Learn what an outstanding balance is, its types, how it impacts finances, calculation methods, common challenges, management strategies, and other aspects.

Outstanding Balance 101: What It Is and How to Handle It

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Outstanding balance refers to the amount a borrower has to pay on any debt or loan that incurs interest. Handling outstanding balances in an efficient way is crucial for avoiding unnecessary hitches or penalties and retaining a healthy credit score and sound financial status.

If you are monitoring your unsettled debts, business loans, and pending client payments, knowing about outstanding balances and how to manage them effectively can be immensely beneficial.

Wondering where to get started? Keep scrolling to find out.

What is an Outstanding Balance?

An outstanding balance indicates the total amount you have to pay, including balance transfers, purchases, fees, cash advances, interest, and so on. This amount reflects the amount of money you still need to pay to close a loan or a financial obligation. It usually comprises the principal amount as well as any accrued interest, penalties, and fees.

Whether it is an unsettled balance on credit cards, loans, or a business invoice, it is essential for you to track these amounts, keep the money prepared and make the payment at the earliest.

Note: Outstanding balances are documented in financial records, such as accounts payable and accounts receivable.

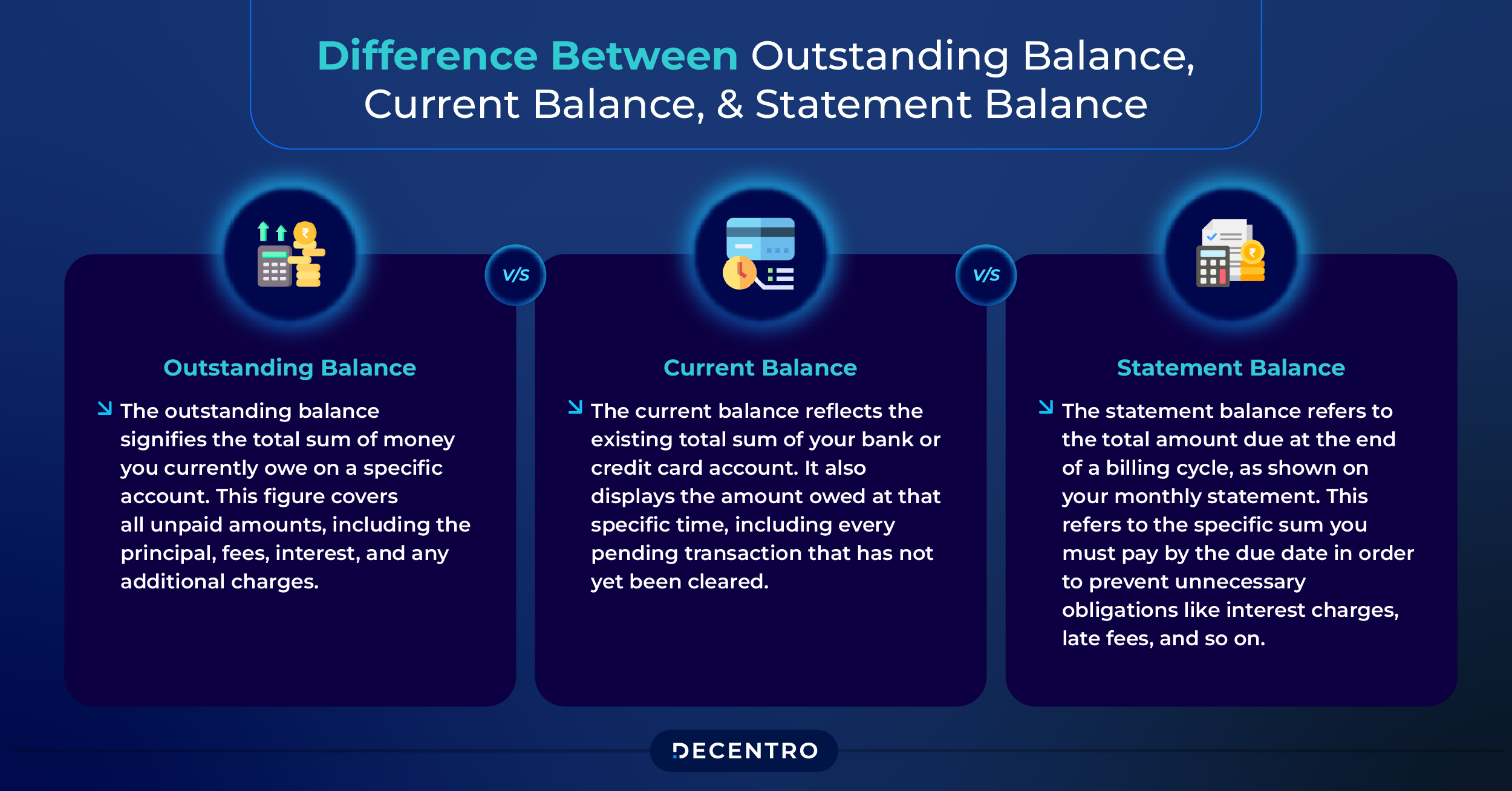

Difference Between Outstanding Balance, Current Balance, and Statement Balance

Understanding the differences between outstanding, current, and statement balances can help you better manage payments and avoid unnecessary penalties. Here are the major distinctions between them:

- Outstanding Balance

The outstanding balance signifies the total sum of money you currently owe on a specific account. This figure covers all unpaid amounts, including the principal, fees, interest, and any additional charges.

- Current Balance

The current balance reflects the existing total sum of your bank or credit card account. It also displays the amount owed at that specific time, including every pending transaction that has not yet been cleared.

- Statement Balance

The statement balance refers to the total amount due at the end of a billing cycle, as shown on your monthly statement. This refers to the specific sum you must pay by the due date in order to prevent unnecessary obligations like interest charges, late fees, and so on.

