Learn about pending payments in detail. Discover why they occur, how to track them, and how to resolve pending payments with banks, merchants, or online platforms.

Pending Payments: Complete Guide to Pending Transactions

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Digital transactions may have taken transaction speeds to a whole new level; however, modern businesses still face the problem of pending payments. If not properly handled from the get-go, these delays can lead to cash flow gaps, working capital shortfalls, increasing administrative costs and even losses.

As per a US Chamber of Commerce survey in 2022, approximately 60% of businesses have lost their clients on account of late payments, with the average revenue loss figures standing at $10,000. Thus, by understanding why pending payments occur, how long they take for resolution, and strategies to avoid such issues, businesses can significantly reduce the impact of these delays on their operations.

Read on for an in-depth insight.

What are Pending Payments?

A pending payment refers to a temporary situation in a transaction where a payment processing has been initiated but is not yet completed, as it awaits approval or confirmation. This situation can be caused by factors like insufficient funds, processing delays, or essential verification steps such as One-Time Passwords (OTPs).

Moreover, network problems or communication disruptions can contribute to these delays. Funds paid during holidays or outside of regular banking hours can remain pending until the next working day.

Common instances of pending payments include card transactions that need bank approval, UPI payments that face internet issues, and direct debits that take time for banks and merchants to finalise.

Note: In October 2024, the MSME Samadhaan portal revealed that micro, small, and medium enterprises (MSMEs) had pending payments of almost ₹21,108 crore across 90,000 applications.

Difference Between Pending and Completed Payments

The main difference between pending payments and completed payments is their status. Here is a detailed distinction between the two:

| Aspects | Pending Payments | Completed Payments |

| Stage | The transaction has started but is not yet settled. | The transaction is completely processed and settled. |

| Merchant Status | Payment has not been credited to the merchant’s account. | Payment has been credited to the merchant’s account. |

| Bank Statement | It is not yet displayed on the bank statement. | Displayed successfully on the bank statement. |

| Funds Deduction | Funds are allocated and subtracted from the available balance. | Funds are permanently debited from the account. |

| Reversal/Cancellation | It can be reversed or cancelled in certain circumstances. | It cannot be reversed or cancelled easily once posted. |

