Explore the best investment platforms in India and beyond with these top WealthTech companies. Get insight into their top features, pros, and cons to help inform your decision.

Top 21 WealthTech Companies In India in 2026

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Platform Name | Value Proposition |

| Alt DRX | World’s first digital real estate WealthTech platform |

| Equirus Wealth Pvt Ltd | Offers complete wealth management solutions for domestic as well as off-shore products |

| Daulat | It lets you make customised multi-asset portfolios to meet your financial goals |

| Koshex | Leverages AI and ML models to develop personalised investment models |

| ArgyleEnigma Tech Labs | It provides a gamified experience to learn financial knowledge and skills |

| Vitt.ai | Boasts generative AI-powered real-time call assistant for front-line sales teams |

| INDMoney | A one-stop personal finance app for you and your family |

| Zerodha | India’s biggest discount broker |

| Upstox | India’s 4th largest online discount brokerage firm |

| Groww | Best app for trading in the Indian and US stock markets |

| Kuvera | It lets you set up investment accounts for you and your family under the same login ID. |

| Scripbox | It lets you track all your investments, insurance, and loans from a single platform. |

| ETMoney | Allows investing in Direct Mutual Funds, P2P lending, FDs, tax saving maximiser schemes, and more |

| WealthDesk | Apt for investing in customised WealthBaskets consisting of stocks and ETFs |

| Cube Wealth | It lets you make a personalised portfolio by consulting directly with industry experts. |

| Sqrrl | It lets you avail a lucrative investment opportunities tailored for millennials and Gen Z. |

| Kaleidofin | Provides goal-based investment solutions on behalf of financial institutions |

| Wealthzi | It lets you develop long-term wealth plans and risk-appropriate portfolios with ease. |

| Tyke | Ideal for investing in startups through various equity or debt-linked instruments |

| Stable Money | The best platform to book FDs in India |

| Smallcase | Buy a portfolio of stocks or exchange-traded funds (ETFs) based on a particular investment theme, idea, or strategy |

Thanks to the emergence of WealthTech companies, an increasing number of individuals and businesses are investing online.

