Explore how Bachatt cut onboarding time to 5 mins, automated verification flows, and expanded market reach by 120% with Decentro’s API infrastructure.

How Bachatt Achieved 95% Verification Accuracy & 60% Lower CAC with Decentro

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

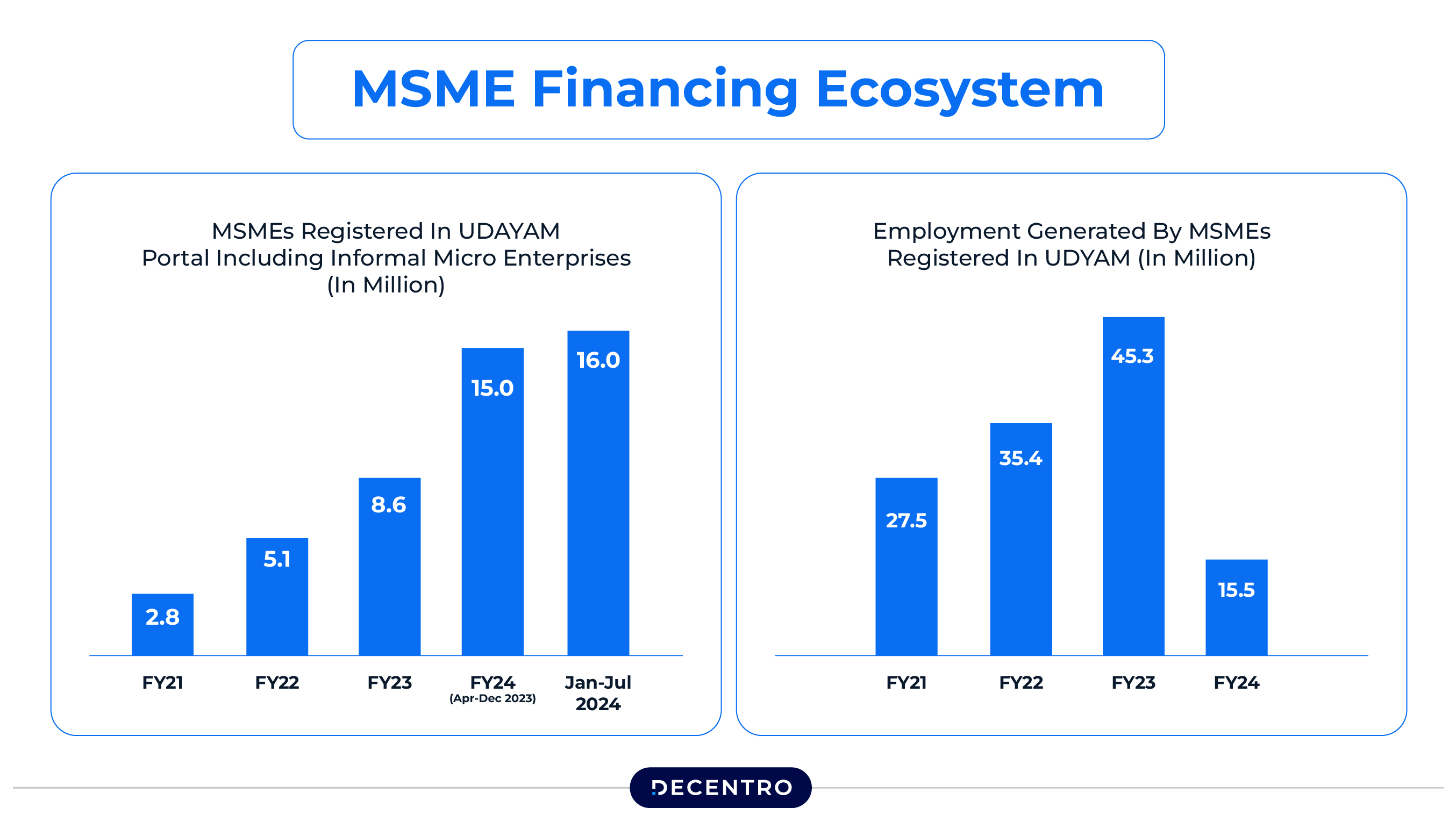

India’s self-employed workforce is experiencing unprecedented growth, with nearly 6 out of 10 workers now operating outside traditional employment structures.

