Deep dive on why reverse penny drop is the future of bank validation. Understand its benefits and how it can protect your financial transactions.

Effortless Bank Account Validation: Reverse Penny Drop Explained

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Globally, newly released Federal Trade Commission data shows that consumers reported losing more than $10 billion to fraud in 2023, marking the first time that fraud losses have reached this benchmark.

This staggering figure marks a 14% increase over reported losses in 2022, underscoring the alarming scale of the problem.

Advances in digital technology are bringing more types of business online, increasing the scale and variety of financial transactions. As financial transactions move from paper-based methods to digital platforms, their growing complexity necessitates robust security protocols.

As a result of this need, businesses need to implement more comprehensive fraud prevention and security mechanisms. At the same time, customers now expect immediate and error-free financial transactions. Meeting these expectations requires the implementation of an adequate bank account verification method.

This blog will delve into the nuances of the Penny Pull/Reverse Penny Drop bank verification method. With a close to 98% success rate and proven track record of reducing onboarding costs by approximately 15-20%, optimizing operational efficiency for every new consumer or merchant, let us walk you through the most effective way to validate bank accounts and speed up transactions.

But before that, let’s look at the other bank account validation method.

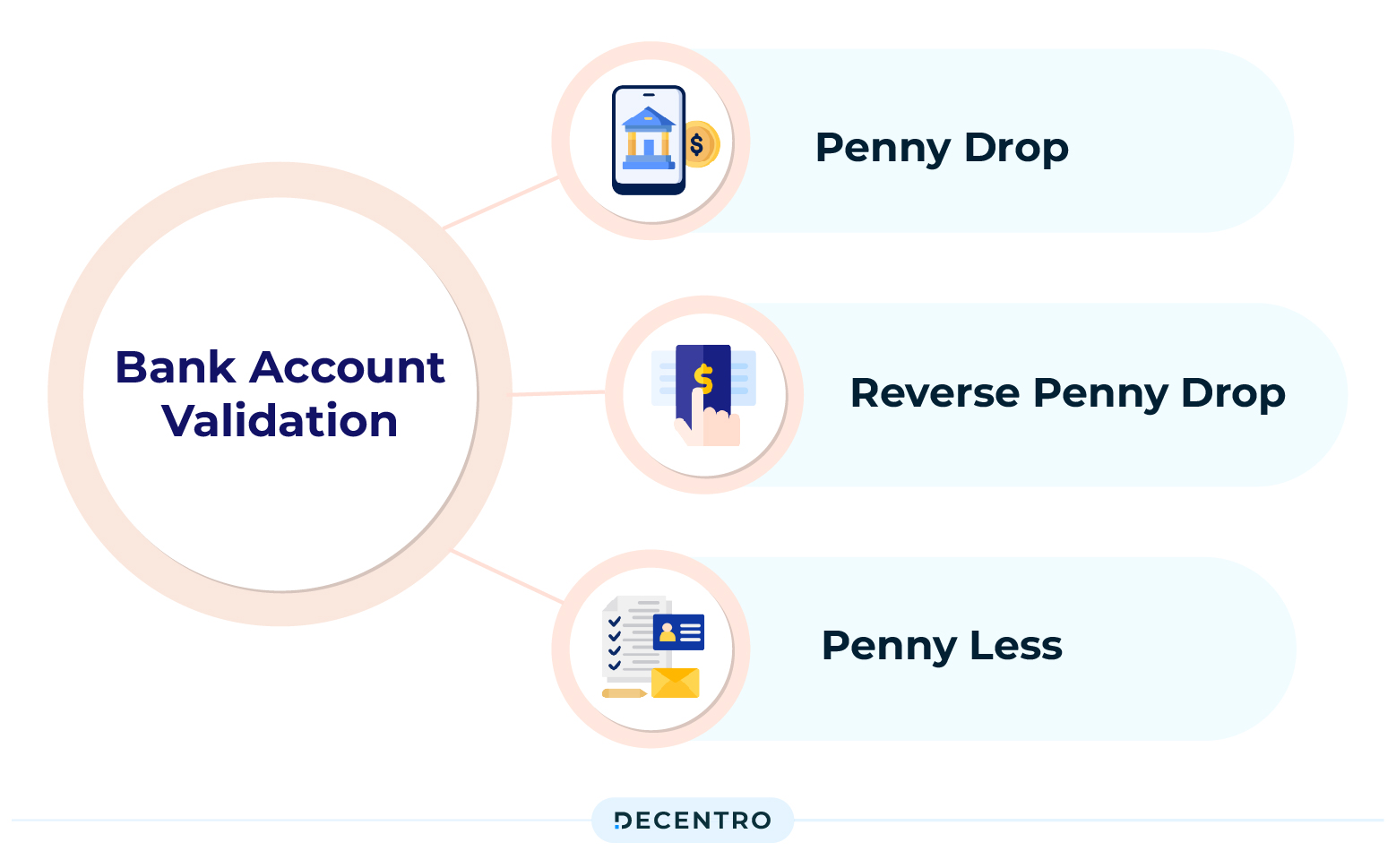

Comprehensive Penny Verification Methods

Bank Account validation is an extensive universe where multiple methods can be deployed. However, if we have to narrow it down to processes that involve a token amount, we have the following options:

Penny Drop

Businesses can verify the legitimacy of the user’s bank account by making a modest deposit of INR 1. This yields verified bank information and the beneficiary and determines whether the associated account is active. Upon confirmation of the legitimacy of the user’s bank account, the token amount is credited back to the user.

Reverse Penny Drop

Businesses can verify bank account details by initiating a small transaction (penny pull) and confirming it with the account holder. The user can also verify the bank account details by launching the UPI app to initiate the transaction. After successful verification, the amount gets reversed, i.e., credited to the beneficiary account.

Penny Less

Businesses can verify bank accounts before sending money with just a few clicks. The Penny-Less Bank Account verification method helps you check the legitimacy of onboarding users by verifying the account holder’s name and status of the bank account via account number and IFSC code. No amount is sent to the end user’s account for verification.

