Explore the importance of embedded payments, how they work, and why businesses, especially SaaS platforms, use this model. Learn its benefits, challenges, and more.

Embedded Payments: The Complete Guide

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

With the fast growth of digital payments and the escalating demand for better user experiences, embedded payments are transforming how businesses interact with customers. This payment model has become a game-changer, especially for SaaS platforms and e-commerce marketplaces, enabling companies to enhance customer satisfaction, drive efficiency, and unlock new revenue streams.

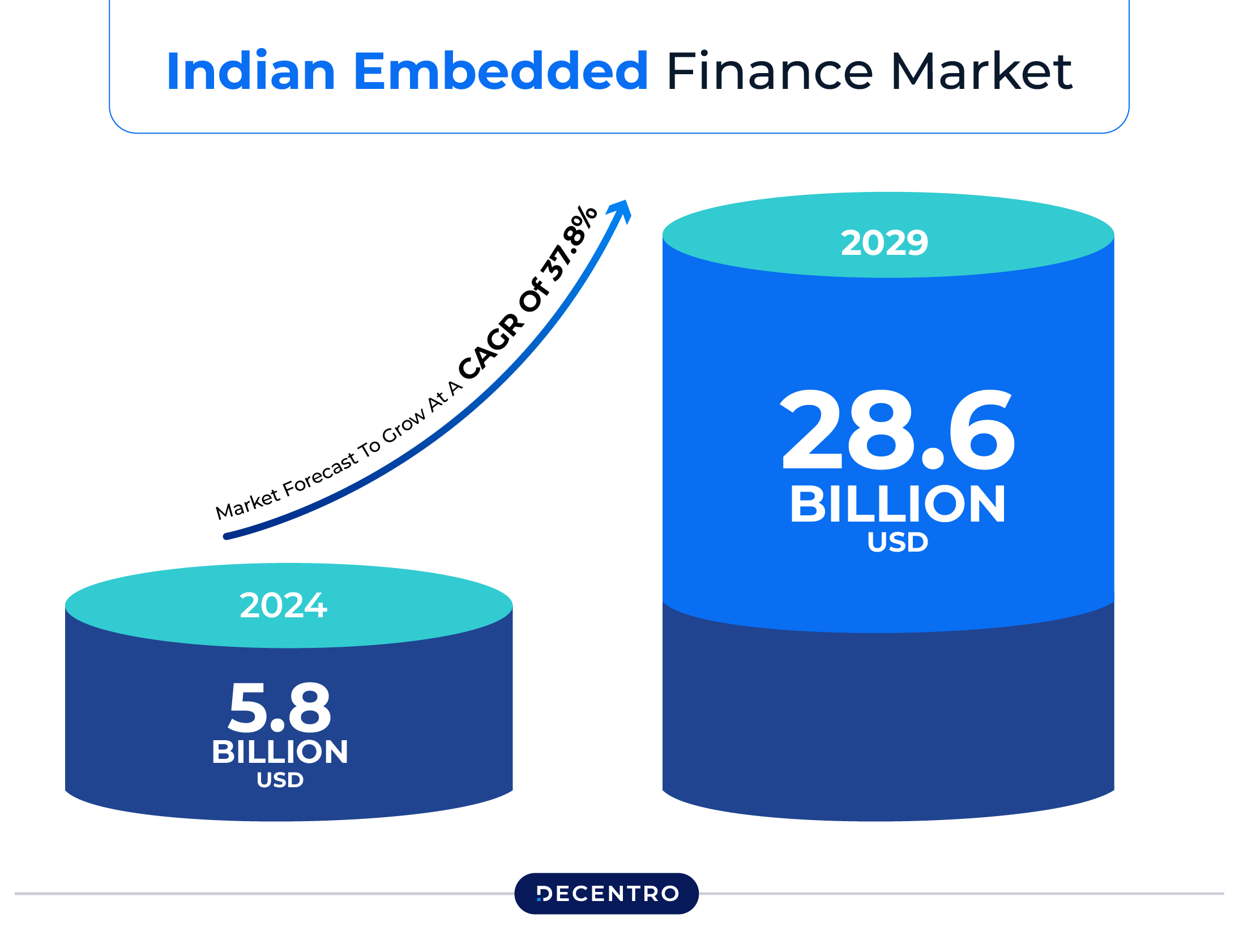

As per experts, India’s embedded finance industry is predicted to reach $21,127.5 million by 2029, indicating a 30.4% CAGR. Thus, for any business planning to streamline payment management or take the user experience to the next level, adopting embedded payments can be an ideal choice.

Wondering how? Keep reading for a detailed insight.

What are Embedded Payments?

The embedded payments allow payment features to be built directly into software applications. These systems enable users to make purchases or complete transactions without leaving the site or application. By directly embedding the payment experience within the user interface, businesses simplify the checkout process and improve conversion rates.

