See how Decentro helped TaxBuddy reduce onboarding time by 75% and cut drop-offs with smart data prefill and verification APIs.

How Decentro Powers TaxBuddy to Simplify Digital Tax Filing in India

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

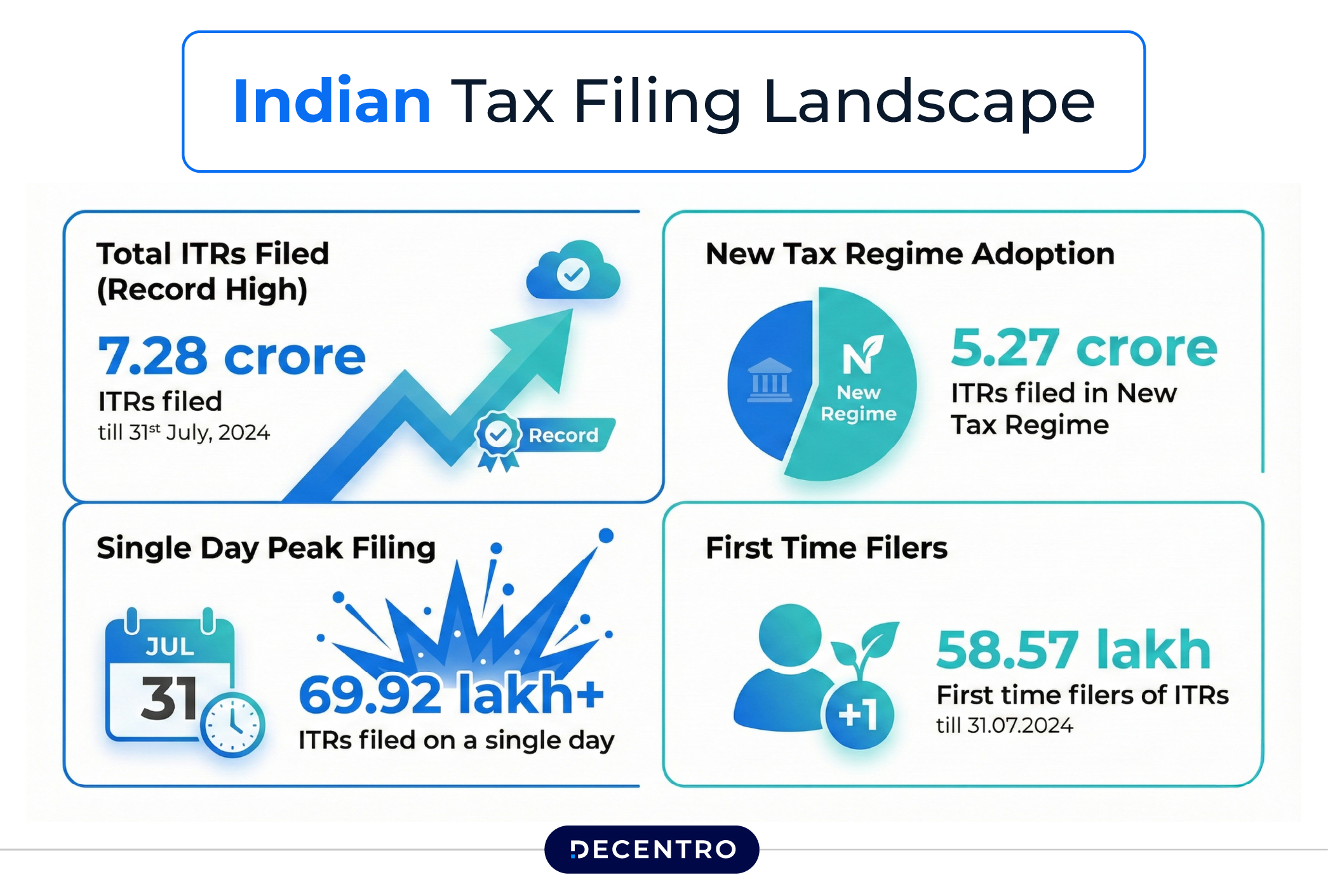

The Indian tax filing landscape is undergoing a massive digital transformation. With over 8.7 crore income tax returns filed in FY 2024-25, the demand for simplified, accurate, and efficient tax filing solutions has never been higher. As more Indians embrace digital-first financial services, tax technology platforms are stepping up to make compliance accessible to everyone.

