RBI rules for inward remittance: which banks can receive foreign payments, mandatory purpose codes, FIRA/e-FIRA process, export realisation timelines, prohibited sources, and documents you must keep

Inward Remittance RBI Guidelines 2026: Purpose Codes & FIRC

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Quick Glance

| Use only RBI-approved Authorised Dealer Category-I banks to receive foreign payments, informal channels or non-authorised institutions violate FEMA. | Maintain comprehensive documentation, including commercial invoices, contracts, and service agreements for all transactions. |

| Every foreign inward remittance must be tagged with a specific purpose code that accurately identifies the transaction nature (e.g., P0802 for software services, P1006 for consulting). | Retain all foreign exchange transaction records (invoices, contracts, FIRC/e-FIRA, bank statements) for a minimum of 5 years. |

| Complete KYC verification is mandatory, requiring PAN card, Aadhaar/passport, GSTIN for businesses, and IEC for goods exporters. | Obtain and preserve your Foreign Inward Remittance Certificate (FIRC) or e-FIRA as proof of receipt for tax compliance, export benefits, and audits. |

| Export proceeds must be realised within 9 months for goods and 12 months for services from the date of export. | Prohibited sources include online gambling, lottery winnings, Ponzi schemes, and other illegal activities; banks will reject and return such remittances. |

What Exactly is Foreign Inward Remittance?

At its core, foreign inward remittance is simply money transferred from abroad into your Indian bank account through authorised banking channels.

Think of it as the digital pathway that connects your global work to your Indian earnings. Whether you’re a software developer getting paid by a Silicon Valley startup, an exporter receiving payment for goods shipped to Europe, a consultant billing a client in Dubai, or a funded startup receiving investment from your US parent company, all these transactions fall under foreign inward remittance.

The typical flow looks like this:

- Initiation: A foreign entity or individual initiates payment from their overseas bank account

- Routing: The payment travels through international networks (usually SWIFT) via one or more intermediary banks

- Conversion: The foreign currency is converted to Indian Rupees at prevailing exchange rates

- Verification: Your Indian bank verifies the transaction details and compliance requirements

- Credit: Funds are deposited into your Indian bank account

- Documentation: A Foreign Inward Remittance Certificate (FIRC) or e-FIRA is generated as proof

Unlike cash transactions or informal channels, foreign inward remittance operates entirely within regulated banking systems, ensuring transparency, traceability, and legal protection for both sender and recipient.

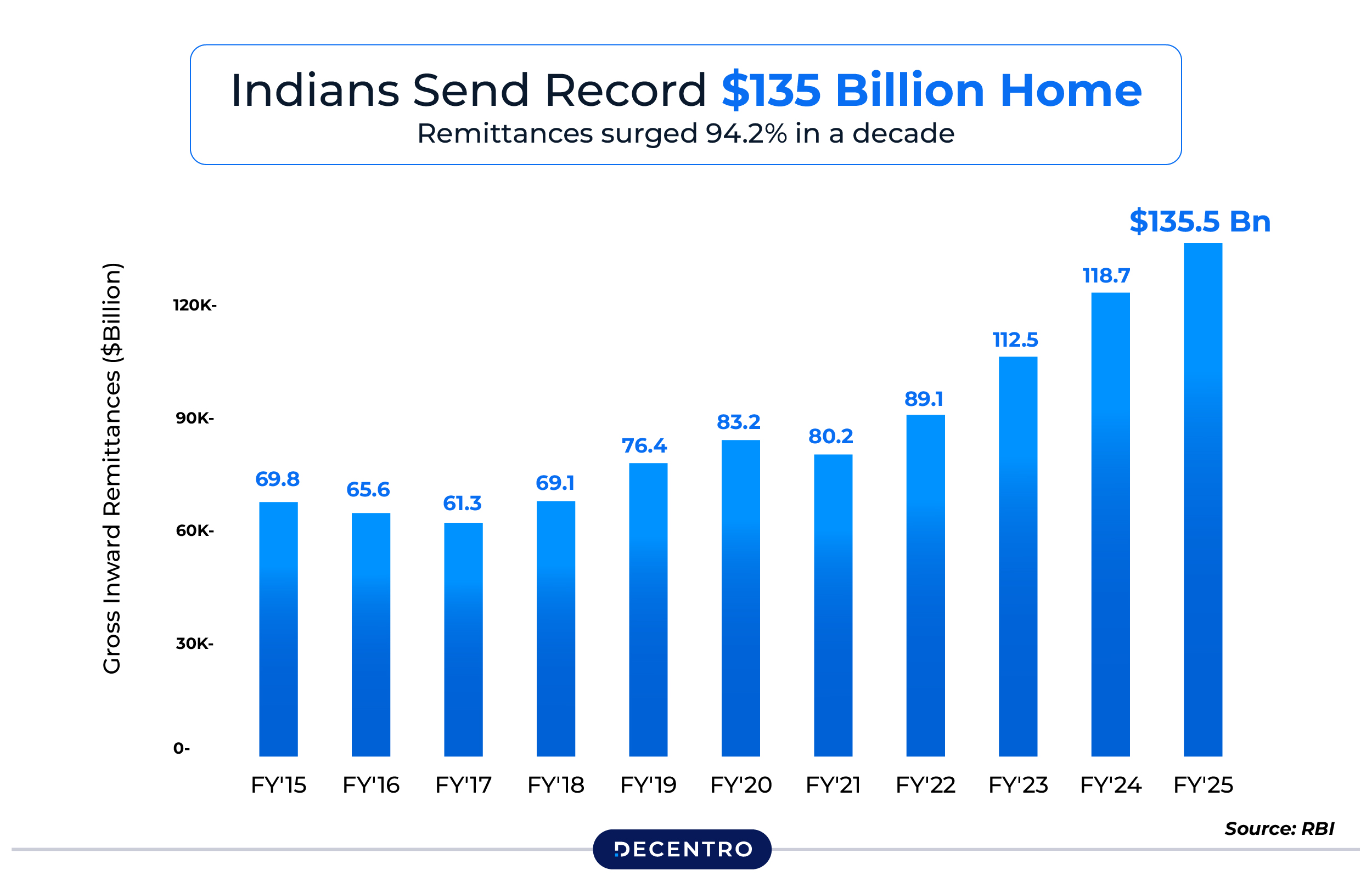

India’s Remittance Story: From $2.1 Billion to Global Leadership

Let’s start with context. When you receive payment from an international client or when someone abroad sends money to support a family in India, you’re participating in one of the world’s most significant financial flows.

India’s journey to becoming the remittance capital of the world is remarkable. In 1991, the country received just $2.1 billion in foreign inward remittances. Fast forward to 2024, and that number has exploded to $137.7 billion, a staggering increase of over 6,400%. According to the World Bank and RBI data, India became the first country ever to cross the $100 billion mark in annual remittance inflows, cementing its position as the undisputed global leader.

This growth reflects several powerful trends: India’s demographic dividend (with 65% of the population under 35), the global migration of skilled professionals, and the digitisation of financial services that make international transfers faster and cheaper than ever before.

Here’s what the numbers tell us:

- India received $135.46 billion in FY 2024-25, up 14% from the previous year

- Remittances now account for more than 10% of India’s gross current account inflows

- These inflows help offset nearly half of India’s merchandise trade deficit

- The number of Indians working overseas has tripled from 6.6 million in 1990 to 18.5 million in 2024

- While Gulf countries were historically the primary sources, advanced economies like the US, UK, Canada, and Australia now lead remittance flows

For startup founders, exporters, and freelancers, this represents an unprecedented opportunity. The world is your market, and receiving payment from international clients is no longer the exception—it’s the new normal.

