Learn about the 10 best alternative investment platforms in India in 2025, their overview, features, pros and cons, and a lot more by clicking on this link.

10 Best Platforms for Alternative Investments in 2025

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Platform Name | Value Proposition |

| Grip Invest | Invest in corporate bonds and Securitized Debt Instruments (SDIs) starting at just ₹1,000. |

| TradeCred | Invest in multiple avenues, such as sovereign bonds, corporate bonds, asset leasing, etc., across 600+ listed brands. |

| Wint Wealth | Invest in top-rated bonds and FDs with high returns. |

| Strata | Options to invest in Grade-A commercial real estate assets starting at just ₹25 Lakh. |

| Alt DrX | Make real estate investments per square foot starting at just ₹10,000. |

| RealX | Make fractional investments in high-yield and high-return properties, starting at just ₹5,000. |

| 13Karat | Earn up to 13% returns via P2P investment opportunities. |

| Faircent | Gain up to 12% returns per annum with P2P investment opportunities. |

| RupeeCircle | Invest in P2P lending and earn up to 25% average returns per annum. |

| Finzy | Opportunities to invest in personal loan requirements across various tenures. |

Alternative investment platforms enable individuals to invest in assets like private equity, venture capital, real estate, artwork, etc. These assets were once only available to institutional investors and high-networth individuals, but thanks to these apps, they are now accessible to the general public.

Such assets provide investors with an excellent opportunity to diversify portfolio risks due to their low correlation to traditional market assets. Moreover, they are not linked to the stock market and thus can protect the investor during times of high volatility, market crashes and economic recessions.

Alternative assets, such as fine wine, private equity funds, venture capital, and crowdfunding, provide unique investment opportunities that are not present in the stock market. As a result, investors can earn significantly higher returns compared to traditional assets.

10 Best Platforms for Alternative Investments in 2024

Find the top 10 alternative investment platforms in India in 2024 listed below:

Grip Invest

Grip Invest is a leading alternative investment platform that offers curated investment opportunities beyond stocks, gold, and fixed deposits. It enables you to gain portfolio diversification and high returns by investing in corporate bonds and Securitized Debt Instruments (SDIs).

Both these assets provide fixed-income opportunities from stock exchange-listed securities, ensuring safety and stable returns.

Features:

- Comes with the safety of RBI and SEBI regulations

- Earn up to 16% pre-tax income per year

Investment Assets: Corporate bonds and Securitized Debt Instruments (SDIs)

Minimum Investment: ₹1,000

Pros:

- Curated alternative investment opportunities via rigorous due diligence and reputed partners

- Availability of in-depth information for each investment opportunity, highlighting returns, risks, partner profiles and commercial terms

Cons:

- Limited product offering

TradeCred

TradeCred is India’s largest fixed-income platform, facilitating investments in multiple avenues, such as sovereign bonds, corporate bonds, asset leasing, blue chip invoices, AA debt, and invoice discounting.

What’s more, this platform has a state-of-the-art algorithm-driven credit model which it uses to curate invoices, thus ensuring low risk and high returns for investors.

Features:

- Investment opportunities in 600+ listed brands like Jio, Amazon, Flipkart, etc.

- Options to down-sell your assets to other investors at any time, facilitating high liquidity

Investment Assets: Sovereign bonds, corporate bonds, asset leasing, blue chip invoices, AA debt, and invoice discounting

Minimum Investment: ₹1 Lakh

Pros:

- Zero defaults till date due to a superior credit model

- User-friendly app that lets you access your investments at any time

- Provides a wide range of investment options

Cons:

- Entry tickets may be too high for new investors

Wint Wealth

Wint Wealth is another leading name in the list of the best alternative investment platforms in India. This company aims to democratise debt investments in the country by offering curated fixed-income investments that provide inflation-beating returns.

Moreover, all investments are handpicked by a team of financial experts after thorough due diligence, making it an ideal place for investors who are new to fixed-income securities.

