Get an in-depth look at Decentro’s growth activities in 2023. We go behind the scenes into how we grew our customer base by 4X and hit 210Mn+ API transactions.

Rewind 2023: The Levers That Helped Decentro Grow by 4X YoY

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

Festive seasons are a reminder of rituals you have cultivated over time.

As for the end-of-the-year rituals at Decentro, this is the time when we open our metrics for you to see. Quite literally.

While we take stock of the year it was, we would like to give you an exclusive scoop of what worked for us across the laterals.

A Year of Collaboration and Collective Contribution.

This one line encapsulates the journey we have had as a team this year.

2023 was all about making significant strides. With the first two years revolving heavily on building our foundation, it was high time that 2023 made some splash. We had built to a point where we now can look at the numbers and reflect on the work that went to reach here.

Numbers such as,

Enabled 800+ businesses globally to launch their fintech products 10X faster

$3 Billion+ Processed Annually

210 Million+ API Transactions

With scalability being the critical focus of 2023, let’s look at a few key highlights peppered across the year.

Collaboration Corner

We started by unifying our modules to serve the demands of a growing customer base looking for end-to-end solutions. We saw the need for new-age use cases and companies seeking out relatively well-evolved, stitched stacks suited to enable white-label and embedded workflows for financial products rather than standard payment gateways in the market.

Voila! Our modules found their way into two end-to-end products.

We launched Flow and Fabric, two complete end-to-end payments and embedded banking stacks, to help businesses with a smooth onboarding experience and management of financial products.

For example, a lending company would use our Fabric module for onboarding & fraud-related checks, the last leg of debt collections, and Flow for setting up recurring payment mandates or payment links.

The collaboration ball was set at the beginning of the year with our strategic acquisition of Neowise Technologies.

Big Dreams are supported through the pillars of collaboration. Championing the same thought, we joined hands with Neowise – a disruptive force in the collections industry, offering innovative solutions that cater to the pressing need for a robust and scalable collections infrastructure.

The last mile of the credit lifecycle, in the form of a collection stack, along with payment capabilities [yes, you read that right], has now been added to our product suite.

Like a well-oiled machine, a fully stitched product suite found its footing beyond India. 2023 was the year when the APAC penetration for Decentro came out of stealth mode.

From engaging with the fintech community across India, Singapore, and beyond to enabling customers beyond borders, 2023 reinforced the grand expansion plan at Decentro.

Solving for the APAC region also saw us take centre stage globally by bagging a runner-up position at the TechCrunch Disrupt 2023 – Showcase in association with VISA at the heart of startup innovation – Silicon Valley!

The highlights across the year were a cumulative result of Collective Collaboration of all our laterals mentioned below.

Business Side of Things

Some of our early customers took a bet on us and have grown at least 3-5x the scale at which they were earlier. In reality, we are seeing the benefits of usage-based pricing, i.e., our growth depends on our customers’ growth.

What works for us is quite simple – pick up the phone, talk to customers, and iterate (really fast).

Team Decentro

As our product offerings matured, we found inbound interest from some prominent unicorn names and were able to solve specific problems for them. Having seen some early success, we intend to double our enterprise customer base in 2023. Engaging with these logos is challenging and needs a multi-prong strategy – we’re lucky to have a solid advisory board (special mention to Siddharth Dhamija for helping us on these fronts).

We now have a regional presence in Delhi NCR & Mumbai to cater to the growing demand from these regions. We realised that some of our customer base also exists outside the core (Delhi, Mumbai, Bangalore) and intend to spend more time with them, i.e., travel across India.

All these efforts collectively helped us win the prestigious “Best Technology Company for Fintech Solutions” award this year from the India Fintech Forum.

Product Probe

Two end-to-end suites with extensive modules built to serve a growing customer base for a product-first company have been solid headways for the product team here at Decentro. While the workings of the suite are a tale for another time, let’s look at the vital ethos that has built products of this calibre here at Decentro.

Deep-diving

Go deep into specific problem statements across the stack to ensure we can deliver meaningful impact.

Holistic-solutions

Go beyond the core product to solve merchant challenges like reconciliation, better experiences, faster integration, and smoother support. It is always about that extra mile you can go, which makes all the difference.

Scale-thinking

Go from building out the 1st version to address pressing problems to building for at least 10x of the current scale. Playing the long-term game allows you to see the bigger picture.

