Explore BimaPay’s digital KYC and onboarding overhaul that reduced verification time, improved success rates, and streamlined insurance EMI financing.

How BimaPay Scaled Insurance Premium Financing with Digital KYC

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Most Indians are aware that they need insurance, but paying ₹50,000-₹1,00,000 upfront for annual premiums? That’s a tough pill to swallow. This is precisely why India’s insurance penetration is so low compared to other countries. The annual report of the Insurance Regulatory and Development Authority of India (IRDAI) has reported a worrying dip in insurance penetration, which fell to 3.7 per cent in the 2023-24 financial year, down from 4 per cent the previous year.

Enter BimaPay, an InsurTech company that devised a simple solution: why not let people pay their insurance premiums in monthly EMIs instead of a single, massive payment?

Sounds simple, right? Well, not quite.

What is BimaPay?

BimaPay (BimaPay Finsure Private Limited) is India’s leading digital premium financing enabler that facilitates personal loans for insurance premium payments through its network partners in the ecosystem . The platform’s core mission is to increase insurance penetration in India by making insurance premiums more accessible through flexible EMI-based payment options.

BimaPay’s Unique Value Proposition:

- Real-time Processing: Complete lending journey executed within minutes

- Fully Digital Experience: From customer onboarding to loan disbursement without manual intervention

- No Income Verification: Streamlined credit assessment process

- Instant policy Issuance: Insurance policies get issued instantly once the journey is complete.

- Partner Ecosystem: Empowering insurance companies, lenders, brokers, agents, and POSPs to expand their customer base

Core Services Include:

- Health Insurance Premium Financing

- Surrender Value Financing

- Corporate Insurance Premium Financing

BimaPay’s innovative approach transforms the traditional insurance payment model, enabling individuals and businesses to convert their annual premium burden into manageable monthly EMIs while helping insurance partners increase their earnings through expanded customer acquisition.