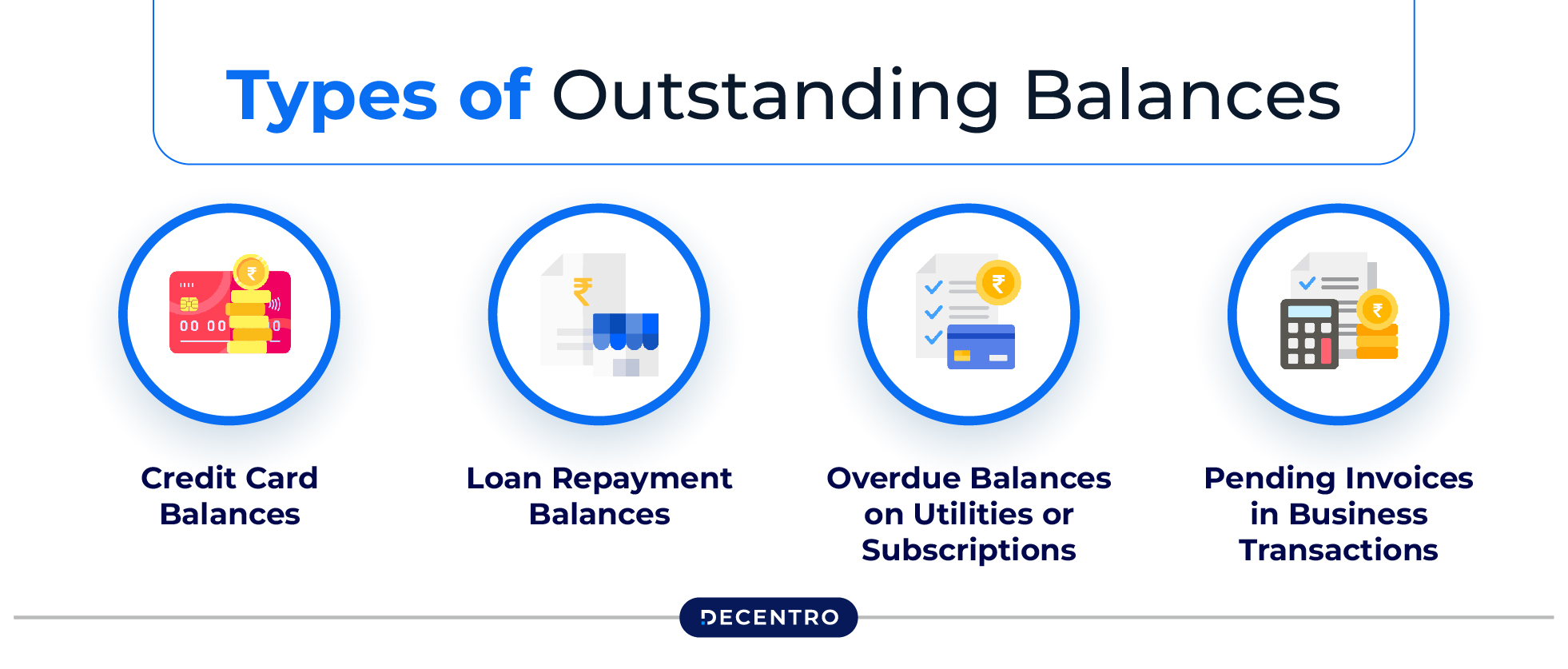

Types of Outstanding Balances

Discussed below are the types of outstanding balances:

- Credit Card Balances

As the name suggests, credit card balances refer to the amounts you are obliged to pay on your credit card after making certain payments. If you fail to clear the debts on time, your lending institution can impose interest, which means you will end up paying more and even face default charges.

- Loan Repayment Balances

This balance signifies the amount you still owe on a loan, including any overdue interest, the original amount you borrowed, and the interest that has accumulated. In case you do not pay your loans or debts on time, the balance can escalate due to compounding interest.

- Overdue Balances on Utilities or Subscriptions

Businesses may also have unpaid balances from subscription payments or overdue utility bills. Even though these amounts could be less than loan debts or credit cards, they still need to be handled sensibly.

If unsettled payments for services like water, electricity, and internet are not made on time, service disruptions, penalties, or extra charges can lead to unnecessary hassles.

- Pending Invoices in Business Transactions

Almost all organisations face difficulties with their unpaid invoices. These unpaid amounts can hinder cash flow, resulting in working capital disruptions, increasing debt and limited growth opportunities. Thus, it is crucial for businesses to monitor and follow up on late payments in order to keep operations running smoothly.

How Do Outstanding Balances Affect Finances?

Managing outstanding balances effectively is essential to keep a business’s finances at an optimum level. Overlooking them can lead to serious issues, like:

- Affecting Credit Score

Outstanding balances can be damaging to your financial status and credit score. Lending institutions assess credit scores to verify the risk of lending money. If you have a high outstanding balance, mainly on loans or credit cards, it can ruin your credit utilisation ratio. In addition, if you have high unsettled balances, lenders charge higher interest rates on your future loans.

- Influence on Loan Approvals

Lending institutions usually verify your current debts while granting you a fresh loan. Higher outstanding balances can increase your debt-to-income ratio, signifying your weakness in managing more debt and resulting in loan rejection or less favourable credit terms.

- Accumulation of Interest for Non-payment

Having a high amount of outstanding balances can attract interest rates and late fees. Many banks and credit card providers impose hefty rates on unsettled balances. Thus, if you do not clear the entire borrowed amount on time, your debt will incur more interest.

For instance, credit card companies may charge an APR that can be between 10% and 25% or more, making it costly to carry a balance.

- Missed Payments and Penalties

Missed payments can trigger penalty fees, which further increase the outstanding balance. Often, a missed payment can result in penalties like a higher interest rate or a lower credit limit.

How to Calculate Outstanding Balances?

Outstanding balance is calculated based on the type of debt used. Discussed below are two major types of outstanding balance computation methods:

- Daily Balance Method

In credit cards, the outstanding balance can be calculated using the daily balance method. This method makes use of the daily outstanding balance to determine the balance in each billing cycle.

Example: Suppose you buy something on your credit card on the 5th of the month and another on the 15th. So, you will need to add up the balances daily, consider the rate of interest, and calculate the total amount at the end of the billing cycle.

- Loan Outstanding Balance (Principal Reduction Method)

For loans, the outstanding balance is calculated by deducting the principal amount after every monthly payment. Later, the outstanding balance declines as both the principal and the interest payments have been made.

