Master RBI purpose codes with our complete guide. Learn how to select the right code, avoid costly mistakes, and simplify cross-border payments with Decentro

RBI Purpose Code for Inward Remittance: Complete Guide

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Quick Takeaways

| What: RBI Purpose Codes are mandatory alphanumeric identifiers (like P0802, P1301) that classify why money is entering India Why: Required under FEMA for compliance, economic monitoring, and preventing financial crimes Impact: The right code means faster payments, clean FIRCs, proper tax treatment, and zero compliance hassles Common Codes: P0802 (software services), P1301 (family support), P0102 (export payments), P1302 (gifts) Key Rule: Select the code that matches your transaction exactly—errors cause delays, tax issues, and compliance problems Pro Tip: Always communicate the exact purpose code with your sender before they initiate the transfer |

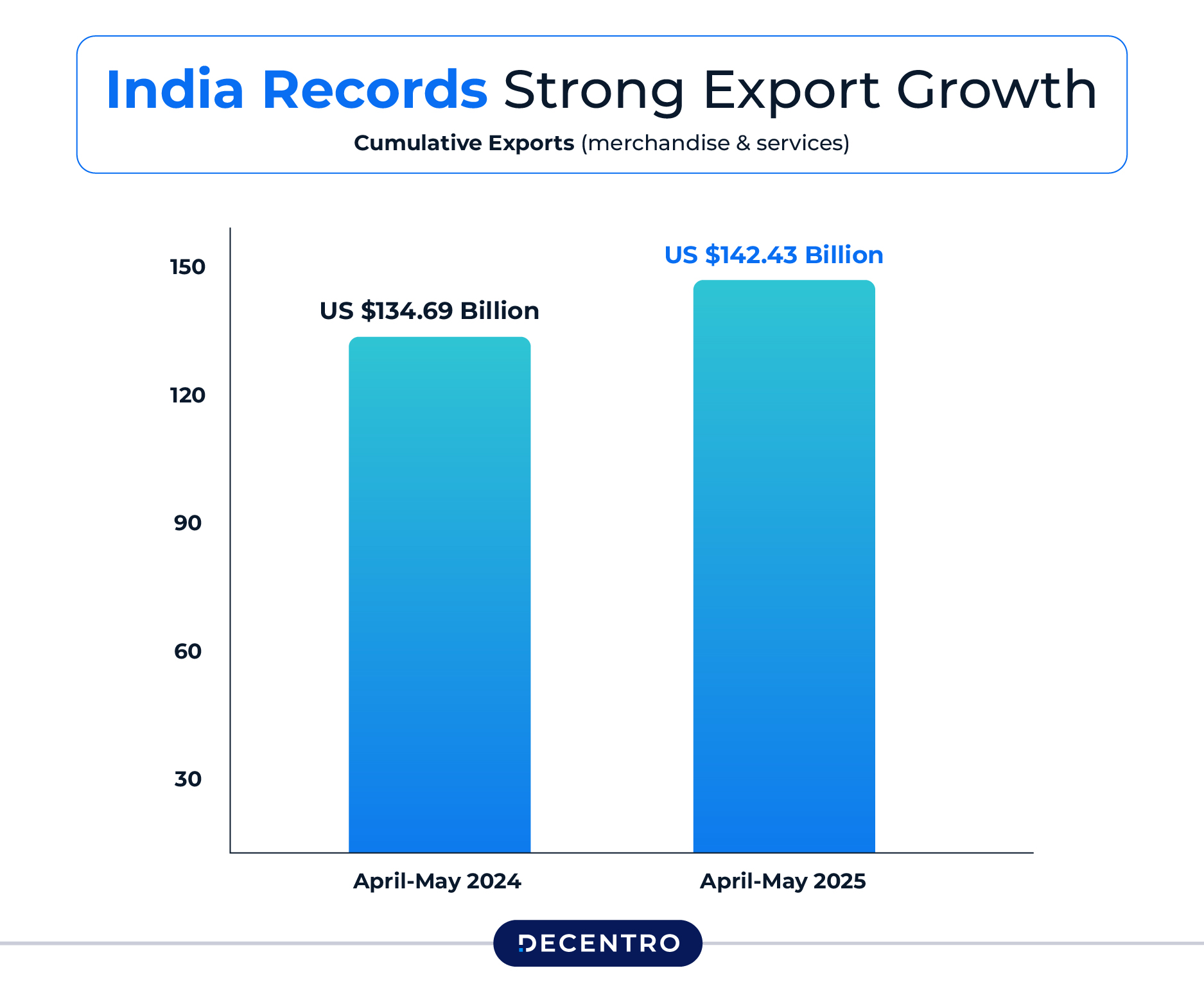

Every year, India receives over $135 billion in inward remittances, making it the world’s largest recipient of international funds. Behind each of these transactions is a small but mighty requirement: the RBI Purpose Code. This alphanumeric code is more than regulatory paperwork—it’s your key to faster payments, clean documentation, and hassle-free compliance. This guide explains what RBI Purpose Codes are, why they matter, how to use them correctly, and how businesses can simplify cross-border payments with the right solutions.

India’s Remittance Landscape: The Numbers Tell the Story

India isn’t just participating in the global remittance market—it’s dominating it.

