Escrow, Nodal, or Current Account: What Suits Your Business Best?

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

If there is money movement involved, the opening of an account is given.

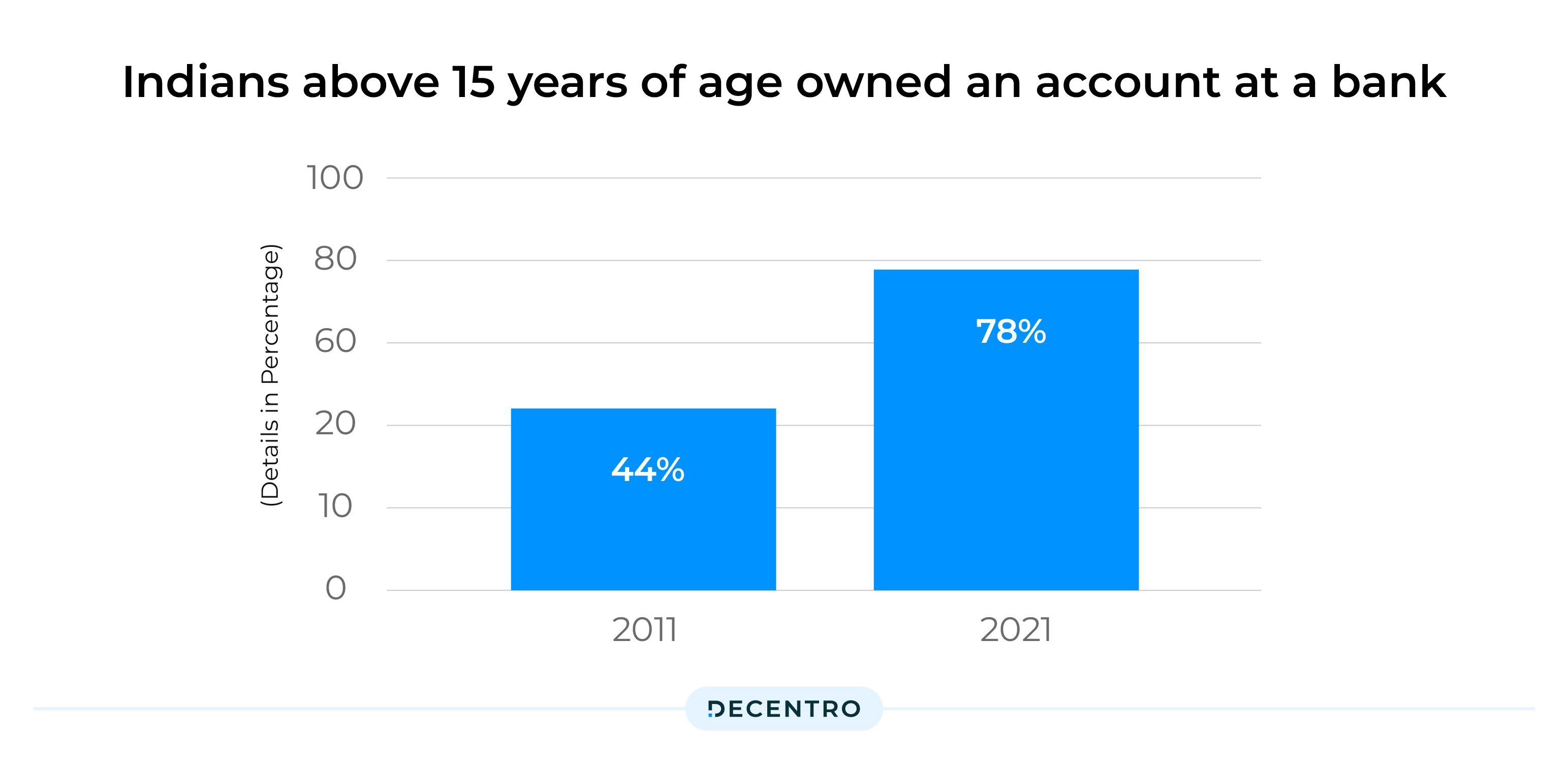

In 2021, about 78 per cent of Indians over 15 years old owned a bank account. This was a significant change from 44 per cent in 2011.

As an individual, the route is relatively straightforward via a Savings Account.

But what about businesses?

