Learn what inward remittance means, how foreign payments reach India, RBI purpose codes, charges, taxes, FIRC rules, and how businesses receive international payments compliantly.

Inward Remittance in India: Process, RBI Guidelines & Charges

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Quick Glance

| Inward remittance is money transferred from a foreign country into an Indian bank account. It requires RBI purpose codes, e-FIRA documentation, EDPMS reporting (for exports), FEMA adherence, and proper tax filing. Common Use Cases: Exporters: Receiving payment for goods shipped internationally Freelancers & Consultants: Getting paid for services rendered to foreign clients IT & Software Companies: Collecting fees for software development, implementation, or SaaS subscriptions Startups: Receiving investment from overseas parent companies or venture funds NRI Families: Getting financial support from family members working abroad Educational Institutions: Receiving tuition fees from international students or donations E-commerce Sellers: Collecting payments from international marketplaces |

The Growing Importance of Inward Remittances in India

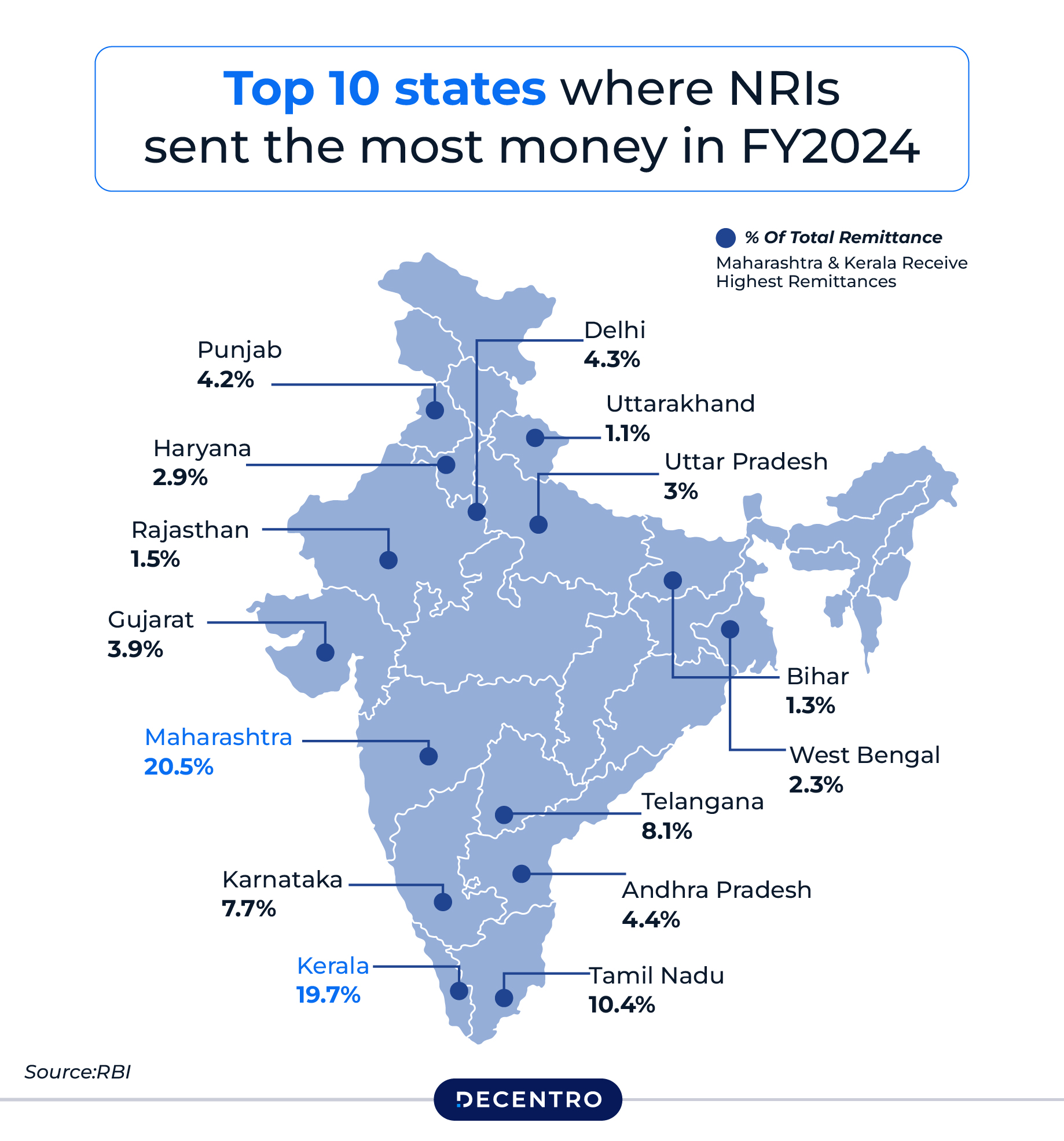

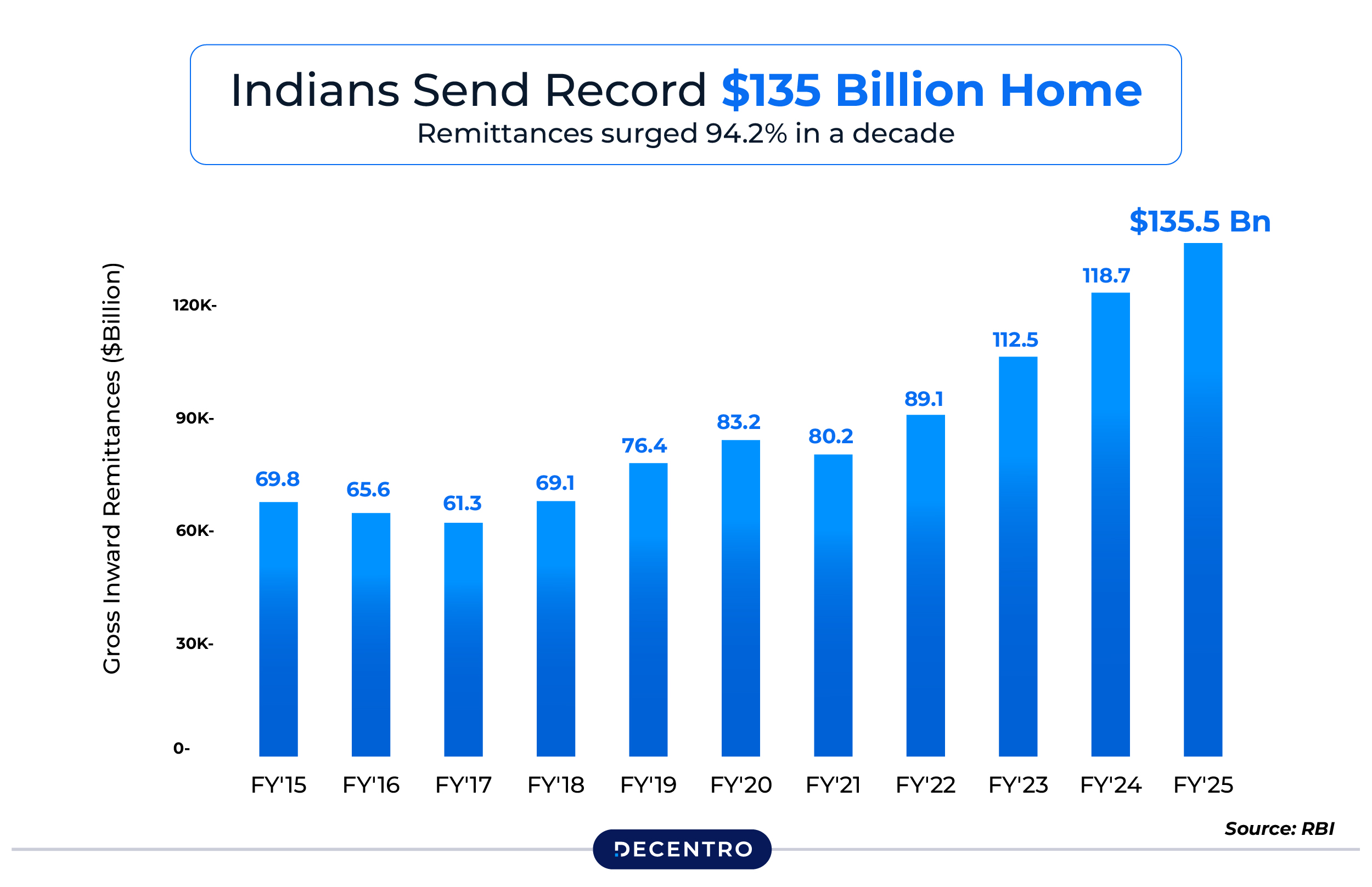

India stands as the world’s undisputed leader in inward remittances. According to recent Reserve Bank of India (RBI) data, the country received $129.4 billion in calendar year 2024 and $135.46 billion in fiscal year 2024-25—more than double the amount received by Mexico, the second-largest recipient. This represents 14.3% of global remittances, the highest share recorded for any country.

These numbers aren’t just statistics—they reflect millions of transactions from IT service exporters, freelancers, funded startups, and businesses receiving payments from clients across the globe. Inflows under private transfers now account for more than 10% of India’s gross current account inflows, making them a cornerstone of economic stability.

India’s journey to remittance leadership began with migration patterns dating back to 1834, but the real transformation occurred in the 1990s. From just $2.1 billion in 1991 to over $137 billion today, a staggering 6,400% growth, this surge reflects India’s demographic dividend (65% population under 35), tripling of overseas workers from 6.6 million to 18.5 million, shifting remittance sources from Gulf nations to advanced economies, and digital payment innovations. The Foreign Exchange Management Act (FEMA) in 1999 further catalyzed this growth by creating a more liberal framework than its predecessor FERA.