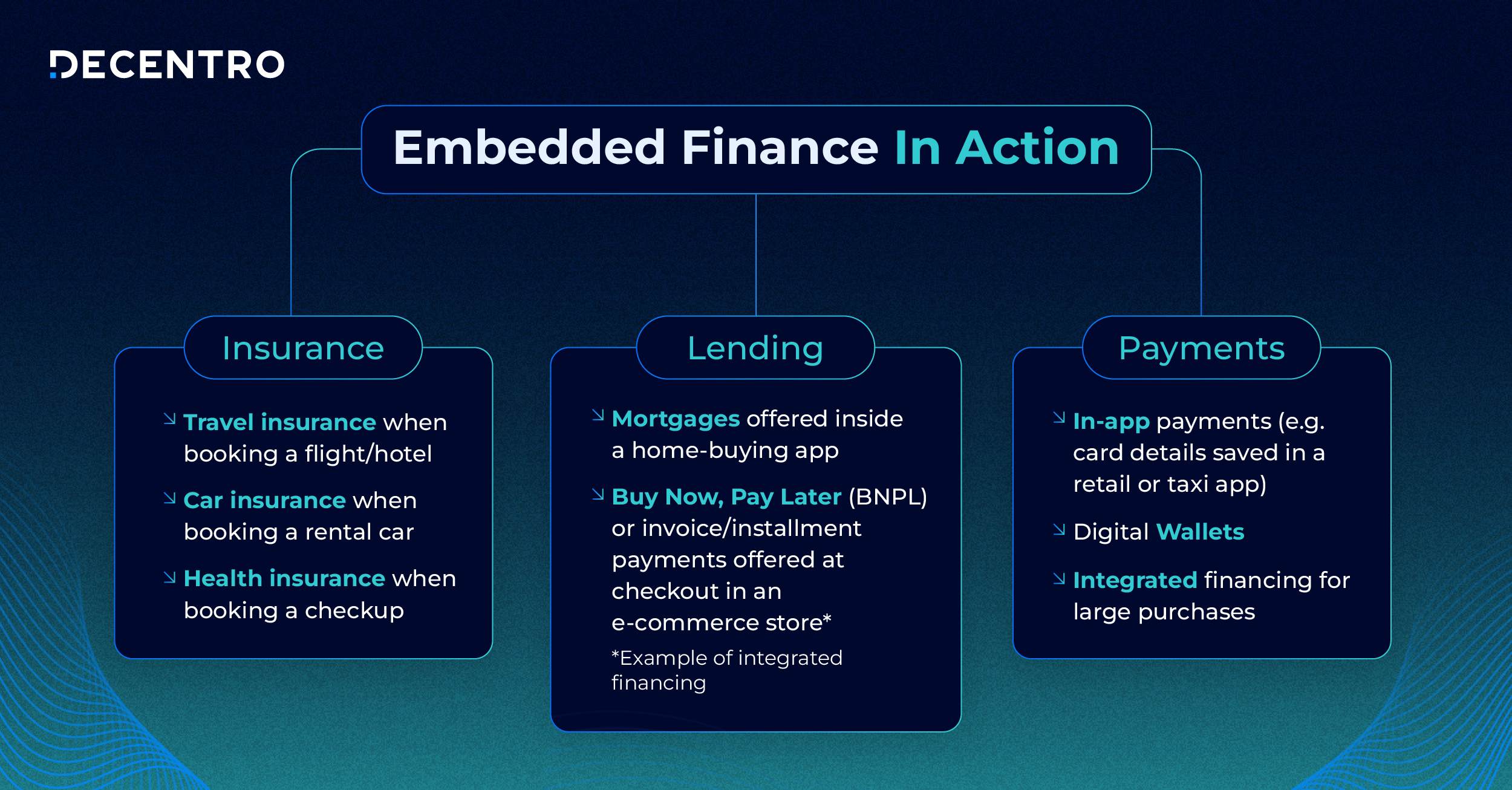

As a result, embedded payments have become a major part of embedded finance, enabling companies to offer payments, banking or lending services within their non-financial offerings.

Some examples of embedded payments include subscription services, where the customer can pay within the app and e-commerce platforms, where individuals can process payments on the website itself while checking out.

