Explore the Virtual Payment Addresses (VPA) world within the Unified Payments Interface (UPI) ecosystem. Understand their function, benefits, and step-by-step instructions for creating your own VPA. This guide will help you harness the full potential of seamless digital transactions.

VPA in UPI: Meaning, How It Works, and How to Create

Avi is a full-stack marketer on a mission to transform the Indian fintech landscape.

Table of Contents

UPI payments have experienced unprecedented growth in recent years, surpassing 100 billion transactions in 2023 alone.

As digital payments become increasingly commonplace, the traditional reliance on cash has evolved dramatically. The ease of making real-time, seamless payments across India using just the recipient’s name, transaction amount, and UPI PIN has transformed the transaction landscape. A key driver of this shift has been the widespread adoption of Virtual Payment Addresses (VPAs), simplifying digital transactions like never before.

What is VPA?

Virtual Payment Address (VPA) is a unique UPI payment system identifier. UPI is a payment service that allows users to transfer money between different bank accounts in real-time. The VPA in UPI is a unique virtual identifier for a bank account that eliminates the need to share sensitive data during transactions, such as account numbers, IFSC codes, etc. With a VPA, senders and recipients can identify your account using just one unique identifier, streamlining the payment process. A VPA in UPI combines letters, numbers and special characters that uniquely identifies a given bank account. A typical VPA could be something like “yourname@bankname” or “yourphonenumber@bankname.

Is VPA the same as UPI ID?

Yes, VPA is the same as UPI ID. Both the terms are used interchangeably to refer to your unique ID required to make UPI payments.

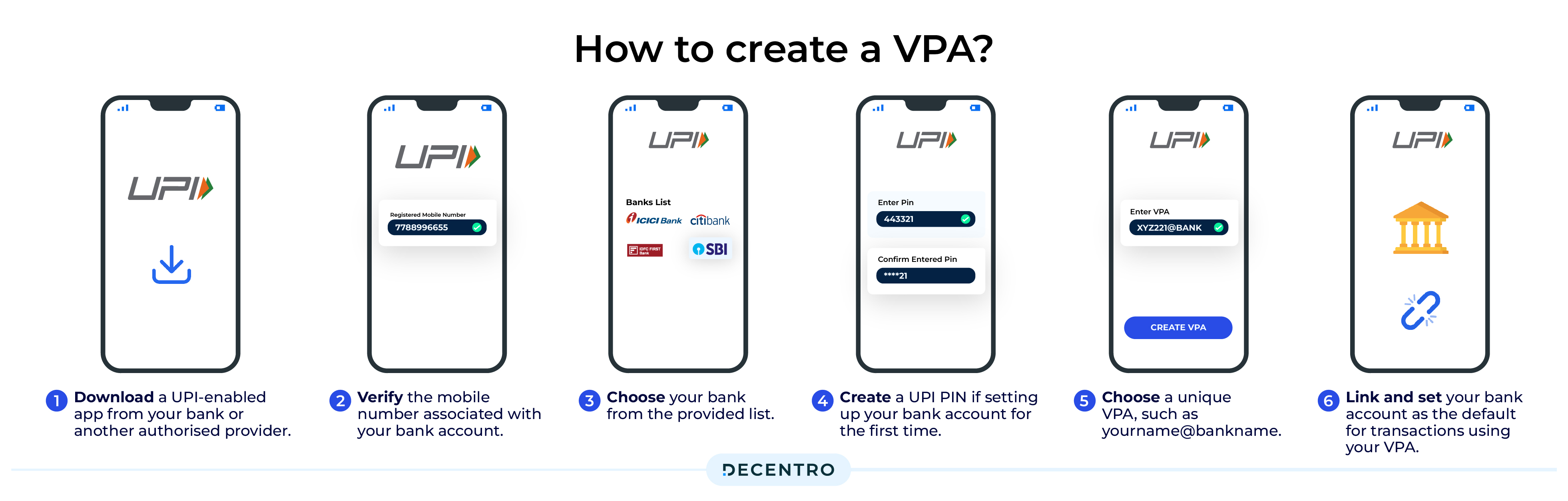

How to create a VPA?

Creating a VPA involves a few simple steps:

- Step 1: Download a UPI-enabled app from your bank or another authorised provider.

- Step 2: Verify the mobile number associated with your bank account.

- Step 3: Choose your bank from the provided list.

- Step 4: Create a UPI PIN if setting up your bank account for the first time.

- Step 5: Choose a unique VPA, such as yourname@bankname.

- Step 6: Link and set your bank account as the default for transactions using your VPA.

Once linked, your VPA allows for easy and secure fund transfers without the need to remember or share complex bank details. You can start sharing your VPA to receive payments.