Features:

- Options to invest in top-rated bond schemes with varying minimum investment, rate of return and maturity periods

- Invest in FDs across different banks without opening a separate savings account

Investment Assets: Bonds and FDs

Minimum Investment: ₹1,000

Pros:

- Compare returns from multiple schemes and choose one that best suits your needs.

- Get a comprehensive idea of your total returns before selecting a scheme

Cons:

- Returns for all FD schemes may not guaranteed by the RBI

Strata

Strata is an Indian alternative investment platform that allows you to invest in Grade-A commercial real estate across top metropolitans like Mumbai, Bangalore, Chennai, Pune, Hyderabad, and more.

This enables you to get the benefits of a monthly cash flow and long-term capital appreciation by investing in a stable asset class.

Features:

- Multiple investment options like fractional investment, strata growth and strata edge enable you to choose as per your risk appetite

- Options to exit investment via Asset Sale, Private Sale or Strata’s Resale Market

Investment Assets: Grade-A commercial real estate

Minimum Investment: ₹25 Lakh

Pros:

- All assets are collateralised by legally vetted ownership in the property, and hard assets

- The lock-in period of just 1 year

- End-to-end management ensures a seamless experience for investors

Cons:

- High-entry tickets may not be suitable for all investors

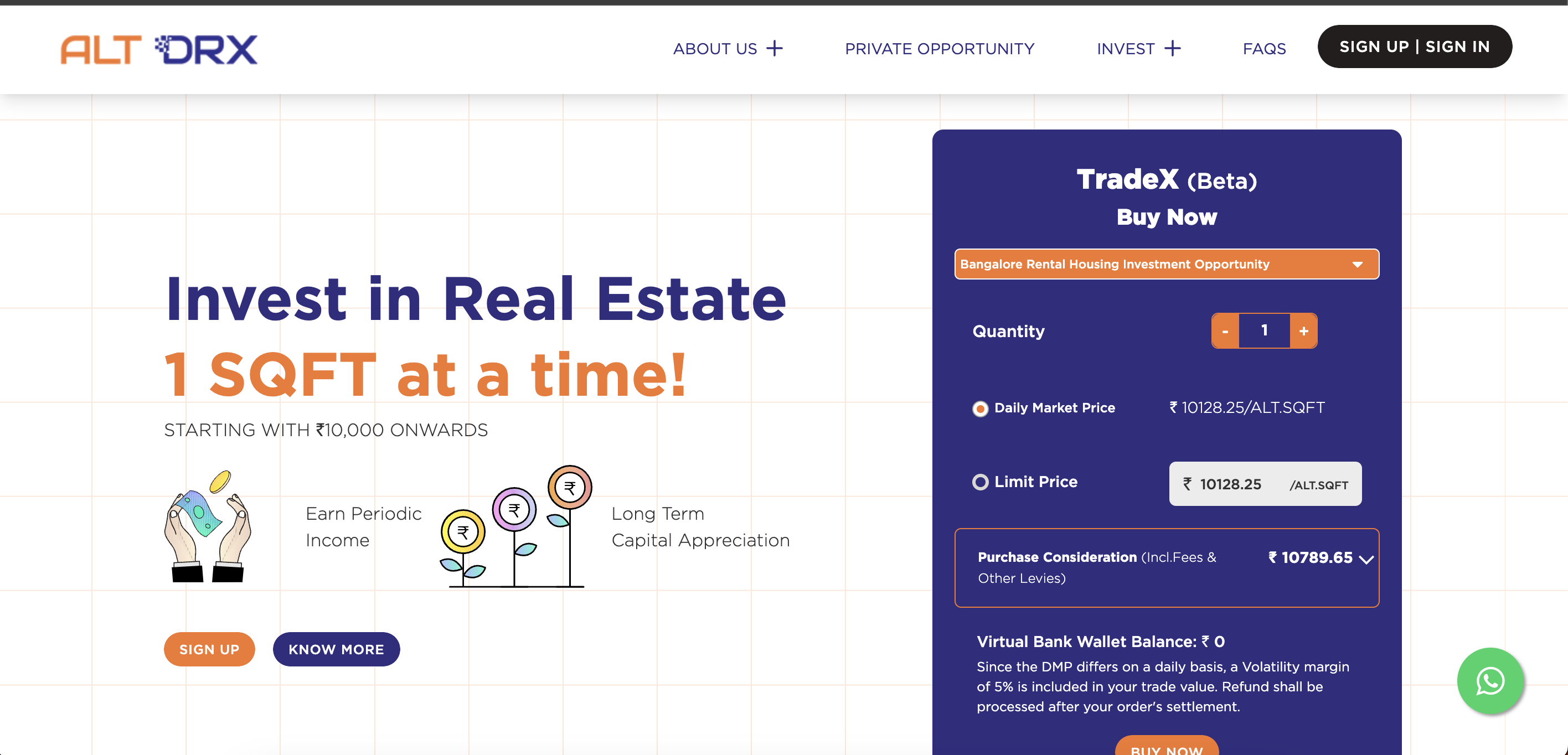

Alt DrX

Alt DrX is an alternative investment platform enabling you to invest in Grade-A real estate per square foot.

You can either go for a Private Opportunity (PO) – where you get early bird investment deals, First Sqft Opportunity (FSO)- the first opportunity to invest in a property, or TradeX – buy and sell real estate-backed tokens.

Features:

- Opportunities to invest in numerous real estate asset classes like rental housing, plotted land, holiday homes and more

- Diversify portfolio risks by investing across multiple properties in the top Indian metropolitans

Investment Assets: Real estate