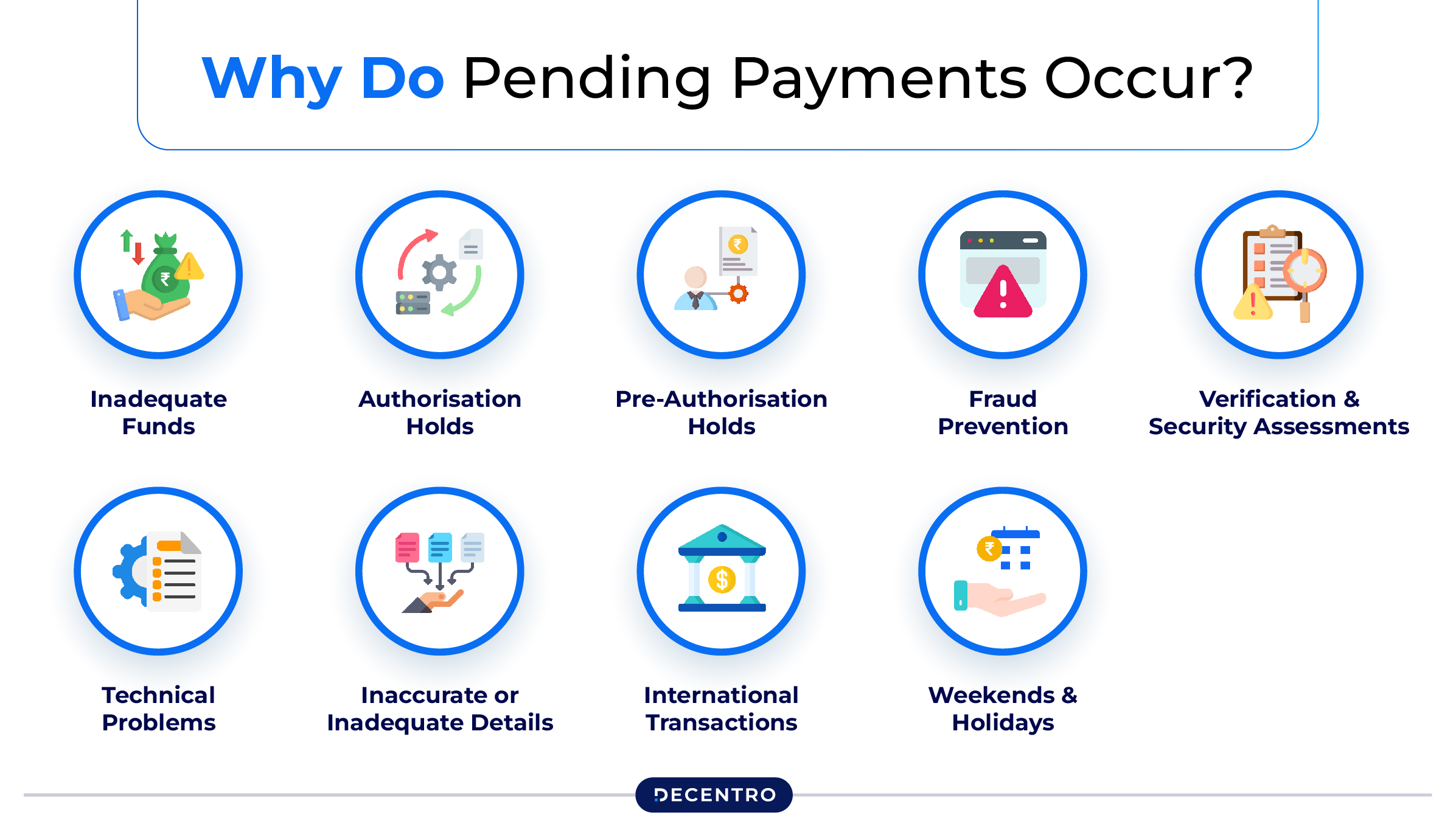

Why Do Pending Payments Occur?

There are multiple factors that can cause a payment to appear as pending:

- Inadequate Funds

If your account lacks sufficient funds at the time of the transaction, the payment may stay pending until you add enough money to cover the cost.

- Authorisation Holds

When a card transaction is initiated, the merchant seeks authorisation from your bank to confirm that sufficient funds are available. Your bank then places a hold on that amount, which will remain pending until the transaction is finalised.

- Pre-Authorisation Holds

Merchants, such as hotels and car rental companies, may place a pre-authorisation hold on your card for an estimated total that includes potential additional charges. This pending amount may exceed the final charge and can take several days to resolve once the final bill is processed.

- Fraud Prevention

Banks often flag transactions that seem unusual as pending while they confirm their authenticity to protect against fraud.

- Verification and Security Assessments

Generally unusual or high-value transactions may require further verification or security assessments. This process can cause delays until the financial institution or payment processor confirms the transaction data.

- Technical Problems

System malfunctions or outages at the bank, payment processor, or merchant can result in transactions being held in a pending state. Usually, these problems are resolved once the systems are restored.

- Inaccurate or Inadequate Details

Transactions may remain pending if there are inaccuracies in the transaction details, such as wrong account numbers or missing information until these discrepancies have been addressed.

- International Transactions

Transactions that involve international transfers or require currency conversion may face longer processing times due to the additional verifications mandated by banks and payment processors.

- Weekends and Holidays

Transactions made outside of standard banking hours may remain pending until the next working day.

Examples from Real-World Scenarios of Pending Payments

Here are some notable real-world examples of pending payments experienced by several companies worldwide:

- A survey from the World Bank in 2023 revealed that companies with large unpaid balances tend to seek outside funding, facing an average rise in borrowing costs of 2.5%.

- In the year 2023, the report from the UK Small Business Federation indicated that 34% of small businesses faced project delays due to late payments, with an average delay of 2 weeks.

- In a certain country, a local manufacturer had pending payments worth $200,000 from different clients, which prevented them from purchasing essential raw materials, thus stalling their production process for weeks.