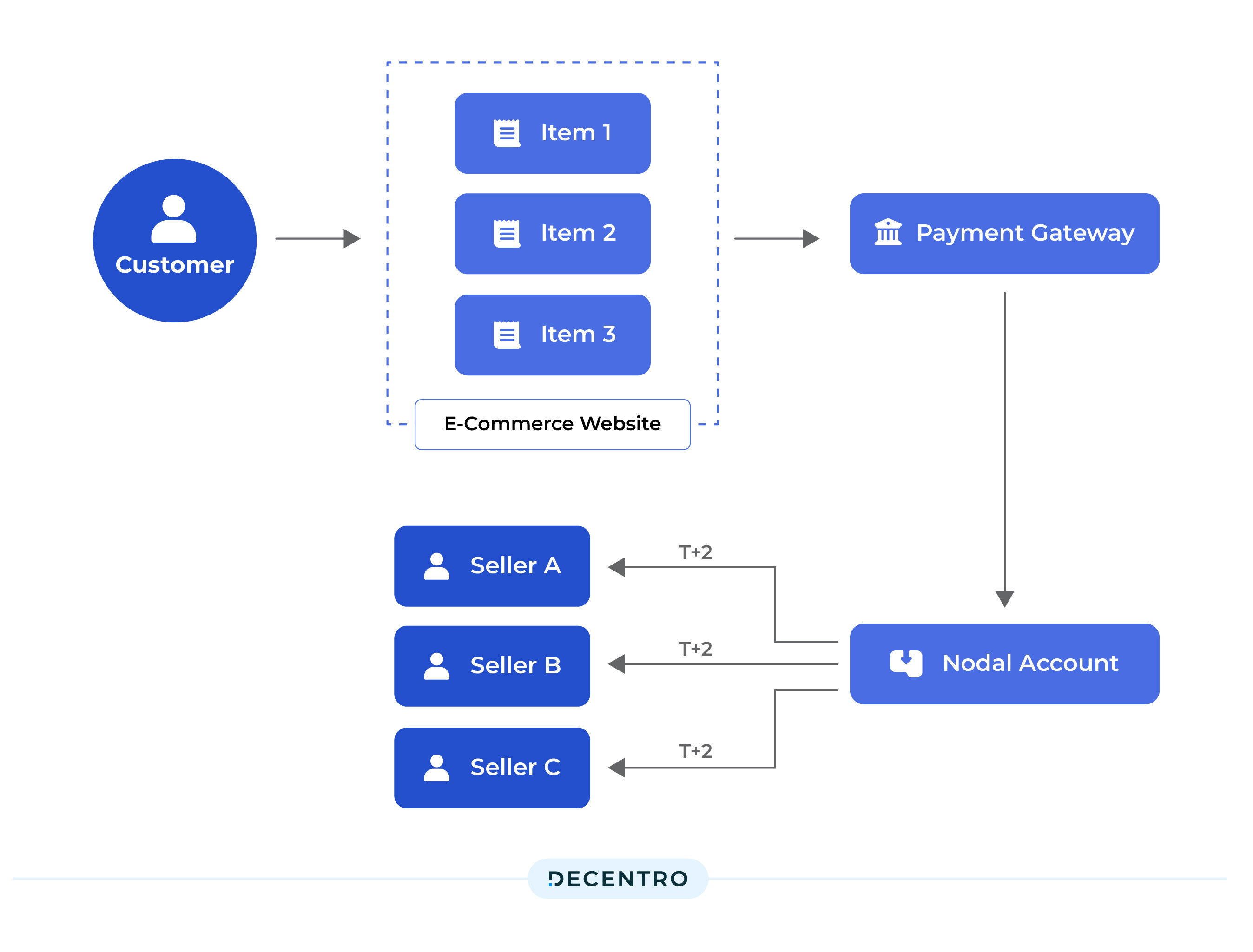

According to the Reserve Bank of India (RBI) guidelines, nodal accounts are mandatory for e-commerce websites. An online seller receiving money on behalf of the actual merchant must credit the same in these accounts. The RBI does not allow e-commerce websites to combine their sales proceeds with those received on behalf of other merchants.

So, do we go the conventional route and have nodal accounts set for business across?

But is there an account better suited for a particular business use case?

Before we conclude about the better-suited account type, let’s first look at the accounts running.

Primarily, there are three types of accounts that a business can operate on,

Nodal, Current and Escrow.

While Nodal and Escrow accounts operate the ethos of having a third-party intervention for fund holding and settlements, the Current Account routes all its payments via the said account.

Let’s now break down each of these laterals in detail.

What is a Nodal Account?

A nodal account is a particular-purpose account mandated by the Reserve Bank of India, used by businesses that act as intermediaries. In other words, this type of bank account is used primarily in the context of online marketplaces or payment aggregators. So, your online business would be an intermediary when you are acting as a middleman connecting two or more parties in a transaction. Either you are

- facilitating transactions,

- Providing a platform for interactions,

- Offering services that help bring buyers and sellers together

A nodal account guarantees that the money will never in any way become the intermediary’s property. The RBI mandated Nodal Accounts for intermediaries like aggregators, e-commerce platforms, and payment gateways.

