Discover India’s top 25 personal loan finance companies in 2025. Compare NBFCs, banks & fintech lenders offering instant approvals & competitive rates.

Top 25 Personal Loan Finance Companies in India in 2026

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

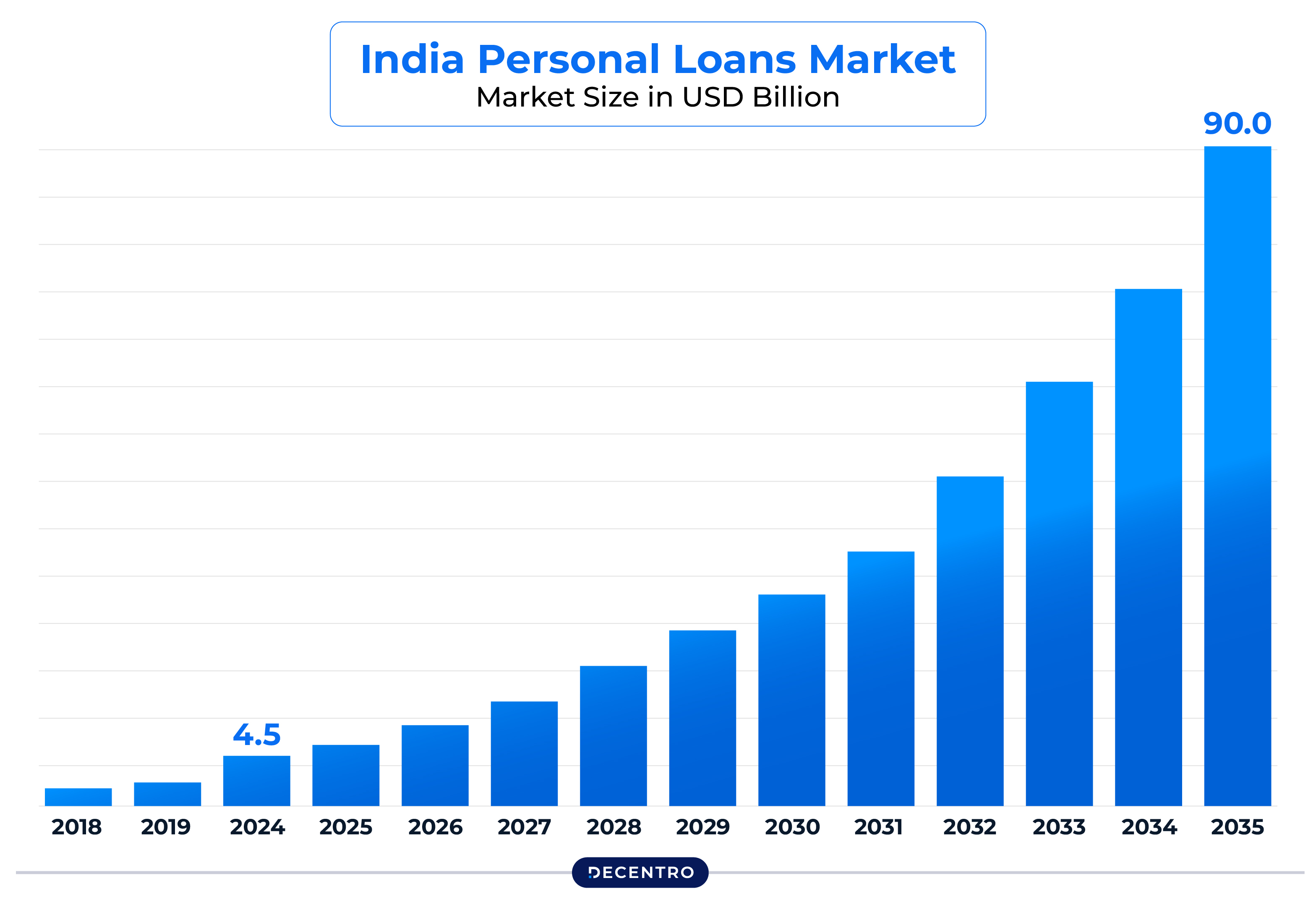

India’s personal lending landscape has experienced a revolutionary transformation, with digital innovation reshaping how millions of Indians access credit. The personal loan market in India, valued at over ₹8.5 trillion, is witnessing unprecedented growth driven by increasing smartphone penetration, evolving customer preferences, and the government’s push toward digital financial inclusion.

