An in-depth analysis of how Decentro is enabling Tramo to empower businesses across rural and urban India with various Banking Services.

How Decentro and Tramo are Redefining Financial Accessibility Across India

A true blue millennial trying to engineer her full time-career around the world of content. How cliché is that?

Table of Contents

Banking the Unbanked.

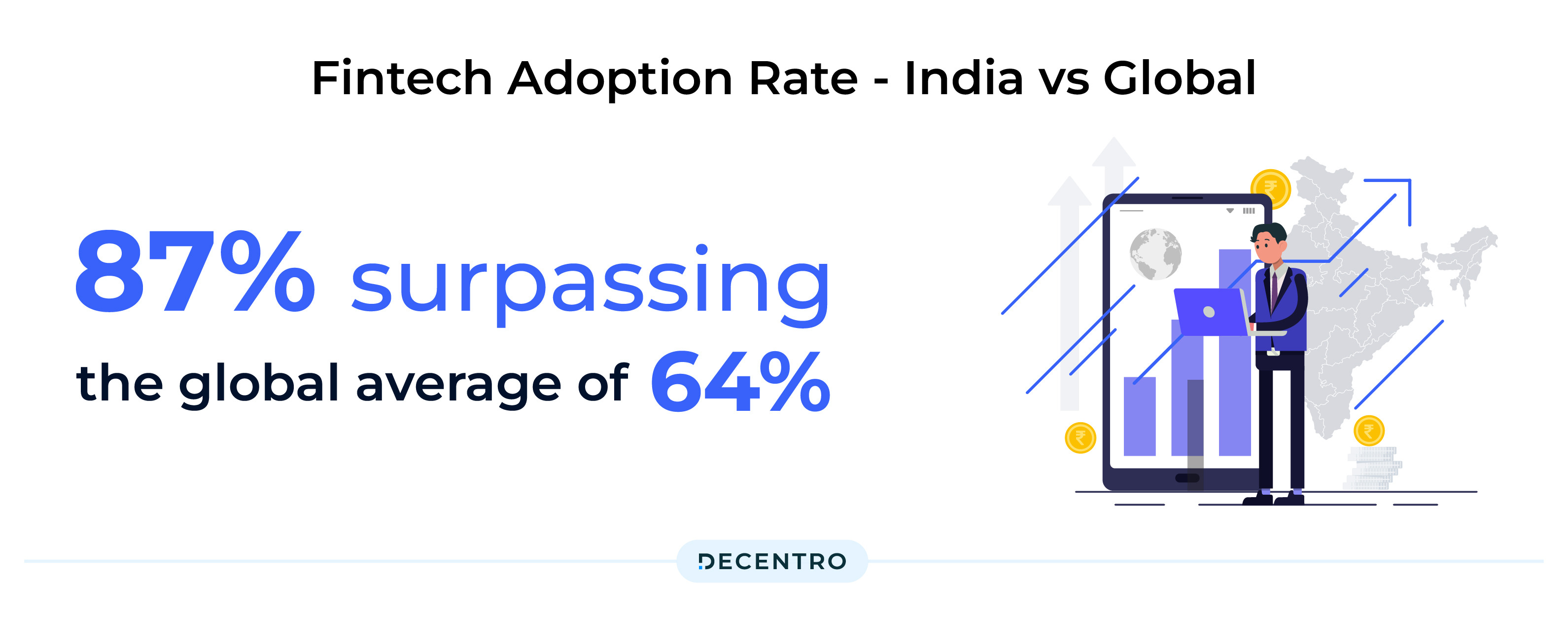

This one statement encapsulates the ethos that drives the financial inclusion narrative in a nation where the fintech adoption rate stands remarkably high at 87 per cent, surpassing the global average of 64 per cent. With the India stack finding a comfortable ally in the form of new-age fintech solutions, access to financial services has penetrated deeper into our country’s demography.