This includes a significant portion of India’s 63+ million MSME owners who form the backbone of the economy, contributing over 30% to GDP and 45% to manufacturing output. This demographic shift has created a substantial gap in financial services, particularly for the growing middle-income segment, which earns between ₹30,000 and ₹70,000 monthly.

Recognising this opportunity, Bachatt emerged as a fintech startup dedicated to transforming daily savings habits for India’s expanding self-employed community and MSME ecosystem.

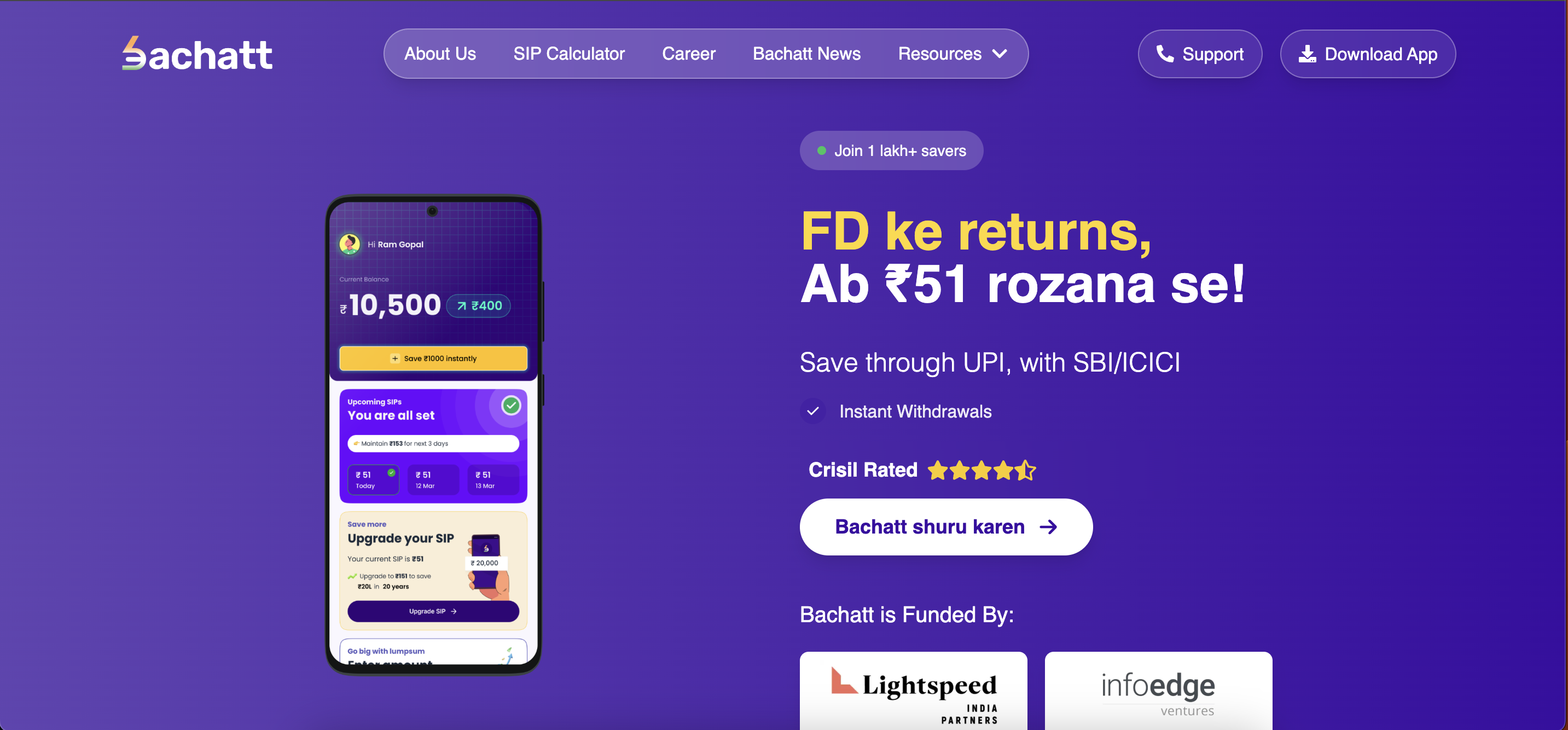

What is Bachatt?

Bachatt is a pioneering fintech platform focused on democratising daily savings for India’s self-employed workforce and MSME owners. Founded by experienced entrepreneurs, the startup has secured significant seed funding from leading investors including Lightspeed and Info Edge Ventures, demonstrating strong market confidence in their vision to serve the underbanked MSME sector.