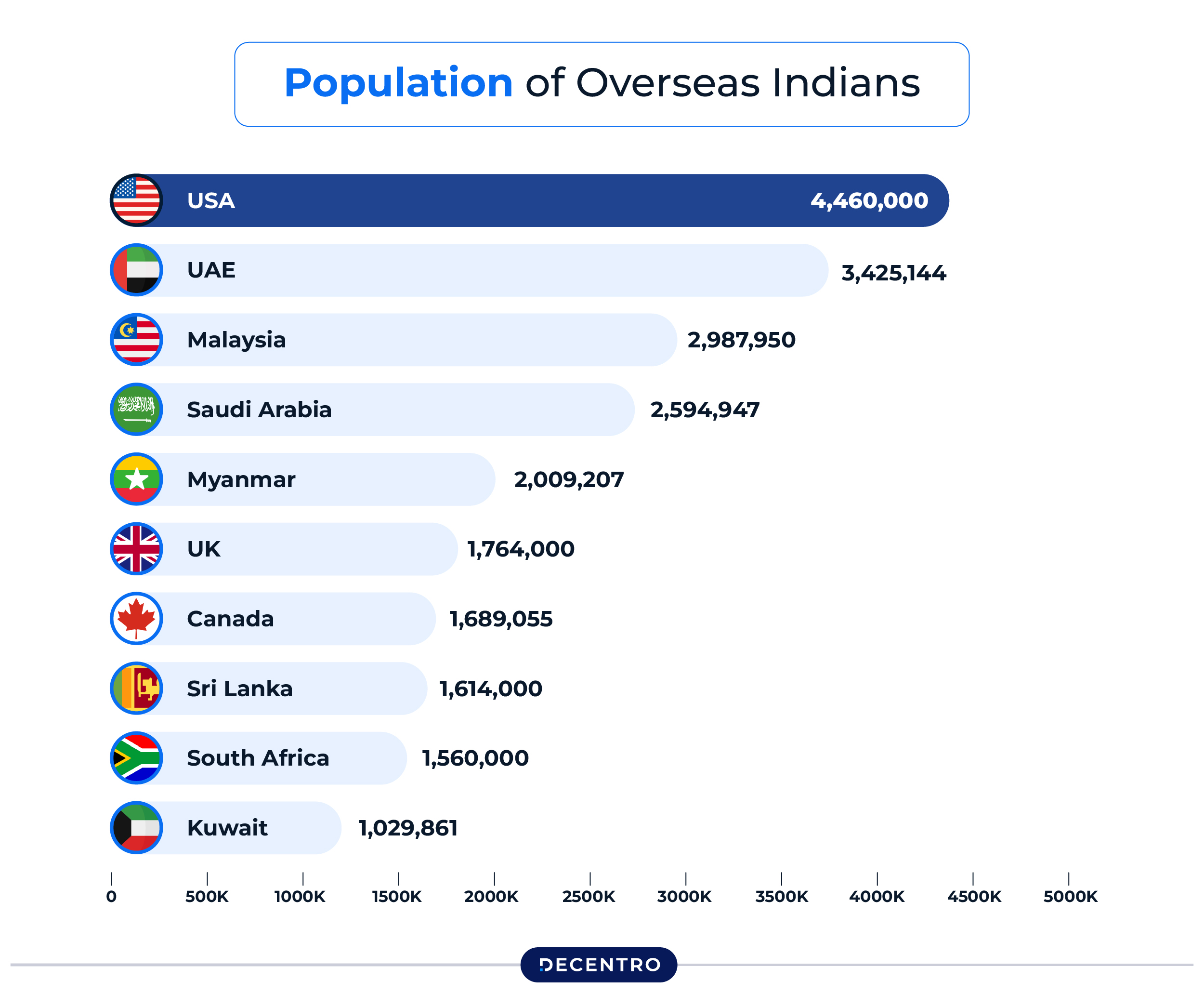

According to the Reserve Bank of India, the country received $137.7 billion in inward remittances in 2024, more than double the amount recorded by Mexico, the second-largest recipient. India accounts for 14.3% of all global remittances, the highest share ever for any country in a single year. To put this in perspective, this is larger than India’s foreign direct investment and official development assistance combined.

What’s fueling this growth? India’s demographic dividend. With 65% of the population under 35 years and the world’s largest pool of STEM graduates, Indians are working across the globe—from Silicon Valley to Singapore, Dubai to London. The number of Indians working overseas has tripled from 6.6 million in 1990 to 18.5 million in 2024. These professionals, entrepreneurs, and workers are sending money home for family support, investments, business operations, and more.

Behind this massive flow of funds is a critical compliance requirement that every sender and recipient must understand: the RBI Purpose Code for Inward Remittance.

What is an RBI Purpose Code for Inward Remittance?

Think of a purpose code as a label or tag that explains why money is crossing borders.

An RBI Purpose Code is a standardised alphanumeric identifier mandated by the Reserve Bank of India to classify the reason behind every foreign exchange transaction entering India. These codes typically start with the letter ‘P’ (for Payment/Receipt) and are followed by four digits. For example, P0802 indicates payment for software services, while P1301 represents family maintenance.

Why Do These Codes Exist?

The RBI introduced purpose codes to create a transparent, organised system for tracking India’s foreign exchange movements. Here’s what they accomplish:

1. Regulatory Compliance

The Foreign Exchange Management Act (FEMA), 1999, requires all Authorised Dealer (AD) banks to report every inward remittance with a valid purpose code. This ensures all cross-border payments are legally categorised and monitored.

2. Economic Monitoring

Purpose codes help the RBI compile Balance of Payments (BoP) statistics, which provide insights into India’s economic health, trade patterns, and foreign exchange reserves.

