Discover how AI Shopping Agents use behavioral data to deliver smarter shopping journeys, prevent fraud instantly, and increase customer conversions

AI Shopping Agents: Boost Conversions & Stop Checkout Fraud

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Executive Summary

AI Shopping Agents are transforming the digital commerce landscape by combining personalised customer experiences with robust fraud prevention capabilities. These intelligent systems analyse over 100 behavioural signals in real-time, delivering unprecedented accuracy in fraud detection while enhancing user engagement.

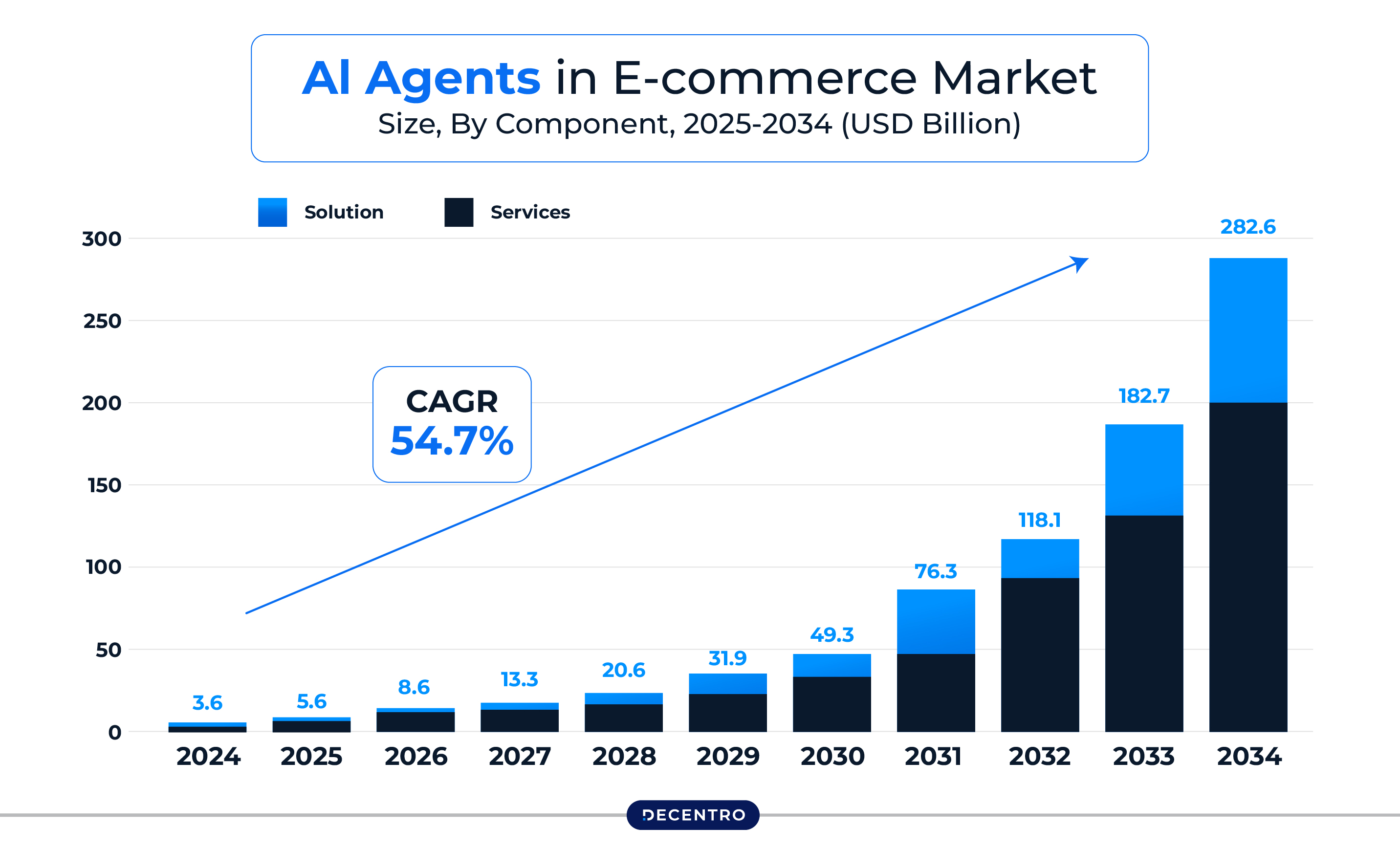

For Indian startup founders and online business owners, understanding and implementing AI-powered shopping agents isn’t just about staying competitive—it’s about survival in a market projected to reach $136.43 billion by 2025, where fraud losses alone could hit $48 billion globally. This comprehensive guide explores how AI shopping agents can revolutionise your e-commerce operations while protecting your business from evolving fraud threats.

