Discover how AI Fraud Detection transforms banking security with real-time monitoring, accuracy, and RBI-compliant automation.

AI Fraud Detection in Banking: Real-Time Security & Compliance

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Executive Summary

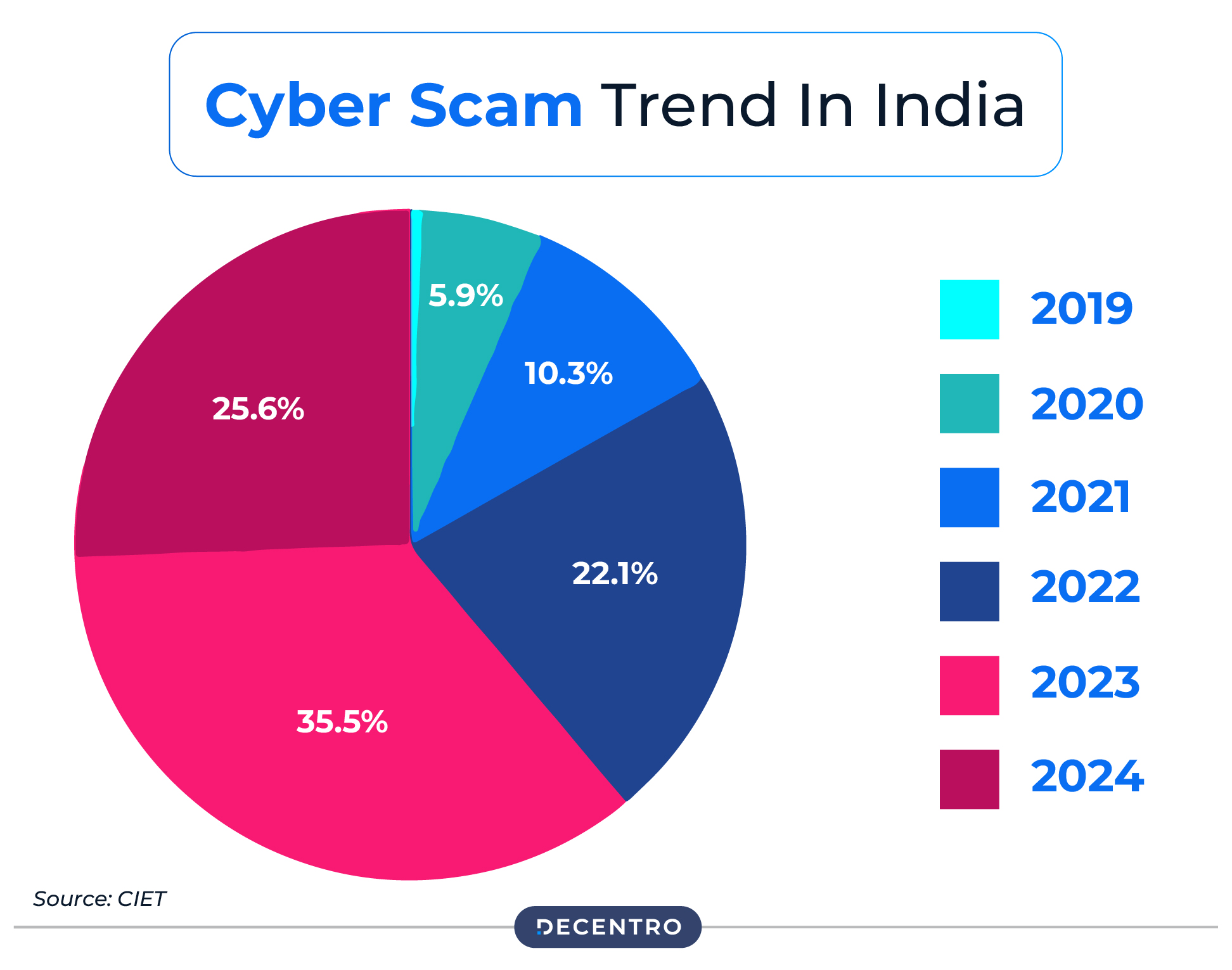

India’s banking sector faces an unprecedented fraud crisis, with financial institutions losing ₹36,014 crore to fraud in FY 2024-25 alone—a staggering 194% increase from the previous year. As digital transactions surge across the country, traditional rule-based fraud detection systems are failing to keep pace with increasingly sophisticated criminal networks

Artificial Intelligence emerges as the game-changing solution, offering real-time fraud detection with 99.1% accuracy while reducing false positives by 80%. This comprehensive guide examines how AI is transforming fraud detection in Indian banking, regulatory compliance frameworks, and practical implementation strategies for startup founders, lenders, and online business owners navigating India’s evolving financial landscape.