The Regulatory Framework: Why FEMA and RBI Matter

Every rupee that enters India from abroad passes through a carefully constructed regulatory framework. This isn’t bureaucratic red tape—it’s economic infrastructure designed to maintain financial stability, prevent money laundering, and ensure transparent capital flows.

The Foreign Exchange Management Act (FEMA)

Introduced in 1999 to replace the stricter Foreign Exchange Regulation Act (FERA), FEMA marked a philosophical shift in how India handles foreign exchange. Rather than criminalising violations, FEMA created a civil law framework that balances facilitation with regulation.

FEMA’s core objectives include:

- Facilitating external trade and payments

- Promoting orderly development and maintenance of the foreign exchange market

- Enabling legitimate cross-border transactions while preventing illicit flows

- Creating a transparent framework for monitoring foreign exchange movements

Think of FEMA as the constitutional framework—it sets the broad principles and empowers the RBI to create operational guidelines.

The Reserve Bank of India’s Role

The RBI, as India’s central banking authority, translates FEMA’s framework into actionable regulations. It determines:

- Which banks can handle foreign exchange (Authorised Dealer Category-I banks)

- What purpose codes must accompany each transaction

- Documentation requirements for different types of remittances

- Reporting mechanisms to track foreign exchange flows

- Timelines for realisation and repatriation of export proceeds

Recent evolution: Under its Payments Vision 2025 initiative, the RBI is actively working to standardise payment information and reduce processing delays. The goal is to make cross-border payments as fast and friction-free as domestic UPI transactions, especially for startups, freelancers, and exporters.

This isn’t just regulatory compliance, it’s economic policy in action. By requiring purpose codes and proper documentation, the RBI gains visibility into capital flows, which helps formulate monetary policy, manage foreign exchange reserves, and maintain economic stability.

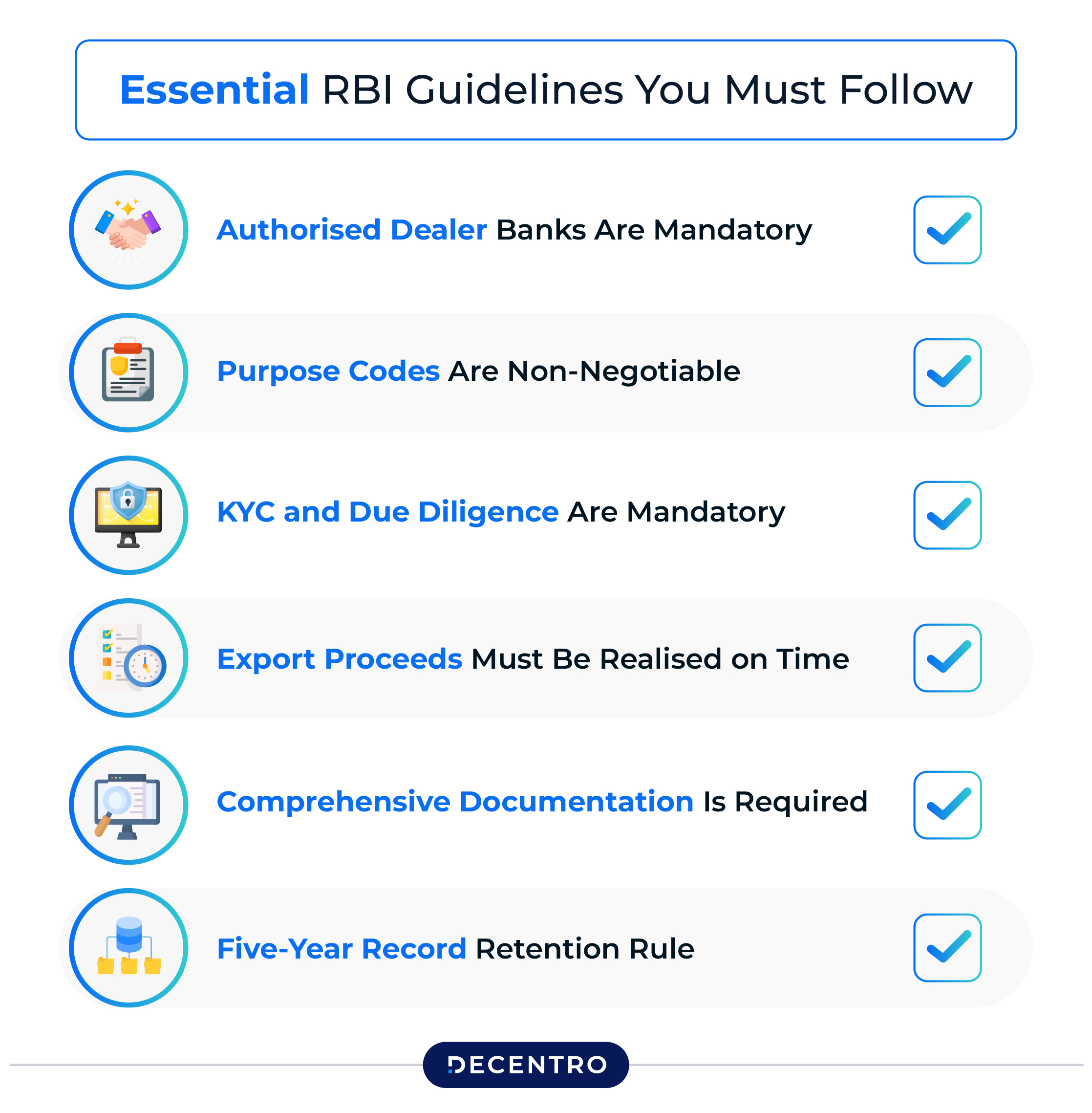

Essential RBI Guidelines You Must Follow

Understanding the rules isn’t optional—it’s the foundation for smooth international payments. Here are the critical RBI guidelines that govern every foreign inward remittance:

1. Authorised Dealer Banks Are Mandatory

You cannot receive foreign payments through just any financial institution. Only RBI-approved Authorised Dealer Category-I (AD Cat-I) banks are licensed to handle foreign exchange transactions.

What this means for you:

- Open an account with a major bank like SBI, HDFC, ICICI, Axis, or similar AD Cat-I banks

- Alternatively, use RBI-compliant fintech platforms that partner with AD banks

- Avoid informal channels or non-authorised money changers—these violate FEMA

2. Purpose Codes Are Non-Negotiable

Every inward remittance must be tagged with a specific RBI purpose code that identifies the nature of the transaction. This isn’t just bureaucratic red tape—it’s how the RBI tracks foreign exchange flows and ensures economic transparency.

Common Purpose Codes for Personal Remittances

| Code | Description | Who Uses It |

| P1301 | Inward remittance for family maintenance and savings | NRIs sending money to parents/family in India for monthly expenses |

| P1302 | Personal gifts and donations | Individuals receiving cash gifts from relatives abroad for birthdays, weddings, etc. |

| S0304 | Education-related services | Students receiving funds from sponsors or family to pay university fees in India |

| S0305 | Medical treatment | Individuals receiving money from abroad to cover hospital or surgery expenses |

| P1401 | Compensation of employees (Salary) | Remote workers receiving salary from foreign employers while working from India |

Common Purpose Codes for Business & Freelance Remittances

| Code | Description | Who Uses It |

| P0103 | Advance receipts against the export of goods | Exporters receiving advance payments before shipping orders |

| P0802 | Software implementation/consultancy services | Freelance developers and consultants receiving payment for software projects |

| P0807 | Off-site Software Exports | IT companies receiving payment for software developed in India for foreign clients |

| P1006 | Business and management consultancy services | Consultants receiving fees for strategy, market entry, or advisory services |

| P1007 | Advertising, market research, and public opinion polling services | Marketing agencies receiving payment for SEO campaigns, branding, or market research |

| P1002 | Trade-related services – Commission on exports/imports | Agents receiving commission for facilitating deals between Indian and foreign parties |

Other Important Purpose Codes (Investments, Loans, Donations)

| Code | Description | Who Uses It |

| P0006 | Foreign investment in India in equity | Foreign companies investing funds to acquire shares in Indian startups or companies |

| P0012 | Loans from non-residents to India | Indian businesses receiving long-term loans from foreign parent companies or lenders |

| P1303 | Donations to religious and charitable institutions in India | NGOs receiving grants from international foundations or donors |

Why purpose codes matter: Using the wrong code can delay your payment, trigger compliance queries, or even result in transaction rejection. If you’re a software consultant and mark the payment as a personal gift, that’s a compliance red flag. Always match the code precisely to your invoice and actual service.