The Indian E-commerce Boom: Setting the Context

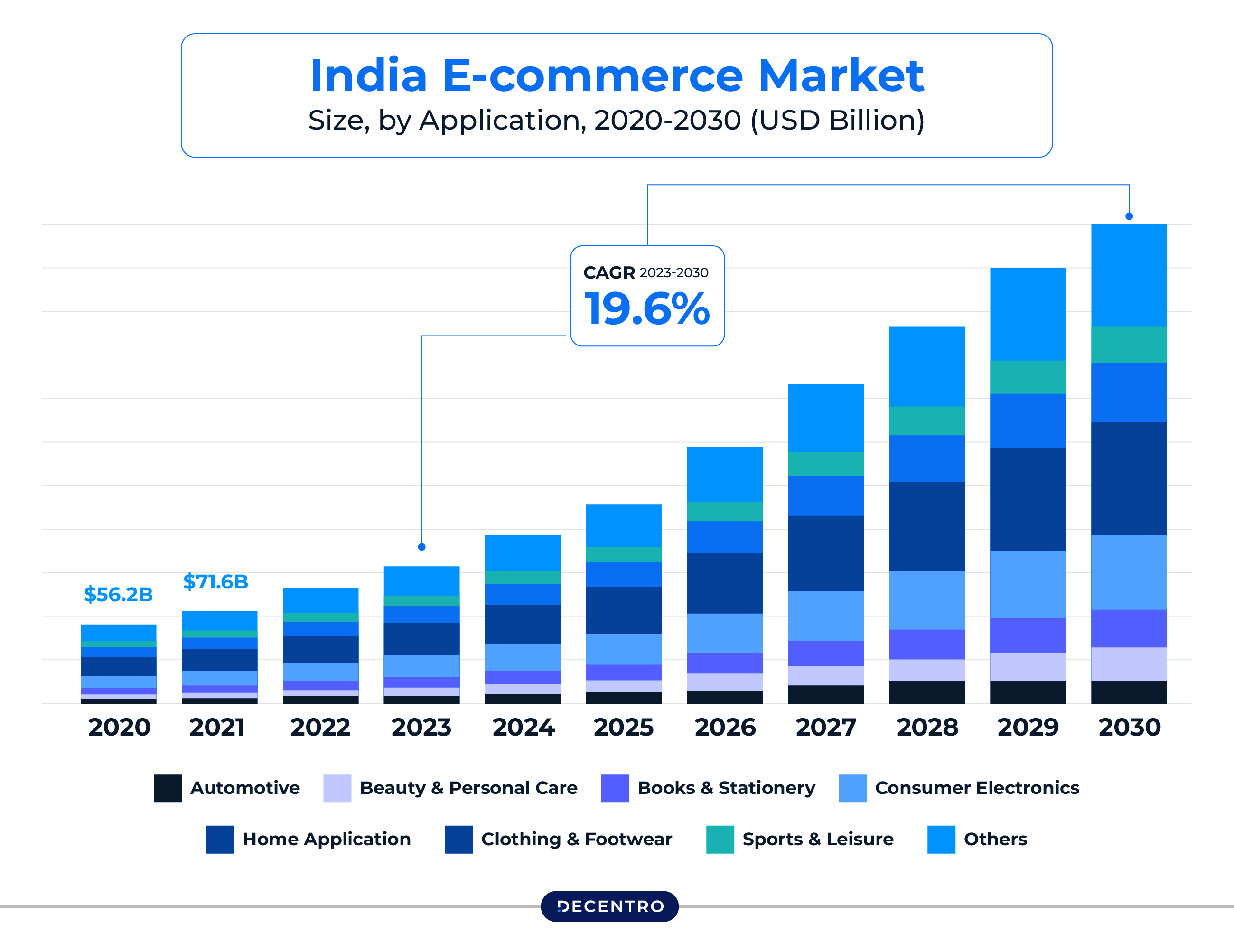

India’s digital commerce revolution is unprecedented in scale and velocity. The country’s e-retail market has surged to approximately $60 billion in gross merchandise value (GMV), boasting the world’s second-largest online shopper base. According to the India Brand Equity Foundation, the e-commerce sector achieved a GMV of approximately Rs. 1.19 lakh crore (US$14 billion) in FY2025, reflecting a 12% year-on-year growth.