The Growing Fraud Epidemic in Indian Banking

Current Market Reality

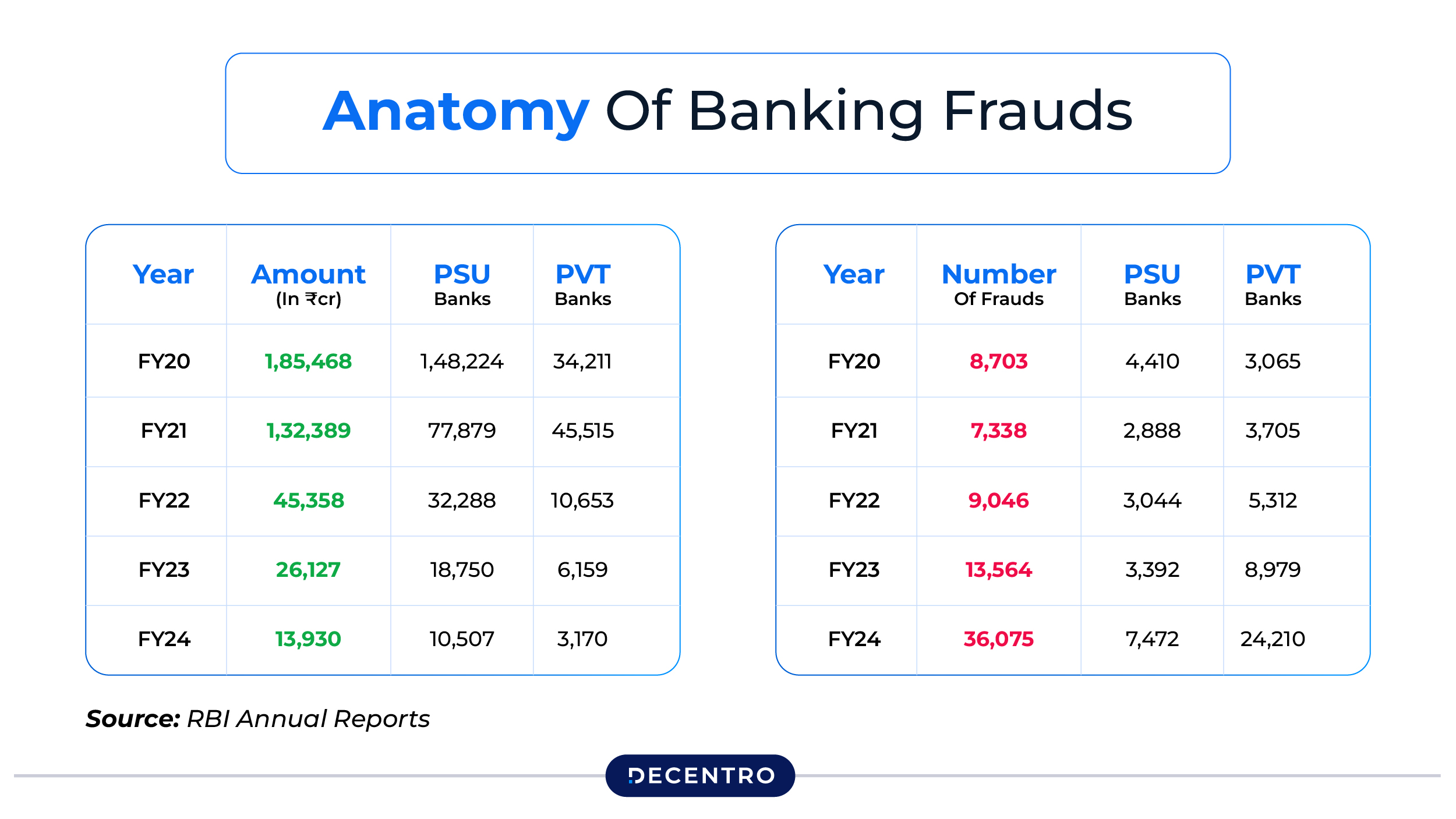

India’s digital economy boom has inadvertently created a fertile ground for financial criminals. Between April 2024 and January 2025, the country reported 24 lakh digital fraud incidents, resulting in losses worth ₹4,245 crore—a 67% increase year-over-year. The scale of this challenge becomes evident when examining the breakdown of fraud distribution across different banking segments :

- Public sector banks: ₹25,667 crore (71% of total losses)

- Private banks: Over 14,000 incidents (highest case count)

- Digital payment frauds: 56% of all cases by volume

Traditional Detection Methods: Why They’re Failing

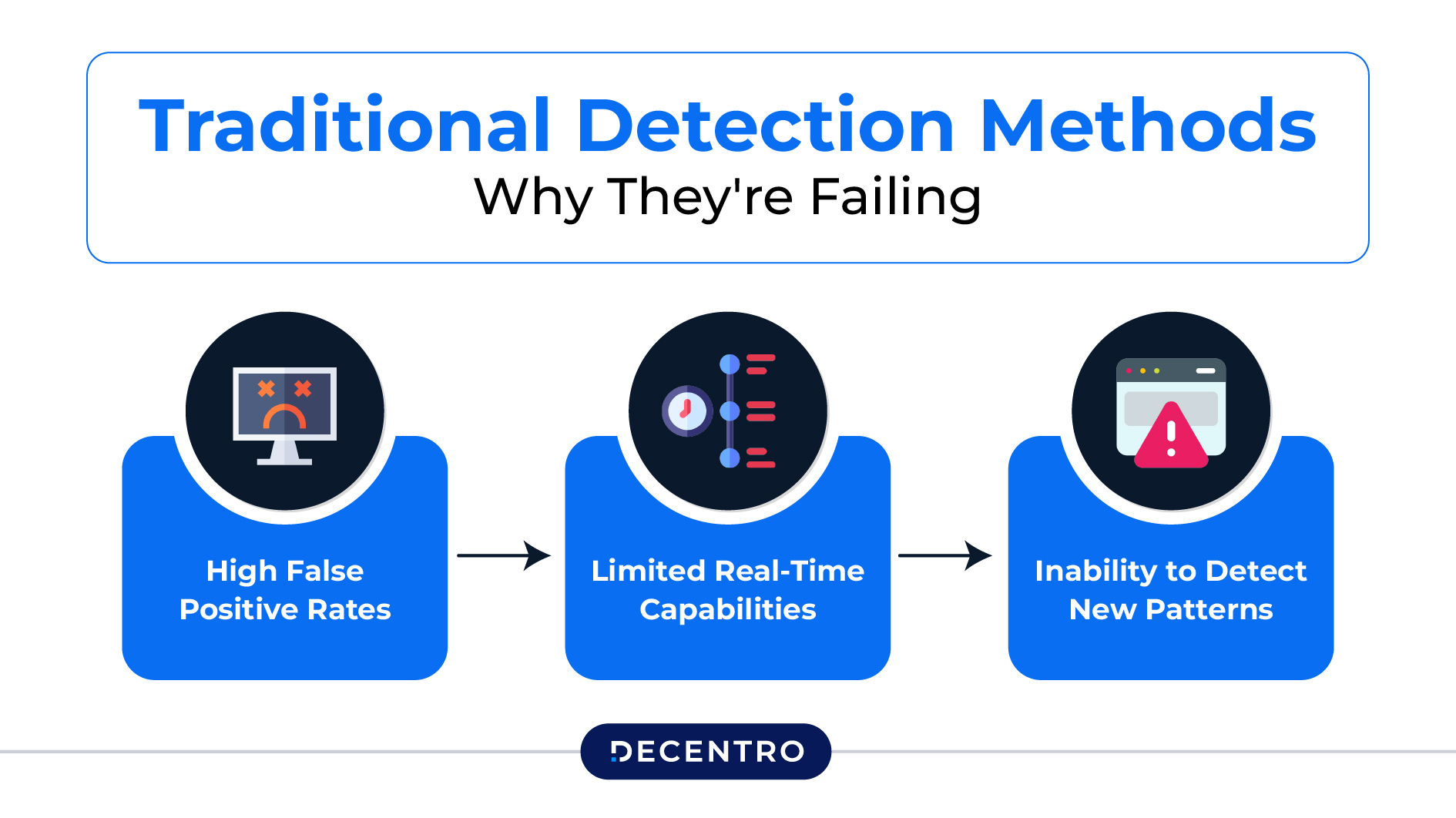

Legacy fraud detection systems rely heavily on static rules and historical patterns, making them inadequate for today’s dynamic threat landscape. These systems suffer from several critical limitations:

High False Positive Rates: Traditional systems generate excessive false alerts, overwhelming compliance teams and creating customer friction. Studies indicate that conventional systems decline legitimate transactions in 20% of cases, particularly affecting travellers and online shoppers.

Limited Real-Time Capabilities: Rule-based systems process transactions in batches, creating detection delays that allow fraudsters to complete illicit activities before alerts are triggered.

Inability to Detect New Patterns: Static rule sets cannot adapt to emerging fraud techniques, leaving institutions vulnerable to novel attack vectors.

How AI Revolutionises Fraud Detection in Banking

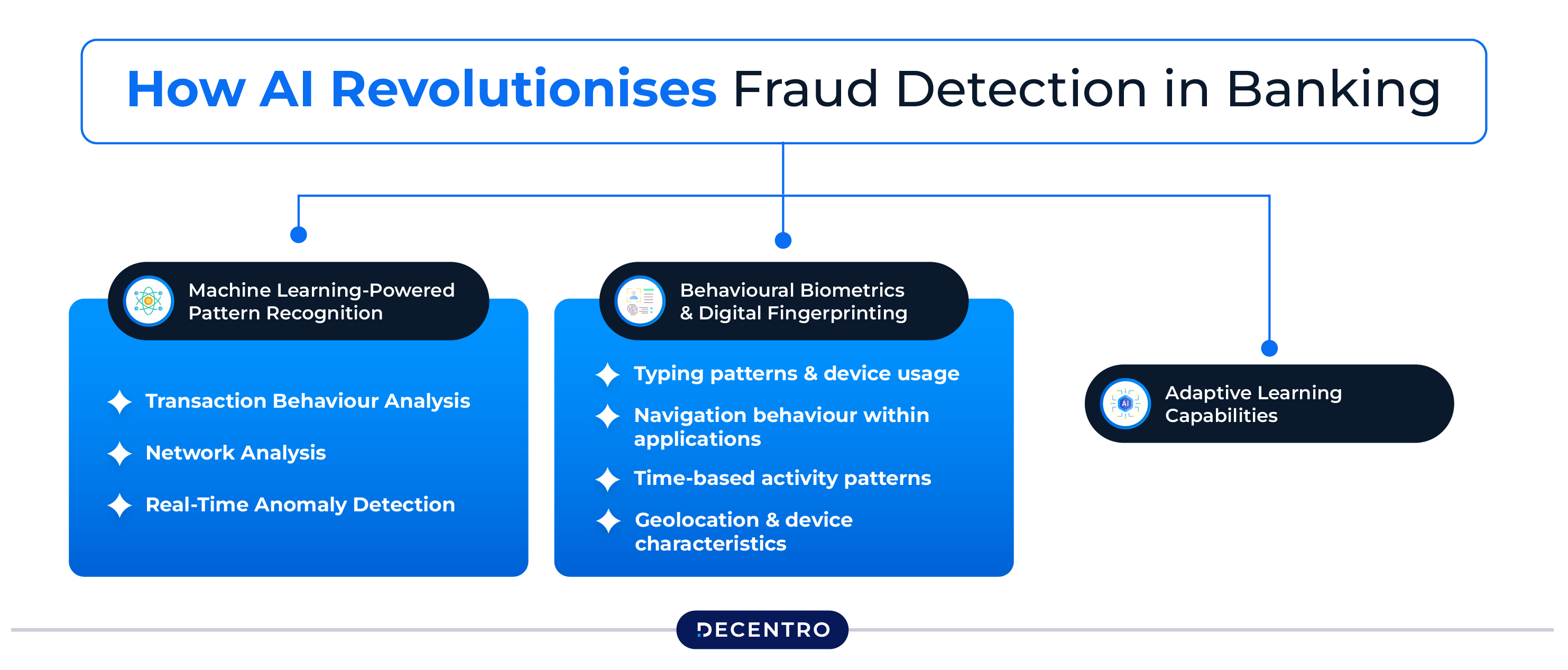

Machine Learning-Powered Pattern Recognition

AI systems excel at identifying subtle patterns across massive datasets that human analysts would miss. Advanced algorithms analyse multiple data dimensions simultaneously, including:

Transaction Behaviour Analysis: Machine learning models examine spending patterns, transaction timing, geographical locations, and merchant categories to establish individual customer baselines.

Network Analysis: AI identifies suspicious connections between accounts, detecting coordinated fraud rings and money mule networks that traditional systems cannot recognise.

Real-Time Anomaly Detection: Neural networks process transactions in milliseconds, flagging suspicious activities before they are completed.

Behavioural Biometrics and Digital Fingerprinting

Modern AI fraud detection incorporates behavioral biometrics to create unique digital fingerprints for each user. These systems analyse

- Typing patterns and device usage

- Navigation behaviour within applications

- Time-based activity patterns

- Geolocation and device characteristics

This multifaceted approach creates robust user profiles that are nearly impossible for fraudsters to replicate.

Adaptive Learning Capabilities

Unlike static rule-based systems, AI models continuously learn from new fraud attempts, automatically updating detection parameters. This self-improving capability ensures that detection accuracy increases over time while maintaining low false positive rates.