For business owners and founders, inward remittances mean more than just receiving payment. They represent global opportunities, international collaborations, and the ability to serve clients anywhere in the world. But with this opportunity comes responsibility—the need to understand and comply with India’s regulatory framework.

What is Inward Remittance?

At its simplest, inward remittance is money transferred from a foreign country into your Indian bank account. Whether you’re a software developer receiving payment from a US client, an exporter getting paid for goods shipped to Europe, or a startup receiving funds from your overseas parent company, these transactions all fall under inward remittance.

The process typically involves:

- A sender (foreign entity or individual) initiating a payment from their overseas bank account

- Routing through one or more intermediary banks (often using the SWIFT network)

- Currency conversion from foreign currency to Indian Rupees (INR)

- Credit to your Indian bank account

- Generation of compliance documentation

Think of it as the digital pathway that brings international earnings to your Indian business account, complete with regulatory checkpoints to ensure transparency and legitimacy.

Purpose Codes: The DNA of Every Transaction

Every inward remittance must be tagged with a specific RBI purpose code that identifies the nature of the transaction. This isn’t just bureaucratic red tape, it’s how the RBI tracks foreign exchange flows and ensures economic transparency.

Common Purpose Codes for Personal Remittances

| Code | Description | Who Uses It |

| P1301 | Inward remittance for family maintenance and savings | NRIs sending money to parents/family in India for monthly expenses |

| P1302 | Personal gifts and donations | Individuals receiving cash gifts from relatives abroad for birthdays, weddings, etc. |

| S0304 | Education-related services | Students receiving funds from sponsors or family to pay university fees in India |

| S0305 | Medical treatment | Individuals receiving money from abroad to cover hospital or surgery expenses |

| P1401 | Compensation of employees (Salary) | Remote workers receiving salary from foreign employers while working from India |

Common Purpose Codes for Business & Freelance Remittances

| Code | Description | Who Uses It |

| P0103 | Advance receipts against the export of goods | Exporters receiving advance payments before shipping orders |

| P0802 | Software implementation/consultancy services | Freelance developers and consultants receiving payment for software projects |

| P0807 | Off-site Software Exports | IT companies receiving payment for software developed in India for foreign clients |

| P1006 | Business and management consultancy services | Consultants receiving fees for strategy, market entry, or advisory services |

| P1007 | Advertising, market research, and public opinion polling services | Marketing agencies receiving payment for SEO campaigns, branding, or market research |

| P1002 | Trade-related services – Commission on exports/imports | Agents receiving commission for facilitating deals between Indian and foreign parties |

Other Important Purpose Codes (Investments, Loans, Donations)

| Code | Description | Who Uses It |

| P0006 | Foreign investment in India in equity | Foreign companies investing funds to acquire shares in Indian startups or companies |

| P0012 | Loans from non-residents to India | Indian businesses receiving long-term loans from foreign parent companies or lenders |

| P1303 | Donations to religious and charitable institutions in India | NGOs receiving grants from international foundations or donors |

Using the wrong purpose code can delay your payment or trigger compliance issues. Always ensure the code matches the service or product described in your invoice.

Transaction Limits and Schemes

The RBI provides different schemes for different types of remittances:

- Rupee Drawing Arrangement (RDA): The primary channel for business and personal remittances with no upper limit for personal purposes. For trade-related transactions, there’s typically a cap of ₹15,00,000 per transaction.

- Money Transfer Service Scheme (MTSS): Used for quick cash transfers through providers like Western Union. Limited to USD 2,500 per transaction with a maximum of 30 transactions per beneficiary per calendar year.

EDPMS: The Digital Tracking System

The Export Data Processing and Monitoring System (EDPMS) is the RBI’s digital portal for monitoring export transactions. When you receive payment, your bank reports it on EDPMS. You then provide supporting documents to “close” the entry, creating a transparent audit trail.

The Step-by-Step Inward Remittance Process

Understanding how money flows from overseas to your Indian account helps you anticipate timing, costs, and documentation needs.

Step 1: Invoice and Agreement

Start with a clear commercial invoice or service agreement that specifies:

- Your client’s details (name, address, country)

- Description of goods or services provided

- Total amount and currency

- Payment terms

- Your Indian business details (PAN, GSTIN, IEC code if applicable)

Step 2: Payment Initiation

Your overseas client initiates the transfer from their bank. They’ll need:

- Your bank account details (account number, bank name, branch)

- SWIFT/BIC code for your Indian bank

- Purpose of remittance

- Any required reference numbers

Step 3: International Routing

The payment travels through the international banking system:

- If your client’s bank has direct ties with your Indian bank, the transfer is straightforward

- Otherwise, it routes through correspondent or intermediary banks

- Currency conversion happens (usually at the recipient bank using prevailing exchange rates)

- Transaction and service fees are deducted

Step 4: Credit to Your Account

Your Indian bank receives the funds, verifies compliance details, and credits your account. You’ll receive:

- A bank credit notification

- Transaction reference number (UTR)

- Details of any charges deducted

Step 5: Documentation Generation

This is critical for compliance:

- e-FIRA (Electronic Foreign Inward Remittance Advice): This digital certificate has replaced the older FIRC (Foreign Inward Remittance Certificate) and serves as official proof that you received a foreign payment

- Bank payment advice or SWIFT message copy

- Purpose code confirmation

Step 6: EDPMS Reporting and Reconciliation

Within 14 days of receiving funds:

- Your bank reports the transaction to EDPMS

- You provide supporting documents (invoices, contracts)

- The entry is reconciled and closed

- Records are maintained for at least 5 years as per FEMA guidelines

Typical Timelines for Inward Remittances

Understanding expected processing times helps you plan cash flow and set client expectations:

| Payment Method | Typical Timeline | Factors Affecting Speed |

| SWIFT Transfer | 1-3 business days | Bank relationships, compliance checks |

| Fintech Platforms | 12-24 hours | Automated compliance, direct banking ties |

| Wire Transfer | 2-5 business days | Intermediary banks, currency conversion |

| Demand Drafts | 10-15 business days | Physical document handling, clearing process |

Common Causes of Payment Delays

Even with proper documentation, delays can occur. Here’s what typically holds up payments:

Compliance-Related Delays (Most Common)

- Incorrect or missing purpose code requiring bank clarification

- Invoice-payment amount mismatch triggering manual review

- Missing or incomplete KYC documentation

- Large transaction amounts requiring additional scrutiny under anti-money laundering (AML) rules

Documentation Issues

- Illegible or incomplete invoices

- Missing IEC code for goods exports

- Absence of required contracts or agreements

- Delayed e-FIRA generation by your bank

Banking Infrastructure

- Intermediary bank holds for verification

- Currency conversion timing during volatile forex periods

- Weekend or holiday processing gaps

- Correspondent banking relationship issues

Technical Problems

- SWIFT message errors or incomplete information

- Wrong account details were provided by the sender

- System downtimes at the sender or the recipient bank

Proactive Solutions: To minimise delays, provide complete documentation upfront, maintain regular communication with your bank’s forex department, set up transaction alerts, and consider using fintech platforms with built-in compliance for faster processing.

The Regulatory Framework: Understanding FEMA and RBI Guidelines

Navigating inward remittances in India means understanding the regulatory guardrails set by the Reserve Bank of India. Here’s what governs your international payments:

Foreign Exchange Management Act (FEMA)

FEMA is the master rulebook for all foreign exchange transactions in India. Enacted in 1999, it empowers the RBI to regulate:

- How and when foreign currency can flow in and out of India

- Documentation requirements for international transactions

- Authorised channels for remittance processing

- Compliance reporting obligations

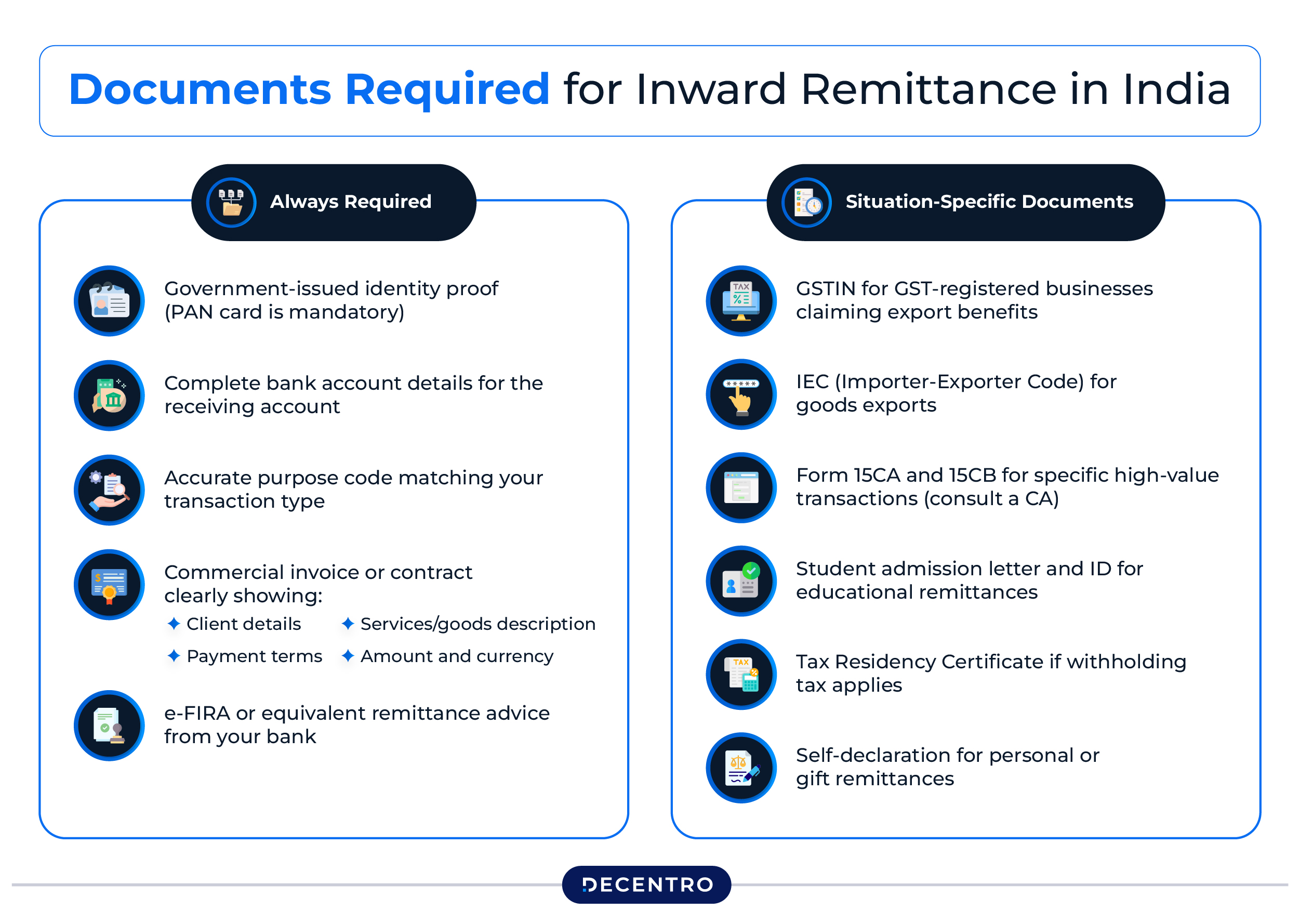

Documents Required for Inward Remittance in India

Being prepared with the right paperwork saves time and prevents payment delays. Here’s your compliance checklist:

Always Required

- Government-issued identity proof (PAN card is mandatory)

- Complete bank account details for the receiving account

- Accurate purpose code matching your transaction type

- Commercial invoice or contract clearly showing:

- Client details

- Services/goods description

- Amount and currency

- Payment terms

- e-FIRA or equivalent remittance advice from your bank

Situation-Specific Documents

- GSTIN for GST-registered businesses claiming export benefits

- IEC (Importer-Exporter Code) for goods exports

- Form 15CA and 15CB for specific high-value transactions (consult a CA)

- Student admission letter and ID for educational remittances

- Tax Residency Certificate if withholding tax applies

- Self-declaration for personal or gift remittances

Record Keeping Best Practices

- Maintain digital and physical copies of all documents

- Keep organized files by transaction date and client

- Save all email correspondence related to payments

- Store documents for at least 5 years (FEMA requirement)

- Keep updated purpose code references handy

Inward Remittance Charges & Hidden Fees

While receiving international payments, various fees can eat into your earnings. Understanding these charges helps you negotiate better rates and set accurate client pricing.

Bank Charges

Indian banks typically levy charges for processing foreign inward remittances:

Processing Fees: ₹200-₹500 per transaction, depending on your bank and account type. Some premium accounts waive these fees for high-value transactions.

Handling Charges: Additional ₹100-₹300 for documentation, SWIFT message processing, and compliance verification.

Minimum Amount Clauses: Some banks charge higher fees for transactions below certain thresholds (e.g., below $1,000).

Negotiation Tip: If you receive regular international payments, negotiate a preferential rate or flat monthly fee with your relationship manager.

Intermediary Bank Fees

When your payment routes through correspondent or intermediary banks (common with SWIFT transfers), each bank in the chain may deduct charges:

Typical Range: $15-$50 per intermediary bank

How It Works: If your client sends $10,000 and two intermediary banks are involved charging $25 each, you might receive only $9,950.

Client Communication: Inform clients beforehand that “charges to beneficiary” mean you’ll bear intermediary fees. Ask them to select “OUR” (sender pays all fees) or “SHA” (shared charges) options when initiating the transfer.

Foreign Exchange (FX) Markup

The forex conversion rate is where significant hidden costs lurk:

Interbank vs. Applied Rate: Banks don’t give you the mid-market (interbank) rate. They apply a markup, typically 1-3% on the spot rate.

Example: If the USD-INR interbank rate is 83.00, your bank might apply 83.80, pocketing ₹0.80 per dollar as margin.

Impact on Large Transactions: On a $50,000 payment, a 2% markup means you lose ₹83,000 (approximately $1,000) to the spread.

Solution: Compare forex rates across banks and fintech platforms. Some modern platforms offer rates within 0.3-0.5% of the interbank rate, significantly better than traditional banks.

GST on Bank Charges

All fees charged by Indian banks for processing inward remittances attract 18% GST:

What’s Taxed: Processing fees, handling charges, SWIFT charges

Example: If your bank charges ₹500 as processing fee, you pay ₹590 (₹500 + 18% GST)

Business Benefit: GST-registered businesses can claim input tax credit (ITC) on these charges, effectively making the GST cost-neutral.

