Today, almost 62% of businesses are using cloud-based payroll software. Such solutions help speed up their payroll processes, cut costs by leveraging automation and enable employees to access their payment and benefits information online hassle-free.

Check out the best payroll software in India in 2025 and its notable features.

17 Best Payroll Software in India in 2026: Stay Compliant & Efficient

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

A Quick Glance

| Platform Name | Value Proposition |

| Craze | All-in-one HR, Payroll, & Compliance for startups and growing businesses. |

| factoHR | All-in-one HR and payroll management solution for small startups to large enterprises. |

| Kredily | All-in-one HRMS and payroll software, designed to simplify employee management and payroll processing for growing businesses. |

| HROne | Easy-to-configure HR and payroll management software support for over 15 ERP platforms. |

| Zoho Payroll | Facilitates instant salary disbursements via its integrated banking partners. |

| Razorpay X Payroll | Provides full-automated payroll and compliance software for startups, SMEs and enterprises. |

| HRMantra | Best HR and payroll software for multinational businesses. |

| greytHR | Reduces payroll related administrative work by 80% via its ESS portal. |

| Pocket HRMS | Enhances payroll flexibility with single-employee and multi-category payroll processing. |

| sumHR | Complete salary disbursement and issue payslips in just 5 simple steps. |

| Keka | Enterprise-grade HRMS platform that simplifies payroll management. |

| Superworks Payroll | Payroll management software for automated and hassle-free payroll processing. |

| Beehive | Dynamic payroll and HR solutions for multiple industries. |

| Zimyo | Facilitates 5 times faster employee expense settlements. |

| 247 HRM | End-to-end payroll management solution for businesses across multiple industries. |

| Officenet | Single-click payroll processing with automatic updates for the changing tax laws. |

| Gusto | Streamlines payroll management for a global workforce. |

| Paychex | Customised payroll solutions for small, medium and enterprise-level businesses. |

Payroll software can benefit companies in several ways. It can automatically consider payroll variables like annual leaves, tax, superannuation, etc., and help with accurate salary calculations.

Moreover, they can integrate with HR and time-tracking programs, track repetitive data entries and send error alerts to users to avoid hassles.

Such solutions also help automate payroll processing tasks, such as employee tax and deduction calculations. This can save the Accounts and HR teams time, enabling them to focus on other tasks.

Apart from this, such software can enable companies to maintain compliance with labour laws and other regulations. These laws usually change, and having a payroll management system can help businesses automate their compliance processes, ensuring their adherence to the updated legal requirements. Additionally, companies can further streamline their financial operations by utilizing accounting outsourcing services, which can provide expert assistance in managing compliance and other financial tasks.

Following are the 17 best payroll software in India in 2026:

Craze

Craze (YC S22) offers startups an all-in-one admin solution. It automates HR, payroll, and compliance tasks to free up founders’ time for business growth.

Its integrated system simplifies admin work from onboarding to offboarding, with features like core HRIS, one-click payroll, simplified compliance, leaves and attendance management. Customers praise Craze for saving them time and providing excellent support.

Craze simplifies payroll with compliant, error-free automation. With just a click, it calculates tax deductions based on location, company policy, headcount and other inputs. It supports various aspects, including reimbursements, bonuses, leave encashment, etc. Employees can access features like leave applications, payslips, tax declarations, and Form 16 through their logins.

It handles legal obligations such as TDS, PF, PT and ESIC with detailed tax liability reports.

Features

- Streamlined payroll processing: Automate payroll tasks and directly pay your team with just one click, eliminating the need for manual bank transactions and constant back-and-forth with HR and Finance departments.

- Compliance assurance: Ensure accuracy and compliance by applying correct deductions for statutory components such as TDS, PF, PT, and ESIC. Quickly generate Form 16 for employees and stay informed about payroll costs with detailed EPF, ESIC, and TDS tax summaries.

- Efficient deductions and reimbursement management: The intuitive and user-friendly Craze dashboard allows you to seamlessly handle bonuses, deductions, and expense approvals.

- Integration with Leaves and Attendance: Set and monitor leave policies, including loss of pay, and effortlessly synchronise payroll for streamlined salary disbursement with just one click.

