Learn how to cancel eMandates in 2025 across various Indian banks. Explore step-by-step guidelines, common reasons for cancellations, challenges, and best practices.

How to Cancel eMandate in 2025?

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

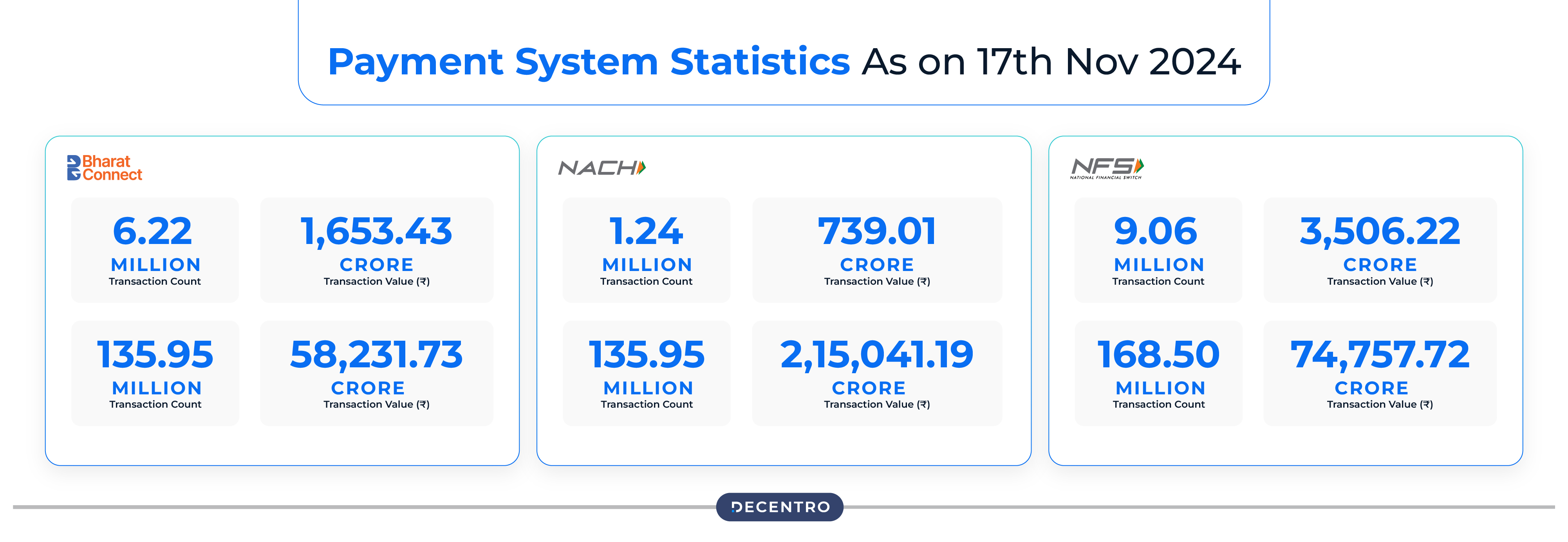

Since its inception in 2018, eMandates have changed the game for businesses when it comes to regular payment collection. This system enables users to automate recurring payments to ensure smooth financial transactions for EMIs, bills, subscriptions, mutual fund investments, and more.

As per the latest update in December 2023, eMandates process monthly transactions of almost ₹2800 crores. However, there are some cases when users need to cancel an eMandate for various reasons, such as repaying a loan amount in full, closing a loan, opting for a different subscription, etc.

Thus, knowing how to cancel eMandate in 2025 is crucial as it helps avoid unnecessary harassment.

Keep scrolling to learn the step-by-step guidelines, common challenges, and best practices.

What is eMandate?

An e-mandate refers to a digital payment mechanism that enables both individuals and businesses to authorise regular payments directly from their bank accounts. This service is facilitated by the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI).

It ensures automatic deductions for payments like subscription services, loan instalments, and utility bills, among others. The e-mandates eliminate the requirement for physical documentation by providing instructions in a digital format, resulting in a better, flawless and more convenient payment process.

eMandate Transaction Limits

As per the guidelines of the Reserve Bank of India, the maximum amount for an e-Mandate is ₹1,00,000 per transaction. However, this limit applies to certain types of transactions, like insurance premium payments, mutual fund subscriptions, and credit card bill payments.

In the case of other categories, the maximum limit is capped at ₹15,000 per transaction.

How Does eMandate Work?

Here is a detailed step-by-step guide on how e-mandate works:

Step 1: Customer Approval for Recurring Payments

The customer allows the payee or recipient to initiate automatic deductions of specified amounts from their bank account as recurring payments. This authorisation can be provided through various channels, including websites, using UPI mobile applications such as PhonePe, Google Pay, BHIM, Paytm, filling out forms, and others. The payer has the flexibility to select the payment amount, frequency, and duration.

Step 2: e-Mandate Verification

The customer confirms the eMandate by using options like net banking or debit card information. This step ensures that the individual or business owns the bank account and agrees to the e-mandate terms.

Step 3: NPCI Review

The NPCI serves as a middleman in the e-mandate process, validating the payer’s information and the payee’s request.

Step 4: Automatic Payment Setup

The customer’s bank establishes a recurring payment instruction, allowing the payee to automatically withdraw funds on the due dates. Additionally, the payer receives a confirmation and can check the e-mandate status on their bank’s app or website.