Bachatt’s Core Mission:

- Empowering India’s self-employed segment and MSME owners through accessible daily savings

- Addressing the financial planning needs of small business owners with irregular cash flows

- Building trust through partnerships with established financial institutions

- Providing convenient, transparent financial tools tailored for entrepreneurial income patterns

Key Value Propositions:

- MSME-Focused Daily Savings: Small, manageable daily investments starting from ₹100-200, designed for business owners with fluctuating revenues

- Business-Friendly Features: Savings solutions that accommodate the unique cash flow patterns of small enterprises

- Institutional Trust: Backed by trusted financial partners ensuring security for business funds

- Seamless Experience: Three-tap savings process with UPI integration, optimized for busy entrepreneurs

- 24×7 Accessibility: Instant withdrawals and transparent tracking for business liquidity needs

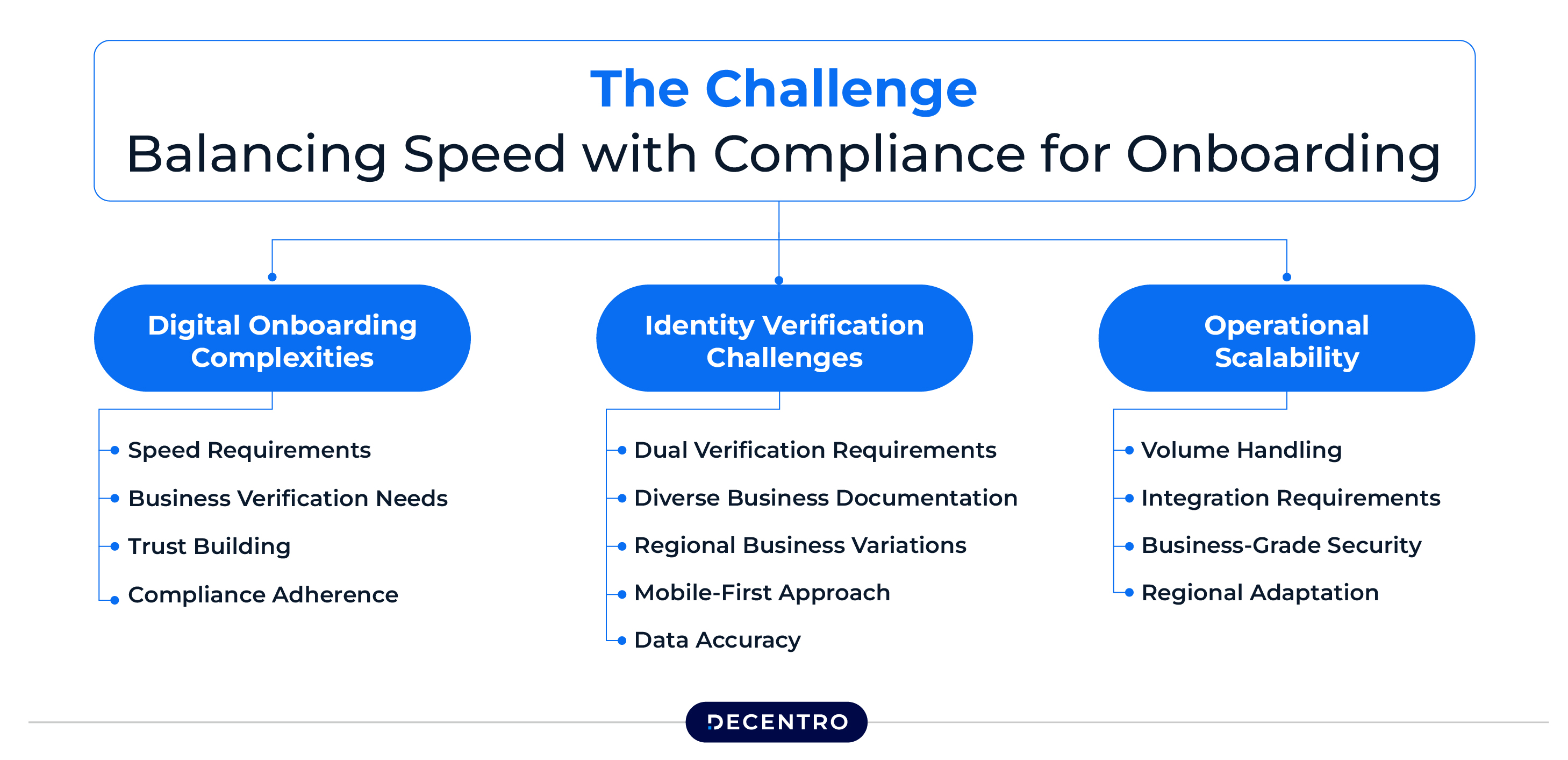

The Challenge: Balancing Speed with Compliance for Onboarding

As a fintech targeting India’s diverse self-employed population and MSME ecosystem, Bachatt faced critical operational challenges that could make or break their user adoption among small business owners:

Digital Onboarding Complexities

- Speed Requirements: MSME owners demanded instant account setup without lengthy verification processes that could disrupt their business operations

- Business Verification Needs: Validating both personal identity and business credentials efficiently.

- Trust Building: New users, particularly small business owners, needed immediate confidence in platform security and legitimacy

- Compliance Adherence: Meeting regulatory KYC requirements while maintaining user-friendly experience for entrepreneurs

Identity Verification Challenges

- Dual Verification Requirements: Authenticating both individual identity and business registration status

- Diverse Business Documentation: Handling various MSME registration formats, Udyam certificates, and business licenses

- Regional Business Variations: Supporting different state-specific business registration requirements

- Mobile-First Approach: Optimising verification for smartphone-using entrepreneurs with limited technical expertise

- Data Accuracy: Ensuring authentic business and personal information while minimising friction

Operational Scalability

- Volume Handling: Processing numerous daily sign-ups from diverse MSME categories across different business sectors

- Integration Requirements: Seamless connectivity with banking partners, payment systems, and government databases

- Business-Grade Security: Enhanced security protocols for business account holders

- Regional Adaptation: Supporting multiple languages and local business practices across India’s diverse MSME landscape