Friction-less

Go deeper into solving customer friction through simple UI-led experiences like SDKs and UIStreams so merchants can focus on experience.

Keep it simple, silly!

Process-optimizations

Go deep into each internal and external process and backend activity to ensure they are fully optimized to deliver a superior experience.

It is a cumulative of these small experiences that set your product journey apart from your peers.

User-enablement

Go out of the way to ensure our users are fully empowered to complete their activities with minimal effort through our dashboard.

All users matter is what we embody.

Infrastructure & Security

2023 has been a year of measuring growth effectively and introducing faster development tools. When the task was to support over 800 customers over two products across multiple modules, we fortified our infrastructure to ensure scalability and robustness.

Recognizing the paramount importance of security for our customers, we implemented advanced measures to fortify our infrastructure against emerging threats. Our commitment to safeguarding your data and transactions remains unwavering, and we uphold the highest cybersecurity standards.

We have also doubled down on multiple tools for measuring metrics within our infrastructure. This allowed us to see bottlenecks and clear them effectively.

This was the year we adopted an AI code assistant and started using no-code/low-code tools (and frameworks). This tooling change has shown incredible gains in reducing development time and solutioning.

Building on open banking principles, we’ve expanded our partnerships and collaborations to offer a more interconnected and seamless financial experience. The result is a network that empowers our users with greater control and access to comprehensive financial services.

