Dive into our comprehensive guide on Cross Border Payments. We go in-depth into how it works, the landscape, and how to set these payments up with Decentro.

Demystifying Cross-Border Payments: A Comprehensive Guide

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Markets your business can cater to today are no longer bound by geography. In this environment, merchants can enter new markets and access new customer bases.

The requirement?

A comprehensive understanding of the consumer of the region you are targeting, coupled with a fast, secure and efficient payment system that supports fund transfer beyond borders.

While the nuances of consumer behaviour are a tale for a different time, we are here to break down the fund transfer part of the equation – commonly known as Cross-Border Payments.

What are Cross-Border Payments?

A cross-border payment refers to any transaction in which the payer and the payee are located in different countries. These transactions can occur between Business-To-Business, Business-To-Peer, Peer-To-Business and Peer-To-Peer. Individuals or businesses can initiate these transactions, which often involve currency conversions and can be made using various payment methods.

The value of cross-border payments is expected to reach over $250 trillion by 2027, making it one of the fastest-growing segments within the global payments ecosystem.

Cross-border payments involve different time zones and different currencies. Multiple compliance checks add layers of friction, such as significant delays, excessive charges and uncertain receipt of payment.

As cumbersome as it sounds, let us walk you through an example of what the cross-border payment process looks like

- If you’re sending 10,000 INR to Singapore, for example:

- Your domestic bank sends the instructions to a settlement bank.

- The settlement bank executes the transaction via its relationship with a corresponding settlement bank in Singapore.

- The international settlement bank transfers the money to the receiver’s bank, ultimately landing it in the bank account.

So, How Does it Work?