The RBI maintains a comprehensive list of purpose codes on its website. When in doubt, consult with your bank or payment platform.

3. KYC and Due Diligence Are Mandatory

Banks must perform complete Know Your Customer verification for all recipients of foreign remittances. This anti-money laundering measure ensures the legitimacy of both sender and recipient.

Required documentation typically includes:

- PAN card (mandatory for all foreign remittances)

- Aadhaar or a passport for identity verification

- GSTIN for GST-registered businesses

- IEC (Importer-Exporter Code) for goods exporters

- Business registration documents for companies

4. Export Proceeds Must Be Realised on Time

For businesses exporting goods or services, FEMA sets clear timelines for receiving payment:

- Goods exports: Full payment must be realised within 9 months from the date of export

- Service exports: Payment must be received within 12 months

Delayed realisation may require additional declarations to your bank or RBI approval. This timeline ensures that export earnings contribute to India’s foreign exchange reserves on time.

5. Comprehensive Documentation Is Required

Beyond purpose codes, you need proper supporting documents:

For business payments:

- Commercial invoice clearly showing services/goods, amount, and client details

- Service agreement or contract

- GSTIN and business registration

- Bank account details with SWIFT/BIC codes

For personal remittances:

- Self-declaration explaining the purpose (family support, gift, etc.)

- Relationship proof if receiving from relatives

- Educational documents if receiving funds for studies

6. Five-Year Record Retention Rule

FEMA mandates that you maintain all foreign exchange transaction records for at least 5 years. This includes invoices, contracts, bank statements, FIRC/e-FIRA, and email correspondence.

Why this matters: During tax audits or RBI inquiries, you need to demonstrate the legitimacy of all foreign receipts. Well-organised records make this process smooth.

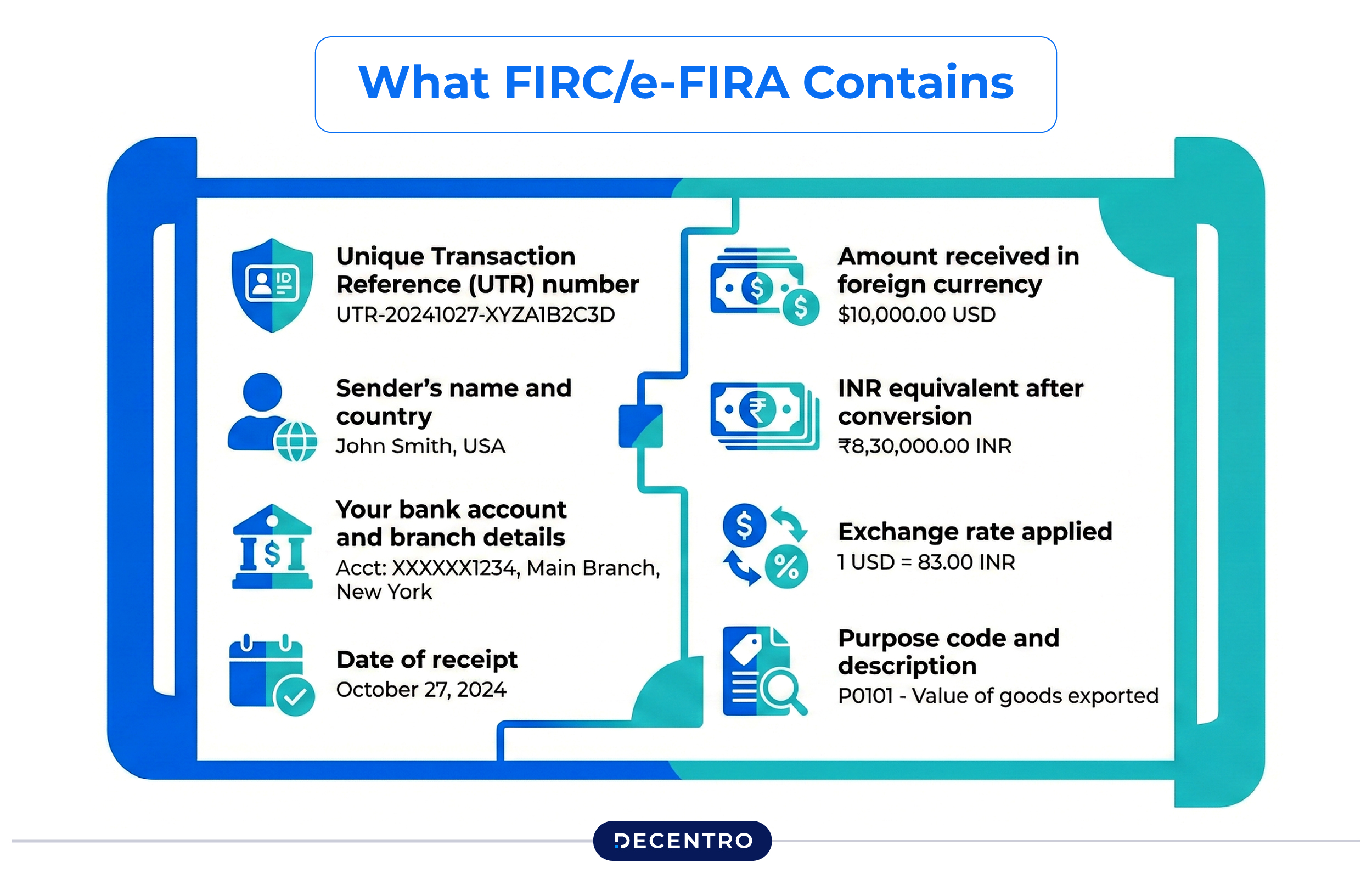

The Foreign Inward Remittance Certificate (FIRC): Your Proof of Receipt

Once you receive money from abroad, the Foreign Inward Remittance Certificate—now increasingly issued in electronic form as e-FIRA—becomes your most important compliance document.

What FIRC/e-FIRA Contains

This certificate includes:

- Unique Transaction Reference (UTR) number

- Sender’s name and country

- Your bank account and branch details

- Amount received in foreign currency

- INR equivalent after conversion

- Exchange rate applied

- Date of receipt

- Purpose code and description

Why You Absolutely Need It

For tax compliance: FIRC serves as official proof of foreign earnings when filing income tax returns. Without it, you may face scrutiny or disputes with tax authorities.

For export incentives: If you’re claiming GST refunds on service exports or benefits under export promotion schemes, FIRC is mandatory documentation.

For audits: Chartered accountants need FIRC during annual audits to verify foreign income and ensure compliance.

For future transactions: Banks may require past FIRCs when processing subsequent remittances to establish your transaction history.