“As our client’s scale, so shall we” remained the mantra for the year as well

Team Decentro

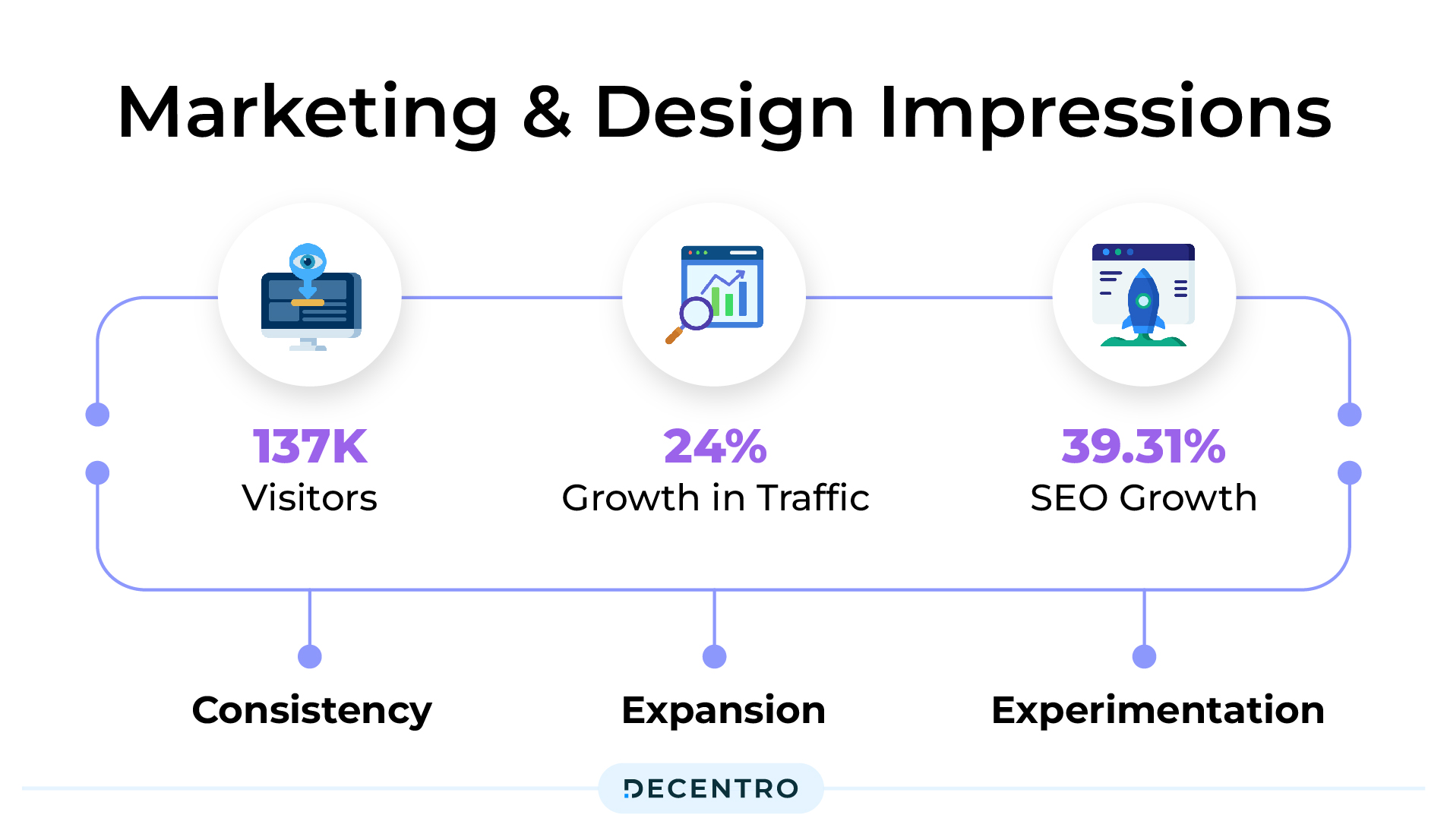

Marketing & Design Impressions

It was imperative that the Marketing Efforts across the year complimented the phenomenal work the other laterals of the organizations were bringing to the table.

The consistency route has been the reason for our churning numbers as high as 137K visitors; hence, it has remained our North Star. However, this year was also the year of expansion and experimentation.

Breaking down our core focuses,

Consistency

With the online marketing effort divided between content, social media, and email marketing and the consistency across the three channels, the following numbers have been making the rounds in Decentro’s Marketing corridors.

- Website Traffic: In pure number play, there was a 24% increase in overall growth percentage, a number that was built via continued efforts.

- The SEO Saga: There was a conscious effort to drive content while keeping our SEO health in mind. A targeted approach towards keywords across forms and short-form blogs, furnished as a result of monthly SEO audits, allowed us to witness pretty incredible results in pure SEO Growth Percentage, sitting at a whopping 39.31%.

- Social Media Impression: Consistency and doubling down on the daily posts, when it came to social media posting, allowed us to grow our follower base to a multiple of 100 weekly, currently sitting at 13,200.

Expansion

As focused as we were on the organic online growth of our brand via the SEO route, there was a conscious effort to expand to the offline marketing territory as well.

2023 marked the year of rigorous offline PR activities for us at Decentro through the medium of In-person events, panel discussions and even magazine branding exercises.

The team attended over 25 events, which extended the brand’s visibility to approx 80,000+ people. From taking centre stage in panels of marquee events like Global Fintech Fest to Singapore Fintech Fest, having the Decentro presence in all the relevant rooms across the geography became the focus of the offline activities.

Experimentation

With 2022 setting the tone for our brand, 2023 allowed us to experiment with formats across online and offline channels. A quick rundown of what worked for us this year,

- A conscious revamp of the website [decentro.tech] to cater to the mature use cases we seek to solve in the subsequent years.

So, what’s new?

Interactive Design: The new website boasts a contemporary look and feel, reflecting our commitment to innovation and progress.

Enhanced User Experience: Navigation has been streamlined for convenience, ensuring you can find the information you need quickly and effortlessly.

- Launching campaigns on our social media platforms, in the form of #TestimonialTuesdays and #ClarityMondays, #DemoDives to build a recall value for the brand simultaneously with taking viewers through the product journeys and nights unique to Decentro

- Leveraging our multi-location prowess to foster the Fintech Community across Delhi and Bangalore. Acquiring customers across India has now put us in a place where we can let our community thrive. In the spirit of collaboration and enabling a diverse community, we focused on getting like-minded individuals under the same roof to enable exclusive conversations through community connection.

- 2023 was also the year we focused on branding our modules to bring a sense of exclusivity to our offerings. The collection stack is now Multi-Collect. The Credit Bureau Stack is Bytes, and Escrow has been renamed InstaEscrow.

Each of these laterals condenses to a single focus effort across the year to make the offerings competitive and get those offerings to the masses.

To put things into perspective, our stacks across the products have been churning solid numbers in just three years.

As we bring the curtains down on another remarkable year, we can’t help but tip a hat to the resilience, adaptability, and relentless pursuit of innovation within the Decentro community – made up of our clients, partners, and the Decentro family.

Looking ahead, the 2024 roadmap is exciting. The horizon beckons with the promise of further innovation, more profound AI and machine learning integration, and the continual evolution of financial services beyond borders.

With the resolve to make Fintech Great Again, here is to another year of exponential learning and #BuildingWithDecentro 🥂