Note: Remember that the payer can cancel the eMandate anytime by contacting their bank or the payee.

Recent Changes for eMandates in 2025

Following are the recent updates and changes for eMandates in 2025:

- As of August 2024, issuers are required to inform customers 24 hours in advance about debiting charges on their accounts.

- The RBI announced on June 7, 2024, that it would support the auto-replenishment of the National Common Mobility Card (NCMC) and FASTag using the eMandate system. This feature will come into play when the balance falls below a specific customer-set limit. However, as they do not come with a fixed periodicity, there will be no pre-debit notification.

What are the Common Reasons for eMandate Cancellation?

A few common reasons for eMandate cancellations are:

- Insufficient Funds in the Account

In case the account linked to the eMandate does not have adequate funds, it leads to a cancellation of the eMandate.

- Closure or Changes of Bank Account

An eMandate would be cancelled automatically if the account on which it is based is closed or there are any changes in the account number, branch, or IFSC code.

- Switching Providers

When customers wish to switch from their current subscription or service, cancelling the eMandate is necessary to prevent overlapping payments.

- Mistakes in Mandate Details

Any mistake in the mandate details, like wrong bank account numbers, IFSC codes or other information, can lead to the cancellation of an eMandate. Similarly, if there is an error in the eMandate date or amount, changing them will require mandate cancellation.

- By Account Holder’s Withdrawal

The account holders have the right to cancel the eMandate at any time through either their bank or the service provider.

- Banking or Payment Gateway Issues

Technical issues such as downtimes in banking services or failures in payment gateways may lead to cancellations or payment issues in eMandates.

- Non-usage or Inactivity of Mandate

The eMandate can get cancelled by the financial institution or service provider if it has not been used or remained inactive for long periods.

- Policy or Regulatory Changes

The changes in banking policy, financial regulations, or Government guidelines may lead to the cancellation of eMandates that no longer comply with updated requirements.

- Insufficient Documentation

If the account holder does not furnish or update the required documents (like KYC details), the bank can cancel the eMandate.

Different Methods to Cancel an eMandate

The payer can cancel the eMandate at any time by informing their bank or the payee. Here are various methods through which you can easily cancel an eMandate:

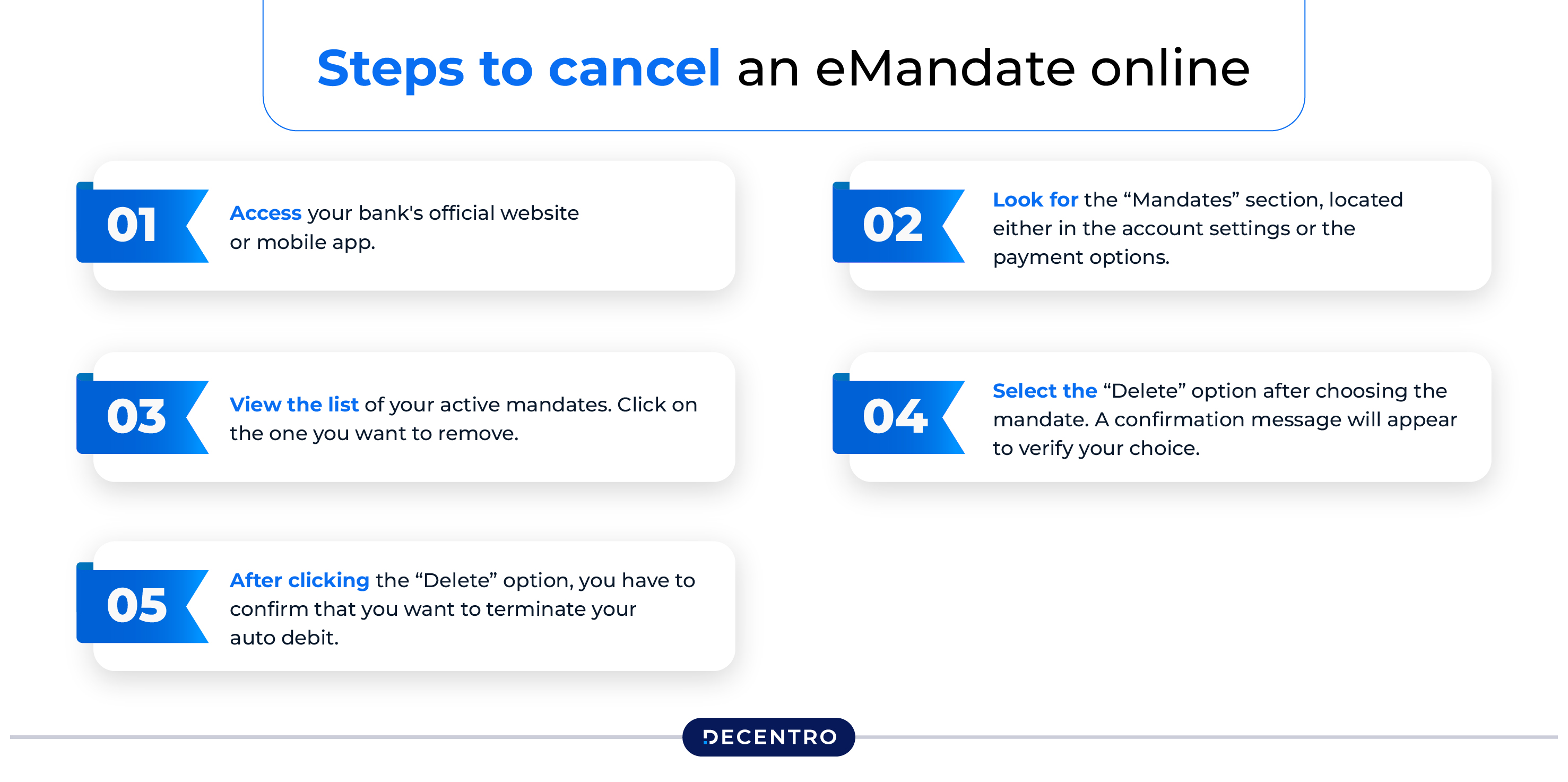

Via Online Method

Following are the steps to cancel an eMandate online:

Step 1: Access your bank’s official website or mobile app.

Step 2: Look for the “Mandates” section, located either in the account settings or the payment options.

Step 3: View the list of your active mandates. Click on the one you want to remove.

Step 4: Select the “Delete” option after choosing the mandate. A confirmation message will appear to verify your choice.

Step 5: After clicking the “Delete” option, you have to confirm that you want to terminate your auto debit.

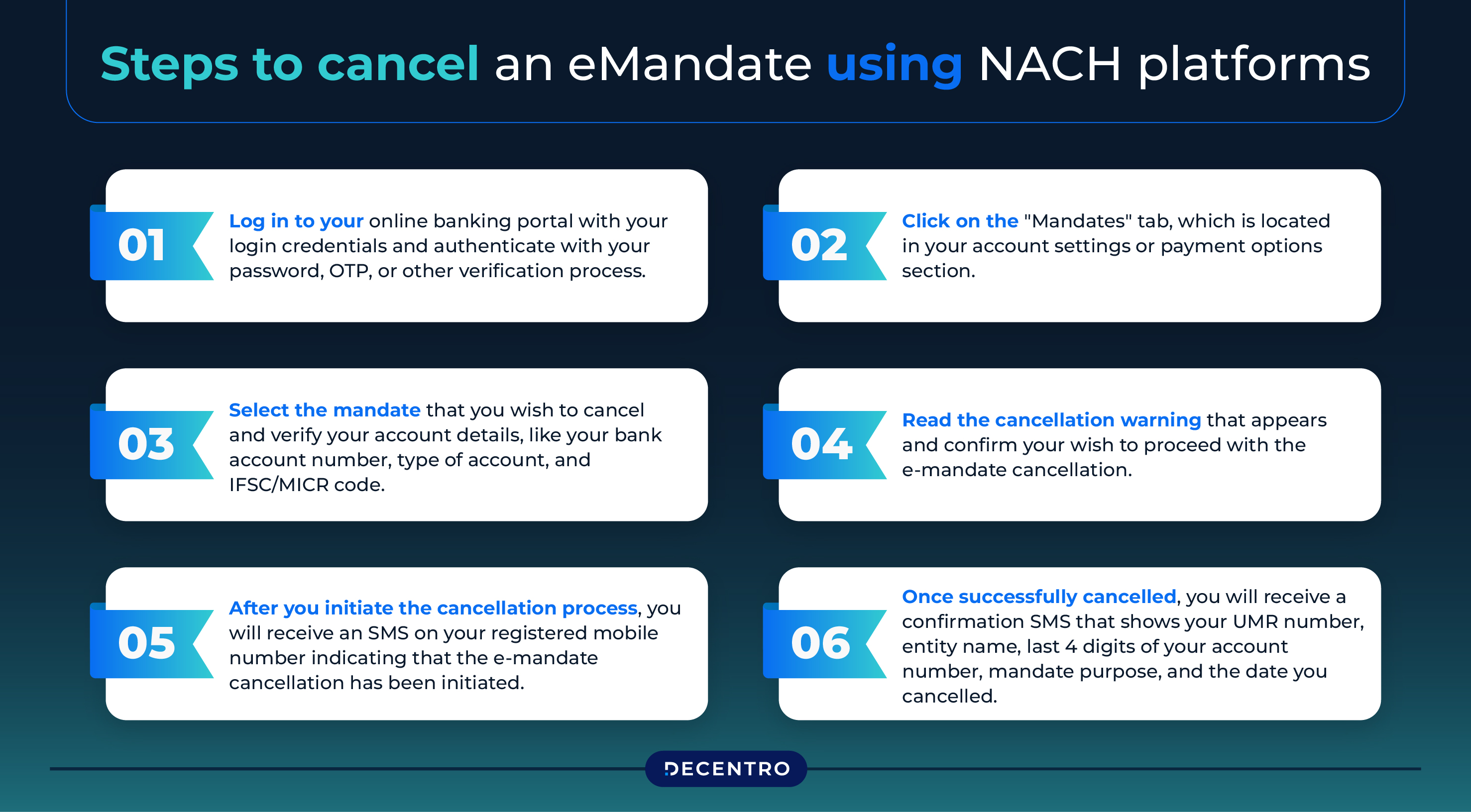

Using NACH Platforms

Here are the steps to cancel an eMandate using NACH platforms:

Step 1: Log in to your online banking portal with your login credentials and authenticate with your password, OTP, or other verification process.

Step 2: Click on the “Mandates” tab, which is located in your account settings or payment options section.