The shift from traditional banking to digital-first lending has been remarkable. Fintech companies now command a significant share of the personal lending market, offering instant approvals, minimal documentation, and seamless digital experiences that were unimaginable just a few years ago. This evolution has democratized credit access, reaching previously underserved segments including young professionals, small business owners, and customers in Tier-2 and Tier-3 cities.

From established NBFCs like Bajaj Finserv and Tata Capital to digital-native platforms like mPokket and TrueBalance, the ecosystem offers diverse solutions catering to every borrower profile. Whether you need emergency funds, debt consolidation, or business working capital, these companies provide tailored solutions with competitive interest rates and flexible repayment terms.

A Quick Glance

| Company | Unique Value Proposition |

| Paytm | Leverages massive user base and transaction data for instant digital personal loans |

| PhonePe | UPI-integrated lending with seamless payment ecosystem integration |

| Bajaj Finserv | Nationwide NBFC with rapid processing and extensive product portfolio |

| Tata Capital | Trusted Tata brand with transparent pricing and hybrid service delivery |

| Kotak Mahindra Bank | Digital-first bank offering competitive rates and pre-approved loan programs |

| Yes Bank | Relationship-based pricing with improved digital experience |

| IIFL Finance | Wide pan-India presence serving both prime and near-prime customers |

| Fullerton India | Semi-urban reach with balanced underwriting and digital-assisted approach |

| L&T Finance | Process-driven NBFC with responsible lending practices |

| IDFC FIRST Bank | Digital-first bank with transparent fees and competitive pre-approved rates |

| Muthoot Fincorp Limited | Extensive branch network with relationship-driven service in Tier-2/3 cities |

| Choice Finserv | Emerging NBFC with digital-friendly processes and near-prime customer focus |

| Laxmi India Finance | Regional NBFC focused on underserved semi-urban markets |

| mPokket | App-based micro-lender targeting students and young professionals |

| TrueBalance | Micro-personal loans with fully digital onboarding and quick approvals |

| Indiabulls Dhani | Instant credit app with paperless approvals for small-ticket loans |

| Home Credit India | Consumer finance company with Tier-2/3 city focus and hybrid channels |

| HDB Financial Services | Transparent pricing with competitive rates and flexible tenures |

| ICICI Bank | Leading private bank with pre-approved offers and nationwide presence |

| HDFC Bank | Most trusted brand with extensive branch network and digital solutions |

| IndusInd Bank | Flexible loan terms with competitive rates and relationship management |

| Axis Bank | Large customer base with digital-branch hybrid and quick pre-approvals |

| Punjab National Bank | Public sector bank with competitive rates and wide branch network |

| Federal Bank | Digital-first experience with transparent pricing and good customer service |

| South Indian Bank | Flexible EMIs with competitive rates and dual application channels |

Paytm

Paytm, India’s leading digital payments platform, has strategically expanded into personal loans by leveraging partnerships with NBFCs and banks. The company’s unique advantage lies in its access to vast user transaction data and behavioral patterns, enabling sophisticated risk assessment and instant credit decisions for millions of users.

The platform primarily targets salaried employees and first-time borrowers across urban centers and Tier-2/3 cities, offering small to medium-ticket loans through a completely digital experience. With extensive app-based distribution and high brand visibility, Paytm provides seamless integration between payments and lending services.

Pros:

- Extensive app-based distribution and high visibility

- Quick digital onboarding and KYC

- Instant approvals for pre-qualified users

- Transparent EMI tracking and in-app reminders

Cons:

- Loan eligibility is limited to select users

- Smaller ticket sizes compared to traditional banks

- Loan terms depend on partner NBFC policies

Top Features:

- Pre-approved loan offers within the app

- eKYC and eNACH-based repayments

- Real-time EMI tracking

PhonePe

PhonePe capitalizes on its position as one of India’s largest UPI applications to deliver personal loans through strategic NBFC partnerships. The platform utilizes comprehensive transaction and wallet activity data to provide app-native, low-friction lending experiences designed explicitly for salaried users and young professionals.