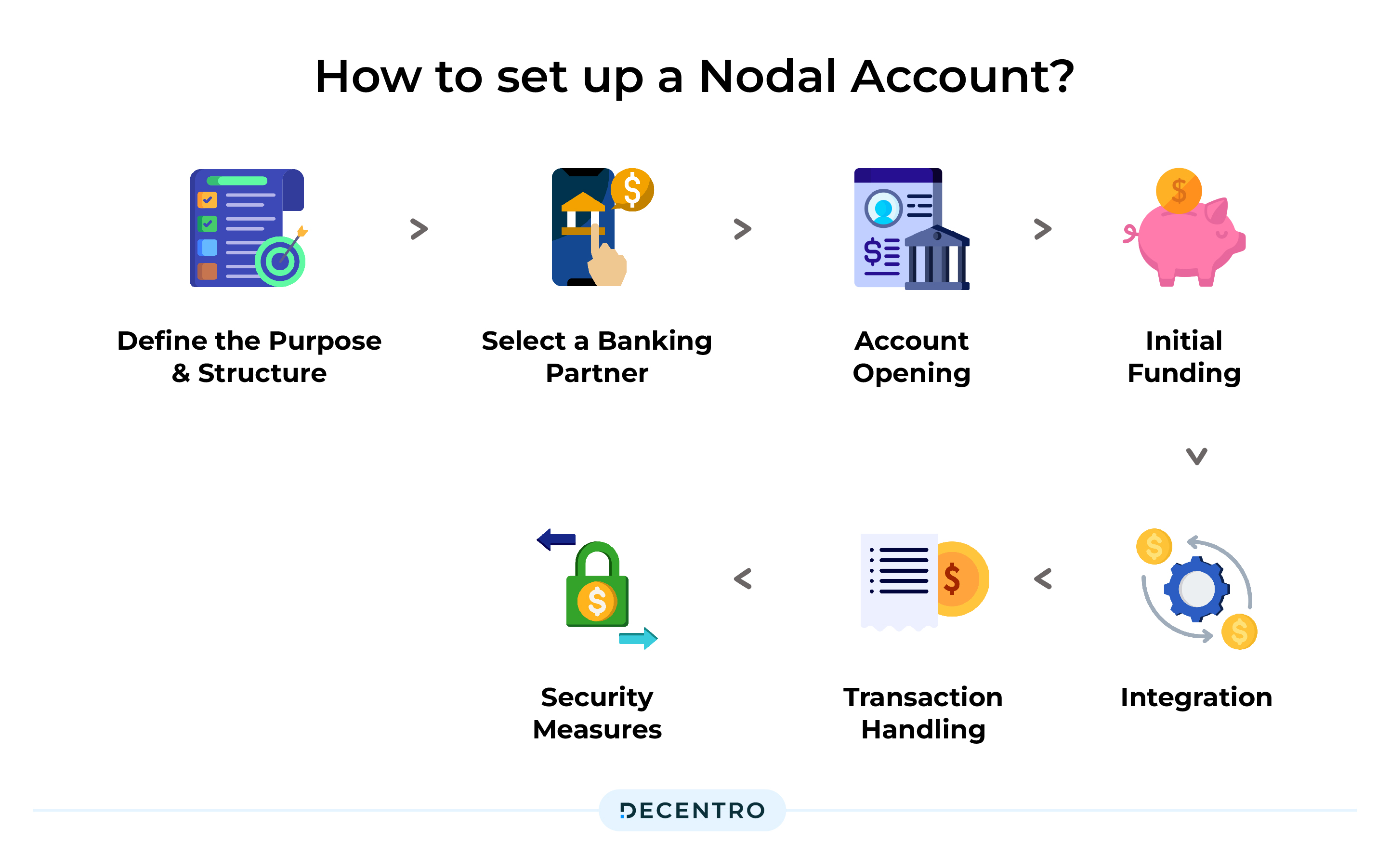

How to set up a Nodal Account?

Setting up a nodal account for your business involves several essential steps to ensure the proper management and disbursement of funds on behalf of multiple parties. Here’s a general guide to setting up a nodal account for your business:

Define the Purpose and Structure

- Clearly define the purpose of the nodal account, including how funds will flow in and out of the account and the parties involved.

- Determine the legal and operational structure of the nodal account, such as whether it will be a trust account, current account, or another type.

Select a Banking Partner

- Identify a reputable bank or financial institution that provides nodal account services. It’s crucial to choose a bank with experience in handling such accounts.

Account Opening:

- Work with the selected bank to open the nodal account. This typically involves providing the bank with the required documentation, agreements, and Know Your Customer (KYC) information.