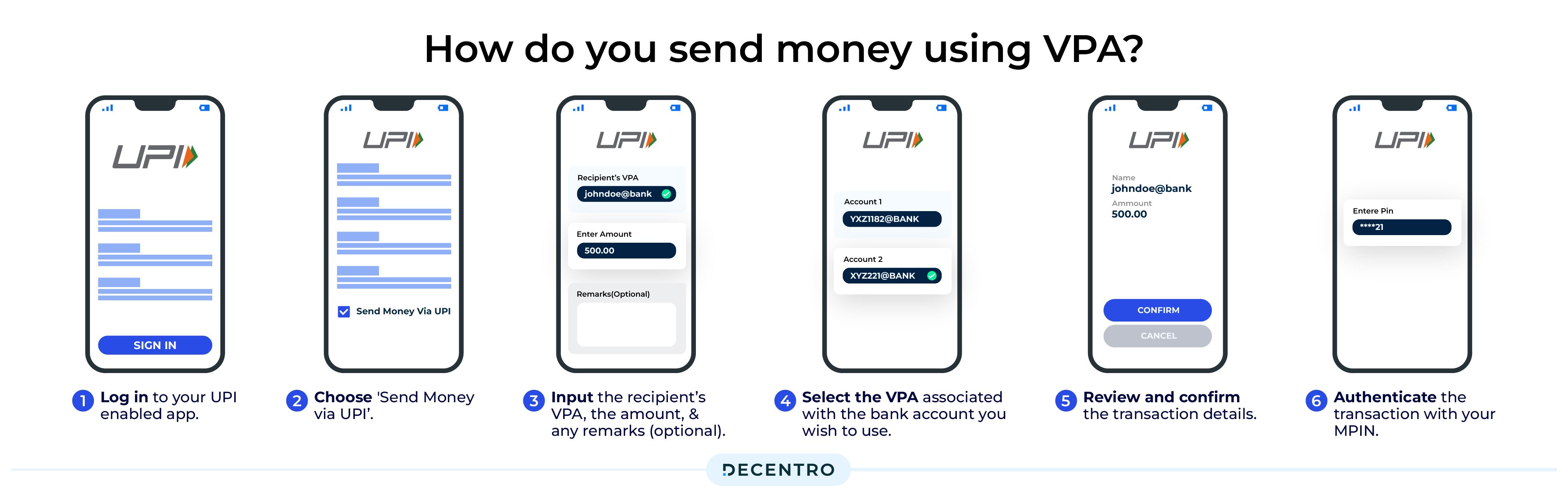

How do you send money using VPA?

To transfer money using a Virtual Payment Address via your UPI app, follow these straightforward steps:

- Step 1: Log in to your UPI-enabled app.

- Step 2: Choose ‘Send Money via UPI’.

- Step 3: Input the recipient’s VPA, the amount, and any remarks (optional).

- Step 4: Select the VPA associated with the bank account you wish to use.

- Step 5: Review and confirm the transaction details.

- Step 6: Authenticate the transaction with your MPIN.

After completing the above steps, your UPI payments can be processed. The transaction status can be tracked within the UPI app.

How to receive money via VPA?

To receive money using a Virtual Payment Address (VPA) through a UPI-based mobile app, follow these steps:

- Step 1: Log into the app and navigate to the UPI section.

- Step 2: Select the “Request Money via UPI” option.

- Step 3: Enter the VPA of the person from whom you are requesting money.

- Step 4: Enter the amount you wish to receive, and add any necessary remarks.

- Step 5: Select the VPA linked to the bank account where you want to receive the funds.

- Step 6: Review and submit the request for approval.

Once you have completed the above steps, the sender will receive direct notifications on their UPI app, nudging them to complete the payment.

