How Decentro enables Baya’s vision of redefining the B2B payment collection processes for SMEs. Let’s connect!

How Decentro is Enabling Baya Redefine B2B Receivables Processes

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

The Small and Medium Enterprises [SME] sector is poised to be the key to unlocking India’s economic development, and rightfully so.

The Ministry of MSME’s annual report for 2020-21 said that India has approximately 6.33 crore MSMEs that contribute significantly to the country’s productivity and employment. The employment of the roots is what this sector is often referred to. As of March 2023, there were 43M GST-registered, active businesses in India.

However, despite its significance and reach, the struggle to acquire credit, among other roadblocks such as effective collections and reconciliations, has hampered the sector’s growth.

So why does this gap exist? The answer is straightforward.

The sector is so vast, more times than not, it doesn’t fit into the blueprint of what a traditional process of collections or credit access would look like.

Additionally, there is a shortage of players that address all the critical pain points faced by the sector, namely Managing Contracts, Managing Invoices, Collecting payments and reconciliations.

This is where a player like Baya is poised to disrupt the SME landscape. Let’s see how this innovative solution that helps businesses manage the entire lifecycle: Contracts, Invoices, Payments, Reconciliations and Credit, plans to execute its vision.

What is Baya?

Built purely to enable SME owners to reach their full potential, Baya, with its fintech background, is a back-office payment automation software for SME owners so they can focus on what matters most, i.e. Growth and Service Quality. Designed for Service Providers, Baya is a unified platform to manage contracts, invoices, payments, reconciliation and access to credit. From managing collections and monitoring receivables, the platform becomes a one-stop shop for all collections needs so business owners can remain focused on boosting cash flow and delivering quality services.

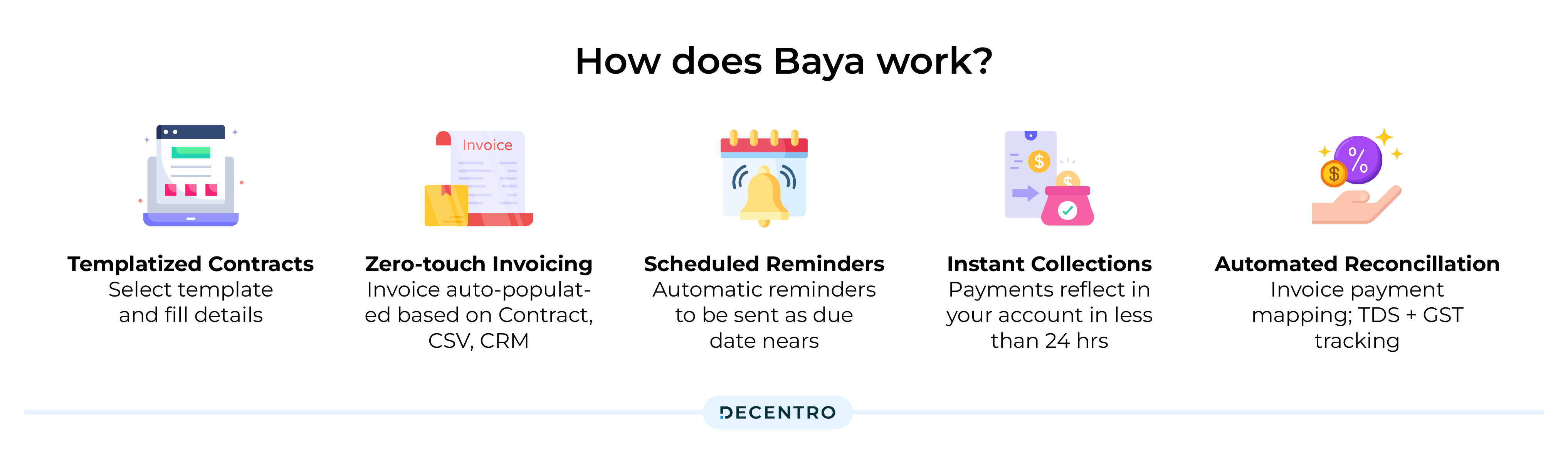

How does Baya work?