Initial Funding

- Fund the nodal account with the necessary capital to facilitate transactions. This funding may come from your business’s funds or an aggregate of funds from various customers, sellers, or investors.

Integration

- If your nodal account is integrated into a digital platform or payment gateway, ensure seamless integration with your payment processing system to facilitate fund flow.

Transaction Handling

- Manage transactions through the nodal account according to the terms defined in your agreements and legal requirements. This includes receiving funds from customers, holding them securely, and disbursing them to the final beneficiaries.

Security Measures

- Implement robust security measures to protect the nodal account from unauthorised access and fraud. The security of nodal accounts is crucial, as they handle funds on behalf of multiple parties.

What is a Current Account?

A current account is the most commonly used account by businesses and can support both online and offline transactions. Current accounts are liquid accounts with no upper limit on the transactions (deposits, withdrawals, transfers, etc.) done in a single day. Current accounts can be opened at all commercial banks, and most banks support multi-location deposit and withdrawal facilities to suit the varying needs of a business.

Why do businesses need a Current Account?

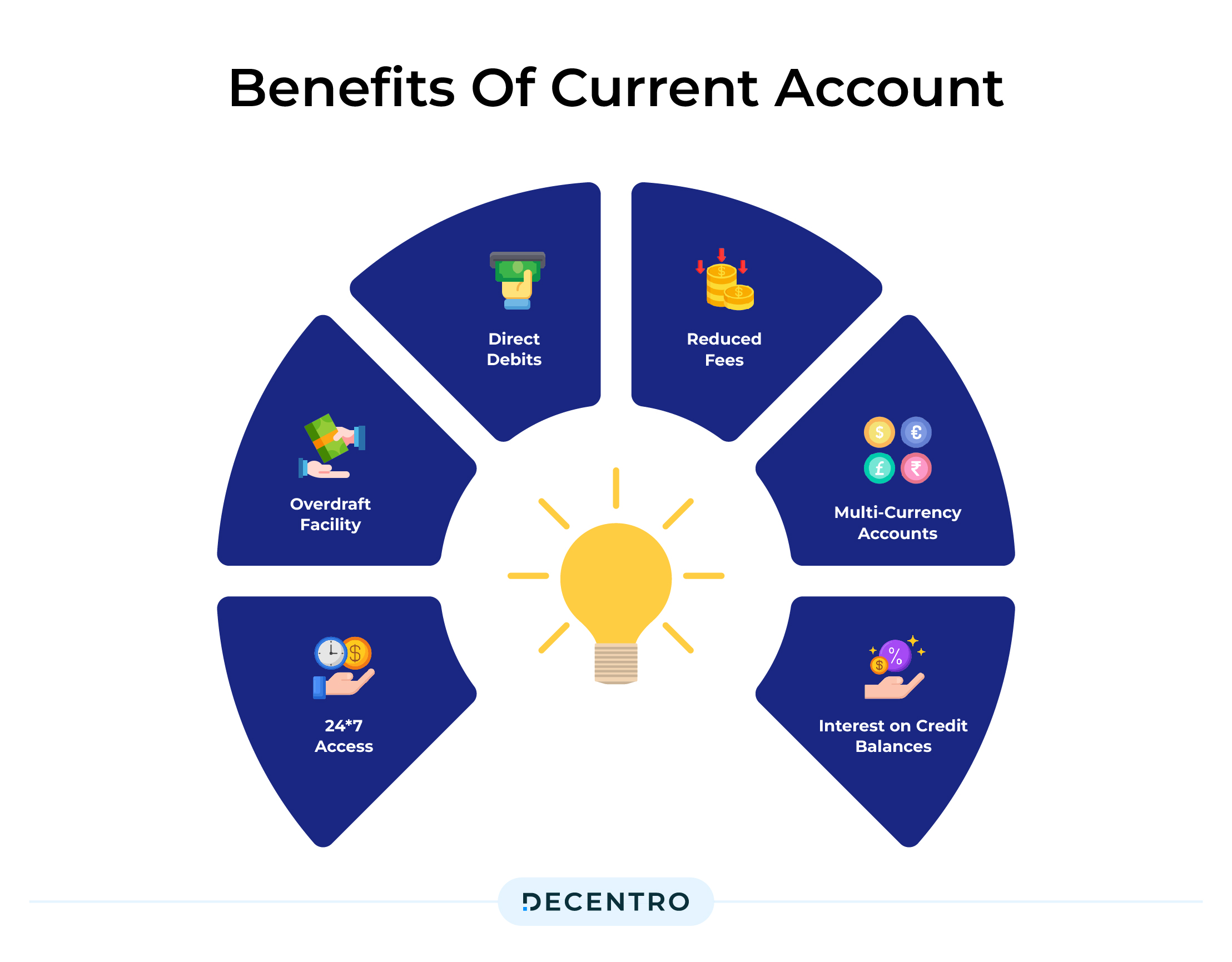

A current account is ideal for your business if you are a business that engages in large payments regularly. It often presents itself as a default function for founders as a first step towards business legitimacy and smoother and more organised financial operations. Chequebook facilities, internet banking and mobile banking, are the basic and common services you get with each bank account. Finally, current bank accounts offer benefits such as:

24*7 Access

A current account provides instant access to funds 24/7, enabling customers to make payments, deposits and withdrawals as per requirement.