The numbers tell a compelling story of opportunity and challenge. India’s e-commerce market is expected to reach $136.43 billion in 2025 and grow at a CAGR of 19.13% to reach $327.38 billion by 2030. However, this explosive growth comes with a darker side—financial institutions lost over ₹15,000 crore to digital fraud in the last fiscal year alone.

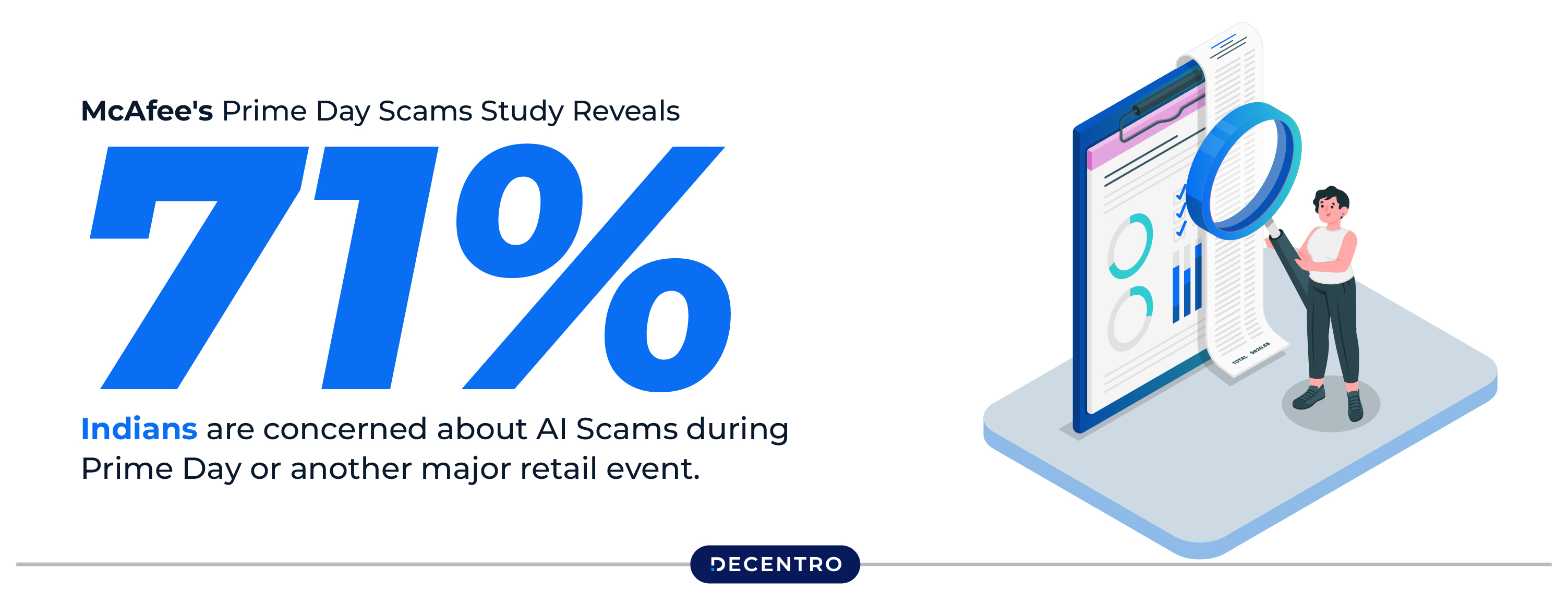

The Fraud Challenge

Global ecommerce fraud losses are projected to hit $48 billion in 2025, representing a 16% increase from the previous year. In India, specifically, online shopping scams are rising at an alarming rate, with fraudsters employing sophisticated methods, including fake websites, phishing messages, and AI-powered deepfakes. The government has issued warnings about the escalating threat of e-commerce fraud, highlighting the urgent need for advanced protection mechanisms.