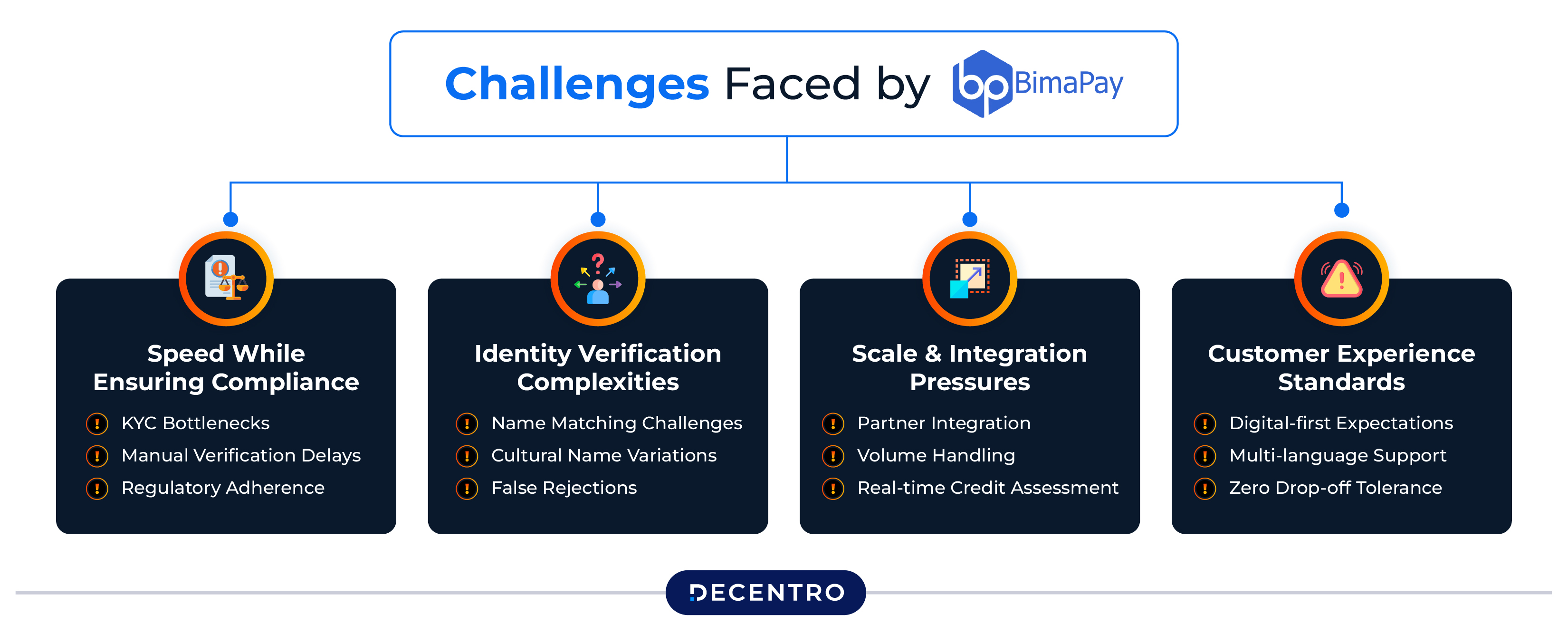

Challenges Faced by BimaPay

As a real-time lending platform promising instant loan processing, BimaPay encountered critical operational challenges that threatened its core value proposition:

Speed while ensuring Compliance

- KYC Bottlenecks: Traditional document verification processes taking 15-20 minutes conflicted with quick service promise

- Manual Verification Delays: OCR-based document collection led to blurred uploads requiring human intervention, breaking the automated workflow

- Regulatory Adherence: Ensuring complete compliance with RBI’s digital lending guidelines while maintaining lightning-fast processing speeds

Identity Verification Complexities

- Name Matching Challenges: Customers often had variations in names across PAN cards, Aadhaar, and bank accounts, causing verification failures

- Cultural Name Variations: Indian naming conventions with honorifics and regional language differences created matching complications

- False Rejections: Legitimate customers were rejected due to minor name discrepancies, impacting conversion rates and customer satisfaction

Scale and Integration Pressures

- Partner Integration: Supporting multiple insurance companies, lenders, brokers, agents, and POSPs required seamless API integrations across diverse platforms

- Volume Handling: Processing 15,000+ loan applications monthly while maintaining seamless & quick journey

- Real-time Credit Assessment: Instant credit checks without compromising accuracy or regulatory compliance

Customer Experience Standards

- Digital-first Expectations: Target demographic expected app-based, intuitive experiences comparable to leading fintech platforms

- Multi-language Support: Serving customers across India required regional language capabilities

- Zero Drop-off Tolerance: Any friction in the premium financing journey resulted in immediate customer abandonment

How Decentro Empowered BimaPay?