The company’s strength lies in its massive, highly engaged user base and the ability to integrate lending services within the payment ecosystem seamlessly. This integration allows for sophisticated credit assessment based on actual spending patterns and financial behavior.

Pros:

- Large, engaged user base

- Digital-first loan journey with instant notifications

- Quick approvals for pre-qualified users

Cons:

- Loans accessible only to eligible users

- Smaller ticket sizes than conventional bank loans

- Loan terms vary by NBFC partner

Top Features:

- Embedded personal loan offers

- App-based application and approval process

- Multiple repayment options via UPI and bank transfers

Bajaj Finserv

Bajaj Finserv stands as one of India’s most prominent NBFCs, offering comprehensive personal loan solutions to both salaried and self-employed individuals. The company’s extensive nationwide presence, combining robust offline infrastructure with advanced online capabilities, enables rapid processing and transparent communication of rates and fees.

Known for its customer-centric approach, Bajaj Finserv provides flexible tenure options, top-up facilities, and balance transfer services. The company’s strong underwriting capabilities and risk management practices have established it as a trusted name in the Indian lending landscape.

Pros:

- Nationwide presence

- Broad eligibility for various borrower profiles

- Rapid processing and digital onboarding

- Top-up and balance transfer options

Cons:

- Stringent eligibility for thin-file borrowers

- Foreclosure and processing fees may apply

Top Features:

- End-to-end digital loan application

- Flexible EMIs and tenures

- Customer support through multiple channels

Tata Capital

Tata Capital, backed by the prestigious Tata Group, provides personal loans to salaried and self-employed individuals with a focus on transparent pricing and hybrid digital-assisted distribution. The company leverages the Tata brand’s trust factor while implementing modern lending practices and technology-driven processes.

The organization offers pre-approved loans and flexible tenure options, combining the reliability of traditional lending with innovative digital solutions. Their balanced approach caters to diverse customer segments while maintaining the high standards associated with the Tata name.

Pros:

- Trusted Tata brand

- Hybrid digital and branch-assisted support

- Flexible tenures and repayment options

- Fast approvals for eligible applicants

Cons:

- Loan approval depends on credit history

- Processing may take longer for complex profiles

Top Features:

- eKYC and digital documentation

- Balance transfer and top-up loans

- Personalized pre-approved offers

Kotak Mahindra Bank

Kotak Mahindra Bank delivers personal loans with competitive interest rates through a digital-first onboarding process and comprehensive pre-approved loan programs for existing customers. The bank specifically targets salaried professionals and self-employed individuals with streamlined application processes.

The bank’s technology-driven approach ensures efficient processing while maintaining strong risk management practices. Their focus on customer experience is evident in their mobile and internet banking integration, making loan management convenient and accessible.

Pros:

- Digital end-to-end journey

- Pre-approved offers for loyal customers

- Balance transfer facilities

- Robust customer support

Cons:

- Strict documentation and eligibility

- Processing times can vary for new-to-credit borrowers

Top Features:

- Mobile and internet banking integration

- Flexible tenure and EMI options

- Quick pre-approval checks

Yes Bank

Yes Bank provides personal loans with a strong emphasis on digital onboarding, transparent fee structures, and competitive pricing for existing relationship customers. The bank’s lending services cater to both salaried and self-employed individuals with improved digital experience and streamlined processes.

The bank has focused on rebuilding its lending portfolio with enhanced risk management and customer service capabilities. Their relationship-based pricing model offers additional benefits to existing customers while maintaining competitive rates for new borrowers.