Indian Regulatory Framework: RBI’s FREE-AI Initiative

Reserve Bank’s Strategic Vision

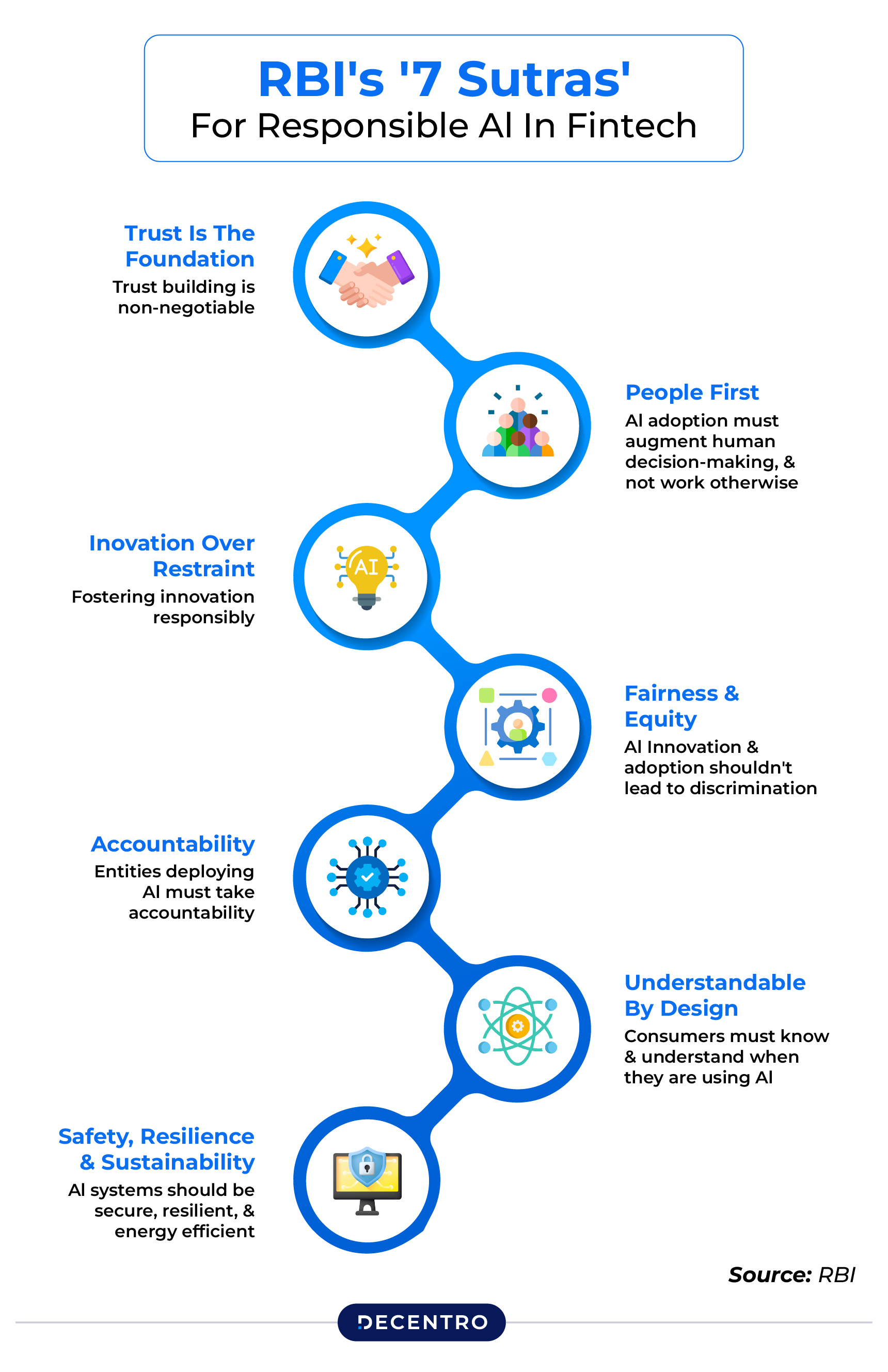

The Reserve Bank of India has taken a proactive stance on AI adoption in financial services through its Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI), released in August 2025. This comprehensive framework establishes seven guiding principles:

- Trust: AI must strengthen confidence in digital financial services

- People First: Human oversight remains paramount in AI decision-making

- Innovation over Restraint: Encouraging technological advancement while maintaining safety

- Fairness: Ensuring consistent outcomes across customer segments

- Accountability: Clear responsibility chains for AI decisions

- Understandability by Design: AI decisions must be explainable and auditable

- Safety: Robust risk management and continuous monitoring

Compliance Requirements for Financial Institutions

The FREE-AI framework mandates specific requirements for AI implementation in fraud detection:

Explainability Standards: All AI-driven fraud decisions must be interpretable and regulator-ready, enabling institutions to provide clear reasoning for blocking transactions or flagging accounts.

Bias Prevention: AI models must deliver consistent outcomes across different customer demographics, preventing discriminatory practices.

Data Governance: Strict protocols for data usage, ensuring minimal collection, proper consent, and privacy protection.

Continuous Monitoring: Ongoing assessment of AI model performance with transparent oversight mechanisms.

Statistical Impact: AI’s Transformation of Indian Banking Security

Quantifiable Improvements

Recent implementation data reveals AI’s dramatic impact on fraud prevention in Indian banking:

Detection Accuracy: AI systems achieve 99.1% accuracy rates compared to 65-70% for traditional rule-based systems.

False Positive Reduction: 80% decrease in legitimate transaction blocks, significantly improving customer experience.

Cost Savings: Indian banks save an estimated ₹3,000 crore annually through the use of AI-powered fraud prevention.

Processing Speed: Real-time transaction analysis compared to batch processing delays in legacy systems.

Case Volume Efficiency: AI-based systems contributed to a 25% reduction in online banking fraud cases in fiscal 2024-25.

Sector-Specific Performance Metrics

Different banking segments have experienced varying levels of AI adoption success:

Credit Card Fraud: AI systems have proven particularly effective in detecting credit card fraud, with some institutions reporting a 60% reduction in fraud rates.

UPI Transaction Monitoring: Real-time AI analysis of UPI transactions has significantly reduced payment fraud, particularly in high-volume scenarios.

Account Takeover Prevention: Behavioural analysis algorithms have improved account security by detecting unauthorised access attempts with 95%+ accuracy.