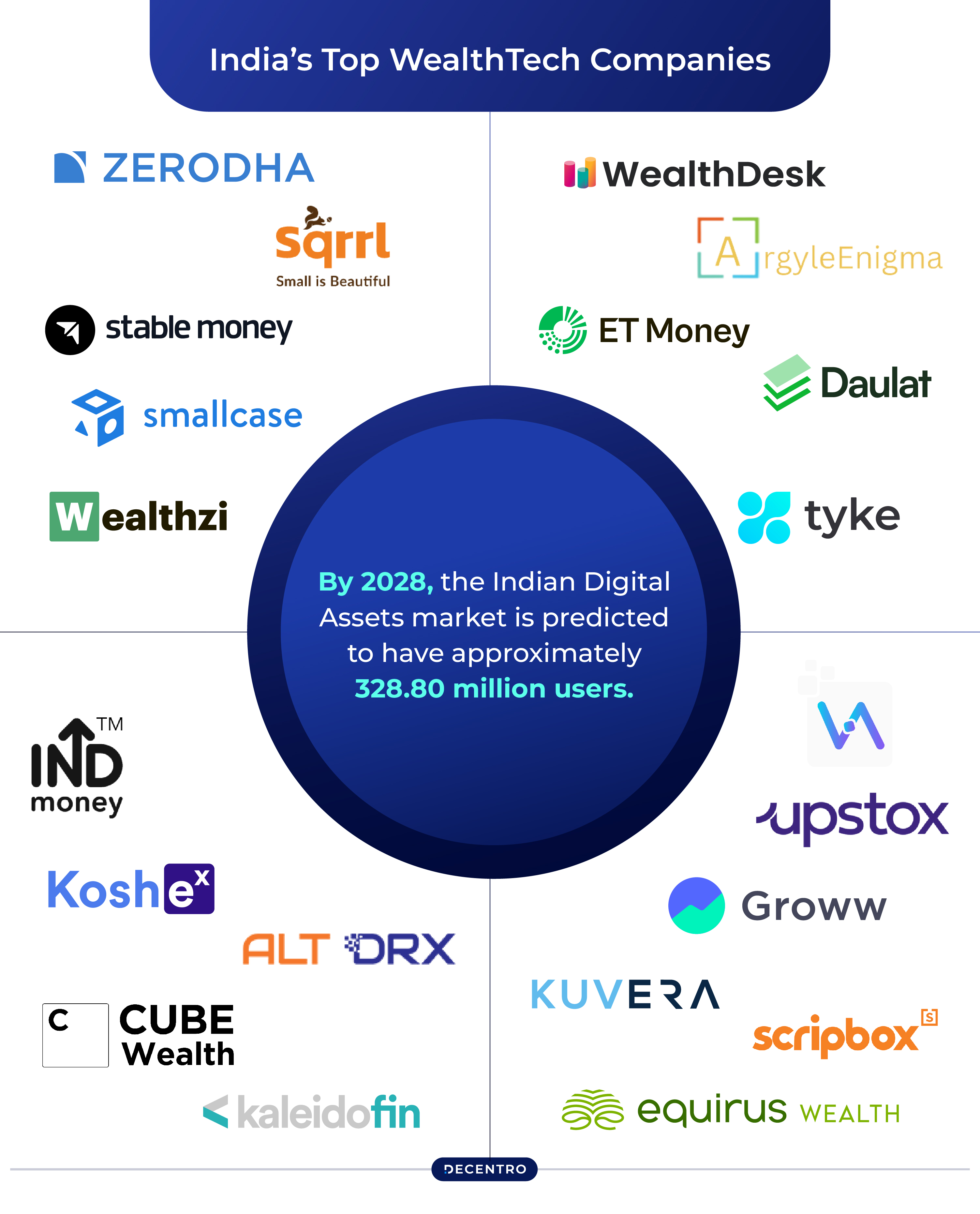

By 2028, the total transaction value in the digital investment market in India is predicted to reach $175.30 billion, indicating a 4.31% CAGR.

Thus, if you are searching for a reliable platform to begin your investment journey, here is a list of the top WealthTech companies in 2024 to help you decide.

One of the biggest benefits of WealthTech companies is that they enable individuals to invest in a wide range of assets from their laptops or smartphones. They can choose the assets that align with their financial goals and the best-performing ones.

Additionally, they can monitor real-time updates of their investments and make informed buy or sell decisions based on market conditions.

What’s more, WealthTech platforms leverage AI & ML algorithms to assess user data and offer personalised financial advice or tailored investment strategies based on the individual’s financial goals and risk appetite.

Moreover, they are integrating AI-powered chatbots to improve user interaction, digital identity verification to comply with regulatory requirements, and blockchain technology to enhance security, efficiency, and transparency in transactions and record-keeping.

Top 21 WealthTech Companies in 2024

Check out the list of the top WealthTech companies in 2024 below:

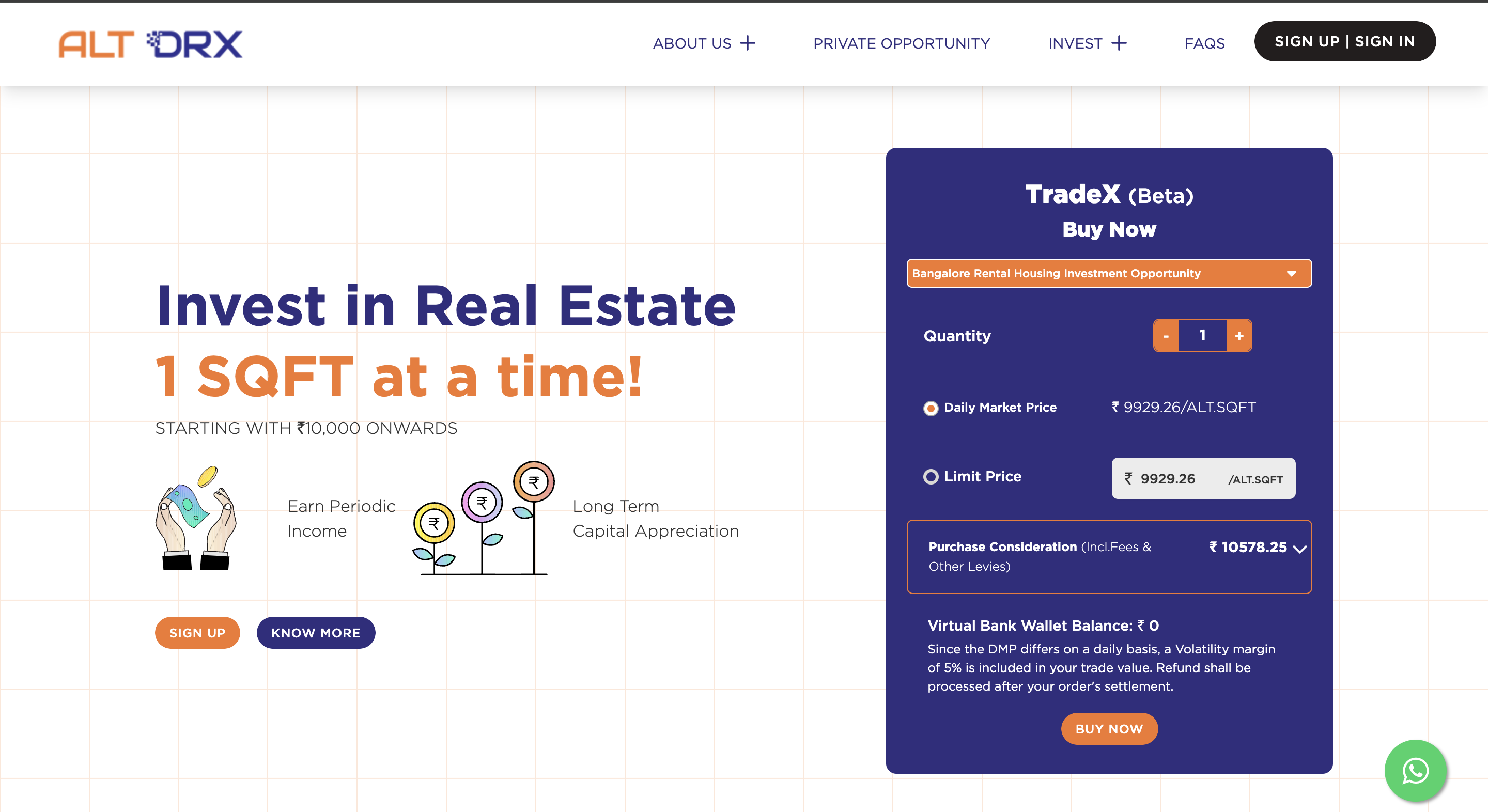

Alt DRX

Alt DRX is the world’s first digital real estate WealthTech platform, which allows users to invest in dematerialised real estate. Investors can buy and sell real estate-backed investment tokens representing less than or equal to 1 square foot of area in a given property.