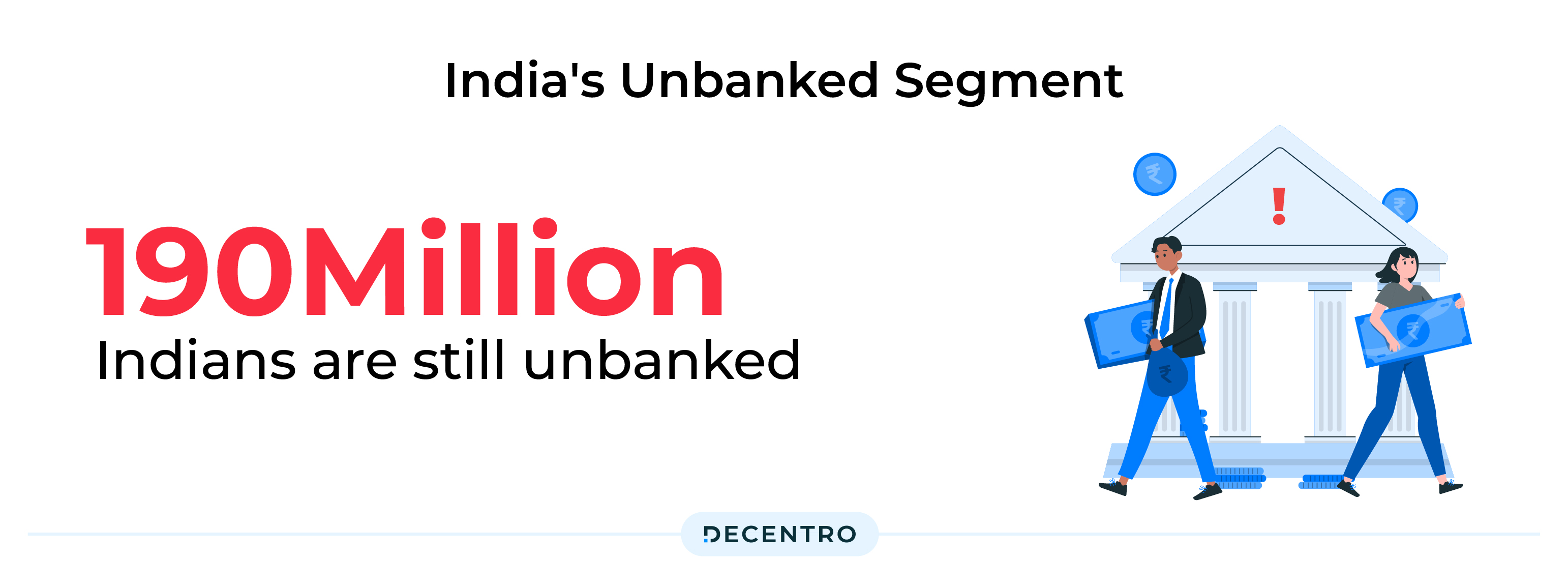

However, despite increased internet usage and tremendous growth, 190 million Indians are still unbanked. Serving this demography is critical and can be enabled only via access to digital financial services.

While banking services are the first step, they also set the tone for poverty reduction and economic growth opportunities.

Tramo helps in addressing the first step of this growth journey. With the vision of enabling businesses of any size via their cutting-edge technology, Tramo focuses on serving the unbanked and underbanked populations by providing them access to secure and convenient digital banking services.

Let’s see how.

What is Tramo Technolab?

With the mission of creating social impact and delivering a promise to transform rural India into a digitally empowered society by serving the unbanked, Tramo aims to empower businesses of any size with tailored tech solutions, innovative expertise, and seamless integration.

If you have a vision, Tramo Technolab will dedicate itself to enabling it via its range of products and services. It will cover all financial product offerings, from onboarding to recollections. The solution is designed to help clients succeed in a rapidly changing business environment.

How does Tramo work?

Tramo Technolab leverages technology as a strategic asset that enables business growth and offers the following services to clients to help them achieve their full potential.

DMT Integration

Experience hassle-free domestic money transfers with Tramo’s robust integration solutions. Seamlessly connect your platform to a network of banks and payment gateways, enabling your customers to transfer funds securely and conveniently.

AEPS Integration

Enable the convenience of making transactions using Aadhar-linked accounts by integrating the Aadhar-enabled Payment System into your business. Through Tramo’s integration, financial transactions are quick, secure, and paperless.

BBPS and Recharges Integration

By integrating the Bharat Bill Payment System via Tramo, stay ahead in the digital payments market. Enable the option to pay fees, recurring payments, and utility bills, mobile and DTH recharge using a single platform for a safe and convenient experience.

CMS (Cash Management Services)

Tramo specialises in integration and end-to-end process deployment of various cash collection and management services. Tramo is not limited to CMS API integration but also deals with developing its own CMS service.

Onboarding and KYC integrations

Utilise seamless customer onboarding and KYC integrations to register customers while abiding by legal regulations efficiently. Enhance customer trust and accelerate the user registration process.

Financial Accounting

Empower financial decisions with the precision of software-driven accounting. Stay ahead with financial accounting software, where numbers speak volumes.

What were Tramo’s key challenges?

Dealing with the breadth of offerings in different businesses of different sizes is tricky. With this focus group expanding to even the rural sectors of the country, collections & reconciliation are generally challenging. Between high-volume client onboarding, disbursals, and collections, Tramo hit a significant roadblock in two major places.

