Where does India stand when it comes to Open Banking? Let’s dig deep.

The State of Open Banking APIs

Chai & Fintech Addict at Decentro. Venture Capitalist in my previous life. Namesake Engineer before that.

I was pleasantly surprised and shocked when my friend, based in London, said he liked his bank. He was referring to the new-age digital banking apps such as Revolut & Monzo.

I wondered if its already time to bank using my phone and stop visiting bank branches. It also got me thinking about the emergence of many digital banking applications in Europe. I was looking for answers on why London is one of the major fintech hubs.

Britain and the rest of Europe are ahead of the curve when it comes to innovation in the financial services industry, as well as the adoption of new fintech apps and contactless payments – Industry executives

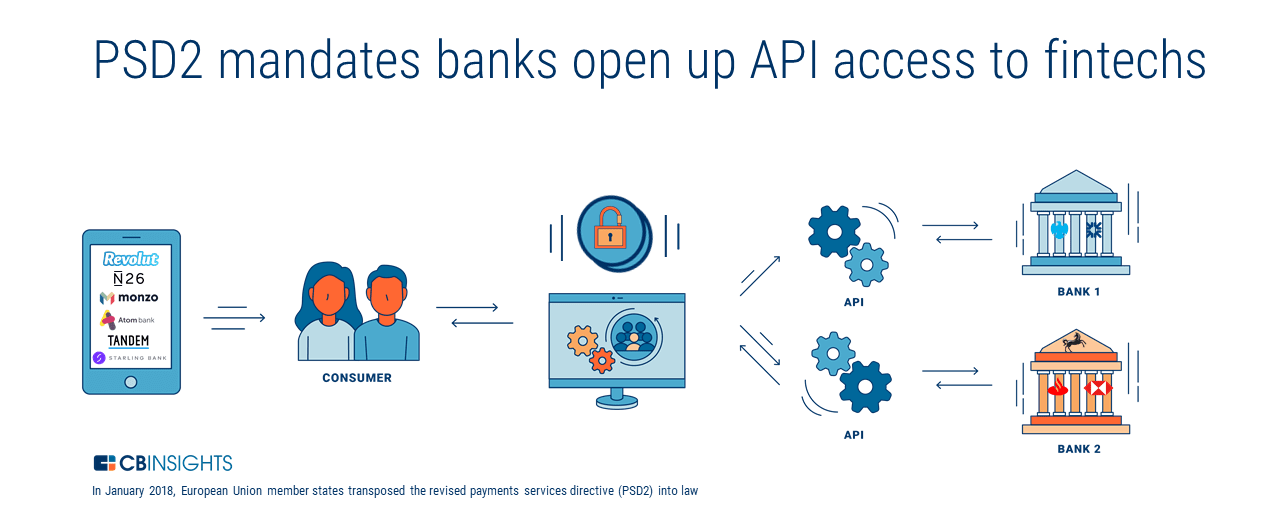

In September 2019, the European Union passed an amendment to the Payment Services Directive (PSD2) regulations to enable Open Banking. This amendment required every European bank to provide Open APIs¹ (Application Program Interfaces).

These APIs allow any company or a third party to access the bank account information (e.g., account balance & transaction data) and trigger payments quickly and securely.

As a result, any company could start building solutions on top of banking data. The possibilities are endless — some obvious use cases include

1) A virtual chatbot that tells you what to do with your money and,

2) Introducing users to different investment products based on their behavior and risk appetite.

Thus, financial institutions started opening up, and these regulations led to innovation and the rise of fintech unicorns in Europe.

One such example is Revolut, the mobile-first financial super-app that was last valued at US$ 5.5 billion and onboarded 12 million users (May ’20).

These users can open bank accounts, link existing bank accounts, perform money transfers, own a fancy metal card, invest in securities (including crypto) while having an excellent user interface and experience.

Revolut does not hold a UK banking license at the time of writing & depends on a separate licensed bank to park its customers’ deposits.

Where does India Exactly Stand in the Open Banking Maze?