Pros:

- Improved digital experience

- Relationship-based pricing for existing customers

- Transparent fee disclosures

Cons:

- Eligibility criteria can be strict

- Limited physical footprint compared to older banks

Top Features:

- App-based application and approval tracking

- Pre-approved loans for select customers

- Flexible repayment options

IIFL Finance

IIFL Finance offers personal loans to salaried and self-employed customers with extensive urban and Tier-2/3 reach across India. The company combines digital onboarding capabilities with assisted channels to support a diverse range of borrower profiles and credit needs.

Their comprehensive approach includes programs designed for both prime and near-prime customers, ensuring broader accessibility to credit. The company’s quick decision-making process and flexible terms make it an attractive option for various customer segments.

Pros:

- Wide pan-India presence

- Programs for prime and near-prime customers

- Quick decision-making for eligible applicants

Cons:

- Ticket sizes and interest rates vary

- Limited in-person servicing in some regions

Top Features:

- Digital application and document upload

- Flexible EMI and tenure options

- Customer support through branches and call centers

Fullerton India

Fullerton India now SMFG IndiaCredit offers personal loans in urban and semi-urban regions through a digital-assisted lending approach that emphasizes transparency and responsible lending practices. The company targets both salaried and self-employed borrowers with a balanced underwriting policy.

Their strength lies in reaching semi-urban markets often underserved by traditional banks while maintaining robust risk assessment capabilities. The combination of assisted and digital channels ensures better accessibility and customer support.

Pros:

- Semi-urban reach

- Balanced underwriting policies

- Assisted and digital channels for better accessibility

Cons:

- Processing timelines may vary

- Higher rates for thin-file or high-risk borrowers

Top Features:

- Digital applications and eKYC

- Flexible tenure and top-up options

- EMI calculators and repayment support

L&T Finance

L&T Finance provides personal loans through a process-driven and risk-disciplined approach that reflects the engineering precision of the L&T Group. Their offerings target both salaried and self-employed segments across India with strong governance and responsible lending practices.

The company’s systematic approach ensures consistent service quality and risk management while offering both assisted and digital channels. Their focus on process discipline helps maintain loan quality and customer satisfaction.

Pros:

- Strong governance and process discipline

- Responsible lending practices

- Assisted and digital channels

Cons:

- Loan availability may be limited geographically

- Documentation can be stricter for self-employed customers

Top Features:

- Digital application and eKYC

- Tenure and EMI flexibility

- Balance transfer and top-up options

Capital First / IDFC FIRST Bank

Post-merger with IDFC Bank, IDFC FIRST Bank provides digital-first personal loans with comprehensive pre-approved programs and transparent fee structures. The bank targets both salaried and self-employed borrowers with competitive rates and streamlined processes.

The merged entity combines the agility of an NBFC with the stability and regulatory framework of a bank. Their strong digital infrastructure enables efficient processing while maintaining transparent communication with customers.

Pros:

- Strong digital infrastructure

- Competitive interest rates for pre-approved users

- Clear and transparent fees

Cons:

- Strict eligibility for new-to-credit borrowers

- Smaller branch network

Top Features:

- Pre-approved loan offers

- Digital KYC and agreements

- Flexible EMIs and tenure options

Muthoot Fincorp Limited

Muthoot Fincorp, widely recognized for its gold loan expertise, also offers unsecured personal loans leveraging its extensive branch network and established customer trust, particularly strong in Tier-2 and Tier-3 towns. The company benefits from the Muthoot brand’s reputation for reliability and customer service.

Their relationship-driven service approach and extensive physical presence provide customers with accessible support and personalized attention. This combination of brand trust and local presence makes them particularly effective in smaller towns and semi-urban areas.

Pros:

- Extensive branch presence

- Relationship-driven service

- Trusted brand for mass-market borrowers

Cons:

- Personal loan offerings smaller compared to gold loans

- Limited availability in some regions

Top Features:

- Assisted applications via branches

- Flexible repayment schedules

- Customer support for post-disbursal management

Choice Finserv

Choice Finserv is an emerging NBFC that offers digital-friendly personal loans for salaried and self-employed borrowers with a focus on innovation and customer experience. The company partners with fintech platforms to streamline customer acquisition and enhance risk assessment capabilities.