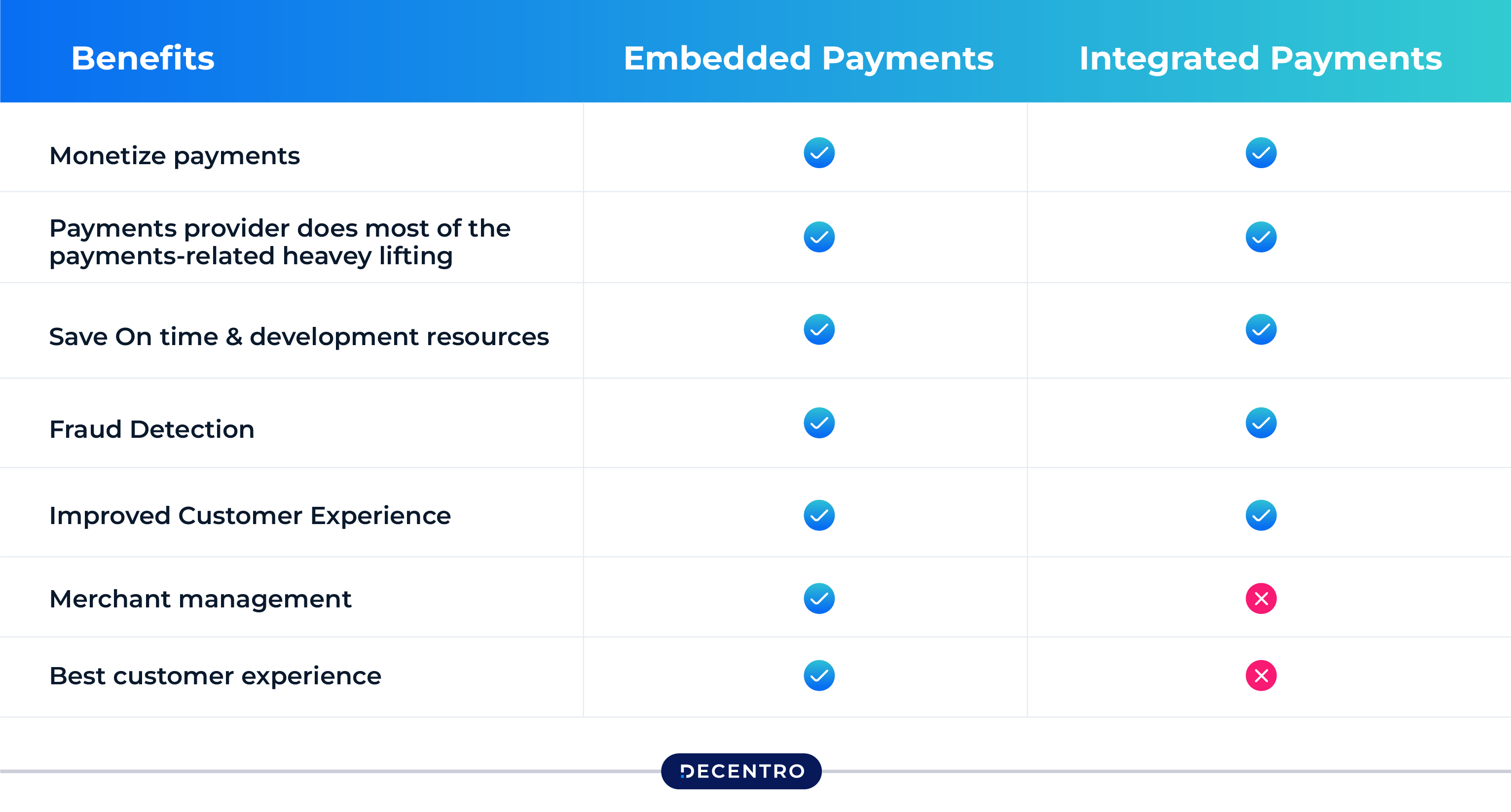

Difference Between Embedded Payments and Integrated Payment Methods

Following are the major differences between embedded payments and integrated payment methods:

| Aspects | Embedded Payments | Integrated Payments |

| Definition | Payments are smoothly incorporated into the application, offering users a streamlined experience and complete control of the payment process to businesses. | The software includes payment features, but the process is managed by a third-party provider. |

| Onboarding Process | Integrated into the app for a hassle-free experience. | Clients are directed to outside providers for onboarding. |

| User Experience | Seamless, unified experience with no involvement of external third parties. | Incoherent experience with third-party interfaces. |

| Control over Payments | Complete control over payments, customer service, and onboarding. | Inadequate control with the provider managing payment services. |

| Ideal For | Businesses want comprehensive control and smooth integration. | Businesses looking for fast connections to external payment systems. |

| Customisation | High level of management and personalisation over the payment experience. | Limited personalisation, run by a third-party provider. |

| Security | Businesses handle security and compliance needs. | The third-party provider manages security and compliance. |

| Examples | Ride-sharing applications, subscription platforms, and e-commerce checkout. | SaaS companies with third-party payment providers. |

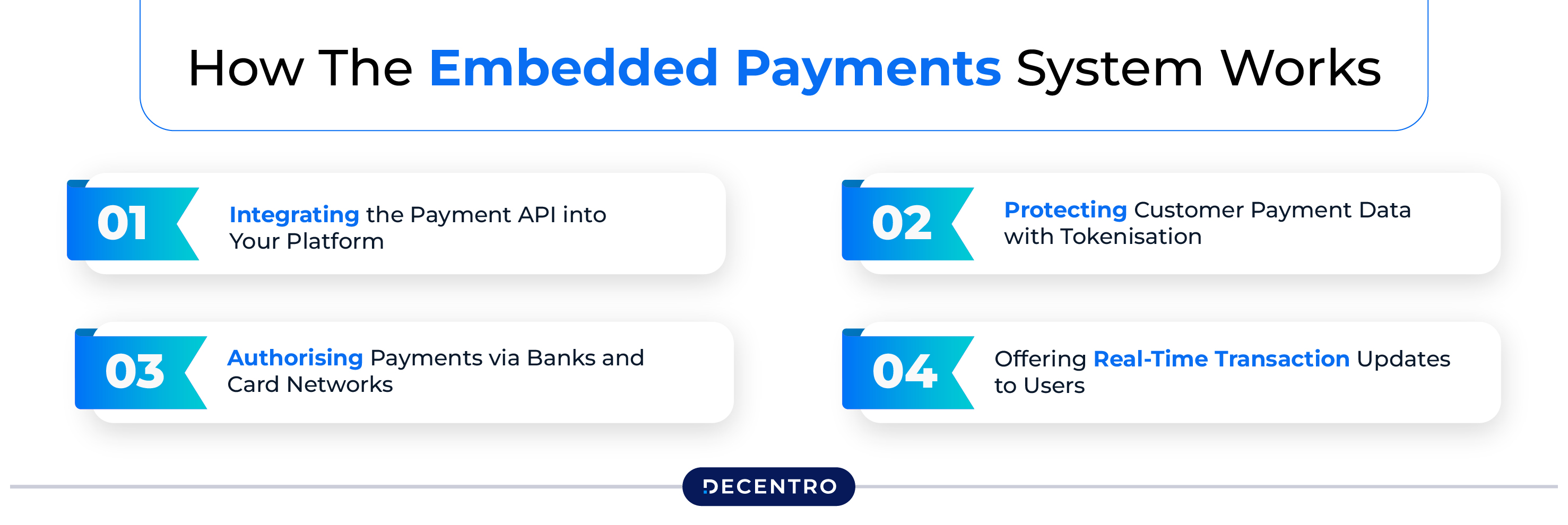

How Embedded Payments Work?