Minimum Investment: ₹10,000

Pros:

- Options to make fractional investments in real estate.

- Earn consistent rental income as well as long-term capital gains

Cons:

- Liquidity can be a bit of a problem as it depends upon the availability and risk appetite of the platform’s users

Having enabled their collection and payout capabilities, the founder had to say about the Decentro and Alt DRX.

“Banks work well, but the months-long approval is what breaks the flow. We were fortunate enough to connect with Rohit from Decentro who made sure to help us set up a dedicated flow for simple collection and reliable payouts. All this in weeks. Decentro’s APIs are simple yet very powerful when it comes into play. We at Alt DRX are highly confident with the team at Decentro making us believe to grow exponentially along with Decentro. More power to the team at Decentro.”

Anand Narayanan, Founder at Alt Realtech Pvt Ltd

RealX

RealX is an alternative investment platform that allows you to make fractional investments in high-yield and high-return properties in digital assets.

Based on your investment objective and risk appetite, you can either opt for Registered Co-Ownership or Property Tokens.

Investment Assets: Real estate

Minimum Investment: ₹5,000

Features:

- Enjoy early access to invest in several top-notch properties across India

- Various exit options like full sale, token listing on other exchanges, and fractional sale

Pros:

- A low-entry ticket makes it a suitable option for all types of investors

- Gain rental income along with long-term value appreciation

Cons:

- Registered co-ownership can be difficult to sell

13Karat

13Karat is an alternative investment platform that offers P2P investment opportunities. This company, in partnership with P2P NBFCs like RupeeCircle and Lendbox, allows you to invest in a hyper-diversified pool of creditworthy borrowers.

You can choose the 12K plan or the 13K plan and gain returns up to 12% and 13% across various investment tenures that you can select according to your financial goals.