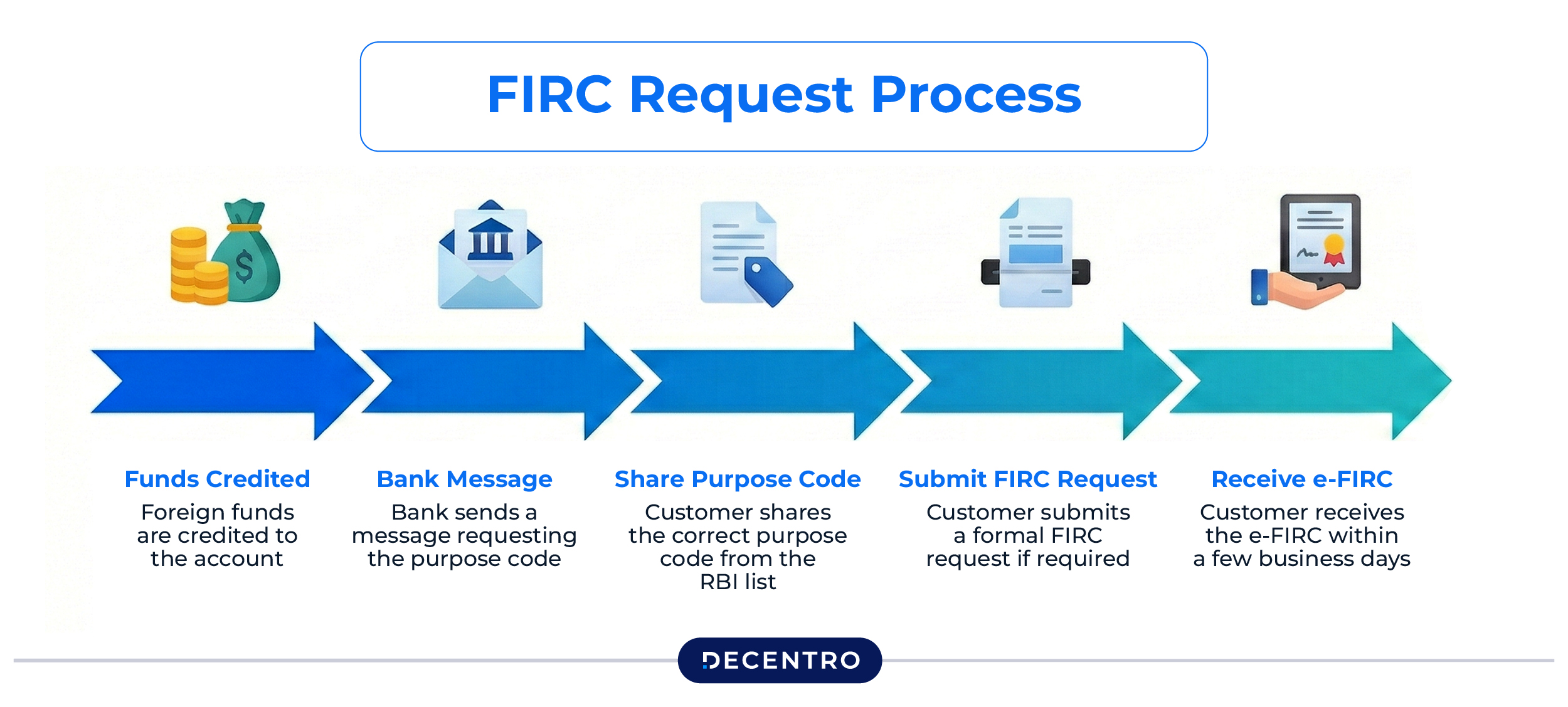

How to Obtain Your FIRC

Traditional bank process:

- Wait for the funds to be credited to your account

- Contact your bank’s foreign exchange or remittance department

- Submit a FIRC request form with transaction details (UTR, amount, sender name, invoice copy)

- Pay any applicable fees (typically ₹300-₹500)

- Receive your FIRC in 5-7 days (physical or PDF format)

Modern fintech platforms: Many RBI-compliant payment platforms now generate e-FIRA automatically and instantly upon credit, at no additional cost. This eliminates the waiting period and manual requests.

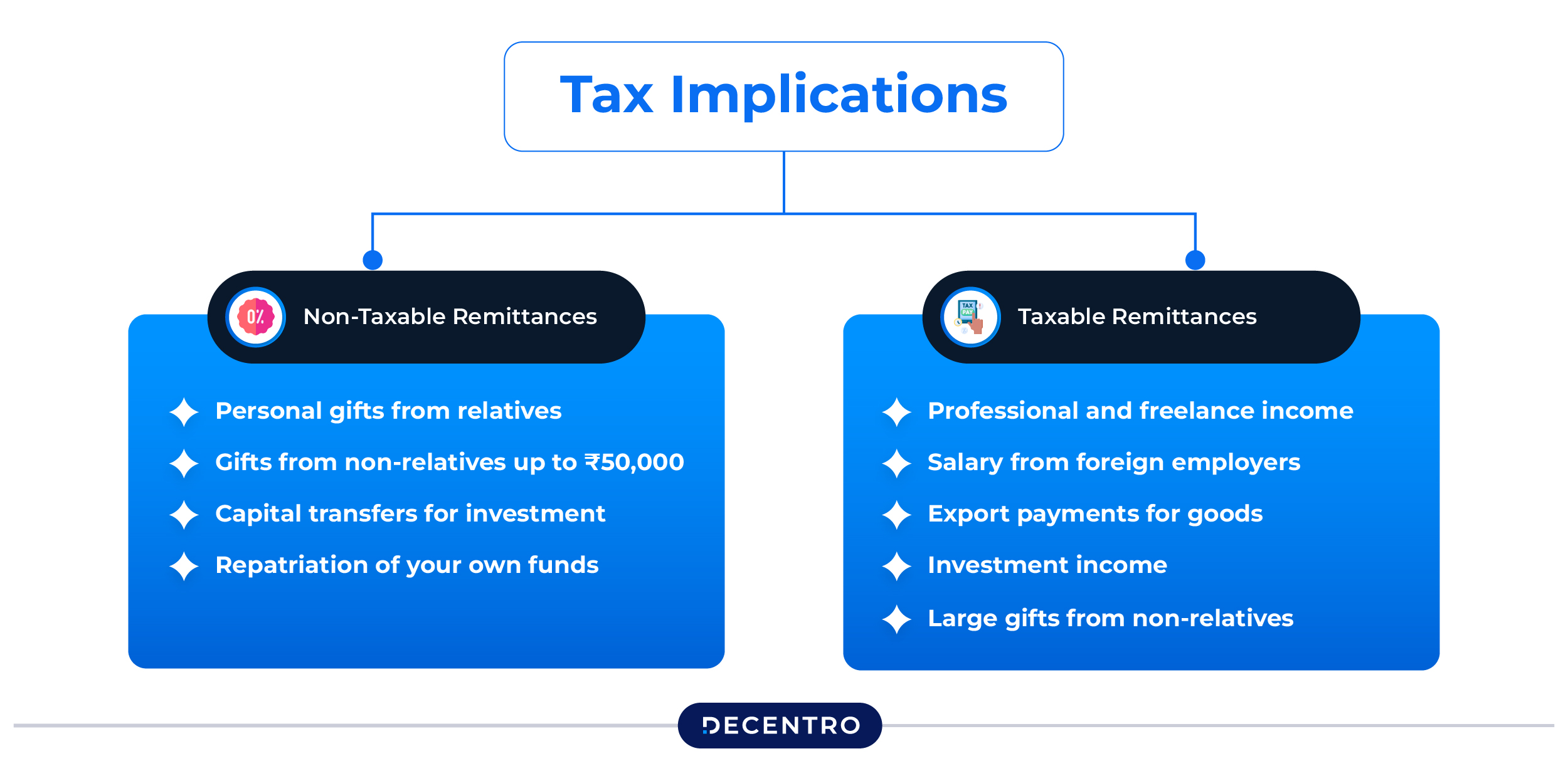

Tax Implications: When You Pay and When You Don’t

A critical question every recipient asks: “Will I owe tax on this foreign inward remittance?”