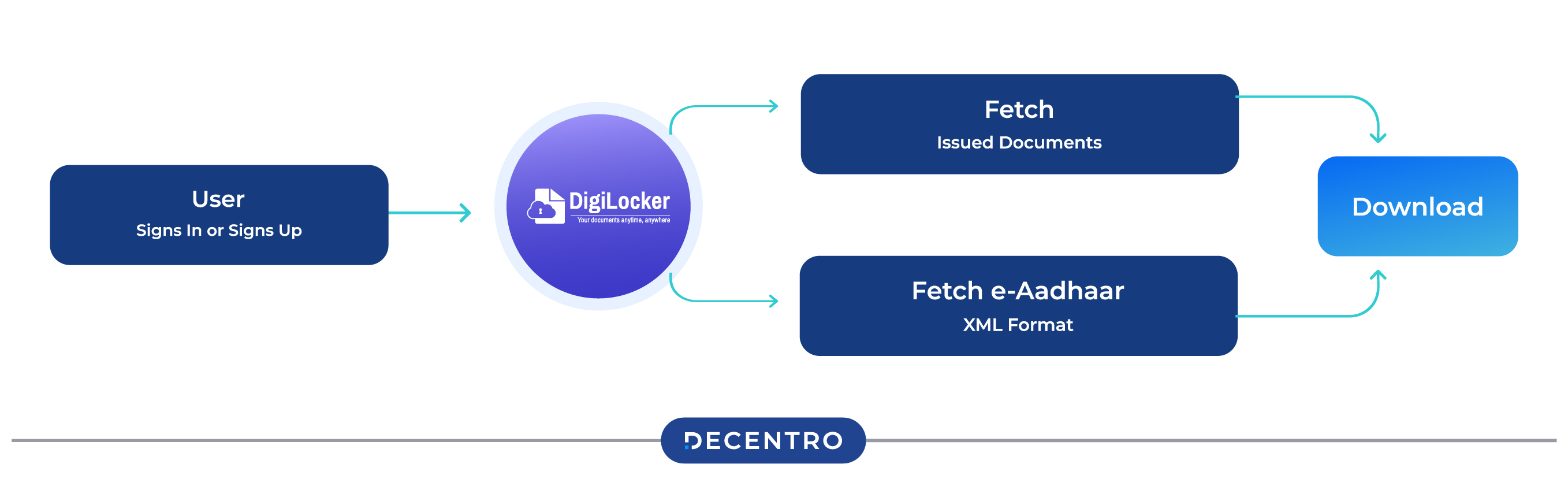

To maintain their industry-leading 100% digital and real-time journey promise while ensuring complete compliance, BimaPay integrated Decentro’s advanced KYC solutions, specifically leveraging DigiLocker UIStreams and Name Matching APIs.

DigiLocker UIStreams Implementation

Real-time Document Verification

- Instant Document Access: Direct integration with DigiLocker eliminated manual document uploads, reducing verification time from 15 minutes to under 2 minutes

- Automated Wallet Scanning: System automatically identified available documents, eliminating customer confusion about required paperwork

- Multi-lingual Interface: Seamless experience for customers across different Indian languages, crucial for insurance penetration in tier-2 and tier-3 cities

Frictionless User Journey

- Pinless Authentication: Streamlined DigiLocker login process eliminated additional authentication steps

- Smart Document Filtering: Automatic isolation of required documents (PAN, Aadhaar, bank statements) without user intervention

- Real-time Form Rendering: Dynamic forms adapted to customer profiles, reducing completion time

