Explore how geolocation prevents fraud by identifying unusual transactions, securing accounts, and enhancing cybersecurity for businesses and users.

What is Geolocation and How It Helps with Fraud Prevention

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

E-commerce and online identities are a new normal now. Fifty years ago, you couldn’t even imagine these things, but here we are, shopping online, paying with our credit cards, and getting stuff delivered to our doorsteps.

Naturally, all new things come with their own unique challenges. In this case, there is identity and credit card fraud. Bad actors use unscrupulous means to steal sensitive information, such as credit card numbers and security codes, and cause financial problems for unsuspecting people.

Naturally, security measures have been created to combat these problems. One of the most successful methods of preventing card fraud is the use of geolocation. Geolocation refers to tracking a person and their activities using information such as their IP address and GPS.

With geolocation, banks and security firms can track suspicious behavior associated with stolen credit cards and stop fraudulent transactions. But how does that work in real life? We will answer that question and more in this article. So read on and find out.

What is Geolocation?

Geolocation refers to the process of determining the geographic location of a user through digital methods. This information can be accessed through your IP address if your device is on a public network or through the device’s GPS data.

Why does it matter? Because, in an increasingly virtual world, physical locations still have significance. Geolocation enables businesses to provide a more personalized customer experience by showing you local ad campaigns, etc.

Geolocation is also helpful in solidifying security systems by detecting changes in user’s activity and behavior.

For instance, if you make an account on Google from Moscow, Russia. Accessing it from Minnesota, USA in a span of a few hours likely raises eyebrows for the peeps at Google. This will likely prompt a notification to your backup email requiring confirmation if this action was taken by you or not.

Companies like Google, Amazon, etc., do take such steps to prevent fraudulent activities, cyberattacks, and other petty crimes happening against your account.

