An in-depth guide on Digilocker, how it works, and how Fintech Platforms can leverage it to rapidly launch and scale their products.

Digilocker 101: Your guide to all things Digilocker

Fintech Serial Entrepreneur. Love solving hard problems. Currently making fintech great again at Decentro!

Table of Contents

The Budget 2023 left the Fintech, enablers, and players begging for more screen time. On the one hand, the narrative of digitalization was still prominent with each measure introduced; hints of enabling innovation for the fintech space were scattered throughout the speech.

In those fleeting moments, there was a crowd favorite in the form of Digilocker, and we are not complaining.

“Digilocker- One-stop KYC maintenance system For business establishments required to have Permanent Account Number, the PAN will be used as a common identifier for all Digital Systems of specified government agencies.”

“An Entity DigiLocker will be set up for use by MSMEs, large businesses, and charitable trusts. This will be towards securely storing and sharing documents online, whenever needed, with various authorities, regulators, banks, and other business entities.”

These two excerpts from FM Nirmala Sitharaman’s 87-minute budget presentation will become the focal point for the financial institution to pivot towards in the coming years, irrespective of the industry they are catering to.

Confused? Let us show you how.

So what is Digilocker?

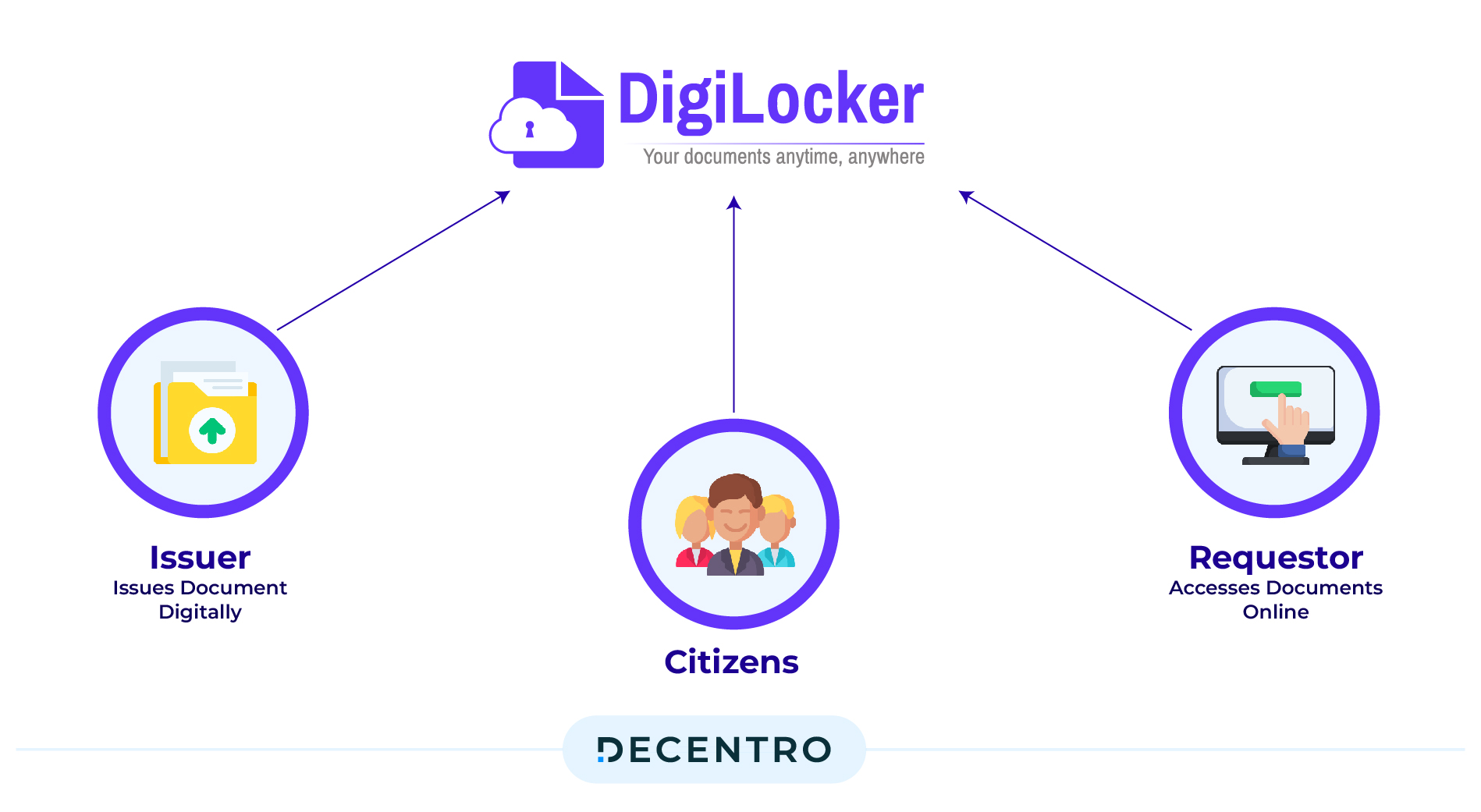

Launched in 2015, DigiLocker is a key initiative under the government’s vision of Digital India. The flagship program aims to make India go paperless while providing a “secure document access platform on a public cloud.”

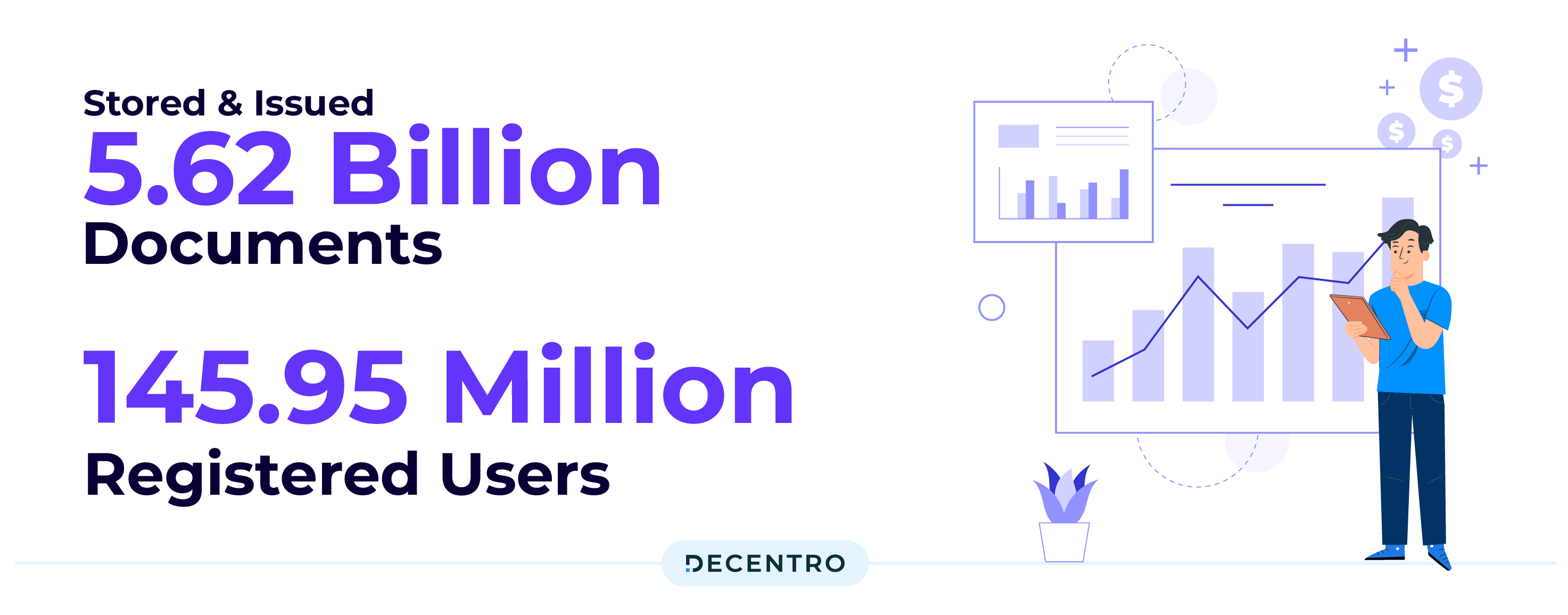

Being a simple and convenient product led by Aadhaar card details, the secure cloud-based platform for storage has 145.95 million users and 5.62 billion documents stored and issued.

But how does Digilocker work?

To set up your Digilocker, you should have an Aadhaar card. Signing up for the Digilocker service is pretty straightforward.

Download the app | Authenticate Adhaar Number / Phone number | set up a PIN | Sign up Complete.

With 1 GB of space, you as a user can scan and store documents digitally varying from your driving license, PAN card, Voter ID, policy documents, etc. These documents are legally on par with originals and can be used as their substitute wherever required.

The model has been reinventing itself with a new Digilocker flow – Meri Pehchaan.

With Single Sign-On [SSO] running the show in multiple organisations, e.g., according to a study by Forrester on behalf of Microsoft, using SSO services provided by Azure AD could save approximately $7.1 million over three years.