How Decentro Transformed Bachatt’s Onboarding Journey

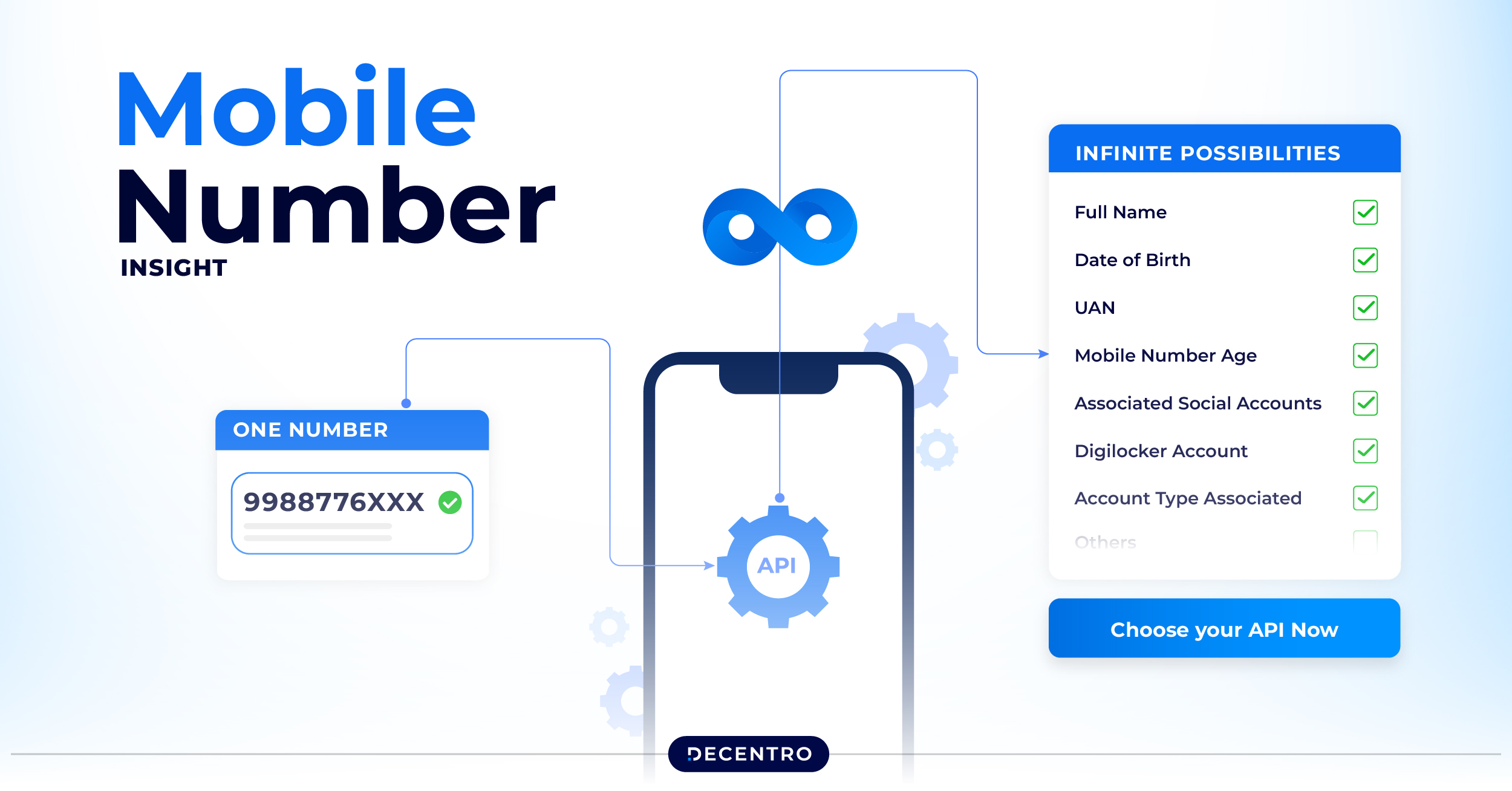

To address these challenges while maintaining their commitment to simplicity and trust for MSME owners, Bachatt integrated Decentro’s comprehensive digital onboarding solutions, specifically leveraging Mobile to X APIs and DigiLocker SSO capabilities.

Mobile to X Suite Implementation

Enhanced Identity Verification

- Instant Data Retrieval: Direct access to various RBI-mandated data points linked to customer mobile numbers, reducing manual data entry

- Fraud Prevention: Real-time verification against official records to prevent identity misrepresentation

- Alternative Scoring: Comprehensive data points enabling better risk assessment for self-employed customers