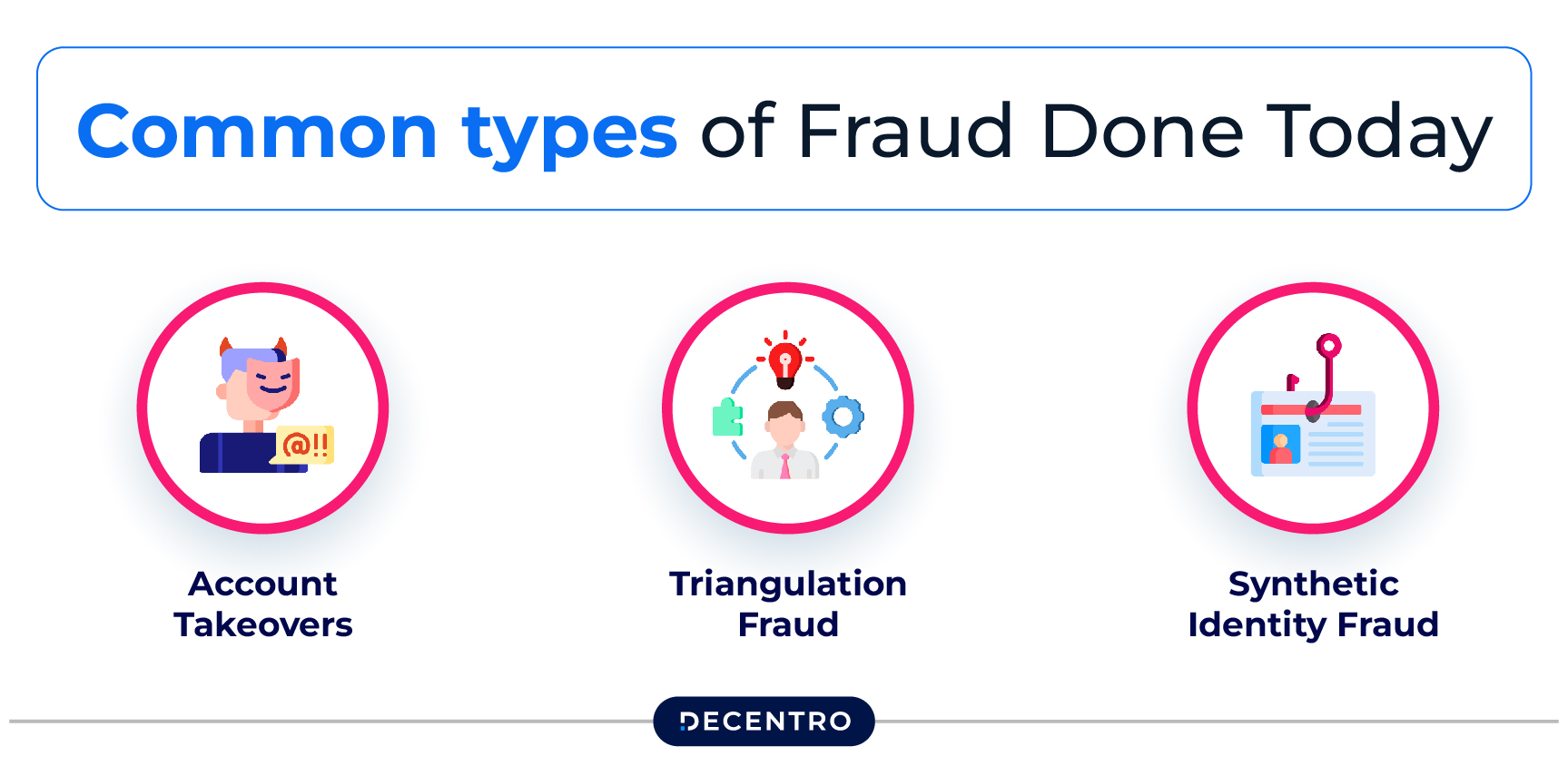

Common types of Fraud Done Today

Nowadays, fraudsters can employ different methods to obtain your information and do other cybercrimes. Different methods have varying degrees of success. Educating yourself about them will help you protect yourself better.

- Account Takeovers

An account takeover is a type of fraud where a bad actor steals a person’s login information and takes over their account. Usually, elaborate phishing scams are employed to steal that info.

For example, a scammer can create a website that looks exactly like a person’s bank/wallet portal. Then, they can send the customer a spoofed email that warns them about their account getting compromised and that they should change their password.

The email has a link to the fake website. The unsuspecting customer clicks the link and enters their old log in info to the fake website before they can add their new info. This info gets sent to the scammer, who then uses it to log in to the account and change the info so that the real owner can’t access it anymore.

Then they can do any number of things with it, including applying for loans, sending money to themselves, etc.

- Triangulation Fraud

Triangulation fraud also starts with a phishing scam. The bad actor creates a website similar to a real online digital store. They spread their fake link around so that unsuspecting customers can come to their site thinking its the real one.

There, they make some purchases with their actual credit/debit card. The money ends up in the scammer’s wallet, who then places an identical order on the real website. The site sends the order to the real customer, while the scammer then does a chargeback on the credit card and gets their money back.

The customer has no idea that all of this is happening because, as far as they know, they placed and paid for a legitimate order. They also get implicated in fraud due to the chargeback on the card, while the scammer just gets away with their money.

- Synthetic Identity Fraud

Synthetic identity fraud is a sophisticated type of fraud that occurs when a fraudster obtains sensitive information like a social security number. They use such information to create a fake identity using a fake name, different email address and phone number.

The social security numbers used in such frauds are typically obtained from data leaks or bought off the dark web. Fraudsters use this new fake identity to apply for loans and credit cards and disappear after using all of the funds.

The usual targets for this kind of fraud are children, the elderly, and the homeless because these demographics are not likely to check credit card statements.

Geolocation and Fraud Prevention

Fraud prevention uses a variety of techniques and supplementary information. Geolocation is one of the primary components of fraud prevention in the financial sector. Here are the details on how it is used.

Getting Geolocation

Mainly, there are three different methods of accessing your geolocation. Sometimes, these are used in parallel or overlap each other to increase the accuracy of your location on the map. While on other occasions, separate methods can still do the job.

IP Address Lookup:

When someone connects online, their device is assigned an IP address. This can provide information about their approximate geographic area. However, the said method only works if the IP address is assigned to a device by an ISP (Internet Service Provider.)

GPS (Global Positioning System):

Satellites communicate with devices to determine precise location data. DGPS or Differential GPS goes a step further in getting to pinpoint accuracy, about 1-3 cm on the ground, according to GISGeography.

Wi-Fi and Cell Tower Triangulation:

Devices connected to public Wi-Fi or cellular networks can be located by analyzing the proximity of the device to known network locations.

