From faster onboarding to audit success—find out why document readiness is a must for financial institutions in today’s compliance landscape.

Why Document Readiness Matters in Lending, KYC & Compliance

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Whether you are applying for a loan, completing a KYC process, or meeting regulatory compliance, document readiness plays a decisive role in ensuring the speed and accuracy of financial operations.

For both lenders and financial institutions, quick access to accurate and verified documents isn’t just a matter of convenience. Instead, it is a regulatory requirement and also a business imperative.

In this blog post, we are going to take a detailed look at why document readiness is considered important in lending, KYC, and compliance.

What Exactly Does Document Readiness Mean?

Document readiness basically refers to a state in which all the documents for a specific finance process are complete, accurate, properly formatted, and easily accessible at any time. The processes include

- Lending

- KYC

- Compliance

And many more.

Remember, some think it simply refers to having all the documents on hand; the truth is, document readiness goes beyond this. It emphasizes that each document meets the required standard and criteria set by the regulatory authority, internal policies, and external partners.

Let us simplify the concept for you a bit more.

A financial document will be considered fully ready when it meets the following criteria:

- Contains all the important information/data

- Contains no errors or inconsistencies

- Written in a valid time frame

- Follows an acceptable format, i.e., original copy or digitally scanned.

- Easily accessible when needed for revision or submission

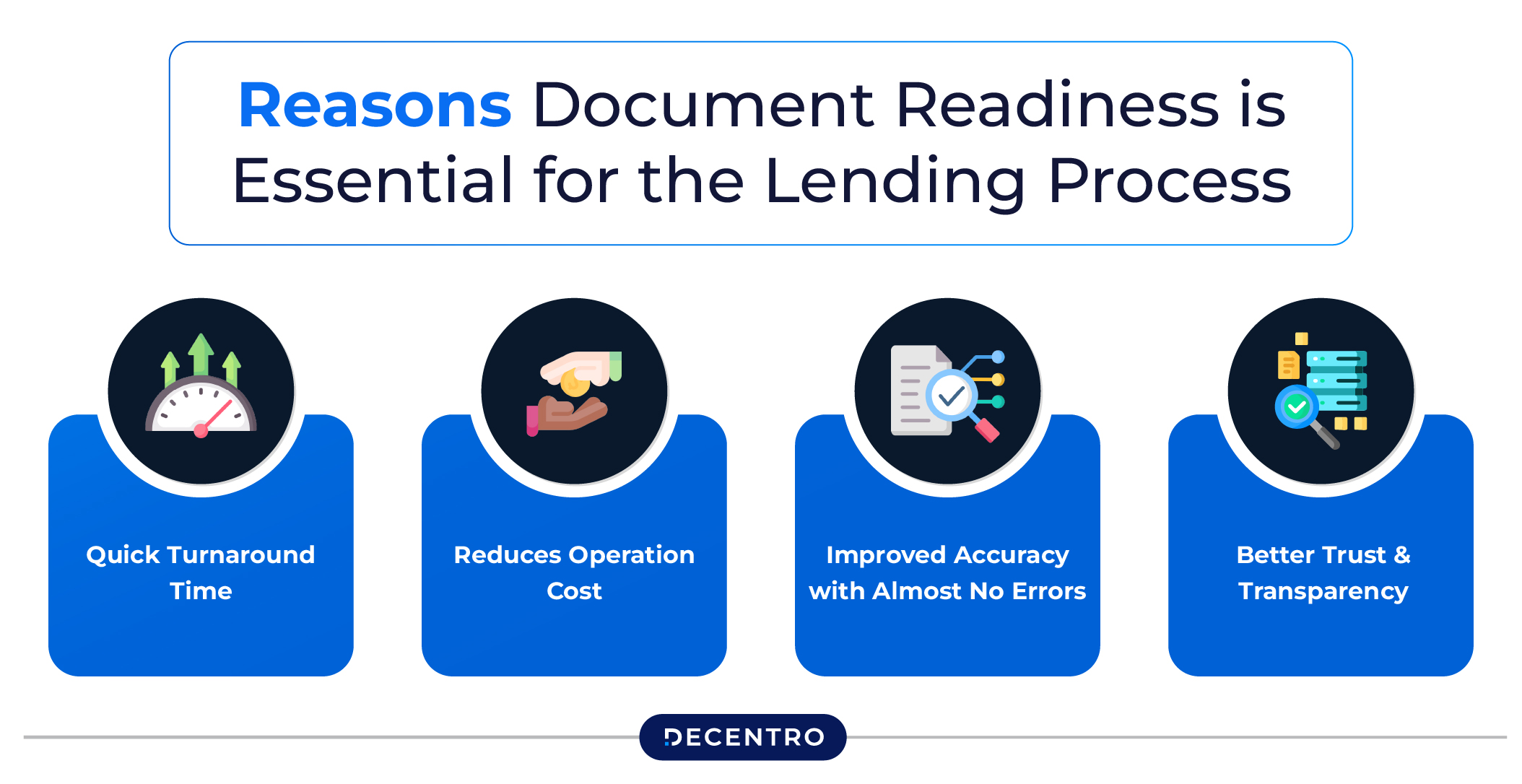

Reasons Document Readiness is Essential for the Lending Process

Here are some of the key reasons through which document readiness is contributing to improving the overall lending process.