The Tax Filing Revolution

India’s tax ecosystem has undergone significant evolution in recent years. From manual paper-based filing to AI-powered platforms, the journey reflects the country’s broader fintech revolution. Key drivers include:

- Increased internet penetration, reaching 49% of the Indian population

- Government initiatives promoting digital tax compliance

- Growing awareness among salaried individuals and freelancers

- Simplified KYC and verification processes

One platform at the forefront of this revolution is TaxBuddy, which is transforming how millions of Indians file their income tax returns. Today, let’s explore how TaxBuddy is leveraging Decentro’s APIs to deliver on its promise of stress-free, accurate tax filing.

What is TaxBuddy?

Founded in 2018 by Sujit Bangar (former Indian Revenue Service officer), along with Samir Jayaswal, Sanjay Godbole, Srinivas Reddy, and Brijmohan Lavaniya, TaxBuddy is India’s most trusted online tax filing platform. With a stellar 4.9-star rating from over 16,000+ reviews, TaxBuddy has helped millions of taxpayers navigate the complexities of income tax returns.

What Makes TaxBuddy Different?

TaxBuddy offers a comprehensive suite of tax services:

- Expert-Assisted ITR Filing: Combining AI technology with human expertise

- DIY Tax Filing: For those who prefer independent filing with AI guidance

- Free Notice Management: Handling tax notices at no extra cost

- 365-Day Post-Filing Support: Year-round assistance for customers

- AI-Powered Tax Filing: File returns in just 3 minutes with instant doubt resolution