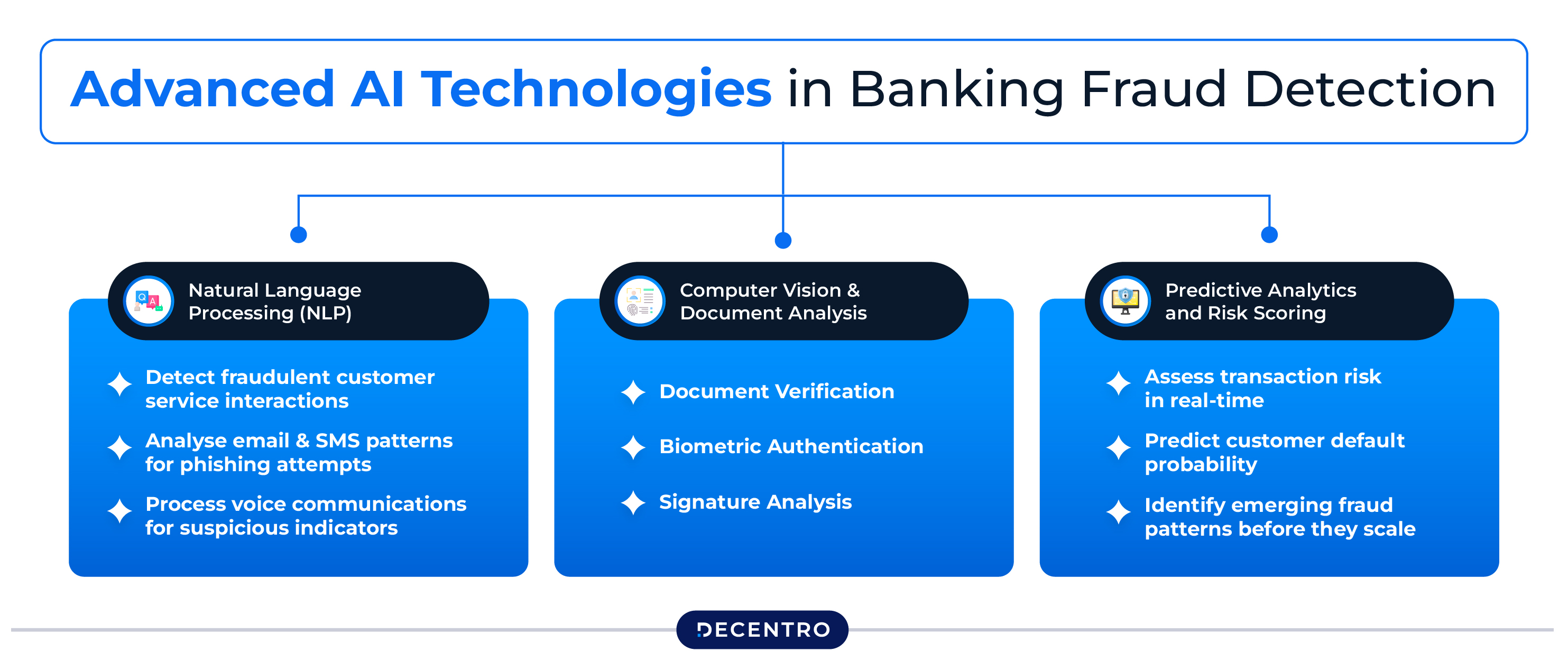

Advanced AI Technologies in Banking Fraud Detection

Natural Language Processing (NLP)

AI systems utilise NLP to analyse customer communications, identifying social engineering attempts and phishing communications. These systems can:

- Detect fraudulent customer service interactions.

- Analyse email and SMS patterns for phishing attempts.

- Process voice communications for suspicious indicators

Computer Vision and Document Analysis

Advanced image recognition capabilities enable AI systems to detect document forgery and manipulation with high accuracy. Key applications include:

Document Verification: Automated detection of altered identity documents, bank statements, and financial records.

Biometric Authentication: Real-time facial recognition and liveness detection to prevent identity spoofing.

Signature Analysis: AI-powered signature verification for high-value transactions and account openings.

Predictive Analytics and Risk Scoring

AI systems generate dynamic risk scores that adapt to changing customer behaviour and market conditions. These predictive models:

- Assess transaction risk in real-time

- Predict customer default probability

- Identify emerging fraud patterns before they scale

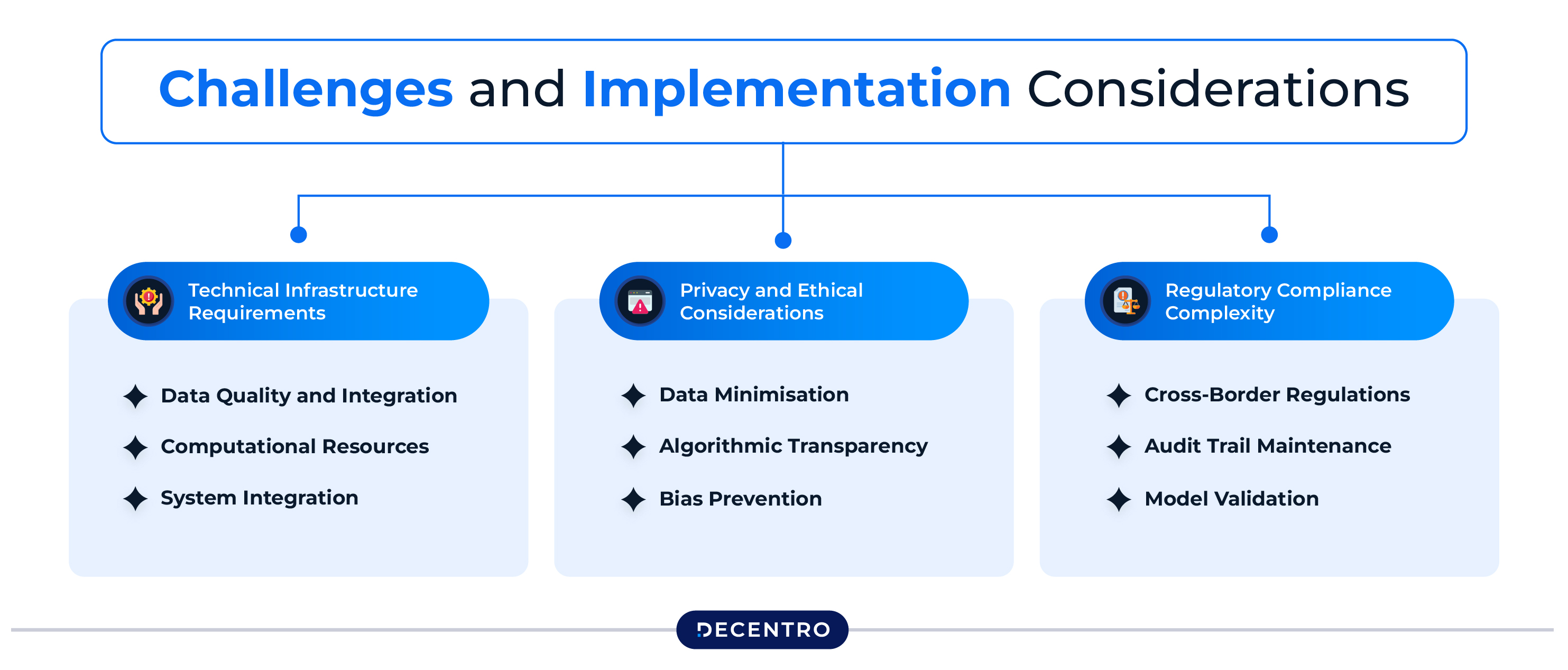

Challenges and Implementation Considerations

Technical Infrastructure Requirements

Successful AI fraud detection implementation requires substantial technical infrastructure:

Data Quality and Integration: AI systems require clean, comprehensive data from multiple sources. Poor data quality can significantly impact the accuracy and reliability of models.

Computational Resources: Real-time AI processing requires substantial computing power, particularly for institutions that handle high transaction volumes.

System Integration: Seamless integration with existing banking infrastructure often requires significant system modifications and API development.

Privacy and Ethical Considerations

AI implementation must balance fraud prevention effectiveness with customer privacy rights:

Data Minimisation: Collecting only necessary data for fraud detection while respecting customer privacy preferences.

Algorithmic Transparency: Ensuring AI decision-making processes remain understandable and auditable for regulatory compliance.

Bias Prevention: Regular testing and adjustment of AI models to prevent discriminatory outcomes across different customer groups.

Regulatory Compliance Complexity

Financial institutions must navigate complex regulatory requirements while implementing AI solutions:

Cross-Border Regulations: International transactions require compliance with multiple jurisdictional requirements.

Audit Trail Maintenance: Comprehensive documentation of AI decision-making processes for regulatory review.

Model Validation: Regular testing and validation of AI models to ensure continued effectiveness and compliance.

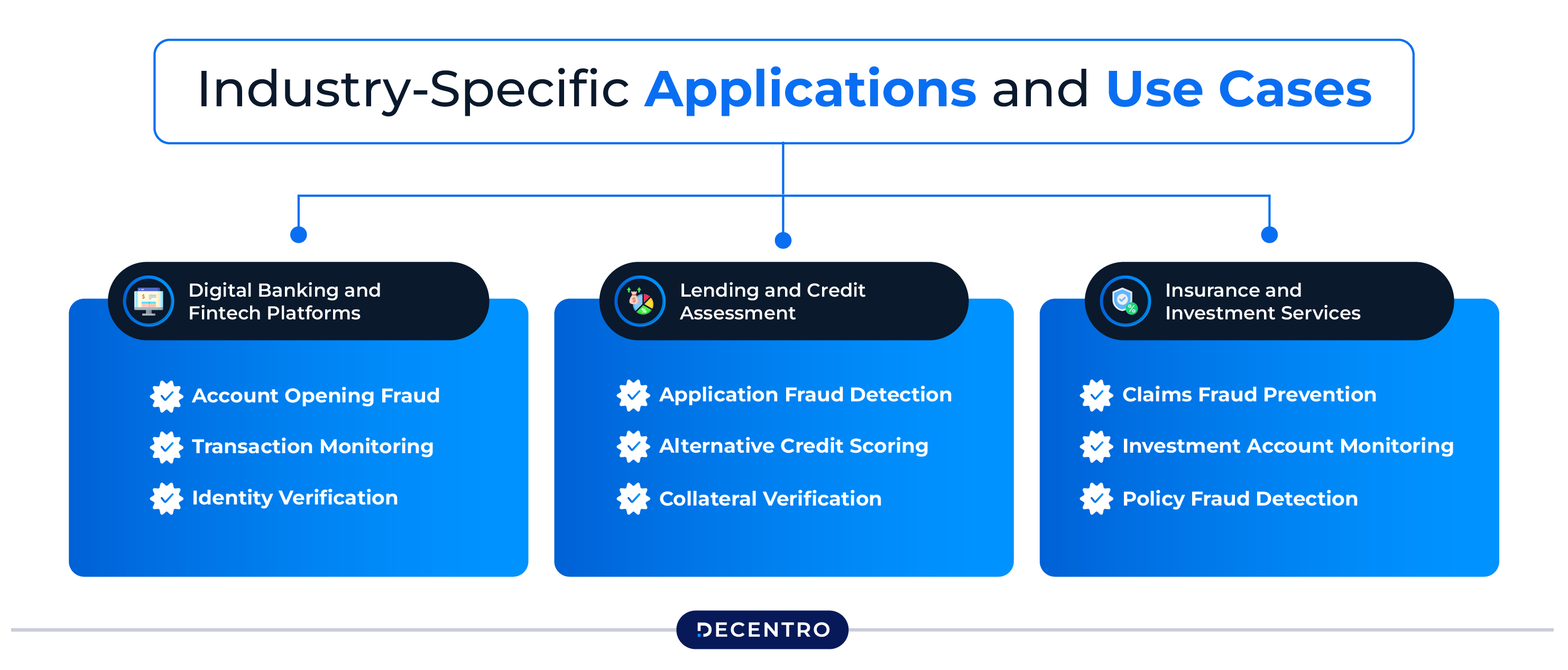

Industry-Specific Applications and Use Cases

Digital Banking and Fintech Platforms

Account Opening Fraud: AI systems analyse application data, device fingerprints, and behavioural patterns to identify fraudulent account creation attempts.