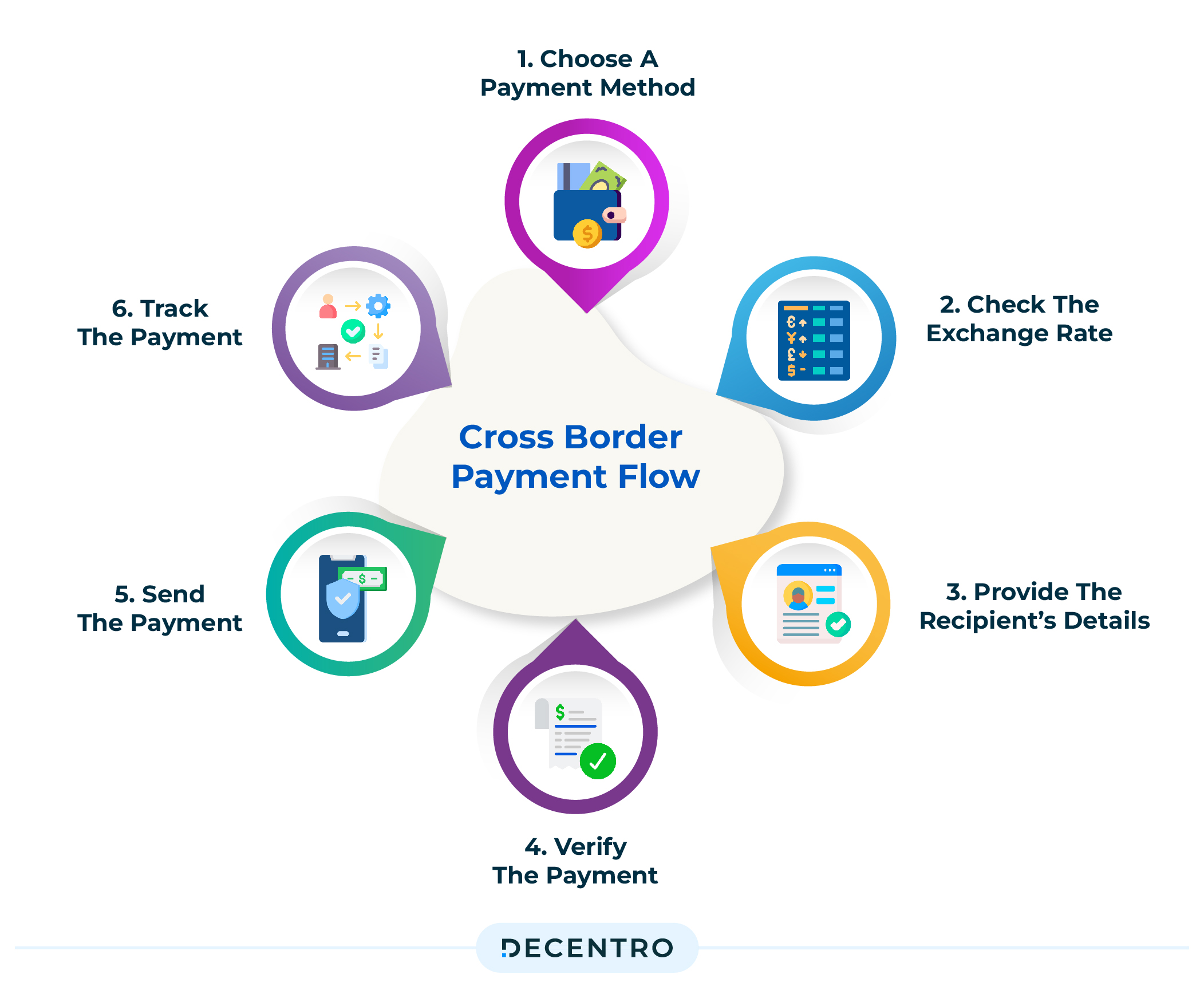

While the process of sending cross-borders may vary, primarily, the flow of a money transfer for cross-borders looks something like this:

Choose a payment method

Choose from the multiple ways you can send cross-border payments, including wire transfers, credit card transactions, electronic funds transfers, international money orders, online payment platforms, and cryptocurrencies best suited to your needs.

Check the exchange rate

Check the transfer cost incurred via the exchange rate prevalent during the time of the payment. Please note that exchange rates can vary depending on the country and payment method.

Provide the recipient’s details

Fill in the basic details such as their name, address, bank account number, and routing number. You may also need to provide additional information, such as the purpose of the payment and any relevant reference numbers. Different financial institutions and transfer networks require different information to process the transfer.

Verify the payment

Before sending a cross-border payment, you should double-check all the details to ensure they are accurate. This will help to avoid any delays or errors in the payment process – which is especially important for irreversible payment methods such as money orders.

Send the payment

Once you have verified the payment, you can send it using your chosen payment method. The time it takes to receive the payment can vary depending on the method used and the countries involved.

Track the payment

Always track your cross-border payment to ensure the recipient receives it via your payment provider’s tracking number or reference number.

Nearly every step here involves manual intervention. Leakages in the form of foreign transaction fees and exchange rate fluctuation make the process less attractive. Despite its challenges, here is a rundown of how different markets fare in the cross-border payment segment.

Landscape Low-Down

At around $83 billion, India is the largest global market for inward remittance flow, followed by China and Mexico, according to a PwC report released in July.

According to a World Bank report in December 2022, remittances from Singapore to India were on track to breach the $100 billion mark in 2023, making it the fourth-highest remitting nation to India, accounting for 5.7 per cent of all inbound remittances.

If we look at the macro level, Global corporations move nearly $23.5 trillion across countries annually, equivalent to about 25% of global GDP.

Interestingly, depending on the region in question, these numbers also have different payment methods attached to them.

For example, mobile wallets are the fastest-growing payment method in Southeast Asia, where the total number of mobile wallets is expected to increase by 311 per cent from 2020 to almost 440 million by 2025. According to a J.P. Morgan report, credit cards are the preferred payment method in North America and account for 47 per cent of all eCommerce transactions.

Though cash-based transactions remain the most popular payment method in Africa, mobile money transfer service M-Pesa has seen significant uptake, with a reported 48 million customers. Originally launched in Kenya, M-Pesa operates in Tanzania, South Africa, Afghanistan, Lesotho, the Democratic Republic of Congo, Ghana, Mozambique, Egypt, and Ethiopia.

In the Buy Now Pay Later space, we have Klarna as the dominant service provider throughout Europe and the U.K. Afterpay drives the BNPL market in Australia and New Zealand. Affirm is an essential player in North America.

Having seen the various payment methods that dominate different geographies, let’s take a closer look at the standard methods of cross-border payments.