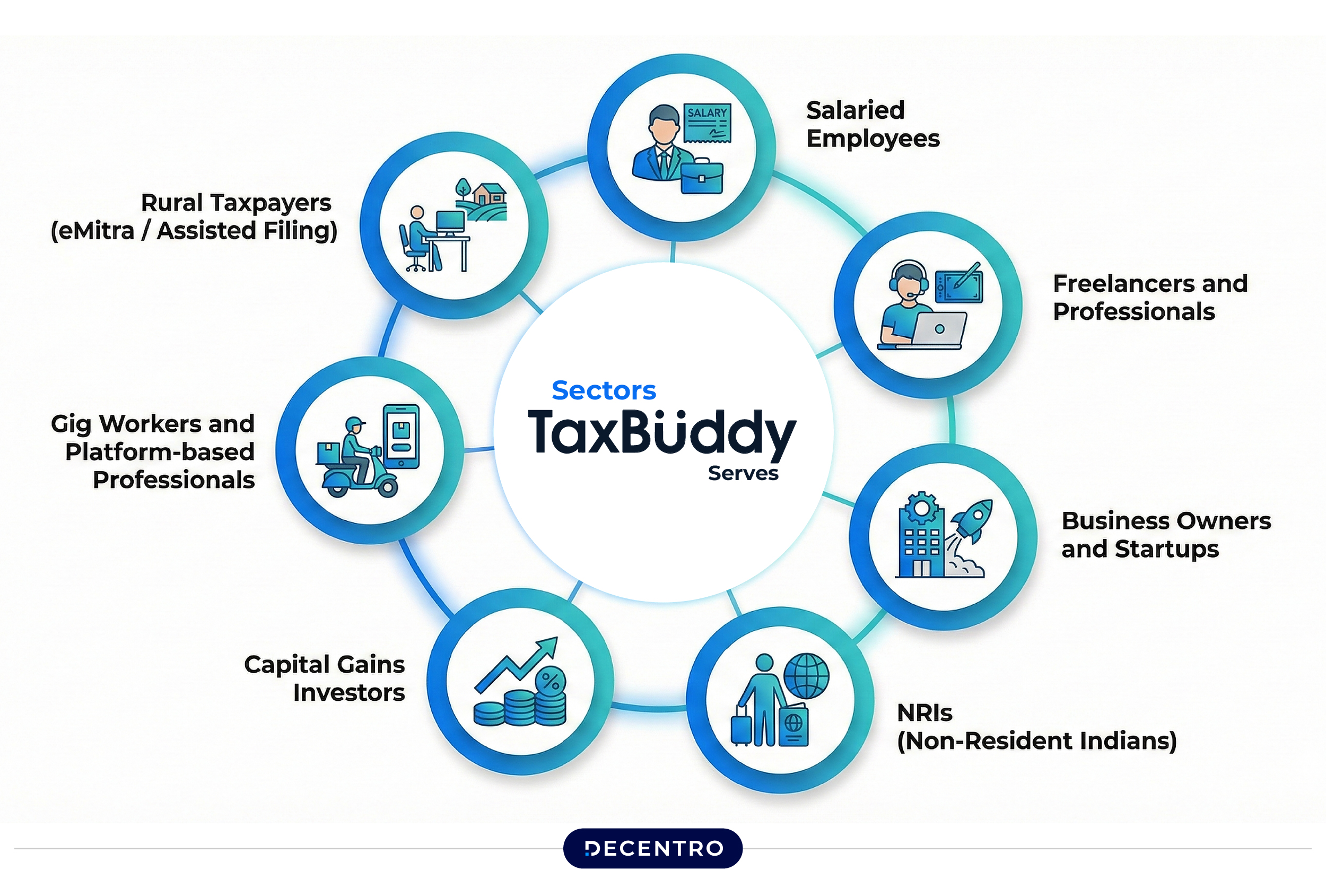

Sectors TaxBuddy Serves

The platform caters to diverse taxpayer segments:

- Salaried Employees

- Freelancers and Professionals

- Business Owners and Startups

- NRIs (Non-Resident Indians)

- Capital Gains Investors

- Gig Workers and Platform-based Professionals

- Rural Taxpayers (eMitra / Assisted Filing)

With millions of returns filed and plans to expand its reach further, TaxBuddy is building India’s largest tax compliance ecosystem.

How Does TaxBuddy Leverage Decentro’s APIs?

Tax filing requires the accurate collection and seamless verification of data to ensure compliance and prevent errors. For TaxBuddy, creating a frictionless onboarding experience while maintaining accuracy was paramount.