What’s more, you can earn interest income from your assets and gain long-term capital gains as the value of your investments soar.

Features:

- Investment opportunities are available in 3 stages: Private Opportunity (PO), First SQFT Opportunity (FSO), and TradeX.

- Diversify your holdings by investing in multiple real estate asset classes, such as rental housing, serviced apartments, plotted lands, and retirement homes.

- Income from interest or sale of tokens is securely stored in a virtual bank wallet from which you can withdraw at any time.

Pros:

- Start with as little as ₹10,000

- No lock-in period

- Investment opportunities for both resident and non-resident Indians

Cons:

- Tokens are non-transferable and cannot be traded outside the platform

- Liquidity (time and value) can be low if not enough users are willing to buy tokens

Having enabled their collection and payout capabilities, the founder had to say about the Decentro and Alt DRX.

“Banks work well, but the months-long approval is what breaks the flow. We were fortunate enough to connect with Rohit from Decentro who made sure to help us set up a dedicated flow for simple collection and reliable payouts. All this in weeks. Decentro’s APIs are simple yet very powerful when it comes into play. We at Alt DRX are highly confident with the team at Decentro making us believe to grow exponentially along with Decentro. More power to the team at Decentro.”

Anand Narayanan, Founder at Alt Realtech Pvt Ltd

Equirus Wealth Pvt Ltd

Equirus Wealth Pvt Ltd is a WealthTech platform offering complete wealth solutions for individuals, businesses, promoters, high-net-worth families, and more. Whether you need to manage your private wealth or enhance your digital wealth, this company provides tailored solutions based on your financial goals.

What’s more, depending on your financial objective, this platform provides a unique calculator that allows you to assess multiple parameters and find a plan that meets your requirements.

Features:

- A wide array of assets, such as stocks, mutual funds, AIFs, offshore products, and fixed-income instruments, are present.

- It offers 250+ listed stocks that more than 25 analysts monitor.

- It provides personalised financial services like portfolio management, estate planning, and HNI broking.

Pros:

- Dedicated wealth managers to help you make informed decisions

- Offers a wide range of comprehensive investment solutions like fulfilment of financial goals, meeting current financial needs, and long-term financial freedom

- Availability of financial products that encompass the entire global market and cover various risk levels

Cons:

- The minimum investment amount is usually on the higher side

Daulat

Daulat is a tech-enabled WealthTech platform offering wealth management services to individuals and businesses. Users can develop customised Daulat Multi-Asset Solutions (DMAS) portfolios, which serve as expertly managed all-in-one investment packages.

While clients have complete access to the purchase and redeeming of investments, the platform’s investment experts help them rebalance their portfolios to keep them on track with their investment goals.

Moreover, they provide timely advice and guidance to ensure you are comfortable with the market’s ups and downs and its effect on your portfolio.

Features:

- There are options to invest in a wide array of mutual funds and funds of funds.

- Construct a tailored investment portfolio based on your financial goals and risk appetite.

- 100% digital onboarding and investment process.

Pros:

- Two-factor authentication ensures that only investors have access to their accounts

- The platform is registered with AMFI and invests only in SEBI-registered mutual funds

- Investments by customers are directly transferred to the Bombay Stock Exchange, which is then transferred to the AMCs to maintain transparency

Cons:

- Entry requires a higher investment amount

- Not for people who wish to make direct equity investments

Koshex

Koshex is a personal money management platform that uses artificial intelligence and machine learning models to develop personalised investment plans for clients.

It derives insights from millions of data points to create optimised allocations, ensuring that your capital stays protected and can generate stable returns to cater to your financial needs.

Features:

- Invest in various asset classes, such as mutual funds, digital gold, smart deposits, and fixed deposits.

- Create personalised watch lists and track your net worth in real-time.

- Avail numerous calculators under one roof and make informed investment choices.

Pros:

- Military-grade encryption (AES 256) to ensure that your data is always secure

- Start investing with as low as ₹100

- Options to invest in personalised buckets that align with your financial goals (tax saving, retirement, etc.)

Cons:

- Lacks direct equity investment options

ArgyleEnigma Tech Labs

ArgyleEnigma Tech Labs is a WealthTech company aiming to bridge the financial knowledge and skills gap through a gamified experience.

The platform offers byte-sized learning modules, quizzes, and videos via its app, Fili, to make financial literacy fun and interactive. This enables individuals to save more money, make judicious financial decisions, and accumulate wealth.

This platform serves as a viable alternative to the long and boring courses on finance and its related subjects. It enables individuals to learn at their own pace. Moreover, the app has a community where users can share their ideas and make constructive decisions.