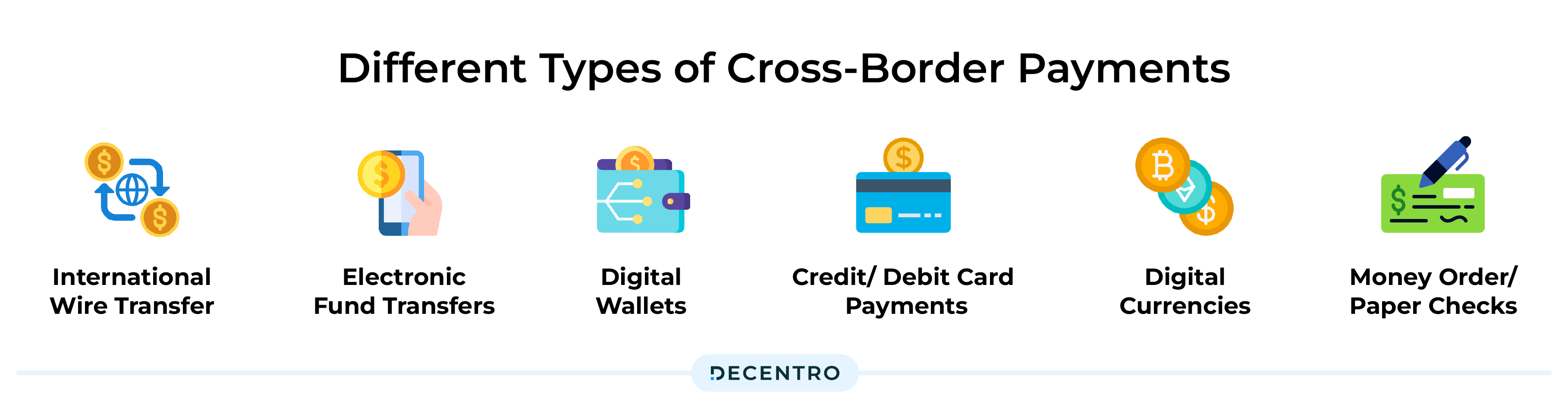

Different Types of Cross-Border Payments

Cross-border payments enable businesses to grow their consumer base by accepting payments in many currencies from customers worldwide. It simplifies the payment processing of orders from international consumers. The ability to accept different currencies is especially useful for companies trying to expand their operations. The demand for it has enabled not one but a number of different secure and efficient methods of completing cross-border payments, such as

- International Wire Transfer – This form of cross-border payment involves the sender providing their bank with instructions to send money to a recipient in another country, and the banks involved in the transfer facilitate the movement of funds across borders. For instance, using IBAN & SWIFT codes to transfer from one bank to another in a different country.

- EFT/ Electronic Fund Transfers – These are electronic transactions where you can transfer funds between the bank accounts within the US. EFT payments are considered very efficient; it takes 1-2 business days for a transfer to be complete, and it also supports many types of payments, such as direct deposit, electronic bill payment, and POS transactions.

- Digital Wallets: Digital wallets are also an example of a cross-border payment. Products such as PayPal, Google Pay or Apple Pay help ease cross-border transactions. However, it’s important to note that digital wallets are not suitable for large transfers but rather for individual or P2P due to the transaction fees that can vary differently.

- Credit/ Debit Card Payments: Credit and debit card payments are considered two cross-border payment examples. Due to their popularity and number of usages, credit and debit cards are used almost everywhere in the world, especially for online and offline purchases. Nevertheless, one should always be wary of the fees incurred while using them.

- Digital Currencies: Digital currencies have become increasingly popular due to the amount of charges and the variety of categories you can use. Some examples are Bitcoin, Litecoin, Ethereum, and many more. One study showed 75% of retailers plan to accept cryptocurrency as a payment method by 2024. These payments can be processed quickly and securely, but crypto has some drawbacks due to volatility in the cryptocurrency market.

- Money Orders and Paper Checks: The classic, timeless option for cross-border payment is still used today. To use paper checks, all you need to do is write the accurate name of the receiver (payee) and their address to send them the check. The best thing about paper checks is that there are neither fees involved in a transaction nor any intermediary banks. However, the downside of paper checks is that it can take weeks from postal mail and must be cashed.