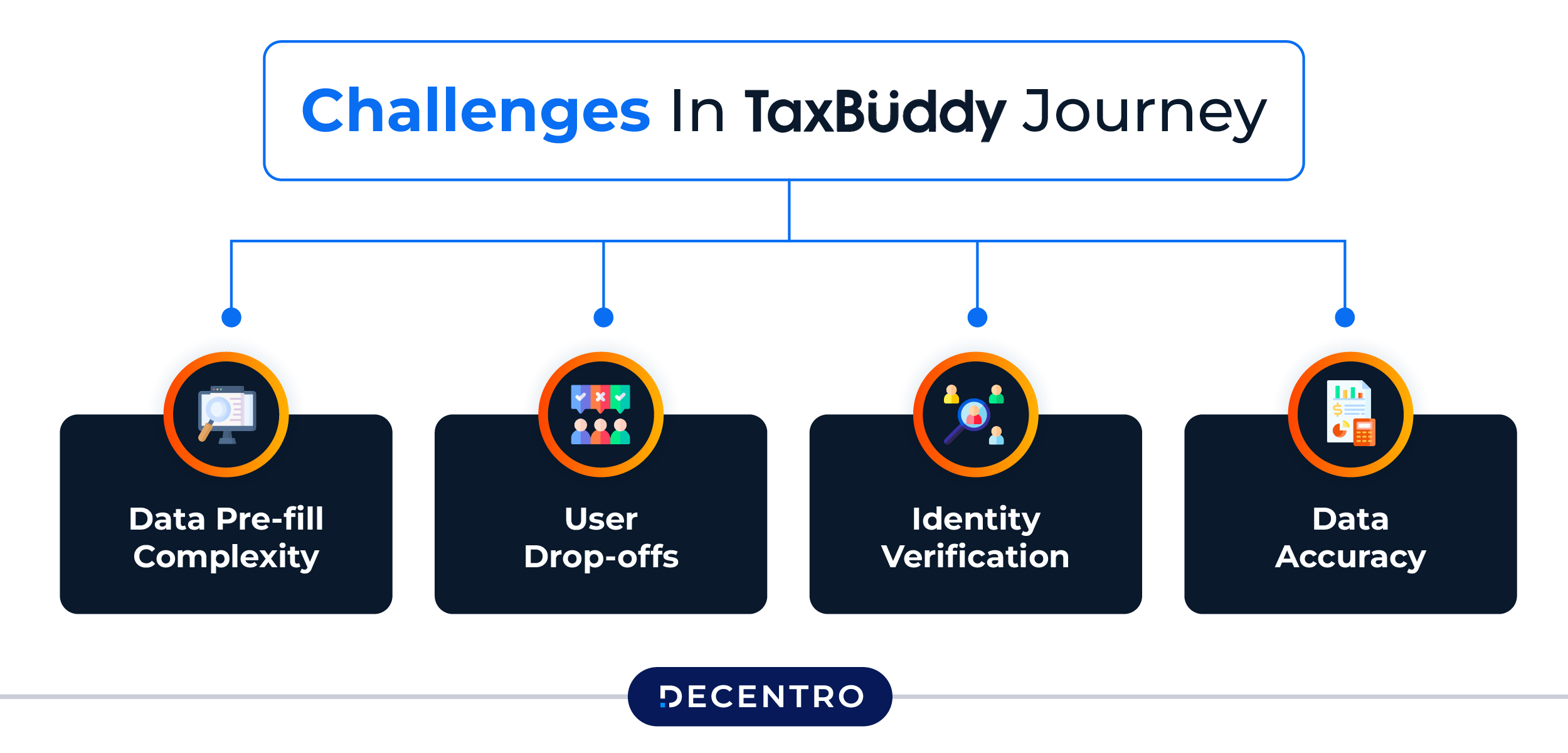

However, the platform faced critical challenges:

- Data Pre-fill Complexity: Manually entering tax-related information is time-consuming and error-prone

- User Drop-offs: Lengthy onboarding processes lead to abandonment

- Identity Verification: Ensuring users are who they claim to be without creating friction

- Data Accuracy: Reducing errors in PAN, mobile number, and demographic information

How Did TaxBuddy Solve This?