- Simplified contractor payments: Effortlessly manage payments to interns or contractors based on TDS or GST slabs. Pay multiple recipients simultaneously, individually, or selectively based on submitted invoices and documents.

Payroll Pricing

- Free for up to 5 people

- ₹50/month per person

- No setup fees

- Expert support

Pros:

- One-click salary disbursement (via Decentro) without requiring a new current bank account

- User-friendly interface with customisable leave policies

- Lightning-fast support with direct access to founders and the team

- Less than 30 minutes to set up with easy import of payroll and leave data

- Comprehensive product suite covering HR, payroll, compliance, IT device/software management, and more

Cons:

- No mobile app

factoHR

factoHR features a secure and fully integrated payroll system with all internal modules and external systems. It comes with plug-and-play integration and a validation engine, ensuring high data output accuracy with minimum human intervention.

Formula-based calculation, unlimited component creation, and process customisation features allow businesses to scale operations according to their needs.

Regarding security, this platform offers fine access control and an audit trail that enables companies to provide top-level security for their employees’ sensitive data.

Features:

- A self-service portal enables employees to view information related to their income tax, compensation, and other relevant details on desktops and mobile devices.

- A formula-driven rule engine allows companies to make customised salary structures based on their business type or industry.

- Auto arrear calculation facilitates easy tracking of all retro changes in attendance or compensation, leading to error-free salary calculations.

Market Share: 0.03%

Price: ₹2,999.00 to ₹5,999.00 per month

Pros:

- Accurate attendance tracking and leave management

- Options for seamless e-resignation process

- Available in the form of a mobile app with an attractive user interface

- Provides 360-degree feedback mechanism

Cons:

- Lacks ticketing support features

- Mobile attendance may sometimes have errors

Kredily

Kredily is a powerful HRMS System crafted to simplify payroll management, attendance tracking, and employee benefits administration for businesses of all sizes.

This HRMS System seamlessly integrates with both internal HR modules and third-party systems, promoting efficient data flow and minimizing manual work. With its formula-based payroll calculations, unlimited component creation, and customizable workflows, Kredily enables businesses to scale their payroll operations precisely to fit their needs.

Features:

- Self-Service Portal: Employees can access their payslips, leave balances, income tax details, and other essential information conveniently on desktop or mobile.

- Customizable Payroll Structure: The rule engine allows flexible, formula-driven salary structures based on industry standards and business demands.

- Automated Arrears Calculation: Automatically tracks retroactive pay adjustments due to attendance or compensation changes, ensuring accurate salary calculations.

- Attendance & Leave Management: With automated leave approvals and in-depth reporting, this cloud-based HRMS System simplifies attendance tracking and leave management for HR teams.

- Performance Management: Kredily’s HRMS Software includes advanced tools like KRA analytics, a 9 Box Grid, and Bell Curve assessments, giving businesses actionable insights into performance.

- Security and Compliance: Kredily prioritizes data security, featuring robust access controls, an audit trail, and encryption to protect sensitive employee information and comply with data regulations.

Price: ₹4,999.00 per month

Pros:

- User-friendly interface for both HR teams and employees

- Automated payroll and tax calculations, reducing manual errors

- Secure, cloud-based storage with top-notch data protection

- Scalable, ideal for small to medium-sized businesses

Cons:

- Basic plans offer limited advanced reporting capabilities

- Customization may be required for larger businesses with complex payroll requirements

HROne

HROne is a payroll management system that is compatible with 15+ Enterprise Resource Planning (ERP) platforms, such as Microsoft Navision, SAP Business One, Oracle ERP, and custom ERP systems.

It automatically syncs databases to facilitate seamless data flow between financial systems and has integrated System Applications and Products (SAPs), eliminating the need for manual reconciliations.

This platform also enables companies to configure pay groups based on their organisational structure, assign salary structures to new joiners and automate payouts for timely salary disbursements.

Features:

- 3D reports facilitate vertical, horizontal, and drill-down views of salary components.

- Auto-deduction of components like PF, ESIC, etc., to ensure compliance with the government’s regulations.

- Automatic error list generation to highlight post-payroll errors.