Example: Suppose you borrow a loan of ₹1,00,000 at 10% interest per year for 5 years and make monthly repayments. In this scenario, the amount you owe will lessen every month by the amount of your payment going to the principal.

Tools and Methods to Track Outstanding Balance

Here are some excellent ways to keep track of outstanding balances:

- Automate Invoicing: Automated systems can make invoice processing efficient, less error-prone, and cost-effective.

- Setting Payment Reminders: It is best to set up reminders so that you do not forget your impending payment dates.

- Centralised Payment Tracking: Keeping track of payments via a single platform can allow you to easily monitor costs and generate reports for better financial decisions.

- Centralised Customer Data Management: Store all client information in one location, including contact info, billing preferences, and payment history, for seamless access and tracking.

- Create a Payment Policy: Create stipulations for charging interest or fees for overdue or late payments.

- Cash Flow Forecasting: With a look at your receivables, you can get an idea of the future cash flow, which is essential for proper budgeting and business functioning.

- Use Invoicing and Time-Tracking Software: Automatic invoicing, invoice reminders, and tracking of the payment history can significantly improve outstanding balance tracking.

Common Challenges Associated with Outstanding Balances

Often, improper management of outstanding balances may cause various challenges that include the following:

- Accumulation of High Interest and Default Fees

If you miss payments on your debts, late fees and interest rates will start to add up, increasing your total debt. Usually, loans and credit cards charge high interest rates, which can increase your outstanding balance.

Furthermore, each late payment can also be problematic as it may lead to penalty fees, adding to your financial strain. These extra costs make it challenging to settle the debt and extend the time required for repayment. Gradually, this can lead to a much higher sum owed than what you initially had.

- Misunderstanding Terms (e.g., Statement Vs. Current Balance)

Another challenge arises due to confusion around terms like “statement balance” and “current balance.” Businesses need to train their teams so that they can become diligent enough to review their financial statements. Confusing between the current balance and the statement balance can cause problems like missed payments or overpayments.

- Impact on Credit Score

Non-payment of debts can negatively impact your credit history as well as bring down your credit score. Having a lower credit score means you will face difficulty in borrowing further loans or other credit facilities.

Besides, missed payments and overdue accounts can remain on your credit report for years, making it tougher to access good loan offers. So, paying your debts before the deadline and maintaining a strong credit score is essential.

- Potential Legal Actions for Prolonged Non-Payment

If you overlook your debts for a longer period, lenders might take legal action against you to get their funds back. This could lead to court cases, hefty penalties, or even imprisonment, thereby worsening your financial situation. In addition, legal actions tend to hurt your business reputation and professional relationship with the lenders.

- Hidden Fees and Charges

When it comes to loans, credit cards, and utility services, there are often fees that may not be readily visible. Such fees may include late payment fines, maintenance costs, or service-based charges. Failing to understand these fees can contribute to considerable debt accumulation.

Strategies to Manage Outstanding Balances

Following are some of the tried and tested strategies that can help you seamlessly manage outstanding balances:

- Set Up Automatic Payments

Setting up automatic payments enables you to clear your bills on time without worrying about the due dates. This practice can be immensely helpful for you to avoid extra interest charges and late fees that can even add more burden to your total debt.

Through automatic payments, you can easily manage your finances and stay away from the risk of missed payments, ensuring timely repayment of loan EMIs and credit card bills and keeping your credit score healthy.

- Focus on High-Interest Debts

Always prioritise the highest interest rates and try to clear the debts first. This is because these loans can snowball, increasing your total outstanding balance. Clearing them at the earliest can cut down on interest charges and help settle your debts sooner. Additionally, this strategy can help you achieve long-term savings.

- Combine Your Debts

Combining several debts into one can help you manage your finances better and lower your total interest costs. By consolidating multiple credits into one loan with a lower interest rate, you can lessen your monthly payments and have a single due date to remember. This can simplify your payment process and help you become debt-free more quickly.

- Negotiate Payment Terms

If you find it difficult to keep up with payments, get the help of your creditors or service providers and let them suggest a better repayment option. This means increasing the repayment tenure or reducing the rate of interest. Many lenders can adjust the repayment terms if you are having a financial crisis so that you can handle your payments wisely.