The answer depends entirely on the nature of the money, not the fact that it came from abroad.

Non-Taxable Remittances

You generally don’t pay tax on:

Personal gifts from relatives: Money sent by parents, siblings, spouse, or other close relatives for personal support, education, or living expenses. There’s no limit on the amount when it’s from close relatives.

Gifts from non-relatives up to ₹50,000: Small gifts from friends or distant acquaintances are tax-free up to ₹50,000 in a financial year. Anything above this threshold becomes taxable under “Income from Other Sources.”

Capital transfers for investment: If you’re receiving funds to invest in your Indian business (but not as payment for services), the principal amount isn’t taxable at receipt. However, any returns generated later (interest, dividends, profits) will be taxable.

Repatriation of your own funds: If you’re bringing back money you previously sent abroad or withdrawing from your own foreign account, it’s not considered income.

Taxable Remittances

You must pay income tax on:

Professional and freelance income: Payments for services rendered—whether software development, consulting, design, writing, or any other work—are fully taxable as business or professional income. You’ll report this under your applicable ITR form (ITR-3 or ITR-4 for presumptive taxation) and pay tax per your slab rate.

Salary from foreign employers: If you work remotely for an overseas company and they remit your salary to India, it’s taxable as salary income, just like any domestic job.

Export payments for goods: Revenue from selling products abroad is taxable business income.

Investment income: Interest earned on foreign bank accounts, dividends from foreign stocks, or rental income from overseas property—when remitted to India—is taxable under “Income from Other Sources.”

Large gifts from non-relatives: Gifts exceeding ₹50,000 from non-relatives in a financial year are taxable.

TDS and Foreign Remittances

Important clarification: Generally, there’s no TDS (Tax Deducted at Source) on inward remittances. Unlike domestic payments, foreign senders don’t deduct tax before sending money to you.

However, you’re responsible for declaring this income in your ITR and paying applicable taxes. Keep your FIRC/e-FIRA as proof when filing returns.

Pro tip: If the foreign payer withheld tax in their country (for example, a US company withheld 30% tax on your consulting fee), you may be able to claim foreign tax credit under Double Taxation Avoidance Agreements (DTAA) by filing Form 67. Consult a chartered accountant for this.

Prohibited Sources: What You Cannot Receive

Not all money is equal under the law. RBI and FEMA explicitly prohibit certain types of foreign remittances to prevent money laundering and illegal activities.

You cannot legally receive remittances from:

- Online gambling, betting, or lottery winnings: Any proceeds from gambling sites, sports betting, online poker, or lottery tickets are strictly banned. Even if you won legitimately abroad, bringing those funds to India is prohibited.

- Speculative or illegal businesses: Money from unauthorised trading, Ponzi schemes, or criminal activities cannot be remitted.

- Crypto-related transactions in certain forms: While regulations are evolving, proceeds from certain cryptocurrency activities may face restrictions depending on their nature.

- Banned publications or content: Proceeds from selling content that’s illegal in India cannot be remitted.

What happens if you try: Banks conduct checks on incoming remittances. If they suspect the source is prohibited, they’ll hold the payment, request detailed explanations, and may ultimately reject and return the funds. In serious cases, this could trigger anti-money laundering investigations.

The bottom line: Only accept remittances for legitimate business, professional services, personal support, or investment purposes. If something feels questionable about the source of funds, it probably violates FEMA.

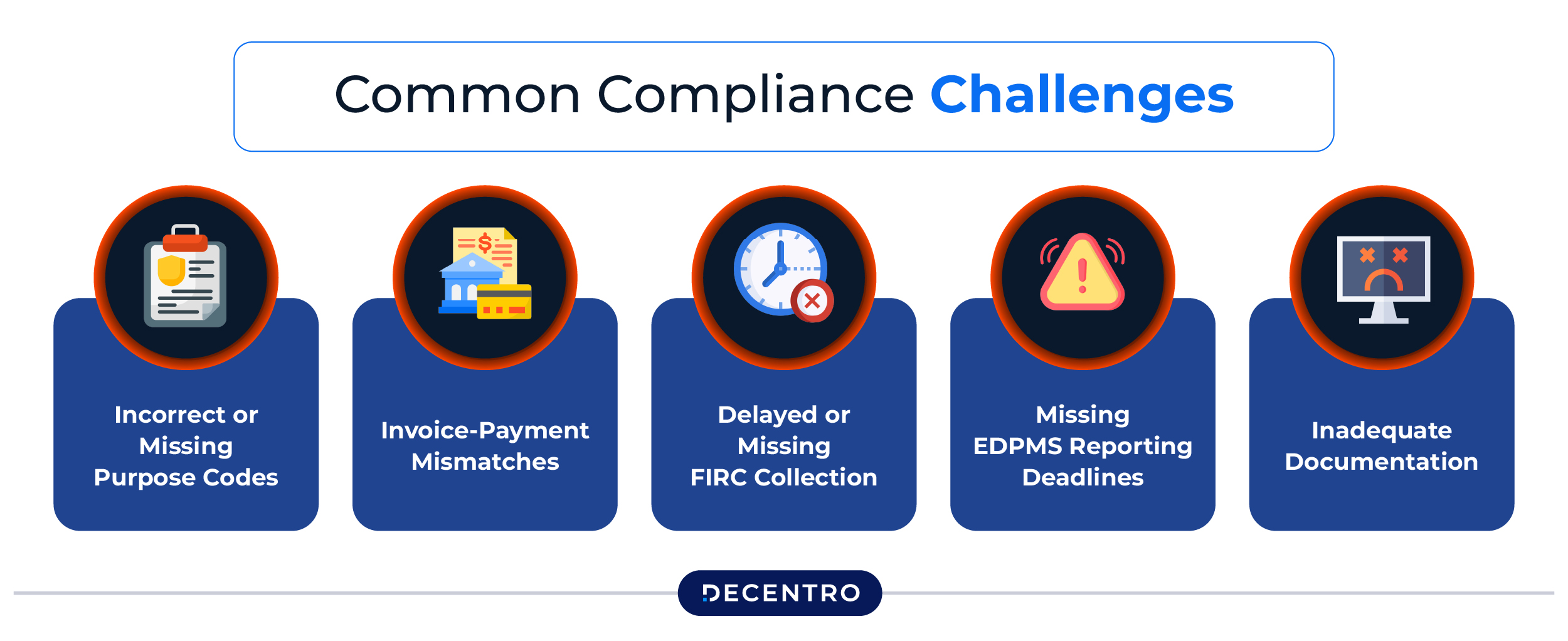

Common Compliance Challenges and How to Avoid Them

Even experienced businesses sometimes encounter obstacles with foreign inward remittances. Here are the most frequent issues and practical solutions:

Challenge 1: Incorrect or Missing Purpose Codes

The problem: You provided purpose code P0802 (software services) when you should have used P1006 (consulting services), or forgot to mention a purpose code entirely.

The consequence: Payment gets flagged, your bank sends queries, and funds may be held pending clarification.

The solution:

- Maintain a reference list of purpose codes relevant to your business

- Double-check the code against your invoice before sharing with clients

- When in doubt, consult your bank’s forex department

- Use payment platforms that help auto-select appropriate codes

Challenge 2: Invoice-Payment Mismatches

The problem: Your invoice shows $10,000, but only $9,750 arrives in your account after intermediary bank fees were deducted. Or the client paid a different amount than invoiced.

The consequence: Reconciliation issues in EDPMS (Export Data Processing and Monitoring System), potential compliance queries.