Price: ₹85 to ₹115 per user per month

Pros:

- Simple and attractive user interface

- Effective attendance tracking facilities

- High-end security features

Cons:

- The mobile app can be slow and time-consuming

- The app integration process needs to be updated

Zoho Payroll

With its automatic payroll calculation and options to create and assign multiple pay slabs for different grades of employees, Zoho Payroll makes payroll management simple and scalable. This platform has partnered with Yes Bank and HSBC to ensure that salaries are disbursed on time.

This helps businesses initiate salary transactions from the platform, reducing processing time. Additionally, Zoho Payroll facilitates seamless compliance handling by considering components like ESI, PF, IT, PT and LWF and automatically deducting them as per the prescribed schedule.

Features:

- Fine-tune admin privileges enable companies to assign role-based access to employees.

- Personalised employee benefit options allow businesses to create custom employee benefit plans.

- Enables companies to store all their employees’ payment data under one roof and secure them with custom passwords.

Price: Up to ₹60 per employee per month

Pros:

- Easy-to-navigate user interface

- Affordable pricing model (free for up to 10 employees)

- Robust attendance management system

Cons:

- Errors can often appear in Zoho Book and bank account integrations

- Zoho Payroll is less customisable than other Zoho apps

Razorpay X Payroll

Razorpay X Payroll is one of the best payroll software in India. It provides 360-degree payroll management by facilitating accurate salary calculations and direct deposits to the employees’ bank accounts.

Companies can also leverage the platform’s online leave management system for tracking, approving and managing the holidays and leaves of their employees. Moreover, they can revise salaries mid-month or on any past or future date and automate arrear payments.

This platform enables businesses to access their complete compliance trail across components like TDS, PF, ESIC, PT, etc., and automatically file and pay all tax liabilities.

Features:

- Options for advanced salary and instant reimbursement payments.

- Bulk Wizard enables additions, deductions and loss of pay calculations all in one go.

- Over 45 integration partners cover insurance, flexible benefits, attendance, HRMS, and more.

Price: 2% platform fees applicable on all transactions + 18% GST

Pros:

- Options for auto time and attendance management

- Hassle-free auto ITR filing and insurance tracking

- Efficient document management service

Cons:

- Search-related issues in its API

- Limited presence in international markets

HRMantra

HRMantra is an integrated hire-to-retire web-based application that enables businesses to perform payroll and FFS processing for branches worldwide from a single platform.

Companies can easily introduce different taxes levied by various nations into their payroll and deduct them from the salaries payable to comply with the regulations. Companies can also make flexible benefits plans according to their employees’ needs and even provide tax-saving investment options to reduce their tax outgoes.

Features:

- Options to define payslip format, salary period, payroll Journal Voucher codes and roundoff.

- Availability of fully automated workflows for processing salary advances, EMI deductions from salaries, etc.

- It provides a comprehensive view of the current month’s total active employees, list of new joiners, and individuals getting increments or exiting the organisation.

Market Share: 0.02%

Price: Customised pricing is available as per the client company’s requirements.

Pros:

- Facilitates automatic leave availing, credit and encashment

- Single-tap payroll processing

- Automated recruitment management with features like online tests, reference checking, offer management, etc.

Cons:

- The expense management system is not up to the mark

- The leave management system is time-consuming

greytHR

Thanks to features like processing reimbursement claims via automatic policy reinforcements and online claim submissions, greytHR reduces payroll-related administrative work by almost 80%.

It provides highly customisable salary structures and unlimited salary components, making it a perfect choice for businesses across various industries. Furthermore, this platform offers features like digitally signed Form 12BA and Form 16 generation, auto-computation of components like PF, ESI, PT, etc., calculation and deduction of the Labour Welfare Fund contributions and more.

Also, there are options for generating comprehensive TDS and eTDS returns, ensuring 100% adherence to all statutory compliances.

Features:

- A direct-debit facility lets companies disburse employees’ salaries directly from the platform.

- Bank-wise and batch-wise payment release options with electronic bank transfer formats for all leading banks.

- Numerous analytics and report features are present for generating payroll statements, statutory compliance reports, MIS and reconciliation reports, etc.