Overdraft Facility

A current account offers an overdraft facility to allow customers to withdraw more money than they have in their account, subject to a pre–agreed limit.

Direct Debits

Customers can set up direct debits or standing orders to make regular payments from their current accounts.

Multi-Currency Accounts

Some banks offer multi–currency current accounts, enabling customers to hold multiple currencies in one account and switch between them as required.

Interest on Credit Balances

Some current accounts may offer interest on credit balances, although this is usually minimal.

Reduced Fees

Many banks offer reduced fees or even free banking to current account customers.

In India, banks offer various types of current accounts to meet the needs of different types of businesses, including SMEs, startups, mid-market, and large enterprises.

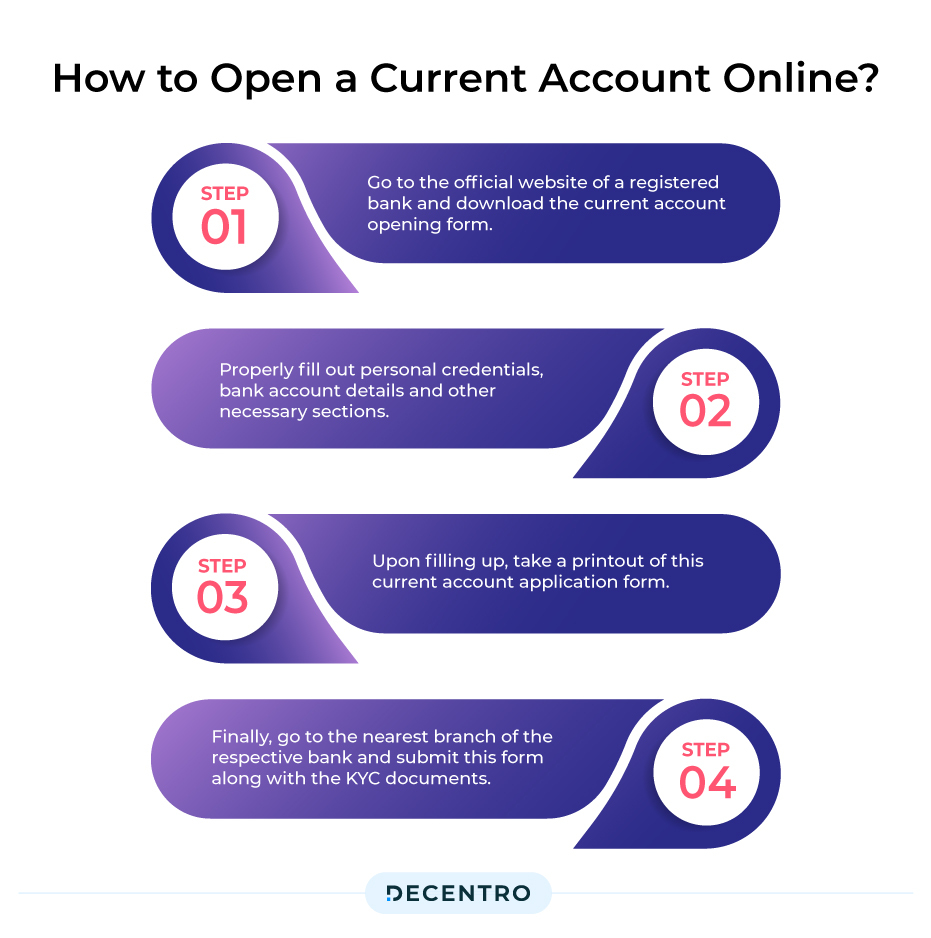

How to Open a Current Account Online?

Step 1: Go to the official website of a registered bank and download the current account opening form.

Step 2: Properly fill out personal credentials, bank account details, and other necessary sections.

Step 3: Upon filling up, take a printout of this current account application form.

Step 4: Finally, go to the nearest branch of the respective bank and submit this form along with the KYC documents.

Apart from the online method, one can visit the nearest bank branch, collect the form from the concerned department, and file it for submission.