- Keep an Eye on Your Spending

It is important to keep track of your daily business expenses, rule out unnecessary costs and find scopes to save. This money can be utilised to clear your debts faster and reduce financial stress.

- Consider Partial Payments

If you are unable to pay your debt all at once, paying partially is an excellent option. Making payments in small lots regularly can help lower your balance down the line and stop it from getting significantly increased due to penal interest or late fees.

Although it might take a longer time to settle the loan amount, paying your dues on time will show your consistency in making the payment of what you owe. By sticking to this strategy, you will slowly lessen your debt and boost your financial condition.

- Review Financial Statements Periodically

Reviewing your financial statements from time to time will help you figure out discrepancies and hidden charges and identify points for reducing the total outstanding balance. Also, it ensures that the figures are accurate, enabling you to make effective business decisions.

Real-life Scenarios: Example of Managing Outstanding Balances

- Case Studies

A handicraft business, CraftCreations, found a consistent increase in its outstanding balances. After performing a detailed assessment of its records, it was found that a major percentage of its “Accounts Receivable” was from some clients who repeatedly delayed payments.

Consequently, the organisation undertook proactive strategies like making their credit policies stringent to avoid further financial obstacles that affect not only their cash flow but also their business functioning.

- Example

A small-scale business invoices a customer for work done or services rendered amounting to ₹70,000. Out of this, the client pays only ₹45,000, leaving an outstanding balance of ₹25,000 with the business. If this continues, it will adversely affect the company’s cash flow and may even lead to legal proceedings to recover its dues.