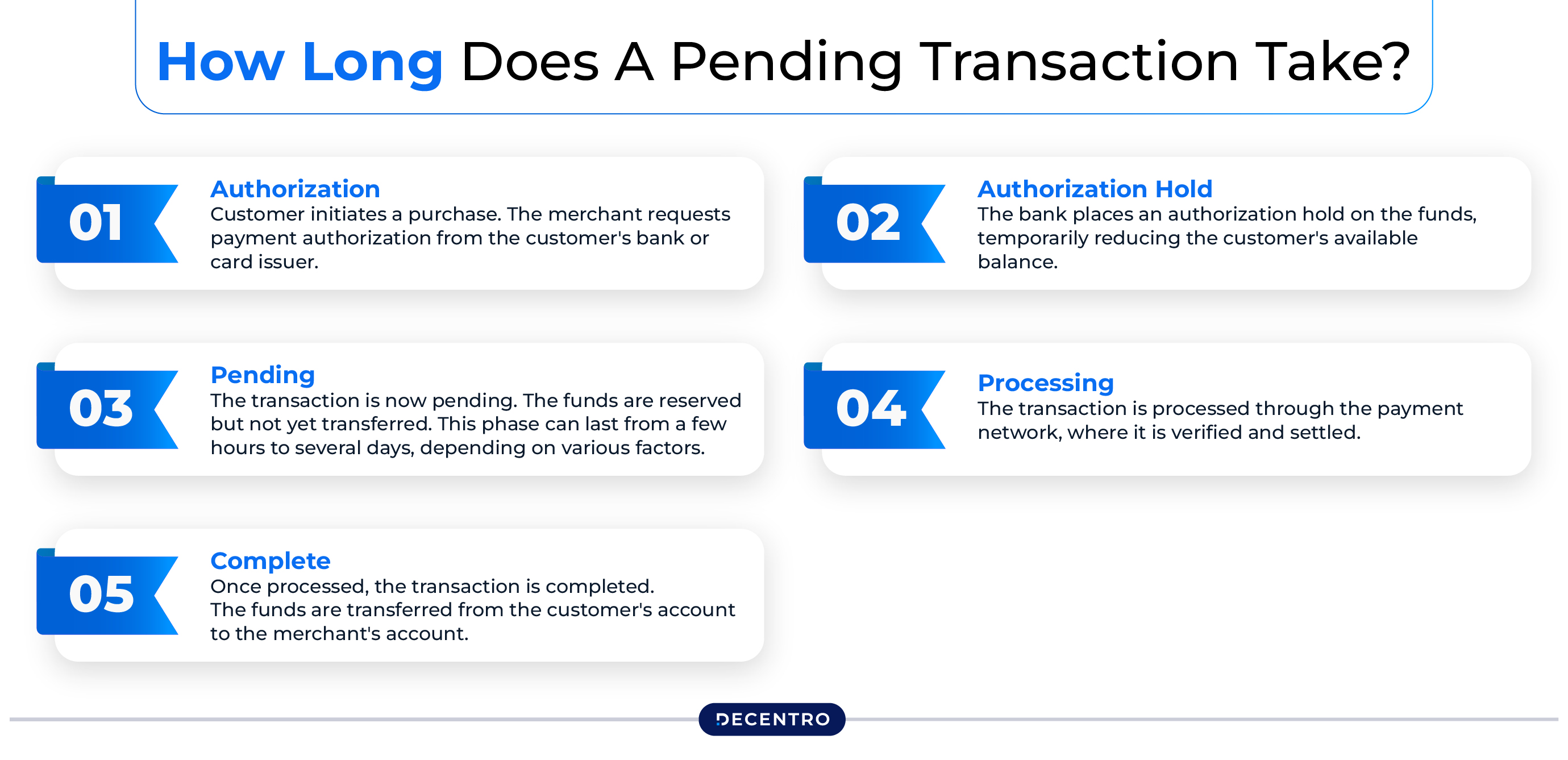

How Long Do Pending Payments Take?

The time taken to clear pending payments varies with the merchant or transaction type. However, most of them are completed within 1 to 5 business days. Here is an overview of how long it usually takes for pending payments to be cleared for various payment methods:

- Credit Cards: Most credit card transactions will clear within three business days, while others may take up to five business days.

- Debit Cards: Debits are generally faster and should clear typically within 24 hours, although the maximum time for debit transactions may take up to 3 business days.

- UPI: Payments made through UPI are usually processed instantaneously or within a few seconds. However, in case a payment is pending, it can take a maximum of up to 24 hours for the status to update.

- Cheques: Cheques usually take longer depending on your bank’s rules, generally making funds available within 2 to 11 business days.

- ACH Transfers: ACH transactions, like direct deposits or bill payments, are batch-processed and generally reflected in the recipient’s bank account within 2 to 3 days.

Apart from these, two main factors affect pending payment timelines, which include regulatory requirements and bank holidays/weekends.

Impact of Pending Payments on Businesses

Pending payments can deeply impact a business, hindering its financial health, cash flow, and overall operations. The following are four key effects of pending payments:

- Liquidity Constraints

Unpaid invoices lessen the available working capital, hindering the ability to cover daily expenses or invest in growth opportunities, potentially stalling operations and growth.