Understanding AI Shopping Agents: Beyond Traditional Chatbots

AI shopping agents represent a fundamental shift from reactive customer service tools to proactive, intelligent assistants that anticipate customer needs while simultaneously protecting against fraud. Unlike traditional chatbots that wait for explicit user input, AI shopping agents perceive context, predict intent, and act autonomously in real time.

Key Differentiators

Predictive Intelligence: AI shopping agents don’t simply react to search inputs—they predict them. By drawing on behavioural patterns, past interactions, and contextual data, these agents anticipate what customers want before they articulate it clearly.

Emotional Connection: These systems utilise emotionally intelligent dialogue to ask thoughtful questions, respond with empathy, and offer tailored suggestions that foster trust and confidence.

Real-time Risk Assessment: Advanced AI agents analyse numerous data points for each transaction in milliseconds, including IP address, device fingerprint, shipping address, purchase history, and typical customer behaviour patterns.

The Fraud Prevention Revolution

Real-Time Transaction Monitoring

AI shopping agents excel at detecting fraudulent transactions in real time, preventing chargebacks and financial losses. These systems analyse numerous data points for each transaction in milliseconds, flagging anomalies like unusually large purchases, multiple attempts with different cards, or purchases from high-risk locations.

The impact is substantial. AI-powered fraud detection can reduce fraudulent transactions by up to 90% in real-time, minimising chargebacks and improving customer trust. PayPal’s AI fraud detection, which examines over 500 data points per transaction, has helped the company block $500 million in fraud each quarter while maintaining fraud rates well below the industry average.

Advanced Behavioural Analytics

Modern AI shopping agents employ sophisticated behavioural analytics to identify suspicious patterns that traditional rule-based systems might miss. These systems monitor:

- Navigation patterns and user interaction sequences

- Typing rhythms and device usage behaviours

- Shopping cart behaviours and checkout patterns

- Session duration and page interaction metrics

- Location and device consistency across sessions

Multi-Layered Authentication

AI shopping agents implement adaptive authentication that balances security and user experience. Risk-based authentication applies stricter verification requirements to suspicious transactions while maintaining a frictionless experience for trusted customers.

AI Shopping Agent Use Cases Across Verticals

Retail and Fashion

AI agents in retail leverage visual matching capabilities to understand colour, style, and product attributes. They can recommend not only similar options but complementary products from other categories, effectively increasing average order values while providing genuine value to customers.

Financial Services and Fintech

In the fintech sector, AI agents monitor transaction patterns for anomalies, assess merchant onboarding risks, and provide real-time compliance monitoring. They excel at cross-borrowing analysis across multiple lending platforms and automated KYC refresh for existing customers.

Consumer Electronics

For electronics retailers, AI agents provide detailed product comparisons, compatibility checks, and personalised recommendations based on technical specifications and user requirements. They can explain complex features in simple language while identifying potentially fraudulent warranty claims.