- Quick Turnaround Time

The name already said everything. A complete set of ready-to-review documents allows the lending staff to quickly skim through each page.

When every document is in the right format and placed in the right order, the decision-making process automatically accelerates, and the borrowers will ultimately experience quick responses.

However, many borrowers save essential documents—such as PAN and Aadhaar cards—in image formats like JPG. Whereas, lenders typically prefer PDF files, which are globally recognized and standardized formats for documents.

In such a situation, relying on a JPG to PDF converter is suggested. It will automatically convert the given images into a scannable and shareable PDF file, reducing unnecessary delays caused by formatting issues.

- Reduces Operation Cost

Cost is one of the most important factors in every task or process. Manually performing routine and repetitive tasks in the lending process ultimately increases the overall operational cost.

However, this isn’t the case with document readiness. This is because, when every detail is complete, accurate, and placed properly, lenders simply need to review and approve the application.

- Improved Accuracy with Almost No Errors

When the lending documents are prepared properly, formatted well, legible, and up-to-date, the overall risk of errors and misinterpretation decreases significantly.

For example, a clear PDF file of a salary slip of the loan borrower is significantly easier to process as compared to an image file. Here again, utilizing intelligent tools and online solutions can prove really handy for lenders.

- Better Trust & Transparency

Last but not least, document readiness significantly contributes to boosting the borrower’s trust in the lending institution.

Imagine there are no repeated requests, seamless document verification, and no technical corrections, ultimately resulting in a better experience. However, it is important to note that this can only be achieved through document readiness.