Features:

- Interactive quests that help introduce you to basic financial concepts.

- Progressive levels are based on specific financial topics.

- Accumulate a certain amount of points to move to the next level or unlock additional content.

Pros:

- Regular app content updates based on market trends and user feedback

- It covers a wide array of finance-related topics, such as saving, budgeting, understanding credit, managing debt, and retirement planning.

- Options to track progress and set goals like paying off debt, saving for a vacation, and building an emergency fund

Cons:

- The app is not yet available for iOS

Vitt.ai

Vitt.ai is a generative AI-powered real-time call assistant for front-line sales teams for financial services companies. It provides real-time cues to help analyse client input, make effective pitches, and achieve faster closures.

This tool listens to live calls and shows the best responses for all types of process/data/advisory-related client queries.

Features:

- It analyses client profiles to create personalised product pitches that comply with the company’s policies and views.

- It captures all relevant data from the call and automates all back-end tasks like updating CRMs.

- It comes pre-trained with more than 50,000 unique financial knowledge parameters and can also be trained using content on the go.

Pros:

- It can be used for front-line sales teams of banks, insurance companies, and other financial services institutions

- Provides more than 85% accuracy in analysing live calls and generating real-time cues in 5 Indian languages

- Integrated plug-and-play architecture with existing soft-phoning, CRM, chatbots, and call centres

Cons:

- Staff may need additional training to operate the tool

INDMoney

INDMoney is a one-stop personal finance app that lets you track finances across all your family members, plan and set up their financial goals, and invest in a wide range of assets.

Moreover, this platform enables you to invest in the National Pension Scheme (NPS), gain insights into your finances, purchase life and health insurance, and even get an instant line of credit.

Features:

- Check your mutual fund’s portfolio, credit card statements, savings accounts, and NPS balance, and track ESOPs under one roof.

- Start SIPs in more than 5,000 stocks and over 160 ETFs at zero account maintenance charges.

- Invest in a wide range of US stocks starting from ₹100.

Pros:

- Set real-time price alerts for your watchlisted stocks

- Get summarised insights on companies listed on the Indian stock exchange via daily news updates

- Avail calculators for various aspects like retirement planning, GST calculation, etc., and get appropriate product recommendations

Zerodha

Apart from being one of the top WealthTech companies in India, Zerodha is also the biggest discount broker in India. It enables users to invest in numerous asset classes, such as stocks, direct mutual funds, fixed-income instruments, futures, and options.

Additionally, you can apply for IPOs via this platform using the BHIM UPI app and even gift assets to your loved ones. If you are a startup, you can utilise Zerodha’s HTTP/JSON APIs to build your trading platform.

Features:

- Ultra-fast flagship trading platform that streams market data and provides access to multiple advanced charts.

- Buy mutual funds online and get them directly transferred to your Demat account without paying any commission.

- Access easy-to-grasp stock market lessons with illustrations and in-depth coverage.

Market Share: 20% as of FY 23

Pros:

- Free equity delivery and lower trading fees than other major Indian brokerage platforms

- Seamless and intuitive user interface that runs smoothly on both Android and iOS

- Gain access to a centralised dashboard, which allows you to gain insights into your investments and trades via visualisations and in-depth reports

Cons:

- Covers only the Indian stock market

- The account opening process can be a bit slow

Upstox

Upstox is India’s fourth-largest online discount brokerage firm. It enables individuals to invest in various asset classes, such as stocks, mutual funds, ETFs, IPOs, SGBs, and more.

Moreover, to promote financial literacy, this platform offers quick videos, webinars, and self-help courses covering many topics that can help one become a better investor.

Features:

- Choose from over 5000 stocks and 2500 mutual funds

- Start SIPs for both stocks and mutual funds with as low as ₹100

- ‘Pre-apply’ features for IPOs allow you to apply before others, that too with ₹0 commission

Market Share: 9% as of FY 23

Pros:

- Zero brokerage charges and flat ₹20 brokerage fees

- Avail ready-made mutual fund portfolios depending upon your risk appetite

- Import all external mutual funds and link your bank accounts to track your wealth from a single app

Cons:

- Margin funding is not available for delivery trades

- Lack of a 3-in-1 account

Groww

Groww is one of the top WealthTech companies in India. It aims to make investing fast, easy, and transparent. It provides instant paperless online account opening, a wide array of stocks, mutual funds, and other assets, and instant and flexible loans.

Moreover, you can open a Demat account on this platform with minimum documentation and avail a wide variety of calculators to make informed financial decisions.

Features:

- Invest across multiple asset classes like stocks, IPOs, ETFs, futures and options, etc.

- Avail 10+ technical charts, a full set of indicators, and instant market updates.

- Track historical data for up to 10 years for your target stock.