An embedded system is a specialised computing device designed to perform specific tasks within a larger system, typically with limited user interaction. Here is a step-by-step guide showing how the embedded payments system works:

Step 1: Integrating the Payment API into Your Platform

A payment gateway or service provider incorporates a payment Application Programming Interface (API) into your application or platform. This integration links your system to payment networks, facilitating smooth and efficient payment processing.

Step 2: Protecting Customer Payment Data with Tokenisation

The integrated system gathers and securely stores customer payment information through tokenisation. This approach substitutes sensitive data with unique tokens, providing enhanced security and quicker future transactions.

Step 3: Authorising Payments via Banks and Card Networks

When a user initiates a payment, the system securely sends transaction details to the payment gateway. The gateway interacts with banks and card networks (such as Visa or MasterCard) to verify and authorise the payment.

Step 4: Offering Real-Time Transaction Updates to Users

Once processing is complete, the system provides real-time updates on the transaction’s success or failure. This confirmation is shown directly within the app or platform, ensuring transparency and a smooth user experience.

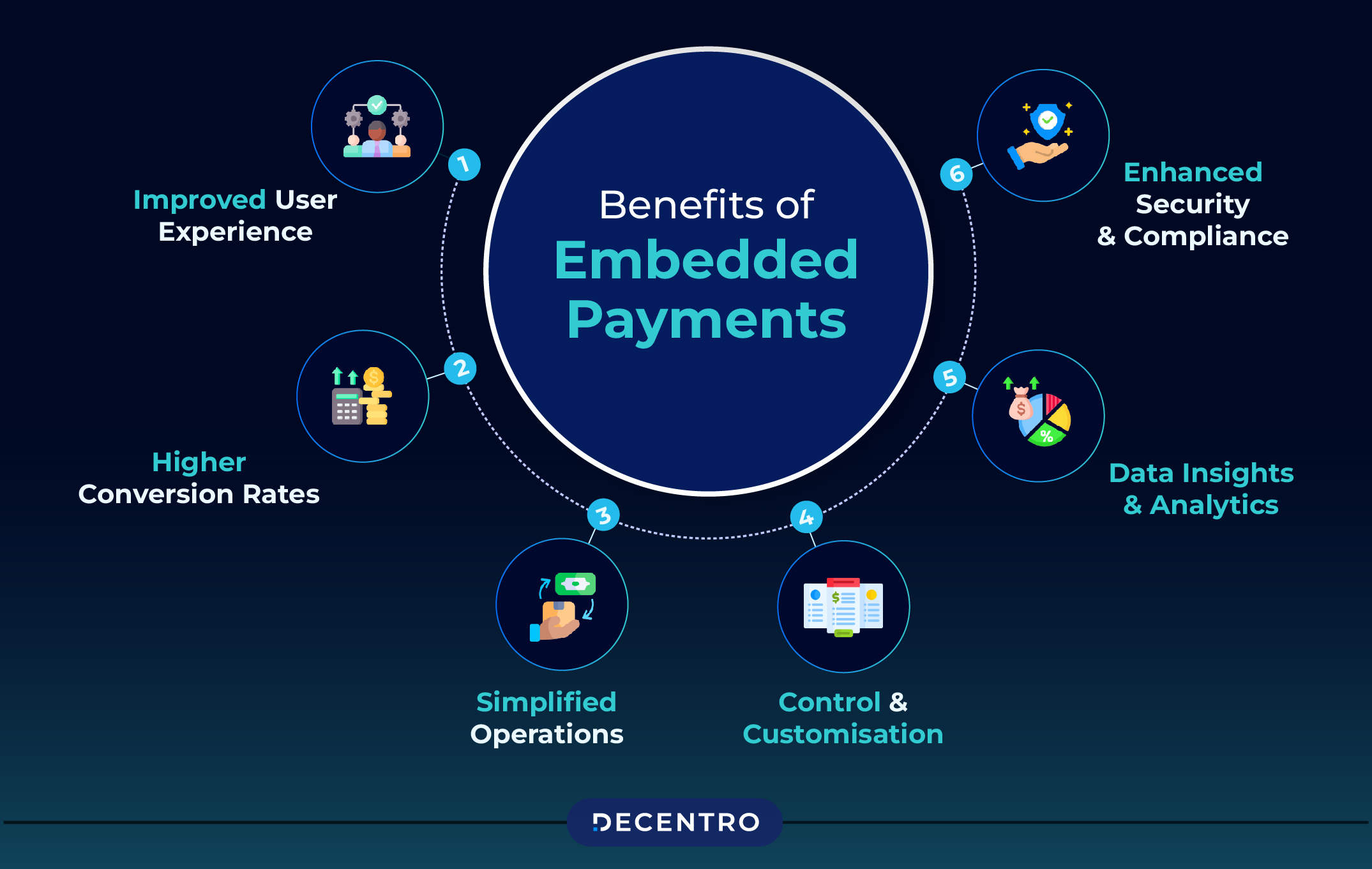

Benefits of Embedded Payments

Embedded payments provide a plethora of advantages to businesses, like:

- Improved User Experience

Embedded payments considerably improve the user experience by allowing payment processing to take place directly within a platform, eliminating the need for users to be redirected elsewhere. This smooth process ensures quicker and more convenient transactions, leading to higher customer satisfaction.

