Check out the top Payments and Banking trends shaping the FinTech ecosystem in 2024. Get an in-depth look at what we’re expecting as we get started with 2024.

Top Payments & Banking Trends in 2024: What To Expect

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

As we bid adieu to 2023 and usher in 2024, the financial landscape is buzzing with transformative trends. With a new set of regulations from the RBI and other regulatory bodies, the financial landscape of India is set for long-term, transformational changes aimed at driving sustainable growth. As the landscape of payments and banking trends shifts each year, staying updated on these changes is increasingly crucial, particularly as we move towards the upcoming new year.

At Decentro, we’re at the forefront, deciphering these shifts for you. Let’s dive into the trends for 2024 that will shape the payments and banking industry.

The Payments Paradigm: Cash will no longer be king

India’s digital payments landscape has been on an upward trajectory in the last few years. With the rise of UPI and several other advancements, the outlook for payment methods in India is exceptionally bright as traditional and newer payment systems continue to expand, reaching a broader user base year-on-year.

UPI Takes Center Stage

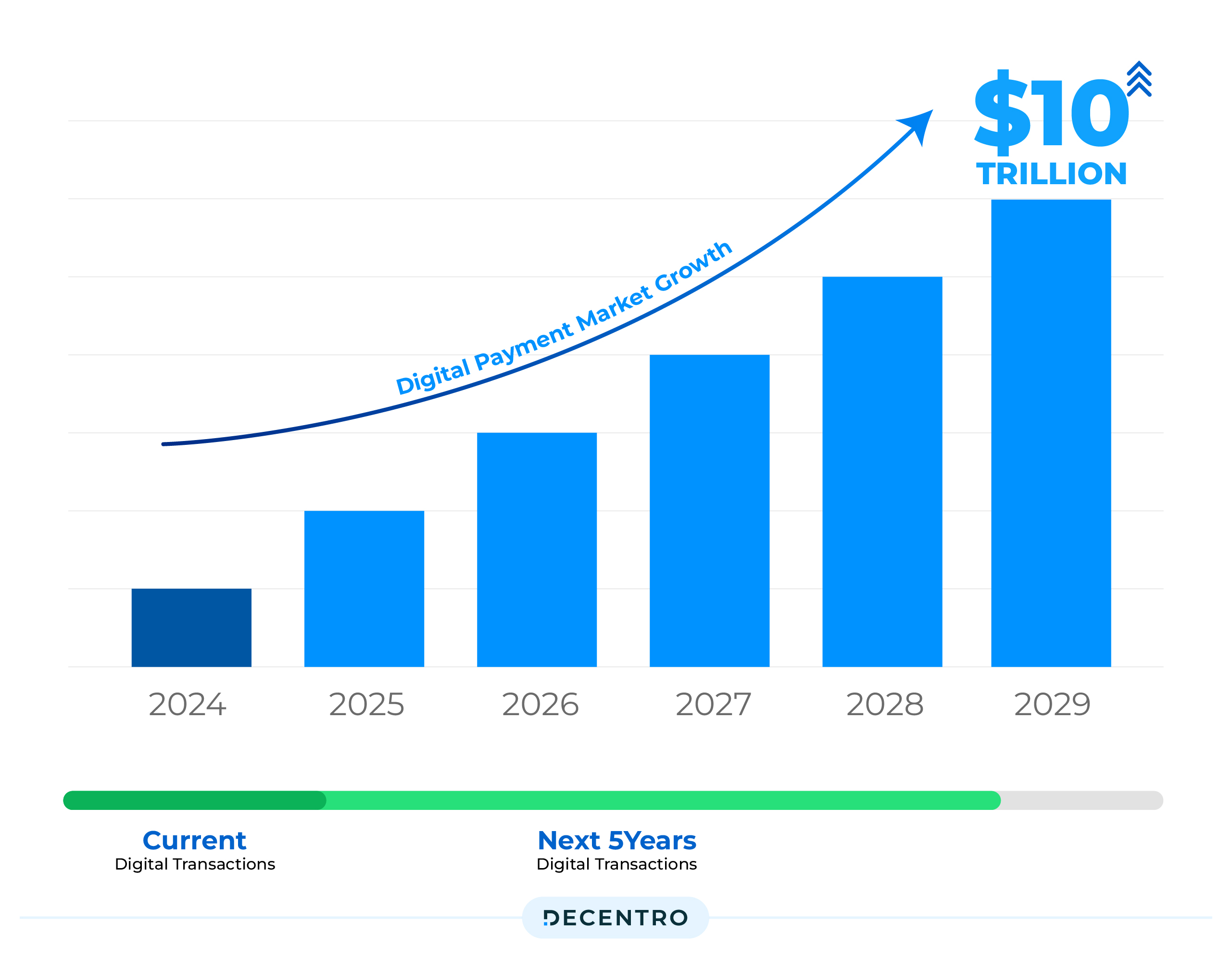