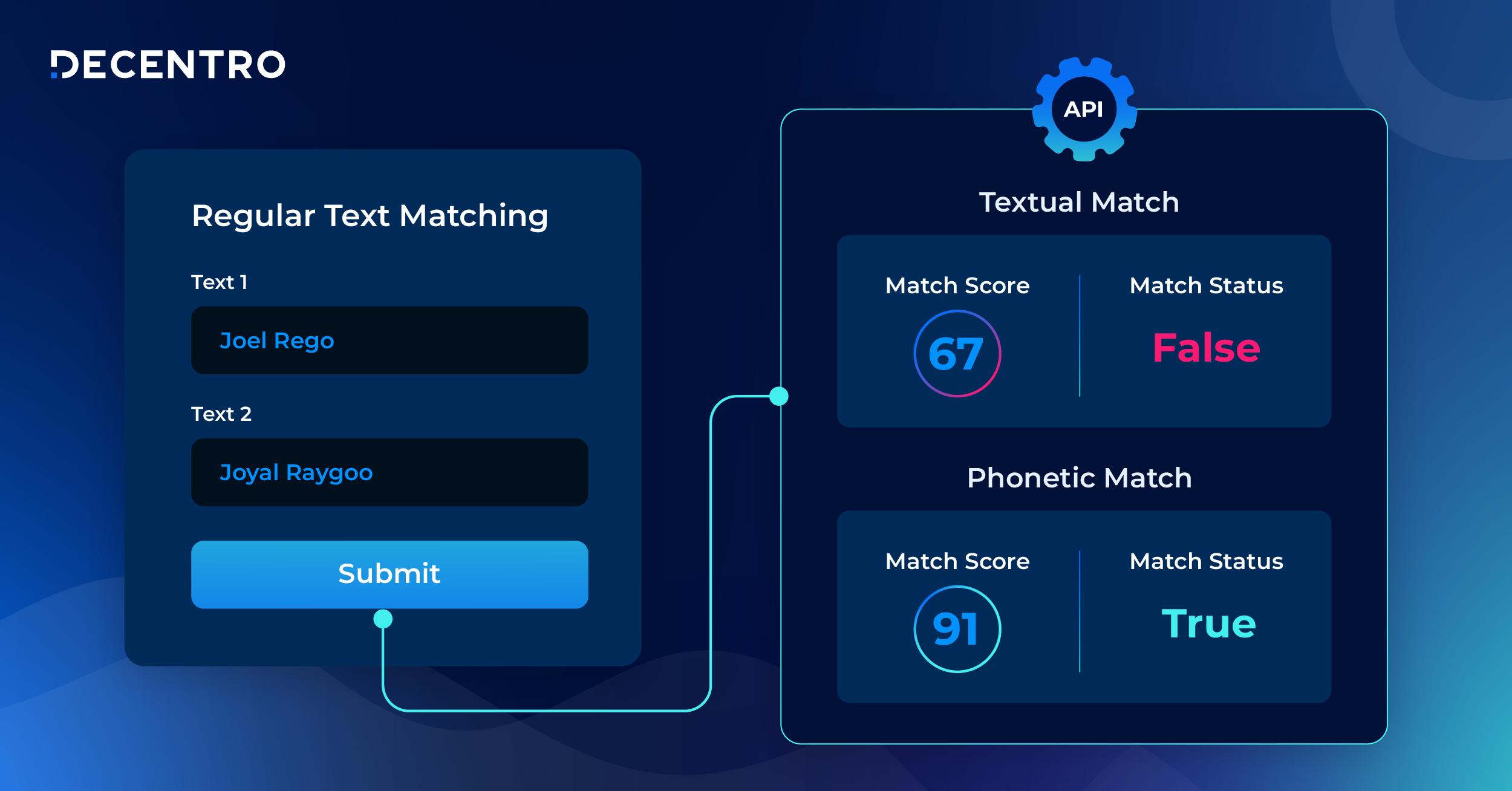

Name Matching API Integration

Culturally Intelligent Verification

- Honorific Recognition: Advanced algorithms automatically handled “Shri Rajesh Kumar,” “R. Kumar,” and “Rajesh-ji” as identical identities

- Phonetic Matching: Recognition of similar-sounding names across different regional pronunciations and spellings

- Component-based Analysis: Intelligent matching of first, middle, and last name components with weighted relevance

Real-time Processing Capabilities

- Instant Match Results: Sub-second response times maintained the super-quick processing promise

- Configurable Thresholds: Adjustable sensitivity settings based on risk appetite and customer segments

- Automated Decision Making: Reduced manual intervention in name verification by 95%

Results and Impact

The implementation of Decentro’s solutions enabled BimaPay to maintain its industry-leading processing speeds while achieving superior compliance and customer experience metrics:

Processing Speed Excellence

- 4-Minute Average Processing: Consistently maintained sub-8-minute loan processing times.

- 65% Faster Document Verification: Reduced KYC time from 15 minutes to 5 minutes.

- 3x Improved Success Rates: Enhanced workflows boosted first-attempt loan approval rates.

- Real-time Decision Making: 98% of applications processed without manual intervention.

- Multi-language Accessibility: Regional language support expanded market reach by 150%.

- Zero Document Resubmission: DigiLocker integration eliminated the need to re-upload documents.

- 100% Compliance Maintenance: Full adherence to RBI guidelines without speed compromise

Leadership Perspective

Speaking about the transformative partnership, Mohit Gupta, Co-founder & CTO of BimaPay Finsure, shared:

“Our entire business model depends on delivering what seems impossible—a complete lending journey in the easiest & quickest way. When customers want to buy insurance, they expect instant gratification, not lengthy verification processes. Decentro’s DigiLocker UIStreams and Name Matching APIs have been absolutely crucial in making this possible. We’ve maintained our sub-8-minute processing promise while achieving 100% compliance—something our competitors thought was impossible. The culturally intelligent name matching has eliminated the frustrating false rejections that previously disrupted our automated workflow. This partnership has been fundamental to our mission of increasing insurance penetration in India by making premiums truly accessible through instant EMI conversion.”

Conclusion

BimaPay’s successful integration of Decentro’s KYC and identity verification solutions demonstrates how cutting-edge technology can revolutionise traditional lending models in the insurance sector.

Our aim to empower fintech players has found fruition through such partners. Not just BimaPay but Decentro has enabled major companies, notably SalarySe, OnMeta, and others, to facilitate a better user onboarding experience and better compliance.

With over 2,000 ID validations per hour and more than 1,000 OCR and extractions per hour processed via Decentro’s KYC stack, we’re well-equipped to support your verification and validation journey.

Ready to Transform Your Onboarding Operations?

If your organisation seeks to achieve similar real-time processing capabilities while maintaining regulatory compliance and superior customer experience, Decentro’s comprehensive API solutions can help you revolutionise your onboarding operations.