Features:

- Flexible investment tenures ranging from 3 months to 12 months

- Investments ranging up to a maximum of ₹50 Lakh

- Earn up to 2X returns from non-market-linked investment options

Investment Assets: P2P loans

Minimum Investment: ₹500

Pros:

- Low default risk thanks to a highly diversified pool of borrowers

- Options to auto-invest at maturity and gain compounding returns

Cons:

- Returns are not guaranteed

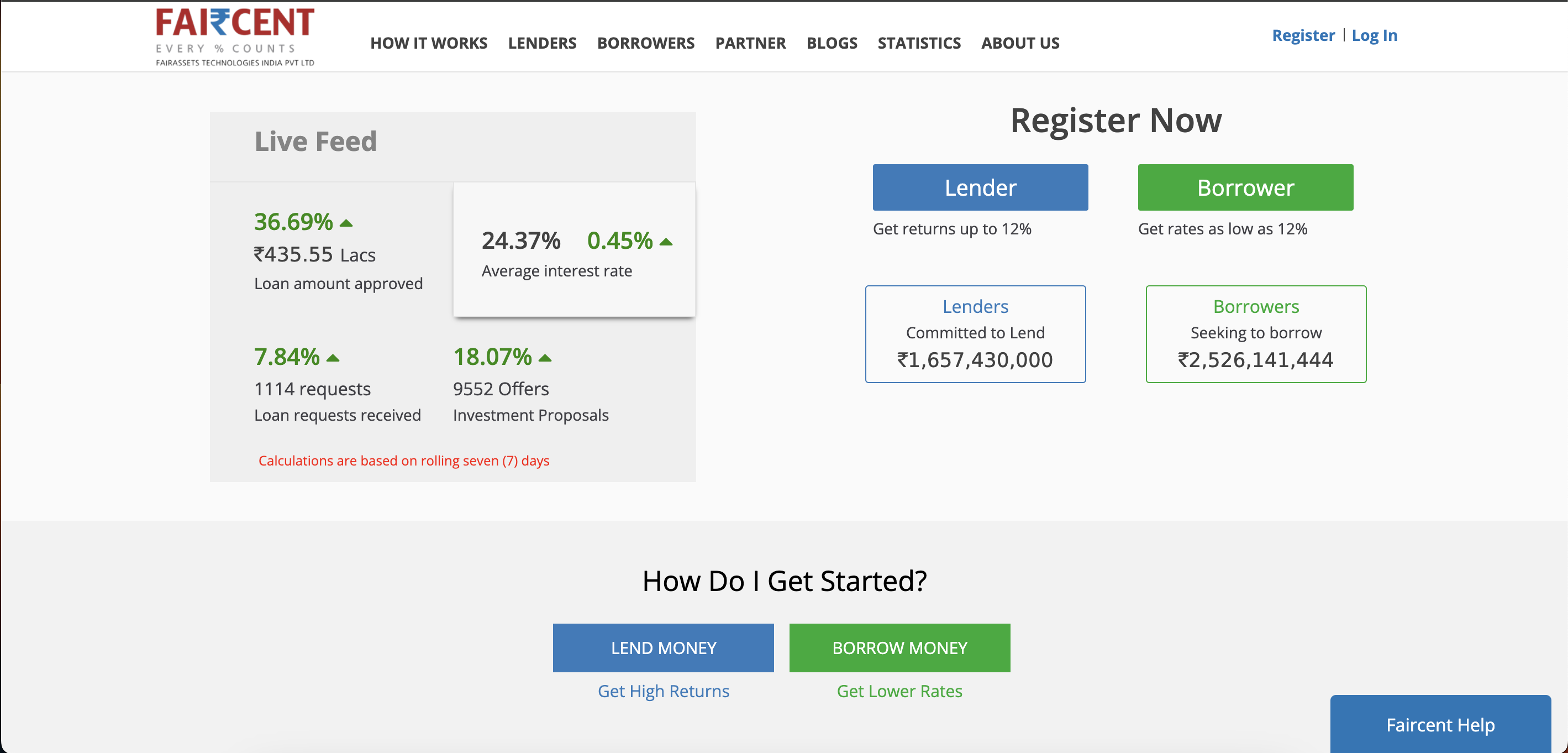

Faircent

Faircent is an RBI-authorised alternative investment platform that enables you to invest in P2P lending. You can create a diversified portfolio of borrowers with varying interest rates based on their loan requirements and creditworthiness.