According to a report by BCG and PhonePe, the digital payment market will grow more than triple to $10 trillion in the next five years, wherein 2 out of 3 transactions will be digital in the next five years as opposed to 2 out of 5 transactions today. The growth and adoption of UPI is mainly powering this growth. UPI transactions are at approximately 9X of credit and debit card transactions today in volume terms in FY22.

Investments will play a crucial role in attracting a new segment of users to the digital payment sphere. The NPCI may introduce nominal fees for more prominent merchants on UPI Payments to facilitate more significant investments.

This game-changer will mark a new era where convenience meets commerce. Both merchants and users can expect to see a surge in innovative uses, more incentives like cashbacks and rewards, and newer sets of users. The monetisation of UPI will also drive businesses to tackle new challenges through strategic decisions, potentially reshaping their approach to digital payments and customer engagement.

The Reserve Bank of India (RBI) has recently authorised the integration of UPI (Unified Payments Interface) applications with RuPay credit cards. This development enables consumers to link their RuPay credit cards to UPI apps, utilising the credit limit on their cards to make purchases. This significant move broadens the scope of UPI, which was previously limited to savings accounts and debit cards, and provides an additional perk for users: the ability to accumulate loyalty points through credit card usage. This move will get many more merchants to use UPI as their primary payment collection method, making it a game-changer for SME businesses.