Market Share: 16% as of FY 23

Pros:

- Free Demat account with zero annual maintenance fees

- Flat ₹20 or 0.05% per executed order (whichever is lower) for equity brokerage

- Covers both the Indian and US stock markets

Cons:

- Lacks trading options in the commodity and currency segments

- Does not offer stock tips or recommendations

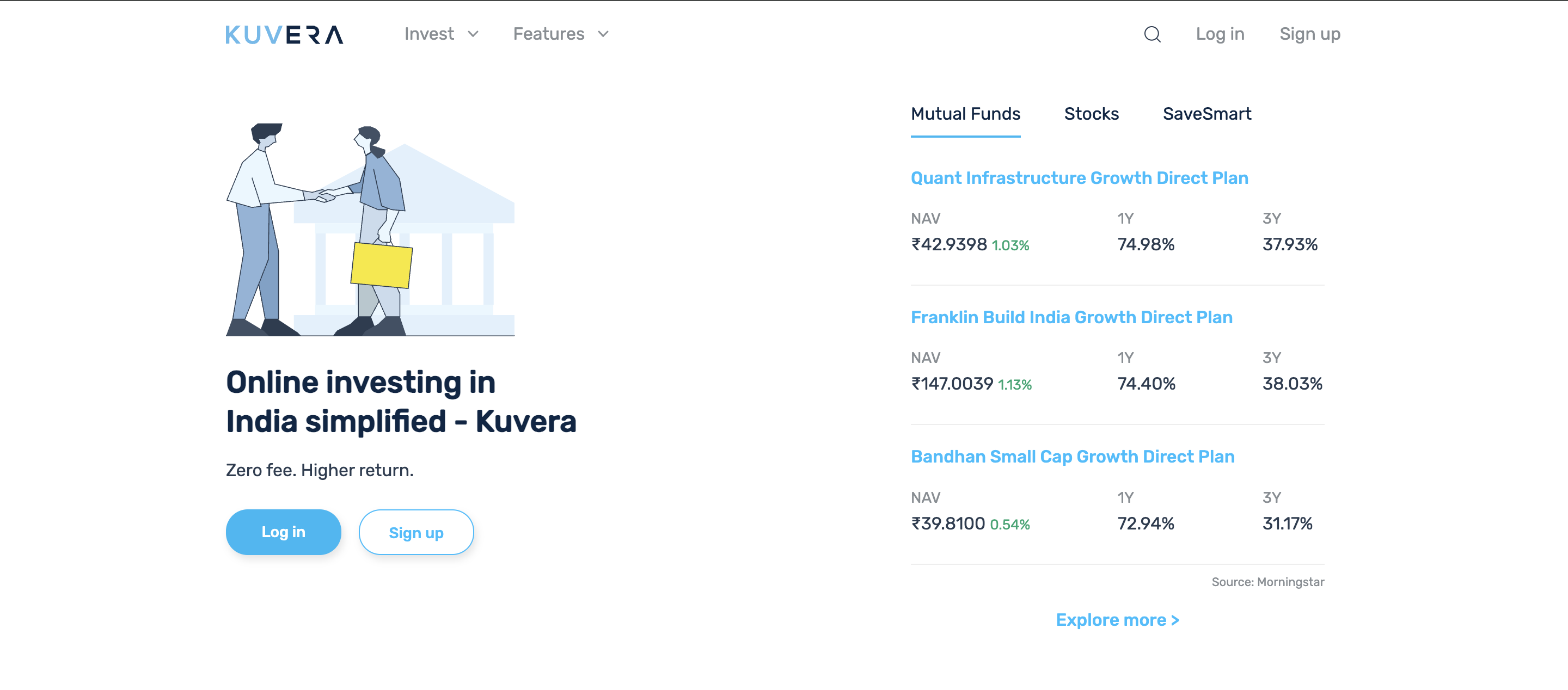

Kuvera

Kuvera aims to simplify online investing by enabling you to access assets like stocks, mutual funds, tax-saving instruments, and more. You can set up a goal per your requirement, enter its details, and look at the recommended mutual fund plans and the monthly investment amounts.

Furthermore, you can track external transactions with Kuvera by setting up auto-forwarding rules for Consolidated Account Statements (CAS). By doing so, they will be automatically forwarded to your mailbox and then to the platform.

Features:

- It provides options to manage multiple accounts under the same login ID.

- Import existing portfolio to Direct Plans.

- View how much you can safely redeem or switch using TradeSmart with the least possible tax implications.

Pros:

- Start investing with as low as ₹500

- Sort assets based on various parameters to choose the ones that align with your investment objective

- Minimise long-term capital gains each financial year through tax harvesting

Cons:

- Does not provide a dedicated relationship manager

- Offers limited mutual funds-related research and analysis features

Scripbox

Scripbox is another leading WealthTech platform that allows you to track all your investments, insurance, and loans using a single app. Based on your risk appetite, the platform lets you get a personalised asset allocation plan with suggested percentages across various asset classes.

Moreover, you can get real-time insights into your overall wealth and gain in-depth insights into your portfolio’s asset allocation and liquidity. Scripbox also has a comprehensive knowledge base section covering various finance-related topics that can help you make better investment decisions.

Features:

- It has personalised investment strategies based on goals, investment horizons, and other aspects.

- A collection of the top mutual funds in India provides exposure to multiple asset classes.

- Calculators for various investment products.

Market Share:

Pros:

- Smooth and intuitive user interface

- Contains mutual funds that enable you to invest in both the Indian and US stock markets

- Plans come with no lock-in period, offering high flexibility

Cons:

- Offers only mutual fund investment options

ETMoney

ETMoney is a leading Indian Wealth Tech platform offering a wide array of lucrative investment options. In addition to Direct Mutual Funds investments, you can invest in peer-to-peer lending, fixed deposits, tax-saving maximiser schemes, and more.