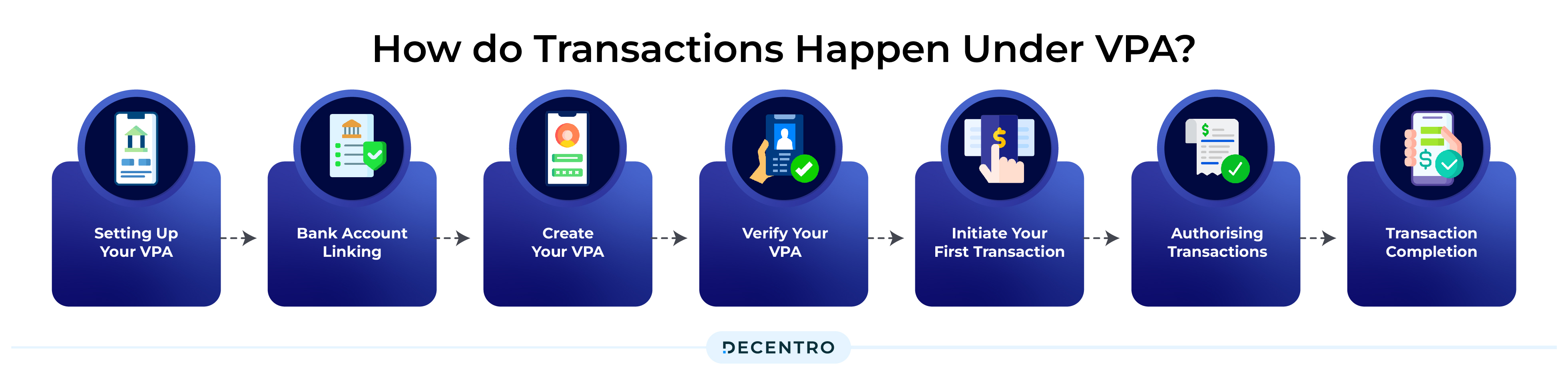

How Do Transactions Happen Under VPA?

A transaction happens under VPA in UPI through several steps:

- Setting up your VPA: The first step is to set up your VPA using a UPI App to register your bank account on UPI.

- Bank Account Linking: The next step is to link your bank account to the UPI app. To do so, you must select your bank from a list of banks and enter your bank account and debit card details.

- Create your VPA: After linking your bank account, you will be prompted to create your VPA/ UPI ID. You can choose any username, but make sure to use a unique but simple username for this step.

- Verify your VPA: This step is crucial since you can start using your VPA only after verification. This usually includes an OTP verification on your bank account-linked mobile number.

- Initiate your first transaction: To initiate your first payment using your VPA, you can share your unique VPA with the recipient and receive money into your bank account directly.

- Authorising transactions: If you receive a payment request on your UPI app, you must authorise the transaction by entering your UPI PIN, a secure 4-6 digit code you established during registration.

- Transaction Completion: Once the transaction is completed successfully, both parties receive a text message confirming the transaction’s success.