The solution:

- Factor in bank fees when preparing invoices, or clearly state who bears these costs

- Maintain clear records explaining any discrepancy (email from client, bank charge statement)

- For exports, reconcile within the 14-day EDPMS reporting window with proper documentation

Challenge 3: Delayed or Missing FIRC Collection

The problem: You received payment weeks or months ago but never requested or received the FIRC from your bank.

The consequence: No proof of foreign earnings for tax filing, export benefits, or audits. May face issues when claiming GST refunds.

The solution:

- Set a calendar reminder to request FIRC within 7 days of payment receipt

- Use platforms that provide instant e-FIRA automatically

- Keep digital copies in organized folders (by client, date, or project)

Challenge 4: Missing EDPMS Reporting Deadlines

The problem: You failed to submit supporting documents to close EDPMS entries within the 14-day window.

The consequence: Non-compliance with RBI export reporting requirements, potential penalties, difficulties in future export transactions.

The solution:

- Integrate EDPMS reporting into your payment receipt workflow

- Assign responsibility to a specific team member

- Use automated reminders or workflow management tools

- Consider platforms that handle compliance reporting automatically

Challenge 5: Inadequate Documentation

The problem: You deleted email threads, lost invoice copies, or didn’t maintain a proper filing system.

The consequence: Audit problems, inability to respond to bank or tax queries, potential penalties.

The solution:

- Implement a digital document management system

- Store all remittance-related documents for 5+ years (FEMA requirement)

- Maintain backups in cloud storage

- Create a simple naming convention for files (ClientName_InvoiceNumber_Date_FIRC)

Payment Methods: How Money Actually Flows to India

Understanding how international payments reach India helps you choose the most cost-effective and efficient method.

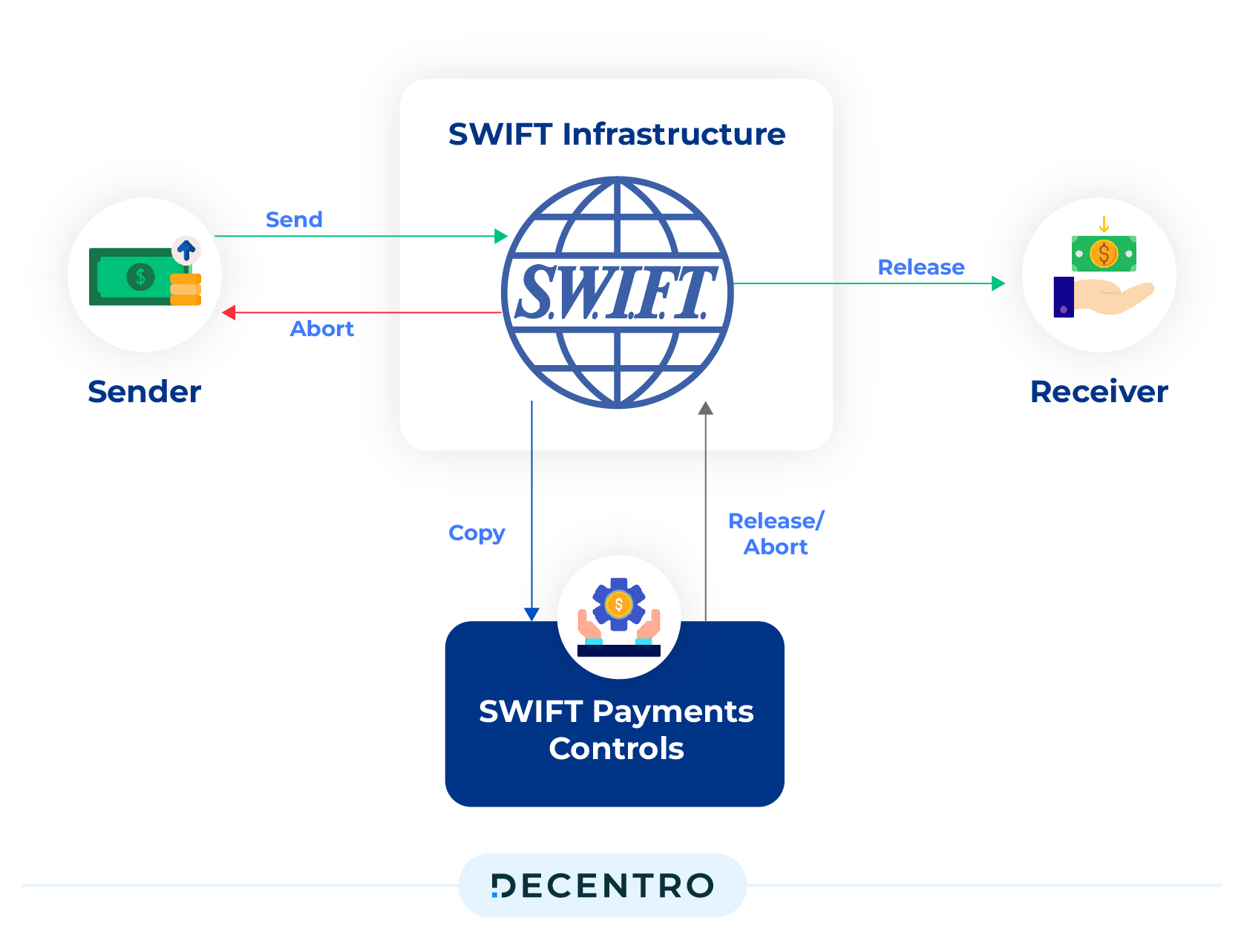

SWIFT Bank Transfers

How it works: The international banking network that routes payments between banks globally. Your client’s bank sends funds via SWIFT to your Indian bank.

Processing time: 1-3 business days, typically

Best for: Business payments, export proceeds, large transactions

Costs: Moderate to high ($15-50 in fees), plus exchange rate markup

Compliance: Full documentation required, generates FIRC

Online Money Transfer Platforms

How it works: Services like Wise, Western Union, or Remitly that facilitate transfers using their own networks often offer better rates than traditional banks.

Processing time: Within 24 hours, sometimes instant

Best for: Personal remittances, smaller amounts, quick transfers

Costs: Low to moderate, competitive exchange rates

Compliance: Simplified for personal use, may have transfer limits

Money Transfer Service Scheme (MTSS)

How it works: Quick cash pickup or account credit through authorised agents like Western Union or MoneyGram.

Processing time: Real-time to same day

Best for: Emergency funds, gifts, small personal transfers

Limits: Maximum $2,500 per transaction, maximum 30 transactions per recipient per year

Costs: Variable based on location and provider

Compliance: Purpose declaration required

Modern Fintech Platforms

How it works: RBI-compliant platforms that provide virtual foreign bank accounts, allowing clients to make local transfers in their currency while you receive INR in India.

Processing time: 1 business day typically

Best for: Businesses, startups, freelancers with regular international clients

Costs: Competitive fees (often 1-2%), transparent exchange rates

Compliance: Built-in compliance, automatic e-FIRA generation

What to Consider When Choosing

- Transaction size: SWIFT for large B2B payments, MTSS for small personal transfers

- Frequency: Regular business payments benefit from platform accounts with better rates

- Urgency: Need it today? MTSS. Can you wait for better rates? SWIFT

- Cost sensitivity: Compare total costs, including fees and exchange rate markups

- Compliance complexity: Platforms with built-in compliance reduce your administrative work

Recent Updates and Future Trends

The foreign inward remittance landscape is evolving rapidly, driven by technology and the RBI’s modernisation initiatives.