Market Share: 0.70%

Price: Up to ₹7,495.00 per 50 employees per month

Pros:

- Options for remote attendance powered by GPS tracking

- Simple and user-friendly user interface

- All company policies are combined in one place in the form of docs

Cons:

- Lacks global communication features

- UI does not go with the latest trends and contains several bugs.

Pocket HRMS

Pocket HRMS significantly enhances payroll management flexibility through its single-employee and multi-category payroll processing options. Businesses can easily create payroll rules for multiple employee categories based on organisational structure.

Moreover, if they have multiple ventures in their business, they can use the same payroll credentials for streamlined access. The conditional formula builder enables the payroll team to modify salary heads without depending on the developer team.

Companies can also perform automatic calculations for components like PF, ESI, professional tax, income tax, leave encashment, asset recovery, gratuity calculations, etc. They can also batch-process payroll data in the background, thus improving their productivity.

Features:

- Custom payslip designer enables companies to develop payslips with their organisation logo and other necessary elements.

- The dedicated Employee Self-Service Portal facilitates downloading tax worksheets and payslips from mobile devices and desktops.

- Super Data Wizard provides custom report generation across 100+ templates.

Price: ₹2495 to ₹3995 per month for up to 50 employees

Pros:

- Dedicated shift management and performance management systems

- Gen-AI-powered recruitment system

- Highly efficient time-tracking

- Presence of self-service portals for requesting leaves, checking payslips and updating information

Cons:

- Lacks international access

- No option for auto-transferring employee data within companies

sumHR

sumHR enables businesses to simplify complex payroll processes in just 5 simple steps. It automates operations like payroll calculation, TDS and PF deductions, calculating tax exemptions, gratuity calculations, etc., enabling companies to make timely salary disbursals.

If they do not have adequate attendance data or it does not matter in their business model, they can skip it altogether to speed up payroll processing. Additionally, they can create their own salary components and configure them based on fixed values or formulas.

Features:

- A multi-company payroll management system enables businesses to run payroll operations for multiple ventures via a single account.

- Availability of flexible salary calculation methods like CTC, Gross Pay uploads, Proration Upload, etc.

- Allows companies to set a clearly defined time window for employees to upload their income tax declarations.

Market Share: 0.09%

Price: ₹49 to ₹119 per user per month

Pros:

- Compatible with numerous platforms like Windows, Linux, Mac, tablets and mobile devices

- Excellent attendance and leave tracking system

- Companies can make customised attendance policies that fit in with their requirements

Cons:

- Response time needs improvement

- New features need to be added

Keka

Keka is an enterprise-grade payroll management solution. It features a range-based salary structure that simplifies the salary configuration automation processes and provides easy salary revision options, enabling even non-finance members to perform such tasks.

Additionally, companies can preview a payroll period multiple times and review each detail before finalising it. They can also compare changes from previous pay periods to analyse them at a micro-level.

This platform also has an integrated expense management system that enables them to configure approval workflows for various employee expenses and schedule expense reimbursements for multiple payroll periods.

Features:

- Unified time tracking and payroll software facilitating effortless employee attendance and leave calculations.

- Efficient reimbursement tracking and options to pay or hold payments for the upcoming month.

- Enables monitoring of payroll, employee and all data related to the cost elements of payroll management in one consolidated and consistent reporting model.

Price: ₹6,999 to ₹13,999 per month for up to 100 employees

Pros:

- Presence of excellent employee management features

- Options for payroll tracking and auditing

- Clean, simple and visually appealing user interface

Cons:

- The process flow is not easily customisable

- Frequent hang-ups on web pages

Superworks Payroll

Superworks Payroll is a Payroll software developed to streamline and

automate the payroll process for companies. It assists in efficient management of

employee wages as well as bonuses, taxes, and deductions, assuring prompt and

accurate payroll processing.

Superworks Payroll typically offers features like tax calculation direct deposits,

benefits administration, and compliance with labour laws and reports capabilities. Its

goal is to eliminate errors made manually, cut down on time and improve the

accuracy of payroll and efficiency, which makes it a useful tool for companies of all

sizes to run their payroll efficiently.