Fraud Prevention with Geolocation

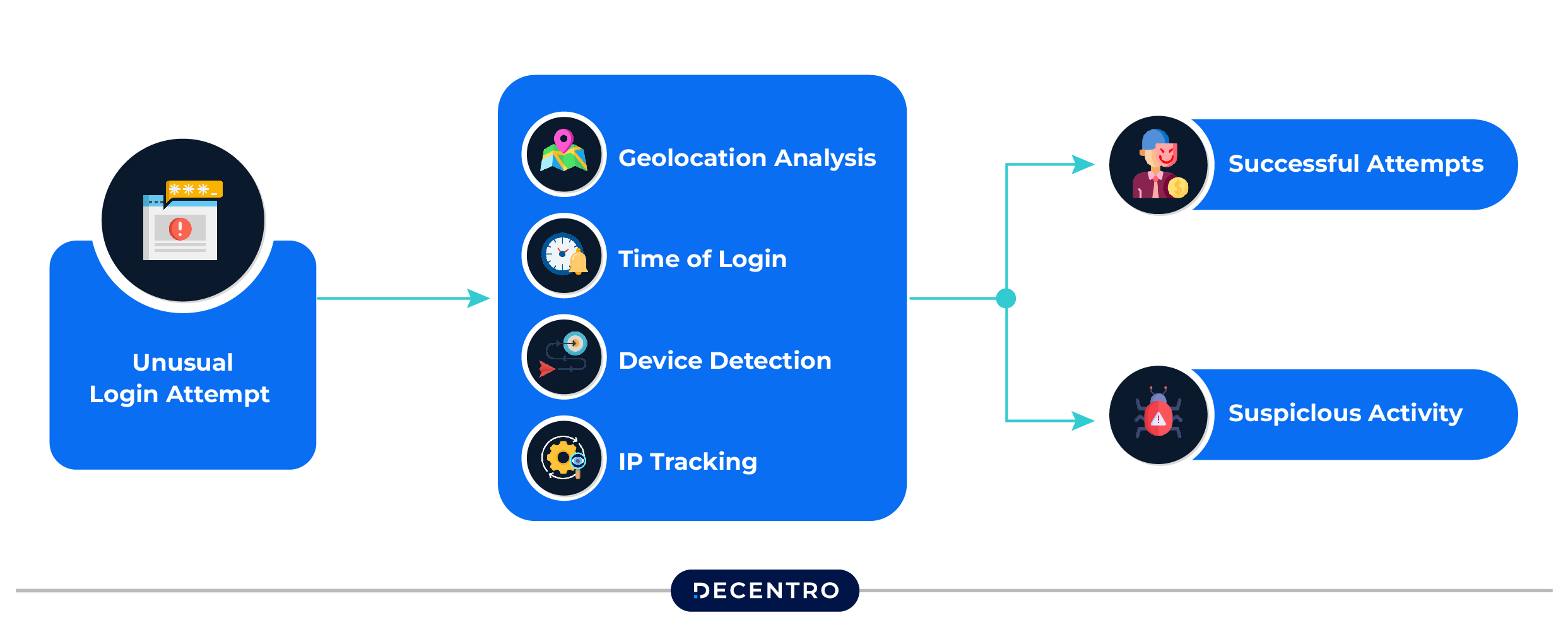

Fraud prevention strategies use geolocation to ensure that online transactions or activities align with the expected user behavior. For instance:

Identifying anomalies in a user’s login location:

If someone logs in from two cities thousands of miles apart in a short time, this could indicate that the account or information within it is comprised. This is a pretty solid indicator to businesses, banking apps, etc., that something’s wrong.

Checking customer purchases:

Every person is registered against their location; it is part of their contract when they first sign up for a credit/debit card or other online services. When geolocation is accessed for every transaction, it can allow or block any transaction, especially those from high-risk geographical areas.

Behavioral Analytics:

Combining geolocation with behavioral analytics lets companies generate user profiles tracking patterns such as preferred devices, purchase behaviors, and login timings. Any deviations from these norms could set off security alerts.

However, one must be considerate of using geolocation services on their platforms. Use them too much and you might annoy the customer just a tad bit more, propelling them to shift toward the competitor market.

Enhancing E-commerce Security Through Geolocation

Security is crucial for E-commerce businesses to safeguard their customers’ private information, bank details, and other crucial data. E-commerce platforms frequently partner with secure banking services like Decentro to protect sensitive data and avoid fraud.

Below is a detailed rundown of how such platforms utilize the power of geolocation to prevent fraudulent activities.

- E-commerce Stores Assure that Payment Locations Correspond to User Profiles: Geolocation comes in handy to find unusual activity from user accounts. A manual inspection can be signaled, or the transaction can be rejected if the buyer deviates too much from their usual location or buying pattern.

- Geolocation Helps E-commerce Businesses Add an Extra Level of Security to Account Logins: Decentro and other platforms like it use Multi-factor authorization when users log in from a different place. This adds a security net for buyers on E-commerce sites.

- Blocking Menaces from Certain Areas: Geolocation allows online businesses to protect customer data and operations by blocking transactions linked to some classified, risky areas worldwide.

Real-World Examples of Geolocation in Action

After learning about the basics of geolocation and how E-commerce businesses leverage it, it is time to look at some real-world examples that employ this information.