Step 3: Select the mandate that you wish to cancel and verify your account details, like your bank account number, type of account, and IFSC/MICR code.

Step 4: Read the cancellation warning that appears and confirm your wish to proceed with the e-mandate cancellation.

Step 5: After you initiate the cancellation process, you will receive an SMS on your registered mobile number indicating that the e-mandate cancellation has been initiated.

Step 6: Once successfully cancelled, you will receive a confirmation SMS that shows your UMR number, entity name, last 4 digits of your account number, mandate purpose, and the date you cancelled.

Via the Service Provider/Company

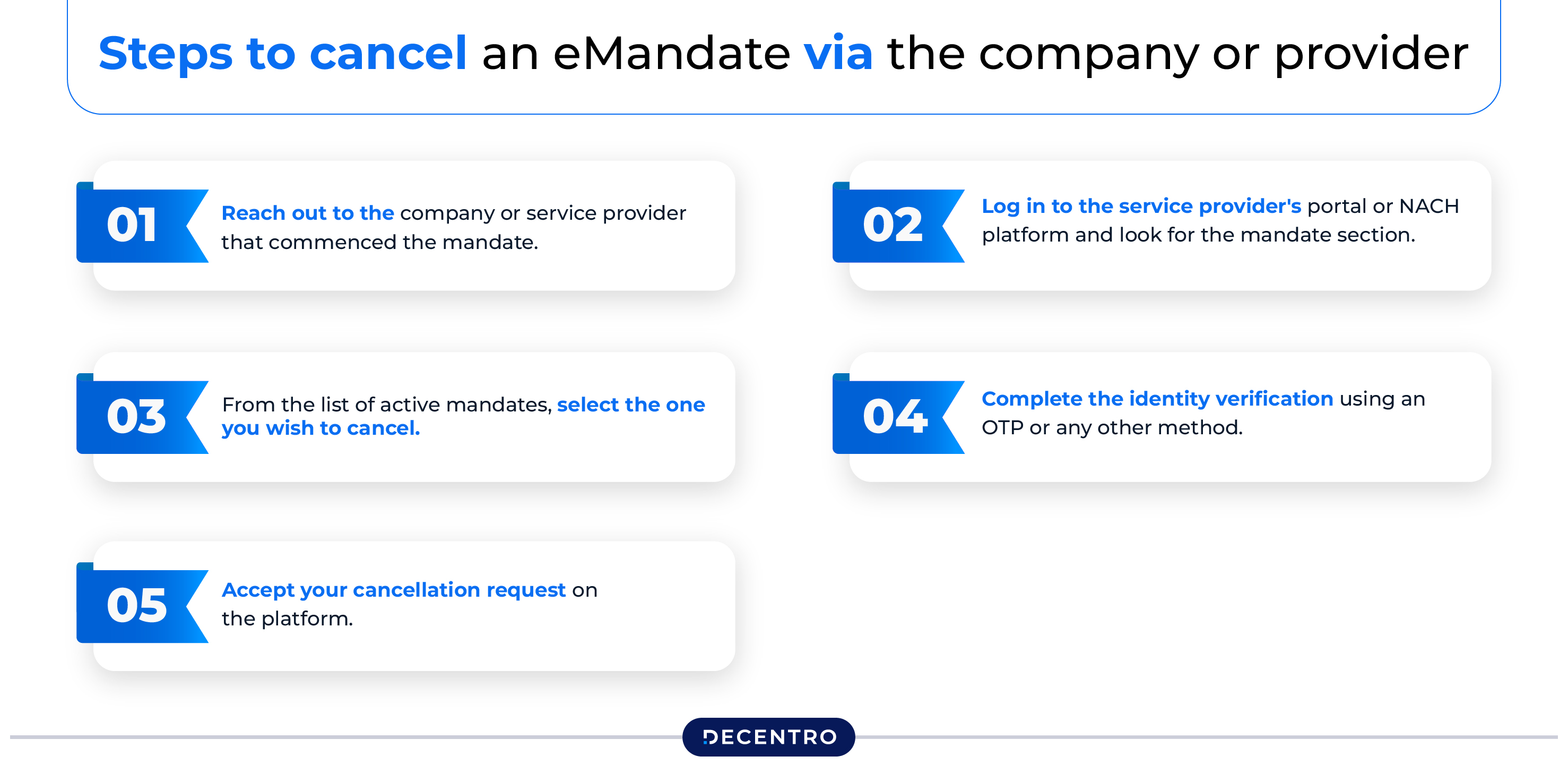

Mentioned below are the steps to cancel an eMandate via the company or provider:

Step 1: Reach out to the company or service provider that commenced the mandate.

Step 2: Log in to the service provider’s portal or NACH platform and look for the mandate section.

Step 3: From the list of active mandates, select the one you wish to cancel.

Step 4: Complete the identity verification using an OTP or any other method.

Step 5: Accept your cancellation request on the platform.

In the case of UPI mandates, you need to do the following:

Step 1: Open your UPI app and navigate to the mandate management area.

Step 2: Use UPI PIN to cancel the e-mandate for authentication.