Features:

- Bonus Calculation

- Statutory Compliance

- Employee Compensation

- Loan Management System

- Salary Structure

- Payroll Reports and Analytics

- Salary Slip

- Advance Salary

- Salary Disbursement

- Tax Management

Starting Price: ₹3499 per 50 employees per month

Pros:

- Automates payroll processing, reducing errors and saving time.

- Enhances compliance with tax laws and regulations.

- Provides robust reporting and analytics for better decision-making.

- Supports integration with other HR and accounting systems.

Cons:

- Initial setup and training can be time-intensive.

- Regular updates needed to comply with changing regulations.

- Costs can be significant for purchase and maintenance.

Beehive

Beehive uses an incremental approach to payroll management, enabling companies to process payroll data for a large number of employees in minutes. It also enables businesses to leverage customisable calculation logic to define and implement various components, deductions, and benefits based on their industry and unique requirements.

Moreover, companies can create various categories and components of employee benefits depending upon their organisational structure and use an intuitive approval workflow to perform loans and advance management.

Features:

- Effortless integrations with leading accounting software and ERP systems like Tally, Farvision, Microsoft Dynamics, etc.

- Segmented access rights and role-based permissions limit unauthorised modifications and ensure employee data security.

- Options for audit trails and data audits to maintain adherence to regulatory compliances.

Price: Up to $84 per month

Pros:

- Timely reminders and notifications for company-related events

- Facilitates streamlined communication with HR teams on the go

- Provides real-time information on policies, leave balances and payslips

Cons:

- The implementation process can be a bit slow

- The mobile app may lack a few features

Zimyo

Zimyo seamlessly integrates with HRMS platforms to facilitate 100% accurate salary calculations, rapid disbursement and high transparency.

Companies can run their payroll on this platform with just 5 clicks and cater to aspects like benefits administration, accurate expense management, compliance updates, income tax, and more.

Additionally, they can settle employee expenses 5 times faster by creating a reimbursement approval workflow that enables individuals to claim expense reimbursements seamlessly.

Features:

- Options for TDS computation, PF and ESIC computation and professional tax deduction to maintain compliance with the payroll tax laws.

- It enables companies to provide benefits like earned salary advances, instant personal loans and insurance coverage.

- Facilities to sync Zimyo with the company’s attendance tracking system to effortlessly track employees’ attendance and leaves, calculate loss of pay and overtime and perform accurate salary calculations.

Market Share: 0.04% (As of February 2024)

Price: ₹60 to ₹150 per user per month

Pros:

- Integration with Microsoft Azure, Okta and Google to reduce phishing risks and streamline the sign-in process

- Options to automate repetitive tasks like approving or rejecting requests

- Attractive and easy-to-use UI

Cons:

- Customer support needs improvement

- The PMS module needs updates

247 HRM

247 HRM is a hire-to-retire payroll solution that facilitates seamless bulk import of employee records like personal, professional, organisational, banking and statutory data for accurate salary calculations.

It has features that can facilitate systematic and equitable salary administration and can be configured to assign salary components based on factors like employment type, location, and grade.

Features:

- Options to create salary structure based on CTC or basic structure based on the company’s preferences.

- Support for loans and advances with automatic EMI deductions from salary and include payroll loan status on the payslip.

- Extensive support for standard deductions and returns for components like PF, ESI, PT, etc.

Price: ₹1499 to ₹4499 per month for up to 30 employees

Pros:

- Accurate salary calculations and income tax management

- Optimised expense management system

- Excellent customer support

Cons:

- Loading time is on the higher side

- The user interface can be a bit complicated

Officenet

Officenet is an all-in-one payroll solution that enables companies to process employees’ salaries in just a single click. It facilitates accurate salary computations by considering components like revisions, arrears, deductions, etc.

Moreover, the platform has advanced features that provide automatic updates whenever the tax laws are amended.

Features:

- Access to extensive tools that help verify and compare data accuracy in each payroll run.

- Options to generate statutory reports without the need for data entry.

- Facilities for automated payroll inputs (loans, advances and reimbursements) and generating customised payslips.