- Strained Business Relationships

Payment delays can ruin the trust between businesses and their clients, suppliers, or partners, hampering long-term relationships and affecting future collaborations.

- Increased Borrowing Costs

Businesses often turn to external financing to manage cash flow gaps caused by pending payments, leading to increased borrowing costs and financial strain.

- Operational Disruptions

Pending payments can lead to delays in payroll, inventory procurement, and project execution, causing inefficiencies, missed deadlines, and reputational damage.

Impact of Pending Payments on Individuals

Just like businesses, pending transactions can also affect individuals. The following are the common impacts:

- Temporary Unavailability of Funds

When payments are pending, the associated funds are typically reserved and not accessible for alternative transactions. This situation can hamper individuals from accomplishing other payment obligations or managing their financial accounts effectively.

- Confusion About Actual Balances

Pending transactions can cause misunderstandings regarding the actual available balance, resulting in discrepancies in financial management and the risk of overdrafts or failed transactions.

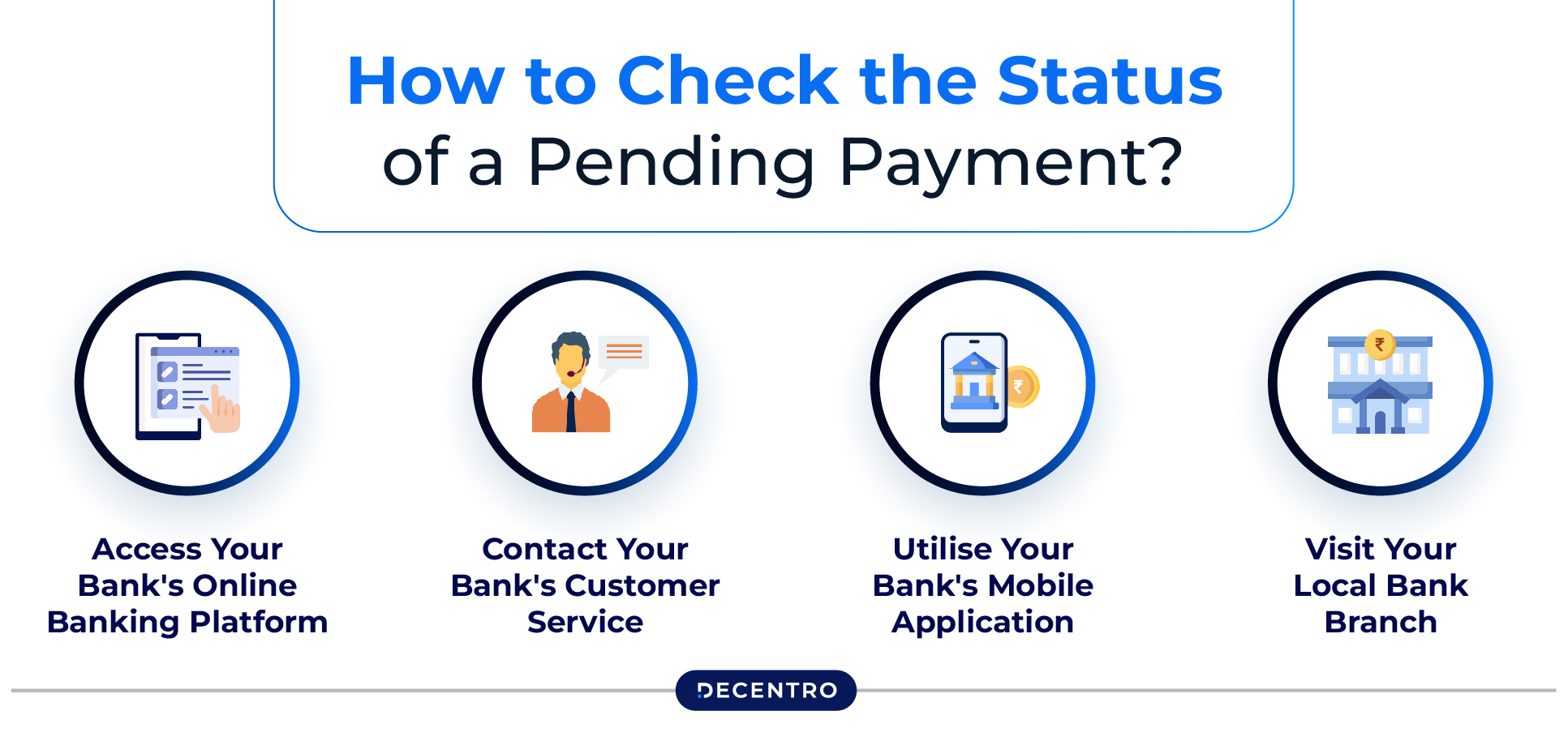

How to Check the Status of a Pending Payment?