This platform also offers a premium membership program that provides personalised investment plans based on your risk appetite, time horizon, and investor personality.

Features:

- There is a vast collection of top mutual fund schemes based on market capitalisation, diversification, sectors, themes, etc.

- Free portfolio health check options covering 11 key parameters.

- There are options to buy personalised term life insurance and health insurance policies from top-ranking providers.

Pros:

- Options to invest in the NPS scheme right from the app

- Contains a ‘Learn’ section in which you can find topics on financial literacy and the latest market updates

- Simple and intuitive user interface

Cons:

- Does not offer its own Demat account

- Lacks trading options

WealthDesk

WealthDesk allows individuals to invest in WealthBaskets. These baskets are a collection of stocks and ETFs curated by SEBI-registered professionals, each representing an investment strategy, segment, or theme.

Moreover, these assets provide the benefits of direct ownership as the underlying stocks and ETFs you invest via WealthBaskets sit right in your Demat account.

Features:

- There are options to receive dividends directly in your bank account.

- Collections of multiple assets provide diversification benefits.

- Regular rebalancing ensures that the WealthBasket reflects the latest investment methodology or research.

Pros:

- No lock-in period for your investment, providing a high degree of flexibility

- No need to create a separate account to invest in WealthBaskets as you can do so with your existing Demat account

- Options to make partial withdrawals

Cons:

- Limited availability of assets

- It does not offer its own Demat account

Cube Wealth

Cube Wealth is a digital WealthTech platform that aims to provide investment advice from industry experts to professionals who wish to grow their wealth but are too busy to conduct market research.

It helps clients create a personalised portfolio with the help of dedicated wealth advisors and invest in assets based on their desired horizon, risk level, and financial goals.

Features:

- Investments in stocks, mutual funds, gold, and more are options.

- P2P lending and other co-investment options are available.

- It covers both the Indian and US stock markets.

Pros:

- Facilities to take the help of wealth coaches to start the right SIP for your financial goals

- The presence of a SIP and lumpsum calculator is used to make an informed investment decision

- No more tracking the Sensex and analysing financial reports to decide where to invest

Cons:

- Unavailability of Demat account

- Lacks charts and other analytical options like other major WealthTech platforms

Sqrrl

Sqrrl is a new-age WealthTech platform offering lucrative investment opportunities, especially for millennials and Gen Z. It focuses on encouraging savings in small sums and investing in the right places, that too with just a few simple clicks.

Apart from mutual fund investment products, this platform offers tax-saving schemes, 13K P2P investment options, digital gold, and fixed deposits.

Features:

- It caters to a wide array of mutual fund schemes like equity, debt, hybrid, etc.

- Goal-based investing options allow you to get tailored investment plans based on your financial goals.

- Round-up investing enables you to round up the change for every transaction you make with a linked card and channel it into a fund you choose.

Pros:

- Start investing with as low as ₹500

- Choose investment portfolios based on your risk appetite

- Withdraw money partially or in full from schemes at any point in time (except for tax-saving instruments)

Cons:

- Lacks direct equity investment options

Kaleidofin

Kaleidofin aims to democratise finance by empowering financial institutions to deliver inclusive financial solutions. This platform specialises in goal-based financial services by leveraging various sustainability and machine learning engines.

It provides solutions that cater to the individual requirements of various stages of customers’ lives and integrate them seamlessly with platform partners like banks, NBFCs, MFIs, and other corporations.

Features:

- It provides solutions like lending as a service, credit assessment, and customer engagement.

- Credit score assessment based on over 30 million data points enables banks to confidently analyse the unbanked and underbanked segments.

- Facilitates omni-channel customer connect, thus facilitating an interactive and seamless banking experience.

Pros:

- Offers a holistic risk management solution that includes impact metrics, customer journey tracking, and comprehensive portfolio management

- Optimises the company’s financial potential through continuous value augmentation, which helps build lasting relationships with customers beyond their one-time transactions

- Provides an intuitive user experience using vernacular and visual flows, which are perfect for guiding even first-time smartphone users

Cons:

- It does not provide any opportunity to invest in the stock market

Wealthzi

Welathzi is an independent digital wealth management platform that helps you create long-term wealth plans and risk-appropriate portfolios.

It is led by a group of experienced wealth managers, entrepreneurs, and technologists who strive to reduce unnecessary risk and exposure to make your investment journey smooth and clutter-free.

Features:

- Proprietary Zi Algorithm that enables users to identify the best-performing mutual funds.

- The Remote Human Assistance feature lets you resolve queries from your smartphone.

- Get recommendations for rebalancing your portfolio to ensure you stay on track of your investment goals.

Pros:

- Start, switch, or withdraw an SPI with just a few clicks

- Begin investing with as low as ₹100

- Efficiently track all your investments right from the app’s dashboard

Cons:

- Focuses only on mutual funds

- Lacks relationship manager services

Tyke

Tyke is a WealthTech platform that funds startups and allows retail investors to invest in such businesses. Companies that raise funds via this platform can issue equity or debt-linked instruments.