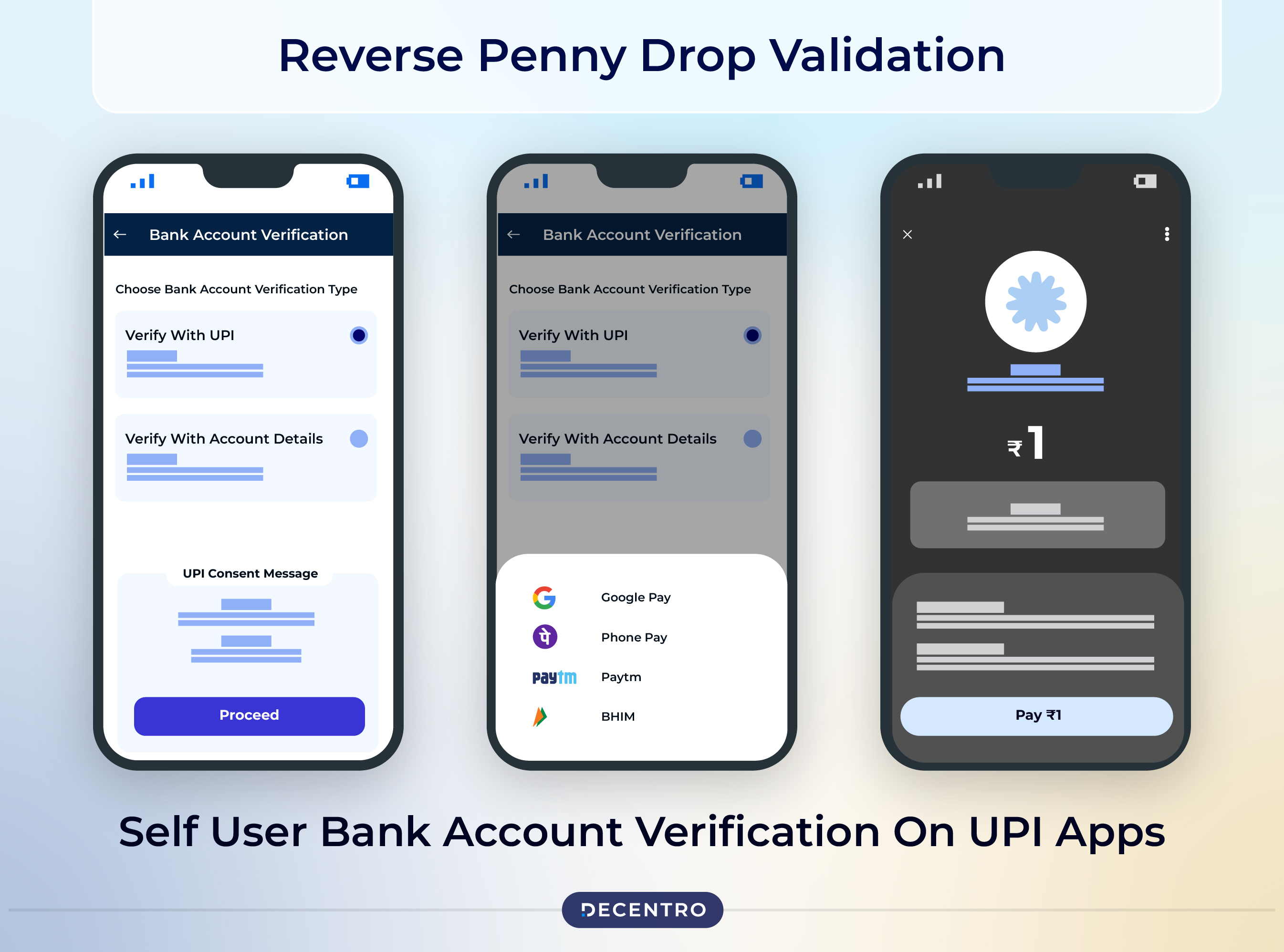

Understanding Reverse Penny Drop Validation

Traditional methods of bank account validation, such as the Penny Drop, have long been used to ensure that an account exists and is active by depositing a small amount of money into the customer’s account. However, as financial fraud becomes more sophisticated, businesses need more secure and reliable methods.

This is where Reverse Penny Drop validation shines as a technique for verifying the ownership and accuracy of a bank account. Unlike the traditional penny-drop method, where a small amount is credited to a customer’s account to confirm its validity, the reverse penny-drop approach involves a small debit transaction.

How It Works:

- Initiate a Small Debit: A financial institution or fintech company initiates a small debit (often a nominal amount, such as ₹1 or $0.01) to the customer’s bank account.

- Customer Confirms: The customer then verifies the amount debited through the platform via a secure online portal or a mobile application.

- Validation Complete: The bank account is validated as correct and active once the customer confirms the transaction amount.

This method leverages banking systems’ secure transaction capabilities and provides a direct way to validate account details with minimal customer involvement.

Is Penny Drop or Bank Verification a regulatory requirement?

In April 2020, SEBI (Securities and Exchange Board of India), which regulates the securities and commodities market in India, in its KYC circular, specifically recommended verifying Bank Accounts using penny drop as part of onboarding investors by SEBI-regulated intermediaries. On 06 October 2020, PFRDA in its VCIP circular mandated instant bank account verification through penny drop to verify the bank account details of the beneficiary. Therefore, multiple regulatory bodies in India have mandated the safe use of penny drop facilities to verify customers.