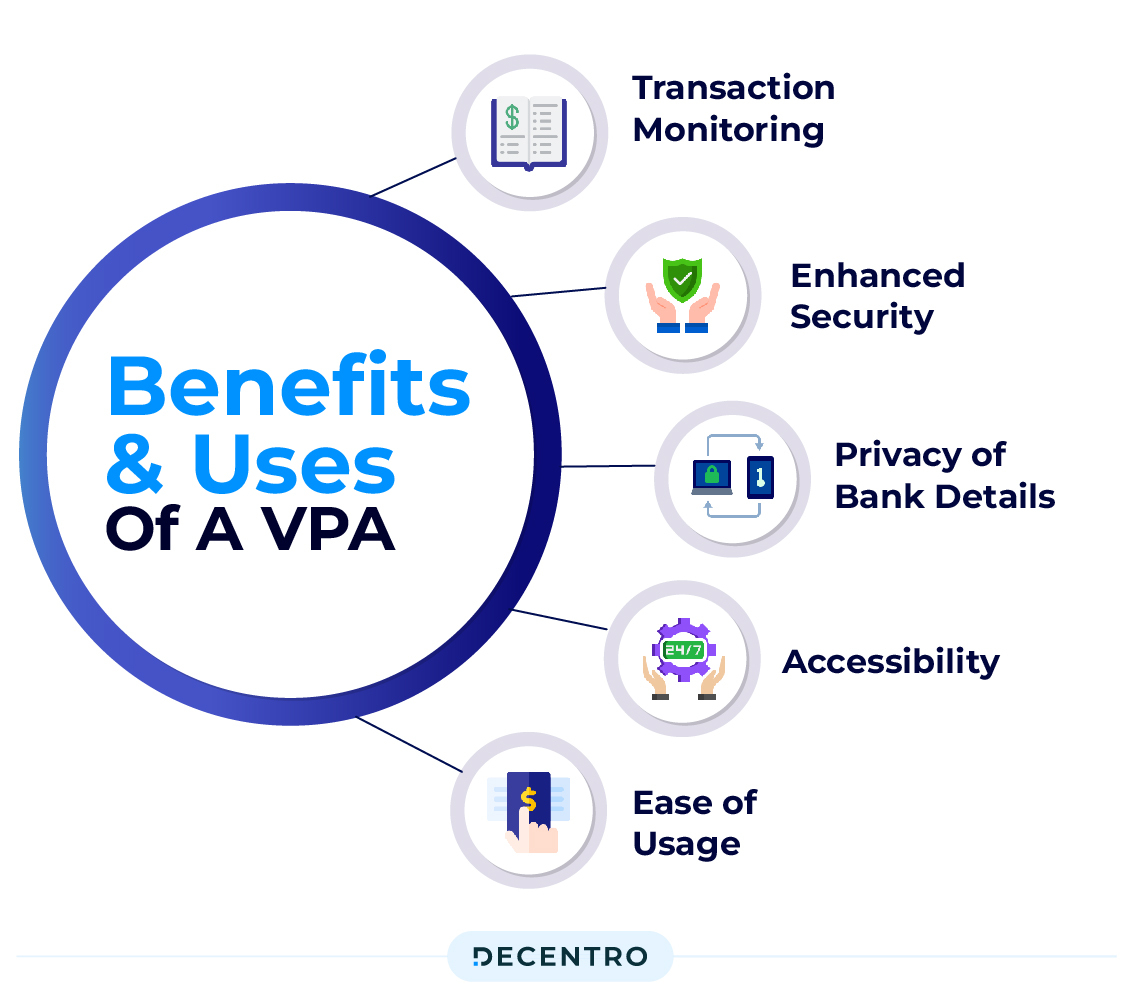

Benefits and Uses of VPA

There are several benefits of using a Virtual Payment Address (VPA):

1. Privacy of Bank Details: A Virtual Payment Address enables individuals to secure their bank account numbers. By employing a VPA, one can obfuscate their actual bank account number while facilitating cashless payments and transfers via Unified Payments Interface (UPI) applications.

2. Ease of usage: A VPA is considerably easier to recall than lengthy and intricate bank account numbers. The simplicity and security associated with VPA numbers contribute to their ease of usage, making them a preferred choice over long bank account numbers.

3. Accessibility: VPAs are accessible around the clock, offering uninterrupted access to account details. This continuous availability facilitates immediate transactions 24×7, enhancing the speed at which payments are processed.

4. Enhanced Security: The Unified Payments Interface (UPI) offers a secure platform for conducting transactions anytime and anywhere. Transactions through VPAs are instantaneous and offer heightened security compared to other transaction methods, such as Real Time Gross Settlement (RTGS) or National Electronic Funds Transfer (NEFT).

5. Transaction Monitoring: Owning a VPA permits tracking all fund transfer activities through the UPI app. This functionality provides valuable insights such as the amount transferred, the time and date of the transaction, recipient information, and other pertinent details.

Does Virtual Payment Address expire when not in use?

Your UPI Virtual Payment Address (VPA) remains active indefinitely, regardless of usage frequency. However, reactivation may be necessary if it has been dormant for a prolonged period.

Can an existing VPA be changed?

No, it is not possible to change an existing VPA. You can customise your VPA based on availability but cannot modify it further once it is created.

How can I find my VPA address?

You can log into your payment apps, such as Google Pay and PhonePe, and look up your VPA address under the settings. Additionally, you can log into your net banking portal or contact your bank for your bank account details.