The Evolution of the Credit Card Ecosystem

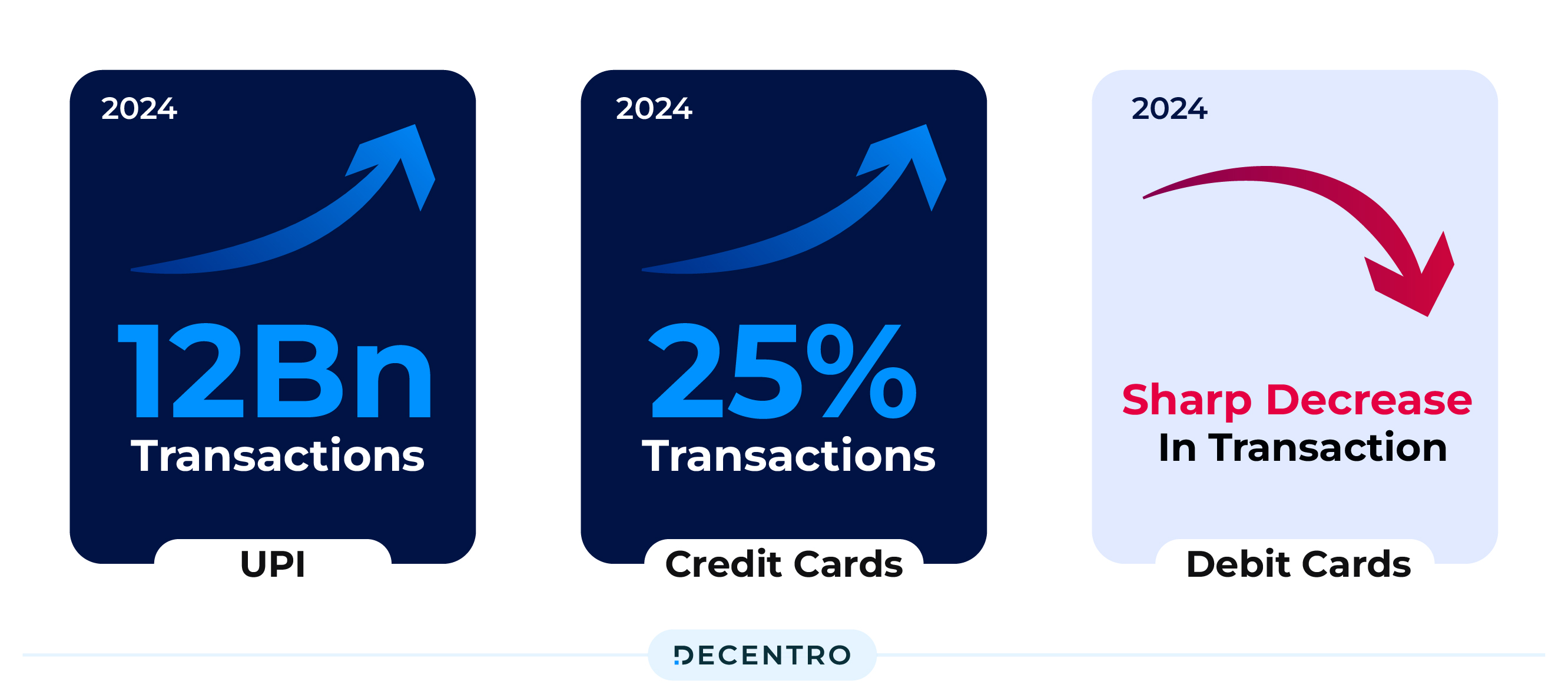

Remember debit cards? They’re becoming relics in the age of UPI and credit cards. According to RBI data, the shift is attributed to customer preference for the rewards that come with credit cards and the convenience provided by the UPI platform. While consumers still use UPI for making smaller transactions, for large and medium-sized expenditures such as travel, electronics, dining, or shopping, individuals tend to favour credit cards due to their rewards and benefits.

It’s not just about paying anymore; it’s about intelligent, seamless transactions.