A group of Venture Capital (VC) investors are aiming for a similar outcome in India and have invested in neobanks such as Bank Open, Jupiter, Niyo, Epifi, and Yelo.

Taking inspiration from their European counterparts, these new-age digital banks are partnering with existing banks since the Reserve Bank of India (RBI) does not have any regulations around digital-only banks.

Integrations with existing banks are painful and time-consuming since these neobanking platforms have to deal with legacy infrastructure that’s ridden with loopholes. Open banking would have made these integrations a bit easier.

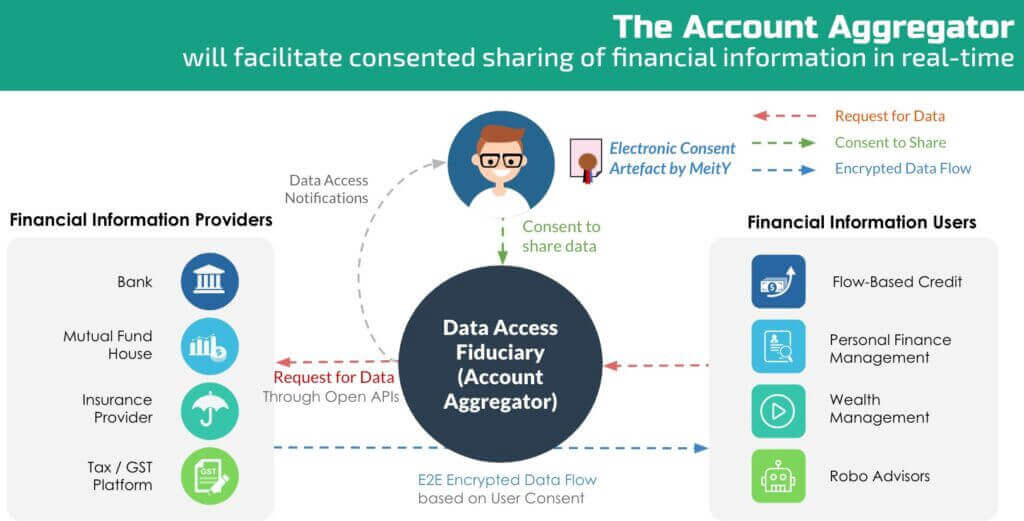

In 2016, the RBI introduced the Account Aggregator NBFC license to enable open banking and, so far, has granted seven licenses, of which four are provisional.

These Account Aggregators will give consumers the ability to share their financial data with any company that asks for it.

To make this a reality, independent bodies such as Sahamti & iSpirit have taken up the ambitious task to fetch consumer data silos lying with banks, mutual funds, governments, and telecoms via consumable APIs.

The Account Aggregation project is quite ambitious since these banks, NBFCs, Mutual Fund houses, and government platforms need to work in tandem.

The group did not meet its initial launch deadlines of December 2019 and May 2020, as some regulated companies could not complete their integrations. We’re hopeful of a soft launch soon as some significant stakeholders are onboarding into the framework.

At Decentro, in addition to the above (as and when it happens), we are going much beyond basic consumer data sharing by giving every company the ability to deeply integrate with the legacy financial institutions.

These integrations will enable Asian enterprises and fintechs to catch up with their Western counterparts in terms of offering fast and innovative solutions to digitally native users as well as companies.

Feel free to drop me a note at pratik[at]decentro[dot]tech if your solution requires you to interact with existing banks and financial institutions or want to discuss your use case with us. We already have some of the key institutions onboarded as our partners and are adding more as we go along.

Keep an eye out on our website for an amazing array of simplified modules that are going to come in the next few weeks and months.

Onwards and upwards!

P.S. If you wish to be a part of this revolution, we’re hiring! Please apply on AngelList to find your next challenge.

1. APIs allow different software applications and systems to ‘talk to’ each other. For example, Uber uses Google Maps APIs to share a real-time update on the driver’s location

References:

UK Open Banking

Sahamati