3. Prevention of Financial Crimes

By categorising transactions, the RBI can detect unusual patterns, prevent money laundering, and ensure funds aren’t used for prohibited activities.

4. Smooth Banking Operations

When banks receive transactions with clear, accurate purpose codes, their automated systems can process payments faster without manual intervention.

The History and Evolution of RBI Purpose Codes

The formalisation of purpose codes came with the Foreign Exchange Management Act (FEMA) in 1999, which replaced the older Foreign Exchange Regulation Act (FERA) of 1973. FEMA introduced a more liberalised approach to foreign exchange management while maintaining robust monitoring mechanisms.

Over the years, the RBI has updated and expanded the purpose code framework to keep pace with India’s evolving economy. Major revisions were made in 2004 and 2012, refining categories to better capture the nature of modern international transactions, especially with the rise of IT services, e-commerce, and digital business models.

The most recent comprehensive update came through RBI’s Annexure II, which provides the official list of purpose codes for forex transactions. These updates reflect India’s transition from a predominantly goods-based export economy to one where services, particularly software, consulting, and digital services, play a massive role.

Today, purpose codes cover everything from traditional exports and family remittances to modern scenarios like freelance software development, digital marketing services, and online platform commissions.

How the RBI Purpose Code Process Works

Understanding the practical mechanics of purpose code declaration helps ensure your transactions go smoothly.

Step 1: Sender Initiates Transfer Abroad

When someone sends money to India, their bank or money transfer service will ask for the transaction’s purpose. The sender needs to select or provide the correct RBI purpose code at this stage. Many international platforms now have built-in dropdown menus with common codes.

Step 2: Transaction Routing

The payment, along with the purpose code, travels through the international banking network (typically via SWIFT) to the recipient’s bank in India.