Their willingness to serve near-prime customers with clear fee disclosures and digital-first processes positions them well in the evolving lending landscape. The company represents the new generation of NBFCs embracing technology and transparent practices.

Pros:

- Digital-first loan process

- Clear fee disclosures

- Willingness to serve near-prime customers

Cons:

- Limited brand awareness

- Expanding geographic coverage

Top Features:

- eKYC and document upload

- Quick loan decisioning

- Digital servicing via app and web

Laxmi India Finance

Laxmi India Finance is a regional NBFC that provides personal loans with a concentrated focus on semi-urban markets and responsible lending practices. The company combines assisted and digital processes to deliver efficient service while maintaining strong customer relationships.

Their targeted approach to underserved markets allows for deeper market penetration and specialized service delivery. The combination of traditional relationship-led support with modern digital processes creates a unique value proposition.

Pros:

- Focused on underserved markets

- Assisted + digital loan processing

- Relationship-led customer support

Cons:

- Limited national visibility

- Product availability varies by location

Top Features:

- Streamlined documentation

- Tenure flexibility

- Branch and call center support

mPokket

mPokket is an innovative app-based lender specifically targeting students and young professionals with small-ticket, short-term personal loans. The platform offers instant approvals, minimal documentation, and fully digital processing designed for the mobile-first generation.

Their unique focus on the underserved student and young professional segment, combined with instant disbursals and app-first experience, addresses a significant market gap. The platform’s understanding of young users’ needs makes it particularly effective for emergency funding requirements.

Pros:

- Instant loan disbursals

- Minimal paperwork

- App-first, digital experience

Cons:

- Higher interest rates than banks

- Small loan amounts

- Shorter tenure loans

Top Features:

- 100% app-based onboarding

- Digital KYC and e-signing

- Multiple repayment modes (UPI/netbanking/cards)

TrueBalance

TrueBalance provides micro-personal loans through NBFC partnerships, targeting daily cash needs for small-ticket borrowers with a fully digital platform. The company offers quick approval processes and comprehensive repayment tracking for better customer experience.

Their accessible micro-loan approach and paperless digital onboarding make credit available to users who might not qualify for traditional bank loans. The clear repayment schedules and digital management tools enhance customer experience.

Pros:

- Accessible micro-loans

- Paperless digital onboarding

- Clear repayment schedules

Cons:

- Higher APRs compared to banks

- Limited ticket sizes

- Availability dependent on NBFC partner

Top Features:

- Fast decisions and disbursal

- Digital KYC and e-agreements

- Multiple repayment options

Indiabulls Dhani

Indiabulls Dhani offers personal loans and instant credit to salaried, self-employed, and young professionals through its mobile application. The digital-first model provides paperless approvals and instant disbursals specifically designed for small-ticket loan requirements.

The platform’s strength lies in its instant approval capability and minimal documentation requirements, making it attractive for users needing quick access to funds. The easy EMI tracking through the app enhances the overall customer experience.

Pros:

- Instant approval and disbursal

- Minimal documentation and 100% digital process

- Easy EMI tracking through app

Cons:

- Interest rates higher than traditional banks

- Limited to small-ticket loans

- Eligibility criteria for new-to-credit users can be restrictive

Top Features:

- Digital KYC and e-sign

- Pre-approved loan offers

- Flexible repayment options via UPI and bank transfer

Home Credit India

Home Credit India is a consumer finance company that provides personal loans and durable goods loans to salaried and self-employed individuals, with particular strength in emerging markets. The company effectively blends digital and offline channels for comprehensive customer service and approvals.

Their presence in Tier-2 and Tier-3 cities, combined with flexible repayment schedules, addresses the specific needs of customers in emerging markets. The hybrid approach ensures accessibility while maintaining service quality.

Pros:

- Presence in Tier-2 and Tier-3 cities

- Flexible repayment schedules

- Hybrid digital and assisted onboarding

Cons:

- Limited national coverage

- Higher interest rates for near-prime customers

Top Features:

- Online and branch-based applications

- EMI calculators

- Pre-approved loan facilities

HDB Financial Services

HDB Financial Services offers personal loans targeting salaried and self-employed individuals with competitive interest rates and transparent fee structures. The company’s approach combines digital applications with branch assistance to provide comprehensive onboarding support.