This enhanced version puts SSO front and centre of the user journey, ensuring more flexibility and control over the user flow. With powers ranging from choosing your sign-in methods to downloading the list of self-uploaded documents to linking documents, this enhanced model has convenience dictating its entire user journey.

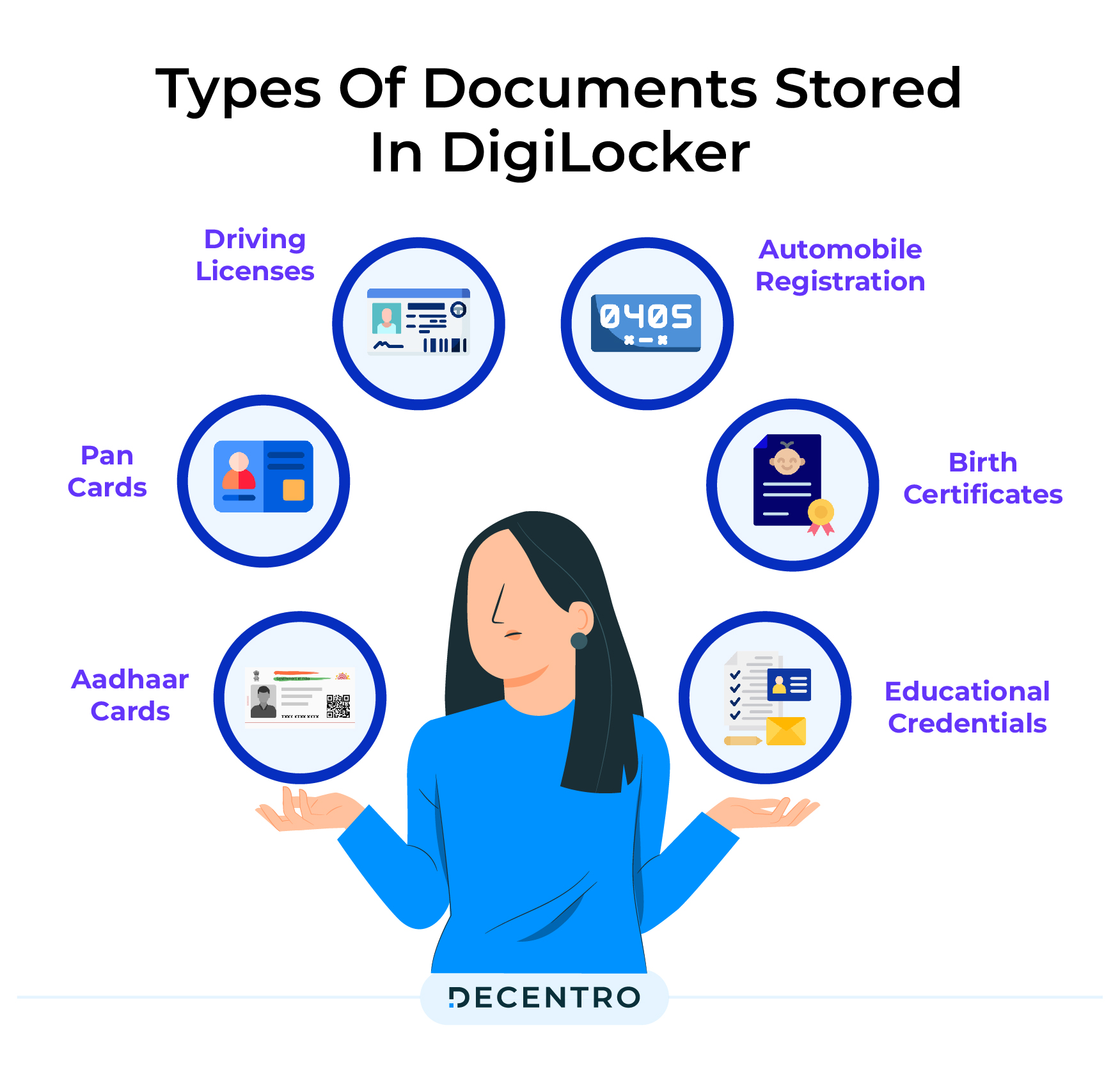

Types of Documents Stored in Digilocker

One can upload and store a host of official documents in DigiLocker, like Aadhar cards, PAN cards, driving licenses, automobile registration certificates, birth certificates, and educational credentials.