Why Reverse Penny Drop is Effective?

Having established the context of Reverse Penny Drop, let’s explore why businesses should prefer this method of bank account validation.

1. High Accuracy and Reliability

Verification of Account Ownership: Unlike other methods that may only validate account existence, the Reverse Penny Drop confirms that the individual providing the account information has access to and control over the account. This ensures a higher level of security and reduces the risk of fraud.

Reduced Errors: Directly involving the account holder in the validation process minimises the likelihood of errors in account information. This contrasts with manual or automated verification methods, which can sometimes miss discrepancies in account details.

2. Enhanced Security

Prevention of Fraud: The user’s need to verify the amount deposited acts as a deterrent against fraudulent activities. Fraudsters would need access to the actual bank account to complete the validation, which is less likely than other methods that only check account format or existence.

Secure Transactions: Since the process involves a monetary transaction, it adds a layer of security. Financial institutions have robust measures to protect monetary transfers, and they leverage these security protocols for the penny-drop validation process.

3. Cost-Effective

Minimal Costs: The amounts transferred are typically very small (often less than a currency unit, in our case Rs.1/-), making the cost per validation negligible. This makes the Reverse Penny Drop method highly cost-effective, especially for businesses needing to validate large account volumes.

Scalability: The low cost and automated nature of the Reverse Penny Drop make it scalable. Businesses can handle thousands of validations without significant increases in operational costs, making it ideal for growing companies or those with extensive customer bases.

