Discover how Udyam verification can transform MSME lending, ensuring faster loan disbursements, improved compliance, and reduced delinquency rates.

How Udyam Verification Can Transform MSME Lending

Coder, Gamer, Magic Man • Building Software for Public Good • Product @ Decentro

Table of Contents

Half of 2024 is behind us. We now stand at an inflection point.

The biggest-ever year for democracy in history is underway.

And the biggest-ever election of the year is already behind us.

Typically, newly formed governments have always tried easing access to credit for MSMEs.

Why? Micro, Small, and Medium Enterprises (MSMEs) have always been the backbone of India’s growth, and easy business loans fuel their growth.

Let’s validate this hypothesis with a few examples.

UPA’s Second Term (2009-2014)

- Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006: This was rigorously implemented and expanded in the second term to provide better credit for SMEs.

- Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGS): Expanded during the second term to enhance credit flow to the SME sector without collateral requirements.

Modi’s Second Term (2019-Present)

- Atmanirbhar Bharat Abhiyan (Self-Reliant India Campaign): Announced in 2020 to strengthen MSMEs with collateral-free loans.

- Production Linked Incentive (PLI) Schemes: Introduced to encourage small businesses to boost production and exports.

These examples show how governments, upon securing re-election, have historically implemented laws to improve access to credit for MSMEs. The government will likely play by this battle-tested playbook this time.

However, we need other steps parallel to deregulation to ease credit access for MSME lending in India.

We need several more factors to push the big private-sector banks to deploy more funds into MSMEs. Due to government pressure, Public Sector Banks (or PSBs) have historically carried the lion’s share of MSME lending. Large private banks have not been reactive to such pressures.

However, over the past few quarters, some significant events have caught the interest of large private-sector banks.

In the lending business, it all boils down to two things: how fast you can deploy and distribute your funds and how accurately you can underwrite and reduce your delinquency rate.

Lenders’ strategy for business loans has worked well so far: They avoid ultra-small business loans of less than 10 lakh rupees, where the delinquency rate is 3X, and focus on the sweet spot—50 lakhs to 1 crore and beyond.

Ironically, private-sector lenders cannot avoid these small, independent businesses entirely.

This is because it is the segment with the highest loan growth rate within the micro, small, and medium enterprises (MSMEs) sector and is expected to grow by 25% YoY, according to a 2018 TransUnion CIBIL-SIDBI report.

Growth is coming at the cost of asset quality for lenders, and it has always seemed that you cannot have both.

However, this has now definitely changed. Delinquency rates have fallen sharply for Q2FY24, according to the same TransUnion CIBIL-SIDBI report.

The MSME loan demand across lenders — private sector, public sector banks (PSBs), and non-banking finance companies (NBFCs) — rose 29 percent year-on-year (Y-o-Y).

The private banks had the fewest delinquent portfolios, at 1.5 per cent, while the PSBs had 3.2 per cent. The delinquency rate for NBFCs was 2.9 per cent.

Such a low delinquency rate could signal to these private sector banks that they aren’t taking enough risk, deploying enough loans, or perhaps not fast enough – significantly when you can offset a slightly larger delinquency rate with higher interest rates and larger convenience fees.

Don’t take my word for it. Look at the numbers.

For years, PSBs have had a 70%+ market share in these mom-and-pop store loans. That is quickly changing, as the number of private sector banks and NBFCs lending to this segment is rising sharply.

Private-sector banks now see the delinquency rate as acceptable. They also have access to better underwriting and want a piece of this sector’s loan demand growth.

This hypothesis has already begun to play out, with private sector lenders more than tripling their market share to SME 69.8% in FY22, according to this CRIF report.

The Holy Trinity

So, to circle back, we now know that:

- The government may make access to credit easier for SMEs in their current tenure.

- Private sector banks, NBFCs, and new-age lenders want a piece of the ultra-small business loan pie.

We only need a little push to get this party started….