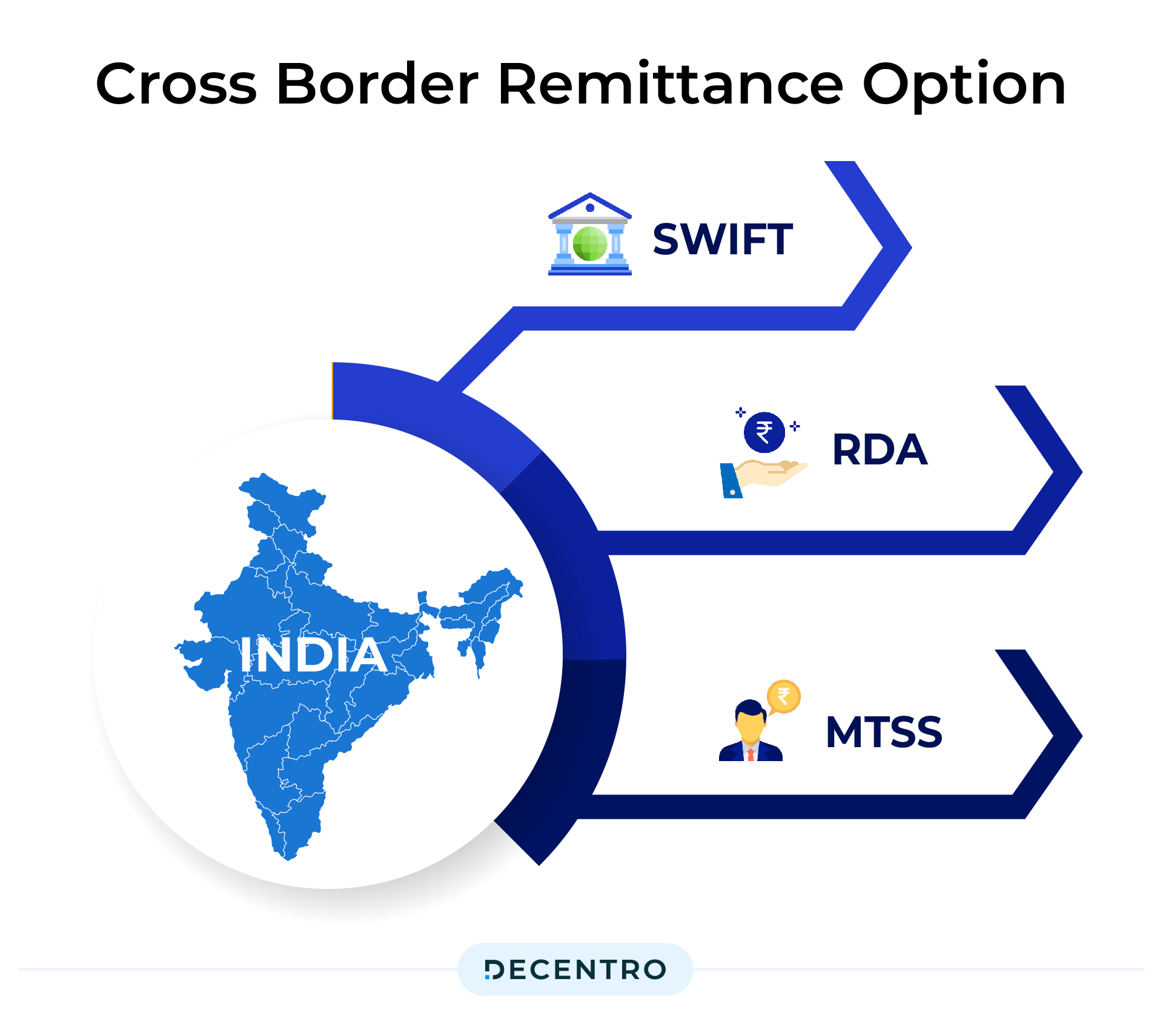

Cross-border remittance options for India are largely divided between SWIFT, RDA or Rupee Drawing Arrangement, and MTSS or Money Transfer Service Scheme.

- SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a global payment network founded in 1973 that facilitates international transactions through bank transfers. The network connects approximately 10,000 financial institutions from 212 countries worldwide, facilitating an average of 11,000 clients worldwide to initiate nearly 33.6 million transactions regularly.

- RDA, or Rupee Drawing Arrangement, is essentially a channel through which Indians can receive remittances from selected countries worldwide. Indian banks have partnered with many international exchange houses to provide a quicker remittance facility to Indians in foreign countries.

- MTSS is a strategic tie-up between overseas principals and Indian agents who disburse funds to beneficiaries in India at ongoing exchange rates. Transfers usually take one to three days, with charges ranging from 0.3–5% of the transaction amount.

What is behind the push for cross-border payments?

We can attribute the unprecedented demand for cross-border payments to a variety of factors, including:

- Increased international trade due to globalisation, global supply chains and the emergence of cross-border marketplaces

- Technological innovation in the payments space, including blockchain, distributed ledger technology, mobile payments and digital and mobile wallets

- Changes within the global regulatory landscape and the rise of open banking initiatives

- Demand from consumers for fast, convenient and transparent cross-border payments with competitive foreign exchange rates

- Opportunities for merchants to expand into new markets and increase revenue by establishing customer bases in different regions

Across the models above, the one thing that stands out is how inefficient the fund flow is when dealing with cross-border entities.