4. Improved User Experience

Simple and Intuitive: The process is straightforward for users: they receive a deposit, check the amount, and confirm it. This simplicity contributes to a positive user experience, reducing friction in the account validation process.

Immediate Confirmation: Users can often see the deposit within a few minutes, allowing for real-time account validation. This immediacy enhances the onboarding experience for new customers or vendors.

5. Compliance and Auditability

Regulatory Adherence: The Reverse Penny Drop method helps businesses adhere to regulatory requirements by providing a verifiable trail of account validation. This is crucial for compliance with financial regulations that mandate account verification processes.

Audit Trails: The method generates clear, auditable records of each validation attempt, which can be crucial for internal audits and regulatory scrutiny. This transparency helps businesses maintain compliance and enhances trust with regulators and partners.

| Method | Security Level | Complexity | User Experience |

| Traditional Penny Drop | Medium | Low | Moderate |

| Reverse Penny Drop | High | Medium | High |

| Penniless | Medium | Medium | Low |

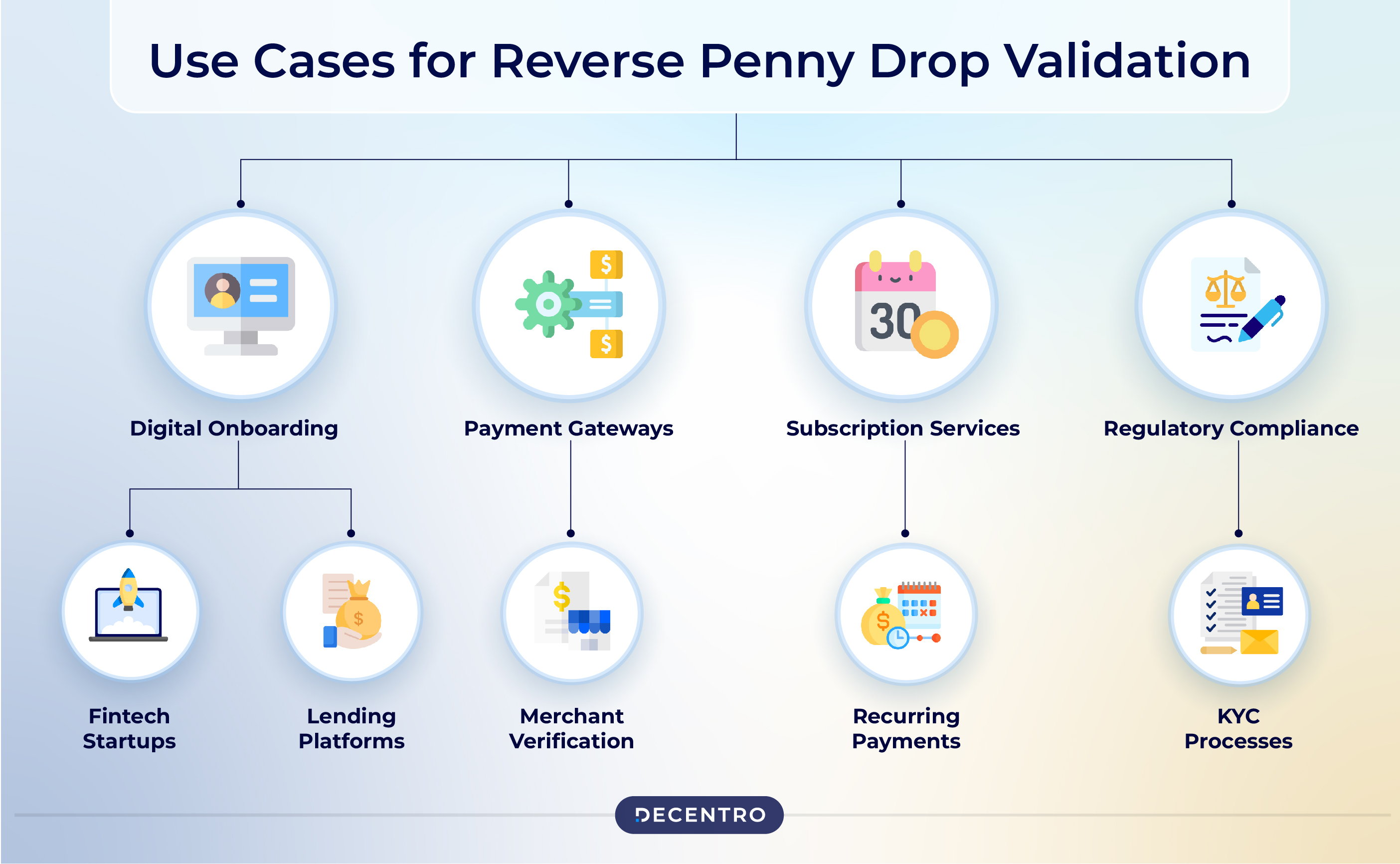

What are the everyday Use Cases for Reverse Penny Drop Validation?

The versatility of Reverse Penny Drop makes it an excellent addition to the following scenarios:

1. Digital Onboarding:

- Fintech Startups: Companies offering digital banking, payment gateways, or digital wallets can use reverse penny drop validation to streamline customer onboarding, ensuring that the bank account provided is valid and active.

- Lending Platforms: This method allows lenders to quickly verify borrower bank accounts, facilitating the smooth disbursement of loans and repayments.

2. Payment Gateways:

- Merchant Verification: Payment gateways can use reverse penny drop validation to verify merchants’ bank accounts, ensuring that payouts and settlements are made to the correct accounts.

3. Subscription Services:

- Recurring Payments: Subscription-based services can use this technique to verify the bank accounts used for recurring payments, reducing the risk of failed transactions due to incorrect account details.

4. Regulatory Compliance:

- KYC Processes: As part of Know Your Customer (KYC) procedures, reverse penny drop validation can provide an additional layer of verification, ensuring compliance with regulatory requirements.

But what about Refunds?

So, what happens to the penny debited for verification purposes?

The API provider will refund any successful payment made by a user after they receive a credit response from the bank partner. This process takes 24 to 48 hours, and refunds are handled in batches.

Some providers also store the user’s account details to handle failed auto-refunds. If the auto-refund fails, it will be processed manually. A default UPI SMS notification will be sent to the user when the refund is settled.