Total Cost Example

Let’s calculate the true cost of receiving a $10,000 payment:

| Component | Amount |

| Payment sent by client | $10,000 |

| Intermediary bank fee 1 | -$25 |

| Intermediary bank fee 2 | -$25 |

| Amount reaching Indian bank | $9,950 |

| FX conversion at 83.50 (2% markup from 83.00) | ₹8,30,825 |

| Indian bank processing fee | -₹500 |

| GST on processing fee (18%) | -₹90 |

| Net amount credited | ₹8,30,235 |

Effective Loss: From the $10,000 sent, you effectively lost $120 (approximately ₹9,960), or about 1.2% of the transaction value.

Cost Optimisation Strategies

- Platform Selection: Fintech platforms often have lower fees and better FX rates than traditional banks

- Transaction Bundling: Instead of receiving 10 small payments, bundle them into 2-3 larger transactions to reduce per-transaction fees

- Account Upgrades: Premium business accounts sometimes offer better forex rates and lower fees for international transactions

- Direct Banking Relationships: Work with banks that have direct correspondent relationships in your client’s country to reduce intermediary banks

- Transparent Pricing: Always ask for a detailed fee breakdown before selecting a payment provider

Tax Implications: When Do You Pay and When Don’t You?

Understanding tax liability on inward remittances is crucial for compliance and financial planning.

Non-Taxable Inward Remittances

Your inward remittance is typically not taxable if it’s:

- Gifts from relatives: Money sent by family members for personal support, education, or living expenses (no tax up to ₹50,000 from non-relatives)

- Capital transfers: Investment funds or business contributions (though income generated later may be taxable)

- NRI income from foreign sources: Money earned abroad by NRIs, not sourced from India

Taxable Inward Remittances

You’ll owe tax if the remittance represents:

- Professional or business income: Payments for freelance work, consulting, software development, or any service rendered

- Income from trade: Payments for goods exported

- Gifts exceeding limits: Non-relative gifts above ₹50,000 in a financial year (taxable under “Income from Other Sources”)

Important Tax Considerations

- TDS (Tax Deducted at Source): Generally, there’s no TDS on foreign remittances received in India. However, keep your e-FIRA as proof for income tax filing.

- GST on exports: Many services exported are zero-rated for GST, but you need proper documentation to claim refunds.

- Income declaration: All taxable remittances must be declared in your annual income tax return under the appropriate heads.

Always consult with a chartered accountant to understand your specific tax obligations based on your business type and transaction nature.

Inward vs Outward Remittance: Key Differences

Understanding the distinction between inward and outward remittances helps businesses manage both receiving and sending international payments effectively.

| Aspect | Inward Remittance | Outward Remittance |

| Definition | Money received in India from foreign countries | Money sent from India to foreign countries |

| Common Examples | Export payments, freelance income, salary from foreign employer, family support from NRIs | Import payments, foreign investments, student fees abroad, overseas travel expenses |

| Primary Regulation | FEMA (Foreign Exchange Management Act) | FEMA + Liberalized Remittance Scheme (LRS) |

| Annual Limits | No limit for most business transactions | Up to $250,000 per financial year for individuals under LRS |

| Purpose Codes | Mandatory for all transactions | Mandatory for all transactions |

| Tax Implications | Professional/business income is taxable; gifts generally exempt | TCS (Tax Collected at Source) applies on amounts >₹7 lakhs; TDS may apply |

| Documentation | e-FIRA, invoices, contracts, IEC (for goods) | PAN card, Form A2, invoices, purpose declaration |

| Processing Time | 1-5 business days typically | 1-3 business days typically |

| Bank Charges | ₹200-₹500 + FX markup | ₹1,000-₹2,000 + FX markup + possible LRS charges |

| Compliance Focus | Export documentation, EDPMS reporting, FIRC generation | LRS compliance, Form 15CA/15CB for certain transactions |

| Common Users | Exporters, freelancers, service providers, NRI families | Importers, students, investors, travelers |

| RBI Reporting | Reported via EDPMS for trade transactions | Reported via Form A2 and monthly bank returns |

| GST Applicability | Zero-rated for exports (with proper documentation) | Not applicable to outward remittances |

Key Takeaway: While inward remittances focus on compliance for receiving foreign earnings (crucial for exporters and freelancers), outward remittances are subject to stricter limits and TCS provisions to monitor capital outflow. Both require accurate purpose codes and proper documentation, but the regulatory emphasis differs based on the direction of fund flow.

Common Compliance Mistakes to Avoid

Even experienced businesses sometimes slip up on compliance. Here are pitfalls to watch out for:

1. Purpose Code Errors

Using a generic or incorrect purpose code is the most common mistake. Each service has a specific code, using P0802 (software services) when you should use P0806 (consulting), which can flag your transaction.