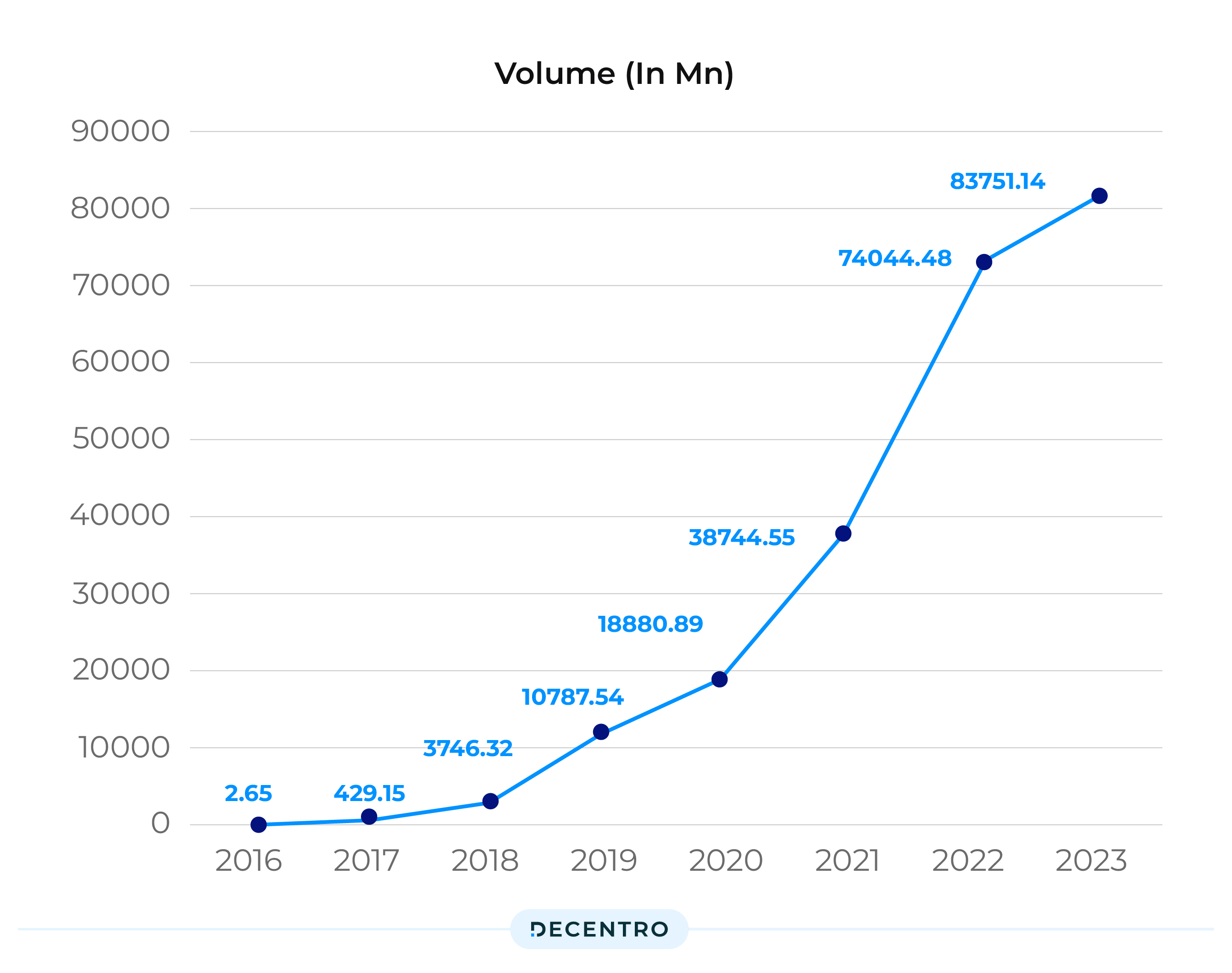

Unified Payments Interface (UPI) ended 2023 at a high, recording over 1,200 crore transactions worth more than ₹18 lakh crore in December, a peak for both the transaction count and value.

Over 11,765 UPI transactions worth ₹182.2 lakh crore were processed in 2023, up 59 per cent in volume and 45 per cent in value compared with 2022, as per data by the National Payments Corporation of India (NPCI).

With UPI growing and credit cards growing by 25 percent this year, debit card usage decreased sharply during the same period.

With the growth of the credit card ecosystem in India, banks and fintechs will introduce more co-branded credit cards. These partnerships will allow these businesses to capitalise on prominent brands’ well-established reputation and customer base. Users might see more customised perks like cashbacks on specific brands and rewards based on their spending patterns.

Mandates on the Rise

The Reserve Bank of India (RBI) has declared an increase in the limit for e-mandates on recurring payments, raising it to INR 1 lakh per transaction from the previous limit of INR 15,000 for mutual funds, insurance premiums, and credit card bills. With this change, customers can set up automated debits up to INR 1 lakh for recurring payments, eliminating the need for an additional authentication factor (AFA) due to the raised limit.

With the growth in subscription services in India, including OTT subscriptions, and the increasing number of retail investors, e-mandates are about to become the new norm, especially in B2B. The need for efficient, recurring payments in various business scenarios will be an essential factor in driving this surge in usage.

Embedded Finance: The New Revenue Frontier

The Indian embedded finance industry will grow at a CAGR of 30.4 per cent and reach $21,127.5 million by 2029. Businesses are exploring uncharted territories for growth, and embedded finance is the treasure trove.

There is anticipated swift growth in ecosystems where credit becomes an integral part of digital payment. Though navigating the complexities of compliance and security is challenging, strategic partnerships offer a viable path to harnessing this potential.

Embedded finance will become a boon to various sectors looking to monetise for additional revenue growth. Easier access to credit will help formalise the economy and start a positive cycle. Digital payments create a record that helps merchants get credit, allowing them to invest and earn more. This can lead to even wider credit access for them. Also, the transparency created via digital payments will improve tax compliance and increase GST collections.