Transaction Monitoring: Real-time analysis of payment patterns, merchant interactions, and fund transfers to detect suspicious activities.

Identity Verification: Advanced biometric authentication and document verification using computer vision and machine learning algorithms.

Lending and Credit Assessment

Application Fraud Detection: AI models assess loan applications for inconsistencies, forged documents, and misrepresented information.

Alternative Credit Scoring: Machine learning algorithms analyse non-traditional data sources to assess creditworthiness for customers without conventional credit histories.

Collateral Verification: Automated verification of asset documentation and valuation for secured lending products.

Insurance and Investment Services

Claims Fraud Prevention: AI systems analyse claim patterns, medical records, and supporting documentation to identify fraudulent insurance claims.

Investment Account Monitoring: Sophisticated algorithms detect market manipulation, insider trading, and unauthorised investment activities.

Policy Fraud Detection: Behavioral analysis identifies potential fraud in life insurance applications and policy modifications.

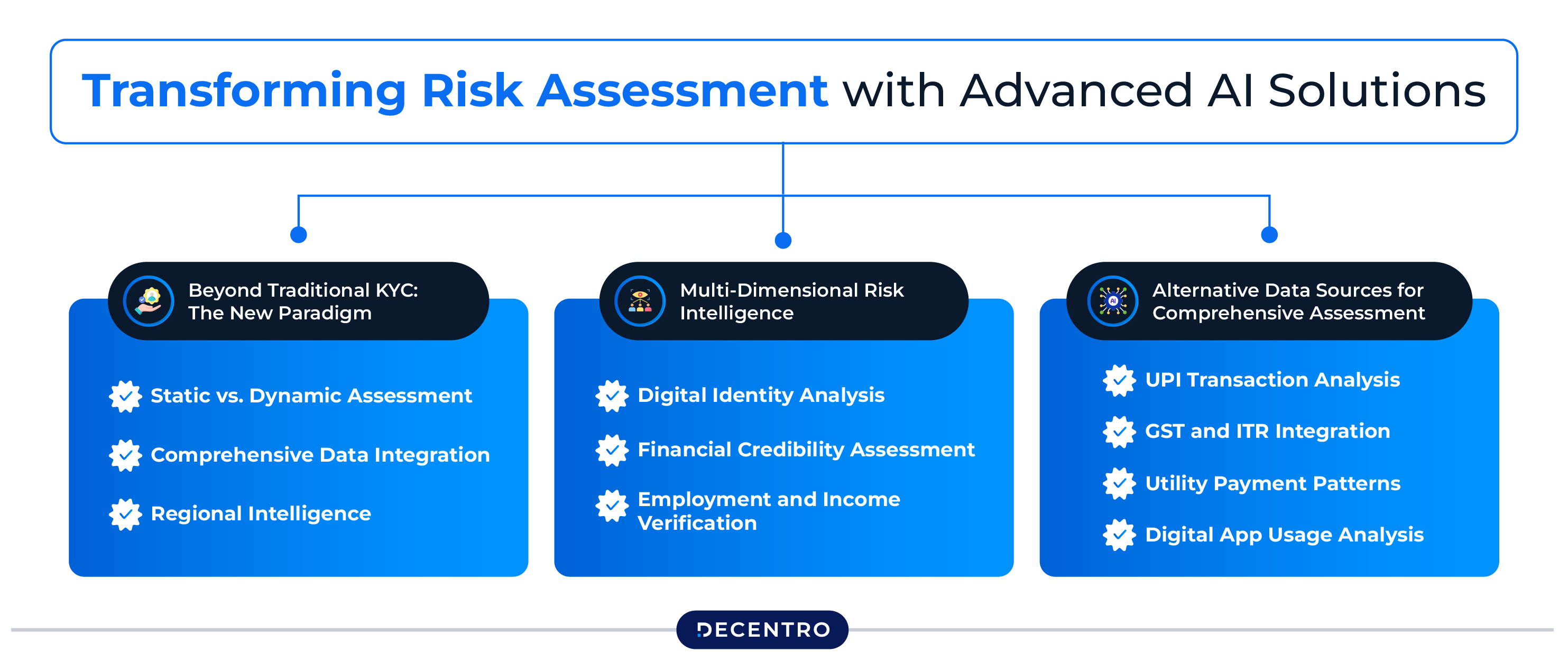

Transforming Risk Assessment with Advanced AI Solutions

Beyond Traditional KYC: The New Paradigm

Modern AI-powered risk assessment transcends conventional Know Your Customer (KYC) processes by incorporating dynamic behavioural analysis and real-time intelligence. This evolution addresses critical limitations of traditional risk rating systems:

Static vs. Dynamic Assessment: Traditional systems assign risk ratings once and rarely update them, while AI systems continuously reassess risk based on evolving customer behaviour and market conditions.

Comprehensive Data Integration: AI platforms analyse over 100 behavioural signals in real-time, providing a 360-degree view of customer trustworthiness that goes far beyond basic credit scores.

Regional Intelligence: AI systems trained specifically on Indian market conditions can better detect fraud patterns unique to the subcontinent, from urban sophistication to rural innovation schemes.

Multi-Dimensional Risk Intelligence

Advanced AI fraud detection platforms employ three distinct intelligence layers:

Digital Identity Analysis: Deep evaluation of mobile number usage patterns, device characteristics, and location behaviour to establish authentic digital footprints.

Financial Credibility Assessment: Analysis of banking relationships, transaction histories, and credit-related data through permissioned access to comprehensive financial profiles.

Employment and Income Verification: Multi-source validation of employment claims, income stability, and professional credentials through digital footprint analysis.

This multi-dimensional approach enables financial institutions to make informed decisions about customer onboarding and ongoing risk management with unprecedented accuracy.

Alternative Data Sources for Comprehensive Assessment

AI systems leverage India’s robust digital infrastructure to access diverse data sources for risk assessment:

UPI Transaction Analysis: Machine learning algorithms analyse spending patterns across India’s Unified Payments Interface to build comprehensive behavioural profiles.

GST and ITR Integration: Automated verification of business income and tax compliance through direct integration with government databases.

Utility Payment Patterns: Assessment of electricity, water, gas, and telecom payment histories as indicators of financial responsibility.