To verify the status of a pending payment, you have several options:

- Access Your Bank’s Online Banking Platform

Log into your online banking account, go to the transactions or payments area, and choose the specific payment you wish to review.

- Contact Your Bank’s Customer Service

Call your bank’s customer service number and provide your account details along with the transaction reference number.

- Utilise Your Bank’s Mobile Application

Log into your bank’s mobile app, navigate to the transactions or payments section, and choose the payment you want to verify.

- Visit Your Local Bank Branch

Go to your bank branch in person and consult with a bank official. Make sure to provide your account information and the transaction reference number.

By keeping an eye on these particulars, along with the payment ID, date, and merchant details, businesses can gain a clearer picture of when their payments will be completed.

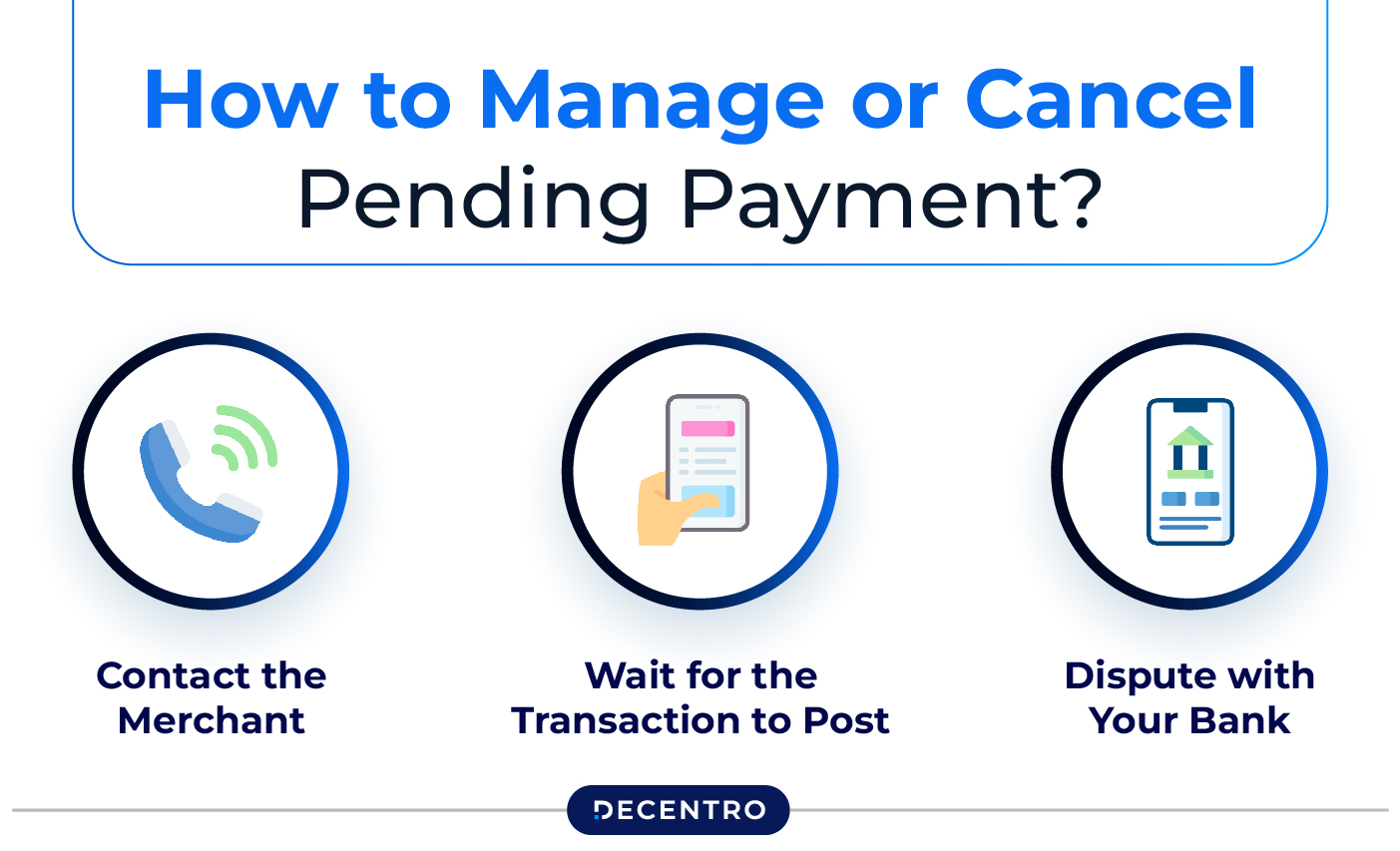

How to Manage or Cancel Pending Payments?