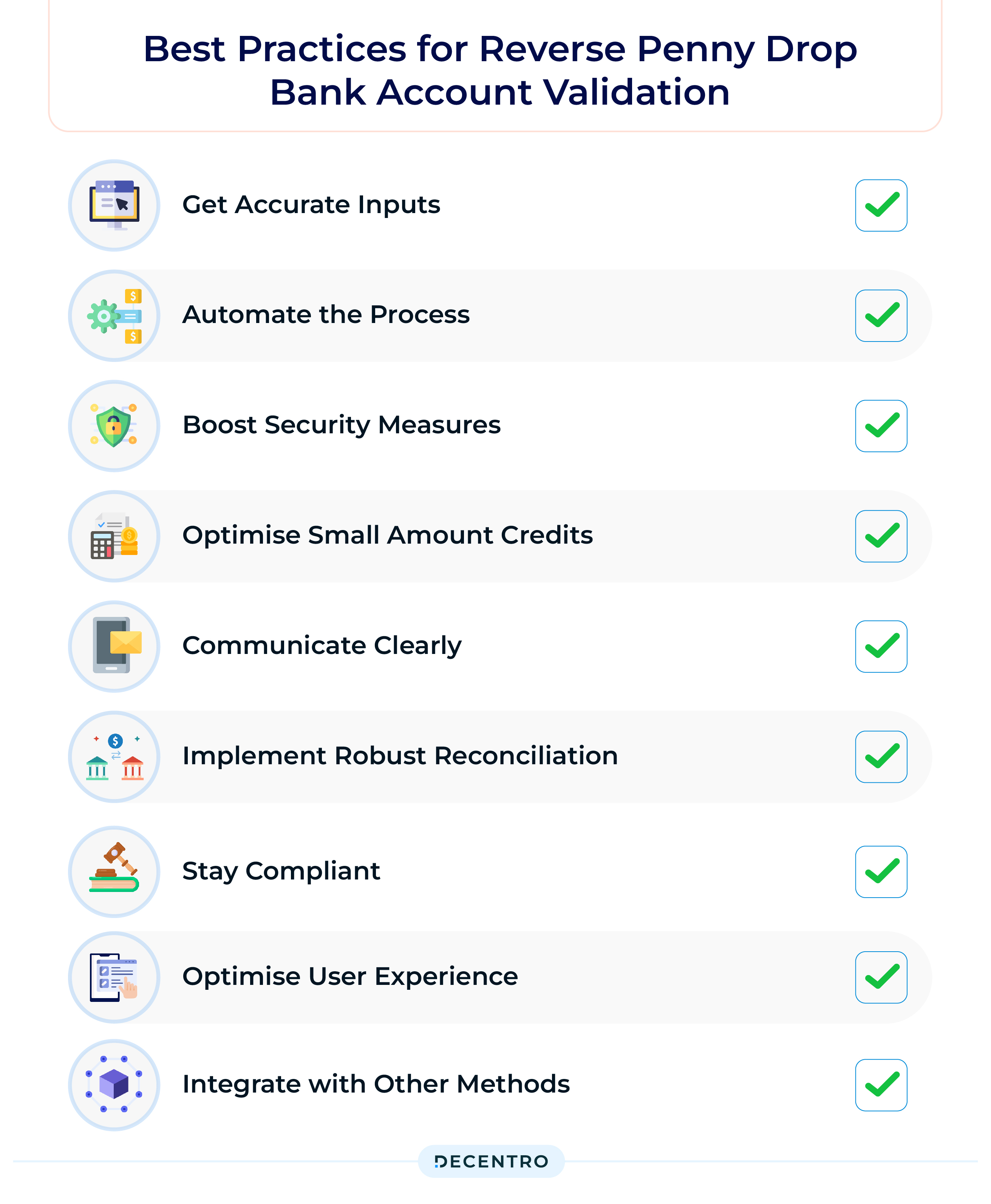

Best Practices for Reverse Penny Drop Bank Account Validation

Having established the efficacy of Reverse Penny Drop as a bank validation method, let’s examine the steps needed to maximise its effectiveness.

1. Get Accurate Inputs

- What to Do: Collect all the necessary account details, such as the account number, IFSC code, and account holder’s name.

- Why It Matters: Having the right data from the start prevents errors down the line.

2. Automate the Process

- How to Automate: Use automated tools to handle the reverse penny drop, reducing manual work and speeding up the process.

- Batch It Up: Process multiple account validations at once with batch processing for efficiency.

3. Boost Security Measures

- Encrypt Everything: Ensure sensitive data is encrypted during transmission and storage to keep it safe.

- Use Secure APIs: Secure your system interactions with protected APIs to prevent unauthorized access.

4. Optimise Small Amount Credits

- Be Unique: Deposit a small, non-round number (like ₹1.57) to make it distinct and avoid easy guessing.

- Balance Costs: Choose unique but cost-effective amounts, especially when dealing with many validations.

5. Communicate Clearly

- Notify Users: Let users know about the small deposit and provide simple instructions for verification via email or SMS.

- Clear Instructions: Make sure the steps for verification are easy to understand.

6. Implement Robust Reconciliation

- Track in Real-Time: Use systems that allow you to track penny drop deposits as they happen.

- Handle Errors: Set up protocols for dealing with failed deposits, including retry options and notifying customers.

7. Stay Compliant

- Follow the Rules: Stick to all financial regulations and guidelines for account verification.

- Keep Records: Maintain detailed records of all transactions for compliance checks and reviews.

8. Optimise User Experience

- Easy Interface: Make sure the user interface for verification is simple and user-friendly.

- Offer Support: Provide customer support to help users with any issues during the verification process.

10. Integrate with Other Methods

- Combine Approaches: Use reverse penny drop alongside other validation methods like KYC (Know Your Customer) and KYB (Know Your Business) for a thorough check.

- Cross-Reference: Enhance accuracy by comparing results from reverse penny drops with other data sources.