Lending: A Balancing Act

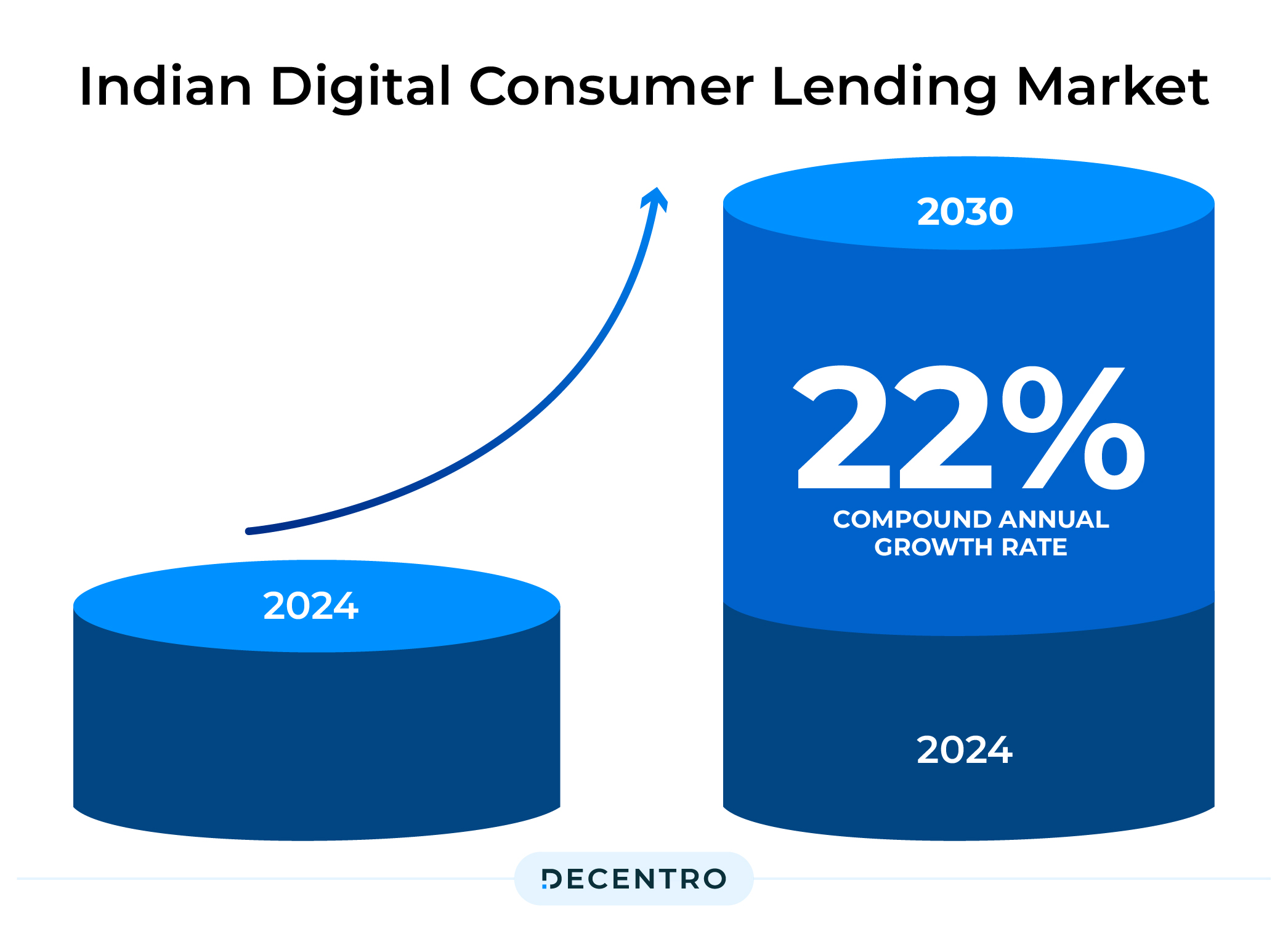

The Indian digital consumer lending market is growing at an impressive 22% compound annual growth rate (CAGR). A bunch of positive socio-economic factors and some timely regulatory measures are fueling this growth.