Step 3: Receiving Bank Verification

When the funds arrive in India, the recipient’s AD bank reviews the purpose code. For business transactions, the bank may request supporting documentation like invoices, contracts, or export documents to verify the code’s accuracy.

Step 4: Credit to Account

Once verified, the funds are credited to the recipient’s account. The bank records the transaction with the purpose code in its compliance system and reports it to the RBI.

Step 5: Documentation

The bank issues a Foreign Inward Remittance Certificate (FIRC) or an electronic FIRC (e-FIRC), which serves as proof of the foreign transfer. The purpose code appears on this certificate, making it crucial for tax filing, GST claims, and export incentive applications.

Common RBI Purpose Codes for Different Scenarios

Choosing the right code depends on the nature of your transaction. Here’s a breakdown of the most commonly used codes:

For Individuals and Families

P1301 – Family Maintenance and Savings

When an NRI sends money to support parents, spouse, or children in India for living expenses, medical bills, or savings.

P1302 – Personal Gifts and Donations

Receiving a monetary gift from a relative abroad for occasions like weddings, birthdays, or other personal events.

P1401 – Compensation of Employees (Salary)

For individuals receiving a salary from a foreign employer, whether working abroad temporarily or remotely from India.

S0304 – Education-Related Services

When funds are received to pay for tuition, educational materials, or related academic expenses in India.

S0305 – Medical Treatment

Money received to cover medical expenses, hospital stays, or treatments in India.

For Freelancers and Service Providers

P0802 – Software Implementation/Consultancy Services

The most common code for software developers, programmers, and IT consultants receiving payment from international clients.

P0807 – Off-site Software Exports

Specifically for software products or services developed in India and delivered to foreign clients electronically.

P1006 – Business and Management Consultancy

For consultants providing strategic advice, business planning, market research, or management services to overseas clients.

P1007 – Advertising, Market Research, and Public Opinion Polling

Digital marketers, SEO specialists, content creators, and market researchers use this code for client payments.

P1002 – Trade-Related Services (Commission)

For agents or intermediaries earning commissions on facilitating exports, imports, or business deals.

For Exporters and Businesses

P0102 – Realization of Export Bills (Goods)

Payment received for physical goods exported from India, once the goods have been shipped and the buyer makes payment.

P0103 – Advance Receipts Against Exports

When an exporter receives partial payment upfront before shipping the goods.

P1009 – Architectural and Engineering Services

For architects, civil engineers, or technical designers receiving payment for plans, designs, or project consultancy.

P1011 – Inward Remittance for Office Maintenance in India

When a foreign company with operations in India sends funds for office expenses, salaries, or maintenance.

For Investments and Capital Transactions

P0006 – Foreign Investment in India in Equity

When foreign investors put money into Indian companies by purchasing shares or equity stakes.

P0012 – Loans from Non-Residents to India

Business loans received from foreign entities or parent companies abroad.

P1407 – Receipt of Dividends by Indians

When Indian residents receive dividend payments from their investments in foreign companies.

Why Accurate Purpose Code Declaration is Critical

Getting the purpose code right isn’t just about following rules—it has real, tangible impacts on your business operations and finances.

1. Speed of Payment Processing

Banks use automated systems to process remittances based on purpose codes. When the code is clear and correct, the transaction flows through instantly. An incorrect or ambiguous code triggers manual review, which can delay your payment by days or even weeks.

2. Clean FIRC Generation

Your Foreign Inward Remittance Certificate depends on the accuracy of the purpose code. An incorrect code on your FIRC can create problems when you need to:

- File income tax returns

- Claim GST exemptions on export services

- Apply for government export incentives

- Prove source of funds for large transactions

3. Compliance and Audit Trail

The RBI and tax authorities use purpose codes to track foreign exchange movements. Consistent, accurate coding builds a clean compliance trail. Incorrect or inconsistent codes can trigger:

- Compliance queries from your bank

- Notices from tax authorities

- Holds on future remittances

- In severe cases, penalties under FEMA regulations

4. Tax Implications

Your purpose code isn’t just a banking formality—it directly influences how the Indian Income Tax Department views and taxes your inward remittance. Here’s what you need to know:

Understanding the Tax-Purpose Code Connection

When you file your income tax return, the tax authorities cross-reference your declared income with the purpose codes on your FIRCs. This means:

- Business Income vs. Personal Receipts: Purpose codes help distinguish between taxable professional income and non-taxable personal transfers

- Tax Rate Determination: Different income types attract different tax rates, and your purpose code signals which category applies

- Audit Trail: Consistent use of appropriate codes creates a clean documentation trail that withstands scrutiny

Tax Treatment by Purpose Code Category

Business and Professional Services (Fully Taxable)

Purpose codes like P0802 (Software Services), P1006 (Business Consultancy), P1007 (Advertising/Marketing), and P0807 (Software Exports) classify receipts as business or professional income. These are:

- Taxable at your applicable income tax slab rate (for individuals) or corporate tax rate (for companies)

- Subject to TDS provisions if applicable

- Eligible for business expense deductions (operating costs, equipment, software subscriptions, etc.)

- Must be reported under “Profits and Gains of Business or Profession” or “Income from Other Sources (Professional)” in your ITR

Example: A freelance software developer receiving $10,000 via P0802 must declare this as business income, pay tax according to their slab rate, but can claim legitimate business expenses.

Export of Goods (Taxable with Benefits)

Purpose code P0102 (Export Bills Realization) indicates you’re receiving payment for goods exported. This income is:

- Fully taxable as business income

- However, eligible for various export benefits and incentives under government schemes

- May qualify for GST refunds or exemptions under the Export of Goods and Services scheme

- Requires matching with your shipping bills and export documentation

Salary and Employment Income (Standard Taxation)

Purpose code P1401 (Compensation of Employees) classifies the receipt as salary income:

- Taxable under “Income from Salary” head

- Subject to TDS if paid by an Indian entity

- Standard deductions under Section 16 apply

- Employer (whether domestic or foreign) must issue Form 16/relevant salary certificate

Family Maintenance (Typically Non-Taxable)

Purpose code P1301 (Family Maintenance and Savings) represents money sent by family members for living expenses. This is generally:

- Not taxable as income, since it’s considered support from family members

- Does not need to be shown as income in your tax return

- However, large or regular amounts might attract scrutiny—maintain proper documentation showing the family relationship and purpose

- If the “family maintenance” is actually disguised business income, tax authorities can reclassify it

Important: The relationship between sender and receiver matters. Receiving ₹10 lakhs from a close relative as family support is different from receiving the same amount from a distant acquaintance.

Personal Gifts (Tax-Free with Conditions)

Purpose code P1302 (Personal Gifts and Donations) has specific tax rules under Section 56(2) of the Income Tax Act:

Tax-Free Scenarios:

- Gifts from specified relatives (parents, siblings, spouse, children, etc.) of any amount

- Gifts up to ₹50,000 in a financial year from non-relatives

- Gifts on the occasion of marriage (from anyone)

- Gifts under a will or by way of inheritance

Taxable Scenarios:

- Gifts exceeding ₹50,000 from non-relatives are fully taxable (not just the excess) under “Income from Other Sources”

- Tax applies at your applicable slab rate

Example: If you receive ₹2,00,000 as a wedding gift from a friend abroad via P1302, it’s tax-free. But if you receive ₹75,000 as a birthday gift from a non-relative, the entire ₹75,000 becomes taxable.

Investment Income (Taxed as Capital Gains or Dividend)

Purpose codes like P1407 (Receipt of Dividends) indicate investment income:

- Dividend income is taxable at your slab rate

- Must be reported under “Income from Other Sources”

- No exemption available (post-2020 tax amendments removed dividend exemptions)

Educational and Medical Receipts (Generally Non-Taxable)

Purpose codes S0304 (Education-Related) and S0305 (Medical Treatment) are typically non-taxable when received for:

- Your own education/medical expenses

- Immediate family members’ expenses

- Properly documented with admission letters, fee receipts, medical bills

However, if you receive educational scholarships or grants that exceed your actual expenses, the surplus may be taxable.

Common Mistakes to Avoid

Using Generic or Vague Codes

Don’t default to “miscellaneous” or “other services” when a specific code exists. Banks may reject generic codes for business transactions.

Mismatching Code with Documentation

If your invoice says “software development” but the purpose code indicates “advertising services,” the bank will flag this inconsistency.