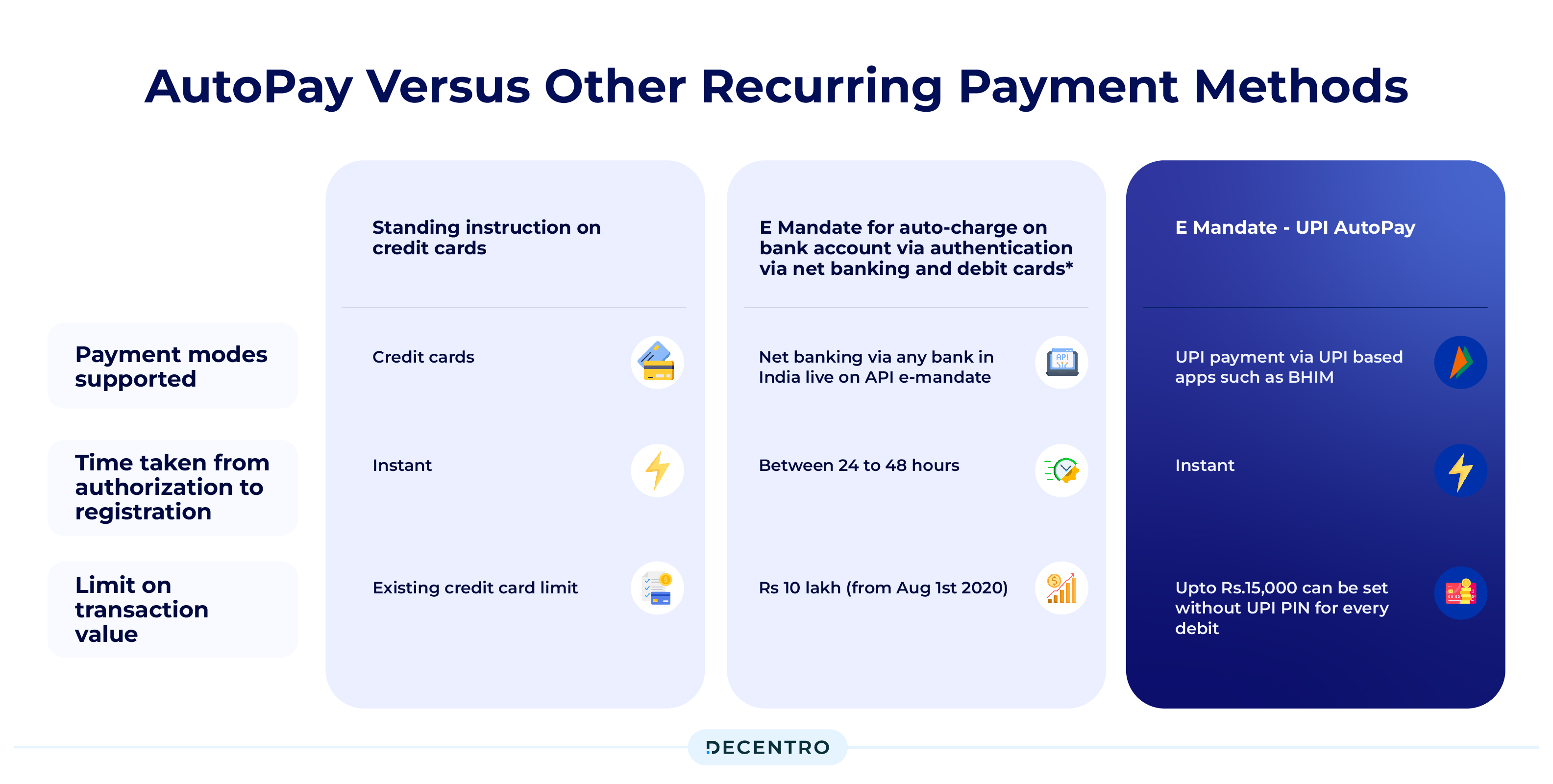

UPI AutoPay

The National Payment Corporation of India (NPCI) launched UPI AutoPay on July 22, 2020, to facilitate seamless recurring transactions via the UPI platform. UPI AutoPay helps eliminate manual intervention while ensuring timely payments and improving consumer convenience regarding subscriptions.

With UPI AutoPay, users can automate transactions up to ₹15,000 for various needs. The RBI also increased the limits for UPI AutoPay to ₹1,00,000 for three categories: subscription to mutual funds, payment of insurance premiums, and credit card bill payments. Popular banks and UPI apps that support UPI Autopay include the State Bank of India (SBI), HDFC Bank, ICICI Bank, Axis Bank, Paytm, PhonePe, Google Pay, and Amazon Pay. The complete list of banks and apps is live on AutoPay here.

If you’re a business planning to use UPI AutoPay to support your business use case, you can start using Decentro’s UPI Autopay stack. Decentro can help set up recurring E-Mandates enabled on your platform via UPI with a one-time notification and real-time updates. You can also set up:

- Custom UPI Handles for Payees

- Pre-Debit Notification

- Flexible debits with customisable time frames

UPI Payment Vs Internet Banking

Unified Payment Interface (UPI) and Internet Banking are popular tools that simplify online banking operations. While both are instant payment systems, they differ in their transaction requirements: UPI requires only the payee’s Virtual Payment Address (VPA), whereas Internet Banking requires detailed beneficiary bank account details. Due to its accessibility and lower risk of transaction errors, UPI is increasingly preferred over Internet Banking. However, there are specific banking tasks that still necessitate the use of Internet Banking where UPI needs to catch up.

| UPI | Internet Banking | |

| Ease of use | Easier to use with 6 customer touch inputs to complete a transaction | The average number of customer touch inputs to complete a transaction is 50 |

| Pricing | Free to use as of today | Small commission is charged (usually Rs. 5 to 15) |

| No. of banks covered | 572 | Almost all banks offer netbanking |

| Beneficiary details | Only VPA is required to process a transaction | Other details such as account number, IFSC code is also needed |

Can I connect an existing VPA to a new application?

No, you cannot use an existing VPA with a new payment application since your VPA is specific to the payment app on which it was created. However, you can create a new VPA when you link your bank account to a new payment application.

How do you edit VPA or UPI ID on a UPI app?

You cannot edit your pre-existing VPA or UPI ID on any payment application. However, you can add UPI IDs on your payment app to ensure higher transaction success rates. For example, if you are a GPay user:

- Open your GPay App.

- Click on your profile menu.