The first product, “GetPaid” was launched with the vision of redefining how SMEs collect B2B invoice payments. This required a process that enables onboarding faster and serves the collection cycle of high volume and ticket size transactions. Baya serves the two points by deploying a process that automates the payment cycle, providing seamless and exceptional service to the vendors.

Another product, “Get Advance”, followed shortly thereafter to facilitate credit access instantly.

What were Baya’s Key Challenges?

The SME landscape is tricky. With this focus group expanding to the length and breadth of the country, collections and reconciliation are generally challenging. In addition to that, any platform that enables processes for such a broad spectrum will need to dedicate valuable hours and resources to keeping track of these transactions.

Between high-volume merchant onboarding and disbursals and recollections, Baya hit a significant roadblock when onboarding users in the following places.

- Verification module

- An Effective Collection Tool

- Keeping Track of Recurring Transactions

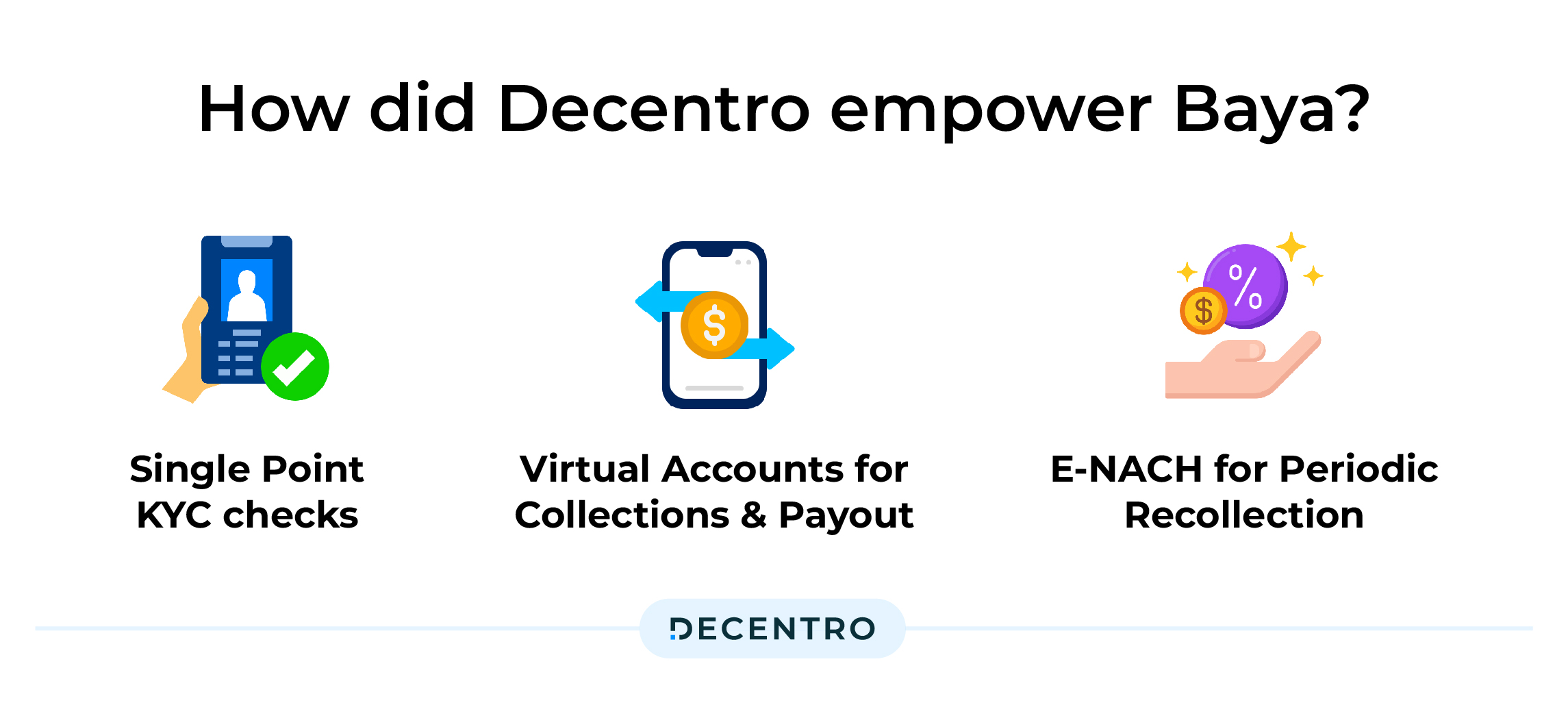

How did Decentro empower Baya?