- PayPal

PayPal, the digital payment behemoth, employs geolocation in its fraud detection systems to track transactions across the globe. The system is alerted when it detects anomalies in transaction patterns to guard users against unrequested transfers, money thefts, identity thefts, etc.

- Netflix

Though not completely connected to fraud prevention, Netflix employs geolocation to confirm user accounts and block unwanted access to regionally restricted materials. Account breaches are identified using the same method to safeguard user data from malevolent use.

- Other E-commerce Platforms

Companies that dominate the e-commerce space, such as Amazon, Etsy, Best Buy, etc., use geolocation to monitor customer activity on their sites. For example, logging from several places quickly can indicate a compromised account in Amazon’s system, which will lock your account temporarily or permanently.

Benefits and Challenges of Using Geolocation for Fraud Prevention

Below, we’ve discussed some benefits and challenges of using geolocation for fraud prevention. Review them closely to avoid missing out on anything.

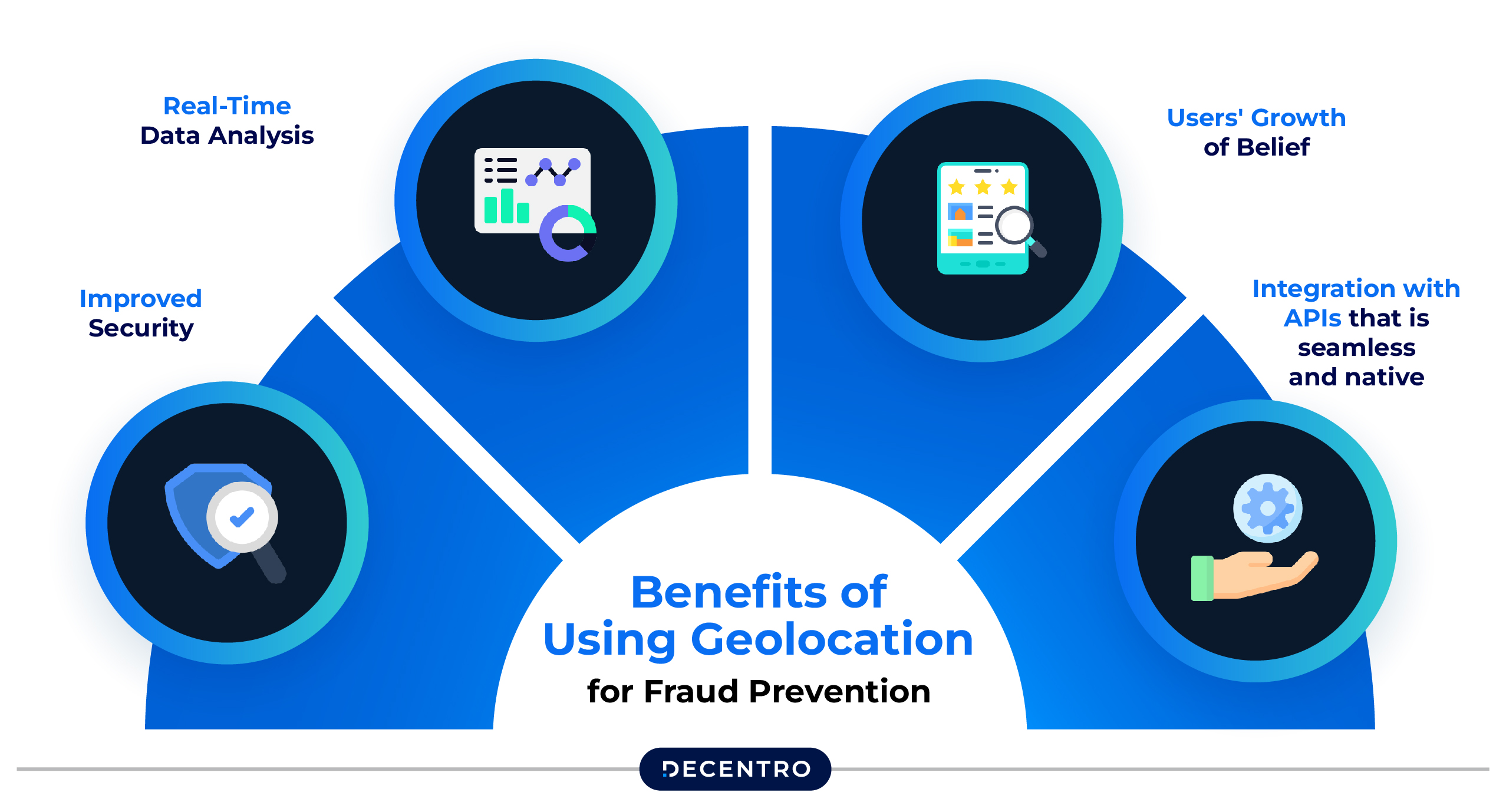

Benefits

- Improved Security: Geolocation helps refine your security systems and protect user data by triggering 2FA authentication on unusual log-ins, etc. This lowers fraud attempts. However, there are still bleak chances of breaches.