Via Banking Channels

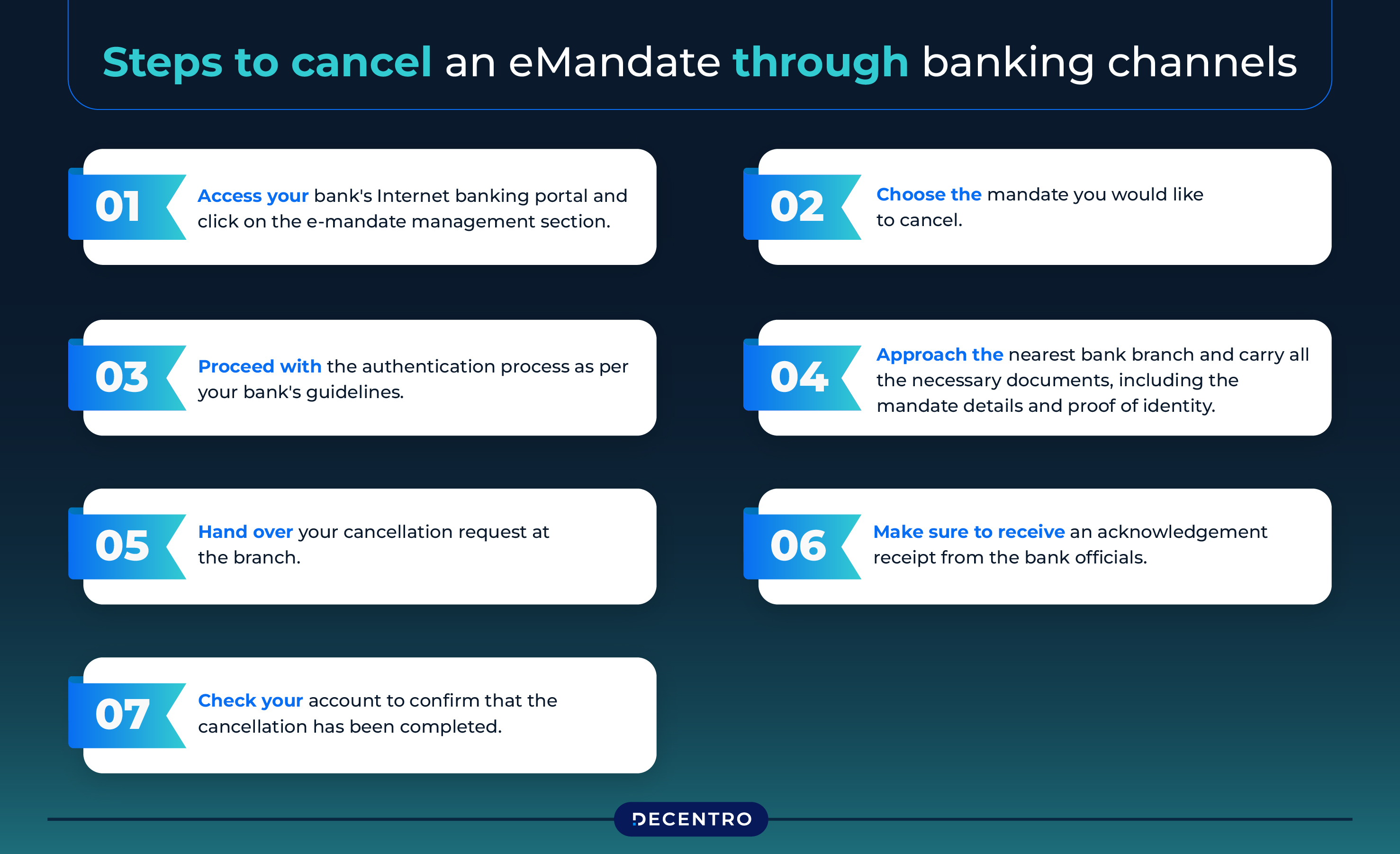

Discussed below are the steps to cancel an eMandate through banking channels:

Step 1: Access your bank’s Internet banking portal and click on the e-mandate management section.

Step 2: Choose the mandate you would like to cancel.

Step 3: Proceed with the authentication process as per your bank’s guidelines.

Step 4: Approach the nearest bank branch and carry all the necessary documents, including the mandate details and proof of identity.

Step 5: Hand over your cancellation request at the branch.

Step 6: Make sure to receive an acknowledgement receipt from the bank officials.

Step 7: Check your account to confirm that the cancellation has been completed.

How to Cancel eMandate in Different Banks?

The process to cancel an eMandate may tend to differ slightly across banks. Following are the mandate cancellation procedures for the top banks across India:

- SBI Online

Here is the step-by-step process to cancel an eMandate through the State Bank of India (SBI) online banking portal:

Step 1: Log in using your account information to access your account.

Step 2: At the website, look for the sidebar menu and click on the ‘Recurring Transaction’ option.

Step 3: On the mobile app, navigate to ‘Services’ and then to ‘Manage Recurring Transaction’.

Step 4: Click on the ‘Proceed’ button to continue the process.

Step 5: Read the terms and conditions and click ‘Proceed’ when prompted.

Step 6: Find the e-mandate you need to cancel and click on the ‘View’ option.

Step 7: To change the maximum amount or expiration date of your e-mandate, click ‘Edit’.

Step 8: Finish the changes by entering the OTP sent to your registered mobile number or email ID.

- ICICI Bank Online

Following is the simple step-by-step procedure to cancel an eMandate through ICICI Bank online:

Step 1: Log in to your ICICI Bank account through the Internet banking website.

Step 2: Select ‘Customer Service’ and then ‘Service Requests’ in the drop-down menu.