Payments Vision 2025

The RBI’s flagship initiative aims to make cross-border payments as seamless as domestic UPI transactions. Key focus areas include:

- Standardised payment information to reduce errors and processing delays

- Faster settlement times, potentially same-day for most transactions

- Reduced costs through more efficient routing and fewer intermediaries

- Enhanced transparency with real-time tracking and status updates

Digital Compliance Tools

In 2025, we’re seeing:

- Automated FIRC generation: Banks and fintech platforms increasingly issue e-FIRA instantly upon credit

- AI-powered verification: Purpose code suggestions and document verification using machine learning

- Integrated reporting: Platforms that automatically report to EDPMS and generate compliance reports

- Digital record keeping: Cloud-based document management with 5-year retention and easy retrieval

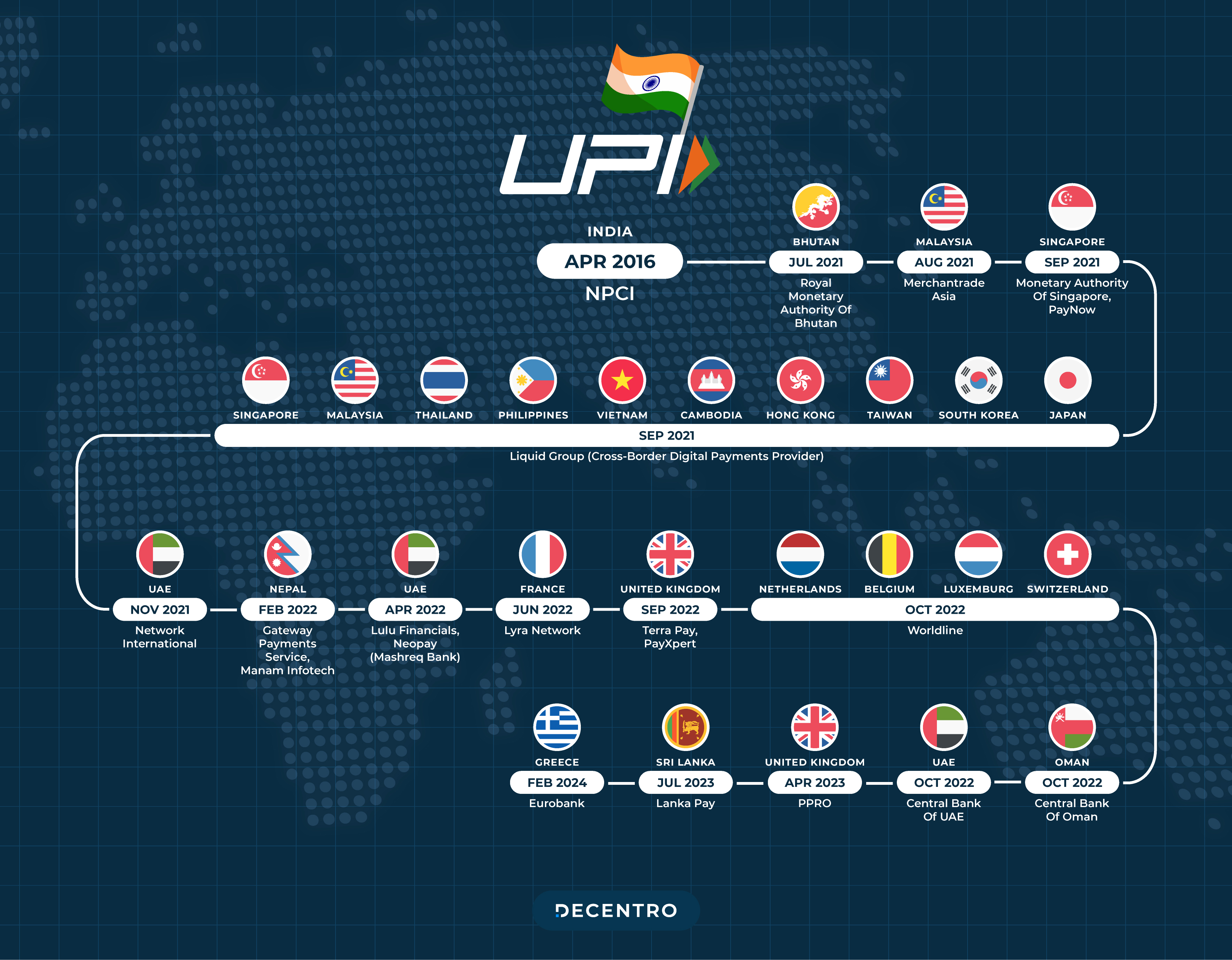

UPI Internationalization

The RBI is actively working to expand UPI to cross-border payments. While currently in pilot phases with select countries, this could revolutionise how Indian businesses receive smaller international payments—potentially offering:

- Real-time settlement

- Minimal fees

- No intermediary banks

- Direct bank-to-bank transfers

Blockchain and Distributed Ledger Technology

Though still emerging, blockchain-based remittance systems promise:

- Near-instant settlement

- Lower transaction costs

- Enhanced transparency and traceability

- Built-in compliance through smart contracts

The bottom line for businesses: The regulatory framework is becoming more supportive of legitimate cross-border commerce while maintaining strong compliance standards. Expect faster payments, lower costs, and easier compliance in the coming years.