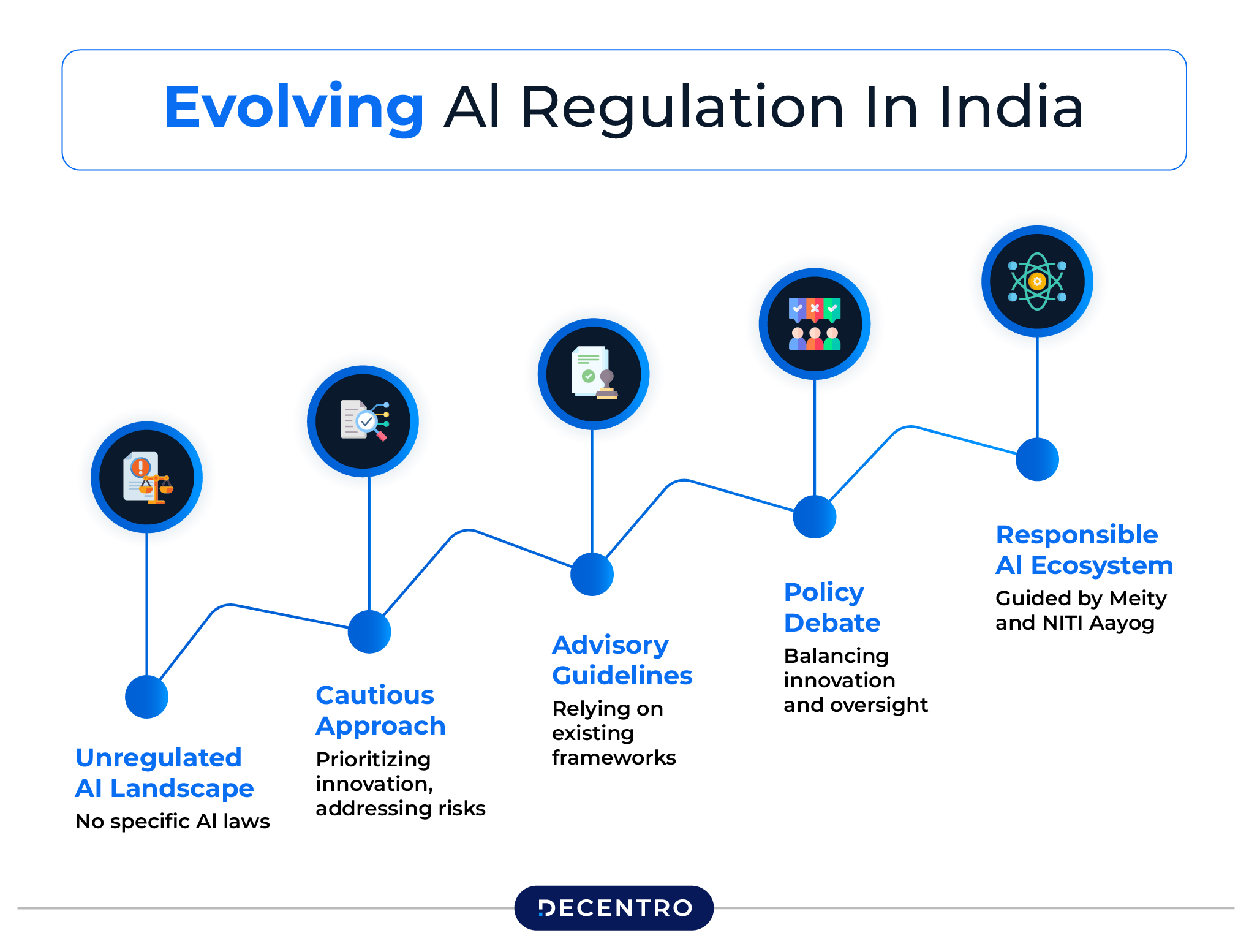

Indian Regulatory Landscape and AI Compliance

Current Regulatory Framework

India’s regulatory approach to AI in commerce is evolving rapidly. The Digital Personal Data Protection Act, 2023, mandates that all personal data be handled lawfully and with user consent, thereby enhancing the security of India’s digital ecosystem. The Reserve Bank of India (RBI) has introduced MuleHunter.AI, an AI solution specifically designed to detect mule accounts with unprecedented accuracy, thereby tackling digital fraud.

Compliance Requirements

Organisations implementing AI shopping agents must ensure:

- Data Privacy Compliance: Adherence to the Digital Personal Data Protection Act, 2023

- Risk Assessment Documentation: Comprehensive documentation of AI decision-making processes

- Bias Testing and Mitigation: Regular evaluation of AI systems for potential discrimination

- Deepfake Detection: Technical measures to detect and prevent synthetic content spread

Industry-Specific Regulations

Telecom operators using AI for network optimisation, customer service, and fraud detection must comply with TRAI regulations and data localisation requirements. Financial institutions must implement zero-threshold fraud reporting, where all frauds, regardless of value, must be reported immediately to the RBI and law enforcement.

The Business Impact: Measurable Results

Conversion and Engagement Metrics

AI shopping agents deliver impressive performance improvements:

- 14x increase in engagement rates compared to traditional tools

- 2x higher conversion rates than standard e-commerce interfaces

- 2.15% lift in revenue per session for leading department stores

- 25-30% reduction in fraud attempts at checkout.