- Select the ‘Set up payment methods’ option.

- Select your bank account for which the UPI ID needs to be added.

- Select ‘Manage UPI IDs’ option.

- Add UPI IDs with partner bank handles like okicici, okaxis and oksbi.

Is it feasible to link multiple bank accounts to a VPA?

Yes, linking multiple bank accounts to the same VPA is possible.

What is the UPI transaction limit?

UPI’s daily transaction limit is Rs.1 lakh by the National Payments Corporation of India (NPCI).

However, payments to educational institutions and healthcare providers can go up to Rs.5 lakh. However, individual banks may set UPI transfer limits, ranging from Rs.25,000 to Rs.1 lakh daily. Additionally, some banks opt for weekly or monthly UPI transfer limits instead of a daily cap. You can see the UPI limits of all major banks in India below:

| Bank name | Bank type | Sponsor Bank | UPI transaction limit |

| Abhyudaya Co-Operative Bank | Cooperative | NA | 25000 |

| Adarsh Co-Op Bank Ltd | Cooperative | HDFC Bank | 50000 |

| Aditya Birla Idea Payments Bank | Payments Bank | NA | 100000 |

| Airtel Payments Bank | Payments Bank | NA | 1,00,000 |

| Allahabad Bank | Public Sector Bank | NA | 25000 |

| Allahabad UP Gramin Bank | RRB | Allahabad | 20000 |

| Andhra Bank | Public Sector Bank | NA | 100000 |

| Andhra Pradesh Grameena Vikas Bank | RRB | SBI | 25000 |

| Andhra Pragathi Grameena Bank | RRB | NA | 10000 |

| Apna Sahakari Bank | Cooperative | NA | 100000 |

| Assam Gramin VIkash Bank | RRB | United Bank of India | 5000 |

| Axis Bank | Private | NA | 100000 |

| Bandhan Bank | Private | NA | 100000 |

| Bank Of Baroda | Public Sector Bank | NA | 25000 |

| Bank of India | Public Sector Bank | NA | 10000 |

| Bank of Maharashtra | Public Sector Bank | NA | 100000 |

| Baroda Gujarat Gramin Bank | RRB | Bank of Baroda | 25000 |

| Baroda Rajasthan Kshetriya Gramin Bank | RRB | BOB | 25000 |

| Baroda Uttar Pradesh Gramin Bank | RRB | Bank of Baroda | 25000 |

| Bassein Catholic Co-Op Bank | Cooperative | NA | 20000 |

| Bhilwara Urban Co Operative Bank LTD | Cooperative | HDFC | 25000 |

| Bihar Gramin Bank | RRB | UCO | Mergerd with DBGB |

| Canara Bank | Public Sector Bank | NA | 100000 |

| Catholic Syrian Bank | Private | NA | 100000 |

| Central Bank of India | Public Sector Bank | NA | 100000 |

| Chaitanya Godavari Grameena Bank | RRB | Andhra Bank | 25000 |

| Chhattisgarh Rajya Gramin Bank | RRB | SBI | 25000 |

| Citibank Retail | Foreign Bank | NA | 100000 |

| City Union Bank | Private | NA | 100000 |

| COASTAL LOCAL AREA BANK LTD | Cooperative | BOM | 50000 |

| Corporation Bank | Public Sector Bank | NA | 50000 |

| DBS Digi Bank | Foreign Bank | NA | 100000 |

| DCB Bank | Private | NA | 5000 |

| Dena Bank | Public Sector Bank | NA | 100000 |

| Dena Gujarat Gramin Bank | RRB | Dena | NA (Merged) |

| Deutsche Bank AG (Web Collect) | Foreign Bank | NA | NA |

| Dhanlaxmi Bank Ltd | Private | NA | 100000 |

| Dombivali Nagrik Sahakari Bank | Cooperative | NA | 100000 |

| Equitas Small Finance Bank | Small Finance Bank | NA | 25000 |

| ESAF Small Finance Bank | Small Finance Bank | NA | 100000 |

| Federal Bank | Private | NA | 100000 |

| FINO Payments Bank | Payments Bank | NA | 100000 |

| G P Parsik Bank | Cooperative | NA | 100000 |

| HDFC | Private | NA | 100000(RS 5000 for new customer) |

| Himachal Pradesh Gramin Bank | RRB | PNB | 50,000 |

| HSBC | Foreign Bank | NA | 100000 |

| Hutatma Sahakari Bank Ltd | Cooperative | ICIC Bank | 100000 |

| ICICI Bank | Private | NA | 10000(25000 for Google Pay users) |

| IDBI Bank | Public Sector Bank | NA | 100000 |

| IDFC | Private | NA | 100000 |

| India Post Payment Bank | Payments Bank | NA | 25000 |

| Indian Bank | Public Sector Bank | NA | 100000 |

| Indian Overseas Bank | Public Sector Bank | NA | 50000 |

| IndusInd Bank | Private | NA | 100000 |

| J&K Grameen Bank | RRB | J&K | 20,000 |

| Jalgaona Janata Sahkari Bank | Cooperative | NA | 100000 |

| Jammu & Kashmir Bank | Private | NA | 20000 |

| Jana Small Finance Bank | Small Finance Bank | NA | 10000 |

| Janta Sahakari Bank Pune | Cooperative | NA | 100000 |

| Jio Payments Bank | Payments Bank | NA | 100000 |

| Kallappanna Awade Ichalkaranji Janata Sahakari Bank Ltd | Cooperative | NA | 25000 |