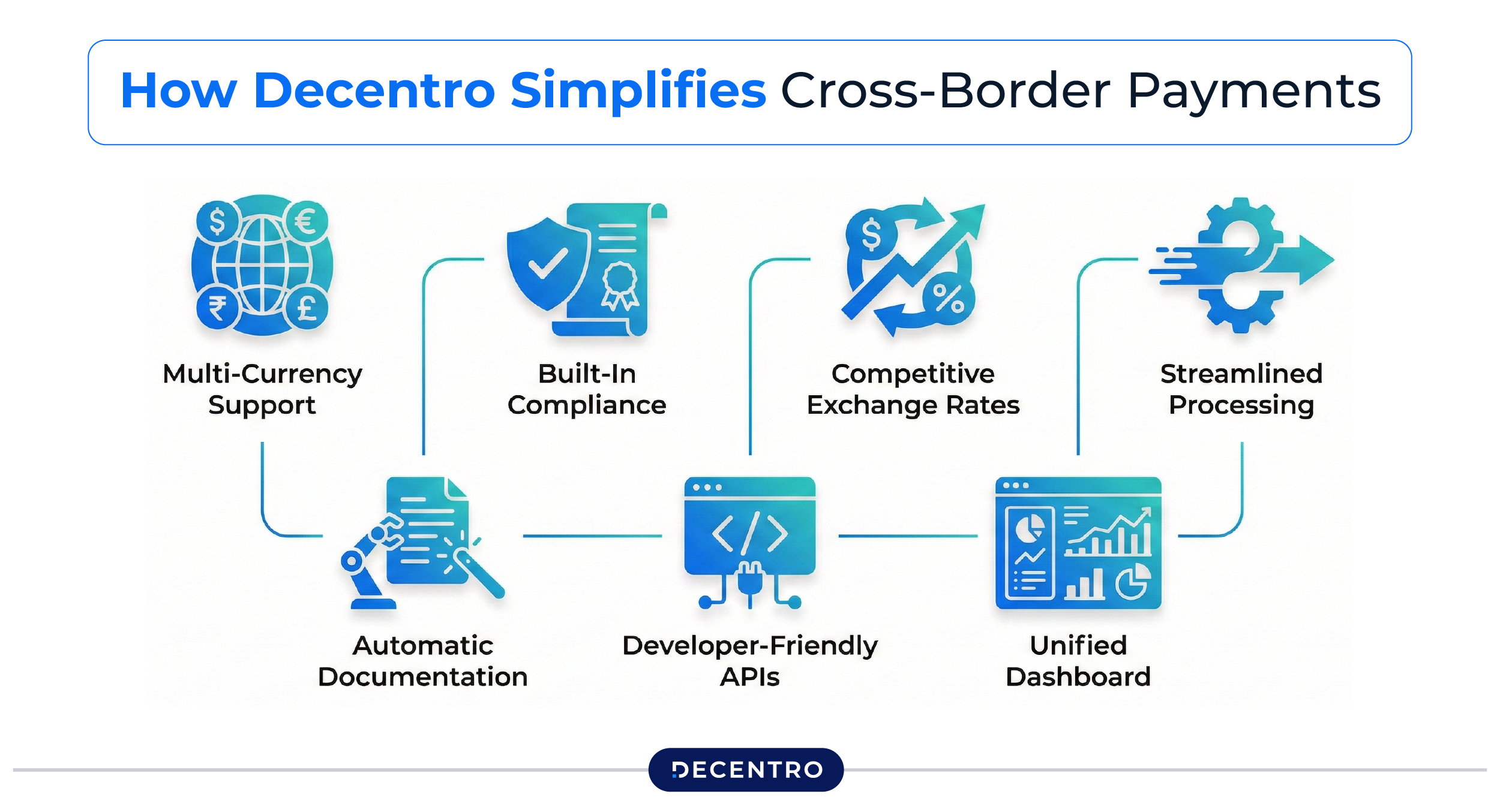

How Decentro Simplifies Cross-Border Payments

While understanding the regulatory landscape is essential, the practical challenge remains: how do you efficiently receive international payments without getting buried in paperwork?

This is where modern fintech infrastructure makes a meaningful difference. Decentro’s Cross-Border Functionality is purpose-built for Indian businesses, startups, and freelancers who need to receive international payments with minimal friction.

What Decentro Offers

Multi-Currency Support: Accept payments in major global currencies and receive settlement in INR, eliminating the need to maintain and manage foreign bank accounts.

Built-In Compliance: Purpose codes, documentation requirements, and regulatory reporting are integrated into the platform. You don’t need to become a FEMA expert—the system handles compliance requirements automatically.

Competitive Exchange Rates: Access to transparent forex rates without hidden markups ensures you maximise the value of every international payment.

Streamlined Processing: Automated workflows reduce the typical 3-5 day bank processing time, getting funds to you faster and improving your cash flow.

Automatic Documentation: e-FIRA generation happens automatically with each payment, giving you instant access to the compliance documentation you need for taxes and audits.

Developer-Friendly APIs: For platforms, marketplaces, and businesses that need to embed cross-border payment capabilities into their own products, Decentro provides robust API infrastructure that’s easy to integrate.

Unified Dashboard: Track all international payments, compliance status, and documentation in one centralised interface, bringing clarity to what can otherwise be a complex process.

For businesses scaling globally, reducing friction in receiving international payments directly impacts cash flow, operational efficiency, and competitive advantage. Solutions like Decentro ensure that while you focus on serving clients worldwide, your payment infrastructure works quietly and efficiently in the background, fully compliant, always transparent, and consistently reliable.

Best Practices for Managing Foreign Inward Remittances

Beyond basic compliance, smart management of international payments can significantly improve your business operations.

Set Up Proper Systems

Dedicated accounts: Consider maintaining a separate bank account for international receipts to simplify tracking and reconciliation.

Automated invoicing: Use software that generates invoices with correct purpose codes, client details, and all required information.

Payment tracking: Maintain a simple spreadsheet or use accounting software to log expected payments, receipt dates, amounts, and FIRC status.

Communication is Critical

Pre-payment clarity: Share complete bank details, required purpose code, and any special instructions with clients before they initiate payment.

Payment confirmation: Ask clients to notify you when payment is sent, including reference numbers and the expected timeline.

Proactive follow-up: If payment doesn’t arrive within the expected window, check with both your client and your bank promptly.

Optimise Your Costs

Negotiate rates: If you receive regular high-value payments, discuss preferential forex rates or reduced fees with your bank.

Strategic timing: For predictable large payments, consider forex hedging or timing transfers during favourable exchange rate periods.

Platform comparison: Regularly evaluate different payment platforms and methods to ensure you’re getting the best combination of speed, cost, and service.

Maintain Compliance Hygiene

Monthly reconciliation: Match all received payments against invoices and expected amounts monthly, not quarterly or annually.

Quarterly compliance review: Verify that all FIRCs are collected, EDPMS entries are closed, and documents are properly archived.

Annual audit preparation: Organise all remittance documents well before year-end to streamline tax filing and reduce last-minute stress.

Professional consultation: For complex situations—large investments, multiple jurisdictions, DTAA claims—don’t hesitate to engage a chartered accountant who specialises in international taxation.

Conclusion

Foreign inward remittance is more than a technical banking process, it’s the financial bridge connecting Indian talent and businesses to global opportunities. With India positioned as the world’s largest remittance recipient and the ecosystem continuously evolving toward greater efficiency, there’s never been a better time to understand and optimise how you receive international payments.

Whether you’re a solo freelancer invoicing your first international client, a growing SaaS startup receiving subscriptions from multiple countries, or an established exporter managing complex trade finance, understanding foreign inward remittance regulations is a core competency for global success.

The world is open for business. With the right knowledge, proper systems, and smart technology choices like Decentro, you’re equipped to receive what you’ve earned, efficiently, compliantly, and with confidence.

Frequently Asked Questions

What is the difference between FIRC and e-FIRA?

FIRC (Foreign Inward Remittance Certificate) and e-FIRA (Electronic Foreign Inward Remittance Advice) serve the same purpose—proof of foreign payment receipt. e-FIRA is simply the digital evolution of FIRC, generated electronically and delivered faster, often instantly. Both are equally valid for tax filing, audits, and claiming export benefits.

Is there a limit on how much foreign remittance I can receive?

Under the Rupee Drawing Arrangement (RDA), there’s no upper limit for most inward remittances. However, trade-related transactions may have specific caps (typically ₹15,00,000 per transaction for certain categories). The Money Transfer Service Scheme (MTSS) is limited to $2,500 per transaction with a maximum of 30 transactions per recipient per year. Large transactions may trigger additional compliance checks.

Do I need a special bank account to receive foreign payments?

No, you can use your regular savings or current account with an Authorised Dealer Category-I bank. However, businesses often find it helpful to maintain a dedicated account for international receipts to simplify tracking and reconciliation. You don’t need to maintain foreign currency accounts unless you have specific business reasons to do so.

How long does it take to receive international payments in India?

SWIFT transfers typically take 1-3 business days. Modern fintech platforms can process payments within 1 business day. Traditional methods like demand drafts may take 10-15 days. The actual timeline depends on the sending bank, intermediary banks involved, compliance verification requirements, and the receiving bank’s processing speed.

What happens if I use the wrong purpose code?

Using an incorrect purpose code can delay your payment while your bank seeks clarification, may result in the transaction being flagged for review, or in some cases could lead to the payment being returned to the sender. If you realize you’ve provided a wrong code, contact your bank immediately to request a correction before the transaction is processed.

Can I receive payments in foreign currency directly?

As a resident Indian, you typically receive payments in INR after currency conversion by your bank. However, if you’re an NRI or meet specific criteria, you can maintain foreign currency accounts (like NRE or FCNR accounts) to hold funds in foreign currency. Consult your bank about account types based on your residency status and business needs.

Do I need Form 15CA/15CB for receiving inward remittances?

Form 15CA and 15CB are typically required for outward remittances (when sending money abroad), not for receiving inward remittances. However, for certain high-value transactions or complex tax situations, you might need these forms. Consult a chartered accountant to determine if they apply to your specific circumstances.

How do I report foreign income in my Income Tax Return?

Report foreign-sourced earnings under the appropriate income head based on what it represents: business/professional income goes in ITR-3 or ITR-4, salary in the salary schedule, investment income under “Income from Other Sources.” There’s no separate section specifically for “foreign remittance”—you report the income nature, not its geographic origin. Keep your FIRC/e-FIRA as supporting documentation.