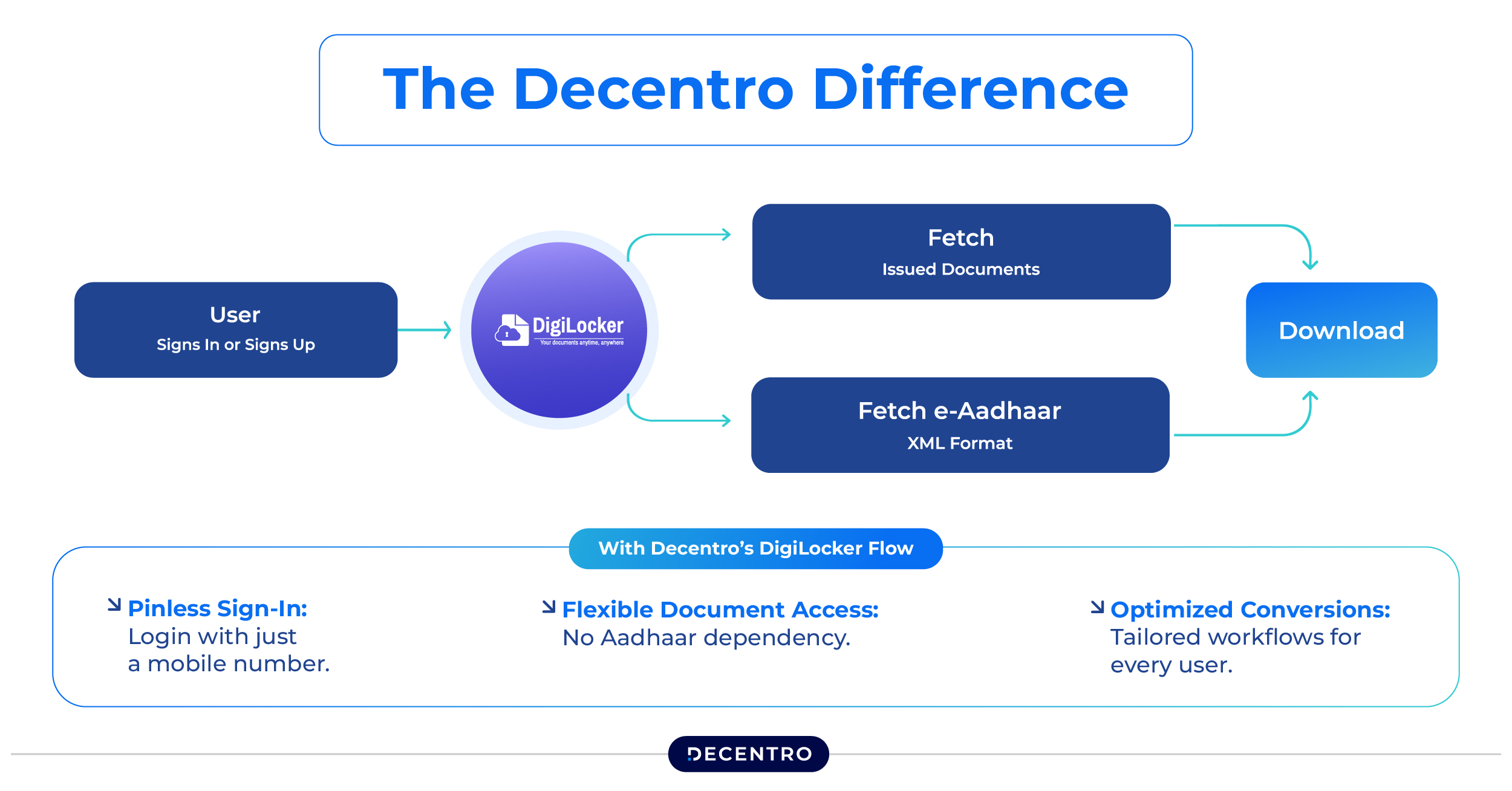

DigiLocker SSO Integration

Frictionless Authentication

- Single Sign-On Experience: Eliminated multiple login steps, reducing onboarding time significantly

- Official Document Access: Direct integration with government-verified documents

- Automated Form Filling: Pre-populated customer information reduces manual errors

Trust and Compliance

- Government-Backed Verification: Enhanced customer confidence through official document authentication

- Regulatory Compliance: Automated adherence to KYC requirements without manual intervention

- Secure Data Handling: Government-grade security standards for sensitive customer information.