| Karnataka Bank | Private | NA | 100000 |

| Karnataka Vikas Grameena Bank | RRB | NA | 25000 |

| Karur Vysaya Bank | Private | NA | 100000 |

| Kashi Gomti Samyut Gramin Bank | RRB | NA | 100000 |

| Kaveri Grameena Bank | RRB | SBI | 25000 |

| Kerala Gramin Bank | RRB | NA | 20000 |

| Kotak Mahindra Bank | Private | NA | 100000 |

| Langpi Dehangi Rural Bank | RRB | SBI | 10000 |

| Madhya Bihar Gramin Bank | RRB | PNB | 25000 |

| Maharashtra Grameen Bank | RRB | BOM | 25000 |

| Maharashtra State Co-Op Bank | Cooperative | NA | 5000 |

| Malwa Gramin Bank (Bank merged with Punjab Gramin Bank) | RRB | SBI | 10000 |

| Manipur Rural Bank | RRB | SBI | 10000 |

| Maratha Co-Op Bank | Cooperative | NA | 100000 |

| Meghalaya Rural Bank | Foreign Bank | SBI | 100000 |

| Mizoram Rural Bank | RRB | SBI | 25000 |

| NKGSB Co-Op. Bank Ltd | Cooperative | NA | 20000 |

| Oriental Bank of Commerce | Public Sector Bank | NA | 100000 |

| Paschim Banga Gramin Bank | RRB | UCO | 5000 |

| Paytm Payments Bank | Payments Bank | NA | 100000 |

| Pragathi Krishna Gramin Bank | RRB | NA | 20000 |

| Prathama Bank | RRB | NA | 10000 |

| Punjab and Maharastra Co-Op Bank | Cooperative | NA | 100000 |

| Punjab and Sind Bank | Public Sector Bank | NA | 10000 |

| Punjab Gramin Bank | RRB | PNB | 10000 |

| Punjab National Bank | Public Sector Bank | NA | 25000 |

| Purvanchal Bank | RRB | SBI | 25000 |

| Rajasthan Marudhara Gramin Bank | RRB | SBI | 25000 |

| Rajkot Nagari Sahakari Bank Ltd | Cooperative | NA | 100000 |

| Samruddhi Co-Op Bank Ltd | Cooperative | TJSB | 100000 |

| Sarva Haryana Gramin Bank | RRB | PNB | 50,000 |

| Sarva UP Gramin Bank | RRB | PNB | 50000 |

| Saurashtra Gramin Bank | RRB | SBI | 20000 |

| Shree Kadi Nagarik Sahakari Bank Ltd | Cooperative | Yes Bank | 100000 |

| South Indian Bank | Private | NA | 100000 |

| Standard Chartered | Foreign Bank | NA | 100000 |

| State Bank of India | Public Sector Bank | NA | 100000 |

| Suco Souharda Sahakari Bank | Cooperative | ICICI Bank | 100000 |

| Suryoday Small Finance Bank Ltd | Small Finance Bank | NA | 100000 |

| Suvarnayug Sahakari Bank Ltd | Cooperative | HDFC | 100000 |

| Syndicate Bank | Public Sector Bank | NA | 10000 |

| Tamilnadu Mercantile Bank | Private | NA | 100000 |

| Telangana Gramin Bank | RRB | SBI | 25000 |

| Telangana State Co-Operative Apex Bank | Cooperative | IDBI | 10000 |

| Thane Bharat Sahakari Bank | Cooperative | NA | 100000 |

| The Cosmos Co-Operative Bank LTD | Cooperative | NA | 10000 |

| The A.P. Mahesh Co-Operative Urban Bank | Cooperative | NA | 25000 |

| The Ahmedabad District Co-Operative Bank Ltd | Cooperative | GSCB | 10000 |

| The Ahmedabad Mercantile Co-Op Bank Ltd | Cooperative | HDFC Bank | 100000 |

| The Andhra Pradesh State Co-Operative | Cooperative | NA | 10000 |

| The Baroda Central Co-Operative Bank Ltd | Cooperative | GSCB | 15000 |

| The Gujarat State Co-Operative Bank Limited | Cooperative | NA | 50000 |

| The Hasti Co-operative Bank Ltd | Cooperative | NA | 100000 |

| The Kalyan Janta Sahkari Bank | Cooperative | NA | 100000 |

| The Lakshmi Vilas Bank Limited | Private | NA | 100000 |

| The Mahanagar Co-Op. Bank Ltd | Cooperative | NA | 25000 |

| The Malad Sahakari Bank Ltd | Cooperative | PMCO | 10000 |

| The Mehsana Urban Co-Operative Bank | Cooperative | NA | 100000 |

| The Municipal Co-Op Bank Ltd | Cooperative | NA | 5000 |

| The Muslim Co-Operative Bank Ltd | Cooperative | HDFC | 100000 |