They can range from a CSOP campaign, an Invoice Discounting campaign, a CCD campaign, a CCPS campaign, or an NCD campaign.

Features:

- Buy and sell Stock Appreciation Rights (SARs) from other users on Tyke Square, the platform’s own peer-to-peer platform.

- Subscribe to multiple startups any number of times during active campaigns.

Pros:

- Start a subscription with just ₹5,000

- Minimum documentation requirements

- Options to reduce or cancel subscriptions within 48 hours of subscribing

Cons:

- Limited diversification options as the focus is solely on startups

We at Decentro have enabled the verification journey for Tyke, and this is what the founders had to say about the association,

“Decentro’s APIs have always been a hot topic of discussion at Tyke invest. It has been seamlessly good so far and we’re all set to go along with them. From penny drop APIs to validate bank account details of thousands of our customers, their APIs ensure a successful hit every time. This is the future of fintech, cheers team Decentro.”

Karan Mehra, Founder at Tyke Invest

Stable Money

Stable Money is another reputed WealthTech platform that deals specifically with fixed deposits. It enables you to find FD schemes offering the highest interest rates and apply for them directly with your bank account.

Moreover, you do not need to pay any transaction charges to book your desired FD scheme.

Features:

- Gain interest income up to 9.10% per annum.

- Upcoming bonds and debt mutual funds investment options.

- Avail insurance for bank FDs up to ₹5 Lakhs.

Pros:

- 100% assured growth

- An excellent way to beat market volatility

- Book fixed deposits with the banks offering the highest returns

Cons:

- Lack of diversification

- The lock-in period and withdrawal rules may vary across schemes

Smallcase

Smallcase is a unique investment platform that allows investors to buy a portfolio of stocks or exchange-traded funds (ETFs) based on a particular investment theme, idea, or strategy.

Features of Smallcase:

- Curated Portfolios: Smallcase offers a wide range of curated portfolios, each built around a specific investment theme, strategy, or market trend. These themes cover various sectors, industries, market caps, and investment styles, catering to different investor preferences.

- Transparent Constituents: Each Smallcase portfolio comprises a set of individual stocks or ETFs carefully selected to align with the underlying theme. Investors can view the constituents of a Smallcase upfront, along with detailed information such as historical performance, risk metrics, and sector exposure.

- Customization Options: Investors can customize and modify their Smallcase portfolios based on their risk appetite, investment horizon, and preferences. They can add or remove stocks, adjust portfolio weights, and rebalance their portfolios as needed.

- Single-Click Investing: Smallcase streamlines the investment process by allowing investors to buy an entire portfolio of stocks or ETFs with a single click. Instead of purchasing each stock individually, investors can invest in a diversified portfolio of securities in one go, saving time and effort.

- Regular Rebalancing: Smallcase regularly rebalances its portfolios to maintain alignment with the underlying investment theme and adapts to changing market conditions. This ensures that investors are exposed to the most relevant and promising investment opportunities over time.

- Integration with Brokerage Platforms: Smallcase seamlessly integrates with leading brokerage platforms, allowing investors to execute trades directly from their accounts. This integration provides a hassle-free investing experience and ensures access to real-time market data, order execution, and portfolio tracking.

Pros

- Smallcase offers diversified portfolios that allow investors to spread their risk across multiple stocks or ETFs, reducing the impact of individual stock volatility.

- Smallcase simplifies the investment process with single-click investing and seamless integration with brokerage platforms, making it easy for investors to access and manage their portfolios.

The Future of the WealthTech Sector

By 2028, the Indian Digital Assets market is predicted to have approximately 328.80 million users, with a penetration rate of about 22.20%. Moreover, Alternative Investments are gaining an increasing share of India’s AUM and are expected to reach 20% by 2026.

Thus, there is ample scope for new WealthTech companies to enter and expand in the digital investment segment. However, having a robust payment network is necessary to be ranked among the top WealthTech companies in India.