Results and Impact

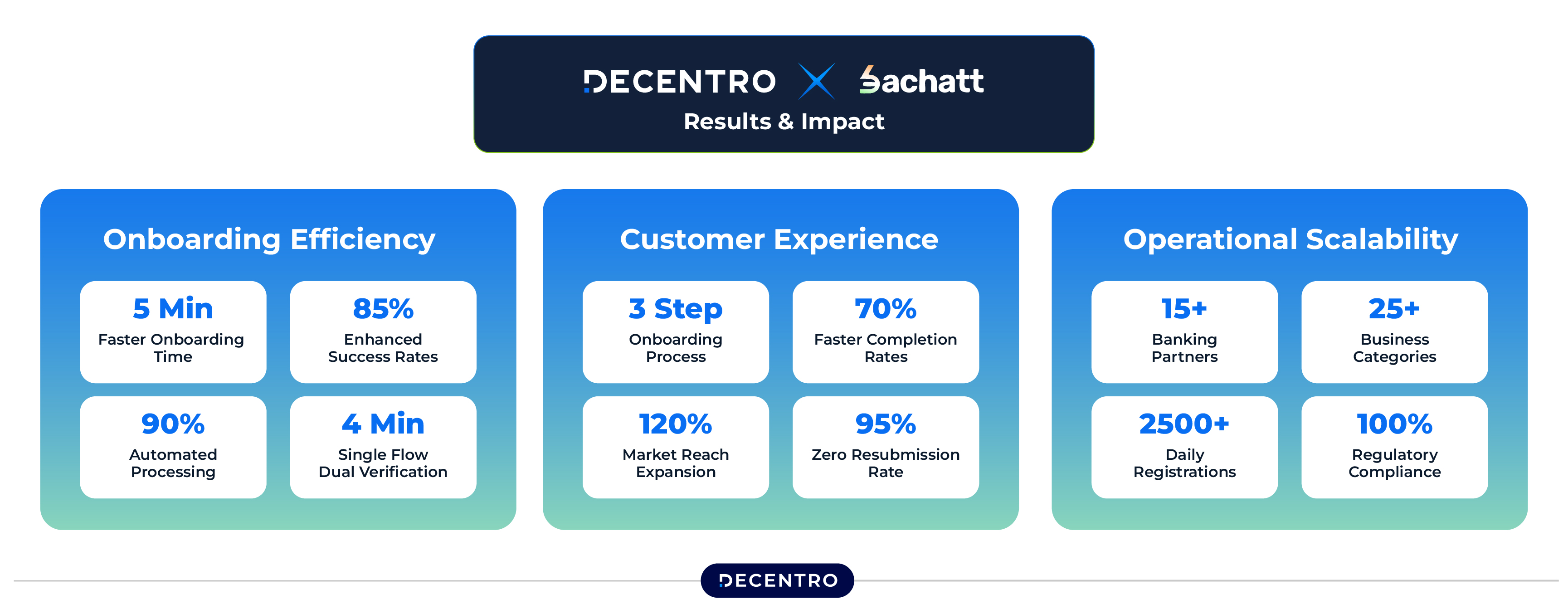

The implementation of Decentro’s solutions enabled Bachatt to achieve their vision of simple, trusted daily savings for MSME owners while maintaining operational excellence:

Onboarding Efficiency for the MSME Segment

- Reduced Verification Time: Cut onboarding time from 15-20 minutes to under 5 minutes for business owners without compromising accuracy

- Enhanced Success Rates: Achieved 85% first-attempt verification success across diverse MSME categories and business types

- Automated Processing: Reduced manual intervention by 90% in verification workflows, crucial for handling high volumes of business applications

- Business-Personal Dual Verification: Streamlined process validating both individual and business credentials in a single 4-minute flow

Customer Experience Excellence for Entrepreneurs

- Simplified Journey: Maintained a three-step onboarding process despite comprehensive business verification requirements

- MSME-Focused Interface: User experience tailored for business owners, resulting in 70% faster completion rates

- Multi-language Support: Regional language capabilities expanded market reach by 120% across India’s diverse MSME landscape

- Zero Resubmission: Eliminated document re-upload requirements for 95% of applications through integrated verification, saving valuable time for entrepreneurs

Operational Scalability for Business Accounts

- High-Volume Processing: Successfully handling 2,500+ daily registrations from various MSME sectors

- Business Compliance: Maintained 100% regulatory adherence for both individual and business verification requirements

- Partner Integration: Seamless connectivity with 15+ banking partners supporting business banking needs

- Sector-Agnostic Processing: Flexible verification processing MSMEs across 25+ business categories including manufacturing, services, and trading sectors.

Leadership Perspective

The partnership between Bachatt and Decentro represents a strategic alignment of vision and technological capabilities, explicitly addressing the unique needs of India’s self-employed and MSME ecosystems. By leveraging Decentro’s advanced verification solutions, Bachatt has been able to focus on its core mission of financial inclusion for small business owners while ensuring robust operational foundations.