- Client verification at scale

- Effective payments collection

How did Decentro empower Tramo?

When you are serving a sector that has almost no exposure to financial services, there is a need for effective collaboration to expedite quick access to capital. While the host of solutions Tramo provided was extensive, partnering with Decentro allowed them to add the prowess of our Banking APIs for the following outcomes:

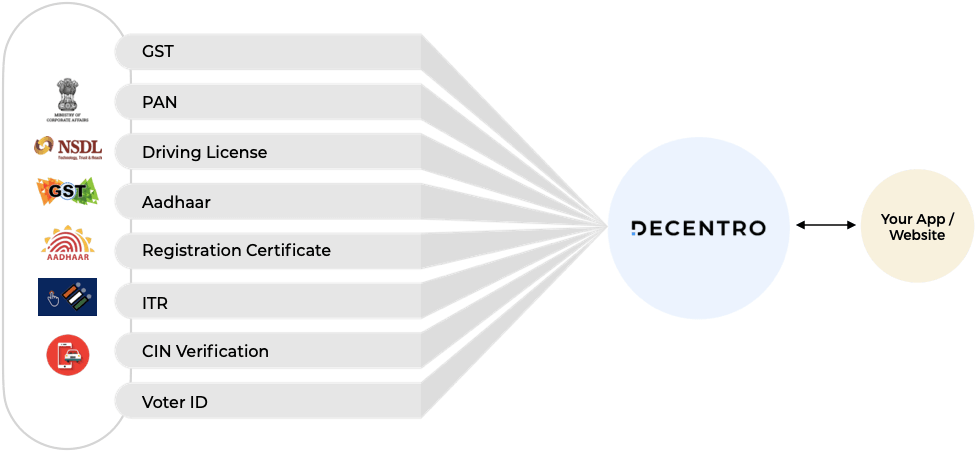

Single-point KYC checks

While dealing with underbanked and unbanked segments, background checks are crucial for any platform. With Decentro’s single end-point for KYC APIs, Tramo set seamless onboarding flows to offer smooth and secure user onboarding.

With single-point access to various data points such as PAN, Aadhaar, Driving License, Voter ID, and more, Tramo can onboard users in real-time and is able to automate the KYC process once and for all.

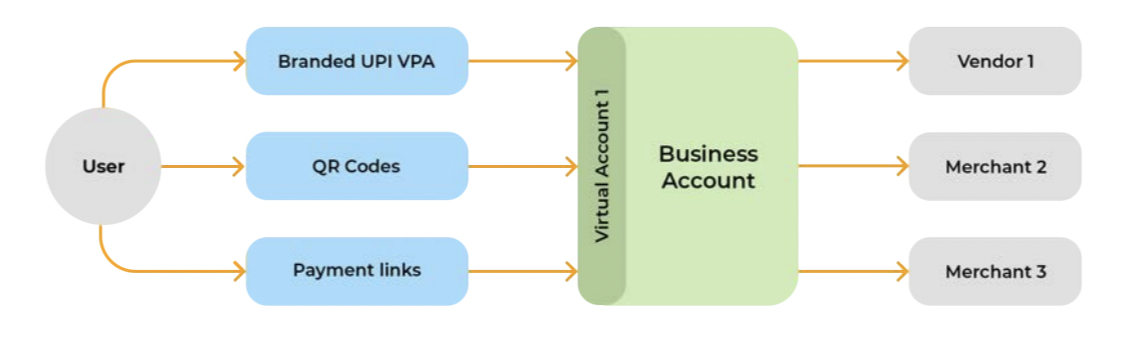

Multi-Collect for Collections and Payouts

The challenge of enabling fund collection, bookkeeping, reconciliation, and payouts was also solved by Tramo by issuing Virtual Bank Wallets for their vendors using Decentro’s Multi Collect API. Eliminating the expending time, effort, and capital for managing fund collections and payments, Tramo leveraged the efficiency of Decentro-enabled VAs for each business on its roster without any hassle.