Not Communicating with Your Sender

Many payment delays happen because the sender abroad used a different code than what the recipient expected. Always communicate the exact code before the transfer.

Trying to Change Codes After Processing

Once a transaction is processed and reported to the RBI, changing the purpose code is extremely difficult, sometimes impossible. Get it right the first time.

Ignoring Documentation Requirements

For business codes, banks typically require supporting documents. Have your invoices, contracts, or service agreements ready.

What to Do If There’s an Error

Mistakes happen. If you discover an incorrect purpose code was used:

Act Immediately

Contact your bank as soon as you notice the error. The faster you act, the easier the correction process.

Provide Documentation

Submit a formal correction request along with supporting documents that prove the actual nature of the transaction—invoices, contracts, emails, or service agreements.

Request Code Correction

Your bank may be able to update internal records and reissue the FIRC with the correct code, though this varies by bank policy.

Keep Records

Maintain all correspondence regarding the correction for future reference and audit purposes.

The Role of Digital Solutions in Simplifying Cross-Border Payments

Managing international payments manually, tracking purpose codes, chasing FIRCs, and reconciling forex rates can drain valuable time and resources from your core business activities.

This is where modern cross-border payment solutions step in.

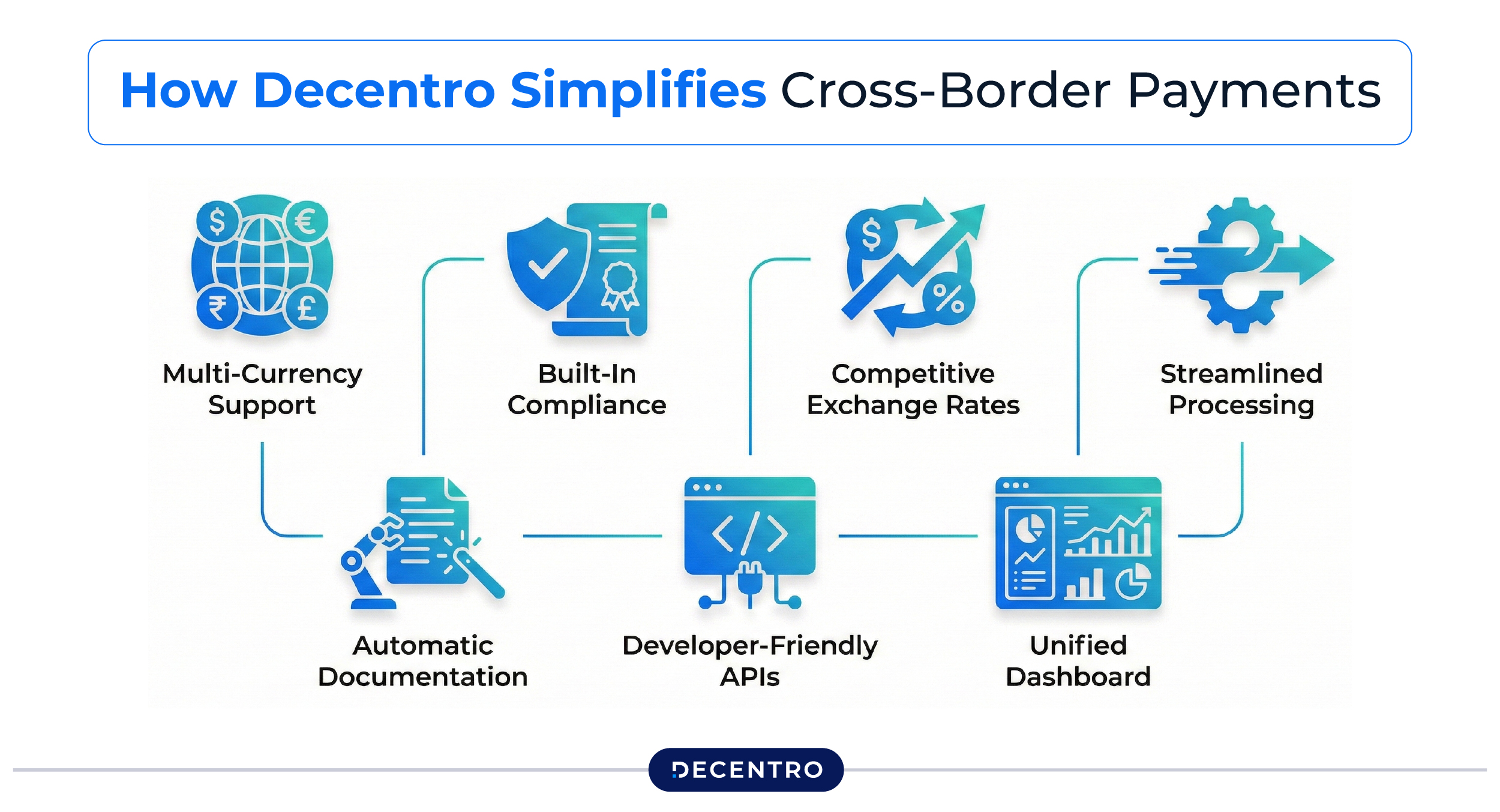

Streamlined Purpose Code Selection

Leading platforms integrate the complete RBI purpose code list directly into their payment interface. Instead of hunting through PDF documents or bank websites, you simply select your transaction type from an organised menu, and the system applies the correct code automatically.

Automatic Compliance Documentation

Advanced platforms generate e-FIRCs instantly and maintain complete digital records of all your international transactions, organized by purpose code. This makes tax filing, audit preparation, and export incentive claims significantly easier.

Transparent Pricing

Traditional wire transfers often hide costs in inflated exchange rates. Modern solutions show you the exact mid-market rate and upfront fees, so you know precisely what you’re paying.

Faster Settlement

While traditional banking channels can take 3-5 business days, digital cross-border platforms often settle payments within 24-48 hours, improving your cash flow.

How Decentro’s Cross-Border Functionality Can Help

For startups and online businesses dealing with international payments, Decentro offers a comprehensive cross-border payment solution designed specifically for the Indian market.