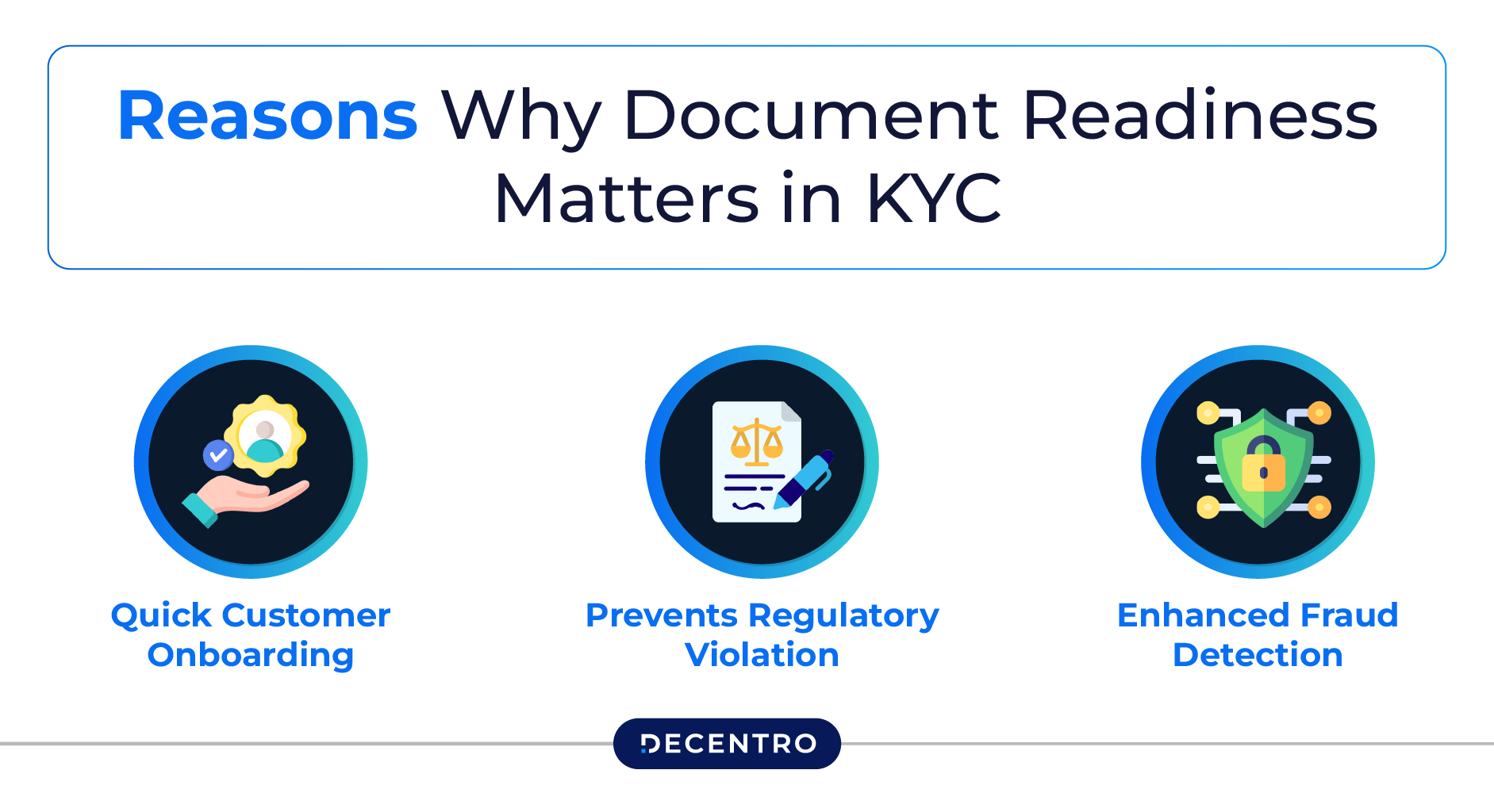

Reasons Why Document Readiness Matters in KYC

Below are a few major reasons why document readiness is considered important for the Know Your Customer (KYC) process.

- Quick Customer Onboarding

We are living in a fast-paced world, where no customer wants to experience a delay in the onboarding process. Also, do you know? One of the main reasons potential customers usually give up on the onboarding process is KYC.

Missing required documents or misaligned or poorly structured documents will bring the institution to the verge of suspending or delaying onboarding. Ultimately, they will have to call the applicant again, provide them resubmission instructions, and repeat the process.

On the other hand, with document readiness, the customer onboarding process will begin instantly. Institutions can pack themselves with a KYC solution to simplify and speed up the onboarding.

- Prevents Regulatory Violation

The KYC process is strictly regulated by anti-money laundering (AML) and counter-terrorism financing regulations. These agencies expect the KYC institutions to effectively adhere to accurate, complete, and auditable records of customer identity.

So, submitting and processing partially complete documents can significantly increase the overall risk of facing severe consequences such as license suspension, financial penalties, or even lawsuits.

On the contrary, document readiness in KYC ensures:

- All the documents are time-stamped

- Available in standard and legible format, PDF is preferred

- Up-to-date information

- Enhanced Fraud Detection:

Fraud is one of the major challenges that institutions usually have to face during the KYC processes.

With fully ready and structured KYC documents, it will be extremely easy for the institution to authenticate them using fraud detection technologies or tools.

For example, when a photo of an ID card is submitted in a proper format and good resolution, a fraud detection tool like Decentro’s Scanner will be able to easily run authenticity checks and detect signs of tampering.

However, if blurred photos, cropped documents, etc., are submitted, then ultimately the fraud detection accuracy will most likely be affected.

Reasons Why Document Readiness Matters in Compliance

Now, we are at the last section of our topic. Whether you are from the insurance field, finance, or banking, document readiness is a must for compliance.

- Ensures Regulatory Adherence:

Compliance with both local and international regulations is highly crucial and requires complete documentation at all stages of the customer interaction and financial operations. Regulatory authorities worldwide expect the institutions to maintain only the records of the documents that are

- Legible

- Arranged in the right order

- Up-to-date

- Accessible any time

- Reduces Audit Failures:

We all know that audits, whether internal or external, are very stressful and hectic. The process becomes even more stressful when the documents are incomplete, poorly formatted, and not accessible. This ultimately increases the overall risk of audit failure.

Whereas, a well-managed and ready document system helps avoid such issues..

- Faster Regulatory Reporting

Many organizers submit quarterly or yearly compliance reports. These include documentation samples, statistical summaries, and much more information.

So, when the documents are fully ready, properly formatted, and organized, the process of preparing regulatory reports becomes much easier and more efficient. Furthermore, web-based reporting solutions allow institutions to integrate documentation into automated reporting pipelines, ultimately ensuring faster reporting.

Bottom Line

The speed and accuracy in lending, KYC, and compliance significantly depend on the document readiness. It is a state in which all the essentials are fully ready in terms of completeness, formatting, and accessibility.

Apart from quickness and accuracy, there are several other reasons why document readiness matters in lending, KYC, and compliance. Wish to know more?