- Real-Time Data Analysis: Spot hack attempts and other related events as they unfold and act quickly to remediate them.

- Users’ Growth of Belief: Knowing that strong systems are in place to shield their online activities and transactions helps consumers feel safer interacting on your platform.

- Integration with APIs that is seamless and native: Including geolocation into APIs for fintech businesses guarantees scalability and versatility.

Challenges

- Privacy Issues: Gathering location information might cause concerns among privacy-conscious consumers. To prevent any accidents or legal problems down the road, it is essential to be compliant with data protection rules, including GDPR.

- Accuracy Concerns: IP-based geolocation doesn’t provide exact location data, therefore causing possible false alarms.

- Integration Complexity: Applying geolocation throughout current systems could be time-consuming and costly. It could also need staff training, particularly for those who are totally out of touch with the tech field.

Best Practices for Implementing Geolocation Technology

To maximize the effectiveness of geolocation in fraud prevention, businesses should adhere to the following best practices:

1. Connect to Multi-Layered Security Systems

Combine geolocation with several other techniques including device fingerprinting, behavioral analytics, and multi-factor authentication to increase fraud detection and prevention.

2. Individualize Regulations by Regions

Create various risk profiles for different areas and customize your fraud protection solutions to reflect geographical patterns.

3. Leverage Well-Known Geolocation Solutions

To guarantee accuracy and dependability in your findings, work with credible geolocation services like an IP address lookup tool.

4. Keep an Open Line of Communication with Customers

Show the consumers how and why location data is obtained to help establish trust. From a legal perspective, this will also aid you in better adhering to data protection policies and legislation.

5. Keep Risk Protocols Up to Date

Keep posted on fresh fraud methods and match your tools with them to offset developing dangers in the future.

Additionally, embedding these methods into APIs can give fintech companies a powerful, scalable fraud prevention structure.

Geolocation’s Role in API-Driven Platforms

Geolocation becomes even more important in protecting API-driven platforms. For example, Decentro provides a set of APIs that fit well with geolocation technology and empower companies to:

- Monitor transactions in real time

- Automate fraud detection

- Provide personalized user experiences based on location

Platforms like Decentro also enable companies to expand their operations while maintaining the highest security standards.

The Future of Geolocation in Fraud Prevention

Geolocation’s future depends on its capacity to interact with cutting-edge technologies such as Artificial Intelligence (AI) and Machine Learning (ML.)

These technologies can help forecast and prevent fraud more accurately by analyzing geolocation data together with other data points.

For instance, an artificial intelligence-powered mechanism might flag strange behaviors before they lead to financial loss by analyzing a user’s location history, spending patterns, and device behavior, all at once.

Final Words

The geolocation services protect against cyberattacks and other criminal activities. Tools that allow IP address lookup and GPS and triangulation networks provide a safety mechanism for detecting anomalies in customer behavior.

However, there are still many issues regarding both accuracy and privacy that need answering for geolocation services. But, in the future, AI integration is expected to boost accuracy in geolocation data, increasing fraud prevention to the next level.

In case you wish to solve a specific use case for your banking and infrastructure needs feel free to reach out to us at hi@decentro.tech

Frequently Asked Questions

Geolocation is the search of a person’s actual position by means of digital technologies like IP address look-up, GPS data, and Wi-Fi triangulation.

Geolocation technology helps users identify unusual behaviors. The security system should detect unusual patterns when one user repeatedly accesses their account across different distant locations within a short time.

There are many industries that benefit from geolocation. However, mainly, some of these are banking apps, streaming platforms, E-commerce sites, etc.

Decentro’s APIs can smoothly include geolocation into payment processes. This enables companies to offer personalized user experiences, track deals in real-time, spot fraud using location mismatches, and provide more customized user experiences.

Some usual difficulties that arise with leveraging geolocation are:

Concerns of privacy: storing and gathering location information may run afoul of privacy regulations including the GDPR.

Accuracy Limitations: IP-based geolocation is not that accurate.

Complexity of integration: Implementing geolocation throughout outdated systems takes great knowledge and resources.

Businesses can protect privacy by:

Letting customers know openly and clearly why location information is gathered.

Storing and processing data using secure and encrypted protocols.