Whether you’re a freelance developer receiving client payments, a SaaS company collecting subscription fees, or an e-commerce business selling to global customers, Decentro’s API-driven infrastructure integrates seamlessly with your existing systems.

Learn more about how Decentro can streamline your cross-border payment operations by dropping a hi at hello@decentro.tech

Conclusion

The RBI Purpose Code for Inward Remittance might seem like a small administrative detail, but it’s fundamental to India’s $135+ billion remittance economy. Getting it right ensures faster payments, cleaner documentation, and hassle-free compliance with FEMA regulations.

As India continues to lead the world in remittance inflows and more businesses tap into global markets, understanding and correctly using purpose codes becomes increasingly important. The good news? With the right knowledge and the right tools, managing international payments can be straightforward and efficient.

Whether you’re receiving a salary from abroad, collecting payment for your services, or running a business with international clients, take the time to understand purpose codes. Communicate clearly with senders, keep proper documentation, and consider using modern payment platforms that simplify the entire process.

In the world of cross-border payments, attention to detail makes all the difference. Master your purpose codes, and you’ll master your international payment flows.

Frequently Asked Questions

1. Can I use the same purpose code for different types of services?

No. Each transaction must have the code that matches its specific nature. If you provide software development (P0802) and digital marketing (P1007), use the respective code for each payment. Mixing codes creates tax complications and compliance issues.

2. What if my client sends money with the wrong purpose code?

Contact your bank immediately with supporting documents (invoice, contract). They may correct it before reporting to the RBI. Prevention is better: always share the exact purpose code with your sender before they transfer funds.

3. Are there limits on amounts I can receive under specific codes?

Business codes (P0802, P0807, P1006) have no upper limits if transactions are genuine and documented. Personal codes have tax implications: gifts from non-relatives (P1302) over ₹50,000 are fully taxable; large family maintenance (P1301) amounts may attract scrutiny.

4. How long does it take to receive my FIRC?

Traditional banks: 7-15 business days. Many now offer e-FIRCs within 24-48 hours via net banking. If you haven’t received it in 15 days, contact your bank’s forex department. Store all FIRCs—you’ll need them for tax filing and GST claims.

5. Do I need a current account for business transactions?

Occasional freelance payments can go to savings accounts. Regular business receipts (multiple per month) typically require a current account, especially for codes like P0802, P0807, P1006. Check your bank’s specific policy on foreign remittances to savings accounts.