Moreover, the platform does not allow you to fund more than 10% of a borrower’s credit requirements, fostering risk diversification.

Features:

- Evaluation of borrowers based on 120+ criteria across 400 data points

- Gain up to 12% returns per annum

- Invest up to a maximum of ₹10,00,000

Investment Assets: P2P loans

Minimum Investment: ₹30,000

Pros:

- Has the Reserve Bank of India’s NBFC-P2P registration

- Any individual or entity with valid documents can register as a lender

Cons:

- The platform does not guarantee returns

RupeeCircle

RupeeCircle is an online P2P lending platform that connects lenders and borrowers. It facilitates diversification opportunities for individuals who wish to gain high returns by investing in non-market-linked assets.

The platform’s team of experts curates a unique bucket of borrowers across various risk profiles, interest rates, and credit requirements, enabling you to diversify your portfolio even within the same asset class.

Features:

- Up to 25% average returns per annum

- Gain favourable risk-adjusted returns thanks to superb credit risk management

- Invest up to ₹50,000 or 25% of the loan amount for an individual investor.

Investment Assets: P2P loans

Minimum Investment: ₹5,000

Pros:

- Options to auto-invest returns to gain the benefits of compounding

- Investor-friendly exit options prompting high liquidity

- Availability of monthly payback schemes to create regular income

Cons:

- The platform does not guarantee returns

Finzy

Finzy is an alternative investment platform that enables you to invest in personal loans. It has an NBFC-P2P registration with the RBI, serving as a digital marketplace for lenders and borrowers to interact with each other.

All borrowers are handpicked using a proprietary credit algorithm, and lenders are allowed to invest up to ₹50,000 in a single borrower. This system not only fosters a high level of diversification but also reduces the risk of losses in case a borrower defaults.

Features:

- Investments range from ₹50,000 to ₹50 Lakh

- Maximum maturity period of up to 36 months

- Options to split investment across multiple borrowers

Investment Assets: Personal loans

Minimum Investment: ₹50,000

Pros:

- Automated EMI collection, along with timely follow-up and recovery

- Options to receive returns on a monthly basis

- Investors can withdraw their capital after the minimum holding period

Cons:

- No set policies in case a borrower defaults

The Future of Alternative Investments in India

As per reports, assets under alternative investments are predicted to reach $23 million by 2026 on a global level. Moreover, to foster this growth, US authorities and lawmakers are prioritising infrastructure funding in the upcoming years.

In India, alternative investments currently account for 12% of the country’s AUM, exhibiting a 24% CAGR. Furthermore, experts predict that by 2026, this asset class will constitute 20% of India’s total AUM and double its growth rate within the next five years.

Thus, there is ample scope for new players to enter the market and gain long-term growth prospects. However, to be included in the list of the best alternative investment platforms, opting for a dedicated payment solution that can streamline transactions and customer onboarding is a must.

Enter Decentro’s APIs.

Integrate our multi-collect API to seamlessly collect funds from individuals and businesses and reconcile them directly via virtual accounts. Moreover, you can leverage our KYC verification APIs to perform real-time KYC checks and significantly reduce customer drop-offs.

What else can we offer that can help set up your business?

Schedule Your Discovery Call NOW

Frequently Asked Questions

Grip Invest, Wint Wealth, TradeCred, Strata, Alt DrX, and RealX are some of the top alternative investment platforms in India.

By 2026, alternative investments are estimated to constitute around 20% of India’s total AUM. Some major driving factors in this regard can be higher returns compared to stocks and mutual funds, low susceptibility to stock market volatility and diversification from traditional asset classes.

Whether alternative investments are better than mutual funds will tend to differ across investors based on their financial goals and risk tolerance levels.