What are Escrow Accounts?

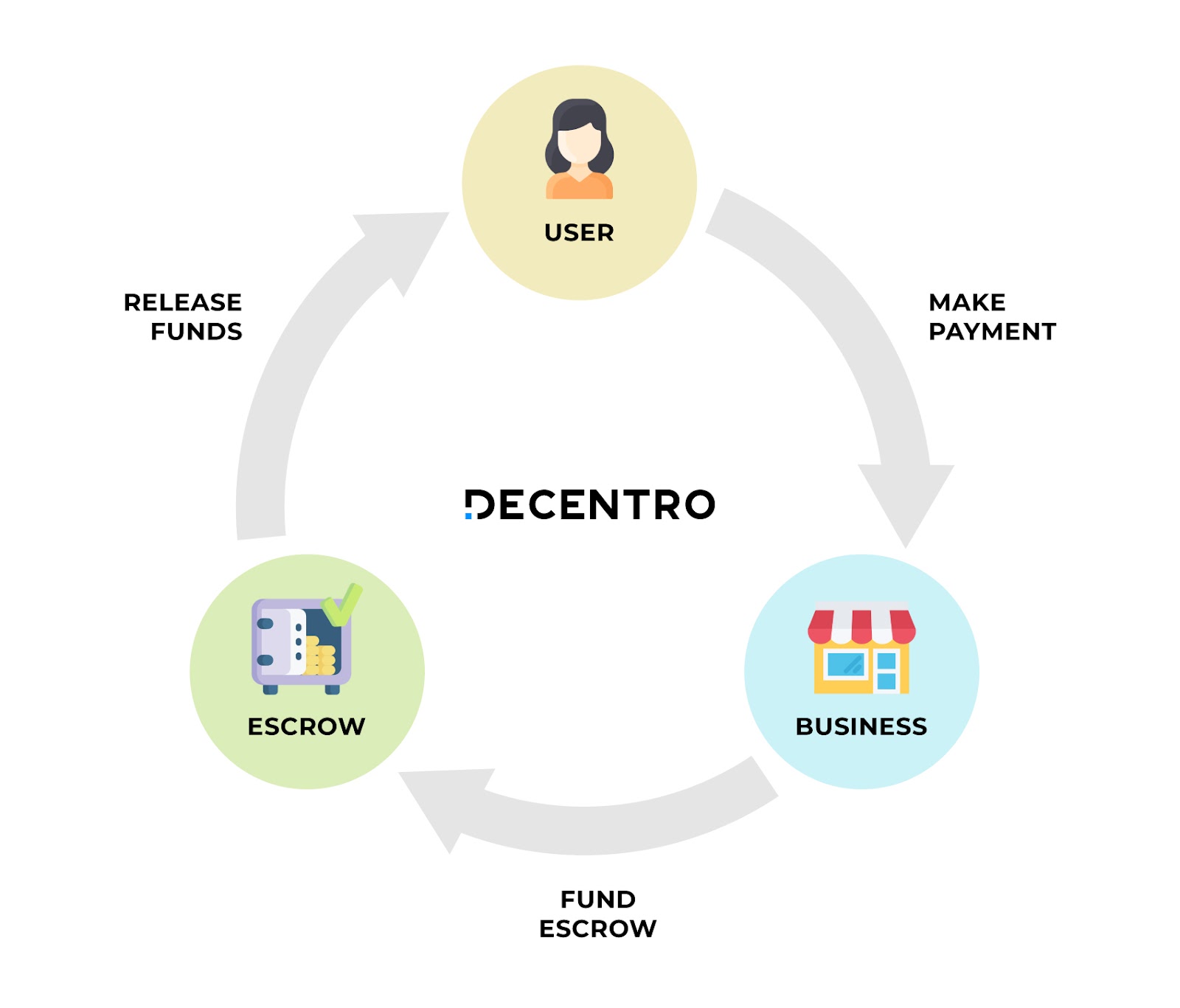

Digital Escrow is the answer to the recurring problem of monetary fraud in the form of money laundering and security breaches. Here, an unbiased third party in the form of digital escrow accounts safely parks your money and facilitates the agreement-based transactions between the two parties. Since the third party is neutral, escrow protects the interests of all transacting parties equally. This ensures a fair transaction process.

Process of Digital Escrow

The digital escrow process reflects its traditional counterpart, with efficiency being the key operative term here.

A neutral digital escrow service provider comes into play in the trust gap between the buyer and seller. The buyer and seller would get clearance to open their digital escrow accounts. The buyer would deposit the seller’s payment in the escrow account and wait for delivery; the seller feels assured the due payment will be released according to the terms of the agreement. The buyer will inspect the goods delivered, and the payout will be initiated according to the agreed terms, thus preserving the interest of both parties involved.