Additionally, by integrating the payment process within a single platform, businesses can enhance their brand image and enjoy higher customer loyalty, which is a crucial aspect of surviving in today’s competitive landscape.

- Higher Conversion Rates

By eliminating the need to navigate to a different platform for payments, embedded payments help businesses make their payment processes smooth and hassle-free, thus increasing conversion rates. In the competitive world of online shopping, every moment matters, and simplifying payment processes can lead to significant revenue growth.

Furthermore, the convenience of integrated payments builds brand loyalty, making customers more inclined to return for future purchases. This well-organised process boosts a company’s profits by encouraging more successful transactions.

- Simplified Operations

Embedded payments streamline business operations by incorporating payment processing into a single system. This centralisation saves time and curbs the risk of errors in financial management. It makes tasks like manual reconciliation and financial reporting easier, boosting operational efficiency.

Also, by automating payment processes, businesses can reduce their internal workload and focus on other core operations. Consequently, embedded payments reduce complexity, enhance productivity, and lessen the likelihood of human error, helping companies focus on their overall growth.

- Control and Customisation

Embedded payments allow businesses to better control and personalise their payment processes. By serving as payment facilitators, they can oversee the entire payment workflow, from authorisation to settlement. This enables companies to adjust the payment experience to fulfil their customers’ specific needs and retain a consistent brand image.

Various embedded payment solutions are available, ranging from easy-to-use options to completely tailored ones that offer superb control. Your choice will affect your customers’ experience.

Although the former can be executed quickly, they may not meet all your and your customers’ payment needs. On the other hand, the tailored options will require collaboration with a provider to create a customisable payment experience for your customers.

- Data Insights and Analytics

Embedded payments offer businesses valuable data insights and analytics. They provide ample information that helps them understand customer preferences and purchasing habits better. By capturing transaction data within their platform, companies can get a better understanding of customer buying habits and preferences.

These insights facilitate data-driven product development, optimisation, and fine-tuned service offerings. Moreover, by assessing consumer behaviour and understanding prevailing market trends, businesses can make more informed decisions, thus improving their market position.

- Enhanced Security and Compliance

Embedded payments boost security by enabling businesses to enjoy better control over their payment systems. Companies can use robust security practices such as tokenisation and encryption in order to keep sensitive payment data safe. Managing transactions internally leads to better fraud protection and data privacy, which helps build trust with users.

Moreover, embedded payments support businesses in complying with industry regulations, ensuring user information is safe and reducing the chances of data breaches. Also, by directly managing payment data, companies can offer a more secure and reliable service that enhances customer trust and loyalty.

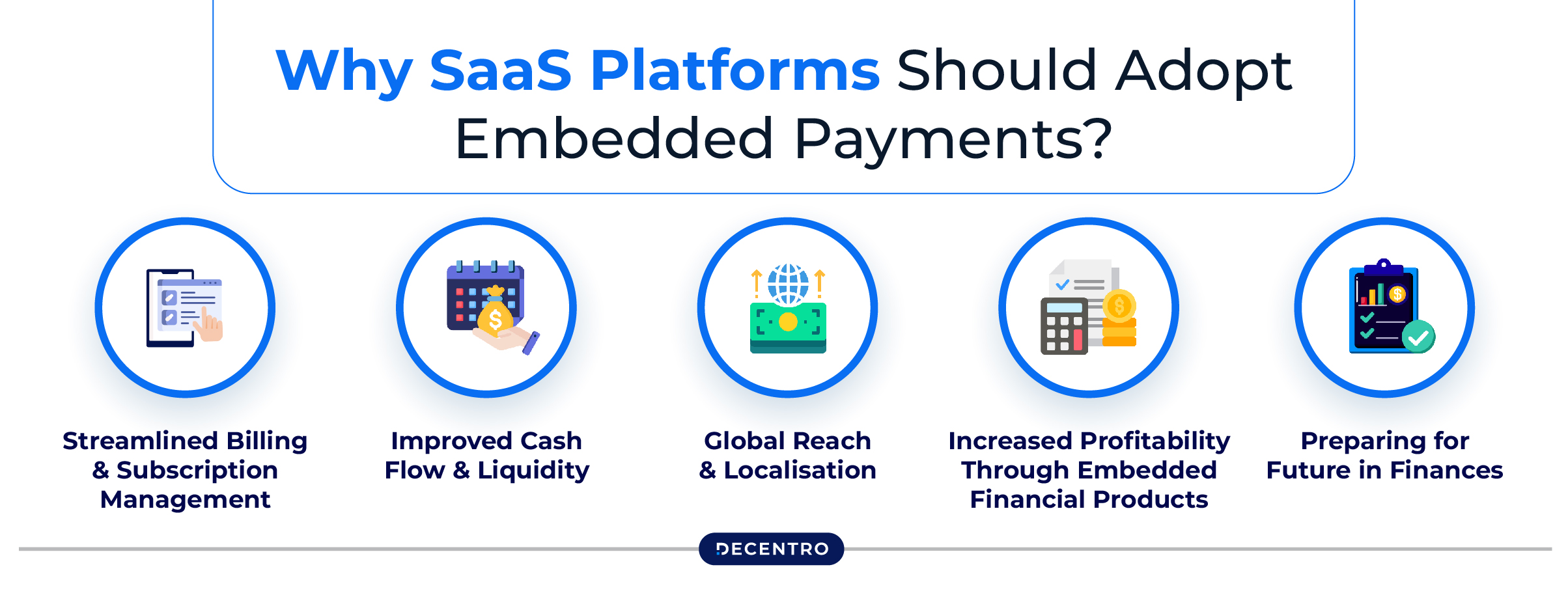

Why SaaS Platforms Should Adopt Embedded Payments?