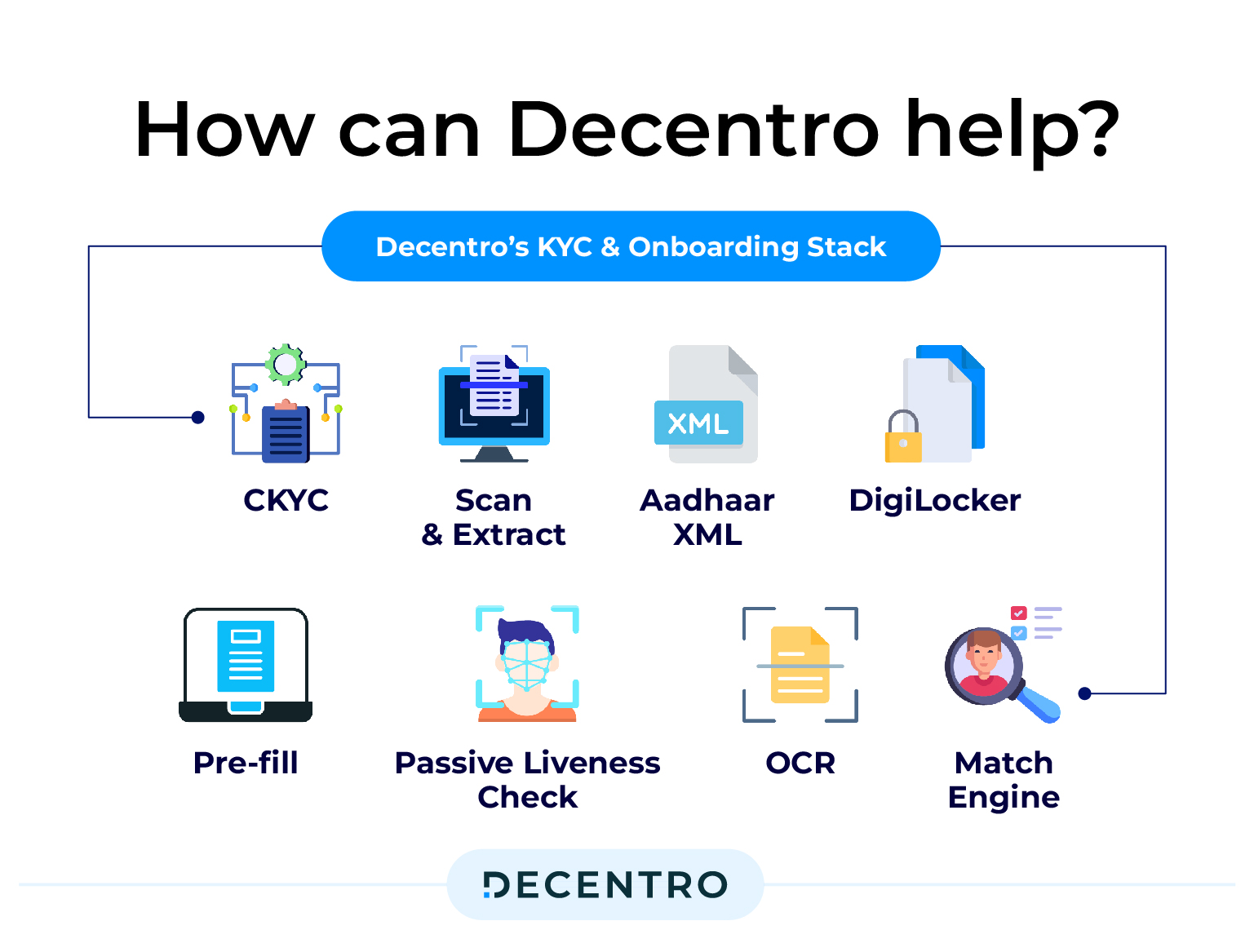

For any company that wishes to enter the WealthTech sector, Decentro’s APIs can help with KYC and onboarding, setting up recurring payments, managing escrow accounts, launching white-labelled lending products, and more.

You can also collect and disburse domestic transfers across multiple payment methods. Additionally, you can seamlessly handle cross-border payments via SWIFT across supported countries.

The Decentro Connect

Decentro offers a comprehensive suite of tools designed to optimise your transaction management process for your WealthTech, making it easier and more efficient than ever before. With the combined strength of our payouts and escrow features, businesses can streamline their payroll operations while ensuring security and compliance at the same time.

Decentro’s KYC and Onboarding stack can help WealthTech companies conduct instant background verifications using real-time KYC checks during user onboarding. Doing 800+ ID validations per hour and 500+ OCR & extractions per hour, Decentro fully understands the importance of enabling faster customer onboarding while being compliant, helping businesses reduce drop-offs and save costs.

Ready to explore how Decentro can accelerate your collections and onboarding process in a compliant manner?

Frequently Asked Questions (FAQs)

1. What is a WealthTech company and how does it differ from a regular fintech company?

A WealthTech company specializes in leveraging advanced technologies—like AI, machine learning, and automation—to improve wealth management, investment planning, and financial advisory services. Unlike broader fintech companies, which focus on various financial services such as payments or lending, WealthTech brands specifically optimize investments, personalized portfolio management, and financial planning digitally

2. Who are the leading WealthTech companies worldwide in 2025?

Prominent global WealthTech companies include FNZ Group, Envestnet, Bravura, iCapital, Betterment, Wealthfront, Robinhood, Stash, Addepar, and BetaNXT. These firms are recognized for innovations in digital wealth management, robo-advisory, and providing comprehensive investor solutions.

3. What features should I look for in a top WealthTech platform?

Top WealthTech platforms typically offer:

- Automated and personalized investment strategies (robo-advisory)

- Low or no minimum investment requirements

- Real-time portfolio tracking and analytics

- Secure, user-friendly digital interfaces

- Transparent fee structures

- Support for diverse asset classes (stocks, mutual funds, ETFs, alternative assets)

- Regulatory compliance and robust security.

4. Are WealthTech platforms safe and regulated?

Yes. Leading WealthTech platforms utilize advanced encryption, two-factor authentication, and frequently conduct security audits. They typically operate under regulatory oversight and comply with financial authorities’ standards to protect users’ funds and data.

5. Can beginners and small investors use WealthTech companies, or are these platforms only for the wealthy?

WealthTech has democratized investing: most top platforms are open to everyone, not just high-net-worth individuals. With low entry points and educational resources, these companies empower beginners and small investors to access diversified investments and professional-grade portfolio management.