The typical digital escrow account opening process looks like this,

Step 1: Transacting parties sign a simple digital contract

Step 2: Fill in the required details inside the API or portal and receive the account details.

Step 3: Transfer funds into your digital escrow account.

Step 4: Track the real-time updates you receive about activity in your account.

Step 5: Verify and process the payouts via APIs on a real-time basis

We also have an in-depth read on why you should deploy the Escrow flow for your use case. Feel free to give it a read.

Choosing the Right Account

As convenient as the current account seems, Escrow adds a layer of security, and Nodal presents itself as the close second.

However, if choices are to be made,

- A nodal account is appropriate if your business primarily involves facilitating transactions and holding funds on behalf of multiple parties.

- If you need to secure transactions, particularly in cases where conditions must be met before funds are released, an escrow account is suitable.

- A current account is best if you need a standard account for routine financial transactions.

Upon choosing the kind of account you as a business want to get started with, deploying Decentro’s Multi Collect Stack and leveraging the Virtual Account capabilities over and above it all just makes the payment reconciliations easier.

Why, you ask?

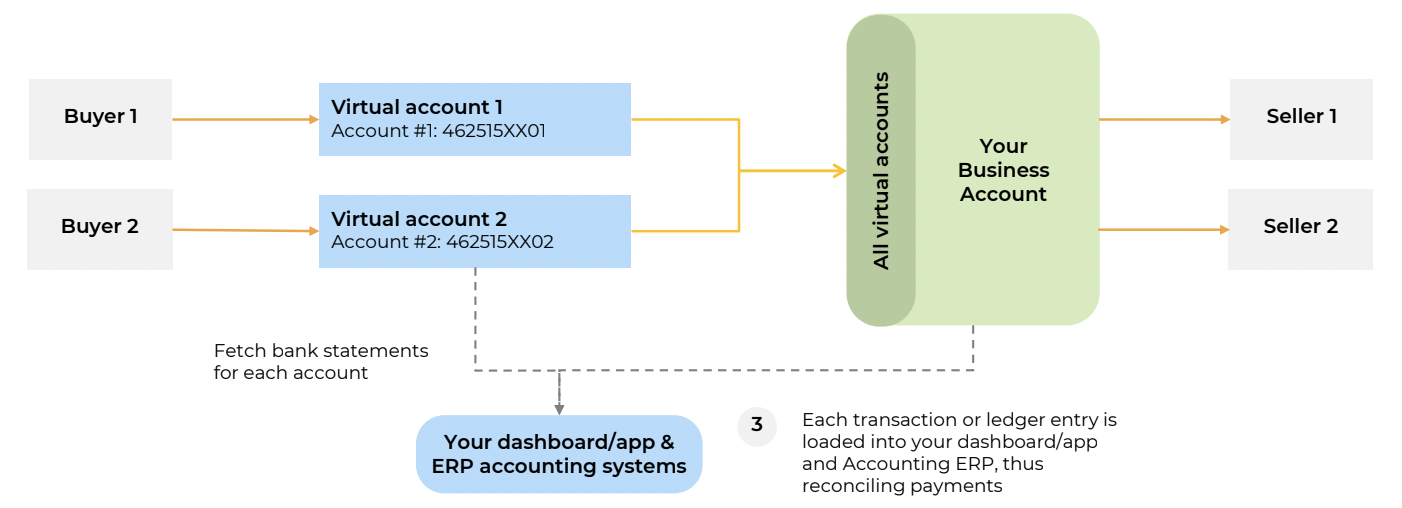

In our Multi Collect stack, we offer two types of virtual accounts:

- Created on top of a nodal or escrow account

Virtual accounts on top of nodal/escrow accounts are temporary. By temporary, we mean that the funds stay within the account only temporarily until it’s transferred to the payee.

The RBI has rolled out Payment Aggregator Regulations, similar to payment gateways, where customers can accept payments through many methods, such as debit/credit cards, net banking, or UPI.

The fund goes to a nodal/escrow payment gateway account (e.g., PayU, Razorpay) when you pay. These gateways have a master nodal/escrow account and various virtual accounts (if required for collections).

Example: When your local business purchases goods from a wholesaler using NEFT/RTGS/IMPS, the funds can be transferred to a virtual account serviced by a payment service provider. It stays there temporarily until it finally reaches the wholesaler on settlement.