| The Nainital Bank Ltd | Private | NA | 20000 |

| The Ratnakar Bank Limited | Private | NA | 25000 |

| The Saraswat Co-Operative Bank | Cooperative | NA | 100000 |

| The Surat People’s Co-Op. Bank Ltd | Cooperative | NA | 25000 |

| The Sutex Co-Op Bank | Cooperative | ICIC Bank | 100000 |

| The SVC Co-Operative Bank Ltd | Cooperative | NA | 10000 |

| The Thane Janta Sahakari Bank Ltd (TJSB) | Cooperative | NA | 100000 |

| The Udaipur Mahila Samridhi Urban Co-Op Bank Ltd | Cooperative | ICIC Bank | 100000 |

| The Udaipur Mahila Urban Co-Op Bank Ltd | Cooperative | NA | 100000 |

| The Urban Cooperative Bank Ltd Dharangaon | Cooperative | ICICI Bank | 20000 |

| The Varachha Co-Op Bank Ltd | Cooperative | NA | 20000 |

| The Vijay Cooperative Bank Ltd | Cooperative | ICIC Bank | 20000 |

| The Vishweshwar Sahakari Bank Ltd | Cooperative | NA | 100000 |

| Tripura Gramin Bank | RRB | SBI | 10000 |

| UCO Bank | Public Sector Bank | NA | 100000 |

| Ujjivan Small Finance Bank Limited | Small Finance Bank | NA | 50000 |

| Union Bank of India | Public Sector Bank | NA | 100000 |

| United Bank of India | Public Sector Bank | NA | 25000 |

| Uttarakhand Gramin Bank | RRB | SBI | 25000 |

| Vananchal Gramin Bank | RRB | SBI | 20000 |

| Vasai Vikas Co-Op Bank Ltd | Cooperative | NA | 100000 |

| Vijaya Bank | Public Sector Bank | NA | 25000 |

| YES Bank | Private | NA | 100000 |

UPI Transaction Limit for BHIM App

The BHIM UPI transaction limits are established by the National Payments Corporation of India (NPCI). The daily cap for all banks is set at ₹1 lakh (Rs 100,000). For new users, there is a reduced limit of ₹5,000 during the first 24 hours.

Banks can increase these limits based on a customer’s risk profile. Customers interested in higher limits can request an adjustment from their bank, which will evaluate their risk profile before potentially raising their BHIM UPI transaction cap.

Once users reach their daily BHIM UPI limit, they must wait until the next day to initiate more transactions via BHIM UPI. However, they can still perform bank transfers using NEFT or RTGS, allowing larger transaction volumes.

UPI Transaction Limit on PayTM

Paytm UPI permits a daily transfer limit of up to Rs 1,00,000.

Additionally, users can make transactions up to Rs 20,000 per hour. Paytm imposes a cap of five transactions per hour and 20 transactions per day through its UPI service.

Is it safe to share my VPA?

Yes, using your VPA to receive money or make payments is safe as it does not include sensitive bank account details such as numbers or passwords. However, as a general practice, it’s always advisable to exercise caution when sharing any personal financial details externally and ensure they are disclosed only to trusted parties.

Conclusion

In conclusion, the Virtual Payment Address (VPA) within the Unified Payments Interface (UPI) has revolutionised how we handle money, offering a seamless, secure, and efficient transaction method. Whether you’re sending or receiving money, setting up a VPA simplifies the process, freeing you from the hassle of sharing sensitive account details. As digital transactions continue to grow in popularity, understanding and utilising tools like VPA can significantly enhance your financial interactions and operational convenience. With the guidance provided in this blog, you’re now equipped to navigate the world of UPI and make the most of your VPA, ensuring smooth and secure digital payments.