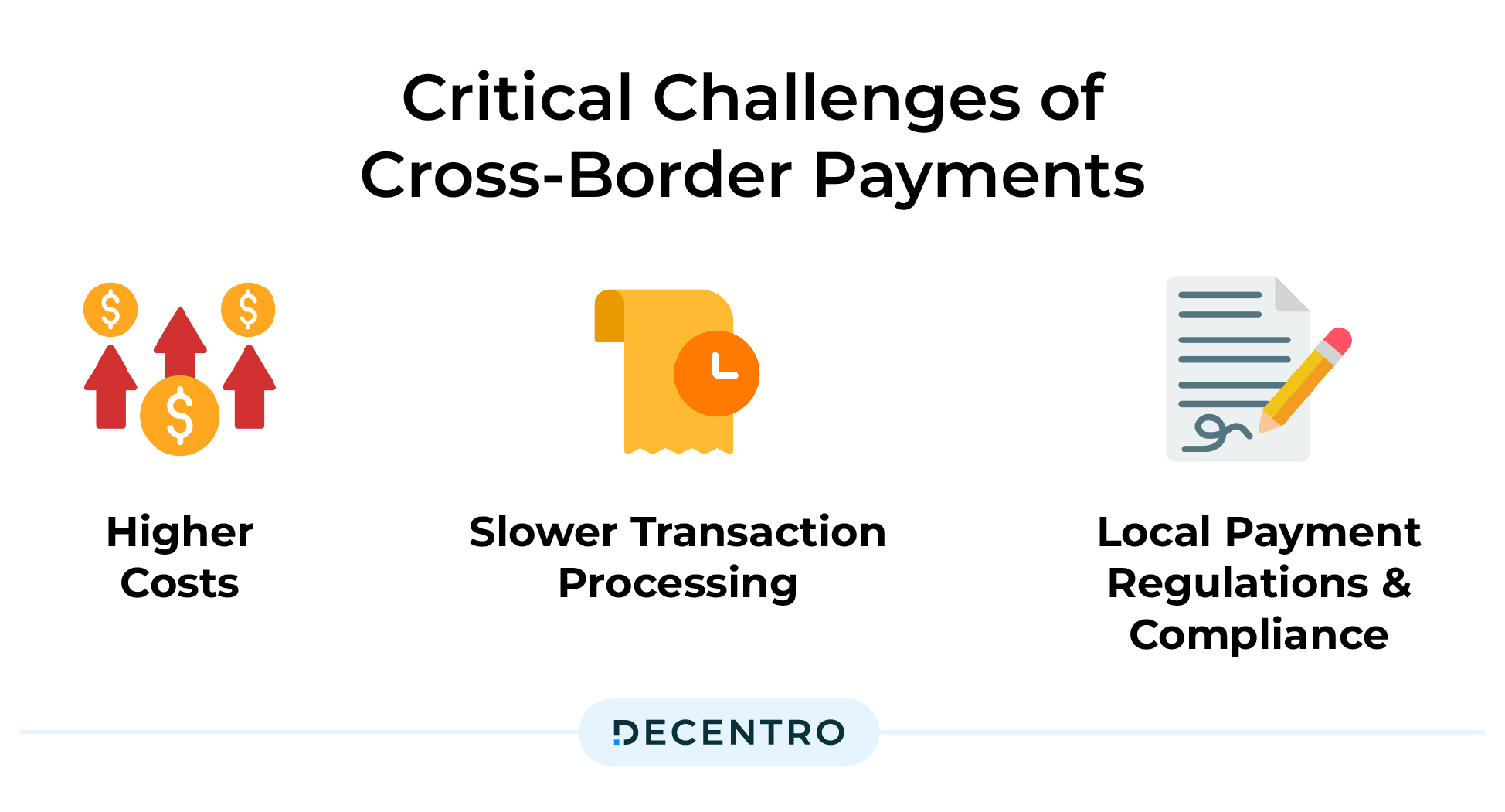

Critical Challenges of Cross-Border Payments

Cross-border payments can be intimidating due to their perceived complexity and the fact that higher costs can be tied to them — from foreign transaction fees to taxes, among others.

Some of the most common challenges online merchants wishing to extend their reach abroad may encounter.

Higher costs

Cross-border transactions usually are pricier than domestic ones due to the costs involved in transferring funds across geographies. Some of these costs may include currency exchange, regulatory, and intermediary charges – namely, the fee each participant in the transaction flow charges for their services.