Navigating the complex, heavily regulated finance sector and providing quick access to capital to vendors were crucial challenges faced by Baya, pushing them to partner with Decentro to leverage our APIs for the following outcomes:

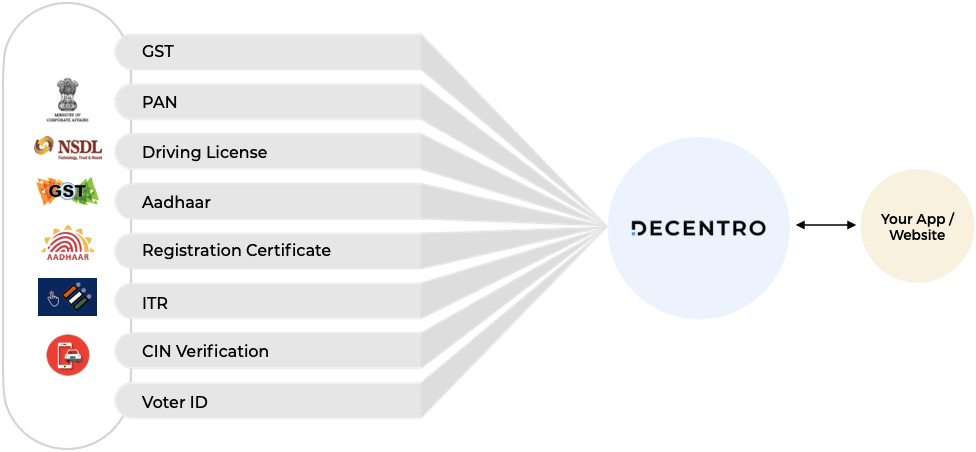

Single Point KYC checks

While dealing with vendors, background checks are crucial for any platform.

With Decentro’s single end-point for KYC APIs, Baya set seamless onboarding flows to offer smooth and secure user onboarding. With single-point access to various data points such as PAN, Aadhaar, Driving License, Voter ID, and more, Baya onboards users in real-time and automates the KYC process once and for all.

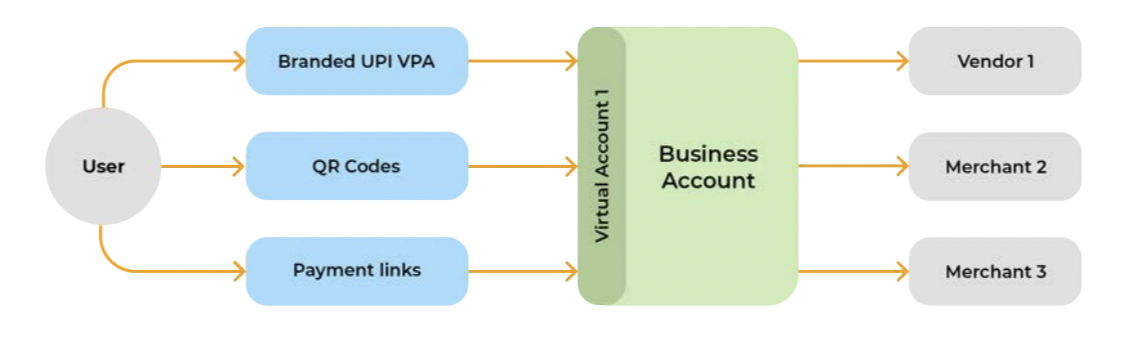

Virtual Accounts for Collections and Payout

The challenge of enabling funds collection, bookkeeping, reconciliation, and payouts was also solved by Baya by issuing Virtual Bank Wallets for their vendors using the Virtual Accounts API. Eliminating the expending time, effort, and capital for managing fund collections and payments, Baya leveraged the efficiency of VAs for each business on their roster without any hassle.