The RBI is giving the digital lending landscape a regulatory makeover to create a sustainable lending market in India. With the RBI increasing its oversight, debt collection becomes crucial for profitability. The key? Balance and vigilance.

The Rise of Co-Lending

The Indian SME sector is on track to hit a value of $300–400 billion by 2025, presenting a massive opportunity for digital lending and potentially unlocking a trillion-dollar market. Thanks to the RBI’s new regulations, we will see more and more partnerships between banks and NBFCs, signalling a collaborative future for lending. Even for fintechs transitioning into NBFCs, co-lending can offer a way to access more capital, especially considering the current difficulties in getting equity and debt funding. The digital lending platform market is projected to grow to USD 26.6 billion by 2028.

Digitalisation: Simplifying Lending

The future growth of digital lending will likely come from Tier-2 cities. This means digital lending startups must create flexible business models to grow and adapt to new changes.

Also, considering the current digital skills in India, a mix of online and traditional methods might work better for long-term success, even though a completely digital approach seems good in theory.

UPI on credit and digital advancements are overhauling the lending workflow. Compliance complexities are here to stay, but digitisation is the simplifying force. With newer guidelines from the RBI, increased risk weightage for lending, and more significant compliance requirements, digitalisation will help enterprises navigate the changing lending landscape smoothly.

Another disruption here has been the digitalisation of the debt recovery process. With the regulator’s view on creating higher quality loan books in the longer term, digitalisation will go a long way in helping companies recover loans using digital channels. Moreover, evolving regulatory frameworks, such as the Digital Markets Act (DMA) rules, are shaping how businesses navigate compliance and competition requirements in the fintech ecosystem. In an environment marked by strong economic performance, low unemployment, and generally positive customer behaviour, the significance of implementing robust processes for debt collections can often be overlooked. Despite a substantial shift in consumer behaviour, consumer credit collections still predominantly rely on the outbound call centre model, with limited optimisation in alternative channels. However, traditional call centre-focused collections operations may not be sufficient moving forward.

To proactively address and prevent delinquencies, lenders must enhance their collection strategies. By doing so, they can boost their current collection efficiency and, looking ahead, significantly increase recoveries, manage costs effectively, and maintain consistent returns. Developing an omnichannel, digitally enabled collections approach is essential for lenders to adapt to these evolving demands.

Managed Collections for Stressed Portfolios

Loan delinquency has been a global problem even before the COVID-19 pandemic. Banks currently have over Rs 93,240 crore in unsecured loans categorised as Special Mention Accounts (SMA), indicating loans under stress or overdue repayments. These SMA loans make up nearly seven per cent of the total unsecured loans outstanding, which amounts to Rs 13.32 lakh crore.

We can expect a rise in managed collections for stressed portfolios. It responds to the increasing importance of efficient debt recovery in lending. With NBFCs and other lenders looking to target sustainable growth now, managed collections for stressed portfolios will become a strategic move for lenders and banks. Digitalisation of the debt recovery process will also play a significant role in managing collections for loan portfolios moving forward.

Cross-Border Payments: Redefining Boundaries

Starting in 2024, we will see many changes in the global payments landscape because of several factors.

RBI’s Tightening Grip

As the nature of business payments changes, the focus on compliance and data security will become more crucial. The complexity and large scale of corporate transactions call for increased attention to following regulations and protecting data. As payment systems become more interconnected, focusing on legal, regulatory, and supervisory frameworks and data exchange across borders is essential.

To address the above factors, the RBI has been moving towards tighter regulations, promising smoother operations and more evolved cross-border payment models.

Introducing CBDCs

The possible launch of central bank digital currencies (CBDCs), currently being explored by over 114 countries, underscores the importance of cooperation between the public and private sectors and the need for robust regulatory frameworks.