Price: Starts from ₹150 per user per month

Pros:

- Options for biometric integration

- 360-degree feedback system

- Clean and intuitive user interface

Cons:

- Customer support needs improvement

- Loading times can be a bit high sometimes

Gusto

Gusto simplifies payroll management by providing customised solutions based on the company’s business type and industry. The business size can range from one employee to small business, mid-size business, and contractors only, and it can include remote, local, and global teams.

This platform automatically calculates and files taxes with the appropriate government agencies each time companies run their payroll and keeps track of changing tax laws to adhere to regulatory compliances.

Features:

- Hire, manage and pay global teams in their local currencies.

- Make hassle-free payments to contractors in over 120 countries.

- Seamless integrations with health insurance, time-tracking, PTO, and other platforms, such as TSheets, QuickBooks, Xero, Trainual, Clover, and more.

Market Share: 0.20% (February 2024)

Price: $40 to $60 per month (exclusive pricing is available for the premium plan)

Pros:

- Presence of domestic and international payroll systems

- Offers employee financial wellness tools

- Provides 3 usage plans to cater to the changing needs of businesses

Cons:

- Requires heavy upfront manual data entry

- Lacks invoicing or accounts receivable features

Paychex

Paychex is a cloud-based hire-to-retire payroll platform that provides customised solutions for small, medium-sized, and enterprise businesses. It enables quick payroll processing from desktops and mobile devices and automatically calculates, files, and pays payroll taxes to the appropriate authorities.

The platform also allows companies to run and review payroll reports before processing to maintain a high level of accuracy. Furthermore, they can view employee contact information and performance evaluations and keep track of in-app conversations.

Features:

- A wide array of payment options like direct deposits, same-day ACH, paper checks, etc.

- Access to over 160 payroll and HR reports, which companies can customise as per their needs.

- Options to perform job costing and labour analysis by monitoring factors like earnings, employer taxes and employer expenses.

Market Share: 0.52%

Price: Starts from $39 per month

Pros:

- Options for digitally signing and storing documents

- Offers group health insurance plans for employees and their families

- Leverages InVision Iris time clocks for accurate log-in and log-out time records

Cons:

- User experience can be a bit complex and comes with a learning curve

- Customer support needs improvement

Emerging Payroll Frontiers

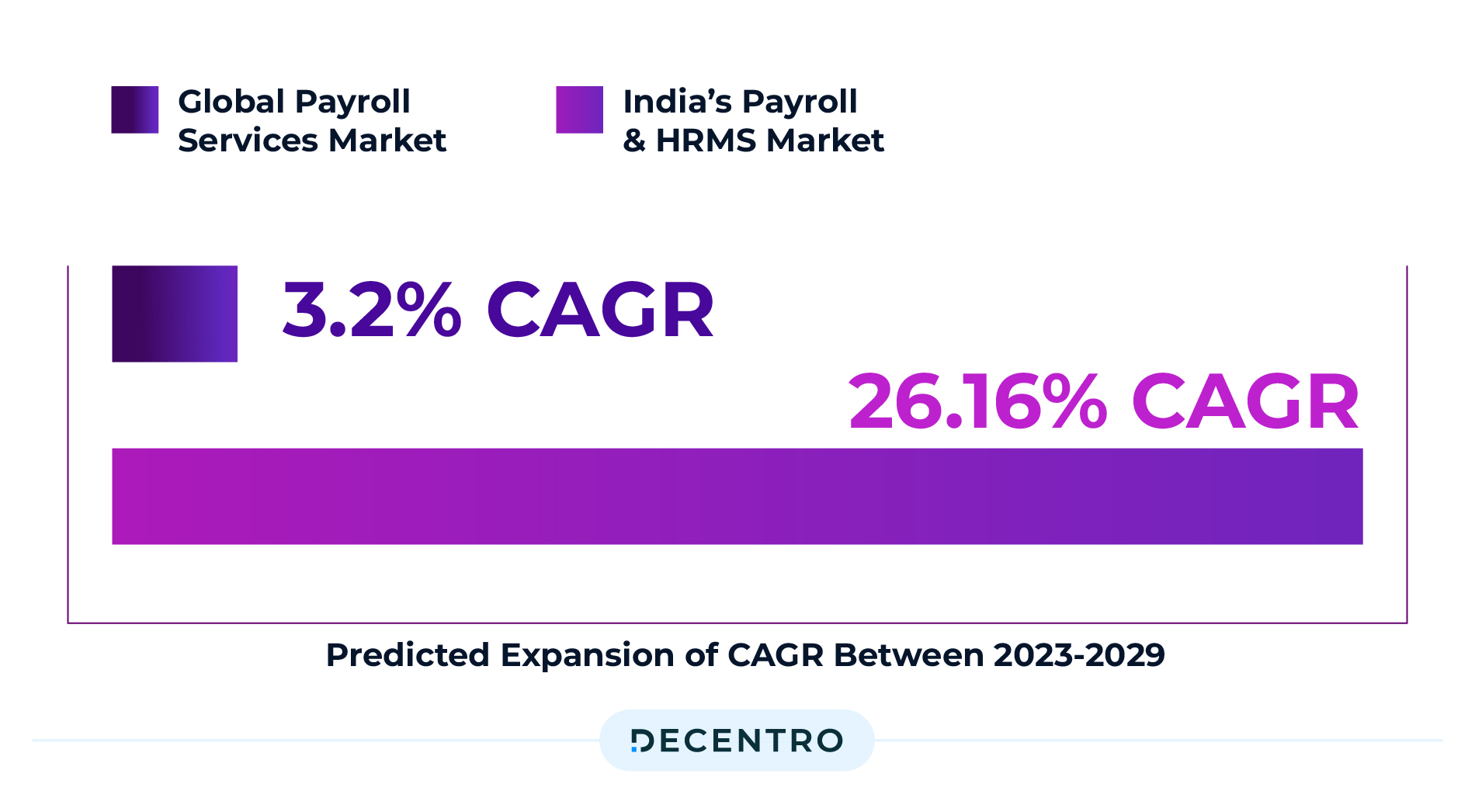

Research shows that by 2028, the global payroll services market will reach $80.97 billion, expanding at a 3.2% CAGR. The primary drivers behind these growth figures are increasing globalisation, the growth of small and medium-sized enterprises (SMEs), and the rising complexities in payroll regulations.

Meanwhile, India’s payroll and HRMS market is predicted to expand at 26.16% CAGR between 2023-29. The main reason why an increasing number of businesses are adopting these solutions is to streamline the payroll and HR management operations, cut down the associated costs and adhere to the changing compliance requirements.

Thus, there is ample scope for new players to enter this segment and ride the growth wave as adopting payroll and HR solutions becomes the norm for most businesses. However, to become one of the best payroll software in India, partnering with a platform that can facilitate fast and seamless payments is a must.

Enter Decentro’s payment APIs.

Decentro offers a comprehensive suite of tools designed to optimise your payroll management process, making it easier and more efficient than ever before. With the combined strength of our payouts and escrow features, businesses can streamline their payroll operations while ensuring security and compliance at the same time.

Decentro’s payout solutions enable businesses to seamlessly disburse employee salaries and benefits, regardless of their preferred payment method. Whether NEFT, RTGS, IMPS, UPI, direct deposits, or bank accounts, our platform supports various payout options to suit your employees’ needs. By automating the payout process, businesses can eliminate manual errors and delays, ensuring timely and accurate payments every time.

Decentro’s escrow accounts provide a secure and transparent way to manage funds for various business transactions, including payroll processing. Whether it’s holding funds for employee bonuses, compliance deposits, or contingent payments, our escrow services offer peace of mind and assurance for both employers and employees. With built-in security features and customisable workflows, businesses can trust Decentro to handle their escrow needs professionally and reliably.

Want to know what else we offer?

Frequently Asked Questions

FactoHR, HROne, Zoho Payroll, Razorpay and HRMantra are some of the best payroll solutions in India.

Compliance issues with tax legislation and employment laws, data protection concerns, managing timesheets and employee information, and miscalculating employees’ salaries are a few challenges related to payroll management.

Companies need payroll solutions to streamline payroll management, adhere to the changing compliance laws, perform accurate salary calculations and ensure on-time salary disbursals.