Step 3: Choose the options available for cancelling ECS/NACH mandates.

Step 4: From the dropdown list, select your savings account.

Step 5: Select the checkbox next to the ECS arrangement for your loan.

Step 6: Read and agree to the terms in the declaration.

Step 7: Tap ‘Submit’ to proceed.

Step 8: Provide the OTP sent to your registered mobile number.

Step 9: Complete the final submission process to cancel the ECS mandate.

- Canara Bank Online

Discussed below is the simple step-by-step process to cancel an eMandate through Canara Bank online:

Step 1: Go to https://www.sihub.in/managesi/canara or check the Canara Bank website (www.canarabank.com).

Step 2: Sign in using your account details.

Step 3: Ensure to complete your e-mandate registration before proceeding.

Step 4: Cancel e-mandates as needed.

In addition, you can cancel your eMandate by visiting your local Canara Bank branch.

- IndusInd Bank

Mentioned below are the steps to cancel an eMandate through IndusInd Bank:

Step 1: Log in to the IndusInd Bank website or mobile banking application.

Step 2: Find the “How do I cancel a Mandate(s)” section.

Step 3: Tap on “Click Here” and enter your registered mobile number.

Step 4: Complete the on-screen instructions to cancel your selected mandate.

Step 5: An OTP will be sent to your registered mobile number.

Step 6: Post cancellation, you will receive a confirmation SMS from the bank.

- Kotak Mahindra Bank

Check out the simple steps to cancel an eMandate on Kotak Mahindra Bank:

Via Online Banking

Step 1: Log in to your Kotak Mahindra online banking account.

Step 2: Go to the ‘Services’ section and then click ‘Account Services’.

Step 3: Select NACH Cancellation to view your existing NACH mandates.

Step 4: Follow the on-screen instructions to cancel the eMandate.

Via Kotak Mobile Banking App

Step 1: Log in by entering your credentials.

Step 2: Navigate to the ‘Services’ menu and click ‘Account Services’.

Step 3: Select ‘NACH Cancellation’ to view current eMandates and apply for their cancellation.

After cancellation, you will get a confirmation message from the financial institution.

Guidelines Set by the NPCI for Mandate Cancellation

When it comes to eMandate cancellation, the NPCI has issued some guidelines, which are as follows:

- To access the system, you must complete a multi-step authentication process that includes entering your username, password, and a one-time code.

- Once authenticated, you can view all mandates associated with your account. After this, select the specific mandates you wish to terminate.

- When prompted by the confirmation window, review and approve the termination request. You will receive a text message indicating that the cancellation process for your NACH mandate has commenced.

- The financial institution which is hosting your mandate will then dispatch and process the termination documents the same day to the associated bank, ensuring that the request received is dealt with promptly.

- You will receive updates on the status as the NACH system communicates through the sponsor bank.

- Finally, expect a confirmation message on your phone once the mandate has been successfully terminated, and the system will be updated to eliminate any future transactions related to the cancelled mandates.

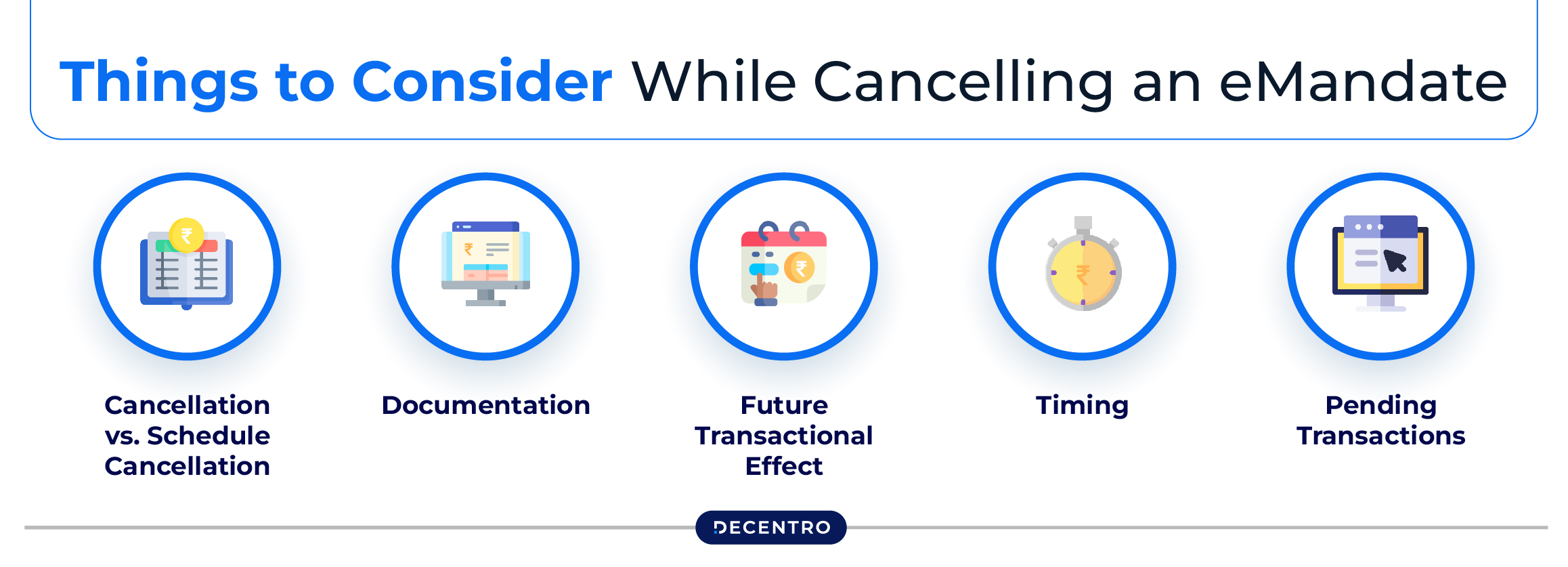

Things to Consider While Cancelling an eMandate

Following are the essential things to keep in mind at the time of cancelling an eMandate:

- Cancellation vs. Schedule Cancellation

In case you want to stop just one payment and not the entire eMandate, just cancel that particular payment schedule. This keeps the mandate intact, removing the need to set it up again for future transactions.

- Documentation

You have to keep documentary evidence related to cancellation requests and confirmations from banks or service providers received. This will be important evidence in case of future disputes over various concerns.

- Future Transactional Effect

Please remember that cancelling an eMandate will stop those auto-deduction transactions created with that eMandate in the future. To reinstate the payment again in the future, you will have to register afresh as a new eMandate.

- Timing

Ensure that the mandate is cancelled long before the next payment date to prevent any automatic deduction by the payee.

- Pending Transactions

Any pending transactions related to a mandate can be processed, even after cancellation. For such payments, reconfirm with the bank.

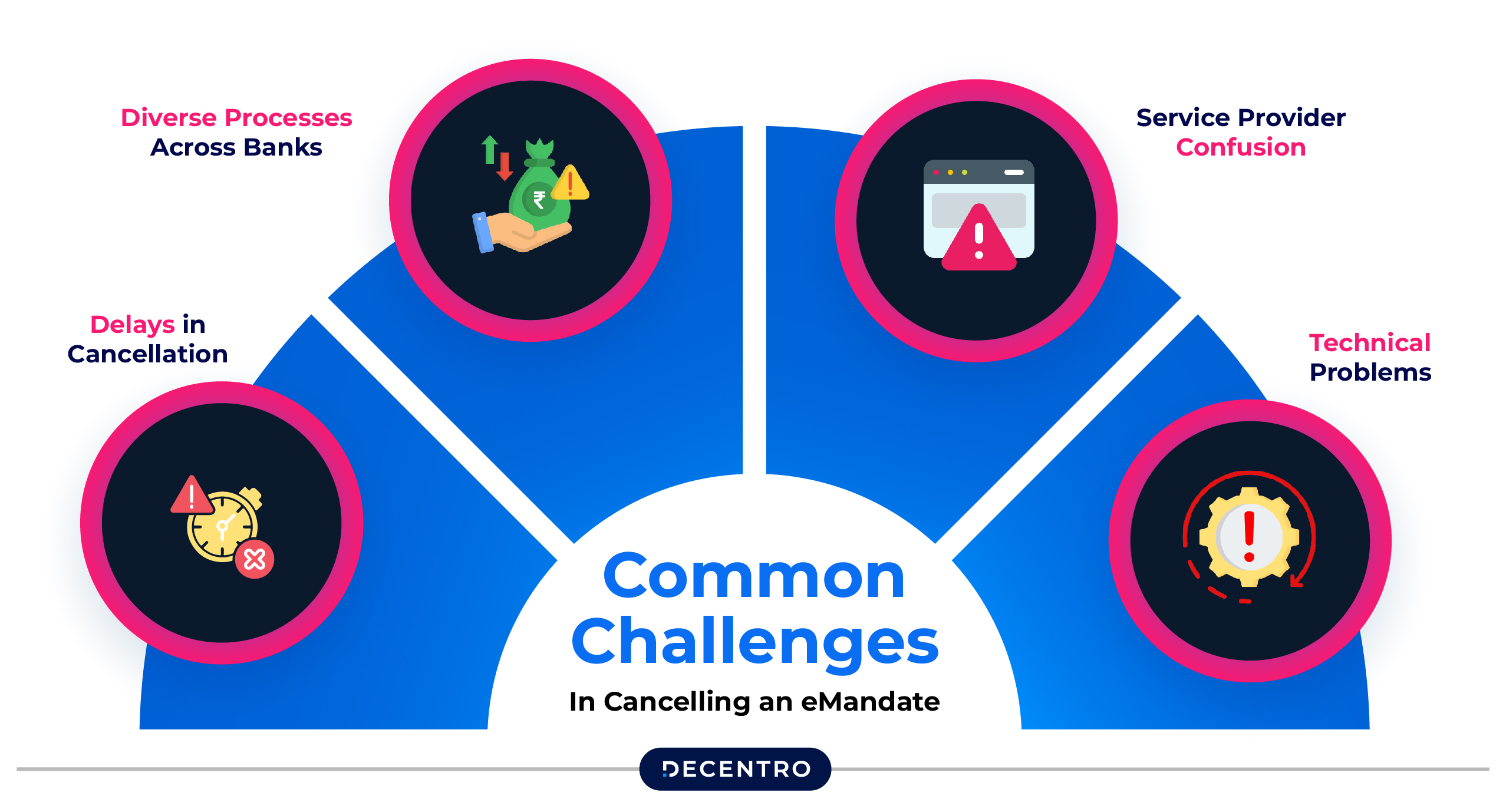

Common Challenges in Cancelling an eMandate

While cancellation of an eMandate is usually quite simple, there are several potential challenges for customers, including:

- Delays in Cancellation

Cancellation may sometimes take longer, resulting in unwanted payments or duplicate payments during the full stages of completion of the process.