In general, directly cancelling a pending transaction is not feasible. Once a merchant authorises a charge, the finalisation process is already in progress. However, you do have a few options to consider:

- Contact the Merchant

Reach out to the merchant as soon as possible and request them to cancel the transaction. If they agree, authorisation can be avoided, and the pending charge should disappear from your account within a few days.

- Wait for the Transaction to Post

If the merchant does not agree to cancel the pending charge, you have to wait for it to be finalised and displayed on your account. As soon as it is posted, you can dispute the charge with your financial institution if you believe it is incorrect or unauthorised.

- Dispute with Your Bank

Talk with your bank and provide them with the transaction details and your reasons for cancellation. Subsequently, your bank will examine the matter and may be able to remove the charge.

Common Challenges with Pending Payments

Following are the major challenges encountered with pending payments:

- Cash Flow Issues

A business’s cash flow, which is integral to its daily operations, can get disrupted by delayed or unpaid payments. If the businesses do not receive timely payments, they may find it difficult to pay for expenditures like salaries, rent, bills, raw materials, etc. Additionally, this cash flow issue can cause delays in order fulfilment and even hinder the business’s growth.

- Network Overload

Network overload happens when too many transactions occur simultaneously, leading to interruption or failure of payment. This annoys customers, which also affects reviews and reduces general satisfaction. Network disturbances resulting in delay or service failure can hamper a company’s revenue and ruin long-term customer relationships.

- Fraud Risks

Payment fraud is a massive worry when dealing with high-volume online transactions. Businesses need to secure their payment systems to safeguard themselves and their customers from scams, such as identity theft or illicit charges. However, such security measures can lead to a slight delay in payment processing.

- Regulatory Requirements

Businesses need to follow several payment-related rules and regulations to maintain compliance with legal regulations. Adhering to them is mandatory for maintaining transaction security and avoiding fines and legal issues arising from non-compliance.

However, it generally leads to complicated procedures, often leading to a delay in payments.

How to Address Challenges in Pending Payments?

Adopting API-driven payment solutions like Decentro can be an excellent way to deal with pending payments. These APIs enable businesses to track transactions in real-time and get automatic updates regarding the transaction status. Also, the platform offers seamless integration with multiple banks and financial services institutions, enabling payments to get processed with minimum delays.

Furthermore, firms can avail of conversational banking features that enable them to contact merchants and customers and resolve pending payment issues effectively.

Best Practices for Avoiding Pending Payment Issues for Business

For businesses, it is essential to handle pending payments properly to provide a seamless customer experience. Here are the best tips for companies to avoid pending payment issues:

- Maintain Clear Communication

Keep clients informed about your payment authorisation and settlement procedures, particularly for transactions that encompass larger holds or lengthy processing times, such as car rentals or hotel reservations.

- Expedite Transaction Processing

Consider finalising and settling payments as early as possible to minimise the time charges for which they remain outstanding. Implementing daily batching of transactions can enhance this efficiency.

- Provide Clear Transaction Descriptors

Ensure your merchant name and transaction details are easily identifiable on customer statements to lessen confusion and potential disputes.

- Respond to Inquiries Promptly

Ensure to address any customer inquiries regarding pending charges instantly. If there is a mistake or delay from your end, explain clearly and work to rectify the issue without delay.

- Educate Your Team

Make sure that your staff is well-informed about payment authorisations and settlements, enabling them to assist customers and manage inquiries successfully.