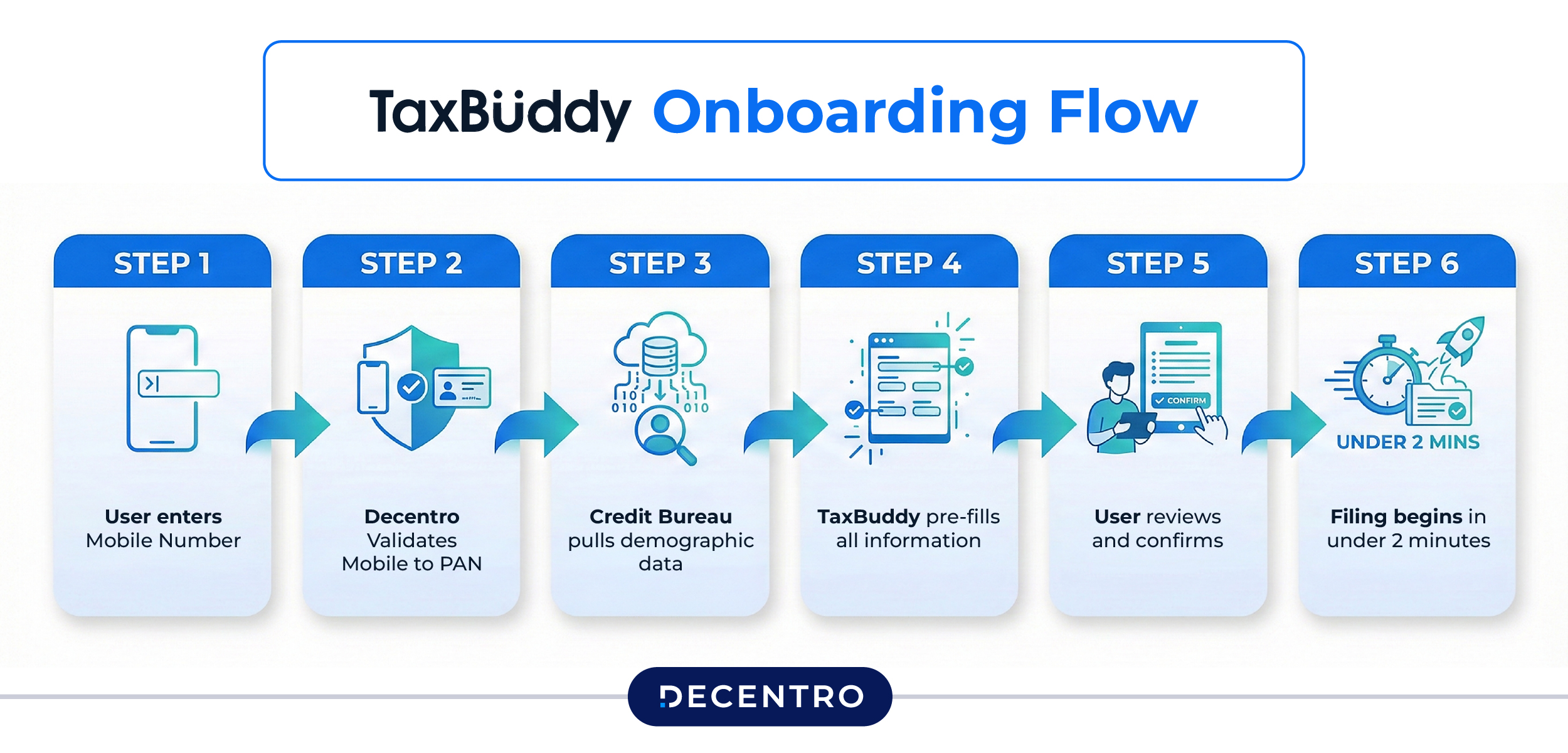

TaxBuddy partnered with Decentro to integrate powerful data pull and verification capabilities. Decentro’s Bytes module provided the perfect solution:

1. Customer Data Pull & Pre-fill APIs

Decentro’s Credit Bureau Data Pull capability enabled TaxBuddy to:

- Automatically fetch demographic data reported to credit bureaus

- Pre-populate user information during onboarding

- Verify the authenticity of identity documents

- Reduce manual data entry by up to 80%

2. Reducing Drop-offs

By combining these capabilities, TaxBuddy created a streamlined onboarding flow:

This frictionless experience dramatically reduced user drop-offs and improved conversion rates.

What were TaxBuddy’s Outcomes?