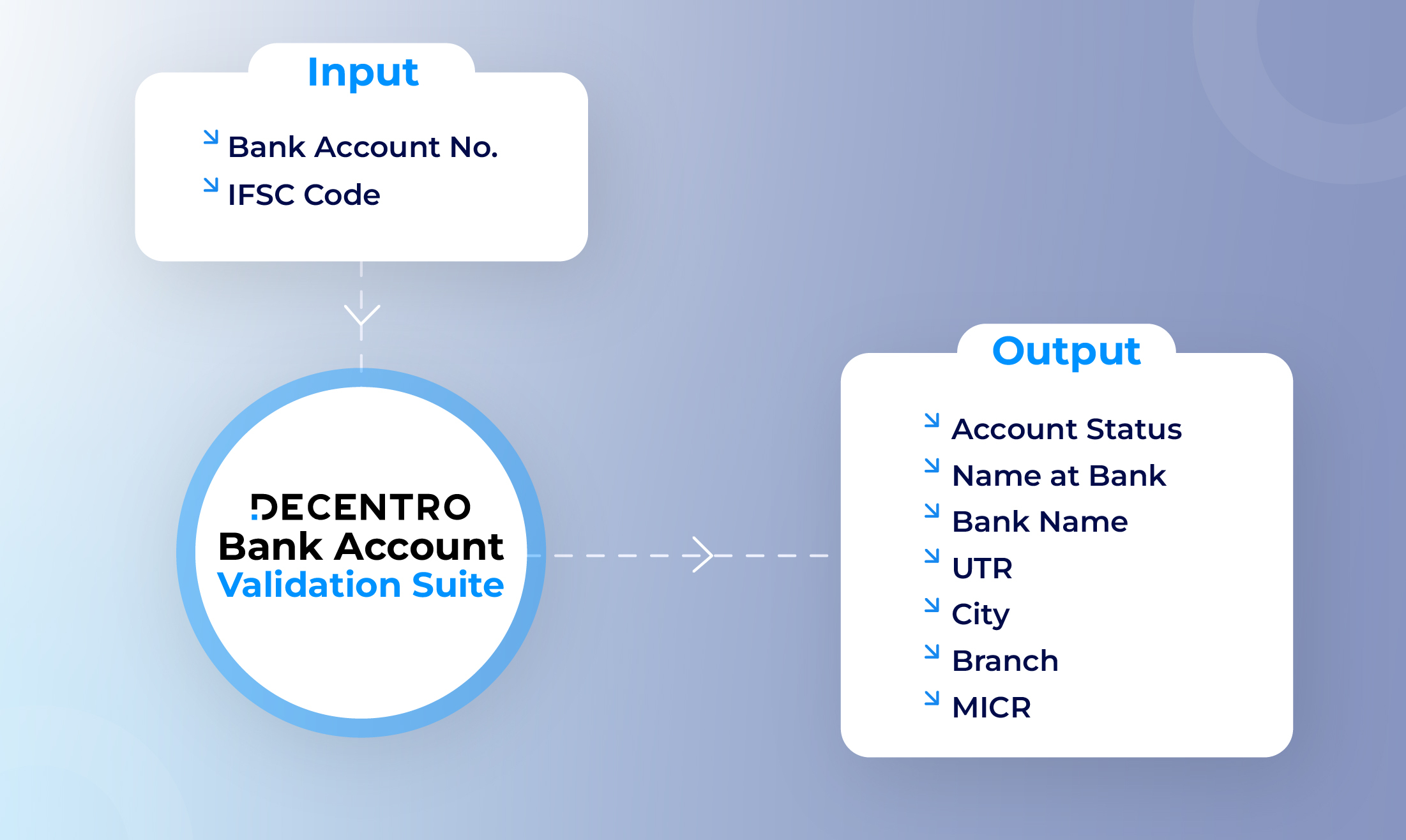

How Decentro Ensures Effective Reverse Penny Drop Verification

As businesses continue to scale and face increasing demands for streamlined, secure processes, the Reverse Penny Drop stands out as a versatile tool that can adapt to these evolving needs, providing a foundation for trustworthy and efficient financial transactions.

Decentro’s larger Bank Validation Suite consists of Reverse Penny Drop API, which can help businesses conduct instant bank account validation with real-time KYC and KYB checks. We work with companies like Rupyy from Cardekho, AU Small Finance Bank, NewTap Finance, CashE, and MoneyTap, helping 800+ enterprises grow and scale.

With Decentro,

- A single API for instantly validating a user’s bank account via penny pull verification.

- Inbuilt approval flow and beneficiary name verification

- Flexible API-based flow that can be embedded easily in your existing workflows

- Verify accounts on the fly while maintaining the accuracy and speed of onboarding and transactions.

- Leverage multi-bank architecture in the backend so that unexpected downtimes, black swan events, or volume spikes will not impact your business.

Ready to explore how Decentro can revolutionise and accelerate your onboarding process by 10X?