Slower transaction processing

International bank payments typically take up to five days to process and clear, which is a slower turnaround time than near-instant domestic payments.

Keeping up with local payment regulations and compliance

Localisation is more than translating your website and communication channels. To facilitate cross-border payments, businesses must ensure compliance with the regulatory requirements in each country their business is selling to.

The growth of Cross-Border Payment Fraud

The latest issue of Global B2B Payments Playbook, a joint publication compiled by PYMNTS.com and Worldpay B2B Payments, finds that 60% of US and UK businesses face cross-border payment fraud. Many businesses have struggled to rebuild their cyber security infrastructures since the advent of remote working and using home networks and personal devices to conduct business. Fraudsters have taken advantage of this, and B2B theft and fraud are rising.

The Fintech Connect

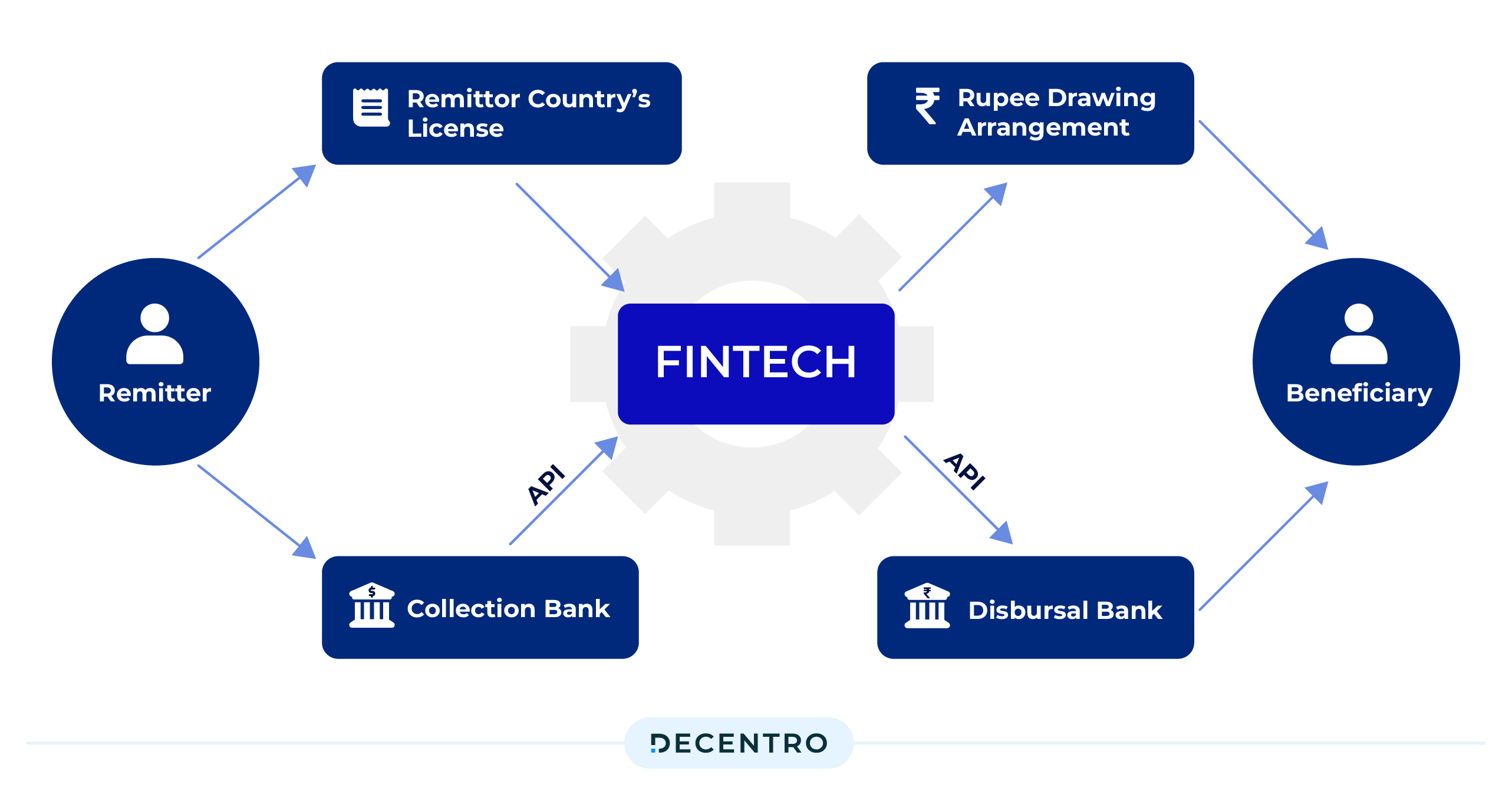

Fintechs have leveraged technology to revolutionise the Cross-Border ecosystem by introducing low-cost solutions for international payments across individuals, small businesses and corporations. Through innovative solutions focused on enhanced customer service, extensive global reach, flexible payment options, lower fees, and reduced transaction times, fintech organisations in the recent past have been facilitating transfers in a secure, fast and affordable way. There are two primary models:

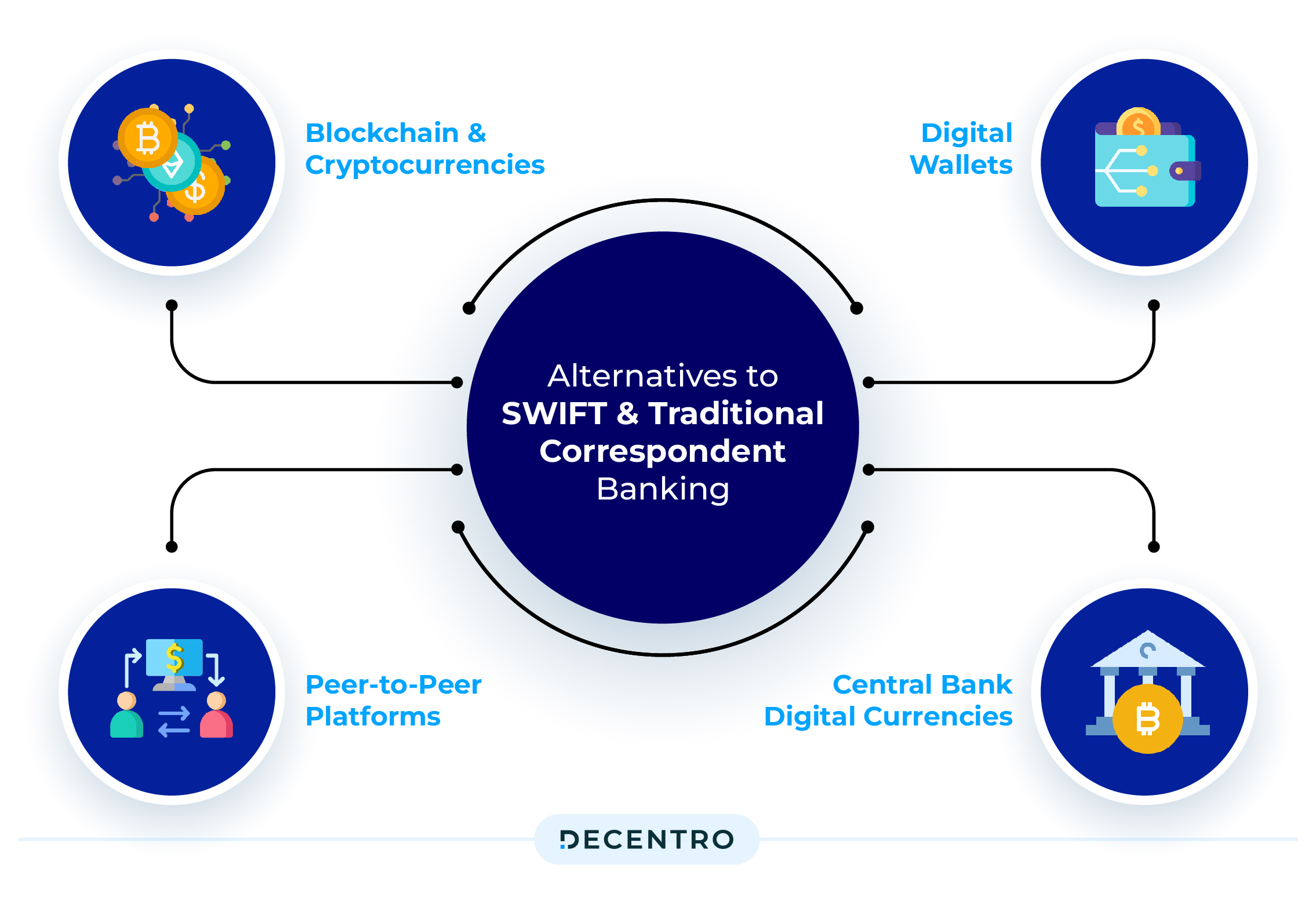

Cross-border payment rails that don’t run on traditional bank networks

These plethoras of solutions refer to alternative systems and technologies designed to facilitate international money transfers and transactions. These systems offer alternatives to the conventional SWIFT network and traditional correspondent banking. We have the likes of

- Blockchain and Cryptocurrencies: Blockchain technology and cryptocurrencies, like Bitcoin, have enabled cross-border payments without the need for traditional banks. Transactions occur directly between parties, typically with lower fees and faster settlement times.