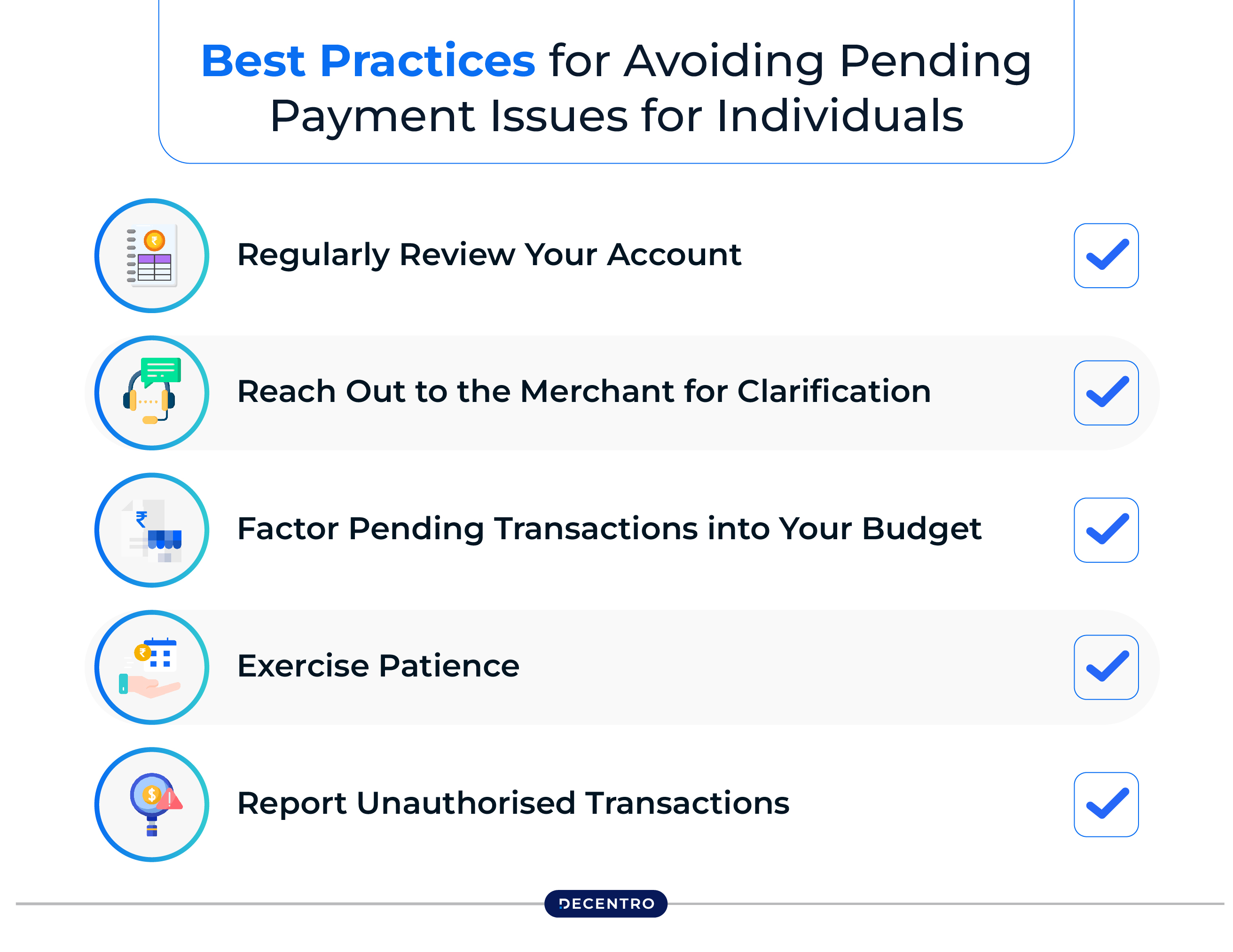

Best Practices for Avoiding Pending Payment Issues for Individuals

As a customer, you can adopt proactive methods to manage pending payments effectively and shield your financial health. Here are some smart tips you can follow:

- Regularly Review Your Account

Regularly verify your online banking or credit card account to spot and address any unauthorised or unforeseen pending transactions.

- Reach Out to the Merchant for Clarification

If you encounter an unfamiliar pending charge or have any inquiries, contact the merchant for further information.

- Factor Pending Transactions into Your Budget

Incorporate pending charges into your financial planning to prevent overspending or overdrawing your account.

- Exercise Patience

Wait a few days for pending charges to process before disputing them, as some transactions may take longer.

- Report Unauthorised Transactions

If you suspect fraudulent activity or face an unrecognised charge, contact your bank immediately to ask about the problem and solve it as soon as possible.

The Future of Pending Payments

In future, issues of pending payments will be improved by new payment processing technologies that enable fast, secure, and efficient transactions.

By 2025, it is estimated that biometric authentication will feature as a key in mobile wallets, banking apps, and payment gateways. This innovation will not only help boost security but also reduce the need for additional verifications, resulting in shorter payment processing timelines.

Furthermore, with innovative payment initiatives such as UPI 2.0 and global real-time payment systems, delays in pending payments will get significantly shorter. There is also an increasing reliance on AI-driven solutions to predict and resolve issues linked to payments, thereby improving transparency and efficiency in payment processing.