Cost Reduction and Efficiency

Implementing AI shopping agents significantly reduces operational costs by:

- Automating customer support for common queries and product information

- Reducing false positive alerts in fraud detection systems

- Streamlining risk assessment processes from days to seconds

- Minimising manual review requirements for routine transactions

Advanced Risk Assessment with Modern Solutions

Beyond Traditional Credit Scoring

Modern AI shopping agents integrate advanced risk assessment capabilities that go far beyond traditional credit scores. These systems evaluate customers through multiple intelligence layers, analysing digital identity patterns, financial credibility indicators, and employment stability markers.

Behavioural Signal Analysis

Contemporary risk assessment systems analyse over 100+ behavioural signals in real-time, including:

- Mobile phone usage patterns and communication behaviours

- Digital app engagement and financial literacy indicators

- E-commerce transaction histories and spending pattern analysis

- Social network analysis for creditworthiness assessment (with consent)

- Utility payment histories, including electricity, water, and telecom payments.

Industry-Specific Applications

AI shopping agents provide tailored risk assessment for different sectors:

Banking and NBFC: Loan default probability scoring using alternative data, cross-borrowing analysis, and automated KYC refresh capabilities.

E-commerce Platforms: Merchant onboarding risk assessment, transaction monitoring for payment aggregators, and cross-border transaction risk evaluation.

Insurance and Investment: Policy fraud detection using behavioural analysis and investment suitability assessment based on comprehensive risk profiles.