- Digital Wallets: Many fintech organizations provide digital wallets that offer cross-border payment solutions that leverage their own networks and partnerships. These services often provide competitive exchange rates and lower fees.

- Peer-to-Peer (P2P) Platforms: P2P payment platforms like PayPal and Venmo have expanded globally, allowing users to send money across borders quickly and efficiently.

- Central Bank Digital Currencies (CBDCs): Some central banks are in the nascent stage of exploring or implementing their digital currencies, which could facilitate more efficient cross-border transactions as the issuing government would directly back them.

Technology solutions that allow clients to connect to legacy bank rails more easily

In this model, a Fintech company has a network of accounts across several countries, maintaining balances in the local currency with a treasury team responsible for managing these local accounts. The customer initiates a transaction at the local FinTech office in the local currency.

The transaction details are passed on to the office in country B, which pays the agreed amount of money in the local currency to the beneficiary’s domestic account.

Each cross-border transaction consists of a set of two individual domestic transactions. Settlement between accounts/offices is done several times monthly to optimise exchange rates. The transfer fees range from 0.25–3% of the transaction amount and depend on the destination.

How to enable smooth and fast international payments with Decentro

Understanding how cross-border transactions work, including any infrastructure developments and current regulations attached to them, is integral to successfully expanding your global footprint. However, international payments can be complicated when a business manages them by itself, so getting a reliable and dedicated partner on board is worth it to ensure you’re on the right track to being compliant and efficient with your fund flow.

Here’s why Decentro is the right partner for sending and receiving international payments.

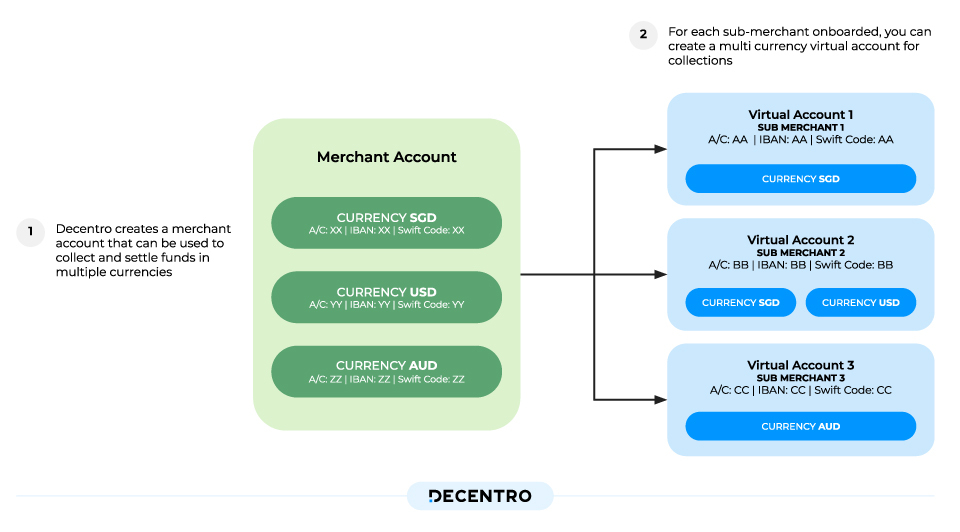

Decentro presents the following product tenets that seamlessly integrate into any online platform’s payment and fintech flows, aiming to transact in multiple currencies. Moreover, Decentro ensures swift integration timelines of mere days alongside highly responsive customer support.

- Multi-Currency Virtual Accounts: Decentro provides multi currency virtual accounts that empower platforms to securely hold funds in various currencies. With Decentro’s multi-currency virtual accounts, platforms can manage and transact in different currencies effortlessly. Say goodbye to the complexities of handling multiple currencies and embrace a streamlined approach to fund management.

- Global Payments: Decentro’s payment products empower platforms to send and accept money via domestic and SWIFT payment methods in the supported countries.

Are you curious to know how we can enable your cross-border payment flow?