Solution: Maintain a reference list of purpose codes relevant to your business and double-check before providing information to your bank.

2. Invoice-Payment Mismatches

Receiving $10,000 when your invoice shows $10,500 (due to bank fees) without proper documentation creates reconciliation issues.

Solution: Account for fees in your invoicing or maintain clear records explaining discrepancies.

3. Delayed e-FIRA Collection

Forgetting to collect your e-FIRA after payment clears leaves you without critical proof for tax filing and export incentives.

Solution: Set a reminder to request e-FIRA from your bank within a week of payment receipt.

4. Missing EDPMS Deadlines

The 14-day window for EDPMS reporting isn’t a suggestion—it’s a requirement.

Solution: Integrate this into your payment receipt workflow. As soon as funds arrive, schedule document submission.

5. Inadequate Record Retention

Deleting email threads or losing invoice copies after a year can create problems during audits.

Solution: Implement a document management system with automatic backups and 5+ year retention.

6. Ignoring Form 15CA/15CB Requirements

For certain large-value transactions, these forms are mandatory. Proceeding without them can result in tax penalties.

Solution: Establish a threshold check system—any transaction above certain limits triggers a CA consultation.

Methods of Receiving International Payments

Choosing the right payment method affects speed, cost, and convenience. Here’s a comparison:

| Method | Processing Time | Best For | Cost | Compliance |

| SWIFT | 1-3 business days | Business payments, salaries, exports | Moderate ($15-50) | Full documentation required |

| Online Money Transfer (Wise, Remitly, XOOM) | Within 24 hours | Personal remittances, small amounts | Low to moderate | Simplified for personal use |

| Foreign Currency Demand Drafts | 10-15 business days | Donations, scholarships | Moderate | Traditional documentation |

| MTSS (Western Union, MoneyGram) | Real-time to 1 day | Emergency funds, gifts | Location-dependent | Limited to $2,500/transaction |

| Modern Fintech Platforms | 1 business day | Businesses, startups, exporters | Competitive | Built-in compliance support |

Factors to Consider When Choosing

- Transaction size: SWIFT for large B2B payments, MTSS for small personal transfers

- Urgency: Need it today? MTSS. Can wait? SWIFT offers better rates for large amounts.

- Frequency: Regular business payments benefit from platform accounts with negotiated rates

- Compliance complexity: Platforms with built-in compliance reduce your administrative burden

- Exchange rates: Compare rates across providers—even 0.5% difference on $10,000 is $50

How Indian Businesses Can Simplify Inward Remittances

The complexity of receiving international payments, juggling purpose codes, compliance documentation, bank fees, and processing delays, can overwhelm businesses focused on growth. Here’s how modern Indian businesses are streamlining their inward remittance processes.

Choose the Right Payment Infrastructure

Traditional Banking Limitations:

- Manual documentation processes

- High FX markups (2-3% above interbank rates)

- Slow processing (3-5 business days typical)

- Limited visibility into transaction status

- Separate systems for compliance and payments

Modern Fintech Solutions:

- Automated compliance workflows with built-in purpose code selection

- Competitive forex rates (0.3-1% markup)

- Faster processing (12-48 hours)

- Real-time tracking and notifications

- Integrated dashboards for payments, documents, and compliance

Key Features to Look For: Simplifying Inward Remittances

When evaluating platforms for receiving international payments, prioritise these capabilities:

1. Multi-Currency Collection Accept payments in USD, EUR, GBP, and other major currencies without maintaining foreign bank accounts. The platform should handle currency conversion transparently with competitive rates.

2. Built-In Compliance Look for platforms that:

- Auto-populate purpose codes based on transaction type

- Generate e-FIRA and required documentation automatically

- Integrate with EDPMS for seamless export reporting

- Maintain audit trails for FEMA compliance

3. Transparent Pricing: Avoid platforms with hidden fees. Look for:

- Clear breakdown of all charges upfront

- No surprise intermediary fees

- Competitive and published FX rates

- Volume-based pricing for regular receivers

4. API Integration. For businesses processing multiple transactions, API access allows:

- Direct integration with accounting software

- Automated invoice-payment reconciliation

- Custom reporting and analytics

- Embedded payment collection in your platform

5. Fast Settlement Time is money. Platforms offering 24-48 hour settlement to your Indian bank account improve cash flow significantly compared to traditional 5-7 day bank transfers.

For businesses scaling globally, reducing the friction in receiving international payments directly impacts cash flow and operational efficiency. Solutions like Decentro ensure that while you focus on serving clients worldwide, your payment infrastructure works quietly and efficiently in the background.

Best Practices for Managing Inward Remittances

Beyond compliance, smart management of your international payments can improve cash flow and reduce headaches.