Outstanding Balances in 2025: Trends and Predictions

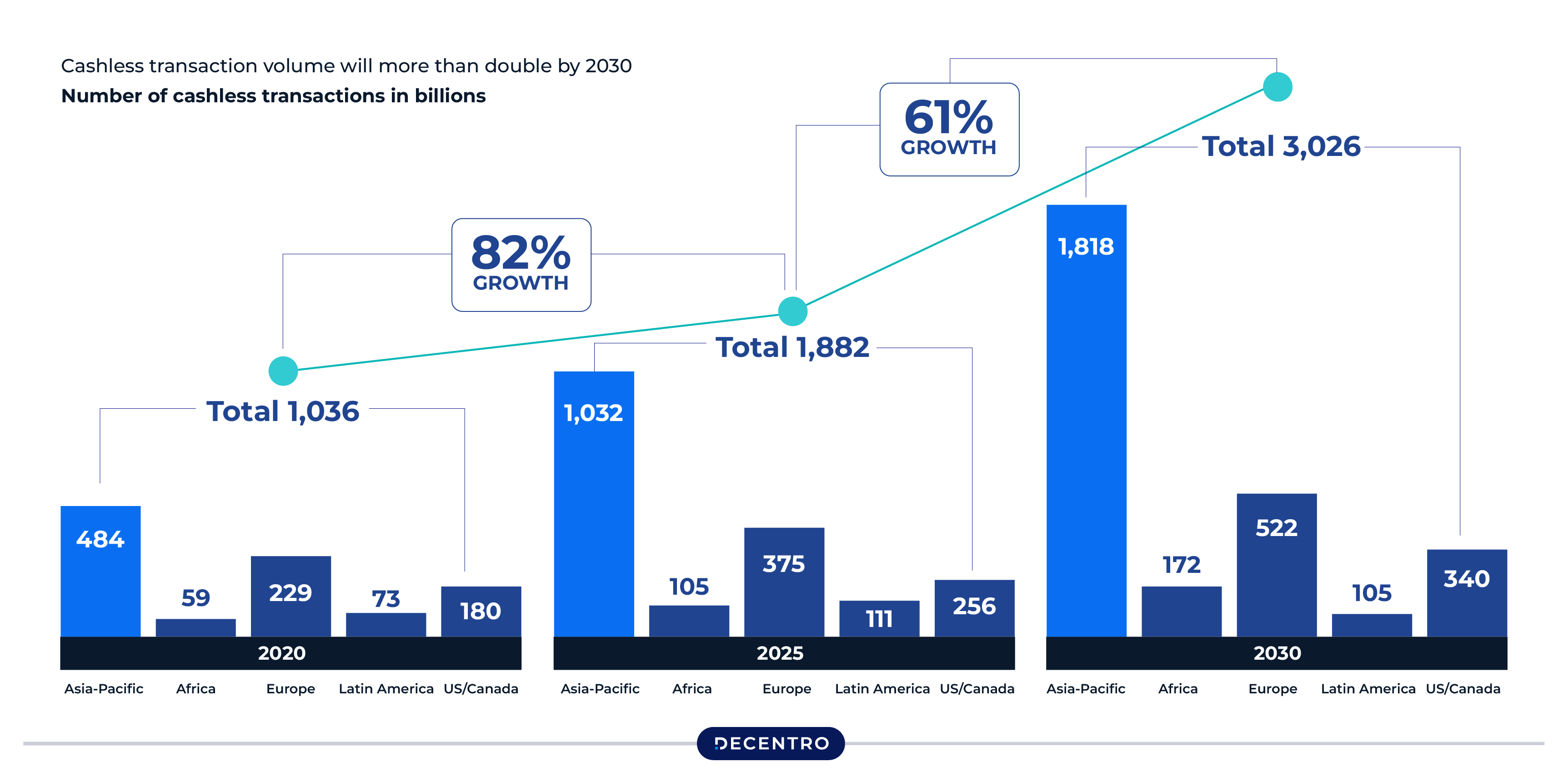

The rapid growth of payment markets is transforming the financial landscape, especially with digital payments becoming the heart of daily transactions. Applications like WeChat and Apple Pay are driving this shift, with adoption surging in Asian markets, positioning digital wallets and instant payment systems at the forefront of cashless economies.

According to PwC and Strategy, cashless payment volumes are likely to increase by more than 80% between 2020 and 2025 internationally. As a result, individuals and businesses can can make better use of these financial tools in order to deal more effectively with outstanding balances.

With real-time tracking of transactions and balances on platforms like Stripe, Square, and PayPal, debt management becomes more efficient and allows for better cash flow.