Users can get a lot of additional documents and certificates issued to their DigiLocker account from various government institutions. Some of the issuers that provided valid documents and certificates through DigiLocker are mentioned below:

| Issuer | Documents Issued |

| New India Assurance Co. Ltd. | Insurance policy documents |

| Ministry of Petroleum and Natural Gas(IOCL) | e-Subscription Voucher for LPG connections |

| BPCL | e-Subscription Voucher for LPG connections |

| HPCL | e-Subscription Voucher for LPG connections |

| eDistrict Uttar Pradesh | Birth, income, caste certificates, etc. |

| Greater Chennai Corporation | Birth and death certificates |

| Department of Food, Public Distribution & Consumer Affairs (PDS) | Jharkhand PDS Certificates |

| Food and Supplies Department | Ration cards for Haryana |

| NIELIT, New Delhi | NDLM Certificates |

| Ministry of Skill Development And Entrepreneurship | ITI Certificates |

| Directorate of Provident Fund (GPF), Ranchi | GPF Statement for Govt. Employees of Jharkhand |

| Department of Sainik Welfare, Govt. of Pondicherry | Dependency Certificates |

| National e-Governance Division | NeGD Training Certificates |

| e-District Delhi | Income, caste, marriage certificates, etc. |

The expansion of scope for Digilocker

For the Individual

With the likes of SafeBase, DocStorer, and similar others, DigiLocker, a Ministry of Electronics Information and Technology (MeitY) initiative, witnessed a relatively slow adoption in an economy striving to be digital in every aspect.

However, with the spotlight shining bright on Digilocker’s adoption now, there is a window for expanding its scope to facilitate ease of business and create room for innovation. This ease has been conveniently piggybacking on the idea of a one-stop shop for your documentation and KYC requirements.

Simply put, your know-your-customer formalities are done once and can be leveraged for additional services. For example, if the documentation proof is submitted for bank account opening, with the help of Digilocker, the same documents can be used for even loan applications.

For the Industry

If scaled beyond a citizen, the exact scope also holds the potential to allow fintech platforms greater flexibility to tap India’s digital infrastructure, and here is how.

India’s fintech market is estimated to grow to $1.3 trillion by 2025, consisting of five significant buckets.

- Payments

- Lending

- Digital banking platforms

- Insurance platforms

- Wealth

With each bucket, there is a high dependency on KYC in validating a specific customer and the need for paperwork.

With this push, fintech platforms in India will soon be able to use documents available in the DigiLocker for individuals to authenticate users for access to financial services. With a repository readily available, the expectation falls on the low-hanging fruit, in the form of application programming interfaces (APIs) to be built, much like Aadhaar and other solutions.

Consume an API from an API banking platform like Decentro > Tap directly into documents stored in Digilocker > Confirm the Validity of Document > Extract Information.

While there is a visible challenge of verifying the businesses with multiple APIs, this gap also paves the way for standardization to find footing in our ecosystem finally. The blueprint will be similar to that of an AA (Account Aggregator) platform, with a central server, and all outside parties access that server for verification.

Industry Deep Dive

Healthcare

The integration of Digilocker to unlock the potential of an interoperable healthcare ecosystem was divided into two phases:

Phase one – Onboarding

DigiLocker had earlier completed level 1 integration with Ayushman Bharat Digital Mission, wherein the platform had added Ayushman Bharat Health Account (ABHA) creation facility for its 13 crore users.

Phase Two – Personal Health Record App

The latest integration will enable users to treat it as a Personal Health Record App. Health documents like records of vaccinations, prescriptions from doctors, lab results, summaries of hospital discharges, etc., may now be stored and accessed on the safe cloud-based storage platform of DigiLocker.

With each phase, the focus remains on integrating public and private sector partners to expand the scheme’s reach to more users.

Insurance

Digilocker found its first takers in the form of the insurance sector with the Regulatory and Development Authority of India (IRDAI), pushing a circular ON February 9, 2021, stating, “To promote the adoption of Digilocker in the insurance sector, the Authority advises all insurers to enable their IT systems to interact with Digilocker facility to enable policyholders to use Digilocker for preserving all their policy documents.”

Centered around a better user experience, the pull of policy documents will not only drive a reduction in operating costs but also lead to

- Improved turned-around time

- Elimination of complaints regarding non-delivery of policy copy

- Reduction in fraud and disputes

- Faster processing and settlements

Wealth Management

The idea of Wealth Management being associated with High Net-worth Individuals (HNIs), big banks, and sophisticated financial advisors has finally found its pivot. Categorically speaking, wealth management is a way of allocating finances to maintain liquidity and invest for growth. The fundamental principles of wealth management have nothing to do with the quantum of wealth to be managed for an individual; therefore, with an allowance for the use of documents digitally, there is the scope of penetration of wealth management in Tier 2,3, and 4 cities.