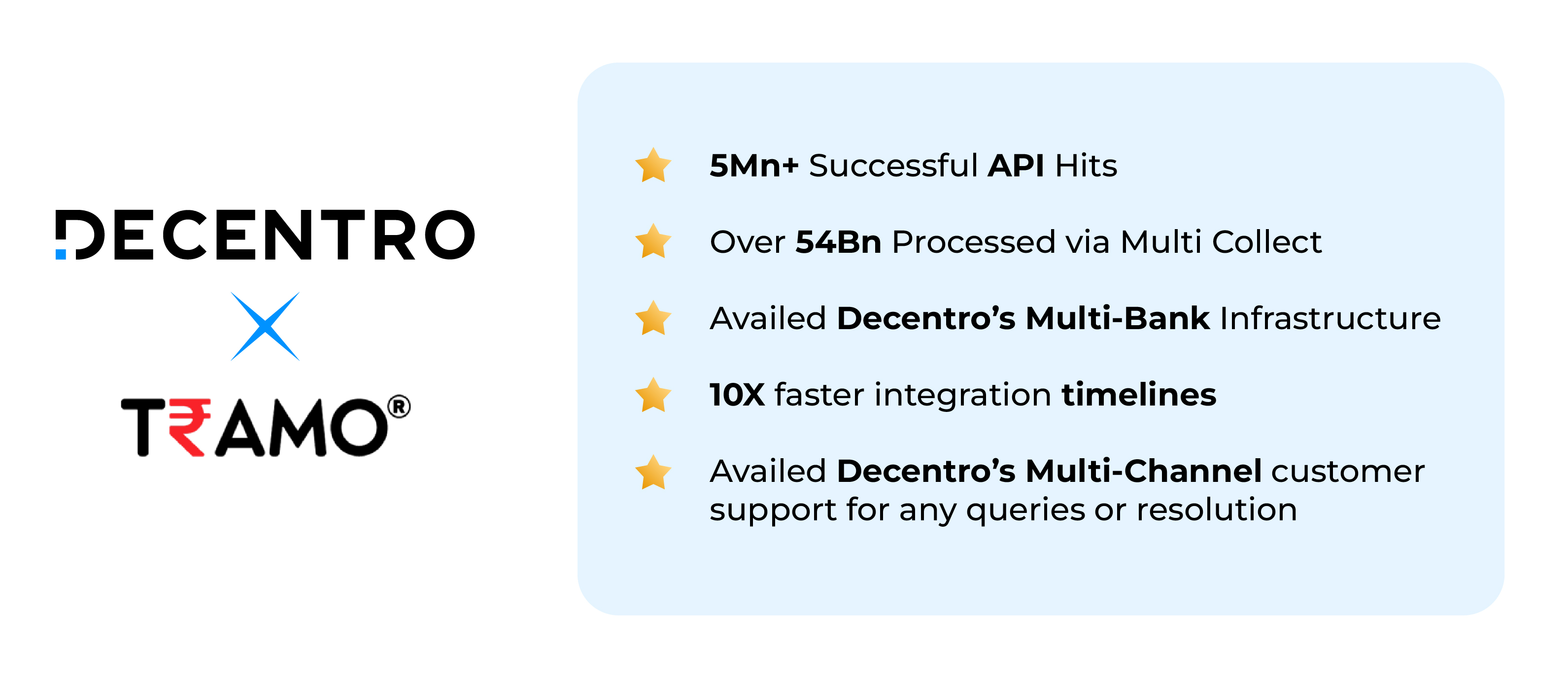

What were the key outcomes for Tramo?

By leveraging Decentro’s API for banking integrations, Tramo has simplified the payment collection process and has been able to drive the following results.

- 5Mn+ Successful API Hits

- Over 54Bn Processed via Multi-Collect

- Availed Decentro’s Multi-Bank Infrastructure

- 10X faster integration timelines.

- Availed Decentro’s multi-channel customer support for any queries or resolution

Let us also take a look at what Ankur Gupta, Co-Founder and COO of Tramo, thinks about this association between two technology-led organizations.

At Tramo, we’ve always aimed to provide seamless and exceptional experiences to clients, and Decentro has been an invaluable partner in helping us achieve precisely that. From streamlining their onboarding process to handling payouts and reconciliations via the virtual accounts stack, we have extracted the best of each of Decentro’s offerings. What truly sets Decentro apart is its unwavering commitment to customer success, which has led to the belief that we’re more than just clients – we’re partners in innovation

Ankur Gupta, Co-Founder & COO, Tramo

In Conclusion,

Our aim to empower fintech players has found fruition through our partners. That’s precisely what our simplified banking APIs are here for! This, coupled with navigating the pertinent mission of financial inclusion with companies like Tramo, not only adds value but also aligns with Decentro’s purpose of making FinTech great again.

Not just Tramo, but Decentro has enabled major companies—notably MoneyTap, CashE and others—to facilitate a better user transaction experience with sharper expense tracking, better compliance, and improved reconciliation.

Decentro’s API offers a plug-and-play solution to your banking integration needs and covers all compliances. Whether your business requires extended credit with custom Buy Now, Pay Later or customer onboarding through thorough verifications via KYC, Decentro has surrounded you with a suite of banking APIs to fulfill all your banking and payment needs.

With efficiency being our promise, feel free to reach out if your business wants to solve a use case involving anything linked to banking. We’re all ears!