Furthermore, as the regulations become more flexible and offer more room for manoeuvring with debt management, borrowers will be able to manage their financial obligations better. This will minimise the chances of penalties and improve conditions for repayment.

Decentro’s Role in Simplifying Financial Management

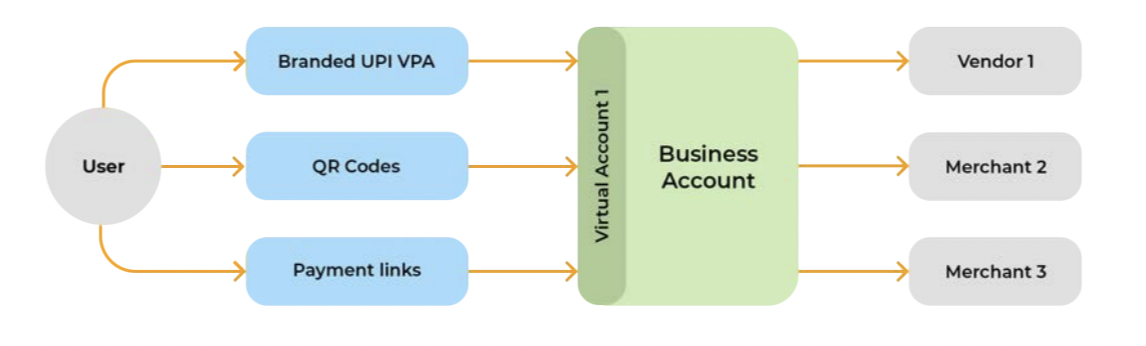

Decentro offers a plethora of APIs that can help businesses manage outstanding balances with ease. Our Multi-Collect API enables you to receive funds from individuals and businesses through a plethora of payment methods like NEFT, UPI, IMPS, and RTGS. What’s more, you get the benefit of auto-reconciliation through virtual accounts while we help you maintain end-to-end compliance with the RBI’s latest regulations.

Furthermore, you can efficiently track payments for each order and customer while facilitating quick disbursements across pre-defined settlement periods.

Leverage Decentro’s Multi-Collect APIs today and make managing business finances fast and easy!