Digital App Usage Analysis: Evaluation of financial application engagement patterns and digital literacy indicators.

Enhanced Fraud Prevention Through Intelligent Automation

Real-Time Transaction Monitoring

Modern AI fraud detection systems process millions of transactions simultaneously, identifying suspicious patterns within milliseconds of transaction initiation. Key capabilities include:

Network Relationship Analysis: Advanced algorithms identify connections between suspected fraudulent accounts, detecting organised crime networks and money mule operations.

Behavioural Pattern Recognition: AI systems establish individual customer baselines and immediately flag deviations that suggest account compromise or unauthorised usage.

Cross-Channel Monitoring: Comprehensive analysis across multiple transaction channels—mobile banking, internet banking, ATM, and point-of-sale—provides holistic fraud detection coverage.

Automated Decision-Making and Response

AI-powered fraud detection systems enable automated responses to detected threats:

Real-Time Transaction Blocking: The immediate suspension of suspicious transactions before fund transfer completion, thereby preventing financial losses.

Risk-Based Authentication: Dynamic adjustment of authentication requirements based on real-time risk assessment, balancing security with customer experience.

Automated Alert Generation: Intelligent prioritisation of fraud alerts, reducing false positives and enabling fraud analysts to focus on genuine threats.

Leveraging Advanced Technology for Modern Banking Security

Decentro’s Scanner: Next-Generation Fraud Detection

As financial institutions seek comprehensive fraud prevention solutions, advanced platforms like Decentro’s Scanner offer integrated fraud detection and user intelligence capabilities specifically designed for the Indian market.

Scanner’s comprehensive approach addresses the full spectrum of fraud detection requirements:

Document and Identity Verification: Advanced computer vision technology detects forged documents, manipulated images, and identity spoofing attempts with high accuracy rates.

Behavioural Intelligence: Real-time analysis of user behaviour patterns, device characteristics, and interaction patterns to identify suspicious activities.

Financial Crime Prevention: Specialised algorithms for detecting money laundering schemes, mule account networks, and organised fraud operations.

Omniscore: Revolutionary Risk Assessment

Omniscore represents a paradigm shift in customer risk evaluation, moving beyond traditional credit scoring to provide dynamic, multi-dimensional risk assessment. This proprietary scoring system offers:

Alternative Credit Assessment: Comprehensive evaluation of customers without conventional credit histories through analysis of digital behaviour, utility payments, and employment verification.

Real-Time Risk Updates: Continuous reassessment of customer risk profiles based on changing behaviour patterns and external factors.

Industry-Specific Models: Tailored risk assessment algorithms for different sectors including banking, lending, insurance, and cryptocurrency platforms.

The system integrates seamlessly with existing financial infrastructure while providing immediate fraud detection insights that enable institutions to make informed decisions about customer onboarding and ongoing risk management.

Comprehensive API Integration

Modern fraud detection solutions offer plug-and-play integration capabilities that minimise implementation complexity:

Mule Detection API: Specialised algorithms for identifying money mule accounts and networks through transaction pattern analysis and behavioural signals.

Real-Time Risk Scoring API: Immediate risk assessment capabilities that provide instant fraud probability scores for customer transactions and account activities.

Document Verification Suite: Advanced optical character recognition and computer vision technologies for automated document analysis and verification.

These integrated solutions enable financial institutions to deploy sophisticated fraud detection capabilities without requiring extensive infrastructure modifications, thereby accelerating the time-to-market for enhanced security measures.

Future Trends and Strategic Implications

Emerging Technologies in Fraud Detection

The next generation of AI fraud detection will incorporate several emerging technologies:

Quantum Computing Applications: Advanced cryptographic analysis and pattern recognition capabilities that will revolutionise fraud detection accuracy and speed.

Federated Learning: Collaborative AI systems that enable financial institutions to share fraud intelligence while maintaining data privacy and competitive advantage.

Edge Computing Integration: Real-time fraud detection processing at the transaction point, reducing latency and improving customer experience.

Strategic Considerations for Financial Institutions

Investment in AI Infrastructure: Organisations must balance the substantial upfront costs of AI implementation with long-term fraud prevention savings and improved operational efficiency.

Talent and Capability Development: Building internal expertise in AI fraud detection requires significant investment in training and recruitment of specialised personnel.

Regulatory Compliance Evolution: Staying ahead of evolving regulatory requirements while maintaining the effectiveness of AI systems requires ongoing attention and resources.

Conclusion

India’s financial sector stands at a critical juncture where traditional fraud detection methods prove inadequate against increasingly sophisticated criminal networks. With fraud losses reaching ₹36,014 crore in FY 2024-25 and digital payment fraud incidents growing by 67% year-over-year, the urgency for advanced fraud detection solutions has never been greater.

Artificial Intelligence emerges not merely as a technological upgrade, but as a fundamental transformation in how financial institutions approach fraud prevention. AI systems delivering 99.1% detection accuracy while reducing false positives by 80% demonstrate clear superiority over legacy rule-based systems. The RBI’s FREE-AI framework provides a structured pathway for the responsible adoption of AI, ensuring that technological advancements align with regulatory compliance and ethical considerations.

For startup founders, lenders, and online business owners, the message is clear: AI-powered fraud detection is no longer optional—it’s essential for survival in India’s digital economy. Organizations that embrace comprehensive solutions combining real-time transaction monitoring, behavioural analysis, and alternative risk assessment will capture competitive advantages while protecting their customers and stakeholders.

The future belongs to financial institutions that can strike a balance between innovation and compliance, speed and security, and growth and responsibility. As India’s fintech market is expected to reach ₹36.47 lakh crore by 2029, those who master AI-powered fraud detection will lead this transformation and capture the largest share of this unprecedented growth opportunity.

Advanced platforms like Decentro’s Scanner and OmniScore represent the next generation of fraud detection technology, specifically engineered for Indian market conditions and regulatory requirements. These solutions demonstrate how modern AI can transform traditional risk assessment into dynamic, comprehensive fraud prevention that scales with India’s digital revolution.

The question for financial institutions is not whether to adopt AI fraud detection, but how quickly they can implement these technologies to protect their customers, comply with regulations, and capture the opportunities of India’s digital financial future.

Ready to transform your fraud detection capabilities?