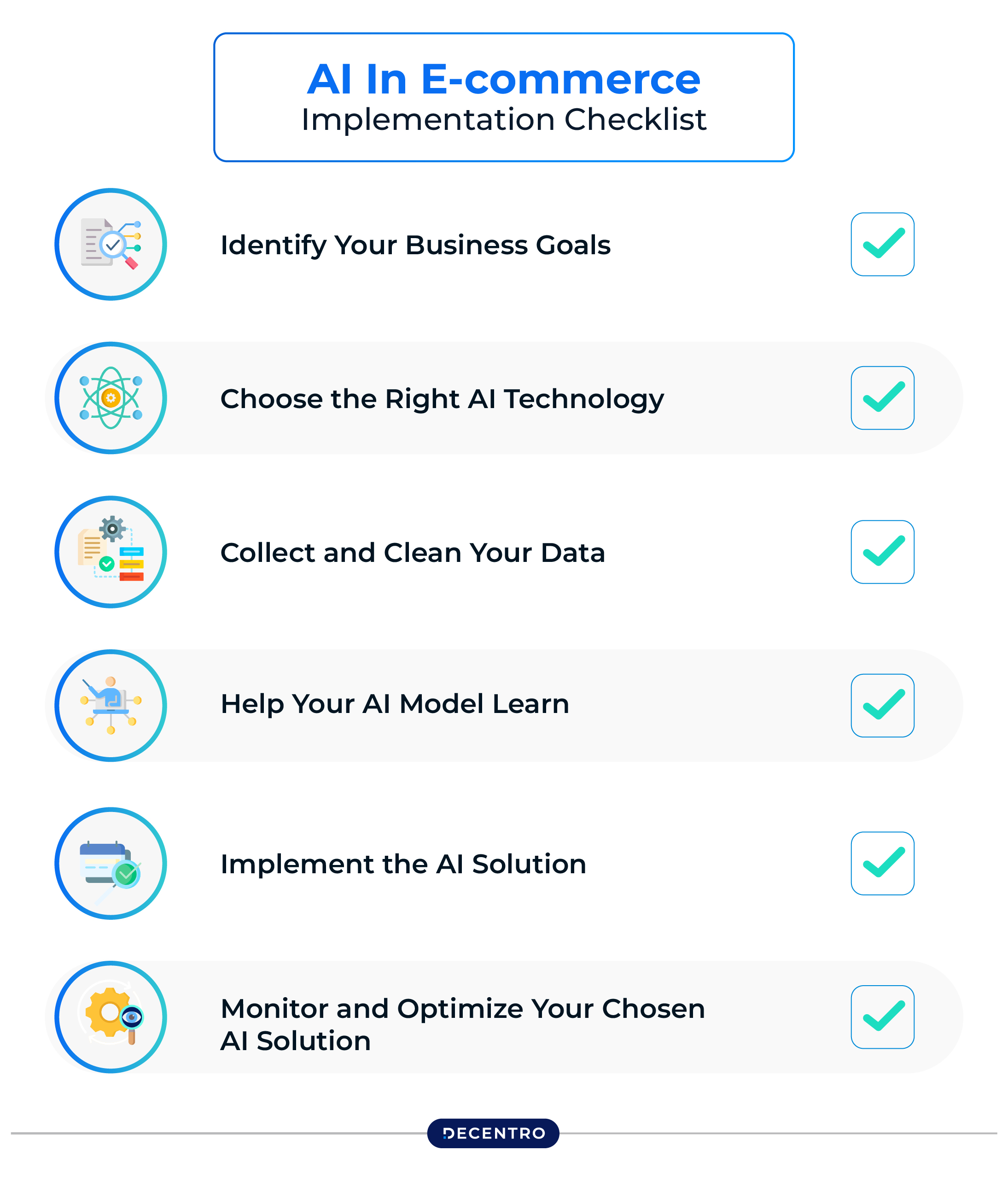

Implementing AI Shopping Agents: A Strategic Approach

Integration Considerations

Successful implementation requires careful consideration of:

- Data Architecture: Ensuring seamless integration with existing customer data platforms

- Real-time Processing: Infrastructure capable of millisecond response times

- Scalability: Systems that can handle traffic spikes during peak shopping periods

- Compliance: Built-in regulatory compliance for the Indian market requirements

Performance Optimization

To maximise effectiveness, AI shopping agents should be configured with:

- Dynamic risk scoring that adapts to changing customer behaviours

- Customizable risk parameters aligned with industry-specific requirements

- Continuous monitoring capabilities with real-time alerts

- Seamless API integration with existing business systems

Innovation in Risk Assessment: Scanner and Omniscore

Modern risk assessment has evolved beyond traditional methods through innovative solutions that leverage India’s digital infrastructure. Advanced platforms now provide real-time, comprehensive risk evaluation by analysing dynamic behavioural signals rather than static identity or credit data.

Comprehensive Risk Intelligence

Next-generation risk assessment systems integrate three distinct intelligence layers: digital identity evaluation through mobile usage patterns, financial credibility analysis using banking and credit data, and employment stability verification through multi-source validation. This multidimensional approach enables businesses to make informed decisions about user intent and trustworthiness, extending beyond traditional KYC or credit bureau limitations.

Real-Time Decision Making

These advanced systems transform risk assessment by providing instant, actionable insights. Instead of relying on static data points, they analyse behavioural patterns in real-time, delivering unprecedented accuracy in fraud detection and user profiling. This capability is particularly valuable for Indian businesses operating in a rapidly digitising economy where traditional risk assessment methods may not capture the whole picture.

Future Trends and Predictions

Emerging Technologies

The future of AI shopping agents will likely include:

- Generative AI integration for more natural conversations

- Augmented reality capabilities for virtual try-ons and product visualisation

- Voice commerce optimisation for hands-free shopping experiences

- Blockchain integration for enhanced security and transparency

Market Evolution

As the Indian e-commerce market continues to expand rapidly, AI shopping agents will become increasingly sophisticated in their fraud detection capabilities while maintaining seamless user experiences. The integration of advanced behavioural analytics with real-time risk assessment will set new standards for digital commerce security.

Conclusion

AI Shopping Agents represent a paradigm shift in digital commerce, offering startup founders and online business owners a powerful tool that simultaneously enhances the customer experience and protects against fraud. In India’s rapidly expanding e-commerce market, these intelligent systems are not just competitive advantages—they’re essential infrastructure for sustainable growth.

The statistics are clear: businesses implementing AI-powered fraud detection see a reduction of up to 90% in fraudulent transactions while achieving 2x higher conversion rates. As the Indian e-commerce market is projected to reach $327.38 billion by 2030, businesses that successfully integrate AI shopping agents with comprehensive risk assessment capabilities will be best positioned to capture this growth while protecting their operations from evolving fraud threats.

For Indian entrepreneurs and business leaders, the message is simple: AI Shopping Agents aren’t the future of e-commerce—they’re the present. The question isn’t whether to adopt these technologies, but how quickly you can implement them to stay ahead of both competition and criminals in India’s digital commerce revolution.

Ready to transform your e-commerce and retail capabilities?