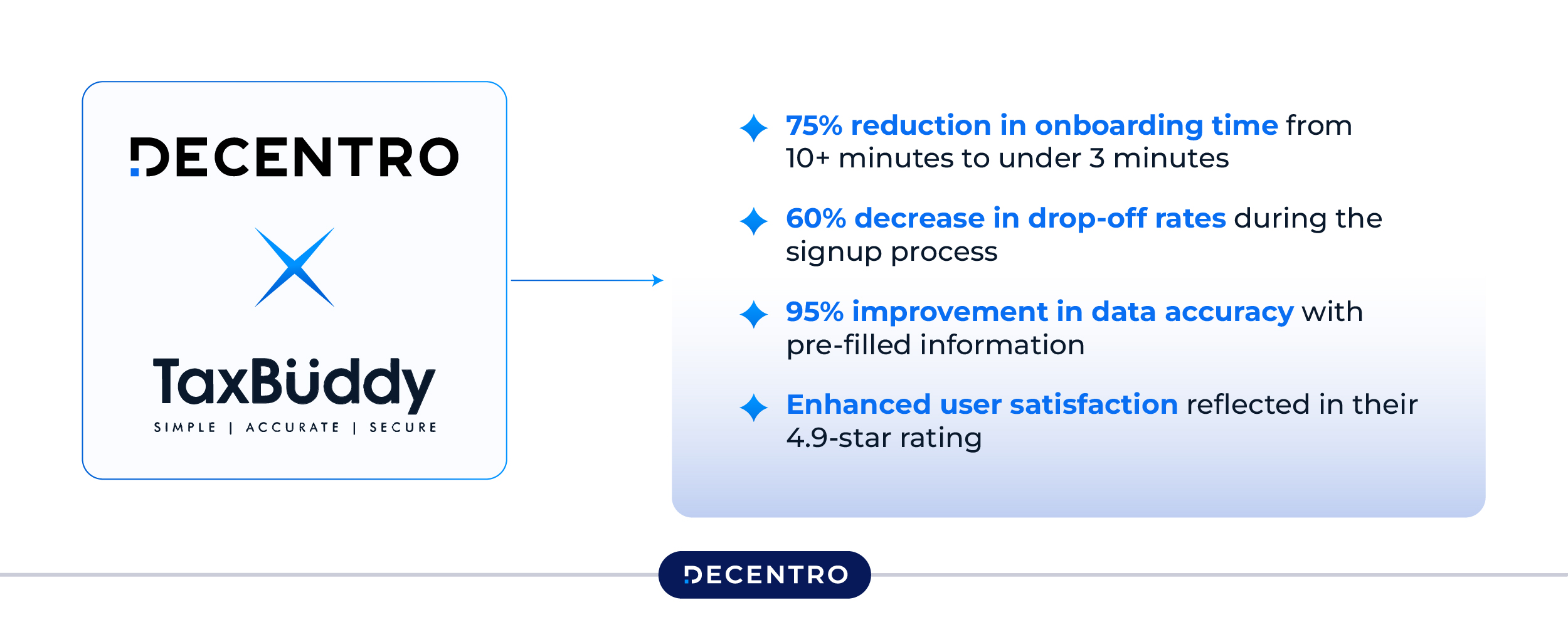

Decentro’s robust APIs enabled TaxBuddy to achieve remarkable results:

Key Metrics:

- 75% reduction in onboarding time from 10+ minutes to under 3 minutes

- 60% decrease in drop-off rates during the signup process

- 95% improvement in data accuracy with pre-filled information

- Enhanced user satisfaction reflected in their 4.9-star rating

Operational Benefits:

Enhanced User Experience:

- Seamless onboarding with minimal user effort

- Instant data validation reduces back-and-forth

- Confidence in data accuracy from the start

Improved Efficiency:

- 10X faster integration timelines with Decentro’s developer-friendly APIs

- Reduced manual data entry errors

- Streamlined compliance processes

Fraud Prevention:

- Real-time identity verification

- Cross-referencing multiple data points

- Early detection of anomalies

24×7 Support:

- Multi-channel customer support from Decentro

- Dedicated technical assistance for integration

- Quick resolution of any queries

Testimonial

In Conclusion

The tax compliance sector in India is experiencing unprecedented growth, driven by digital adoption and a regulatory push for transparency. As millions of first-time filers enter the system and existing taxpayers demand better experiences, platforms like TaxBuddy are setting new benchmarks for speed, accuracy, and customer satisfaction.

Decentro’s Bytes module, specifically the Credit Bureau data pull and Mobile to X Suite, has been instrumental in enabling TaxBuddy to deliver on its promise of “filing taxes as simple as making an online payment.”

The Power of Intelligent Data APIs

Having partnered with leading fintech players across lending, insurance, and compliance sectors, we understand that the future belongs to platforms that can:

- Minimise user effort while maximising accuracy

- Verify identities instantly without compromising security

- Pre-fill data intelligently using verified sources

- Reduce friction at every touchpoint

Beyond Tax Filing

Our suite of APIs has solved critical use cases across the financial services industry:

For Lending Platforms: CKYC verification, credit assessments, and fraud detection

For Insurance Companies: Quick KYC, policy issuance, and claims verification

For Compliance-First Businesses: Regulatory adherence, data accuracy, and audit trails

With Decentro’s comprehensive API stack, including:

- Bytes (alternative data and verification)

- KYC & Onboarding (DigiLocker, CKYC, identity verification)

- Payments (collections, payouts, user verification)

- Virtual Accounts (seamless fund management)

We’re empowering businesses to build the next generation of financial products.