2. Top of a Business or Current Account

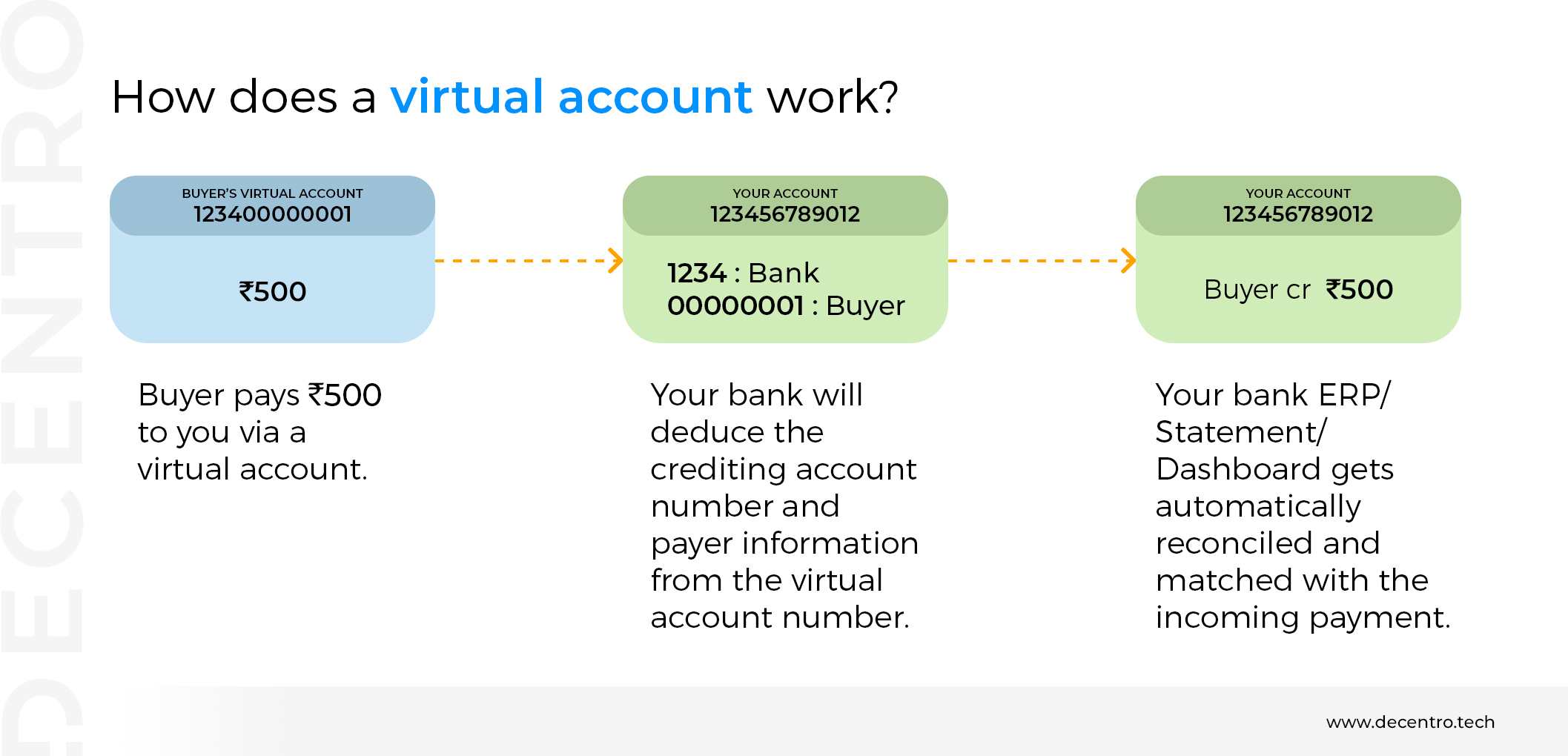

The second type, where virtual accounts exist on top of a business or current account, is where a banking partner could help set up virtual accounts. When a customer transacts through a virtual account, the company can identify the payer’s details through the virtual account number.

The company can deduce customer information and reconcile payments with ease. Not just the details, a business can understand an overview of transactions across departments or geographies. Compliance ensures all regulatory requirements are followed to the dot.

Example: Virtual accounts could be a godsend for colleges and educational institutions to manage student fees easily. Each student can be assigned a virtual account number, for instance, based on their roll number and batch details. The institution can easily e-collect fees via bank accounts and use the account number to track the payment’s origin.

It’s not just virtual accounts that Decentro’s Banking APIs can help your business with. Are you looking to create a unique instant digital escrow facility with eKYC and agreement signing at a much lower turnaround time than traditional escrows?

In just two years, our KYC stack has been churning solid numbers.

With over 400+ Identity validations, 250+ Image recognitions, and 300+ Repository fetches happening via Decentro’s KYC stack per hour, we’re more than equipped to enable your verification and validation journey.

We can help you custom-build your flow, irrespective of the kind of account you want to operate, in a matter of weeks. Want to know more?