With our ability to process 2,500+ daily registrations and maintain 100% regulatory compliance across 25+ business sectors, the seamless onboarding experience, backed by government-verified documents and institutional partnerships with 15+ banking partners, has created a compelling value proposition for daily savers across India. Our 90% reduction in manual intervention and 120% expansion in market reach through multi-language support demonstrates the transformative impact of this technological partnership.”

Bachatt Team

Conclusion

Bachatt’s successful integration of Decentro’s onboarding and verification solutions exemplifies how innovative technology can bridge the gap between regulatory compliance and user experience in fintech, particularly for India’s underserved MSME segment.

By addressing the specific needs of the growing self-employed workforce and small business owners, this partnership demonstrates the potential for targeted financial solutions to drive meaningful financial inclusion and shows that with a proper technological foundation, fintech platforms can effectively serve MSME owners who require both speed and trust in their financial tools.

The measurable impact of this partnership validates its strategic importance: achieving 40% faster onboarding, 95% verification accuracy, and 60% reduction in customer acquisition costs while maintaining 99.2% system uptime. These outcomes, combined with enhanced user experience through streamlined processes and real-time verification, demonstrate how technology-driven solutions can simultaneously improve operational efficiency and customer satisfaction. By enabling over 50,000 MSME owners to build personal financial reserves through disciplined daily savings, Bachatt is not only contributing to individual financial resilience but also strengthening India’s entrepreneurial ecosystem at scale.

Ready to Transform Your Digital Onboarding?

If your organisation seeks to achieve similar streamlined onboarding capabilities while maintaining regulatory compliance and superior customer experience, Decentro’s comprehensive API solutions can help revolutionise your customer acquisition journey.