Their focus on transparent pricing and clear terms, combined with flexible loan tenures, makes them attractive to borrowers seeking straightforward lending solutions. The dual-channel approach ensures accessibility across different customer preferences.

Pros:

- Transparent pricing and clear terms

- Flexible loan tenures

- App and branch support

Cons:

- Smaller ticket sizes compared to larger banks

- Limited coverage in some regions

Top Features:

- Digital applications and eKYC

- EMI calculators and flexible tenure

- Pre-approved loan options for existing customers

ICICI Bank

ICICI Bank offers personal loans to salaried, self-employed, and existing customers through a fully digital onboarding process with comprehensive pre-approved offers for loyal users. The bank leverages its wide branch network across India to provide both digital and physical customer support.

As one of India’s leading private banks, ICICI Bank combines technological innovation with traditional banking strength. Their pre-approved loan programs and balance transfer options provide additional value to existing customers.

Pros:

- Trusted brand with nationwide presence

- Pre-approved offers for existing customers

- Digital and branch-based onboarding

Cons:

- Strict eligibility for new-to-credit borrowers

- Documentation requirements can be cumbersome

Top Features:

- Pre-approved loan offers

- Balance transfer options

- Online EMI management

HDFC Bank

HDFC Bank provides personal loans with a strong digital and branch network, targeting salaried, self-employed, and relationship customers. The bank’s offerings include flexible tenures, balance transfers, and top-up loans, making it one of the most comprehensive personal loan providers in India.

As India’s largest private bank by assets, HDFC Bank combines brand trust with extensive reach and competitive products. Their wide coverage and established branch network provide customers with multiple touchpoints for service and support.

Pros:

- Trusted and well-known brand

- Flexible tenures and repayment options

- Wide coverage and branch network

Cons:

- Higher documentation requirements

- Approval dependent on credit history

Top Features:

- Digital application and eKYC

- Pre-approved loans for select customers

- Balance transfer and top-up options

IndusInd Bank

IndusInd Bank provides personal loans to salaried and self-employed borrowers with flexible terms and competitive interest rates. The bank combines digital applications with relationship management support to deliver personalized customer experiences.

Their focus on flexible loan amounts and tenures, combined with transparent fee structures, makes them competitive in the personal lending space. The digital and branch assistance ensures comprehensive customer support.

Pros:

- Flexible loan amounts and tenures

- Digital and branch assistance

- Transparent fee structure

Cons:

- Limited reach in semi-urban areas

- Stricter eligibility for self-employed individuals

Top Features:

- Pre-approved offers

- Online application and EMI tracking

- Balance transfer facilities

Axis Bank

Axis Bank offers personal loans to salaried, self-employed, and existing customers through a combination of digital onboarding and branch-assisted processing. The bank provides quick pre-approval checks and flexible EMI options to accommodate diverse customer needs.

With a large customer base and established banking infrastructure, Axis Bank leverages mobile banking integration and online tools to enhance customer experience. Their quick pre-approved loan options provide additional convenience for existing customers.

Pros:

- Large customer base

- Digital and branch-assisted applications

- Quick pre-approved loan options

Cons:

- Strict credit eligibility

- Documentation-heavy process for some borrowers

Top Features:

- Mobile banking integration

- Online EMI calculators

- Top-up and balance transfer facilities

Punjab National Bank (PNB)

PNB offers personal loans to salaried and self-employed borrowers with transparent interest rates and flexible tenure options. The bank leverages both its extensive branch network and online portals for comprehensive application processing and customer service.

As a trusted public sector bank with wide reach across India, PNB provides competitive interest rates and established banking relationships. Their branch network ensures accessibility in both urban and rural areas.

Pros:

- Trusted public sector bank

- Wide branch network across India

- Competitive interest rates

Cons:

- Slower processing compared to private banks

- Digital experience less robust

Top Features:

- Online application portal

- Flexible EMI and tenure options

- Pre-approved loans for select customers

Federal Bank

Federal Bank provides personal loans with a focus on customer-friendly digital experience and transparent pricing. The bank serves salaried, self-employed, and relationship customers through streamlined processes and competitive offerings.