Most major SaaS (Software as a Service) platforms have been adopting embedded payments in order to stay competitive and fulfil the rising demands of their users. Check out the major reasons why:

- Streamlined Billing and Subscription Management

Embedded payments enable SaaS providers to handle recurring billing and subscriptions directly on the platform, reducing the need for third-party systems. Additionally, this lessens the burden of billing errors while providing a more accurate and efficient billing experience.

- Improved Cash Flow and Liquidity

Using embedded payments, SaaS businesses enjoy real-time payment settlements, thus improving overall cash flow management. This lessens delays associated with third-party processors, ensuring enhanced liquidity and enabling faster scaling and investment opportunities.

- Global Reach and Localisation

Embedded payment solutions support multi-language and multi-currency capabilities, making it easier for SaaS platforms to serve worldwide customers. These features allow platforms to receive payments from international users in their preferred currency, removing the difficulty of handling numerous payment gateways.

- Increased Profitability Through Embedded Financial Products

Embedded payments help SaaS platforms diversify their revenue streams by offering additional financial services like business accounts and cash advances. These offerings not only enable users to tackle unpredictable economic situations but also increase platform stickiness and profitability.

- Preparing for Future in Finances

Integrating embedded finance is becoming a key competitive advantage, with more than 60% of SMBs eager for integrated financial services. Adopting embedded payments ensures your platform stays ahead of the current market trends, attracting and retaining many users while positioning itself as a future-ready entity.

Case Studies: Real-Life Examples of Embedded Payments

A growing number of successful businesses are using embedded payments to improve user experience and promote growth. Let’s check some real-life instances of firms that have profited from this financial advancement:

- Uber

Uber has effectively incorporated payment processing within its online cab booking application. Users can finalise transactions without exiting the app, as the company securely retains payment information and automatically bills customers at the end of each ride. This effortless experience has been a key factor in Uber’s success and its high user retention rate.

- Shopify

As a top-tier e-commerce platform, Shopify has embraced embedded payments to support transactions from diverse channels, including online, in-store, and mobile. This all-encompassing solution optimises the payment process for merchants, thus significantly enhancing their e-commerce experience.

- Stripe

Stripe delivers integrated payment solutions for businesses, regardless of their size. It facilitates the incorporation of payment systems into websites and applications. With a powerful API and tools designed for developers, Stripe allows businesses to craft tailored payment experiences.

These embedded payment options enhance brand engagement and cater to user preferences.

Challenges in Implementing Embedded Payments

Here are the three major challenges which is experienced by businesses while implementing embedded payment systems:

- Complexity of Integration

Embedded payments are technically complex, thereby requiring businesses to spend on technology and trained personnel to ensure that the system operates as per their expectations.

- Security

Embedded payment systems usually come with robust security measures, like tokenisation, encryption, fraud detection, etc.; however, they will not protect organisations from cyber threats. Besides, the huge costs incurred by companies for encryption and anti-fraud technologies to protect customer data could be challenging.

- Regulatory Compliance

Apart from the laws and regulations attached to their respective sectors, businesses have to deal with varying regulatory compliances with respect to financial payment processing. Non-adherence to such regulations can lead to hefty penalties, legal complications and loss of reputation.

In this regard, choosing the right embedded payment partner can significantly help navigate such issues.

Tips to Choose the Best Embedded Payments Provider

Here are the best tips to pick the ideal embedded payment provider:

- Select Simple Integration

Find a payment gateway that will easily be integrated with your current software. Consider looking for solutions that offer develop-friendly APIs, no-code setup, and minimal disruptions in operations.

- Verify Reputation and Reliability

Conduct proper research on client reviews, testimonials, case studies, and other similar feedback. The provider’s performance, availability, reliability, etc., should meet your requirements.

- Check Compliance

Choose a supplier that complies with regulations like the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS). This ensures high safety of sensitive financial data and protection from unnecessary legal issues.

- Consider Scalability and Flexibility

Flexible terms, omnichannel capabilities, and the ability to handle rising transaction volumes are some of the key factors that you should look for when choosing an embedded payments provider.

- Customer Care Review and Pricing

The provider should have round-the-clock customer helplines across multiple channels. Also, they must have dedicated account managers for quick response and priority service.

Apart from this, you must analyse the implementation charges, transaction fees and other associated expenses, along with comparing the pricing models of various platforms.

How to Overcome Challenges in Implementing Embedded Payments?

While embedded payments may appear challenging, they can be handled with proper strategies and solutions. Mentioned below are some effective methods to tackle common issues:

- Understanding the Importance of API-Driven Platforms

Using an API-driven platform is one of the finest approaches to streamlining embedded payments. APIs allow businesses to integrate payment solutions into their platforms without starting from scratch. Also, payment APIs provide convenient infrastructure, ensuring smooth transactions, compliance, and hassle-free operations.