And that little push comes in the form of FORMALISATION.

And the government’s answer for formalization is Udyam!

The Growth of Udyam

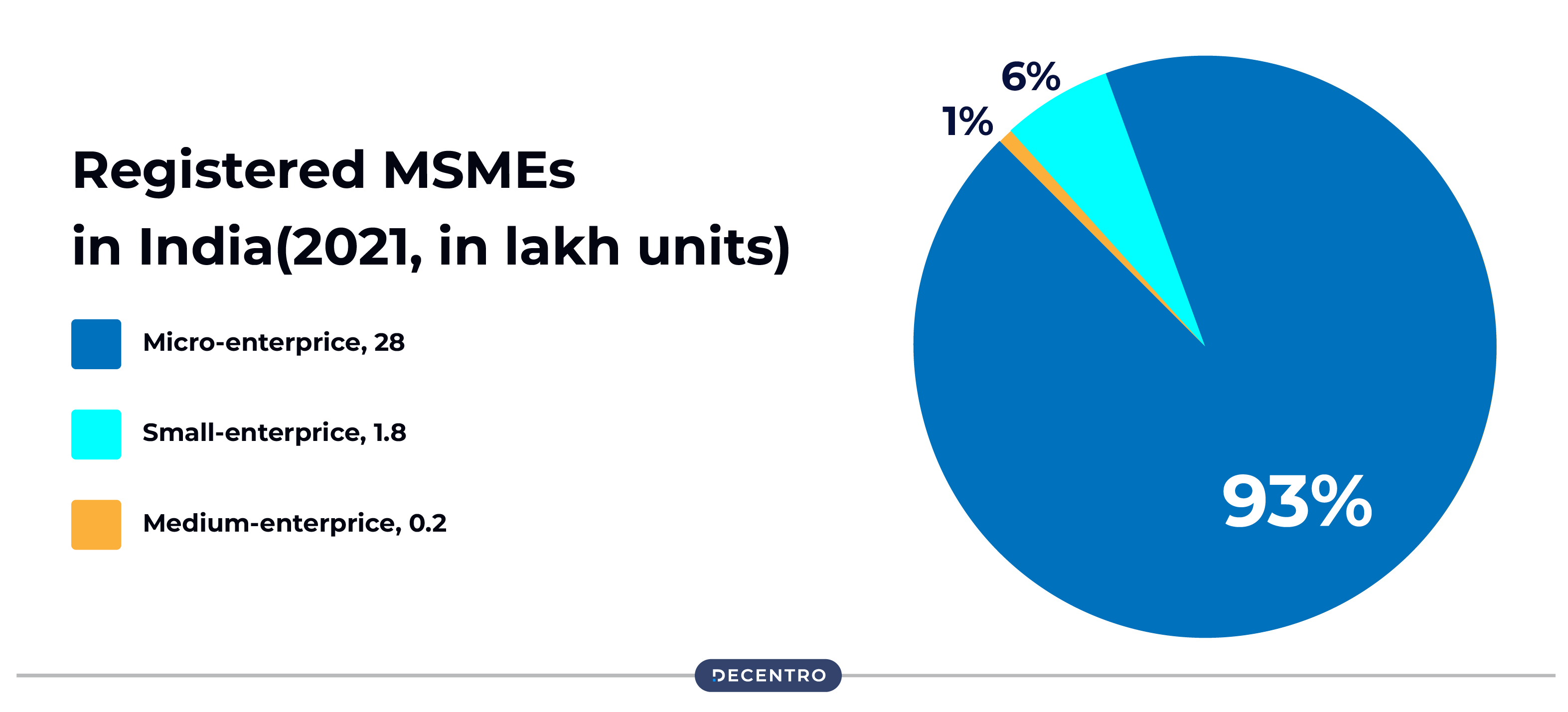

More than 90% of SMEs registered on Udyam are in the micro-enterprise category:

That makes Udyam a repository of the highest loan-growth TG for lenders. And a lot more are registering on the Udyam platform every single day:

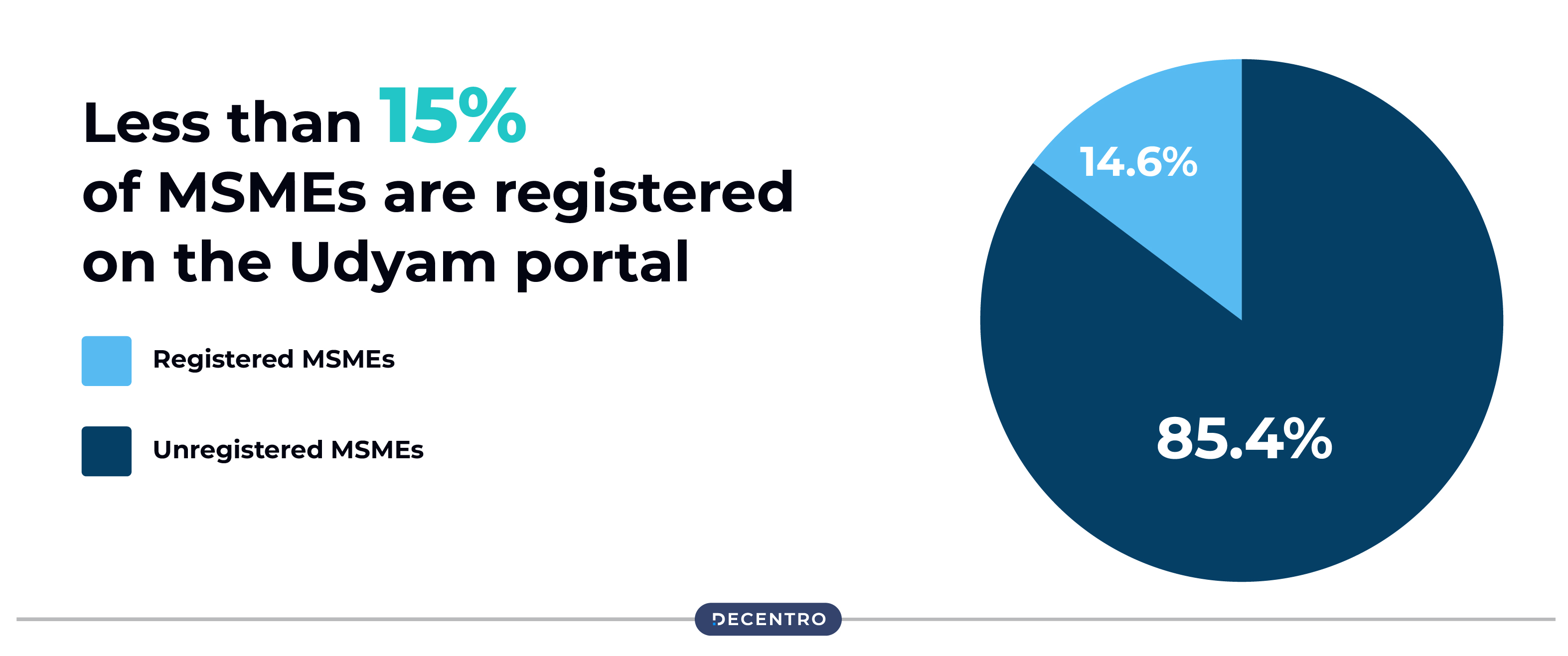

And this is where there’s a huge gap in supply.

Here’s yet another report from the TransUnion CIBIL-SIDBI report identifying an opportunity for fintech and NBFCs:

Enter the new-age SME lenders partnering with Decentro’s APIs. These players are uniquely positioned and poised to take the market by storm.

The future of SME lending is here, and those who embrace it will undoubtedly eat their competitors’ lunch!

Are you ready to transform your lending business? Partner with Decentro today and experience the power of instant business loans.