Decentro’s Role in Simplifying Pending Payments

At Decentro, we understand the struggle of dealing with pending payments, bookkeeping, pay-outs, and reconciliation. To solve such issues, we offer Multi-Collect APIs, which focus on simplifying these complex tasks.

Firms can generate virtual accounts for individuals and businesses and enjoy seamless fund collection across multiple modes (UPI, NEFT, and more), auto-reconciliation, payment tracking and real-time updates.

Our APIs help lessen manual errors, save time, and enhance overall financial management, making it a perfect game-changer for businesses looking to streamline their financial transactions.

Case Studies Showcasing Decentro’s Impact

Over the years, Decentro’s API solutions have helped businesses solve major operational hurdles and streamline their overall processes. Here are a few examples:

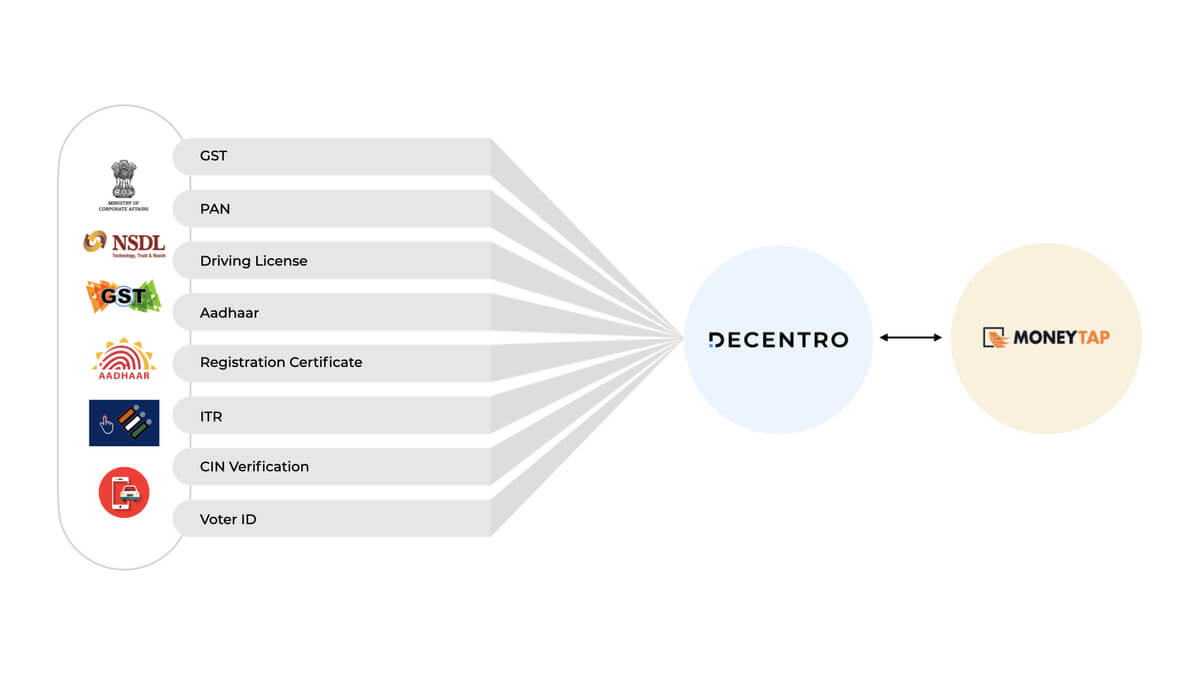

- MoneyTap

MoneyTap is an advanced platform that simplifies lending by giving users quick access to personal credit. Thanks to Decentro’s banking APIs, MoneyTap has made the user experience smoother with real-time KYC verification, reducing the onboarding time by 95%.

Also, the company can now conduct 20,000+ KYC validations every day while leveraging multi-channel customer support for resolving queries and market expansion.

- CASHe

CASHe is a prominent fintech player in India that delivers short-term credit and financial solutions to salaried millennials. This company was having issues finding a secure document repository and a reliable verification module, which Decentro helped solve with its identity verification APIs.

It enabled the platform to set Digilocker onboarding flows, which served as a single point of access for securely verifying all identity documents. As a result, CASHe got 10x faster integration timelines and over 1.31 Lakh successful eAdhaar API hits. Furthermore, the firm enhanced its user experience by solving queries through Decentro’s multi-channel customer support feature.

Facing problems with pending payments?