Set Up Proper Systems

- Dedicated business account: Keep international payments separate from domestic transactions for easier tracking

- Automated invoicing: Use software that generates invoices with correct purpose codes and client details

- Payment tracking spreadsheet: Record expected payments, actual receipt dates, and document status

Communication is Key

- Inform clients early: Provide complete bank details, purpose codes, and any special instructions before work begins

- Confirm payment initiation: Ask clients to notify you when payment is sent with reference numbers

- Follow up promptly: If payment doesn’t arrive within expected timeframe, check with both client and bank

Optimize Your Costs

- Negotiate bank charges: If you receive regular high-value payments, discuss preferential rates with your bank

- Time transactions strategically: Large payments during favorable exchange rate periods can significantly impact your bottom line

- Consider forex hedging: For predictable large payments, explore hedging to lock in rates

Maintain Compliance Hygiene

- Monthly reconciliation: Match all received payments against invoices monthly, not quarterly

- Quarterly compliance review: Check that all e-FIRAs are collected, EDPMS entries closed, and documents archived

- Annual audit preparation: Organise all remittance documents ahead of year-end to streamline tax filing

Looking Ahead: The Future of Inward Remittances in India

The RBI projects India will receive $160 billion in remittances by 2029, driven by continued growth in skilled workforce migration and expanding opportunities in advanced economies.

Several trends are shaping the future:

Digital-First Solutions: Digital remittances accounted for 73.5% of total transactions in 2023-24, a trend that will only accelerate with fintech innovation.

Regulatory Evolution: The RBI continues to refine FEMA guidelines, generally moving toward simplified compliance for bona fide business transactions while maintaining vigilance against money laundering.

Blockchain and DLT: Distributed ledger technology promises faster, cheaper cross-border payments with built-in compliance tracking.

API-First Banking: The rise of neo-banking and embedded finance means international payment capabilities will be built directly into business software and platforms.

For Indian businesses, the message is clear: understanding inward remittance compliance isn’t optional—it’s a core competency for anyone operating in the global market.

Conclusion

Inward remittances represent more than just money flowing into India—they reflect the success of Indian talent and businesses on the global stage. Whether you’re a solo freelancer invoicing your first international client or a growing startup receiving venture funding from overseas, understanding the compliance framework is essential.

The key takeaways:

- India is the world’s largest remittance recipient, making this a well-established, mature ecosystem

- FEMA and RBI guidelines provide clear (if sometimes complex) rules for compliance

- Purpose codes, e-FIRA, and EDPMS reporting are non-negotiable requirements

- Proper documentation and timely reporting prevent delays and penalties

- Tax implications vary based on transaction nature—professional income is taxable, gifts generally aren’t

- Modern fintech solutions like Decentro can significantly reduce compliance burden

As cross-border commerce continues to grow, your ability to receive international payments smoothly and compliantly will increasingly determine your competitive advantage. Invest time in understanding the system, set up proper processes, and consider leveraging specialized platforms designed to make inward remittances seamless.

The global marketplace is open for business. With the right knowledge and tools, you’re ready to receive what you’ve earned, compliantly and efficiently.

Let’s Connect

Frequently Asked Questions

Is there a limit to how much I can receive as an inward remittance?

No, there’s no upper limit for most inward remittances under the Rupee Drawing Arrangement. However, trade-related transactions may have a ₹15,00,000 per transaction cap depending on the nature of the payment. The MTSS scheme is limited to USD 2,500 per transfer with a maximum of 30 transfers per year.

Do I need to pay tax on all inward remittances?

No. Personal gifts from relatives, support for education, and capital transfers are generally not taxable. However, professional income, payments for services rendered, and non-relative gifts above ₹50,000 are taxable under Indian income tax laws.

What is the difference between e-FIRA and FIRC?

e-FIRA (Electronic Foreign Inward Remittance Advice) is the digital successor to FIRC (Foreign Inward Remittance Certificate). Both serve the same purpose, official proof of foreign payment receipt, but e-FIRA is faster to generate and easier to manage.

How long does it take to receive an international payment in India?

SWIFT transfers typically take 1-3 business days, while modern fintech platforms can process payments within 1 business day. Traditional methods like demand drafts can take 10-15 days. Actual timing depends on the sender’s bank, intermediary banks involved, and compliance verification.

Can I receive payments in foreign currency directly?

As an Indian resident, you generally receive payments in INR after currency conversion. However, you can maintain an NRE (Non-Resident External) account if you’re an NRI, or an FCNR (Foreign Currency Non-Resident) account, which allows holding funds in foreign currency. Consult your bank about specific account types based on your resident status.

What happens if I use the wrong purpose code?

Using an incorrect purpose code can delay your payment while the bank seeks clarification. In some cases, it may result in the payment being held pending documentation review. Always verify the purpose code matches your invoice and service type before submitting to your bank.

Do I need a chartered accountant to handle inward remittances?

For straightforward business payments with proper documentation, you can manage compliance yourself. However, for high-value transactions, complex tax situations, or if Form 15CA/15CB is required, consulting a CA is advisable. They can ensure you’re not missing any compliance requirements or tax optimisation opportunities.