Market regulator Securities & Exchange Board of India (SEBI), while easing the know-your-customer (KYC) process, had enabled the usage of Digilocker to facilitate investors to submit their officially valid documents (OVDs) (proof of identity and proof of address), for KYC.

In an attempt to push for ease of investing, the intermediary is required only to verify the investor’s mobile number, e-mail id, and bank details (through penny drop) to cross-verify the information provided by the investor.

Apart from the industries mentioned above, bypassing malpractices advantage forms a crucial piece for logistics industry, allowing instant validation of merchants getting onboarded onto the system.

Additionally, the statutory body, the University Grant Commission (UGC), has been using Digilocker to store mark sheets, degrees, and other education-related information.

The Entity Play

The proposition that makes Digilocker click is the “secure document exchange” along with the “verification module” that would allow government agencies to verify data directly from issuers, post user consent.

Scaling this offering to the entity level is deemed a masterstroke of this budget, with micro, small, and medium enterprises (MSMEs), large businesses, and charitable trusts coming under the umbrella of its operations.

This is where financial inclusion comes to the front and center and finally packages the entire Digilocker push as a guided effort to serve the underserved population in the country.

The Advantage

The one big takeaway from this entire push is that there will be a guided movement toward expanding segment coverage, reducing turnaround times, and cutting down the operating cost of lending. With the three heavyweights of operations addressed, fintech players would have room to innovate and enable seamless finance to the underserved population.

Let’s delve deeper into how Digilocker can drive the above sentiments for the players in the fintech domain.

Cost Savings

One of the critical benefits of Digilocker for FinTech is the reduction in operational costs associated with physical document collection and verification process. Traditionally, as an industry, Fintech relied on physical copies of documents submitted by customers for KYC purposes. This involved high costs and efforts in collecting, storing, and verifying these physical documents.

Aimed at the concept of paperless governance, Digilocker reduces administrative overhead by minimising paper use and curtailing the verification process. Issued documents available via DigiLocker are fetched directly from the issuing agency in real-time. This saves costs and speeds up the KYC process, enabling fintech players to onboard customers quickly and efficiently.

Easing KYC Process,

Digilocker can streamline the KYC process through integration with fintech systems. With Digilocker APIs, fintech can integrate the platform into existing workflows, making the KYC process more efficient and automated. It provides a seamless experience and supports a smoother onboarding process.

Fintechs can also retrieve specific data points from Digilocker based on the consent provided by customers, further customising the KYC process to their requirements. A provider like Decentro, through their APIs, can easily integrate with your existing user journey, making Digilocker-powered KYC a breeze.

Access to Authentic Data

Besides cost savings, Digilocker enhances the authenticity and accuracy of customer data used for KYC. Digilocker is linked to government databases, so the documents stored in Digilocker are considered authentic and reliable. Thus, eliminating the risks associated with fake or forged documents reduces the chances of identity fraud or misrepresentation.

Furthermore, Digilocker’s integration capabilities allow fintech to verify documents in real-time, reducing the risk of relying on outdated or fraudulent documents. These enhance the overall security and integrity of the KYC process, helping FinTech comply with regulatory requirements and prevent fraud.

So, what does a compliant solution look like?

As per UIDAI, MeiTY & other regulators, the following actions are mandatory for a compliant Digilocker flow:

- Mandatory redirection to the Digilocker page

- Manual Entry of Aadhaar details, OTP, and captcha by the customer

- The verification process is performed by a requesting partner who is Digilocker-authorized

Digilocker Flow With Decentro

With centralisation and expansion being the major takeaways for the entire fintech landscape, there is now a playing field that is not only level but has the potential for players to innovate. Right now, the need of the hour is for a fully compliant and scalable tech bridge that can thrive in this sandbox that the government has created. A 10X simplified process of integrating the solution, and we at Decentro have exactly that as part of our product suite.

Rest assured, Decentro’s Digilocker solution fulfils the demands listed above and, therefore, is a fully compliant and secure solution, already being adopted at scale by multiple fintech & NBFCs.

How would you like it if your Digilocker onboarding flows in place within a week? And a fully automated real-time onboarding?

Our single end-point for APIs eliminates any complexities tied to KYC onboarding and lays out a frictionless and automated system, in real-time, that’s scalable as your business grows, compliant, and entirely driven by user consent.

Drop a line below, and we will walk you through the process.