- Diverse Processes Across Banks

Each bank may have different processes for cancellation which may be puzzling for the users.

- Service Provider Confusion

Sometimes, the provider may not actually recognise the cancellation request, thereby leading to further payments or confusion regarding the status of a mandate.

- Technical Problems

Technical problems or system errors within the bank or service provider may delay the eMandate cancellation process.

Best Practices for Managing eMandates

To overcome the challenges regarding eMandate cancellation, here are a few best practices to follow:

- Monitor eMandates: Keep checking your eMandates and reviewing the details to avoid unwanted or duplicate mandates.

- Use a Trusted Platform: Always choose secure and reliable platforms that allow for centralised management of eMandates.

- Keep Lines of Communication Open: Keep your bank and service provider informed of any changes or cancellations.

- Be Proactive: Set reminders to review or cancel mandates before they come up for renewal.

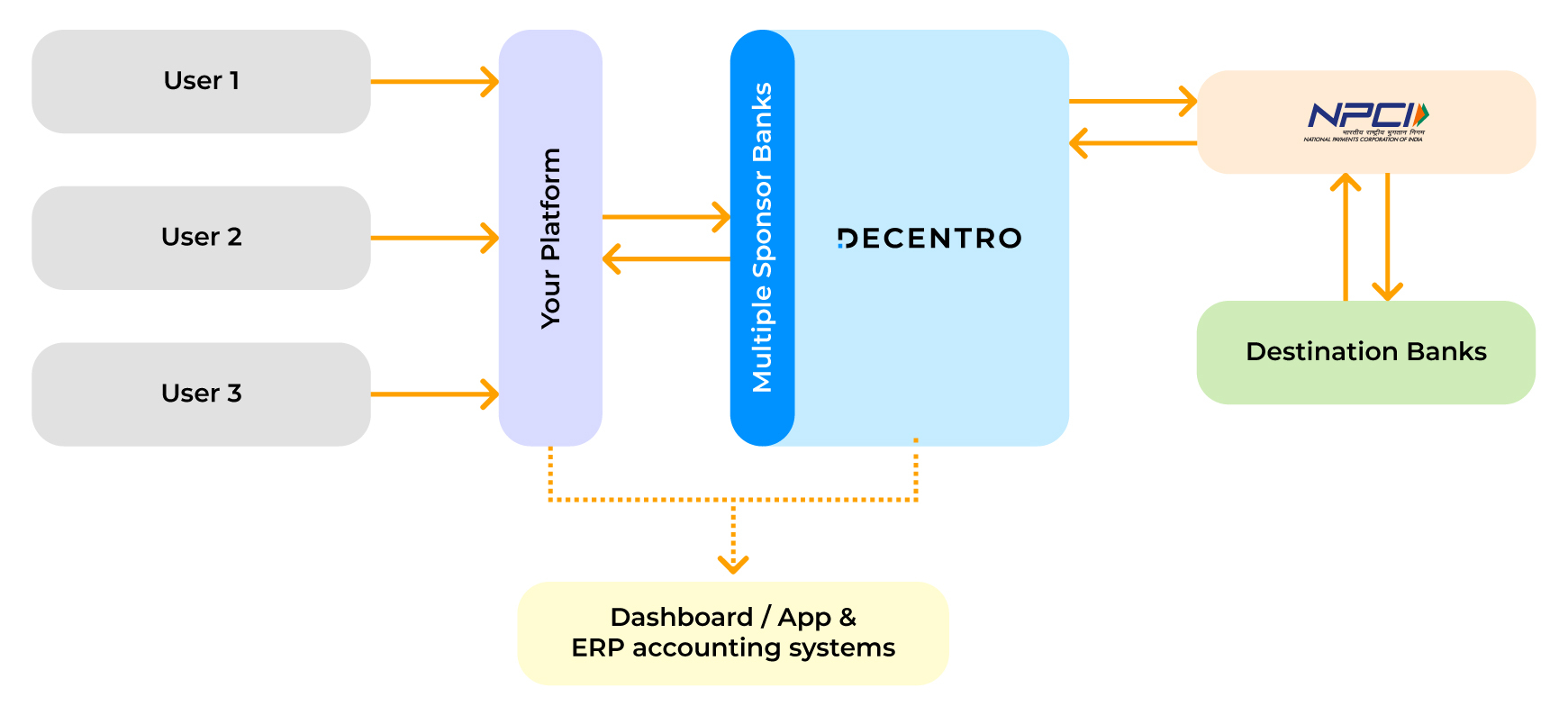

Simplify Payment Management with Decentro’s APIs

Now that you have a clear idea of how to cancel eMandates, you can terminate recurring payments without any hassles. However, if your business model includes collecting recurring payments and you have a growing customer base, manually setting up eMandates can be a pretty hectic task.

Decentro’s e-NACH APIs enable you to automate recurring payments with a single click. Customers enjoy a hassle-free experience via digital mandate registration and single-time authentication.

Meanwhile, businesses get the benefits of auto-reconciliation, reduced follow-up costs and end-to-end compliance with RBI’s regulations.