- Looking for Platforms with Easy Integration

A sound embedded payments solution should encompass user-friendly SDKs (Software Development Kits) and plug-and-play APIs, making integrations simple. Such solutions also come with minimum coding requirements, enabling businesses to incorporate them into their apps or websites without relying on professional help.

- Considering Providers with Built-in Compliance Support

For many businesses, meeting the regulatory requirements for integrating embedded payment systems can be a major challenge. Fortunately, payment APIs from trusted providers often involve built-in compliance features. These solutions enable businesses to fulfil essential security standards such as PCI DSS, lessening the risk of penalties or security issues.

- Adopt Scalable Solutions for High Transaction Volumes

As businesses continue to expand, their transaction volumes also rise in tandem. To support this growth, firms can go for embedded payment solutions having a scalable cloud-based infrastructure, real-time reconciliation, seamless integration with multiple banks and more.

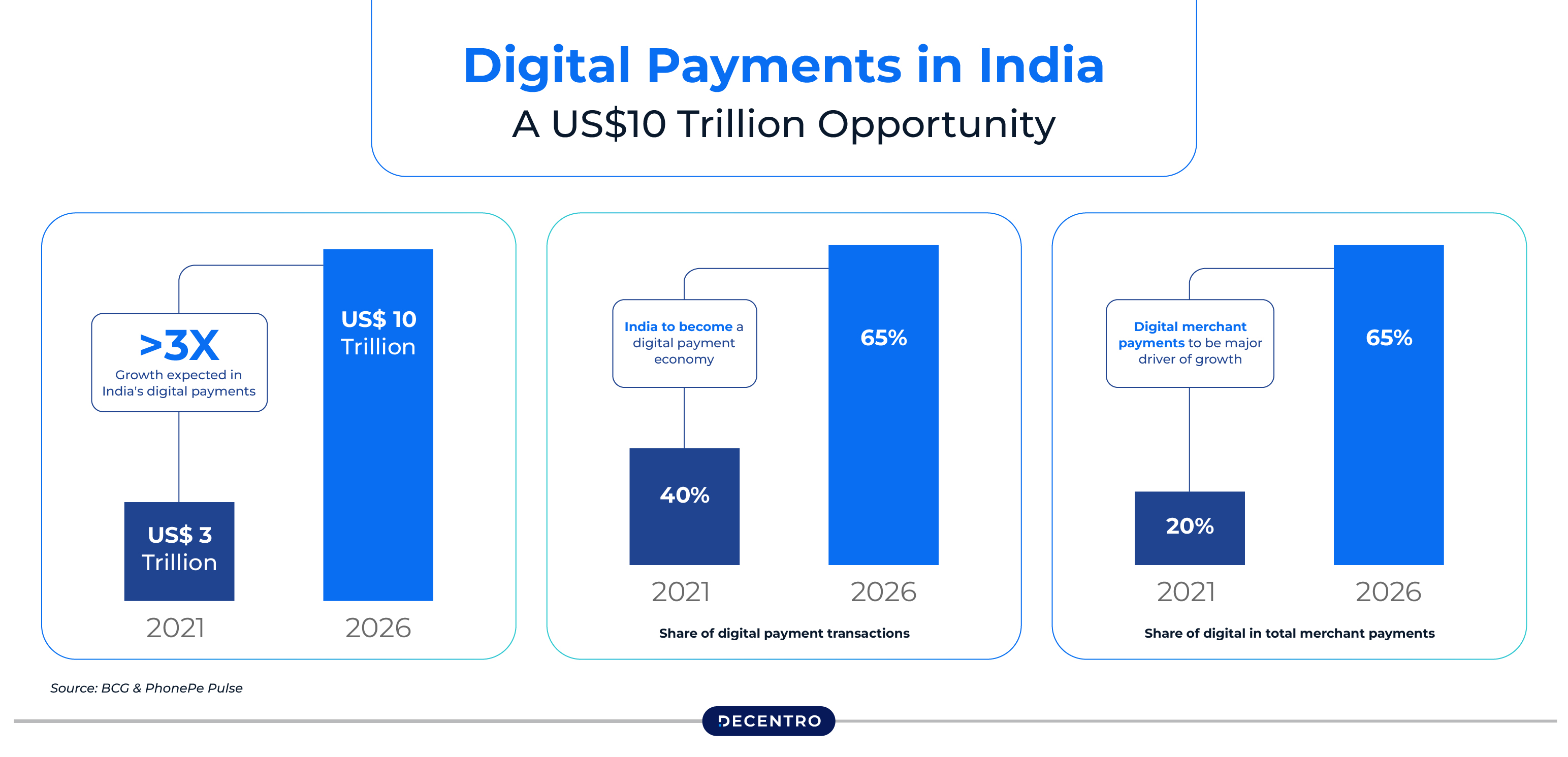

The Future of Embedded Payments in India

The emergence of embedded payment mechanisms can seem to be a boon for businesses involved in SaaS, e-commerce, financial services, etc. Here is a brief overview of the future of embedded payment systems, along with its estimated market size:

- Road Ahead for Embedded Payments

The services, ranging from payment to lending and insurance, are now embedded into everyday platforms, reshaping the financial landscape in India by enhancing user convenience and propagating financial inclusion.

As this sector expands, it is expected to revolutionise industries, foster innovation, and significantly contribute to India’s digital economy. Additionally, the growth of digital payment solutions, supported by the government’s drive for a cashless economy, is building an ecosystem that is quite conducive to embedded payments.