Their digital-first application process and transparent pricing, combined with good customer service, positions them well in the competitive personal lending market. The bank’s focus on customer experience differentiates it from traditional approaches.

Pros:

- Digital-first application process

- Transparent pricing

- Good customer service

Cons:

- Limited reach in rural areas

- Smaller pre-approved loan base

Top Features:

- Digital onboarding and eKYC

- Flexible EMI plans

- Online loan tracking

South Indian Bank

South Indian Bank provides personal loans to salaried and self-employed borrowers, emphasizing flexible repayment options, competitive interest rates, and both digital and branch-assisted applications. The bank focuses on delivering personalized service while maintaining competitive pricing.

Their balanced approach combining digital convenience with traditional banking relationships ensures comprehensive customer support. The flexible EMI and tenure options, along with transparent charges, make them competitive in the personal lending space.

Pros:

- Flexible EMIs and tenures

- Transparent charges

- Both digital and assisted application process

Cons:

- Smaller footprint compared to larger banks

- Slower processing in some regions

Top Features:

- Digital application and approval

- EMI calculators

- Pre-approved loan offers

The Future of Personal Lending in India

India’s personal lending landscape is rapidly evolving, driven by technological innovation, regulatory support, and changing customer expectations. The market is witnessing several transformative trends that will shape the future of credit access in the country.

Digital transformation has become the cornerstone of modern lending, with API-driven infrastructure enabling seamless integration between lenders, fintechs, and distribution platforms. This technological foundation is creating new opportunities for innovation in credit assessment, customer onboarding, and loan servicing.

Financial inclusion remains a key driver, with digital lending platforms successfully reaching previously underserved segments including rural customers, young professionals, and small business owners. The combination of alternative data sources, simplified documentation, and mobile-first experiences is democratizing access to formal credit across India’s diverse population.

How Decentro Enables the Next Generation of Lending

The complexity of building and scaling lending operations in India’s regulatory environment requires sophisticated financial infrastructure. Modern lending companies need robust APIs for KYC verification, payment processing, compliance management, and data integration to compete effectively in today’s market.

Decentro provides comprehensive API-based financial infrastructure that empowers lending companies to focus on customer acquisition and risk management while we handle the technical complexity. Our solutions enable faster time-to-market, reduced operational costs, and seamless scalability for lending businesses of all sizes.

Whether you’re an established NBFC looking to digitize operations or a fintech startup building innovative lending products, Decentro’s infrastructure APIs provide the foundation for success in India’s rapidly evolving personal lending market. From instant KYC verification to loan underwriting, our solutions help lending companies deliver the seamless digital experiences that today’s borrowers expect.

Ready to transform your lending operations? Discover how Decentro can accelerate your growth in India’s personal lending opportunity.

Frequently Asked Questions

Which types of lenders offer personal loans in India in 2025?

Personal loans are offered by private/public banks, NBFCs, and regulated digital lending apps working with banks/NBFCs, all of which fall under RBI oversight for unsecured credit today; this includes digital-first journeys with eKYC, app-based underwriting, and pre-approved programs surfaced inside large payment ecosystems and bank apps for eligible borrowers.

What new RBI rules in 2025 should borrowers know before applying?

Key 2025 changes emphasize transparency and affordability: lenders must give a Key Fact Statement with APR, fees, EMIs, and total cost; cannot increase limits without consent; must disburse to the borrower’s bank account; and must show all charges upfront, with grievance redressal mandates and stronger verification of existing debts used in affordability checks.

How do digital lending apps assess eligibility for instant or micro personal loans?

Digital lenders and their partner NBFCs/banks use eKYC and consented data to assess creditworthiness, combining bureau checks with transactional behavior; RBI’s digital lending and KYC frameworks require robust identity verification, regulated data handling, AML monitoring, and integration with credit information companies to avoid over-leveraging while maintaining borrower privacy and compliance.