The RBI launched the e-rupee pilot in December 2022. Still, by the end of October, daily transactions averaged only 25,000, despite its application being greatly expanded by integrating it with the widely used United Payments Interface. India’s CBDC transactions crossed the one million mark a day for the first time on December 27 and have since reached a peak of over two million daily.

CBDCs will significantly reduce cross-border transaction costs while enhancing the efficiency and speed of businesses and users. CBDCs align well with the increasing digitisation of economies, reducing the risk of fraud and cyber-attacks compared to private digital currencies.

UPI-PayNow: Bridging Borders

Singapore has become the first country with cross-border Person-to-person (P2P) payment facilities to be launched on the UPI platform. The UPI-PayNow linkage is a game changer for sectors like e-commerce, heralding a new era in cross-border payments. This move also marks the versatility of the UPI platform and the benefits that UPI can bring to newer geographies.

The UPI-PayNow linkage will help enable faster and more economical cross-border remittance options. The collaboration offers various currency choices, helping small and medium-sized enterprises (SMEs) expand their businesses by simplifying payment procedures.

PA-CB Regulations: Key impacts

The RBI issued a new set of regulatory guidelines for payments aggregators operating in the cross-border space, incorporating all entities (including AD banks) engaged in settling and processing cross-border transactions to import and export goods and services. The regulations have categorised the service providers into three categories: a) Import Only, b) Export Only, and c) Export and Import, with conditions for each type of goods and services provided.

The PA-CB Regulations by the RBI are set to expand the scope of cross-border payments by bringing multiple modes of payment under one umbrella. With the new set of regulations, the RBI is also attempting to curb illegal activities such as money laundering since every cross-border transaction will now come under the purview of the RBI. The new regulations will make money movement smoother with different escrow accounts and a transparent way to settle transactions through PA-CBs, building trust among businesses that deal with cross-border transactions. Fintech companies, however, will have to work with businesses to navigate through several compliance requirements in the space.

KYC and Onboarding: The Age of Verification

Compliance requirements are skyrocketing with all central banks globally ramping up security measures against fraud and illegal activities, making KYC a mainstream necessity across most industry verticals. The continuing emergence of deepfakes and AI, regulatory changes, seamless verification, and the need for transaction monitoring will also impact customer verification.

Digilocker is poised to become the preferred KYC method thanks to its widespread reach and user-friendly experience. With the Govt. of India pushing to expand the scope of Digilocker, including passport verification, DigiLocker will be the most widely used method for customer verification and onboarding.

Since many industry verticals, including retail investments, job portals, and marketplaces, will have multiple use cases for automated user verification, embedded verification is set to become commonplace, integrating seamlessly across different types of applications.