These developments are complemented by AI and blockchain technologies, enhancing the speed, security, and fraud detection of such transactions while providing improved transparency and overall system integrity.

- Predictions for Market Size and Adoption Rates

Embedded payments in India are going to grow exponentially as most businesses adopt integrated payment solutions catering to the ever-increasing number of tech-savvy consumers. According to industry experts, the digital payments market in India is going to touch $1 trillion by 2025, with embedded payments contributing significantly to that growth.

Decentro’s Role in Embedded Payments

Decentro leads the way in making embedded payments easy for businesses with its powerful payment APIs. For instance, our Multi-Collect APIs enable you to receive funds from individuals and firms via a plethora of online payment methods like UPI, NEFT, IMPS and RTGS.

Also, we provide features like auto-reconciliation, payment tracking, real-time notifications, quick settlements and more while ensuring end-to-end compliance with the RBI’s latest regulations.

Case Studies: Examples of Businesses Leveraging Decentro’s APIs for Growth

Several businesses have leveraged Decentro’s embedded payment APIs to scale efficiently and enhance customer experiences. Here are a few examples:

Pickrr

Pickrr is a virtual courier service that caters to brands, SMEs, e-commerce sellers, etc. In order to provide a pre-paid payment mode to customers, this company adopted Decentro’s UPI API suite, thus offering customers a smooth payment flow and negating reconciliation hassles.

Additionally, Pickrr got the benefits of instant settlements and an 80% cost reduction in comparison to traditional payment gateways.

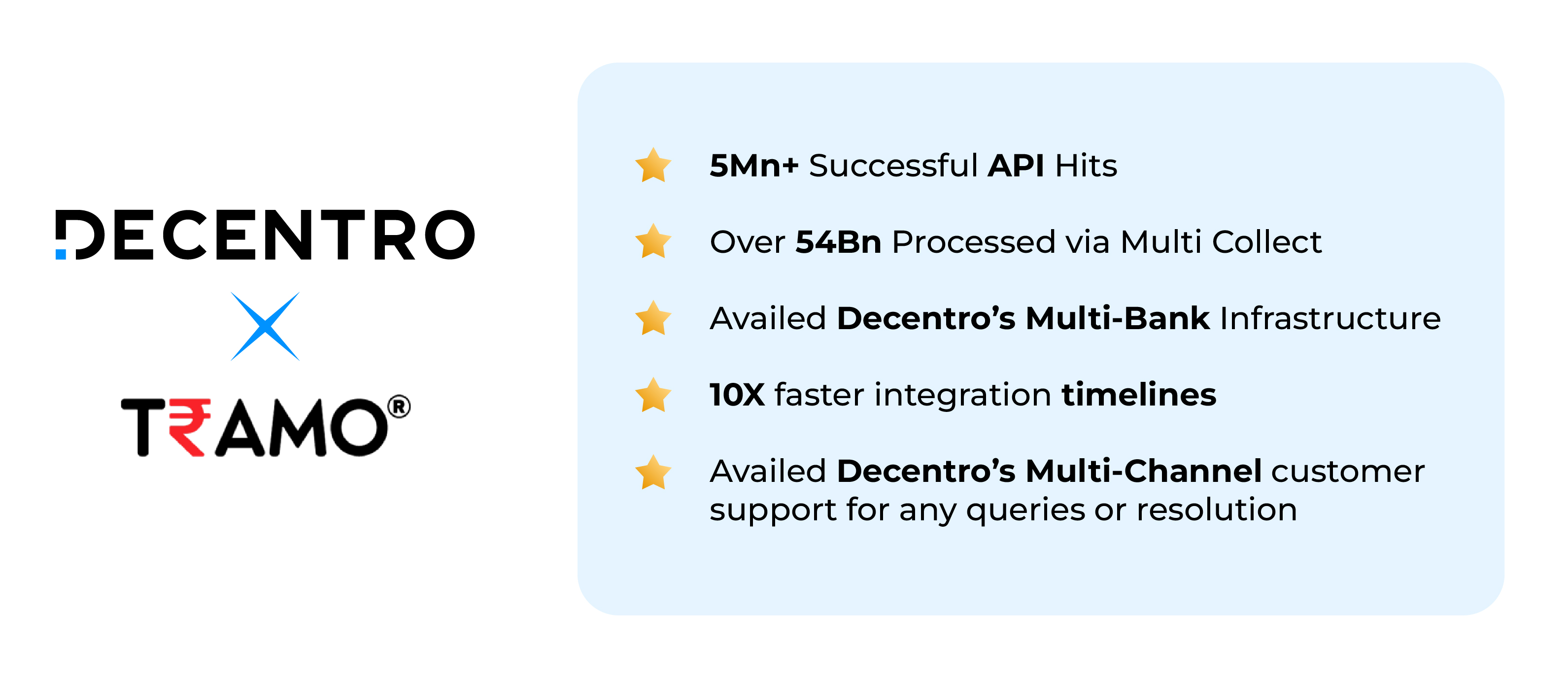

Tramo

Tramo offers tailored tech solutions to businesses of all sizes, including CMS, financial accounting, onboarding and KYC integrations, etc. By leveraging Decentro’s KYC APIs, Tramo streamlined its onboarding flows.

Additionally, with Decentro’s Multi-Collect API, the company issued virtual bank wallets that streamlined challenges regarding payouts, fund collection, reconciliation and bookkeeping.

As a result, Tramo’s integration timelines became 10x faster and processed more than 54 billion through Multi-Collect.

Ready to streamline your payment processes?