E-NACH for Periodic Recollection

Baya also set up recurring payment mandates through eNACH to recollect money periodically. The primary underlying objective of e-Nach here is to help businesses on Baya’s roster reduce the follow-up time for recurring transactions.

Decentro’s e-NACH APIs come with a one-time authorization of the mandate and post that recurring payments are automatically debited from users’ accounts, reducing time spent on recollections.

What were the key outcomes for Baya?

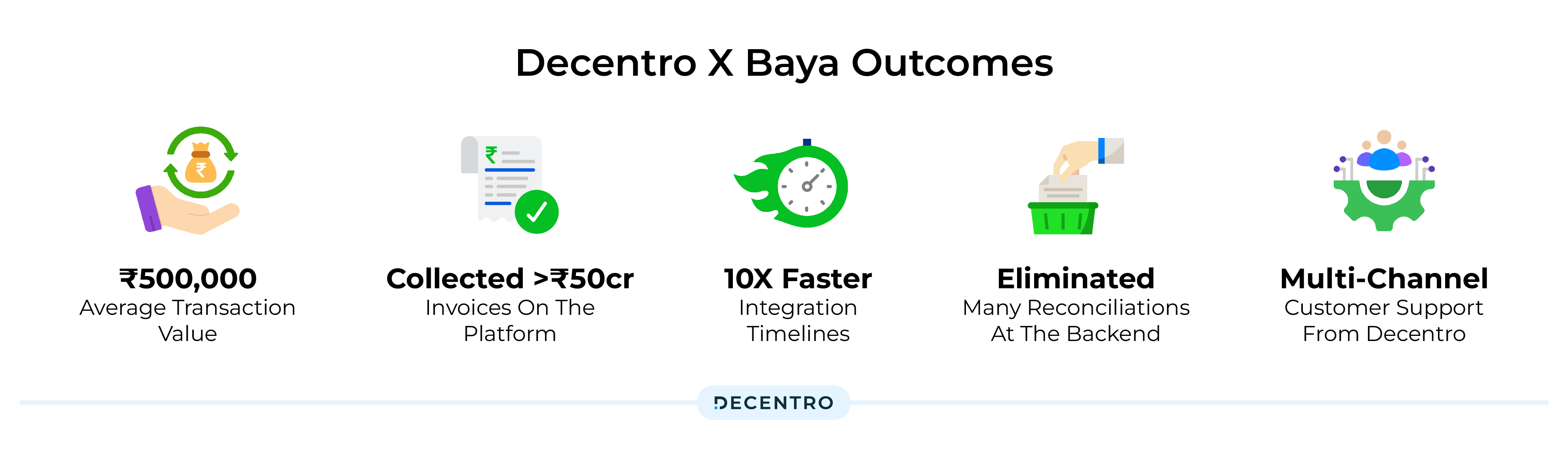

By leveraging Decentro’s API for banking integrations, Baya has simplified the payment collection process and drove the following results.

- Average Transaction Value of ₹500,000

- Successfully collected >₹50cr of invoices on the platform as of September 2023

- 10X faster integration timelines.

- Decentro’s improved compliance has allowed Baya to eliminate many reconciliations at the backend.

- Availed Decentro’s multi-channel customer support for any queries or resolution

In Conclusion

The aim to empower fintech players has found its fruition through our partners. That’s precisely what our simplified banking APIs are here for! Not just Baya but Decentro has enabled major companies – notably MoneyTap, CashE and others – to facilitate a better user transaction experience with sharper expense tracking, better compliance, and improved reconciliation.

Decentro’s API offers a plug-and-play solution to your banking integration needs and covers all compliances. Whether your business requires extended credit with custom Buy Now, Pay Later or ensuring thorough verifications via KYC, Decentro has surrounded you with a suite of banking APIs.

With efficiency being our promise, feel free to reach out if your business wants to solve a use case involving anything linked to banking. We’re all ears!