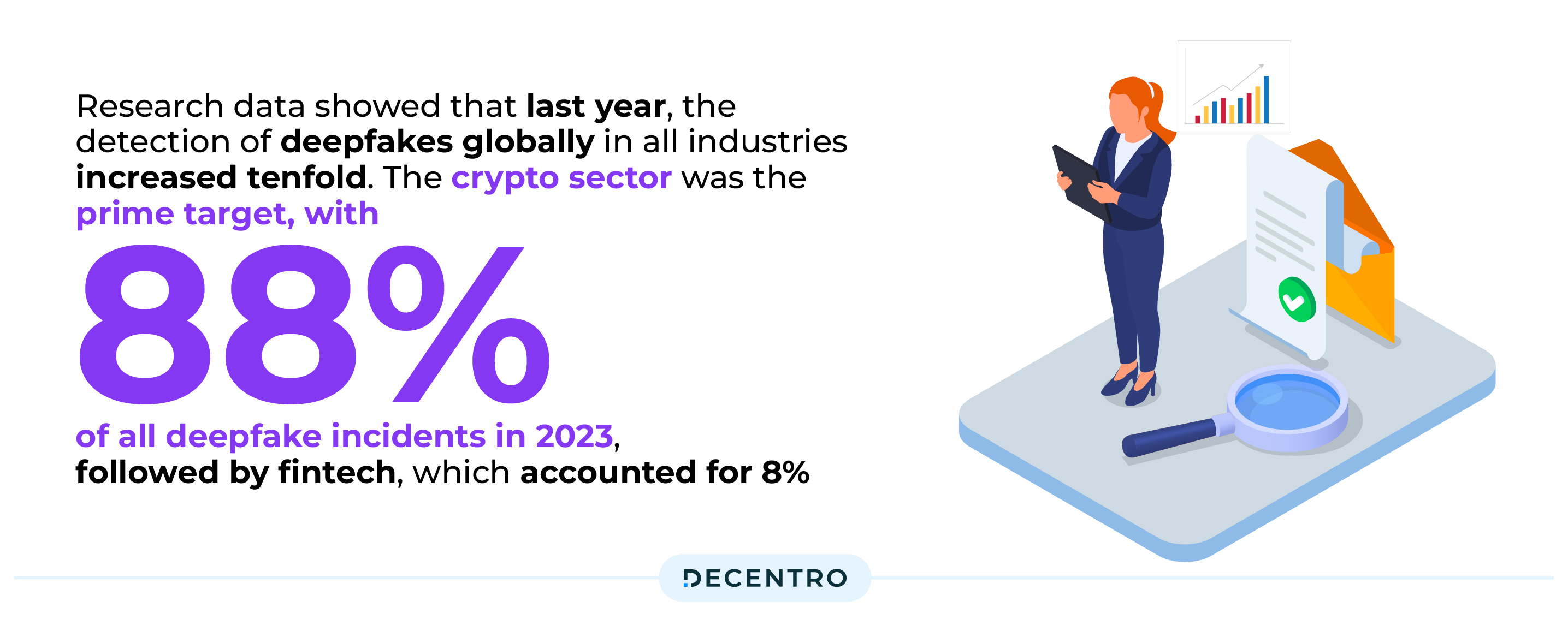

AI-created fraud, particularly deepfakes, is on the rise. Research data showed that last year, the detection of deepfakes globally in all industries increased tenfold. The crypto sector was the prime target, with 88% of all deepfake incidents in 2023, followed by fintech, which accounted for 8%. Because of this, businesses must use more than just essential deepfake detection. They should have multi-layered anti-fraud strategies, including monitoring behaviour and transactions. This well-rounded approach strengthens their defences against fake content and boosts their overall security, offering better protection against new digital risks.

The Other Game Changers

ONDC/OCEN: Gaining Momentum

Watch out for ONDC/OCEN as they gain significant traction, potentially revolutionising how we do business.

The Rise of Low-Code Products

Low-code products are about to become a significant trend, democratising technology and empowering more businesses to innovate.

Towards a Seamless Financial Future: The Decentro Edge

As India transitions into a digital-first economy, Decentro’s products stand at the forefront, offering businesses seamless and efficient payment solutions. With the growth of UPI, credit card ecosystems, and the rise of e-mandates, Decentro’s capabilities in facilitating various modes of payment collection can help businesses start collecting payments from Day 1. Our solutions are designed to support businesses in adapting to these changes, ensuring smoother, faster, and more secure transactions. Whether integrating with UPI for payment collections or providing the proper infrastructure for handling recurring payments, Decentro’s offerings cater to the dynamic needs of modern businesses, enabling them to stay ahead in a rapidly evolving financial landscape.

Moreover, Decentro’s commitment to innovation and compliance positions it as a critical player in the KYC and digital lending sectors. Decentro provides the necessary tools and frameworks to ensure compliance and efficiency as businesses seek to navigate the complexities of regulatory changes and digitalisation. Their focus on embedding finance into various business models aligns with the predicted growth in digital lending, especially from Tier-2 cities. Furthermore, with the rise of cross-border payments, Decentro’s advanced solutions in managing multi-currency transactions and ensuring data security become increasingly vital.

As the financial ecosystem becomes more interconnected and regulated, Decentro’s products offer businesses the agility and security needed to thrive in the digital age, making us an indispensable partner for businesses looking to capitalise on the future of payments and banking.